Insurtech Market Overview

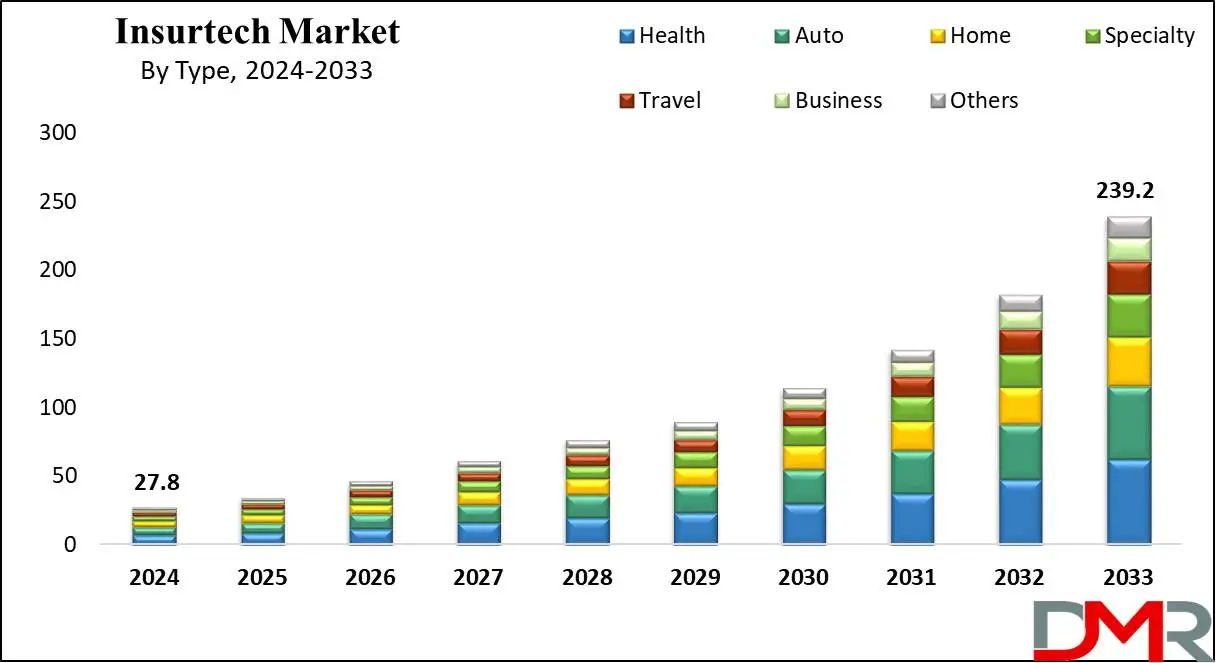

The Global Insurtech Market is projected to reach USD 27.8 billion in 2024 and grow at a compound annual growth rate of 27.0% from there until 2033 to reach a value of USD 239.2 billion.

Insurtech means the use of technology and innovative approaches to improve and transform the insurance industry, which term combines "insurance" and "technology," highlighting the integration of digital solutions & development to enhance various aspects of insurance services. As part of the expanding digital insurance technology ecosystem, it focuses on enhancing customer experience, reducing operational costs, enhancing risk assessment, and driving innovation within the insurance industry, making it more accessible, efficient, and responsive to modern needs.

Digital technologies play a crucial role in understanding customer needs and evolving offerings to meet ever-evolving customer demands. According to an EIS Group software company survey from 2021, 59% of insurance companies increased their investments in digital infrastructure during that year; blockchain stood out among these technologies due to its cost savings, faster payments, fraud mitigation features and popularity with insurance firms.

This technology can be found used in Know Your Customer (KYC), Anti-Money Laundering (AML), claims handling processes, or peer-to-peer insurance models as examples, demonstrating how insurance technology innovations continue to reshape the sector.

