The insulin delivery devices market encompasses the global industry focused on developing, manufacturing, and distributing these devices to help patients maintain better control over their diabetes.

In 2025, the insulin delivery devices market is poised for significant growth, presenting ample opportunities for both established and emerging businesses. As the global diabetes prevalence continues to rise, demand for innovative, user-friendly insulin delivery solutions is expected to increase.

Big players in the market, such as Novo Nordisk, Sanofi, and Eli Lilly, are focused on advancing technologies and expanding their portfolios. At the same time, newer and entry-level businesses can capitalize on the demand for affordability and simplicity, offering cost-effective solutions. Digital innovations like smartphone-integrated devices and needle-free options are expected to drive further expansion, creating a broader market for both established and startup companies.

Key trends in the insulin delivery devices market indicate a shift toward greater patient convenience and personalization. One major trend is the growing adoption of insulin pens, with 74% of patients finding them easier to use than traditional vial-and-syringe methods. This preference has led to an increased focus on simplifying design and improving the patient experience.

Additionally, technological advancements like connected insulin pens, wearable pumps, and automated insulin delivery systems are transforming the landscape, improving accuracy and making management more seamless. As the market continues to evolve, these innovations are likely to attract more patients, fostering long-term growth opportunities.

Key Takeaways

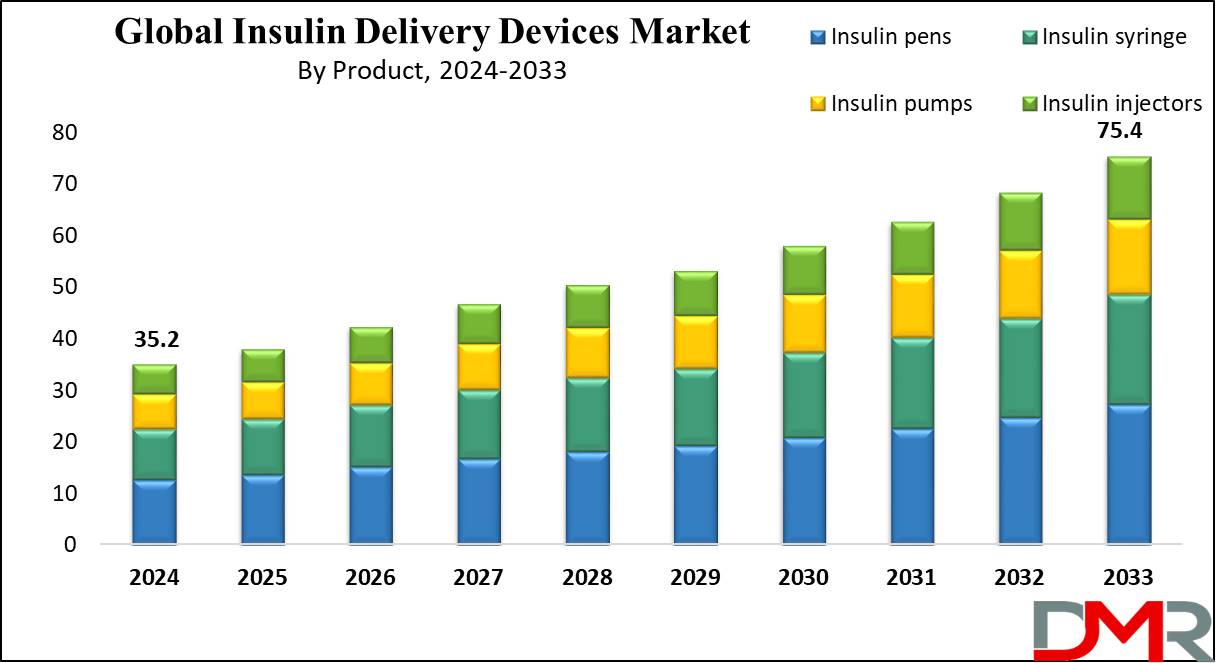

- The Global Insulin Delivery Devices Market is expected to dominate with USD 35.2 billion in 2024 and is anticipated to grow to USD 75.4 billion by 2033 at a CAGR of 8.8%.

