Market Overview

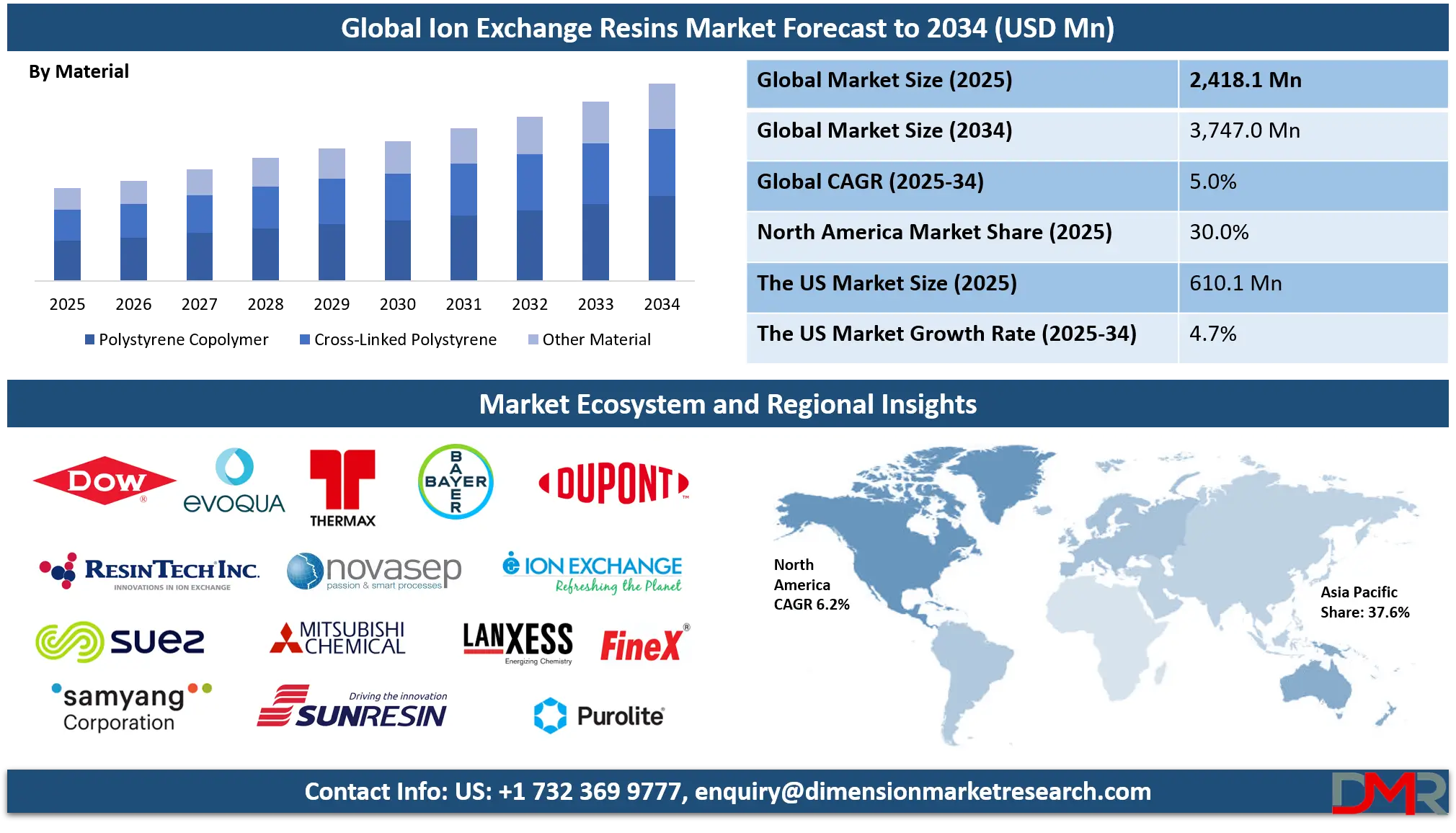

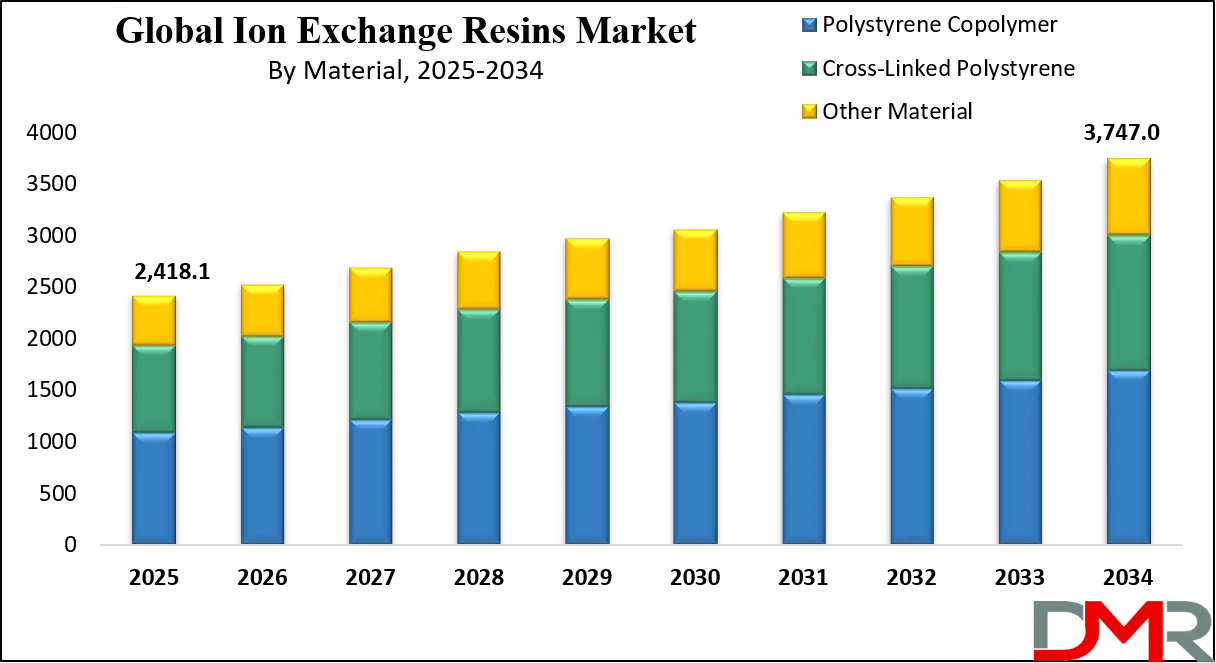

The Global Ion Exchange Resins Market is projected to reach USD 2,418.1 million in 2025 and grow at a compound annual growth rate of 5.0% from there until 2034 to reach a value of USD 3,747.0 million.

The global ion exchange resins market is on the rise, driven by the rising demand for water purification, environmental sustainability, and industrial processes. Ion exchange resins (which are mainly crosslinked polystyrene) are critical to usage in everything from water-softening to transforming chemical synthesis work. The rapid industrialization and strict environmental laws have escalated the demand for efficient water treatment solutions, which has increased demand for ion exchange resins, thus causing a rise in the market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The industrial activities in the emerging economies have increased, leading to elevated water pollution. This situation has brought about the necessity to implement the use of ion exchange resins so that they can effectively treat the water, creating an enormous open-ended chance for market development. Also, the pharmaceutical firms and the food & beverage industry are using them for purification purposes, increasing the market size.

However, the market has encountered hindrances like high prices of raw materials and the complexity of resin regeneration processes. The disposal of the used resins is also connected to environmental issues that become restraints. Despite these challenges, there are constant research and development activities in the area of preventing the inferiority of resins and making them cost-efficient, and this is anticipated to reduce these problems in the long run.