Insurtech companies are increasingly teaming up with insurance firms to implement blockchain-based solutions. Amodo, an insurtech firm, collaborated with Galileo Platforms Limited - a technology firm - in December 2021, to implement this blockchain technology and help insurers introduce innovative products while improving customer experiences.

Cryptocurrency payments have also made strides within the industry; Metromile Auto Insurance announced plans in December 2021 to accept crypto payments both for premium payments and claims settlement purposes as part of an effort to strengthen market presence while staying abrrive emerging trends.

Coinlaw reports that early-stage investments constitute 35% of total insurtech funding in 2024, highlighting strong interest in innovation-driven startups. Mergers and acquisitions in the sector hit a record 70 deals in Q1 2024, as companies pursued scalability and new market access.

Funding for AI and automation-based insurtech solutions climbed 23% year-over-year, reinforcing the industry's commitment to tech-driven efficiency. The number of insurtech unicorns—companies valued at over $1 billion—expanded by 15%, reaching 30 by 2024.

While the U.S. and Europe maintain dominance in insurtech funding, the Asia-Pacific region recorded a 45% surge in investments, reflecting growing demand for digital insurance solutions. Embedded insurance models also gained traction, attracting nearly $1.5 billion in funding as non-insurance businesses continued integrating insurance products into their offerings.

In a positive shift towards inclusivity, female-led insurtech startups secured 20% more funding than in 2023. Within Europe, the UK and Germany accounted for nearly 55% of all regional insurtech investments in 2024.

The US Insurtech Market

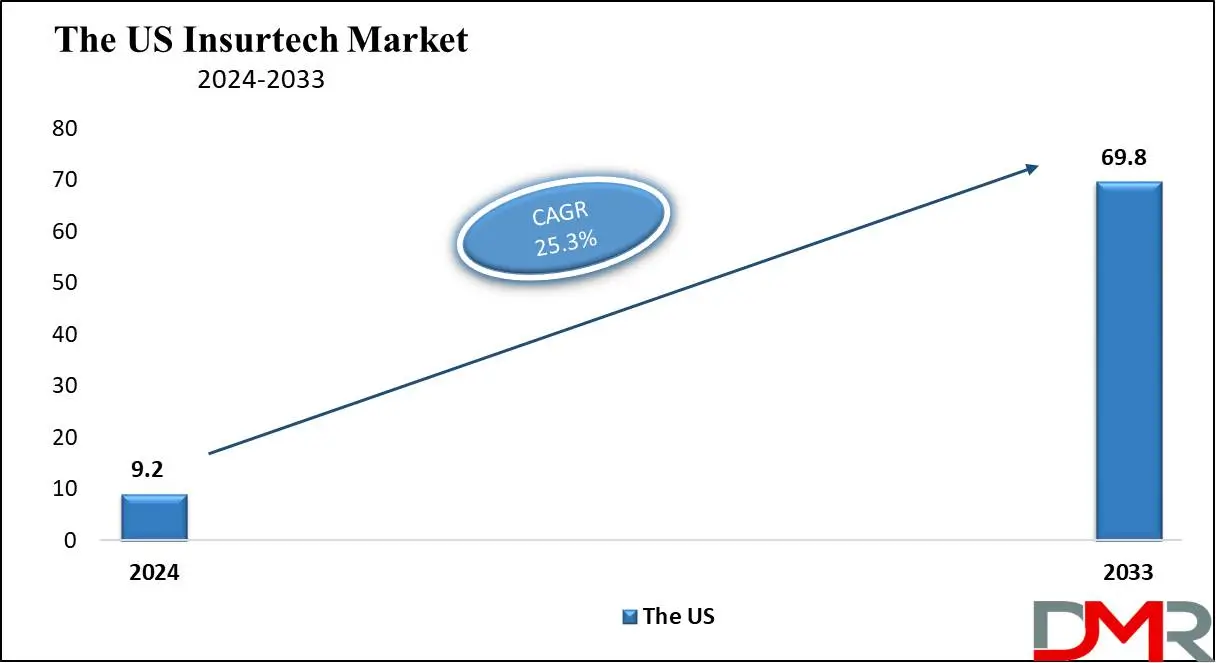

The

US Insurtech Market is projected to reach

USD 9.2 billion in 2024 at a compound annual

growth rate of 25.3% over its forecast period.