- The insulin pens segment is expected to dominate the market with the largest revenue share of 36.0 % in 2024.

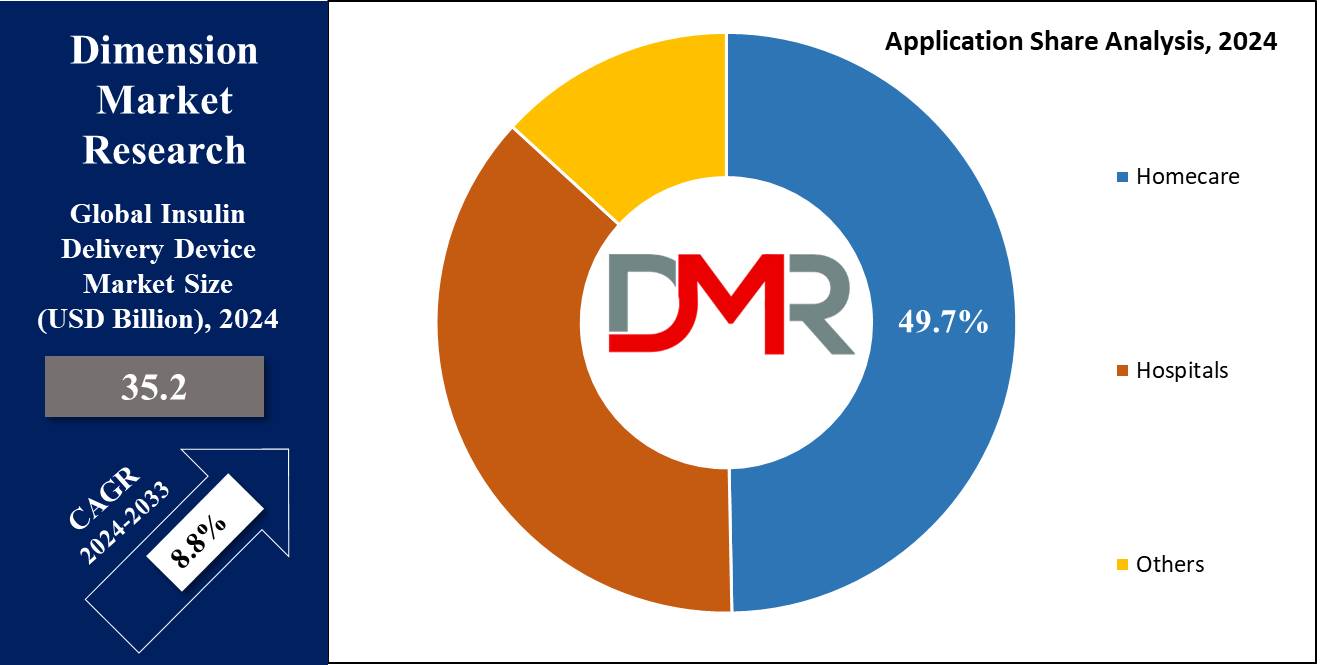

- This market is expected to be dominated by the home care segment, accounting for the highest revenue share of 49.7% in 2024.

