As industries prioritize environmental and cost efficiency, effective pipeline insulation solutions become critical components of operational effectiveness and regulatory compliance. Market leaders leverage advanced technologies and cutting-edge materials to meet this growing need, which is driven by better thermal management requirements and lower greenhouse gas emissions.

Recently developed technological innovations in insulation materials like aerogels and high-performance options are poised to disrupt market standards, setting a new bar in terms of thermal performance. Furthermore, these advancements support global sustainability initiatives by significantly lowering carbon footprints for companies. Retrofitting existing facilities with modern energy standards further expands market opportunities.

Key Takeaways

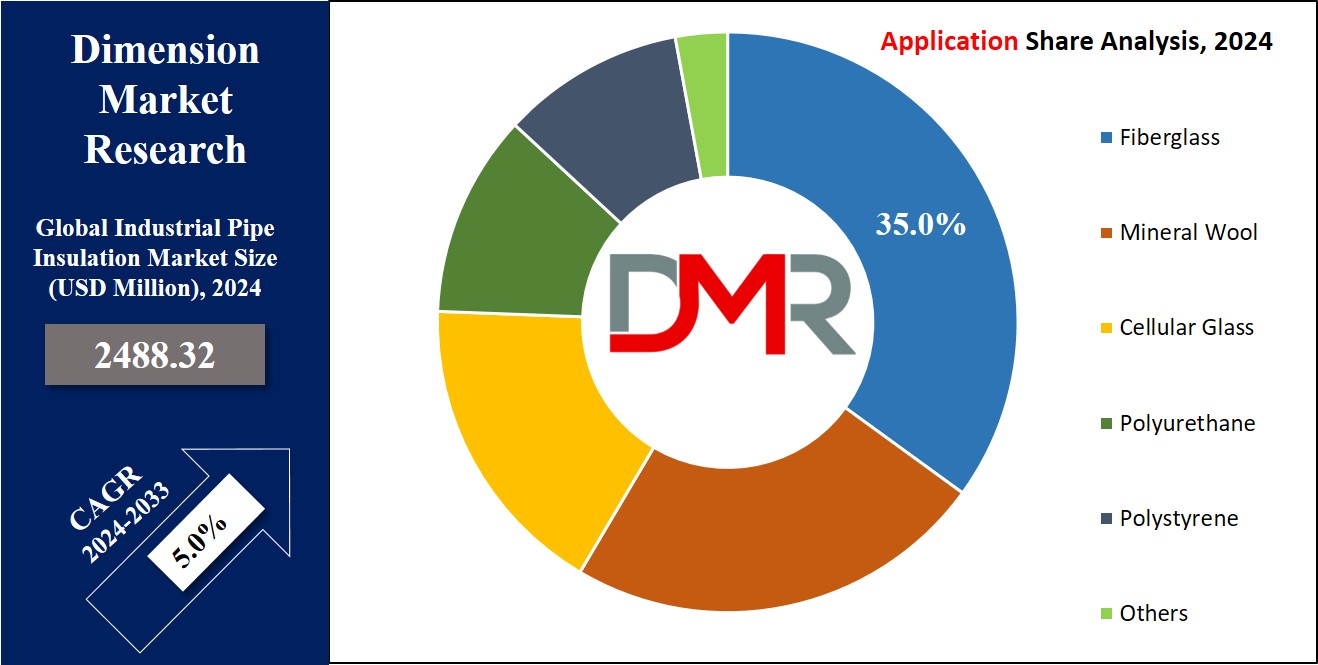

- Market Growth: The market is projected to grow from USD 2,617.6 Million in 2023 to USD 4,078.0 Million by 2033, at a CAGR of 5.0%.

- Dominating Material: Fiberglass leads the market with a 35% share, favored for its thermal performance, versatility, and cost-effectiveness.

- Key Application Segment: Prefabricated insulation holds the largest market share at 42%, driven by its time-saving and installation ease.

- Leading Region: North America dominates the market with a 35% share, supported by strong industrial infrastructure and stringent energy regulations.

- Driving Factors: Increased energy efficiency awareness and rising energy costs are significant growth drivers, pushing industries to invest in advanced insulation solutions.

- Competitive Landscape: Major players include Owens Corning, Johns Manville, and Armacell, focusing on innovation and sustainability to meet growing market demands.

Use Cases

- Chemical Processing Efficiency: Use advanced fiberglass or mineral wool insulation to reduce heat loss, enhance energy efficiency, and lower operational costs in chemical facilities.

- Oil & Gas Asset Protection: Implement cellular glass or polyurethane insulation for pipelines to maintain temperature integrity, ensuring safety and regulatory compliance in extreme environments.

