Market Overview

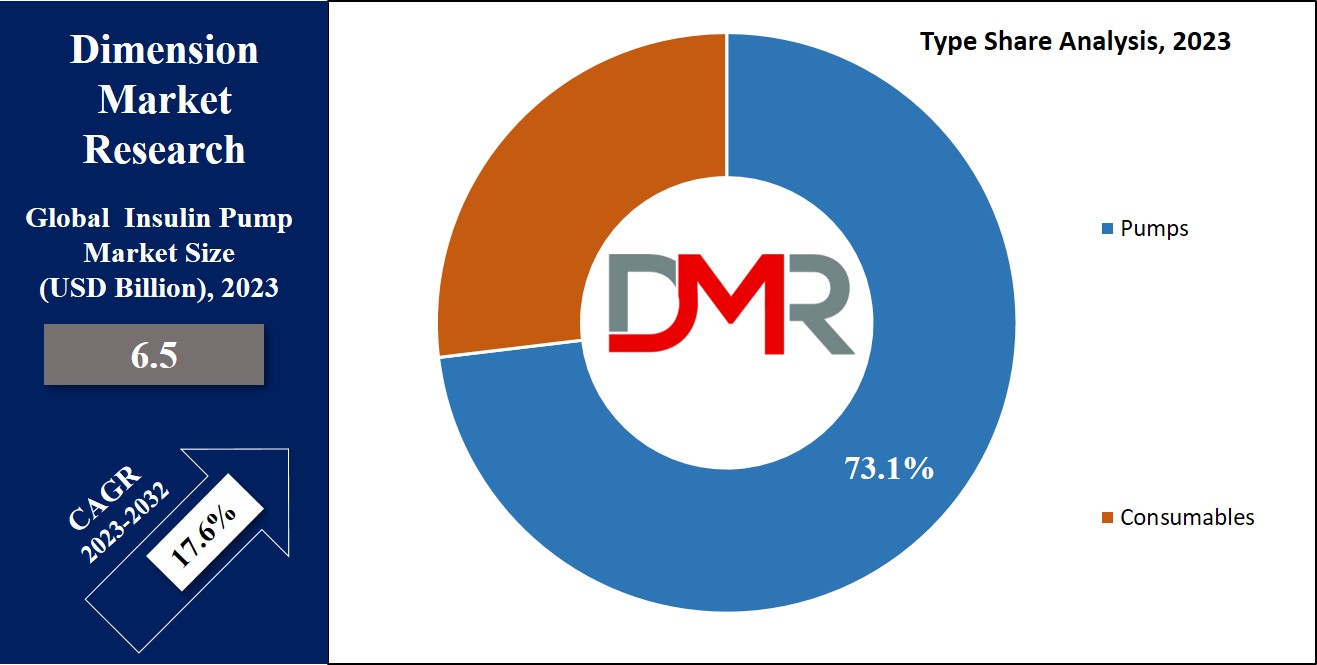

The Global Insulin Pump Market is expected to reach a market value of

USD 6.5 billion in 2023 and is further anticipated to reach a value of

USD 28.0 billion at a

CAGR of 17.6% for the forecast period (2023-2032).

The global insulin pump market is a dynamic sector within the

healthcare industry, primarily driven by the increasing prevalence of diabetic patients. This industry revolves around the development, manufacturing, and distribution of insulin pumps. These devices are designed to help individuals diagnosed with type 1 and 2 diabetes who need insulin, to effectively manage their blood glucose levels. The market consists of various types of insulin pumps, including patch and tethered pumps, as well as consumables like infusion sets and reservoirs used in conjunction with the pumps. However, many patients suffering from type 1 and type 2 diabetes prefers insulin pump therapy over multiple daily injections due to the convenience, precision, and improved blood glucose control offered by pumps. This shift in consumer preference drives the growth of the global insulin pump market.

Market Dynamic

The global insulin pump market is characterized by several factors that influence its growth are the rising number of diabetic patients, technological advancements in insulin pump devices, shifts in patient preferences, distribution channels such as retail pharmacies and online outlets, and regional variations in healthcare infrastructure and policies.

The growing cases of diabetes patients, both Type 1 and Type 2, are one of the major drivers of the insulin pump market. The ongoing research for the development of insulin pump design and functionality leads to technological advancements in the global insulin pump market. These developments include accuracy in results, easy use, connectivity with other health technologies (e.g., continuous glucose monitors), and the development of hybrid closed-loop systems, enhancing overall patient experience. Insulin pump manufacturers have been integrating many advanced features into their products, making it easier for healthcare providers to remotely monitor and adjust the insulin levels of diabetic patients. The COVID-19 pandemic further accelerated the adoption of insulin pumps instead of traditional insulin injections.