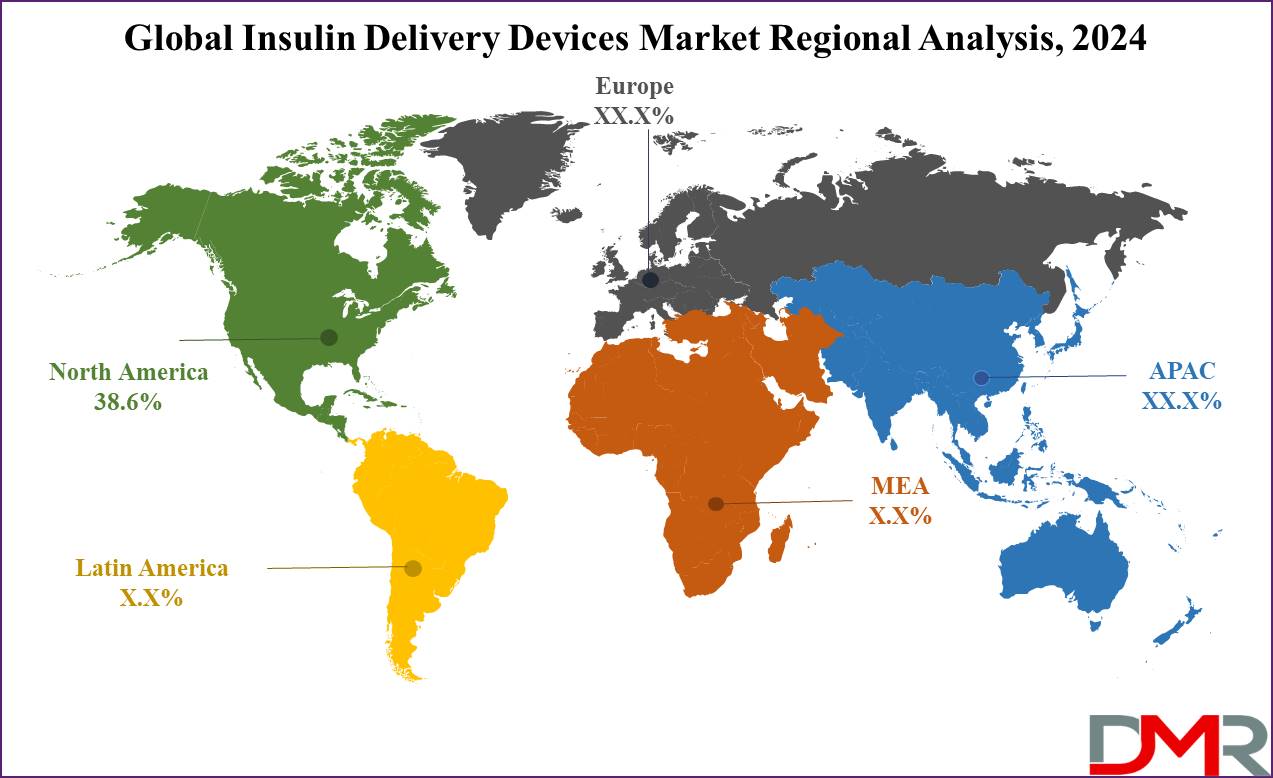

- North America is anticipated to dominate the market with the largest revenue of 38.6% in 2024.

Use Cases

- Insulin pens are widely used for regulating insulin conveniently and discreetly. They are particularly useful for patients who need daily insulin injections.

- Daily insulin delivery from insulin pumps helps to stable blood sugar levels during the night and in regular meals as it is helpful for those with type 1 diabetes, who need to have accurate insulin delivery day and night.

- Insulin syringes are used to collect insulin from containers and inject it into the skin beneath for the patient who prefers or requires manual injections.

- Insulin jet injectors provide an alternative to needle injections for the delivery of insulin as they reduce the discomfort of needle injections and can improve insulin therapy, especially in patients who are afraid of needles.

Market Dynamic

The major factor for market expansion is the growing occurrence of diabetes due to aging, obesity, and bad lifestyle choices. Diabetes incidence is strongly correlated with risk factors like obesity and overweight.

Consequently, the market for insulin delivery devices is rising, driven by the large population suffering from diabetes. The demand for chronic disease management and remote patient monitoring is directly tied to the increase in diabetes cases. Further, the growing demand for medical plastics extrusion market components for manufacturing insulin delivery devices will contribute to the market’s growth.

Also, patients are given access to a very dependable and practical solution due to the development of digital diabetes management technologies and their integration with insulin delivery devices. The rise of the healthcare virtual assistants also complements these developments by enabling patients to manage their condition effectively from home.

However, the growth of this market is hampered by strict government laws and regulations controlling the process of product approval and the high price of synthetic insulin. Nevertheless, the healthcare insurance market continues to grow, supporting coverage for these devices.

