In industry, "tube" and "pipe" are nearly interchangeable terms. Both mainly describe long hollow cylinders of uniform material with a certain amount of rigidity and permanence, which in contrast to "hose", is typically more portable and flexible, and is made up of multiple layers of different materials which vary based on the application.

The US Market Overview

The US Industrial Tubes Market is expected to reach

USD 177.0 billion in 2024 at a

CAGR of 7.5% over the forecast period of 2024 to 2033.

The growth of the US industrial tubes market is driven by higher demand from the automotive & construction sectors, development in manufacturing technologies, and a growth in infrastructure projects. These tubes are increasingly used in

water and wastewater treatment equipment and chemical logistics networks that support large-scale energy and manufacturing operations.

Further, opportunities in the US industrial tubes market include the growth of renewable energy projects, higher adoption of automation in manufacturing, and the rise in the need for efficient transportation systems.

Also, trends like the development of lightweight & high-strength tube materials, advancements in corrosion-resistant coatings, and the integration of smart technologies for better performance and monitoring in industrial applications are driving the market growth in the country.

Key Takeaways

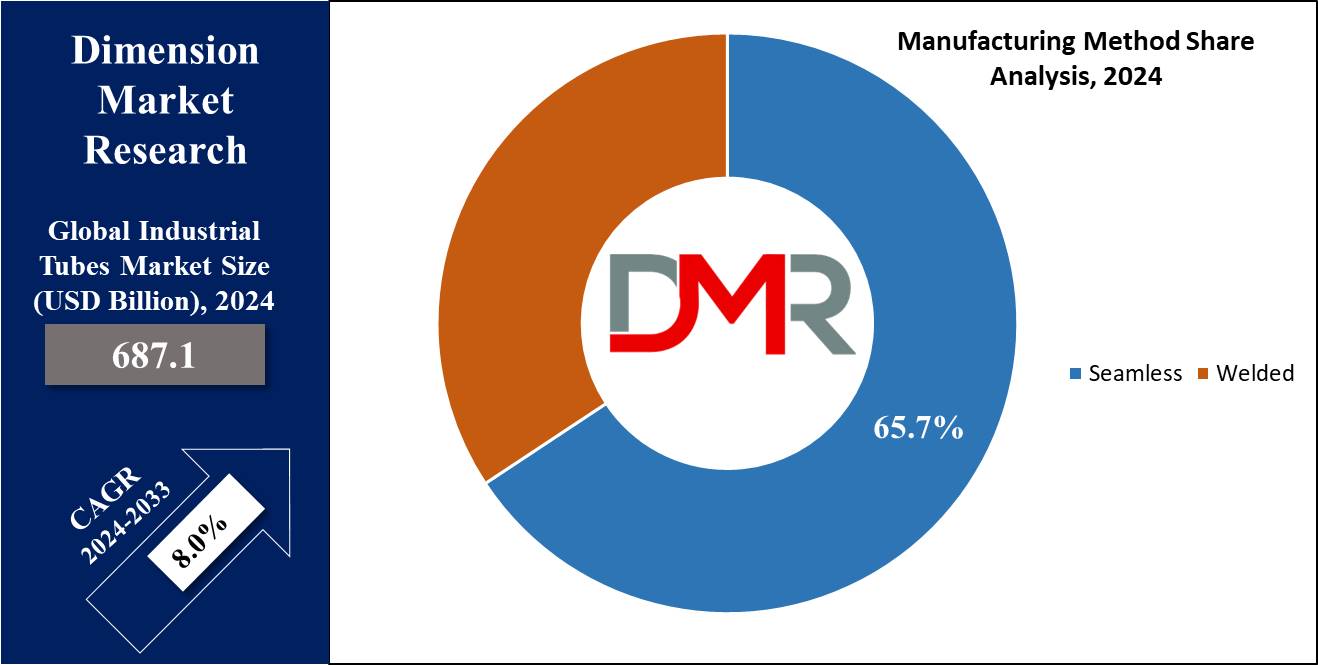

- Market Growth: The Industrial Tubes Market size is expected to grow by 636.7 billion, at a CAGR of 8.0% during the forecasted period of 2025 to 2033.

- By Material: The steel tubes segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Manufacturing Method: The seamless tube segment is expected to lead the Industrial Tubes market in 2024.

- By End-use Industry: The food & beverages segment is expected to get the largest revenue share in 2024 in the Industrial Tubes market.