Research Scope and Analysis

By Type

Pumps dominate the insulin pump market in by type segment, as they hold 73.1% of the market share in 2023 and are expected to show significant growth in the forthcoming period of 2023 to 2032.

Insulin pumps, whether it is in the form of patch pumps or tethered pumps, are the core devices that deliver insulin to individuals who are suffering from diabetes. These pumps play an essential role in continuous and precise insulin delivery, making them the dominant force in the global insulin pump market. The pumps provide a continuous and customizable delivery of insulin according to the patient's requirement.

Insulin pumps are more convenient for diabetes patients as they reduce the need for multiple daily injections, offering a more comfortable method for insulin administration. Which is highly valued by patients suffering from diabetes, pushing the worth of the global insulin pump market.

Moreover, the continuous development of insulin pump technology has resulted in the development of user-friendly, feature-rich pumps which enhance patient experience and further boost the growth of pumps in the global insulin pump market.

By Disease Indication

Based on the disease indication, Type 1 diabetes dominates this segment as it holds the highest portion of the global insulin pump market in 2023 and is anticipated to show significant growth in the forecasted period of 2023 to 2032.

Type 1 diabetes patients lack insulin as the pancreas does not make insulin in their body, which is why they require regular and precise insulin administration to manage glucose levels in their blood, making them heavily dependent on insulin pumps for continuous insulin delivery. Type 1 diabetes patients are often diagnosed at a very young age, and many patients live with this condition for their entire lives. Consequently, that is why they require long-term diabetes management solutions to solve this problem and insulin pumps act as the ideal solution to the respective issue. It is recommended by many physicians around the world that people suffering from type 1 diabetes must maintain tight control over their blood glucose levels to prevent complications. Insulin pumps are the prominent choice for achieving stable blood sugar levels as they offer a high degree of precision and flexibility in insulin delivery.

Nowadays, many insulin pumps are integrated with continuous glucose monitoring (CGM) systems, that provide real-time data on the blood glucose levels of the patients. This is particularly valuable for people with Type 1 Diabetes who need to make rapid adjustments to their insulin delivery.

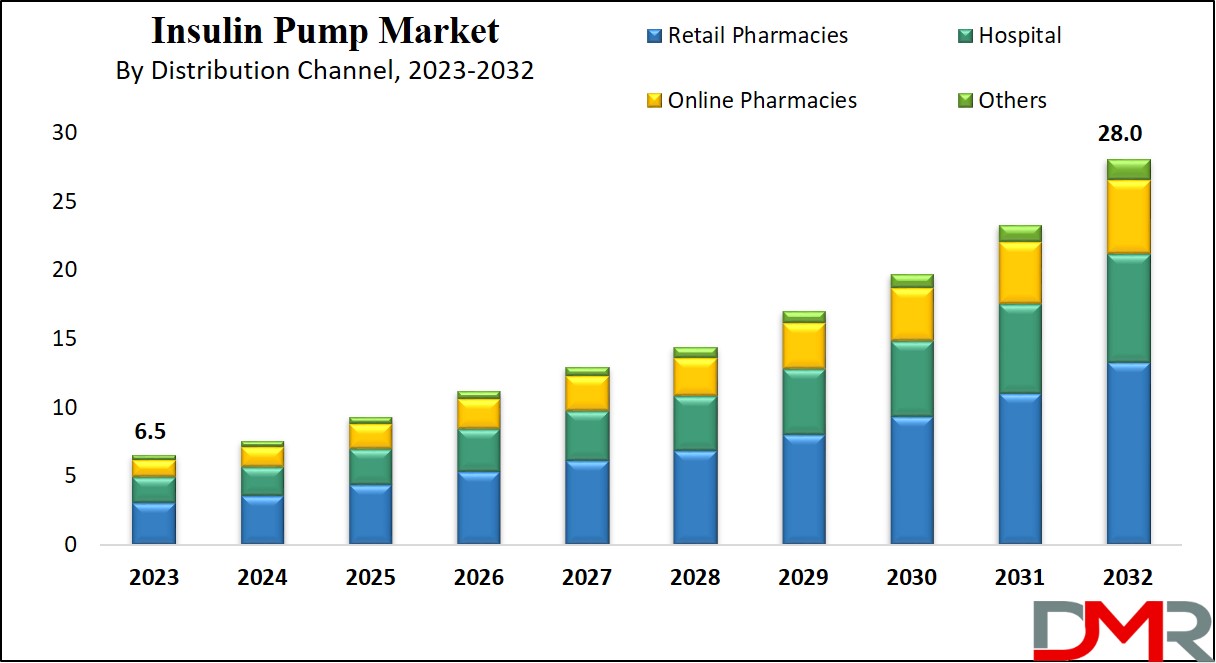

By Distribution Channel

In distribution channel segmentation, retail pharmacies dominate the global insulin pump market as it holds 47.2% of the market share in 2023.