The insurtech market in the US provides growth opportunities through the adoption of advanced technologies like AI and

machine learning, improving customer experience and operational efficiency. The growth in the demand for customized insurance products and seamless digital platforms provides further potential. In addition, expanding partnerships between traditional insurers and tech startups can drive innovation and address transforming consumer needs in the insurance landscape.

Further, it is driven by developments in technology, like

Artificial Intelligence and data analytics, allowing personalized services and better efficiency. However, regulatory challenges and compliance complexities pose many restraints, making it difficult for new players to navigate the insurance landscape. Balancing innovation with regulatory requirements will be crucial for sustained market growth.

Insurtech Market Key Takeaways

- Market Growth: The Insurtech Market size is expected to grow by 204.7 billion, at a CAGR of 27.0% during the forecasted period of 2025 to 2033.

- By Type: The health segment is anticipated to get the majority share of the Insurtech Market in 2024.

- By Technology: The cloud computing segment is expected to be leading the market in 2024

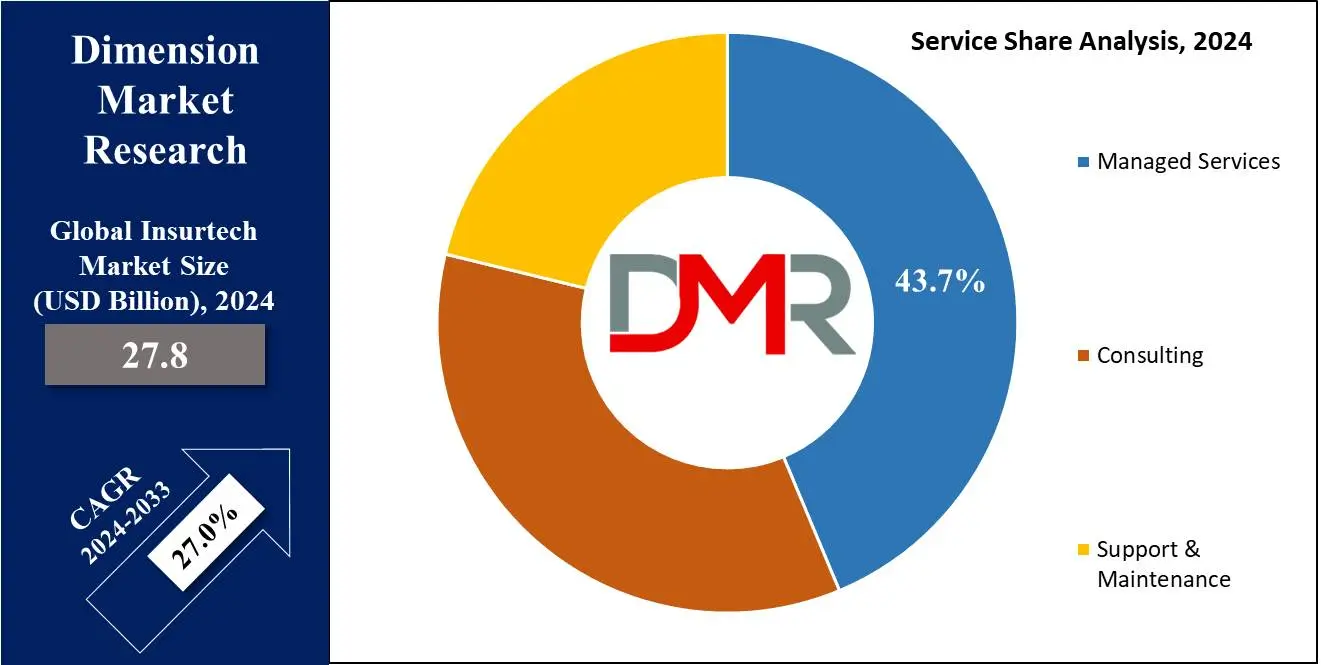

- By Service: The managed service segment is expected to get the largest revenue share in 2024 in the Insurtech Market.

