Market Overview

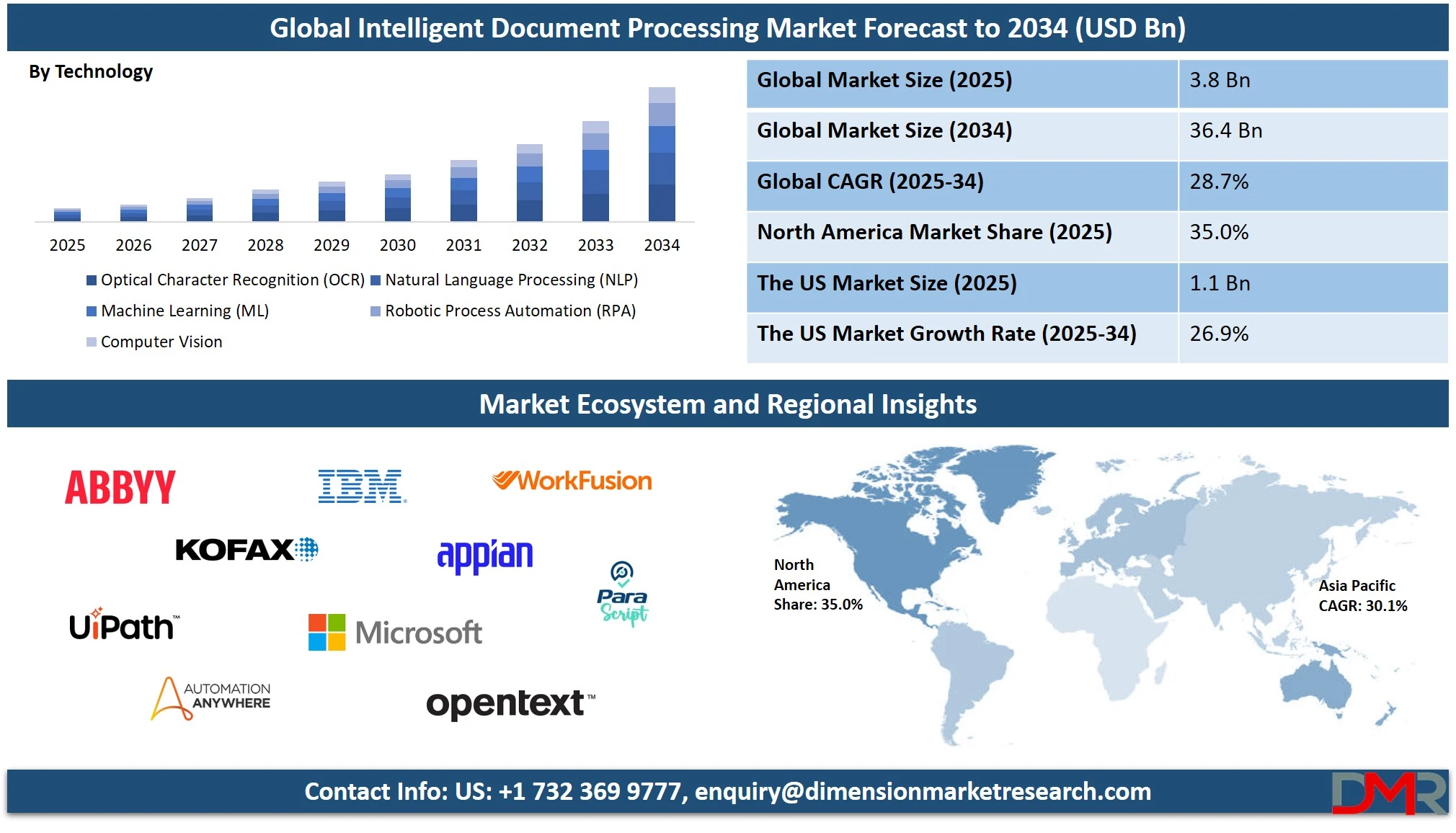

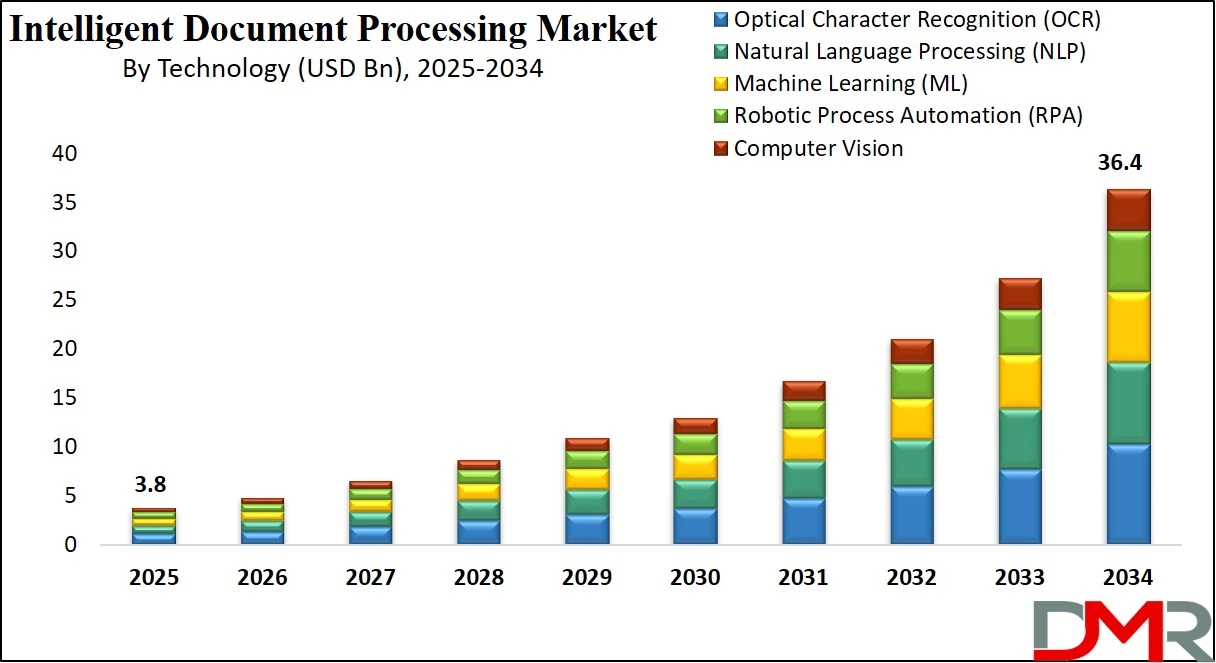

The Global Intelligent Document Processing (IDP) Market is projected to grow from USD 3.8 billion in 2025 to USD 36.4 billion by 2034, expanding at a robust CAGR of 28.7%. This growth is driven by the growing adoption of AI-powered document automation, cognitive data extraction, and end-to-end workflow optimization across industries.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Intelligent Document Processing (IDP) software is an advanced automation solution that leverages technologies such as artificial intelligence, machine learning,

natural language processing, and optical character recognition to automatically extract, classify, validate, and process data from a wide variety of structured, semi-structured, and unstructured documents.

These platforms are designed to handle high volumes of documents like invoices, receipts, contracts, forms, and emails, significantly reducing manual input while improving data accuracy and operational efficiency.

IDP tools enable seamless integration with enterprise systems, supporting end-to-end document workflow automation across industries such as banking, healthcare, insurance, and government. By combining cognitive automation and contextual understanding, IDP software empowers organizations to streamline back-office operations, ensure compliance, and enhance decision-making with actionable insights.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global Intelligent Document Processing market has witnessed remarkable growth as organizations pursue digital transformation and seek to automate data-intensive business processes. Rising demand for paperless workflows, enhanced operational efficiency, and real-time analytics is driving widespread adoption of IDP solutions across diverse sectors.

Enterprises are turning to AI-powered document automation to tackle complex use cases such as claims processing, KYC verification, invoice handling, and regulatory documentation. As the volume of enterprise content continues to rise, the need for scalable and intelligent data extraction tools is becoming a strategic priority for CIOs and digital leaders globally.

The market is further propelled by the rapid integration of cloud-based platforms, API-driven architectures, and low-code automation capabilities, enabling faster deployment and scalability for businesses of all sizes. Additionally, the emergence of intelligent bots, real-time data validation, and multilingual document processing is expanding the functional capabilities of IDP systems.

Regional growth in markets such as the Asia Pacific and Latin America is fueled by increased investments in digital infrastructure, government initiatives promoting automation, and a growing ecosystem of technology providers. As organizations strive to unlock business value from unstructured data, the Intelligent Document Processing market is positioned to become a cornerstone of next-generation enterprise automation strategies.

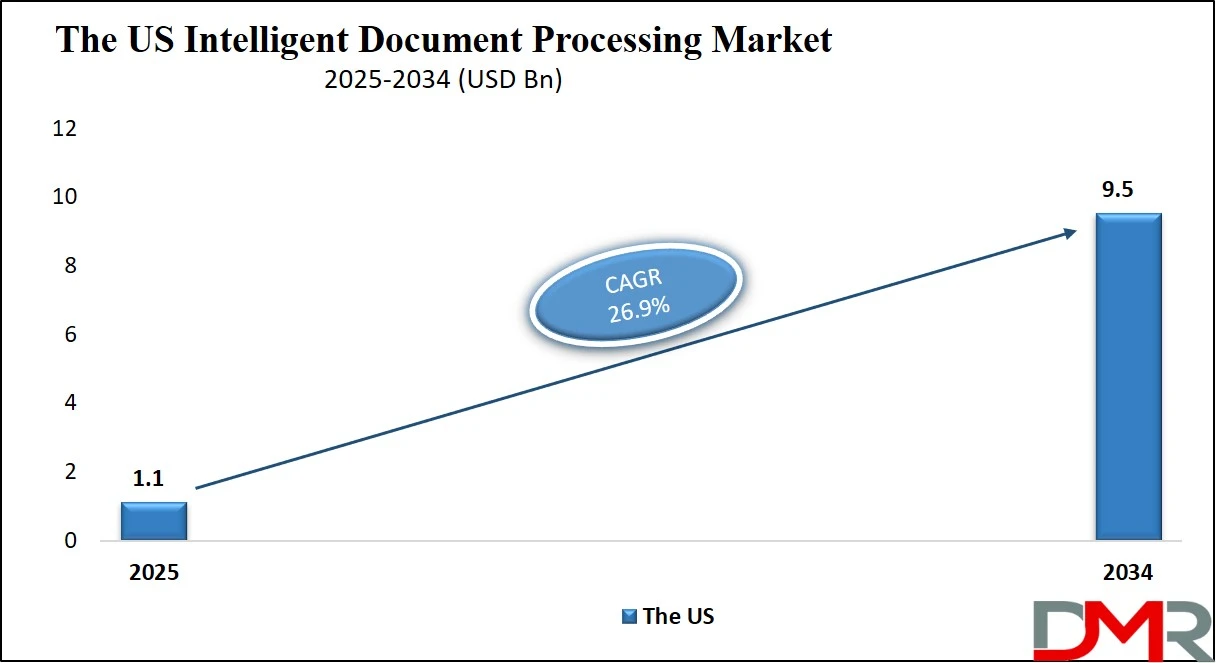

The US Intelligent Document Processing Market

The U.S. Intelligent Document Processing Market size is projected to be valued at USD 1.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 9.5 billion in 2034 at a CAGR of 26.9%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The United States Intelligent Document Processing (IDP) market is witnessing significant growth as enterprises rapidly embrace automation to manage large volumes of structured and unstructured data. With a strong presence of technology innovators and early adopters, the US leads in deploying AI-driven document automation solutions across sectors such as banking, insurance, healthcare, and government.

Organizations are leveraging intelligent OCR, natural language processing, and machine learning algorithms to streamline high-volume tasks like invoice processing, claims management, customer onboarding, and regulatory compliance. The rising demand for cloud-based IDP platforms and API-integrated systems is further enabling real-time document classification, smart data capture, and seamless integration with enterprise content management and robotic process automation (RPA) systems.

Regulatory pressures, the push for digital transformation, and the need to reduce operational costs are accelerating IDP adoption across small and large enterprises in the US. The growing emphasis on remote work, paperless workflows, and secure document handling has fueled investment in advanced IDP solutions with capabilities such as multi-language support, intelligent validation, and adaptive learning.

Additionally, the presence of key players such as IBM, Microsoft, Kofax, and UiPath has fostered a competitive innovation landscape. With growing awareness of the benefits of intelligent document workflows, integrated with scalable SaaS-based deployments, the US market is expected to maintain its dominance in the global IDP ecosystem over the coming years.

Europe Intelligent Document Processing Market

The Europe Intelligent Document Processing (IDP) market is projected to reach approximately USD 1.0 billion in 2025. This significant share underscores Europe’s position as a mature and technologically advanced region with widespread adoption of intelligent automation tools.

The surge in demand is being fueled by stringent regulatory compliance requirements such as GDPR, which have compelled enterprises, particularly within the BFSI, healthcare, and public sectors, to adopt secure and efficient document management solutions. Countries like Germany, the United Kingdom, France, and the Netherlands are at the forefront of this transition, driven by growing investments in AI, machine learning, and cloud-based document processing systems.

The European IDP market is expected to grow at a robust CAGR of 26.8% from 2025 to 2034, supported by rising enterprise-level digital transformation initiatives and government-backed AI innovation programs. As organizations deal with rising volumes of unstructured and semi-structured data, there is a growing emphasis on intelligent automation to streamline workflows, enhance compliance, and reduce operational costs.

Moreover, the growing collaboration between European tech firms and IDP solution providers, integrated with the region’s strong focus on sustainability and data privacy, is set to further accelerate adoption. This evolving landscape positions Europe as one of the most progressive and opportunity-rich regions for intelligent document processing over the next decade.

Japan Intelligent Document Processing Market

The Intelligent Document Processing (IDP) market in Japan is estimated to reach approximately USD 190 million in 2025. Although relatively modest in size compared to regions like North America and Europe, Japan’s IDP adoption is gaining momentum due to its pressing need for workflow automation and operational efficiency. With a high reliance on paper-based documentation, especially in traditional sectors such as manufacturing, government, and financial services, Japanese enterprises are gradually embracing intelligent automation to improve document handling, enhance productivity, and reduce human error.

Japan’s IDP market is projected to grow at a strong CAGR of 25.5% between 2025 and 2034, driven by the country’s demographic challenges, including an aging workforce and labor shortages. These issues are pushing organizations to invest in technologies that minimize manual tasks and optimize back-office operations.

Additionally, Japan’s well-established tech ecosystem and commitment to robotics and artificial intelligence provide a solid foundation for scaling IDP solutions. As digital transformation accelerates across industries, especially with government support for digital infrastructure, Japan is expected to witness steady growth in the deployment of AI-powered document processing tools over the coming years.

Global Intelligent Document Processing Market: Key Takeaways

- Market Value: The global intelligent document processing market size is expected to reach a value of USD 36.4 billion by 2034 from a base value of USD 3.8 billion in 2025 at a CAGR of 28.7%.

- By Component Segment Analysis: Solutions are anticipated to dominate the component segment, capturing 68.0% of the total market share in 2025.

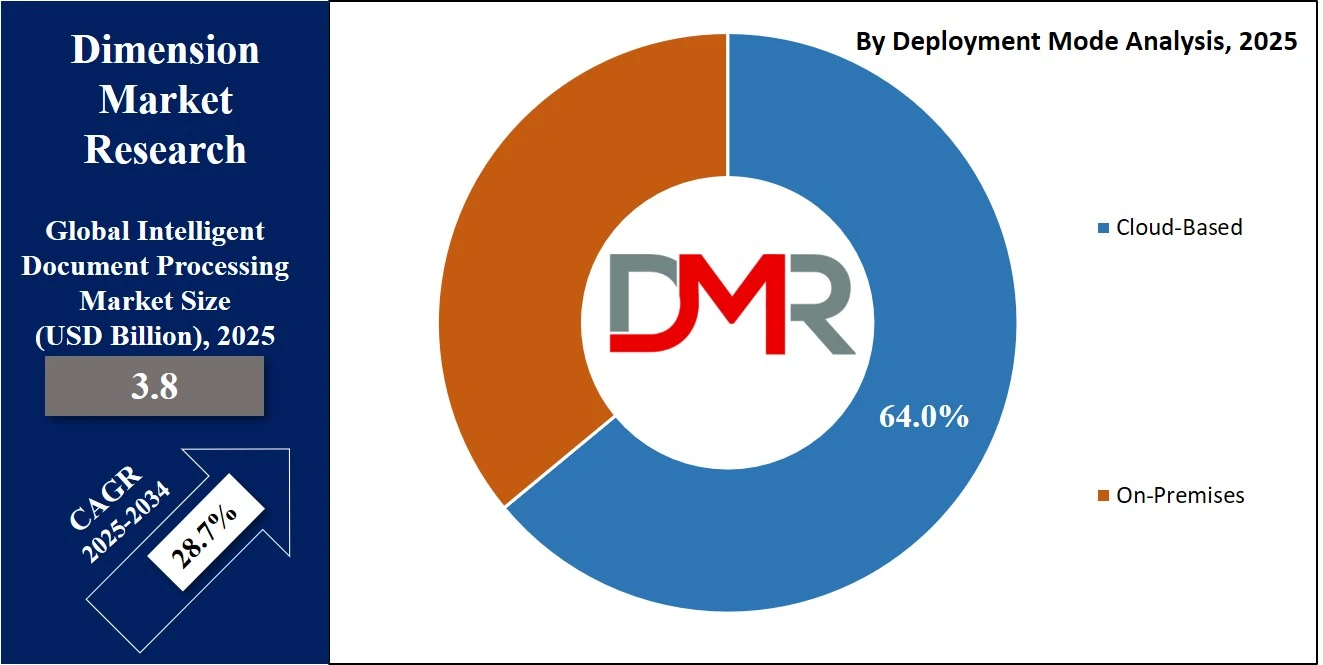

- By Deployment Mode Segment Analysis: Cloud-based deployment is expected to maintain its dominance in the deployment mode segment, capturing 64.0% of the total market share in 2025.

- By Technology Segment Analysis: Optical Character Recognition (OCR) is poised to consolidate its dominance in the technology segment, capturing 28.0% of the total market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises will dominate the organization size segment, capturing 69.0% of the market share in 2025.

- By Application Segment Analysis: Invoice & Receipt Processing will dominate the application segment, capturing 23.0% of the market share in 2025.

- By End-Use Industry Segment Analysis: The BFSI industry is poised to consolidate its market position in the end-use industry segment, capturing 26.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global intelligent document processing market landscape with 35.0% of total global market revenue in 2025.

- Key Players: Some key players in the global intelligent document processing market include ABBYY, Kofax, UiPath, Automation Anywhere, IBM, Microsoft, OpenText, WorkFusion, Appian, Parascript, Hyperscience, AntWorks, Datamatics, Rossum, HyperScience, and Others.

Global Intelligent Document Processing Market: Use Cases

- Invoice and Accounts Payable Automation: Enterprises across industries are using Intelligent Document Processing solutions to automate invoice handling and accounts payable processes. IDP platforms can capture invoice data from various formats, such as PDFs, scanned images, and emails, and utilize intelligent OCR, machine learning, and validation rules to extract critical fields, including invoice number, vendor name, date, and total amount. These solutions integrate directly with ERP and financial management systems to ensure seamless workflow automation, reducing manual entry errors and accelerating payment cycles. In industries like manufacturing, retail, and logistics, where high invoice volumes are routine, IDP enables scalable, touchless processing that enhances accuracy, reduces processing time, and ensures compliance with internal policies and tax regulations.

- Customer Onboarding and KYC in Banking: Banks and financial institutions are deploying IDP technologies to streamline customer onboarding and Know Your Customer (KYC) processes. Traditionally, customer onboarding involves manually reviewing documents such as passports, utility bills, ID cards, and bank statements, often resulting in delays and compliance risks. Intelligent Document Processing solutions can automatically classify documents, extract and validate data such as customer names, addresses, and identification numbers, and cross-check against internal databases and regulatory watchlists. By automating these steps with AI-powered document recognition and data extraction, financial institutions significantly reduce onboarding time, improve customer experience, and ensure adherence to AML and KYC regulations, making IDP a critical enabler of digital banking transformation.

- Claims Processing in Insurance: Insurance companies are leveraging IDP solutions to automate and accelerate claims processing workflows. Handling insurance claims typically involves processing diverse document types such as claim forms, damage reports, police records, medical bills, and correspondence. Intelligent Document Processing platforms classify these documents, extract relevant data points, and feed structured information into claims management systems for review and decision-making. This not only reduces manual review effort and claim cycle time but also helps insurers detect inconsistencies and potential fraud through intelligent pattern analysis. By integrating with RPA and workflow tools, insurers create end-to-end automation, boosting operational efficiency, improving customer satisfaction, and enabling scalable claims handling during high-volume events such as natural disasters or pandemics.

- Healthcare Records Digitization and EHR Integration: In the healthcare sector, IDP solutions are transforming how medical records and clinical documents are managed and integrated into Electronic Health Records (EHR) systems. Hospitals and healthcare providers deal with large volumes of unstructured documents, lab reports, physician notes, discharge summaries, and consent forms, which need to be accurately digitized and categorized. Intelligent Document Processing tools use NLP and machine learning to extract diagnosis codes, treatment details, and patient information while maintaining compliance with data privacy laws such as HIPAA. These tools improve data quality, reduce administrative burden on medical staff, and enable faster access to critical information for clinical decisions. IDP also supports interoperability between legacy systems and modern EHR platforms, enhancing the overall efficiency of healthcare documentation workflows.

Impact of Artificial Intelligence on the Intelligent Document Processing Market

Artificial Intelligence is significantly reshaping the Intelligent Document Processing market by introducing advanced capabilities that go far beyond traditional automation. AI technologies such as machine learning, deep learning, and computer vision are enabling IDP platforms to accurately extract, interpret, and process information from both structured and unstructured documents.

Unlike basic OCR tools that rely on template-based extraction, AI-powered IDP solutions can understand document layouts, adapt to different formats, and extract relevant data even from scanned images or handwritten notes. This results in improved accuracy, reduced manual intervention, and increased scalability across diverse document types and business functions.

Another major impact of artificial intelligence on IDP is through the use of Natural Language Processing NLP allows systems to comprehend the context and meaning of textual data, making it possible to analyze contracts, legal documents, medical records, and customer communications with a human-like understanding. AI enables multilingual processing and semantic analysis, which is especially useful in global enterprises dealing with varied languages and document types.

Moreover, AI supports continuous learning through feedback loops, allowing the system to improve performance over time by learning from user corrections. This self-improving nature of AI enhances automation outcomes, reduces exceptions, and drives better compliance and decision-making. Overall, AI is not just enhancing document processing efficiency but also enabling intelligent workflows that contribute to broader digital transformation initiatives.

Global Intelligent Document Processing Market: Stats & Facts

Digital Agency, Japan (Government of Japan)

- Analog regulation clauses revised increased to 4,365 by March 2024, up from 1,012 in March 2023, showing a 3,353‑clause increase.

- Technology Map entries climbed from 27 in July 2023 to 196 by July 2024.

- gBizID Prime registrations reached 1.22 million by mid‑2024, marking a 22% increase since July 2023.

- e‑Gov applications totaled 28.63 million as of June 2024.

- 292,000 electronic bidding projects recorded as of June 2024 via e‑procurement.

- 223,000 jGrants users by July 2024.

- 177 local governments had scheduled introduction of the Public Medical Hub system by August 2024.

- School‑affairs digitalization: 33% for campus materials, 31% for absence/late arrival communication as of mid‑2024.

- 42% use of generative AI within the Digital Agency and government administration in fiscal 2023.

- 9 AI utilization studies conducted by the Digital Agency in fiscal 2023.

UK Government / Public Sector (Department for Science, Innovation and Technology & Cabinet Office)

- A trial involving 20,000 civil servants found AI saved nearly 2 working weeks per person per year, averaging 26 minutes saved daily.

- UK central government handles approximately 1 billion citizen‑facing transactions annually, of which 143 million are complex repetitive tasks.

- 84% of those complex transactions are assessed as highly automatable via AI.

- Saving just 1 minute per complex transaction could free up the equivalent of 1,200 person‑years of work per annum.

- The government's Plan for Change aims for up to £45 billion in public sector savings, composed of £36 b from automation, £4 b from online service migration, and £6 b from reducing fraud and error.

- The Incubator for AI (i.AI) is expanding staff to 70 people and increasing its budget to £110 million as part of AI deployment in government.

- A UK‑commissioned report suggests AI could automate up to one‑third of daily public‑sector tasks, potentially generating up to £38 billion in annual savings by 2030.

- Routine GP inquiries of 350 million patient contacts could reduce as many as 320 million via automation, saving thousands of hours in administrative work.

- Streamlining DWP and HMRC processes could save up to 4,300 working years through AI‑led automation of interactions.

- Up to 91% of GP appointment booking calls and basic queries could be automated, based on government‑backed analysis.

Global Intelligent Document Processing Market: Market Dynamics

Global Intelligent Document Processing Market: Driving Factors

Rising Demand for Workflow Automation and Operational Efficiency

Organizations across industries are prioritizing digital transformation to streamline operations and reduce manual dependencies. Intelligent Document Processing solutions are being adopted to automate repetitive, document-centric workflows such as invoice management, claims processing, and HR documentation. The integration of AI-powered data extraction tools allows enterprises to improve accuracy, reduce processing time, and lower operational costs, fueling widespread market growth.

Growing Volume of Unstructured Data across Enterprises

With the surge in emails, scanned documents, PDFs, and handwritten forms, companies face mounting challenges in managing unstructured content. IDP systems equipped with machine learning and natural language processing offer the ability to intelligently classify and extract insights from this unstructured data. This capability is becoming essential for compliance reporting, business intelligence, and customer service automation, making it a core driver of adoption.

Global Intelligent Document Processing Market: Restraints

High Implementation Costs and Integration Complexity

Despite its benefits, IDP deployment can be resource-intensive, especially for small and medium enterprises. The upfront investment in AI software, infrastructure upgrades, and employee training can deter adoption. Additionally, integrating IDP with legacy systems, ERP platforms, or industry-specific applications often requires customization, which can prolong deployment and increase overall project complexity.

Data Privacy and Compliance Concerns

Processing sensitive documents, such as medical records, financial statements, or legal contracts, raises significant concerns regarding data security and regulatory compliance. In regions governed by strict data protection laws, such as the GDPR or HIPAA, organizations must ensure that IDP solutions are compliant and maintain full transparency over how data is extracted and stored. These legal and ethical concerns can slow down adoption in heavily regulated industries.

Global Intelligent Document Processing Market: Opportunities

Expansion in Emerging Markets and Untapped Industries

As digital infrastructure improves across regions like Asia Pacific, Latin America, and the Middle East, new opportunities are emerging for IDP vendors. Industries such as education, public sector, logistics, and agriculture are beginning to explore intelligent automation for document handling, presenting untapped growth avenues. Cloud-based IDP platforms with modular pricing models are especially well-suited for these developing markets.

Integration with Advanced Technologies like RPA and Analytics

The growing convergence of IDP with technologies such as robotic process automation, predictive analytics, and conversational AI is unlocking new use cases. For instance, when integrated with RPA, IDP can trigger automated workflows based on extracted document data. Similarly, advanced analytics built into IDP systems enable real-time insights and data-driven decision-making. These integrations enhance the value proposition and functionality of IDP systems, encouraging broader enterprise adoption.

Global Intelligent Document Processing Market: Trends

Shift Toward Cloud-Native and SaaS-Based IDP Solutions

There is a noticeable shift in preference toward cloud-based IDP platforms that offer scalability, flexibility, and lower capital expenditure. SaaS-based document automation tools are gaining popularity among both SMEs and large enterprises, enabling users to access intelligent OCR, document classification, and data extraction capabilities on demand. This trend is also driving faster deployment cycles and reducing the burden of IT infrastructure management.

Emergence of Industry-Specific IDP Applications

Vendors are tailoring IDP solutions to meet the unique document processing needs of specific sectors. For example, IDP platforms for healthcare are optimized to extract medical codes and patient data, while legal-focused systems emphasize contract clause recognition and compliance tracking. This verticalization trend is enabling deeper market penetration and delivering more precise value to end users across domains.

Global Intelligent Document Processing Market: Research Scope and Analysis

By Component Analysis

In the Intelligent Document Processing market, the solutions segment is expected to hold a dominant position, accounting for approximately 68.0% of the total market share in 2025. This dominance can be attributed to the growing demand for advanced document automation tools that incorporate artificial intelligence, machine learning, and natural language processing capabilities.

These solutions offer functionalities such as intelligent data extraction, document classification, context recognition, and workflow automation, which are critical for businesses aiming to reduce manual intervention and improve accuracy.

Enterprises are adopting these platforms to handle a growing volume of unstructured and semi-structured data, enabling faster processing of documents like invoices, contracts, emails, and forms. The integration of IDP solutions with existing enterprise systems such as ERP, CRM, and content management platforms is further driving their adoption, especially among large organizations with complex operational workflows.

On the other hand, the services segment also plays a crucial role in the overall market, supporting the deployment, customization, and ongoing optimization of IDP solutions. These services include consulting, system integration, training, and technical support, which are essential for organizations to successfully implement and scale intelligent document processing capabilities.

As many enterprises lack in-house expertise in AI and automation technologies, service providers offer valuable assistance in aligning IDP solutions with specific business needs, ensuring compliance with industry regulations, and maintaining system performance over time. With the rising complexity of enterprise document workflows and the continuous evolution of AI models, the demand for specialized IDP services is expected to grow steadily, complementing the expansion of solution offerings in the market.

By Deployment Mode Analysis

In the Intelligent Document Processing market, cloud-based deployment is projected to dominate the deployment mode segment, accounting for 64.0% of the total market share in 2025. This dominance is largely driven by the scalability, flexibility, and cost-efficiency offered by cloud platforms. Businesses are adopting cloud-based IDP solutions as they allow quick deployment, easier updates, and seamless integration with other cloud-native enterprise applications.

These solutions are especially attractive to organizations with distributed teams or those aiming for rapid digital transformation without the burden of heavy infrastructure investments. Cloud deployment also enables real-time processing, remote access to document workflows, and the ability to scale up or down based on business needs, making it ideal for industries with fluctuating document volumes like retail, logistics, and financial services.

Despite the growing popularity of the cloud, on-premises deployment continues to be relevant, particularly for organizations that prioritize data security, regulatory compliance, and full control over their IT environments. Sectors such as banking, government, and healthcare often handle highly sensitive or confidential documents, making them more inclined to adopt on-premises IDP solutions.

These deployments offer greater customization and can be tightly integrated with legacy systems, which is critical for companies with complex or outdated infrastructures. However, on-premises solutions typically involve higher upfront costs, longer implementation times, and greater IT management responsibilities. While their market share is smaller compared to cloud-based models, on-premises deployments will remain a vital part of the IDP landscape, especially in industries with stringent data governance requirements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Technology Analysis

In the Intelligent Document Processing market, Optical Character Recognition, or OCR, is expected to maintain its leading position within the technology segment, accounting for 28.0% of the total market share in 2025. OCR serves as the foundational technology for most IDP solutions, enabling the conversion of printed, typed, or handwritten text from scanned documents and images into machine-readable data.

Its widespread applicability across industries, ranging from finance and healthcare to retail and logistics, has made it an essential tool for digitizing paper-based workflows. OCR is used to automate data entry from high-volume documents such as invoices, receipts, shipping labels, and forms, significantly improving operational speed and reducing human errors. Advances in intelligent OCR now allow for better accuracy, support for multiple languages, and the ability to interpret varied layouts, which continues to expand its adoption.

Alongside OCR, Natural Language Processing, or NLP, is playing a vital role in enhancing the intelligence of document processing systems. NLP enables machines to understand, interpret, and derive meaning from human language, which is crucial for extracting context-driven insights from unstructured text such as contracts, emails, legal documents, and customer feedback.

In the IDP ecosystem, NLP is used to identify entities, classify content, detect sentiment, and even summarize complex documents. This is especially valuable in sectors like legal, insurance, and healthcare, where understanding the semantic meaning of text is critical. As organizations seek more advanced capabilities beyond basic text extraction, NLP is gaining traction for its ability to provide contextual awareness and enable more sophisticated automation across a wide range of document types.

By Organization Size Analysis

In the Intelligent Document Processing market, large enterprises are expected to dominate the organization size segment, holding approximately 69.0% of the market share in 2025. This dominance is largely attributed to the high volume of documents these organizations handle daily across departments such as finance, legal, HR, and operations. Large enterprises often have complex workflows and regulatory requirements that demand robust, scalable, and intelligent automation solutions.

By adopting IDP systems, these organizations can streamline document-heavy processes like invoice handling, compliance reporting, customer onboarding, and claims management. Additionally, large enterprises are more capable of investing in advanced AI-driven technologies and customizing them to align with their existing enterprise resource planning and document management systems. Their focus on efficiency, compliance, and digital transformation makes them the primary drivers of IDP adoption on a global scale.

Small and medium-sized enterprises (SMEs), while currently representing a smaller portion of the market, are gradually growing their adoption of IDP solutions. With growing awareness of the benefits of intelligent automation, SMEs are turning to cloud-based, subscription-model IDP platforms that require less upfront investment and are easier to deploy. These solutions help SMEs automate routine documentation tasks, reduce operational bottlenecks, and improve customer service.

As digitalization becomes essential for business continuity and competitiveness, especially in sectors like e-commerce, logistics, and professional services, the demand for cost-effective and scalable document processing tools among SMEs is expected to rise steadily. Moreover, the availability of pre-configured, industry-specific IDP solutions is further lowering the entry barrier for SMEs in this evolving market.

By Application Analysis

In the Intelligent Document Processing market, invoice and receipt processing is anticipated to lead the application segment, accounting for around of the total market share in 2025. This dominance is driven by the widespread need across industries to automate financial workflows that involve high volumes of invoices, purchase orders, and receipts. Traditional methods of invoice processing are time-consuming, error-prone, and labor-intensive, often leading to delays in payment cycles and strained vendor relationships.

IDP solutions equipped with intelligent OCR, machine learning, and rule-based validation can extract key data points such as invoice numbers, tax amounts, payment terms, and supplier information with high accuracy. By integrating with enterprise resource planning systems, businesses can automate the end-to-end accounts payable process, improve compliance, and reduce operational costs. This makes invoice and receipt processing one of the most common and impactful use cases for document automation, especially in sectors like manufacturing, retail, logistics, and finance.

Customer onboarding and Know Your Customer (KYC) processes are another critical application area where IDP is adding substantial value. In industries such as banking, insurance, telecom, and fintech, customer onboarding involves collecting and verifying a wide range of documents, including ID cards, address proofs, income statements, and application forms. Traditionally manual and slow, this process has been transformed by IDP systems that can automatically extract data from submitted documents, verify information against databases, and flag inconsistencies or incomplete entries.

Natural Language Processing and AI algorithms enhance the system's ability to handle multilingual documents and different document formats with ease. By accelerating the onboarding process, improving data accuracy, and ensuring regulatory compliance, IDP enables institutions to enhance customer experience while meeting stringent AML and KYC requirements. This use case is especially vital in competitive, compliance-driven industries looking to scale operations efficiently.

By End-Use Industry Analysis

In the Intelligent Document Processing market, the BFSI industry is set to maintain a leading position in the end-use industry segment, holding an estimated 26.0% of the market share in 2025. The sector's reliance on document-intensive workflows such as loan processing, account opening, insurance claims, regulatory reporting, and compliance documentation makes it a prime adopter of IDP solutions.

Financial institutions are turning to AI-powered document automation to extract data from structured and unstructured formats, validate customer credentials, and process transactions more efficiently. IDP technologies help reduce manual errors, ensure adherence to regulatory standards like KYC and AML, and accelerate decision-making processes. With growing competition in digital banking and increased pressure to enhance customer experience, banks and insurers are investing heavily in intelligent automation tools to streamline operations, lower costs, and improve service delivery.

In parallel, the healthcare and life sciences sector is emerging as a significant adopter of Intelligent Document Processing due to the growing need for accurate and efficient handling of medical documentation. Hospitals, clinics, pharmaceutical companies, and research institutions manage massive volumes of documents, including patient records, clinical trial data, insurance forms, prescriptions, and diagnostic reports. IDP solutions enable healthcare providers to digitize and extract information from these documents with high accuracy, ensuring timely access to patient data and supporting clinical decision-making.

Furthermore, IDP helps improve compliance with health regulations such as HIPAA by automating secure document handling and minimizing the risk of data breaches. In life sciences, IDP assists in processing regulatory submissions, manufacturing records, and laboratory data, enhancing operational efficiency and accelerating drug development timelines. As the healthcare industry continues to digitize and shift toward patient-centric models, the adoption of intelligent document automation is expected to expand rapidly.

The Intelligent Document Processing Market Report is segmented based on the following:

By Component

By Deployment Mode

By Technology

- Optical Character Recognition (OCR)

- Natural Language Processing (NLP)

- Machine Learning (ML)

- Computer Vision

- Robotic Process Automation (RPA)

By Organization Size

By Application

- Invoice & Receipt Processing

- Customer Onboarding (KYC)

- Compliance & Risk Management

- HR & Payroll Document Processing

- Claims Processing

- Contract & Legal Document Processing

- Others

By End-Use Industry

- BFSI

- Healthcare & Life Sciences

- Government & Public Sector

- Retail & eCommerce

- Manufacturing

- Telecom & IT

- Transportation & Logistics

- Others

Global Intelligent Document Processing Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global Intelligent Document Processing market in 2025, capturing approximately 35.0% of total market revenue. This dominance is driven by the early adoption of advanced technologies, strong digital infrastructure, and the presence of major IDP vendors such as IBM, Microsoft, and Kofax.

Enterprises across industries in the region, particularly in banking, insurance, healthcare, and government, are leveraging AI-powered document automation to streamline operations, ensure regulatory compliance, and enhance customer experience. The growing demand for cloud-based solutions, combined with significant investments in artificial intelligence and enterprise automation, continues to position North America as the most mature and lucrative market for intelligent document processing solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

Asia Pacific is expected to witness the most significant growth in the Intelligent Document Processing market over the forecast period, driven by rapid digital transformation, expanding enterprise automation initiatives, and growing adoption of AI and cloud technologies.

Countries like China, India, Japan, and South Korea are investing heavily in digital infrastructure, with enterprises across sectors such as banking, manufacturing, telecom, and healthcare embracing intelligent document automation to manage high volumes of data and improve operational efficiency.

The growing presence of local technology vendors, rising demand for cost-effective document solutions among SMEs, and supportive government policies promoting digitalization are further accelerating the region's growth trajectory, making Asia Pacific a key emerging market for IDP solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Intelligent Document Processing Market: Competitive Landscape

The global competitive landscape of the Intelligent Document Processing market is characterized by a mix of established technology giants and agile AI-driven startups, all competing to deliver advanced, scalable, and industry-specific document automation solutions. Leading players such as ABBYY, Kofax, IBM, Microsoft, and UiPath dominate the market with comprehensive platforms that integrate AI, machine learning, OCR, and natural language processing to automate complex document workflows across enterprises.

At the same time, innovative companies like Rossum, Hyperscience, AntWorks, and WorkFusion are gaining traction by offering cloud-native, low-code, and customizable solutions tailored to niche use cases and verticals. Strategic partnerships, product innovation, and investments in AI capabilities are key differentiators, while mergers and acquisitions continue to shape the competitive dynamics. As demand grows across both developed and emerging markets, competition is intensifying, driving continuous technological advancements and expanding the accessibility of IDP platforms to organizations of all sizes.

Some of the prominent players in the global intelligent document processing market are:

- ABBYY

- Kofax

- UiPath

- Automation Anywhere

- IBM

- Microsoft

- OpenText

- WorkFusion

- Appian

- Parascript

- Hyperscience

- AntWorks

- Datamatics

- Rossum

- HyperScience

- Ephesoft

- Kodak Alaris

- Celaton

- Indico

- Hyland Software

- Other Key Players

Global Intelligent Document Processing Market: Recent Developments

- Jul 2025: ABBYY launched two new process AI solutions, Process AI for Consulting and IDP Analytics, to enhance document-centric workflows with data-driven insights, furthering its position in enterprise automation.

- May 2025: Hyland introduced its Agentic Document Processing platform, embedding semantic, context-aware AI to enable more autonomous and intelligent actions within IDP systems.

- Mar 2025: SER Group completed the acquisition of Dutch IDP innovator Klippa to integrate AI-driven document processing into its Doxis content automation suite.

- Feb 2025: Cogniquest secured USD 1.2 million in a seed funding round led by Cedar-IBSi Capital and FinTech Lab to scale its context-aware AI document intelligence platform aimed at unstructured data insights.

- Jan 2025: Ripcord merged with VASTEC, combining advanced AI-driven scanning and document transformation capabilities to create a stronger, secure document conversion and IDP offering.

- Sep 2024: DeepOpinion closed an €11 million Series A round to expand its IDP platform powered by machine learning, enhancing its ability to extract structured data from diverse document types.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.8 Bn |

| Forecast Value (2034) |

USD 36.4 Bn |

| CAGR (2025–2034) |

28.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Deployment Mode (Cloud-Based and On-Premises), By Technology (Optical Character Recognition, Natural Language Processing, Machine Learning, Computer Vision, and Robotic Process Automation), By Organization Size (Large Enterprises and SMEs), By Application (Invoice & Receipt Processing, Customer Onboarding, Compliance & Risk Management, HR & Payroll Document Processing, Claims Processing, Contract & Legal Document Processing, and Others), and By End-Use Industry (BFSI, Healthcare & Life Sciences, Government & Public Sector, Retail & eCommerce, Manufacturing, Telecom & IT, Transportation & Logistics, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ABBYY, Kofax, UiPath, Automation Anywhere, IBM, Microsoft, OpenText, WorkFusion, Appian, Parascript, Hyperscience, AntWorks, Datamatics, Rossum, HyperScience, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global intelligent document processing market?

▾ The global intelligent document processing market size is estimated to have a value of USD 3.8 billion in 2025 and is expected to reach USD 36.4 billion by the end of 2034.

What is the size of the US intelligent document processing market?

▾ The US intelligent document processing market is projected to be valued at USD 1.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 9.5 billion in 2034 at a CAGR of 26.9%.

Which region accounted for the largest global intelligent document processing market?

▾ North America is expected to have the largest market share in the global intelligent document processing market, with a share of about 35.0% in 2025.

Who are the key players in the global intelligent document processing market?

▾ Some of the major key players in the global intelligent document processing market are ABBYY, Kofax, UiPath, Automation Anywhere, IBM, Microsoft, OpenText, WorkFusion, Appian, Parascript, Hyperscience, AntWorks, Datamatics, Rossum, HyperScience, and Others.

What is the growth rate of the global intelligent document processing market?

▾ The market is growing at a CAGR of 28.7 percent over the forecasted period.