- Construction Time Savings: Utilize prefabricated insulation systems to streamline installation processes, reduce labor costs, and meet energy efficiency standards in construction projects.

- Sustainable Power Generation: Adopt eco-friendly insulation materials in power plants to lower carbon footprints and improve energy efficiency, aligning with environmental regulations.

- Local Sourcing for Supply Chain Resilience: Source insulation materials locally to mitigate supply chain disruptions, ensuring stable supply and timely project execution.

Driving Factors

Environmental Awareness Fosters Long-Term Solutions

Environmental issues have had a dramatic effect on the Global Industrial Pipe Insulation Market. With businesses and consumers becoming increasingly conscious of their carbon footprints, there has been an upsurge in sustainable practices across industries. As regulatory pressure intensifies and companies adopt energy efficient technologies--including effective insulation solutions--such as materials that not only increase thermal performance but also decrease greenhouse gas emissions--this trend fosters innovation while simultaneously meeting both regulatory standards and consumer demands.

Growth of Oil and Gas Sector Spurs Demand for More Supplies

Oil and gas industries are major players in the Global Industrial Pipe Insulation Market, accounting for an abundance of demand across its total value. As global energy needs continue to expand rapidly, so too has this sector seen rapid expansion - particularly within North America and Middle East regions. According to industry reports, industry forecasters anticipate an average compound annual compound annual growth rate of approximately five percent during the next five years in terms of global oil and gas sales. Due to this exponential expansion, insulation solutions with advanced insulation technologies will become ever more necessary to increase operational efficiencies, minimize heat loss, and safeguard pipeline systems under extreme conditions.

Demand for Energy Efficiency Fuels Market Development

Energy efficiency is one of the primary forces driving growth in the Global Industrial Pipe Insulation Market. Industries from different verticals recognize that effective insulation not only reduces operational costs by cutting energy use, but it can also boost overall system performance. With energy prices fluctuating frequently and prices sometimes increasing significantly, companies must find long-term energy-saving solutions such as insulation. It has been estimated that properly implemented insulation solutions may lead to savings of up to 30% when implemented in industrial settings - further supported by government initiatives focused on conserving energy, which fuels market expansion.

Growth Opportunities

Rising Awareness of Energy Efficiency

2023 has seen significant expansion for the global industrial pipe insulation market due to heightened awareness of energy efficiency among various industries. Organizations seeking to lower operational costs and minimize their carbon footprint have become increasingly aware of its benefits; as they strive to reduce operational expenses while aligning their sustainability efforts. Companies have increasingly invested in advanced insulation technologies that optimize energy use for heating and cooling systems - creating significant market opportunities in turn.

Increased Energy Costs

Rising energy costs are another driving force influencing the industrial pipe insulation market. Businesses facing fluctuating energy prices must find ways to lower expenses; superior insulation helps control temperatures while reducing energy losses - an essential part of energy management strategies and an essential component in energy conservation plans. As a result, investing in high-performance insulation products may become even more essential, expanding market reach even further—especially in high-consumption industries like beverage manufacturing, where

Energy Drinks production lines require precise temperature control to maintain quality.

Adopting Advanced Insulation Materials

Advanced insulation materials are rapidly altering market dynamics. Innovations like aerogel and advanced polymers offer superior thermal performance, reduced weight, and resistance to extreme temperatures - ideal for various industrial applications. As these materials become more accessible with cost reductions encouraging wider adoption rates; competitive dynamics will only become stronger while new opportunities to innovate and increase market share will arise for companies.

Key Trends

Focus on energy cost reduction

2023 will see an intensified focus on energy cost reduction within the global industrial pipe insulation market, driven by rising energy prices. Industries are prioritizing investments that enhance energy efficiency and decrease operational costs through proper insulation solutions that improve their energy performance and lower operational expenses. Effective insulation not only cuts consumption for heating and cooling processes but can lead to significant long-term savings; companies are actively seeking innovative materials and technologies with improved thermal performance and longevity.

Customization and Specialized Solutions

One notable trend is the surge in customization and specialized solutions. As industries diversify, demand for tailored insulation products that fulfill specific operational requirements has grown steadily. Manufacturers are responding with tailored insulation solutions designed specifically for specific applications such as high-temperature processes or corrosion-prone environments - this trend toward specialization increases customer satisfaction while creating long-term partnerships between producers and end-users.

Initiatives of research and development

Research and development (R&D) initiatives are also driving innovation in the market. Companies have invested significantly in R&D to develop advanced materials that improve insulation performance, sustainability, and safety; explore eco-friendly materials that align with environmental regulations as well as market demands; explore composites; as well as discover cutting-edge products to meet changing industry demands. As a result, advancements in R&D should lead to cutting-edge products being introduced onto the market that meet current industry demands.