In statistical terms, the market is anticipated to move on an upward trajectory, and there is the promise of considerable segment growth, including power generation, where ion exchange resins play a critical role in boiler feed water treatment. Market growth is also augmented through the use of these resins in the production of ultra-pure water, which is needed in the semiconductor manufacturing operations in the electronics industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Prospects for future growth exist in the ion exchange resins market. The advances in resin technology, growing usage in new industrial areas, and rising environmental concerns are expected to shape the future of the market. The advancement of bio-based and more long-lasting resins is promising a new path for the market that would ensure that it is resilient and flexible in an ever-changing industrial landscape.

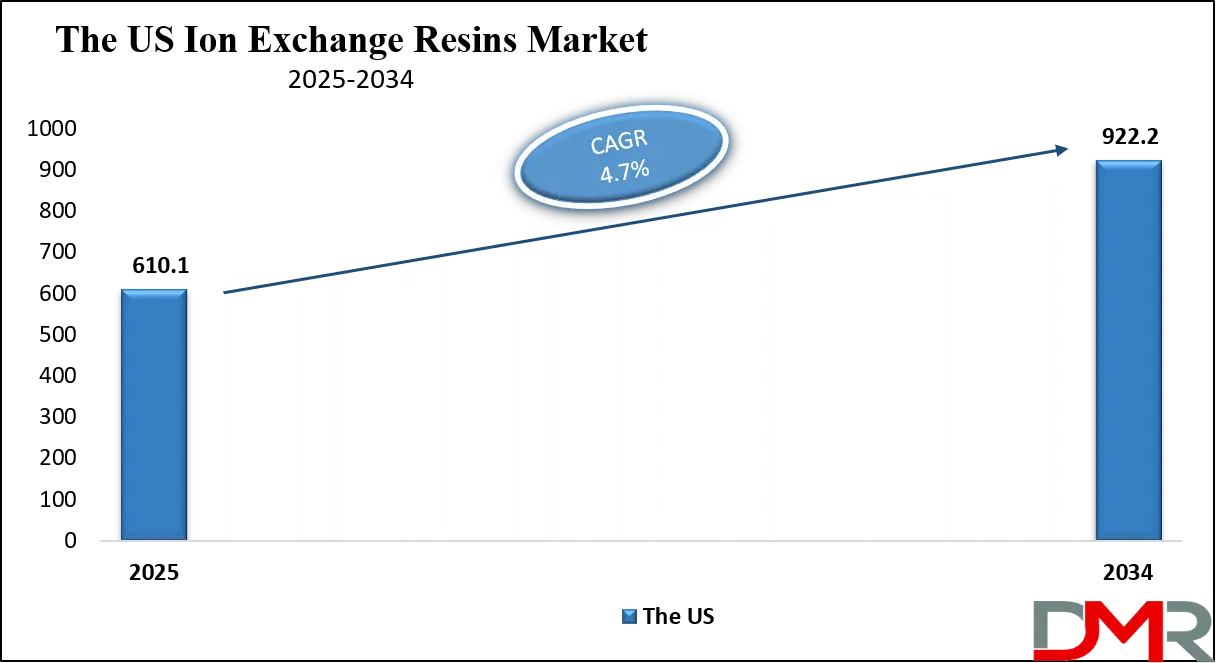

The US Ion Exchange Resins Market

The US Ion Exchange Resins Market is projected to reach USD 610.1 million in 2025 at a compound annual growth rate of 4.7% over its forecast period.

The position of the United States as a significant player among the market players in ion exchange resins is only made possible through its technologically strong industrial infrastructure and strict environmental guidelines. The U.S. Environmental Protection Agency (EPA) stipulates stringent water quality regulations, which require the use of ion exchange resins at municipal and industrial water treatment processes. These resins are also important for industries like power generation, pharmaceuticals, food & beverage for several purification purposes.