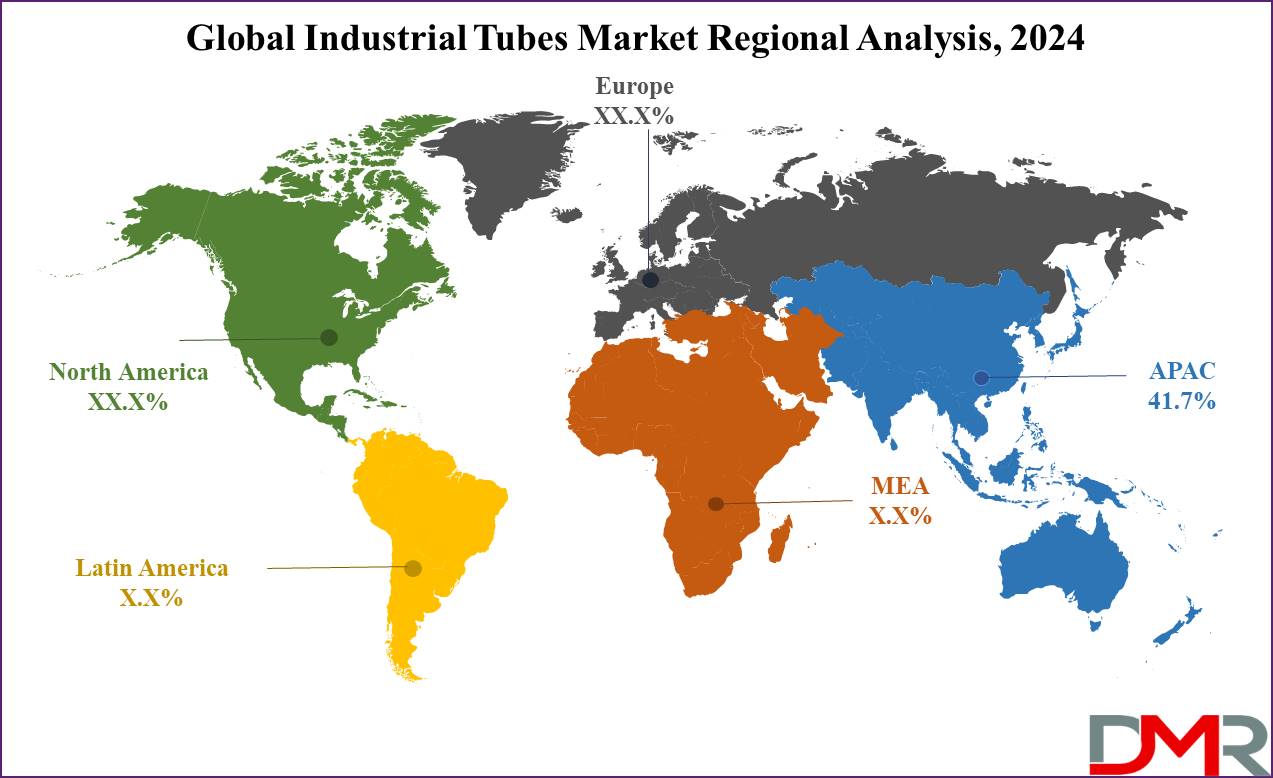

- Regional Insight: Asia Pacific is expected to hold a 41.7% share of revenue in the Global Industrial Tubes Market in 2024.

- Use Cases: Some of the use cases of Industrial Tubes include heat exchangers, piping systems, and more.

Use Cases

- Transportation of Fluids: Industrial tubes are utilized to transport different fluids like water, oil, gases, and chemicals within manufacturing plants and industrial processes.

- Heat Exchangers: Tubes are integral components of heat exchangers, supporting the transfer of heat between fluids, commonly used in HVAC systems, refrigeration units, and industrial processes.

- Structural Support: Tubes act as structural supports in building frameworks, scaffolding, and frameworks for industrial equipment and machinery.

- Piping Systems: They form important parts of piping systems for conveying materials in industries like construction, agriculture, mining, and chemical processing.

Market Dynamic

Driving Factors

Increasing Industrialization and Infrastructure Development

The current industrialization across regions, along with the development of advanced infrastructure projects worldwide, drives the demand for industrial tubes. These tubes are important for the construction, manufacturing, energy production, and transportation sectors. They also serve key roles in drilling fluids, oilfield chemicals, and industrial gases transport systems, which require corrosion-resistant and high-pressure tubes.

Advancements in Material and Manufacturing Technologies

Innovations in materials and manufacturing technologies are improving the performance, durability, and efficiency of industrial tubes, which drives adoption across different applications, from high-performance aerospace components to everyday plumbing systems.