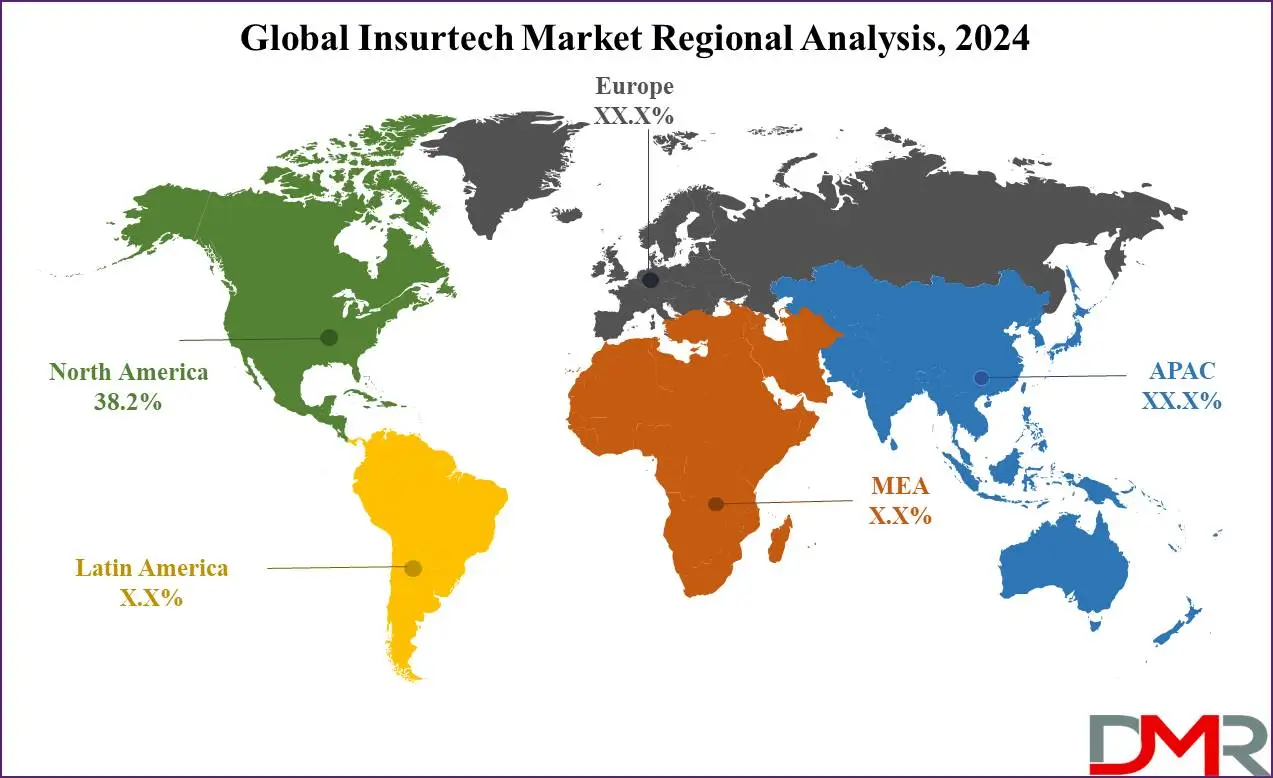

- Regional Insight: North America is expected to hold a 38.2% share of revenue in the Global Insurtech Market in 2024.

- Use Cases: Some of the use cases of Smart Parking systems include automated claims processing, peer-to-peer insurance, and more.

Insurtech Market Use Cases

- On-Demand Insurance: Insurtech platforms enable customers to purchase insurance coverage for specific events or periods, like travel or rental cars, which meets the demand of modern consumers, who prefer only paying for coverage when they require it.