Demographically, the U.S. is elated by a massive and diverse industrial base that has a high demand for clean water, a reason why the market for ion exchange resins thrives. The patriotic commitment to sustainable practices and conserving the environment is added fuel to the adoption of these resins in diverse fields.

Government interventions to enhance water infrastructure and support the use of clean energy have also contributed to the development of the market. For example, there has been an increase in ion exchange technology applications that have been brought about by federal funding for the improvement of the size of water treatment facilities. In addition, the U.S Department of Energy has adopted the implementation of clean energy solutions, leading to the usage of ion exchange resins in the production of biofuel and other renewable energy.

On the whole, the U.S. ion exchange resins market is predictably expanding, supported by regulatory initiatives, technological progress, and persistent industrial requirements for proper purification solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Ion Exchange Resins Market

The Europe Ion Exchange Resins Market is estimated to be valued at USD 425.6 million in 2025 and is further anticipated to reach USD 555.3 million by 2034 at a CAGR of 3.0%.

Europe’s market for ion exchange resins shares an affinity for being environment-friendly and utilizing advanced industrial techniques. The strict water quality directives posed by the European Union require the use of efficient water treatment solutions where ion exchange resins assist in achieving such standards. These resins are used in different purification and separation processes in industries spread over the region, such as pharmaceuticals, food & beverage, and power generation.

The real advantage of the target market in Europe consists of a highly developed industrial sector and a strong focus on research and development. Germany, France, and the Netherlands are leading the race in the advancement of innovativeness in water treatment technologies, including ion exchange resins, for greater efficiency and eco-compliance.

The reliance on recycling and reuse practices, as well as sustainable industrial activities, has additionally sped up the use of ion exchange resins through the government policies focused on circular economy strategies. The efforts to cut down on industrial waste and promote water reuse have led to higher investment in refinements in resins. In addition, the European emphasis on renewable energy and carbon emission decrease created new opportunities for the use of ion exchange resins in creating biofuels and carbon capture.

On the whole, the European market of ion exchange resins draws its growth on an impair of regulation frameworks, advancements in technology, and robust industrial sectors, making the market a leader in sustainable purification solutions.

The Japan Ion Exchange Resins Market

The Japan Ion Exchange Resins Market is projected to be valued at USD 145.1 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 215.6 million in 2034 at a CAGR of 4.5%.

Japan’s ion exchange resins market is distinguished by its high level of technology and environmental regulation. Due to these processes, the country’s advanced manufacturing industry, ranging from electronics, automotive, and pharmaceutical industries, is highly dependent on ion exchange resins that are used to produce ultra-pure water, metal separation, and chemical purification.

The demographics of Japan a highly populated country with little natural water have led to the creation of sophisticated water treatment systems. The concern to protect the environment and the sustainable use of resources has resulted in extensive use of ion exchange technologies by both municipalities and industrial partners.

Japanese companies are leading the way in improving resin technology and creating high-performance resins for personal use around specific applications. Advancements in resin design have increased selectivity and regeneration efficiency, thus lowering the cost of running the plant and the use of toxic chemicals. In addition, Japan’s dedication to research and development has made it possible to integrate ion exchange resins in upcoming areas such as renewable energy and advanced manufacturing of materials.

Programs introduced by the government that encourage the use of clean technology and environmental conservation practices have added more strength to the market. People have invested in ion exchange systems after adopting policies that facilitate the reduction of industrial waste and the use of resources efficiently. Therefore, Japan’s ion exchange resins market is likely to continue marching forward with innovation in technology and a serious commitment to environmental stewardship.

Global Ion Exchange Resins Market: Key Takeaways

- Global Market Share Insights: The Global Ion Exchange Resins Market size is estimated to have a value of USD 2,418.1 million in 2025 and is expected to reach USD 3,747.0 million by the end of 2034.

- The US Market Share Insights: The US Ion Exchange Resins Market is projected to be valued at USD 610.1 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 922.2 million in 2034 at a CAGR of 4.7%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global Ion Exchange Resins Market with a share of about 37.6% in 2025.

- Key Players: Some of the major key players in the Global Ion Exchange Resins Market are DuPont Water Solutions, Purolite Corporation, Lanxess AG, Mitsubishi Chemical Corporation, Thermax Limited, ResinTech Inc., Ion Exchange (India) Ltd., Evoqua Water Technologies, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 5.0 percent over the forecasted period of 2025.

Global Ion Exchange Resins Market: Use Cases

- Water Softening in Municipal Supplies: Municipal water treatment facilities use ion exchange resins to add sodium to squash out calcium and magnesium ions to nullify hard water by preventing scales from forming in the pipelines.

- Pharmaceutical Purification Processes: In the pharmaceutical industry, ion exchange resins are used to purify the active pharmaceutical ingredients to eliminate unwanted ionic impurities and improve the performance of the product.

- Food and Beverage Industry Applications: Ion exchange resins are used to decolorize and purify sugar solutions, improving the quality and taste of products like soft drinks and confectioneries.

- Nuclear Power Plant Operations: Nuclear facilities use ion exchange resins to remove radioactive isotopes from wastewater, ensuring environmental safety and compliance with regulatory standards.

- Electronics Manufacturing: Semiconductor manufacturing demands ultra-pure water obtained with the help of ion exchange resins, which remove ionic impurities that preserve electronic components.

Global Ion Exchange Resins Market: Stats & Facts

- U.S. Environmental Protection Agency (EPA): Approximately one-third of U.S. lakes and rivers are unsafe for drinking, fishing, and swimming, underscoring the need for effective water treatment solutions like ion exchange resins. The U.S. government is focusing on establishing 16,000 wastewater treatment facilities to ensure safe drinking water across the country.

- International Atomic Energy Agency (IAEA): Global nuclear capacity is projected to grow at an average annual rate of 1.6% from 2016 to 2040, increasing the demand for ion exchange resins in nuclear power applications. By 2030–2035, 10–12 countries plan to operate nuclear power reactors, further driving the need for ion exchange resins in water purification processes within the nuclear industry.

- World Health Organization (WHO) / UNICEF Joint Monitoring Programme (JMP): In the Asia-Pacific region, approximately 500 million people lack access to basic water supply services, highlighting the critical role of ion exchange resins in providing clean water.

- Asian Development Bank (ADB): Despite improvements, 600 million urban and 1.5 billion rural residents in Asia-Pacific still lack proper water and sanitation, driving the demand for innovative water treatment technologies, including ion exchange resins.

- International Energy Agency (IEA): Latin America's mining sector is projected to be worth over USD 120 billion by 2030, with ion exchange resins playing a vital role in metal recovery and purification processes.

- European Commission: The European Union's Water Framework Directive mandates stringent water quality standards, promoting the adoption of ion exchange resins in municipal and industrial water treatment facilities.

- U.S. Energy Information Administration (EIA): The cost of crude oil accounted for about 50% of the monthly average U.S. retail on-highway diesel fuel prices from 2004 through 2023, directly impacting the production costs of petrochemical-based ion exchange resins.

- International Monetary Fund (IMF): Emerging economies like India and China are experiencing rapid industrialization, leading to increased demand for water treatment solutions, including ion exchange resins, to support sustainable development.

- U.S. Department of Energy (DOE): The DOE emphasizes the importance of clean energy solutions, with ion exchange resins being integral in biofuel production and other renewable energy applications.

- European Environment Agency (EEA): The EEA reports that over 60% of European surface waters are not in good ecological status, necessitating advanced water treatment technologies like ion exchange resins to improve water quality.

- United Nations Industrial Development Organization (UNIDO): UNIDO highlights the role of ion exchange resins in facilitating cleaner production processes in industries, contributing to environmental sustainability and compliance with international standards.

- U.S. Geological Survey (USGS): The USGS indicates that industrial activities contribute significantly to water pollution, reinforcing the need for effective treatment methods like ion exchange resins to remove contaminants.

- European Chemicals Agency (ECHA): ECHA's regulations on chemical safety have led to increased adoption of ion exchange resins in various applications to ensure compliance with environmental and health standards.

- United Nations Environment Programme (UNEP): UNEP advocates for sustainable water management practices, with ion exchange resins being a key technology in achieving water purification and conservation goals globally.

Global Ion Exchange Resins Market: Market Dynamic

Driving Factors in the Global Ion Exchange Resins Market

Rising Demand for Clean Water

Access to clean and safe drinking water is becoming a pressing global challenge due to increasing urbanization, industrial activities, and agricultural runoff. Ion exchange resins play a crucial role in removing dissolved inorganic and organic contaminants such as nitrates, sulfates, arsenic, and heavy metals from water. Their use in municipal water treatment plants, residential filtration systems, and industrial water purification facilities has become indispensable. As water quality regulations tighten around the world, the demand for advanced water purification solutions, including ion exchange resins, is escalating. This is particularly evident in regions with acute water stress, where governments and private entities are investing heavily in treatment infrastructure.

Additionally, the reuse and recycling of water in industrial settings for sustainability and cost-efficiency have increased the adoption of ion exchange systems. These resins are also critical in desalination processes and zero liquid discharge systems. As water scarcity intensifies due to climate change and population growth, the need for efficient, scalable, and cost-effective purification technologies ensures a robust demand trajectory for ion exchange resins across both developed and emerging economies.

Stringent Environmental Regulations

Governments and environmental agencies across the globe are implementing increasingly strict regulations on industrial wastewater discharge and potable water standards. These regulatory frameworks are compelling industries such as power, chemical, mining, pharmaceuticals, and food & beverage to adopt high-efficiency water purification systems. Ion exchange resins are widely used to meet these compliance standards due to their ability to selectively remove harmful ions and contaminants. For instance, industries must now limit the concentration of heavy metals and nitrates in their effluent streams, a requirement that ion exchange systems are well-suited to handle.

In addition, laws related to air quality and emissions indirectly influence the use of ion exchange in flue gas treatment and chemical scrubbing. Compliance with these standards not only avoids legal penalties but also aligns companies with growing ESG (Environmental, Social, and Governance) expectations from investors and customers. As these regulations become stricter and more globally aligned, the demand for ion exchange resins is expected to surge, creating a stable and recurring revenue stream for manufacturers. The regulatory push for sustainable industrial practices is therefore a strong driving force behind the market’s growth.

Restraints in the Global Ion Exchange Resins Market

Environmental Concerns Related to Resin Disposal

Despite their role in improving water and chemical purity, ion exchange resins themselves present environmental challenges when it comes to disposal. Once these resins are exhausted or fouled, they often contain concentrated contaminants, including heavy metals and hazardous organics, making disposal a complex and potentially polluting process. Inadequate disposal practices can lead to leaching of toxins into soil and groundwater, causing long-term ecological harm. The disposal process is also energy-intensive, requiring incineration or specialized landfills, which raises operational costs and carbon emissions.

Moreover, in some regions, strict environmental regulations govern the treatment and disposal of used resins, adding logistical and financial burdens on users. As sustainability becomes a key criterion for industrial decision-making, the environmental impact of resin use may become a more prominent barrier to adoption. While efforts are underway to recycle or regenerate spent resins more efficiently, current infrastructure is insufficient in many parts of the world. Until robust recycling and waste management systems are widely implemented, environmental concerns will remain a significant restraint on market expansion.

Competition from Alternative Technologies

Ion exchange resins face growing competition from alternative purification technologies, particularly membrane-based systems like reverse osmosis (RO), nanofiltration, and ultrafiltration. These technologies often offer comparable or superior removal of contaminants while also reducing chemical usage and operational complexity. Membrane systems require less space and can be more energy-efficient, especially for large-scale desalination or ultrapure water applications.

Additionally, activated carbon and advanced oxidation processes are gaining traction for removing organic compounds and emerging contaminants. These alternatives are increasingly preferred in industries that value simplicity, modularity, and low maintenance. The initial investment for some of these systems may be higher, but their long-term cost-effectiveness and ease of automation make them appealing.

As technology matures and becomes more affordable, the adoption of non-resin-based solutions may limit the market share of ion exchange resins in certain applications. This growing preference for alternative treatment methods forces resin manufacturers to continuously innovate and improve their offerings to stay competitive in a rapidly evolving market.

Opportunities in the Global Ion Exchange Resins Market

Rapid Industrialization in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and Africa are undergoing significant industrialization, which is expanding the demand for water and process treatment solutions. Countries like India, China, Indonesia, and Vietnam are building new infrastructure in sectors such as power, petrochemicals, textiles, and mining, all of which rely heavily on purified water and chemical processing.

As industrial output increases, so does the need for efficient and scalable purification systems, including ion exchange resins. These countries are also adopting more stringent environmental regulations and sustainability goals, thereby driving the use of high-performance resins. With increasing foreign direct investment and government-backed initiatives to improve industrial infrastructure and water management systems, the scope for resin deployment is broadening. In many of these countries, industries are shifting from traditional purification methods to ion exchange due to its reliability, adaptability, and cost-efficiency over time.

Additionally, rising consumer awareness and health concerns are increasing the use of resin-based filtration in residential and commercial applications. This industrial growth in underpenetrated markets offers tremendous long-term opportunities for global and regional resin manufacturers to establish production facilities, forge partnerships, and expand their market footprint.

Expansion in Pharmaceutical and Bioprocessing Industries

The pharmaceutical and biotechnology sectors are experiencing unprecedented growth, driven by rising healthcare demands, aging populations, and the expansion of biologics and precision medicine. Ion exchange resins are critical in these industries for processes such as drug purification, protein separation, enzyme stabilization, and active pharmaceutical ingredient (API) isolation.

As drug formulations become more complex, the need for high-purity water and highly selective purification systems becomes more critical. Biopharmaceutical manufacturing, in particular, depends heavily on chromatography-grade resins for isolating valuable biomolecules.

Furthermore, the surge in vaccine and biosimilar production has accelerated the demand for reliable purification technologies that ensure product safety and regulatory compliance. With emerging markets increasing their pharmaceutical manufacturing capabilities and developed countries upgrading their production to meet global quality standards, the demand for advanced ion exchange resins is growing.

Innovations such as continuous processing and single-use systems in bioprocessing are also pushing the need for specialized resin formulations. This ongoing evolution in drug development and production methods presents a lucrative opportunity for resin manufacturers to cater to niche and high-value segments of the life sciences market.

Trends in the Global Ion Exchange Resins Market

Technological Advancements in Resin Formulations

The ion exchange resins market is being reshaped by technological innovations that aim to enhance performance and application diversity. Manufacturers are investing in the development of resins with improved chemical and thermal stability, increased ion selectivity, and longer operational life. These advances allow resins to be used in extreme pH conditions and higher temperatures, which is especially valuable in power generation, nuclear, and biopharmaceutical applications. Continuous innovation in polymer engineering has led to the development of macroporous resins with optimized porosity and functional group distribution, which enhances their ion exchange efficiency.

Additionally, digital modeling tools are helping engineers design custom resins tailored to specific industrial needs, improving throughput and reducing energy costs in processes like chromatography and metal recovery. As industries demand higher throughput and efficiency, such improvements offer a competitive edge, enabling processes that require precise separation or removal of ionic contaminants.

The rise in smart manufacturing and Industry 4.0 principles is also encouraging the integration of real-time monitoring systems with resin-based operations to optimize regeneration cycles and improve sustainability. This trend reflects the broader shift toward high-performance materials that align with both cost-efficiency and environmental sustainability, making advanced resin formulations a key focus area for manufacturers globally.

Emphasis on Sustainability and Green Technologies

There is a growing trend across industries to adopt environmentally sustainable and eco-conscious solutions, and the ion exchange resins sector is no exception. Increasing pressure from governments, environmental watchdogs, and end consumers is prompting companies to develop resins with a reduced carbon footprint. This has led to innovations in resin manufacturing processes that avoid harmful solvents and use renewable raw materials wherever possible.

Solvent-free production techniques and bio-based feedstocks are increasingly being explored to minimize environmental impact during production and usage. Another important sustainability trend is the design of resins that are easier to regenerate and dispose of without harmful residues, extending the product life cycle and reducing landfill waste. Water treatment facilities and industries that previously used resins as single-use products are now adopting circular approaches, including regeneration and reuse cycles.

Additionally, companies are working on improving resin recyclability and recovering valuable metals and chemicals from spent resins. These shifts reflect the alignment of the resin market with global sustainability goals such as those outlined in the UN’s Sustainable Development Goals (SDGs). With rising awareness of environmental degradation and climate change, these green innovations are not just trends but strategic necessities for long-term market growth and regulatory compliance.

Global Ion Exchange Resins Market: Research Scope and Analysis

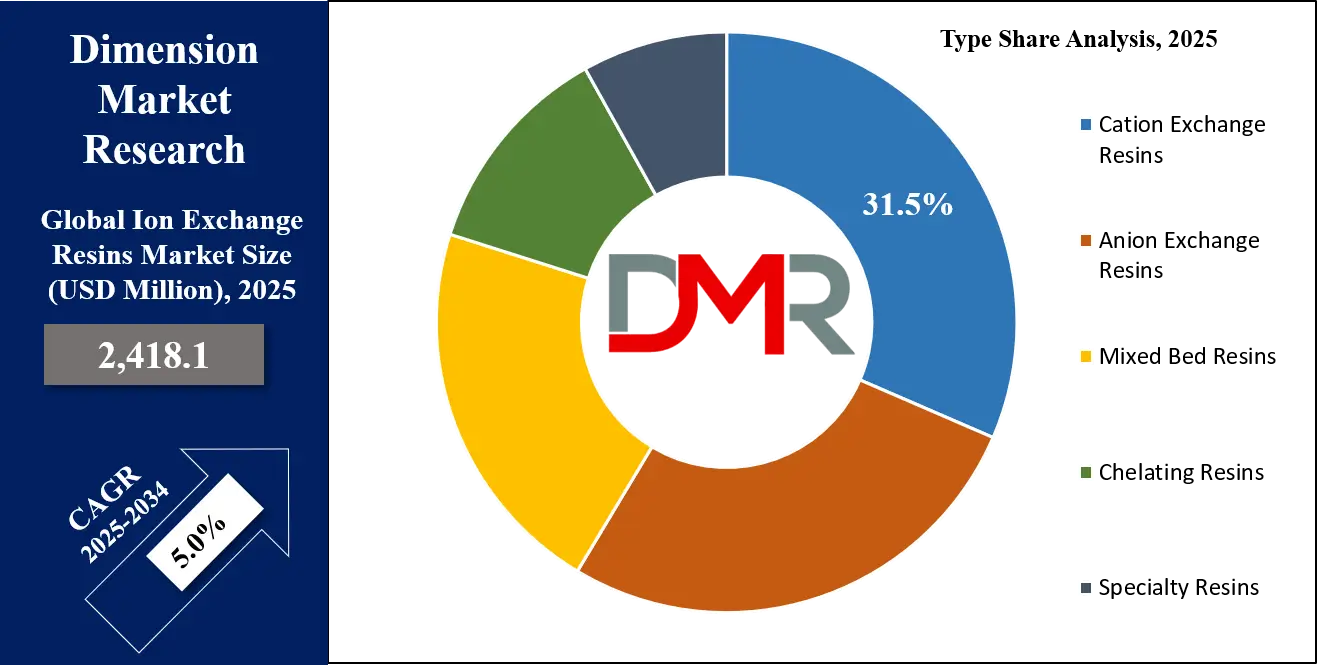

By Type Analysis

Cation exchange resins are projected to dominate the ion exchange resins market due to their broad applicability, high efficiency, and essential role in critical purification processes across multiple industries. These resins function by exchanging positively charged ions (cations) like calcium, magnesium, iron, and hydrogen with other cations present in the resin, making them crucial in softening water and removing hardness. Water softening, in particular, is one of the most common uses, especially in industrial boilers, power plants, and residential systems, where scaling must be prevented to maintain equipment longevity and performance.

In industries such as food & beverage, pharmaceuticals, and chemical processing, cation resins are extensively used to achieve ultrapure water, which is essential for quality and safety. They are also used in metal recovery and decontamination applications, where selectivity and high exchange capacity are necessary to extract or separate specific cations from complex mixtures.

Technological improvements in cation resins, including enhanced cross-linking and functionalization, have boosted their thermal and chemical resistance, enabling their use in more aggressive operating conditions. Their cost-effectiveness, operational simplicity, and compatibility with a wide range of water chemistries give them a competitive edge over other resin types.

The global rise in water pollution, increased industrial wastewater generation, and tightening water quality regulations have further driven demand. Moreover, cation exchange resins are often the first step in multi-stage purification systems, reinforcing their foundational role in ion exchange processes. Their dominance is thus underpinned by a combination of necessity, efficiency, and adaptability across sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Structure Analysis

Porous bead structures are poised to dominate the ion exchange resin market due to their superior surface area, high exchange capacity, and mechanical stability, making them ideal for high-throughput and high-precision applications. These resins are manufactured with a network of interconnected pores, allowing greater accessibility to functional groups within the bead, which facilitates faster ion exchange reactions and higher treatment efficiency. The high porosity enables them to handle large volumes of water or solution with minimal pressure drop, which is a crucial factor in industrial-scale operations.

Their physical robustness allows them to withstand repeated regeneration cycles without degradation, a key requirement in demanding applications such as demineralization, chemical synthesis, and pharmaceutical purification. Porous beads are also more resistant to fouling and chemical wear, ensuring long-term usability and reduced maintenance costs. This makes them highly preferred in sectors like power generation, food processing, and electronic manufacturing, where process reliability is paramount.

Furthermore, the customizable pore sizes and resin cross-linking densities offer flexibility in designing resin systems for specific applications, such as selectively targeting heavy metals or organic contaminants. This adaptability has significantly broadened the use of porous bead resins across complex separation tasks.

Advancements in polymer chemistry and resin manufacturing have further enhanced the functional capabilities of porous beads, making them compatible with emerging technologies in biotechnology and environmental engineering. Their proven performance, reliability, and scalability have firmly established porous beads as the dominant structure in the ion exchange resin market, especially where precision, capacity, and operational longevity are critical factors.

By Material Analysis

Polystyrene copolymer is anticipated to be the leading raw material for ion exchange resins because of its chemical stability, economic viability, and relative aspect of functionalization. It is widely used for constructing a majority of synthetic ion exchange resins and provides a long-term stable base that maintains its structure within various chemical conditions present in water treatment, medicine, and industry. Its affinity for both cationic and anionic functional groups makes this material fit for use in various types of resins.

It also has the advantage of better mechanical strength and more robust structure that helps in not only in holding the bead shape but also sustaining its operation during the back washing and regeneration processes. This kind of property provides a longer operating time and most stable performance making this kind of industries benefit from the consistent need of using resin in the long term.

Polystyrene copolymers also make it easy to add cross-linking agents such as divinylbenzene (DVB) to the resins making it more durable, porous, and with better ion exchange rates. The versatility provided by the structure of the material allows for the production of both gel type and macroporous or porous bead type resins, thus increasing the extent of application of the material in the market.

Due to the copolymerization technology some researchers has been able to develop resin types that are well suited for certain processes like; selective metal recovery, chromatographic separation and food grade purification. It is also relatively inexpensive compared to other specialty polymers, making it costs effective for volume use. All in all, polystyrene copolymer still serves as the basis of the current ion exchange resin because of the combination of good performance, adaptability, and economic benefit.

By Application Analysis

The largest application segment in the Ion exchange resin market is projected to be the water treatment industry all around the world, and the use of clean water across the globe, which is useful for residential, municipal, and industrial usage. These resins are used mainly for softening of hard water, demineralization, and removal of toxic ions like nitrates, arsenic, lead, heavy metals, etc. With the increased focus on water quality, especially in the current global market, ion exchange has assumed the position of being one of the most crucial in water purification and management of industrial wastewater.

In municipal water treatment, these resins are used if the water quality needs to be improved according to EN 1015/ISO 10500. They also assist in preventing scaling and corrosion of equipments through softening of hardness ions and dissolved solids in industries involving boilers, cooling towers and manufacturing processes. Huge demand also exists in sectors like power generation, pharma, and semiconductors for ultrapure water and this will lead to an increased demand of resin.

However, due to growing concerns over environmental conservation as well as water requirement, the ion exchange resins are also used in wastewater treatment for reuse and recycling. Their ability to be regenerated adds value to their usage since they will not be as costly in the long run, especially with operations and impacts on the environment.

Urbanization and industrialization in developing countries are exerting pressure on water systems, and the increasing installation of ion exchange treatment systems. Water treatment remains the largest application segment, across small applications, such as domestic level filters, to large-scale seawater conversion applications, such as desalination plants & hence the importance of ION exchange resins, which are suited for all types of water sources, enhances this application segment.

The Global Ion Exchange Resins Market Report is segmented on the basis of the following:

By Type

- Cation Exchange Resins

- Strong Acid Cation (SAC)

- Weak Acid Cation (WAC)

- Anion Exchange Resins

- Strong Base Anion (SBA)

- Weak Base Anion (WBA)

- Mixed Bed Resins

- Chelating Resins

- Specialty Resins

By Structure

- Porous Beads

- Batteries

- Gels

By Material

- Polystyrene Copolymer

- Cross-Linked Polystyrene

- Other Material

By Application

- Water Treatment

- Industrial Water Treatment

- Municipal Water Treatment

- Food & Beverage

- Sugar Refining

- Beverage Decolorization

- Pharmaceuticals

- Power Generation

- Chemical Processing

- Mining & Metallurgy

- Nuclear Power

- Electronics

Global Ion Exchange Resins Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is expected to lead the global ion exchange resins market as it is poised to command over 37.6% of market share by the end of 2025. This is due to its strong industrial base, growing population, and expanding infrastructure across key sectors. Countries like China, India, Japan, and South Korea are investing heavily in water treatment, power generation, pharmaceuticals, and food & beverage industries each of which is a major consumer of ion exchange technology. With rising environmental concerns and regulatory mandates, regional governments are prioritizing sustainable water management and industrial effluent treatment, accelerating resin demand.

Additionally, Asia-Pacific’s large-scale chemical manufacturing, textile, and mining activities require advanced purification processes that rely on ion exchange systems. Urbanization and increased freshwater consumption have also intensified the demand for municipal water treatment plants.

Moreover, the presence of key resin producers and low manufacturing costs in countries like China and India enhance local production and regional supply capabilities. Growing export activities, especially to developing economies in Southeast Asia and the Middle East, further boost the market. The combination of strong demand, policy support, and industrialization firmly establishes Asia-Pacific as the dominant region in this sector.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

North America is projected to exhibit the highest CAGR in the ion exchange resins market due to rapid technological innovation, rising environmental awareness, and strict regulatory standards from agencies such as the U.S. Environmental Protection Agency (EPA). The region’s emphasis on clean energy and water reuse, coupled with investments in smart water infrastructure, is fostering demand for advanced resin technologies.

Growing pharmaceutical and biotechnology industries, particularly in the United States, are accelerating the use of chromatography-grade resins in drug purification and manufacturing. Furthermore, the shift toward renewable energy and nuclear power, where ion exchange resins are used for water decontamination and cooling systems, is creating new growth avenues.

Increasing consumer awareness about drinking water quality and the rise in household water filtration installations are also contributing to demand. The U.S. also benefits from a mature R&D ecosystem, allowing rapid commercialization of next-gen resins. This innovation-centric environment, combined with favorable government policies, positions North America for accelerated growth over the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Ion Exchange Resins Market: Competitive Landscape

The global ion exchange resins market is characterized by a mix of multinational chemical giants and specialized resin manufacturers that compete based on product innovation, application-specific customization, and sustainability. Leading companies such as DuPont Water Solutions, Lanxess AG, Mitsubishi Chemical Corporation, and Purolite Corporation hold significant market shares due to their extensive global distribution networks, R&D capabilities, and diversified product portfolios. These players focus on developing advanced resins with higher selectivity, longer lifecycle, and environmental compliance to cater to industries like water treatment, power generation, pharmaceuticals, and electronics.

Smaller and regional players, such as Ion Exchange (India) Ltd., Thermax Limited, and Sunresin New Materials, are expanding rapidly in emerging markets by offering cost-competitive and application-specific solutions. Strategic collaborations, mergers, and acquisitions are common, as companies seek to expand their geographic presence and technological capabilities.

Furthermore, rising emphasis on green chemistry and circular economy principles is driving competition around sustainable resin formulations and regenerative technologies. With growing demand across diverse sectors and increasing regulatory requirements, the market is witnessing intensified innovation and strategic positioning. Competitive differentiation now hinges not only on technical performance but also on eco-friendly production, end-use adaptability, and after-sales support.

Some of the prominent players in the Global Ion Exchange Resins Market are:

- DuPont Water Solutions

- Purolite Corporation

- Lanxess AG

- Mitsubishi Chemical Corporation

- Thermax Limited

- ResinTech Inc.

- Ion Exchange (India) Ltd.

- Evoqua Water Technologies

- Graver Technologies

- Samyang Corporation

- Finex Oy

- SUEZ Water Technologies & Solutions

- Novasep

- Bayer AG

- Aldex Chemical Company

- Sunresin New Materials Co. Ltd.

- Dow Chemical Company

- Shandong Dongda Chemical Industry

- Zhejiang Zhengguang Industrial Co., Ltd.

- Hebi Higer Chemical Co., Ltd.

- Other Key Players

Recent Developments in Global Ion Exchange Resins Market

October 2024

- Mitsubishi Chemical Group Expansion: Announced plans to increase ion exchange resin production capacity at its Kyushu-Fukuoka Plant in Kitakyushu City, Japan. This expansion aims to meet the growing demand for ultrapure water in semiconductor manufacturing, with operations expected to commence by Q1 2026.

September 2024

- DuPont's AmberLite P2X110 Launch: Introduced AmberLite P2X110, an ion exchange resin designed for green hydrogen production. The resin enhances thermal stability and contaminant removal in electrolyzer systems, contributing to the durability and efficiency of green hydrogen production processes.

June 2024

- Ecolab and Repligen Collaboration: Ecolab Life Sciences and Repligen launched DurA-Cycle affinity resins, engineered for large-scale biologic manufacturing. These resins offer enhanced durability and performance for continuous purification processes in biopharmaceutical production.

April 2024

- LANXESS's Lewatit S 1567 Scopeblue Introduction: Expanded its range of sustainable ion exchange resins with the launch of Lewatit S 1567 Scopeblue. This product is designed for softening drinking water in industrial settings and standard household filter cartridges, offering improved resistance to disinfectants.

- EPA's PFAS Regulation Finalization: The U.S. Environmental Protection Agency finalized a National Primary Drinking Water Regulation setting Maximum Contaminant Levels for six PFAS compounds. This regulation is driving demand for effective PFAS removal technologies, with ion exchange resins emerging as a cost-effective solution for existing drinking water treatment plants.

February 2024

- Thermax Limited Acquisition: Acquired TSA Process Equipments for US$9 million, enhancing its capabilities in the process equipment sector, particularly in energy and environment solutions. This strategic acquisition is expected to strengthen Thermax's product portfolio and market capabilities, potentially impacting its growth in the ion exchange resin market.

November 2023

- LANXESS and Caldic Distribution Partnership: Announced a new distribution partnership with Caldic to sell its Lewatit ion exchange resins and Bayoxide iron oxide adsorbents in France. This move aims to improve service quality in the region and help meet stringent environmental regulations amid limited water availability.

August 2023

- DuPont's AmberLite P2X110 Recognition: DuPont's AmberLite P2X110 ion exchange resin was recognized as the 2024 Sustainability Product of the Year for optimizing Proton Exchange Membrane electrolyzers in green hydrogen production. This highlights the resin's innovative capacity to enhance water purification essential for hydrogen yield, resulting in minimal greenhouse gas emissions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,418.1 Mn |

| Forecast Value (2034) |

USD 3,747.0 Mn |

| CAGR (2025–2034) |

5.0% |

| The US Market Size (2025) |

USD 610.1 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Cation Exchange Resins, Anion Exchange Resins, Mixed Bed Resins, Chelating Resins, Specialty Resins), By Structure (Porous Beads, Batteries, Gels), By Material (Polystyrene Copolymer, Cross-Linked Polystyrene, Others), By Application (Water Treatment, Food & Beverage, Pharmaceuticals, Power Generation, Chemical Processing, Mining & Metallurgy, Nuclear Power, Electronics) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

DuPont Water Solutions, Purolite Corporation, Lanxess AG, Mitsubishi Chemical Corporation, Thermax Limited, ResinTech Inc., Ion Exchange (India) Ltd., Evoqua Water Technologies, Graver Technologies, Samyang Corporation, Finex Oy, SUEZ Water Technologies & Solutions, Novasep, Bayer AG, Aldex Chemical Company, Sunresin New Materials Co. Ltd., Dow Chemical Company, Shandong Dongda Chemical Industry, Zhejiang Zhengguang Industrial Co., Ltd., Hebi Higer Chemical Co., Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Ion Exchange Resins Market?

▾ The Global Ion Exchange Resins Market size is estimated to have a value of USD 2,418.1 million in 2025 and is expected to reach USD 3,747.0 million by the end of 2034.

What is the size of the US Ion Exchange Resins Market?

▾ The US Ion Exchange Resins Market is projected to be valued at USD 610.1 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 922.2 million in 2034 at a CAGR of 4.7%.

Which region accounted for the largest Global Ion Exchange Resins Market?

▾ Asia Pacific is expected to have the largest market share in the Global Ion Exchange Resins Market with a share of about 37.6% in 2025.

Who are the key players in the Global Ion Exchange Resins Market?

▾ Some of the major key players in the Global Ion Exchange Resins Market are DuPont Water Solutions, Purolite Corporation, Lanxess AG, Mitsubishi Chemical Corporation, Thermax Limited, ResinTech Inc., Ion Exchange (India) Ltd., Evoqua Water Technologies, and many others.

What is the growth rate in the Global Ion Exchange Resins Market in 2025?

▾ What is the growth rate in the Global Ion Exchange Resins Market in 2025?