Research Scope and Analysis

By Product

The insulin pens segment is expected to dominate the market with the largest revenue share of 36.0 % in 2024 due to its benefits over other devices. Also, its popularity rate, easy-to-use design, and growing customer base are the main reasons that led to this segment's highest revenue share.

These devices are often prefilled with insulin, removing the need for manual drawing and measuring of insulin doses, as it is desired by patients who lead active lifestyles or who travel regularly.

Further, patients find it easier to use and less terrifying than syringes, particularly those who are newly diagnosed with diabetes. Further, growing use of pens among the geriatric consumer is also expected to boost the demand for this segment. In developing countries where patient capacity is low, reusable pen devices are predicted to grow.

The syringe segment is anticipated to grow with the highest CAGR during the forecasted period due to its availability and user-friendly and self-administerable characteristics. Moreover, insulin jet injections are needleless, while pumps are comfortably wearable by patients.

By Application

This market is expected to be dominated by the home care segment, accounting for the highest revenue share of 49.7% in 2024, and it continues to hold its position during the upcoming period.

The main reasons for this segment's significant expansion are rising patient adoption of these devices at home, as it reduces waiting times, hospital or clinic fees, and visit expenses.

The modern devices, which come in the form of pens, injectors, and pumps, are small, highly portable, and always useful. Insulin users are selecting self-care diabetes control solutions at home due to their improved ease of use and increased accessibility.

Moreover, the hospital segment is important in this market as it often uses devices like pumps and pens to manage blood sugar levels in diabetic patients, which allow for precise dosing and continuous delivery of insulin, enabling medical professionals to maintain insulin control among patients.

The Insulin Delivery Market Report is segmented based on the following

By Product

- Insulin syringes

- Insulin pens

- Insulin pumps

- Insulin injectors

By Application

- Homecare

- Hospitals

- Others

Regional Analysis

North America is expected to dominate the market and account for the largest revenue of 38.6% in 2024 due to rising population and the use of modern high technology device in this region. The growing occurrence of patients suffering from diabetes is anticipated to boost the market in this region.

Also, the market of this region is significantly growing due to the rising biotechnology industry and the availability of an equipped healthcare sector. Further, the growth of insulin storage in this region encourages the launch and availability of many devices, which also boosts the growth of the market. The market in this region is driven by a high awareness level among consumer and great healthcare spending by the government.

This market is anticipated to grow fast over the upcoming year in the Asia-Pacific region due to a high incidence of diabetes and growing awareness of the disease in developing countries like China and India.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The key players in this market are focused on expanding their portfolio through collaboration, mergers, and acquisitions, that also help them increase the market presence on a global level. Further companies are collaborating with local players to improve their market reach.

The manufacturer is focused on promoting innovation and advancement is a major factor for high revenue. For instance, Novo Nordisk launched a new device, NoVo Pen Echo with a memory function and half-unit dosage features. Foreign vendors are expanding their business and provide high end product for diabetes care.

Some of the prominent players in the global insulin delivery device market are

- Novo Nordisk A/S

- Sanofi

- Eli Lilly and Company

- Biocon Ltd.

- Ypsomed AG

- Wockhardt Ltd.

- Medtronic

- Abbott Laboratories

- F. Hoffmann-La Roche, Ltd.

- Others

Recent Development

- In June 2023, Novo Nordisk acquired BIO JAG which aimed of delivering cutting edge devices and delivery solutions to improve care for consumer across the globe living with serious chronic diseases.

- In February 2023, Eli Lilly partnered with IABL to supply its active pharmaceutical ingredient for human insulin at a reduced price in an effort to increase patient access and improve affordability for high-quality insulin.

- In January 2023, Embecta announced to open its new headquarters at 300 Kimball Drive, Suite 300, in Parsippany, New Jersey.

- In November 2022, Medtronic plc announced the launch of infusion set which is the first and only infusion set labelled for up to 7-day wear, used to delivers insulin from an insulin pump to the body and typically need a set change every two to three days.