- Data-Driven Risk Assessment: Insurtech companies use big data and AI analytics to improve underwriting processes. By analyzing a variety of data points, they can more accurately assess risk, set premiums, and reduce fraud, resulting in improved profitability.

- Automated Claims Processing: Using AI and machine learning, Insurtech firms simplify the claims process by automating tasks like documentation, verification, and payout, which speeds up claim resolution, increases customer satisfaction, and reduces operational costs.

- Peer-to-Peer Insurance: Insurtech introduces models where groups of individuals pool their resources to provide coverage for each other, which can lower costs and support trust among members, promoting a more personalized insurance experience.

Insurtech Market Dynamic

Driving Factors

Technological Advancements

The quick development of technologies like AI, machine learning, and blockchain is transforming the insurance landscape. These innovations improve data analytics, streamline operations, and enhance customer engagement, leading to more personalized and efficient insurance solutions.

Changing Consumer Preferences

Consumers highly demand more flexibility, transparency, and convenience in their insurance experiences, as the growth of digital platforms and mobile apps allows Insurtech companies to meet these expectations by providing on-demand coverage, easy policy management, and simple claims processes, driving market growth.

Restraints

Regulatory Challenges

The insurance industry is heavily regulated, and Insurtech companies face complex compliance requirements that can differ by region. Navigating these regulations can be time-consuming and costly, potentially impacting innovation and market entry for new players.

Data Privacy Concerns

As Insurtech highly on data collection and analysis, concerns regarding data privacy and security are important. Customers may be hesitant to share personal information, and any data breaches can damage trust & reputation, creating a barrier to growth in the industry.

Opportunities

Expansion into Emerging Markets

Various emerging economies have low insurance penetration rates, providing a major growth opportunity for Insurtech companies. By providing affordable, accessible, and technology-driven insurance products customized to local needs, these companies can capture untapped markets and promote financial inclusion.

Integration of IoT and Wearable Technology

The increase in the adoption of Internet of Things (IoT) devices and

wearable technology unlocks new avenues for data collection and risk assessment. Insurtech firms can use this data to offer customized insurance products, real-time monitoring, and proactive risk management solutions, improving customer engagement and reducing claims.

Trends

Rise of Embedded Insurance

Insurtech companies are highly integrating insurance providing directly into other products and services, a concept known as embedded insurance, which allows consumers to purchase coverage smoothly at the point of sale, enhancing customer convenience and driving insurance adoption across many industries, like travel, e-commerce, and automotive.

Focus on Sustainability and ESG Practices

There is an increase in the focus on environmental, social, and governance (ESG) factors within the insurtech market. Companies are creating products that promote sustainable practices, like carbon offset insurance or coverage for renewable energy projects, appealing to environmentally conscious consumers and investors while contributing to a more sustainable future.

Research Scope and Analysis

By Type

The health segment is projected to lead the insurtech market in 2024, capturing a majority share of global revenue. The increase in the demand for digital platforms that connect exchanges, brokers, providers, and insurers in the health insurance sector is likely to drive this trend, as they are highly turning to advanced analytics to better understand and serve their customers.

Many health insurance companies are adopting insurtech solutions to smooth their claims processing, making it more efficient. In addition, insurers are integrating mobility features into their health services to improve customer convenience. Further, the home insurance segment is anticipated to experience the highest growth during the forecast period, as various home insurance companies are looking to create innovative products customized for both commercial and residential real estate professionals, along with their tenants and residents.

To achieve this, they are implementing insurtech solutions that expand the time from listing to leasing. These solutions use AI technology to develop customized insurance policies and efficiently manage claims, often removing the need for insurance brokers, which allows companies to better meet the needs of their customers in a fast-paced market.