Restraints

Fluctuating Raw Material Prices

The industrial tube market can be largely affected by fluctuations in the prices of raw materials like steel, copper, and polymers, which can impact manufacturing costs and profit margins for tube manufacturers and end-users alike.

Stringent Regulatory Requirements

Compliance with strict regulatory standards and environmental regulations can create challenges for industrial tube manufacturers. Meeting these requirements mostly requires investments in technology and processes, which can increase production costs & affect market competitiveness. To overcome this, companies are integrating antimicrobial coating and

passive fire protection solutions into their tube systems.

Opportunities

Growing Demand for Sustainable Solutions

Growing awareness and regulations related to environmental sustainability are driving the need for eco-friendly materials and manufacturing processes in the industrial tubes market, which provides opportunities for manufacturers to innovate and offer products that are energy-efficient, recyclable, and have a lesser environmental impact. Tube makers are also exploring advanced

concrete floor coating and industrial filtration systems to ensure greater performance and sustainability in production facilities.

Rising Adoption of Advanced Manufacturing Technologies

The adoption of advanced manufacturing technologies like 3D printing and automation offers opportunities to enhance production efficiency, reduce lead times, & customize industrial tubes according to specific customer requirements, which can enhance competitiveness and open new markets for industrial tube manufacturers.

Trends

Industry 4.0 Integration

The integration of Industry 4.0 technologies like IoT (Internet of Things), AI (Artificial Intelligence), and automation is transforming manufacturing processes in the industrial tubes sector, which is leading to smart factories that optimize production efficiency, minimize downtime, and improve quality control. The use of industrial lubricants and

marine lubricants in automated systems further improves machinery lifespan and operational consistency.

Shift towards Lightweight and High-Performance Materials

There is a major trend towards using lightweight and high-performance materials like composites, advanced alloys, and polymers in industrial tube manufacturing. These materials provide advantages like better strength-to-weight ratios, corrosion resistance, and design flexibility, catering to different industrial applications.

Research Scope and Analysis

By Type

The process pipes segment is expected to generate the highest revenue during the forecast period, due to the growing use of these pipes for converting liquids, chemicals, fuels, gases, and other raw materials into usable products. These tubes are essential in

HVAC systems, chillers, and heat exchangers, supporting thermal management across industries.

Further, the heat exchanger tube is expected to experience rapid growth, due to the rising adoption of AI technologies to control & monitor heat exchangers, optimizing heat treatment processes and efficient usage of high-temperature energy from flue gas, which is particularly beneficial for clean coal energy.

In addition, rapid industrialization in developing countries across the Asia Pacific, coupled with major investments in manufacturing, commercial, and industrial projects, is boosting the need for heat exchanger tubes. The product's growing use in industries like power generation, petrochemicals, chemicals, HVAC and refrigeration, and food and beverage is further driving segment growth in the region.

By Material

Steel tubes are expected to lead the industrial tubes industry due to their superior mechanical properties, geometric tolerance, and weldability. Highly used in sectors like construction, mining, oil and gas, and manufacturing, steel tubes are important for transporting high-temperature fluids and gases. The use of extra thick steel plate, heat treated steel plates, and services from

steel service centers helps improve strength and durability.

Their popularity stems from their ability to create lightweight yet high-load-bearing structures. The market is also benefiting from material developments in manufacturing, particularly for offshore jacket structures, which are expected to further drive growth in the industrial tubes market.

By Manufacturing Method

In terms of the manufacturing method, the seamless tube segment is expected to dominate the industrial tubes market in 2024, majorly due to its large use in oil and gas applications, like riser pipes, OCTG (Oil Country Tubular Goods), heat exchanger tubes, subsea flow lines, and instrumentation tubes, which is further supported by the growing demand for seamless tubes in the chemical sector, where their reliability and strength are crucial.

In addition, the seamless manufacturing method provides superior quality and performance, making these tubes essential for high-pressure and high-temperature environments. Also, the significant penetration of seamless tubes in these major industries is projected to drive substantial market growth throughout the forecast period.

By End-user Industry

The automotive industry segment is anticipated to grow rapidly throughout the forecast period, driven by the numerous applications of industrial tubes in vehicle manufacturing. A major factor contributing to this growth is the adoption of tube hydroforming, a technology that allows the production of lightweight automotive components, which not only enhances the structural integrity and performance of vehicles but also assists the industry's shift towards lightweight, fuel-efficient designs.