Retail pharmacies are common and easily accessible all over the world, making them a prominent option for purchasing insulin pumps for consumers suffering from diabetes. Retail pharmacies are more convenient for diabetes patients, as they can easily visit their local pharmacy to consult with pharmacists, learn about different insulin pump options, and take the right pump according to their current condition. As, the retail pharmacies provide an opportunity for face-to-face consultations with pharmacists who can offer guidance and answer questions about insulin pump options, usage, and maintenance. This personalized interaction is valued by many patients and is one of the most prominent reasons why this segment dominates the global insulin pump market. Retail pharmacies keep a stock of insulin pumps in advance so that patients can obtain the pumps easily in cases of emergency.

Furthermore, retail pharmacies often offer facilities where patients can directly navigate with the insurance companies to solve the complex process of insurance reimbursement for insulin pumps. The pharmacists assist patients in the negotiation, processing of claims and ensuring that patients receive enough

medical coverage for their devices.

The Insulin Pump Market Report is segmented on the basis of the following:

By Type

- Pumps

- Patch Pumps

- Tethered Pumps

- Consumables

By Disease Indication

- Type 1 Diabetes

- Type 2 Diabetes

By Distribution Channel

- Retail Pharmacies

- Hospital

- Online Pharmacies

- Others

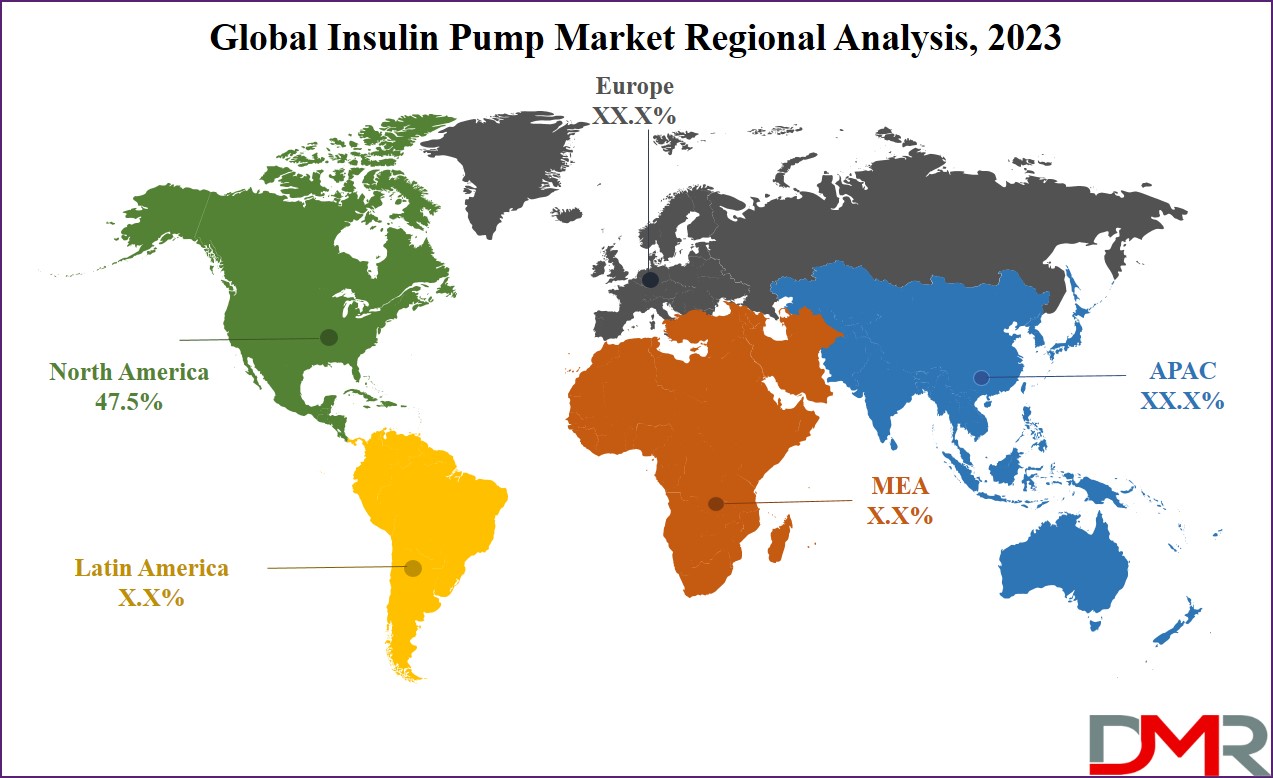

Regional Analysis

North America dominates the global insulin pump market as it holds 47.5% of market shares in 2023 and is expected to show significant growth in the forthcoming period of 2023 to 2032.