By Technology

The cloud computing segment is expected to significantly boost the insurtech market, contributing a majority share of revenue in 2024. Cloud technology has transformed the insurance industry by providing greater flexibility, ease of deployment, and intelligent solutions, so the large adoption of Bring Your Own Device (BYOD) policies, along with the rise in the volume of data collected by insurance companies, is likely to drive growth in this area.

Insurers are highly using cloud computing because of its advantages, like rapid deployment, affordable, and scalability. In addition, partnerships between cloud service providers and insurance companies are improving the development of innovative insurtech products, which is anticipated to drive market growth.

Further, the blockchain segment is anticipated to see the highest growth during the forecast period. Blockchain technology enables insurance companies to lower operational costs and enhance efficiencies, which supports innovation, connects many insurtech platforms, and allows new services to reach the market, mainly for those who previously lacked access to insurance.

Insurtech firms are likely to aggressively adopt blockchain due to its features, like smart contracts, advanced automation, and strong online security., which will help drive further development in the industry, making insurance more accessible and efficient.

By Service

The managed services segment is anticipated to capture the largest share of revenue in the insurtech market by 2024. Managed service providers provide insurers with a strategic pathway to transformation by integrating their expertise with new technologies. They also deliver best practices, operational efficiencies, and compliance support to insurers, which allows insurance companies to tackle challenges & seize opportunities in IT and operations.

As insurers highly recognize the value of advanced business models, the managed services sector is expected for significant growth. In addition, the support & maintenance segment is anticipated to see the highest growth during the forecast period, which can be attributed to the rising adoption of advanced technologies and distribution channels by insurance companies.

Many insurers across the world are focusing on implementing advanced e-technology and adapting legacy software to meet specific needs., which is expected to drive demand for support & maintenance services around the world, as companies seek reliable solutions to improve their operations and customer experiences. By investing in these areas, insurers can ensure they remain competitive in a fast evolving market.

By End User

The BFSI (Banking, Financial Services, and Insurance) segment is expected to lead the insurtech market, holding the largest share of global revenue by 2024, as they are highly adopting insurtech solutions to improve their operational efficiency. With the growth in connected devices within BFSI, a large volume of data is being generated.

Insurance companies have recognized the potential of this data to enhance services, reduce costs, and increase revenue through valuable insights. In addition, the global growth in smartphone usage is further driving the demand for insurtech solutions in this sector. Further, the healthcare segment is anticipated to grow the fastest during the forecast period. As the insurance sector becomes more digitized, healthcare organizations are turning to insurtech solutions to enhance data management and monitoring.

The expansion of devices has created a demand for better handling of information within healthcare companies. Customers are also looking for easier access to insurance technology services as they become more digitally savvy. Moreover, the growth in the adoption of blockchain technology among health and life insurance providers is expected to contribute significantly to the growth of this segment.

The Insurtech Market Report is segmented on the basis of the following

By Type

- Health

- Auto

- Home

- Specialty

- Travel

- Business

- Others

By Technology

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

By Service

- Consulting

- Support & Maintenance

- Managed Services

By End User

- BFSI

- Automotive

- Manufacturing

- Transportation

- Government

- Health

- Retail

- Others

How Does Artificial Intelligence Contribute To Improve Insurtech Market ?

- Risk Assessment and Pricing: AI-powered predictive analytics helps insurers evaluate risks more accurately, enabling personalized pricing based on customer behavior and real-time data.

- Fraud Detection: Advanced machine learning algorithms detect unusual patterns and potential fraud in claims, improving security and reducing financial losses.

- Claims Processing: AI streamlines claims handling through automation, reducing processing time and minimizing errors, leading to faster settlements.

- Customer Experience: AI-driven chatbots and virtual assistants provide 24/7 customer support, ensuring quick responses to queries and seamless onboarding experiences.

- Product Customization: Insurtech firms leverage AI to analyze customer data and offer tailored insurance products, improving relevance and customer engagement.

- Underwriting Efficiency: AI enhances underwriting processes by automating data collection and risk analysis, leading to faster and more accurate decisions.