As a result, tube hydroforming is highly boosting revenue growth within the automotive industry segment, reflecting the increasing demand for advanced manufacturing solutions in the sector.

The Industrial Tubes Market Report is segmented on the basis of the following

By Type

- Process Pipes

- Mechanical Tubes

- Heat Exchanger Tubes

- Structural Tubes

- Hydraulic & Instrumentation Tubes

- Others

By Material

- Steel

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Non-Steel

By Manufacturing Method

By End-user Industry

- Oil & Gas and Petrochemical

- Automotive

- Mechanical & Engineering

- Construction

- Chemical

- Others

Regional Analysis

The Asia-Pacific region is projected to lead the global industrial tubes market in 2024, commanding a

41.7% share, which is due to the expanding manufacturing sector and rapid growth in the construction industry. Countries like India & China are experiencing significant industrialization and urbanization, along with higher usage of chemical products, all contributing to market revenue growth. The region is also witnessing growth in construction chemicals, industrial bulk packaging, and plastic compounding, enhancing demand for durable tube systems.

Over the past two decades, China's petrochemical sector has seen rapid investment and fierce competition, causing the development of large-scale facilities & more advanced industrial technologies. Also, India is experiencing significant growth in commercial infrastructure due to higher public investment. In addition, the region's automotive manufacturing capacity is expanding significantly, driven by strong demand, which is further boosting the need for industrial tubes.

Moreover, in North America, the industrial tubes market is also expected to see strong revenue growth throughout the forecast period. The United States & Canada are major contributors to this growth, mainly due to the increased use of seamless steel pipes in the automotive sector.

These pipes are essential for various applications, like automobile exhaust systems, cylinder blocks, liquid storage cylinders, side door anti-collision bars, and high-strength fasteners. Further, the higher demand for seamless steel pipes in these applications is driving the market forward, highlighting the region's significant role in the global industrial tubes market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the global industrial tube market is characterized by strong rivalry among key players, driven by technological developments and product innovation. Companies are aiming to enhance their product portfolios and expand their manufacturing capacities to meet growing demand across various sectors like oil and gas, automotive, construction, and chemicals.

Further, strategic collaborations, mergers, and acquisitions are common as businesses focus on strengthening their market positions and expanding their global footprint. In addition, there is a strong focus on R&D to introduce advanced, high-performance materials and improve manufacturing processes, further intensifying competition in the market.

Some of the prominent players in the Global Industrial Tubes Market are:

- Vallourec SA

- TPCO

- Tenaris

- JFE Steel Corporation

- Tata Steel

- Gerdau

- Jindal Saw Ltd

- VIZ Steel

- China Baowu Steel Group Corporation Limited

- Sandvik AB

- Other Key Players

Recent Developments

- In May 2024, Neopac introduced a new cosmetics tube line at its Wilson, NC plant. The advanced tube line will now support enhanced capacity and capabilities, enabling the production of an additional 70 million tubes per year, ranging in size from 25-40mm in diameter and 15-150ml in volume. The investment will feature full tube body colorations, and 7-color offset printing capabilities, with options for matte, silk, and glossy lacquers.

- In March 2024, Adani Group announced the start of the first phase of the world's largest single-location copper manufacturing plant at Mundra in Gujarat, which will help cut India's dependency on imports and help energy transition.

- In January 2024, Arcelor Mittal announces a partnership with the Indian Institute of Technology Madras (IIT Madras) and is working closely with IIT Madras’ Hyperloop Technology teams - Avishkar Hyperloop, student team, and TuTr Hyperloop, a start-up incubated at IIT Madras, that are creating an affordable Hyperloop technology for passenger and cargo mobility at scale.

- November 2023, Energy technology company Baker Hughes launched its new PythonPipe portfolio, the latest in reinforced thermoplastic pipe (RTP) technology that allows faster installation, reduced time to first production and lower lifecycle emissions. Also providing a 60% reduction in installation time and at one-fifth the cost of comparative steel installation, the PythonPipe portfolio includes American Petroleum Institute 15s qualified, flexible, and non-metallic RTP with a large selection of sizes, materials, and liner options.

- In June 2023, Corning Incorporated and SGD Pharma announced a joint venture including the opening of a new glass tubing facility to expand pharmaceutical manufacturing in India and allow SGD Pharma to adopt Corning’s Velocity Vial technology platform. Combining SGD Pharma’s vial-converting expertise with Corning’s proprietary glass-coating technology, the collaboration will improve vial quality, enhance filling-line productivity, and speed up the global delivery of injectable treatments.