Restraining Factors

Lack of Standardization

A lack of standardization in industrial pipe insulation poses a formidable hurdle to market growth. Due to differing regulations and performance metrics across regions, manufacturers experience difficulty maintaining compliance. This fragmentation leads to confusion among end-users regarding the effectiveness or suitability of specific applications of insulation products and can decrease market expansion over time. Furthermore, manufacturers may incur extra costs in meeting various regulations which ultimately compromise pricing strategies or market competitiveness.

Available Substitute Products

Substitute products play a pivotal role in driving the growth of the global industrial pipe insulation market. Spray foam insulation, mineral wool, and even advanced composites offer similar thermal performance, potentially offloading demand from more traditional insulation materials. Substitute products' increasing adoption is likely attributed to their cost-efficiency and ease of installation; for instance, spray foam insulation has seen significant traction across different industries due to its superior air-sealing properties and fast application process. Due to competition from these substitute products, traditional insulation manufacturers must continually innovate to retain market share without hindering growth dynamics.

Supply Chain Disruptions

Recent supply chain disruptions have hurt the industrial pipe insulation market. Raw material shortages, transportation delays, and geopolitical tensions have had devastating results on product costs as well as lead times resulting from supply chain interruptions affecting lead time for insulation products and delivery times for delivery services. Industry reports reveal that these disruptions have resulted in production costs rising as much as 20%, prompting manufacturers to pass these costs on to consumers. Thus, market demand may decrease as end users review budgets and project timelines, with supply chain vulnerabilities potentially creating inconsistent product availability eroding customer trust, and leading potential buyers towards less risky options.

Research Scope Analysis

By Material Type

In 2023, fiberglass held the highest market share for the product type insulation market segment of the global industrial pipe insulation market at

approximately 35%. Its popularity can be attributed to its excellent thermal performance, versatility, and cost-effectiveness making it the go-to material in various industrial applications. Mineral wool then emerged as the second-largest segment composing 25% of the market. Mineral wool's soundproofing qualities and fire resistance make it increasingly preferred by industries that prioritize safety and noise reduction over comfort levels.

Cellular glass holds around 15% of the market and is widely respected for its exceptional insulating properties and durability in harsh environments, as well as its resistance to moisture and chemicals, making it suitable for high-demand industrial settings. Polyurethane's market share has steadily been growing over time due to its lightweight nature and thermal efficiency - ideal for energy-sensitive applications.

Polystyrene made up roughly 8% of the market, valued for its affordability and easy installation. It serves a range of applications in less demanding environments. The remaining 7% was divided among other insulation materials like innovative composites or eco-friendly options that have become increasingly popular as industries shift towards sustainable practices. Together these product segments illustrate the complexity and variety of industrial pipe insulation markets; each segment providing distinct advantages and applications.

By Application

Prefabricated insulation held the highest market share among product types for the global industrial pipe insulation market in 2023, accounting for roughly 42%. Prefabricates popularity stems from its time-saving advantages and ease of installation - two key considerations when streamlining operations. Roll and batt insulation captured 28%, being widely utilized due to their reliable thermal performance as well as their ability to reduce noise transmission.

Spray insulation has quickly become an impressive segment of the market, accounting for approximately 20%. Its unique application method allows seamless coverage over complex surfaces while dramatically improving insulation performance by eliminating air leakage and thermal bridges, making spray insulation increasingly desirable for energy-efficient projects and renovations. Another 10% comprises innovative insulation materials designed specifically to address niche applications - eco-friendly solutions are among them and help meet growing sustainability expectations.

Collectively, these segments depict the diverse landscape of industrial pipe insulation markets; each contributing unique benefits that meet modern industrial applications' specific requirements while driving overall market expansion.

By End Use

Chemicals were the dominant product type segment of the global industrial pipe insulation market in 2023, accounting for roughly 30% of the total market share. Their prominence can be attributed to the high demand for insulation solutions in chemical processing facilities where temperature control and energy loss prevention is of critical importance. Food and beverages industries followed closely behind, accounting for 25% market share despite strict hygiene requirements that necessitated effective temperature regulation that necessitated specialist insulation solutions to maintain operational efficiency.

Oil and gas industries accounted for approximately 20% of the market, driven by insulation needs in extreme temperature environments and hazardous environments, such as pipelines and storage facilities. Insulation products played an integral role in preserving pipeline integrity and safety as well as safety during operations and storage facilities' long-term functionality. Power generation held about 15% market share due to an emphasis on energy efficiency and environmental sustainability within power plants and related infrastructure.

Insulation solutions play an integral part in metal manufacturing, helping maintain process temperatures and increasing energy efficiency. Construction and HVAC applications also accounted for around 7% of market revenues; their insulation solutions increasingly becoming necessary for complying with energy regulations and performance standards.