- Predictive Maintenance: In industries like auto and health insurance, AI predicts potential issues (e.g., vehicle breakdowns or health risks) and recommends preventive actions.

- Market Insights: AI tools analyze vast datasets to uncover market trends, helping insurers make informed strategic decisions and optimize their portfolios.

Insurtech Market Regional Analysis

North America is anticipated to lead the insurtech market in 2024,

capturing over 38.2% of the global revenue, which is driven by higher customer spending on insurance products and the need for customizable and flexible plans, mainly in property and health insurance.

In addition, the rise in the number of insurtech startups in the region is further boosting market expansion as these companies introduce innovative solutions that meet consumer needs. In addition, the Asia Pacific region is expected to become the fastest-growing insurtech market during the forecast period, which is driven by the presence of various emerging economies and financial hubs, like Singapore, India, and Hong Kong.

Insurance providers in this region are aiming to offer affordable premium plans to attract more customers. Furthermore, the growing penetration of smartphones in Asia Pacific countries is likely to drive the adoption of insurtech solutions, as mobile look to insurance services becomes more prevalent, which positions the Asia Pacific region for significant growth in the insurtech sector.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Insurtech Market Competitive Landscape

The Insurtech market has a distinctive competitive landscape with both established insurance companies and innovative startups. Traditional insurers are accepting new technologies to improve their services, while startups look to disrupt the market with fresh ideas and customer-centric solutions.

Key players collaborate with tech firms to enhance data analytics, simple processes, and create customized offerings. As consumer expectations transform, competition intensifies, driving companies to create unique products and use digital platforms, which promotes innovation, making insurance more accessible and customized to individual needs.

Some of the prominent players in the Global Insurtech are

- DXC Technology Company

- Insurance Technology Services

- Shift Technology

- Damco Group

- Wipro Ltd

- ZhongAn Insurance

- Quantemplate

- Appian

- EIS Group

- Prima Solutions

- Other Key Players

Insurtech Market Recent Developments

- In October 2024, Insurity unveiled that Insurance at Glia will provide a keynote address at Excellence in Insurance, which is designed as a peer forum for insurance and MGA executives and professionals and would bring together over 300 experts from 115+ leading insurance companies and MGAs to network, discuss, and generate innovative ideas to propel P&C insurance forward.

- In September 2024, Bharatsure launched four insurance products for gig workers, students, digital users and companies looking for advanced employee benefits, which provide health and personal accident coverage at a premium payment of Rs 69 monthly and already insure 20,000 gig workers in logistics, mobility, and staffing and hospitalization and accidental injury or death.

- In August 2024, NEXT Insurance announced that it has been named to CNBC's inaugural list of the World's Top Insurtech Companies of 2024 in the digital insurer category, which highlights the transformative power of its early investment in technology to transform small business insurance and address a critical market gap in the industry.

Insurtech Market Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 27.8 Bn |

| Forecast Value (2033) |

USD 239.2 Bn |

| CAGR (2024-2033) |

27.0% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 9.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Health, Auto, Home, Specialty, Travel, Business, and Others), By Technology (Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory, and Others), By Service (Consulting, Support & Maintenance, and Managed Services), By End User (BFSI, Automotive, Manufacturing, Transportation, Government, Health, Retail, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

DXC Technology Company, Insurance Technology Services, Shift Technology, Damco Group, Wipro Ltd, ZhongAn Insurance, Quantemplate, Appian, EIS Group, Prima Solutions, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Insurtech Market size is expected to reach a value of USD 27.8 billion in 2024 and is expected to reach USD 239.2 billion by the end of 2033.

North America is expected to have the largest market share in the Global Insurtech Market with a share of about 38.2% in 2024.

The Insurtech Market in the US is expected to reach USD 9.2 billion in 2024.

Some of the major key players in the Global Insurtech Market are DXC Technology Company, Insurance Technology Services, Shift Technology, and others.

The market is growing at a CAGR of 27.0 percent over the forecasted period.