This region dominates this market as it has one of the highest numbers of diabetes patients in the world. The high number of diabetes patients in this region drives the demand for insulin pumps for diabetes patients. The region has a well-developed ecosystem of healthcare infrastructure and insurance systems that often cover the cost of insulin pumps for eligible patients. This easy accessibility of insulin pumps in the region further strengthens its position in the global insulin pump market.

Additionally, North America is the home of many major leading insulin manufacturers as they have built their manufacturing units and headquarters in this region. This region oversees heavy investments in the insulin pump market, which is fueling the development and growth of insulin pump technology, making these devices more efficient, user-friendly, and integrated with other healthcare technologies. These factors collectively contribute to North America's dominant position in the global insulin pump market. While other regions are still growing and gaining their place in the global market, North America remains a key hub for insulin pump manufacturers.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global insulin pump market features a competitive landscape with several key players vying and competing with each other to gain a competitive edge over one another. Leading companies in the global insulin pump market include many industry giants like Medtronic, which offers a wide range of insulin pumps and glucose monitoring systems, placing them at the top of the global insulin pump market. Also, Insulet Corporation has gained a huge place in this market as it offers a tubeless Omnipod System, focusing on user convenience and portability.

There are a variety of factors such as customization of pumps, and integration of pumps with digital health technology are key areas of competition as these companies are heavily investing in research and development to meet the ever-growing demand of the global insulin pump market. Some of the prominent players in the Global Insulin Pump Market include Hoffmann-La Roche Ltd, Tandem Diabetic Care Inc., Insulet Corporation, Cellenovo, Jiangsu Delfu Co. Ltd., Medtronic, Nipro Diagnostic Inc., Sooil Development, Tandem Diabetes Care Inc., Valeritas Inc., Ypsomed AG, JingasuDelfu Co. Ltd. and others

Some of the prominent players in the Global Insulin Pump Market are:

- Medtronic

- Hoffmann-La Roche Ltd

- Tandem Diabetic Care Inc.

- Insulet Corporation

- Cellenovo

- Jiangsu Delfu Co. Ltd.

- Medtronic

- Nipro Diagnostic Inc.

- Sooil Development

- Tandem Diabetes Care Inc.

- Valeritas Inc.

- JingasuDelfu Co. Ltd.

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Insulin Pump Market:

The global insulin pump market underwent significant changes during the COVID-19 pandemic and the subsequent economic recession. As, in the initial phase, the pandemic accelerated the adoption of insulin pump technology in the healthcare sector, as it allowed to monitor diabetic patients remotely. It reduced the requirement for in-person medical visits, which became riskier during the COVID-19 pandemic, which boosted demand for insulin pumps. Moreover, the economic recession that followed the pandemic put economic and financial constraints on individuals and healthcare systems. This economic strain slowed the growth of the global insulin pump market, as both consumers and healthcare providers had become more cautious about investing in insulin pumps.

Despite the challenges pushed forward by the COVID-19 pandemic, government support and healthcare policies aimed at improving the lives of diabetic patients sustained demand. Moreover, the manufacturers adapted to the changing market trend by introducing more user-friendly and cost-effective insulin pump models.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 6.5 Bn |

| Forecast Value (2032) |

USD 28.0 Bn |

| CAGR (2023-2032) |

17.6% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Pumps and Consumables), By Disease

Indication (Type 1 Diabetes and Type 2 Diabetes), By

Distribution Channel (Retail Pharmacies, Hospital,

Online Pharmacies and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Medtronic, Hoffmann-La Roche Ltd, Tandem Diabetic

Care Inc., Insulet Corporation, Cellenovo, Jiangsu

Delfu Co. Ltd, Nipro Diagnostic Inc., Sooil

Development, Tandem Diabetes Care Inc., Valeritas

Inc., JingasuDelfu Co. Ltd, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Insulin Pump Market is expected to reach a value of USD 6.5 billion in 2023.

The Global Insulin Pump Market is expected to grow at a compound annual growth rate of 17.6% from

2023 to 2032.

North America dominates the Global Insulin Pump Market accounting for 47.5% in 2023.

Some of the prominent players in the Global Insulin Pump Market include Hoffmann-La Roche Ltd,

Tandem Diabetic Care Inc., Insulet Corporation, Cellenovo, Jiangsu Delfu Co. Ltd., Medtronic, Nipro

Diagnostic Inc., Sooil Development, Tandem Diabetes Care Inc., Valeritas Inc., Ypsomed AG, JingasuDelfu

Co. Ltd. and others.