The Global Industrial Pipe Insulation Market Report is segmented based on the following:

By Material Type

- Fiberglass

- Mineral Wool

- Cellular Glass

- Polyurethane

- Polystyrene

- Others

By Application

- Prefabricated

- Rolla & Batts

- Spray

By End Use

- Chemicals

- Food & Beverages

- Oil & Gas

- Power

- Metal Manufacturing

- Other Industrial

Regional Analysis

North America held the greatest share in 2023 of the global industrial pipe insulation market with a 35% market share, driven primarily by robust industry infrastructure such as in oil & gas, chemical, and power generation sectors that generate high levels of demand for effective insulation solutions. Furthermore, strict energy efficiency regulations and an emphasis on sustainability encouraged investments in advanced insulation technologies in North America.

Europe followed closely, accounting for around 30% of the market share.

Europe's focus on environmental regulations and energy efficiency initiatives in manufacturing and construction has contributed significantly to the increased adoption of innovative insulation materials; further, the European Union's commitment to curb greenhouse gas emissions has inspired industries to seek insulation solutions that offer overall cost savings.

Asia Pacific represented approximately 25% of the market, propelled by rapid industrialization and urbanization across countries like China and India, along with rising energy efficiency demands in manufacturing projects and infrastructure developments. Government initiatives encouraging energy conservation measures as well as advanced material applications were projected to further propel market prospects in this region.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

2023's global industrial pipe insulation market is defined by an increasingly dynamic competitive landscape with several key players. Owens Corning stands out as an industry leader thanks to its diverse lineup of fiberglass insulation products that serve various industrial applications and its strong commitment to sustainability and energy efficiency - factors which align perfectly with market trends for industries looking to reduce their environmental impact. Furthermore, its focus on innovative solutions allows Owens Corning to maintain significant market share while meeting rising demand for effective insulation materials.

Johns Manville stands out as another significant competitor, best-known for its mineral wool products that emphasize fireproofing and soundproofing properties. Through their research and development initiatives, they have created innovative solutions that surpass stringent industry standards, cementing Johns Manville's place in the market as well as appealing to sectors where safety and compliance are prioritized. Armacell excels at flexible insulation solutions tailored to HVAC applications where moisture resistance and thermal performance is crucial.

Knauf Insulation and Paroc Group are also major players, both known for their sustainable practices and high-quality materials. Research and development investments by these manufacturers are fuelling advancements in product performance, catering to an increase in energy-efficient insulation needs. Emerging companies such as L'ISOLANTE K-FLEX, Ode Yalitim and Kaimann GmbH have established niches by providing custom solutions tailored to regional market needs - particularly those in Europe and the Middle East. Gilsulate International and Praxair Technology Inc specialize in developing groundbreaking insulation technologies to address unique industrial insulation challenges. Together, these players foster an environment where innovation and sustainability play key roles.

Some of the prominent players in the Global Global Industrial Pipe Insulation Market are:

- Owens Corning

- Johns Manville

- Armacell

- Knauf Insulation

- Paroc Group

- L'ISOLANTE K-FLEX

- Ode Yalitim

- Kaimann GmbH

- Gilsulate International

- Praxair Technology

Recent developments

- In 2022, March, a shift towards sustainable materials emerged, with manufacturers introducing bio-based insulation options in response to regulatory pressures and consumer demand for eco-friendly products.

- In 2022, September, innovations in aerogel insulation technology were showcased, offering improved thermal performance and lightweight characteristics for high-temperature applications, particularly in the oil and gas sector.

- In 2023, January, high-performance polyurethane insulation products were launched, featuring enhanced energy efficiency and moisture resistance, gaining traction in construction for retrofitting existing infrastructure.

- In 2023, June, the adoption of prefabricated insulation systems increased significantly, streamlining installation processes and reducing labor costs across various industrial sectors.

- In 2024, February, research highlighted the growth of custom insulation solutions, tailored for specific applications, which enhanced customer satisfaction and fostered long-term partnerships in the market.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 2,617.6 Million |

| Forecast Value (2032) |

USD 4,078.0 Million |

| CAGR (2023-2032) |

5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Material Type(Fiberglass,Mineral Wool,Cellular Glass,Polyurethane,Polystyrene,Others), By Application(Prefabricated, Rolla & Batts,Spray), By End Use(Chemicals,Food & Beverages,Oil & Gas,Power,Metal Manufacturing,Other Industrial) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Owens Corning, Johns Manville, Armacell, Knauf Insulation, Paroc Group, L'ISOLANTE K-FLEX, Ode Yalitim, Kaimann GmbH, Gilsulate International, Inc., and Praxair Technology, Inc |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |