Market Overview

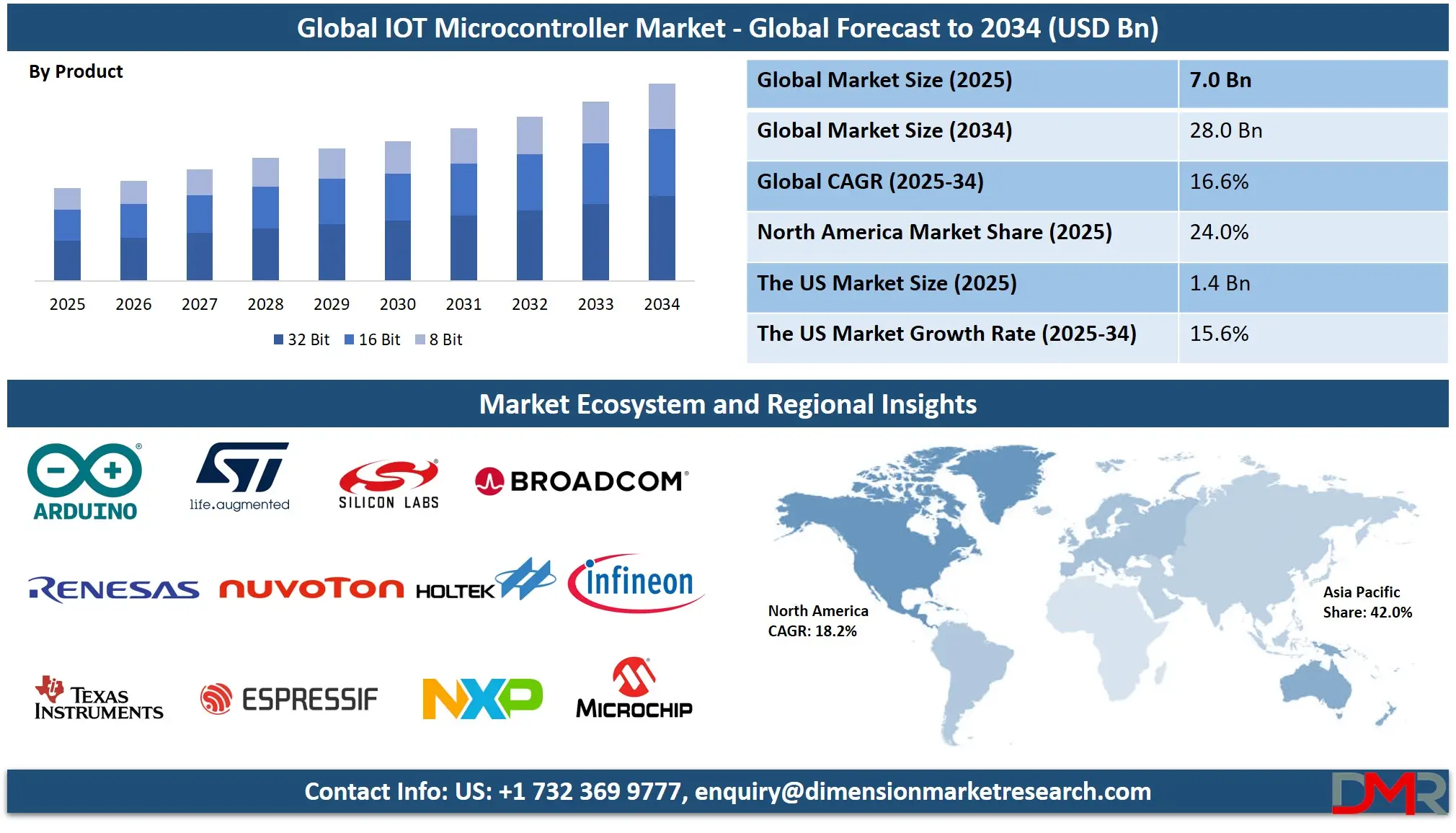

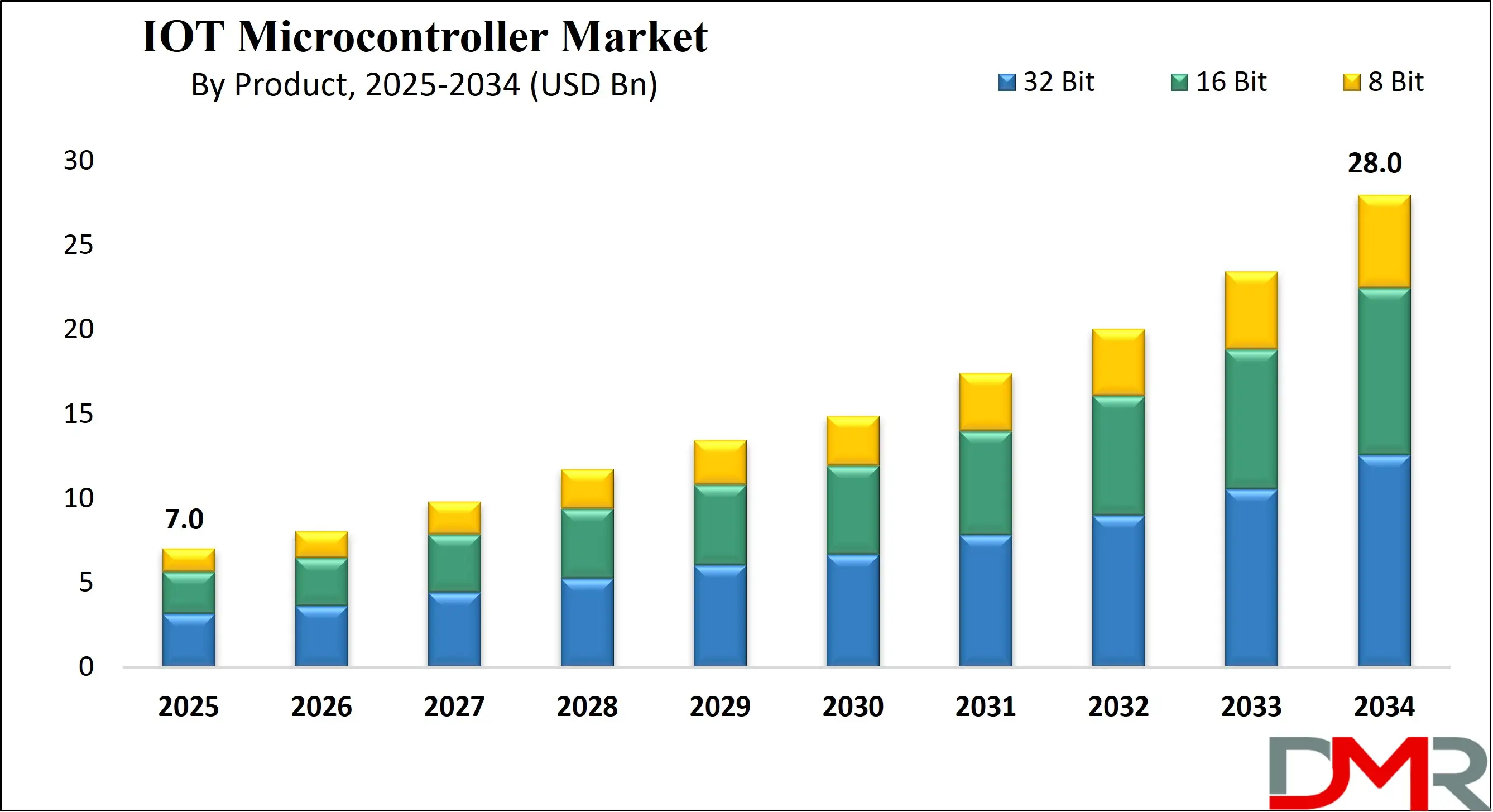

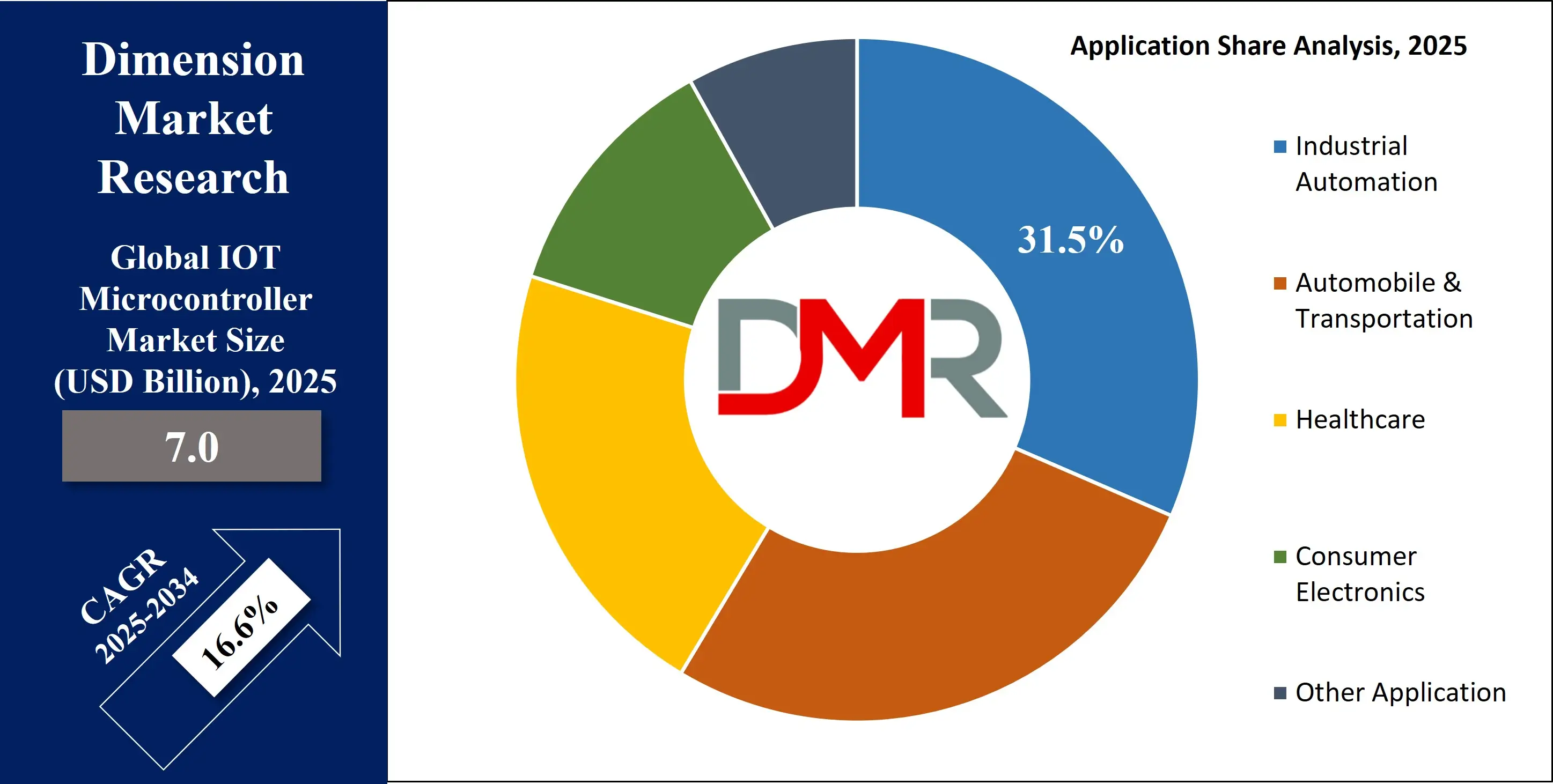

The Global IOT Microcontroller Market is projected to reach USD 7.0 billion in 2025 and grow at a compound annual growth rate of 16.6% from there until 2034 to reach a value of USD 28.0 billion.

The global IoT microcontroller market is experiencing robust growth, driven by the proliferation of smart devices, automation across industries, and increased demand for low-power embedded systems. These microcontrollers serve as the core computing units in devices ranging from Smart Homes Systems, smart thermostats, and industrial sensors to connected vehicles and wearable health monitors.

As edge computing gains traction, 32-bit microcontrollers are dominating due to their balance of performance and energy efficiency. A key trend is the convergence of wireless connectivity with microcontroller units (MCUs), leading to integrated system-on-chip (SoC) architectures that simplify Internet of Things deployments and enhance embedded processors efficiency.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growth opportunities are amplified by Industry 4.0 and the global push for smart infrastructure. Governments and private entities are investing in smart city projects, digital health platforms, and energy-efficient systems, all of which require embedded intelligence powered by MCUs. Additionally, the shift toward electric and autonomous vehicles is fueling MCU adoption in the automotive sector for real-time control, telemetry, and sensor interfacing.

Despite this growth, the market faces constraints such as fluctuating semiconductor supply, rising silicon costs, and cybersecurity vulnerabilities in connected systems. Hardware design complexity and compatibility issues with legacy systems also restrain adoption across some traditional sectors.

Statistically, 32-bit microcontrollers account for the largest revenue share, followed by 8-bit and 16-bit architectures used in simpler applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Asia-Pacific region leads global production and consumption, with strong support from manufacturing hubs like China, Taiwan, and South Korea. Over the next decade, increasing integration with AI accelerators, edge analytics, and low-power wireless standards like Bluetooth LE and LoRa will shape future market evolution. Wireless microcontrollers and IoT chipsets are expected to play a pivotal role in enabling Smart Lighting solutions, connected healthcare, and industrial IoT deployments.

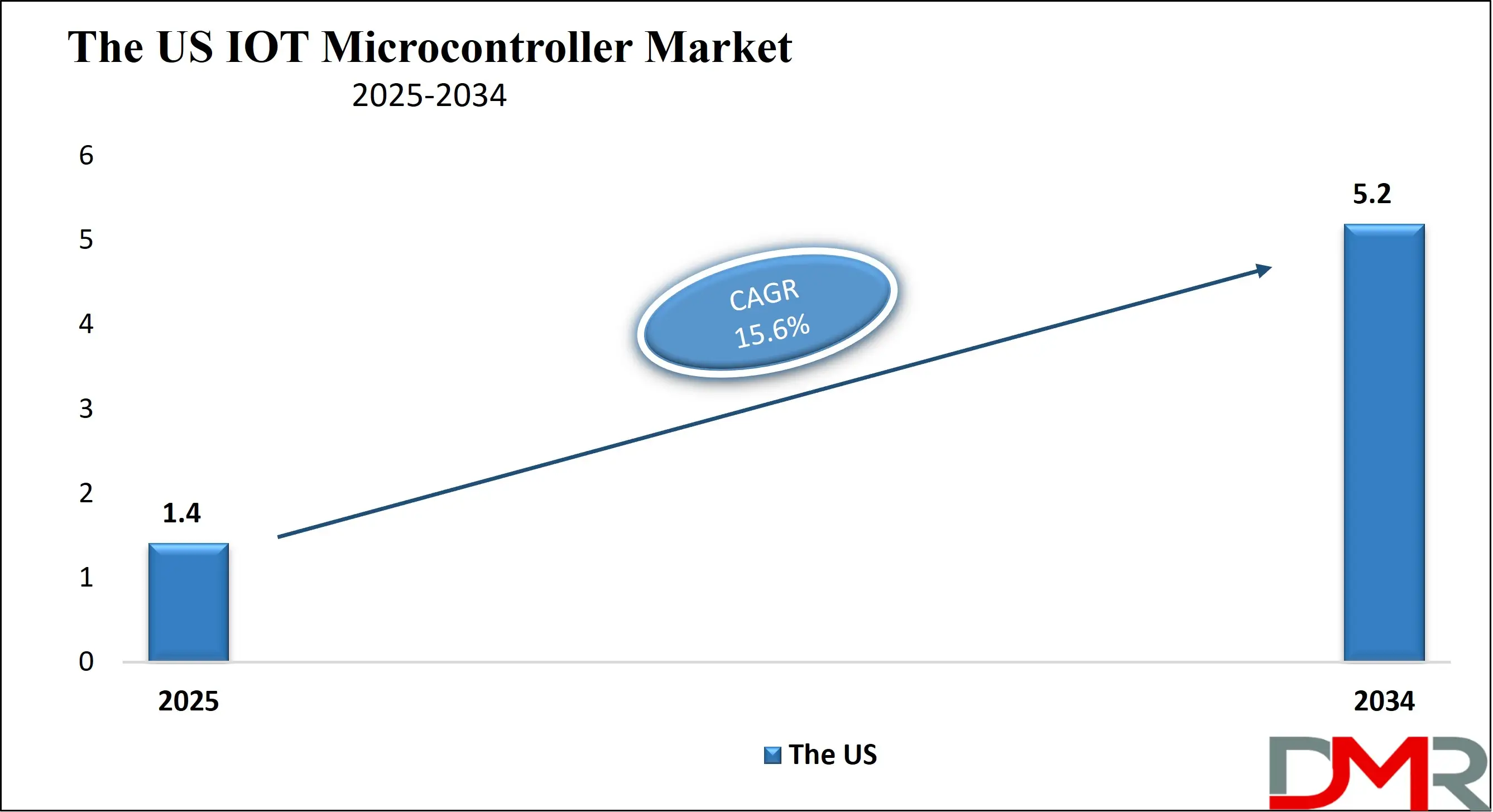

The US IOT Microcontroller Market

The US IOT Microcontroller Market is projected to reach USD 1.4 billion in 2025 at a compound annual growth rate of 15.6% over its forecast period.

The U.S. IoT microcontroller market is underpinned by the country’s leading position in semiconductor innovation, robust digital infrastructure, and policy support for smart technologies. With over 135 million smart devices in U.S. households and increasing adoption in industrial automation, MCUs are foundational to expanding IoT applications. The U.S. Department of Energy has funded smart grid and connected building projects through initiatives like the "Connected Communities" program, creating demand for embedded control systems. Similarly, the National Institutes of Health (NIH) supports digital health technologies, spurring the use of MCUs in telehealth devices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Demographically, the U.S. has a tech-savvy population and high broadband penetration, which facilitates the adoption of connected devices. According to the U.S. Census Bureau, over 85% of American homes had broadband subscriptions in 2022. This infrastructure supports the proliferation of smart home ecosystems and personal health monitors that depend on MCUs.

U.S. industrial leaders in aerospace, automotive, and consumer electronics are investing in edge computing and embedded intelligence. For instance, smart factories using cyber-physical systems leverage MCUs for real-time control and remote diagnostics. The Federal Highway Administration’s connected vehicle initiatives are also stimulating demand for microcontrollers in transport telematics.

Moreover, research from NIST (National Institute of Standards and Technology) outlines the importance of embedded security in microcontrollers to guard against IoT vulnerabilities. As cybersecurity and real-time analytics become priorities, the U.S. market is well-positioned to lead in high-reliability, low-latency IoT microcontroller applications across critical sectors.

The Europe IOT Microcontroller Market

The Europe IOT Microcontroller Market is estimated to be valued at USD 1.1 billion in 2025 and is further anticipated to reach USD 3.5 billion by 2034 at a CAGR of 14.4%.

Europe’s IoT microcontroller market is driven by the region’s strong regulatory push for energy efficiency, environmental monitoring, and industrial modernization. Initiatives like the European Green Deal and Horizon Europe programs are stimulating investment in smart infrastructure, clean energy systems, and digital health technologies, all of which rely on microcontrollers for real-time sensing and control. The EU Commission’s Digital Decade targets 100% internet-connected households and digitally transformed industries by 2030, reinforcing IoT integration.

Germany, France, and the Nordics are leading adopters of smart manufacturing, driven by Industry 4.0 mandates. The German Federal Ministry for Economic Affairs and Climate Action supports embedded electronics R&D for smart factories, where MCUs facilitate robotics, predictive maintenance, and machine-to-machine communication. Similarly, the UK’s National Health Service (NHS) is piloting connected care solutions that embed MCUs in wearable devices for elderly monitoring and chronic disease management.

Demographically, Europe's aging population fuels demand for health-related IoT devices, while urbanization promotes the adoption of smart city solutions. The European Environment Agency reports increasing deployment of air quality and energy consumption sensors across metropolitan areas, many of which are powered by energy-efficient MCUs.

Security frameworks like ENISA’s Cybersecurity for IoT guidelines also support MCU development with built-in secure boot and data encryption capabilities. As Europe emphasizes digital sovereignty and local chip production, the region is expected to witness steady growth in embedded microcontroller use across verticals such as transportation, energy, and healthcare.

The Japan IOT Microcontroller Market

The Japan IOT Microcontroller Market is projected to be valued at USD 420.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.48 billion in 2034 at a CAGR of 15.0%.

Japan’s IoT microcontroller market benefits from the country’s deep expertise in electronics manufacturing, aging population, and focus on smart automation. Known for its world-class precision engineering and embedded system development, Japan continues to lead innovation in compact, power-efficient microcontrollers for IoT devices.

Government bodies like METI (Ministry of Economy, Trade and Industry) and NEDO (New Energy and Industrial Technology Development Organization) support R&D in smart factories and connected robotics under initiatives like “Society 5.0.”

Japan's demographic shift, with over 29% of its population aged 65 and above, per the Statistics Bureau of Japan is pushing demand for health monitoring wearables, assistive robots, and smart home safety devices, many of which operate on embedded MCUs. The government’s long-term care reforms and smart city investments provide a favorable environment for MCU deployment in elderly care and urban infrastructure.

From a manufacturing perspective, Japan is home to global leaders in sensor, automotive, and semiconductor industries. Companies are integrating MCUs into ADAS platforms, energy metering devices, and factory automation tools. According to JETRO (Japan External Trade Organization), the country is expanding its focus on smart mobility and energy-efficient buildings, both requiring real-time control systems based on microcontrollers.

Additionally, Japan’s strong adoption of wireless protocols like Wi-SUN and LPWA networks enhances the utility of MCUs in outdoor and long-range IoT applications. With high internet penetration, reliable infrastructure, and policy-driven innovation, Japan remains a key market for scalable, secure, and responsive microcontroller-based IoT solutions.

Global IOT Microcontroller Market: Key Takeaways

- Global Market Size Insights: The Global IOT Microcontroller Market size is estimated to have a value of USD 7.0 billion in 2025 and is expected to reach USD 28.0 billion by the end of 2034.

- The US Market Size Insights: The US IOT Microcontroller Market is projected to be valued at USD 1.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.2 billion in 2034 at a CAGR of 15.6%.

- Regional Insights: Asia Pacific is expected to have the largest market share in the Global IOT Microcontroller Market with a share of about 42.0% in 2025.

- Key Players: Some of the major key players in the Global IOT Microcontroller Market are Broadcom, Espressif Systems, Holtek Semiconductor, Infineon Technologies, Microchip Technology, Nuvoton Technology, NXP Semiconductors, Silicon Laboratories, STMicroelectronics, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 16.6 percent over the forecasted period of 2025.

Global IOT Microcontroller Market: Use Cases

- Smart Home Automation: IoT microcontrollers power smart thermostats, lighting systems, and security sensors. By integrating wireless connectivity and control logic, MCUs enable devices to respond to user preferences, optimize energy usage, and interact with voice assistants, enhancing convenience and sustainability in connected living spaces.

- Remote Health Monitoring: Wearable medical devices like heart rate monitors and glucose sensors rely on microcontrollers for data acquisition and real-time transmission. These MCUs enable continuous patient monitoring, allowing healthcare professionals to detect anomalies early, reducing hospitalization rates, and supporting the rise of telehealth and remote diagnostics.

- Predictive Maintenance in Manufacturing: Industrial IoT systems equipped with MCUs gather machine performance data, enabling predictive maintenance. By analyzing vibration, temperature, and usage patterns, these systems minimize unplanned downtime and extend equipment lifespan, boosting operational efficiency and reducing repair costs in automated facilities.

- Smart Agriculture: Microcontrollers are embedded in soil moisture sensors, drone controls, and weather stations for precision agriculture. These low-power chips support efficient irrigation, crop health analysis, and autonomous operations, helping farmers improve yield, reduce input costs, and address food security challenges globally.

- Connected Automotive Systems: MCUs facilitate real-time decision-making in connected vehicles, managing ADAS (advanced driver-assistance systems), infotainment, and engine control. Their low latency and resilience make them essential for automotive safety, efficiency, and connectivity in both conventional and electric vehicle architectures.

Global IOT Microcontroller Market: Stats & Facts

U.S. Department of Energy (DOE)

- Smart Grid Investment Growth: Investment in advanced metering and smart grid infrastructure by U.S. electric utilities grew from approximately USD 3.4 billion in 2014 to USD 6.4 billion in 2018. This figure is projected to surpass USD 16.4 billion annually by 2026, reflecting the growing integration of IoT microcontrollers in power distribution and grid monitoring systems.

- Utility Infrastructure Spending: In 2019 alone, U.S. electric utilities spent around USD 80 billion upgrading and expanding their transmission and distribution infrastructure, much of which includes embedded microcontrollers for monitoring voltage, current, and grid conditions in real-time.

- Growth of Utility IT Systems: Between 2014 and 2016, U.S. smart grid-related investments in IT and grid digitization increased over 41% annually, showing how microcontroller-based automation is becoming core to grid modernization.

- Public-Private Investments Under ARRA: Under the American Recovery and Reinvestment Act (ARRA), more than USD 9 billion was invested in smart grid initiatives between 2009 and 2015. These included the wide-scale deployment of microcontroller-based systems in utilities and substations.

- Federal Smart Grid Grants: U.S. government funding for smart grid projects ranged from USD 400,000 to over USD 200 million per project, supporting the installation of over 200,000 smart transformers, 850+ sensor networks, and nearly 700 automated substations that rely heavily on embedded microcontrollers.

- Cost of Power Outages: American businesses suffer an estimated USD 150 billion in losses each year due to power outages. IoT microcontrollers in smart grid systems are key to predictive maintenance and fault detection, helping to mitigate these economic losses.

OECD – Organisation for Economic Co-operation and Development

- IoT Economic Framework: The OECD has initiated comprehensive tracking of the economic and social impact of IoT, including its effects on productivity, employment patterns, and education systems. This underscores how widespread deployment of IoT microcontrollers has implications beyond technical performance.

Japan Cabinet Office & Statistics Bureau

- Aging Population: As of 2022, over 29.1% of Japan’s population was aged 65 or older. This percentage is expected to exceed 33% by 2050. This demographic shift is driving demand for microcontroller-powered healthcare wearables, fall detection systems, and assistive robots.

- Population Estimate: As of June 2025, Japan’s estimated population stood at 123.36 million, making it a mature, high-tech consumer market with strong potential for IoT device penetration.

- Median Age in Japan: The country has one of the highest median ages in the world at approximately 49.5 years, indicating an older population base that increasingly depends on digital health monitoring tools powered by embedded MCUs.

- Age Structure Snapshot: In 2025, Japan’s age distribution included 11.1% children (0–14 years), 59.6% working-age adults (15–64 years), and 29.3% seniors (65+ years). This structure emphasizes the rising need for senior-focused IoT devices.

- Elderly Household Share: Half of all households in Japan in 2019 included at least one person aged 65 or older. This demographic reality supports market expansion for smart home medical devices and eldercare systems.

- Elderly Living Alone: In 2020, 22% of Japanese women aged 65+ and 15% of men in the same age group lived alone. These figures are projected to increase by 2040, creating a strong case for remote monitoring and AI-integrated microcontroller applications.

- Rural Aging Rates: In prefectures like Akita, the elderly make up over 38.6% of the population, highlighting a unique demand for remote monitoring and smart healthcare IoT systems in underserved rural areas.

- Fertility Rate Trends: Japan's fertility rate was 1.14 children per woman in 2024, well below the replacement level. As the working-age population shrinks, automation and microcontroller-powered robotics are becoming essential to productivity.

- Labor Shortage Projection: Japan is expected to see a 20% decline in its working-age population by 2040. This is fueling massive interest in automation and embedded control systems across manufacturing, logistics, and eldercare.

- Senior Technology Use: Only 54.2% of Japanese individuals aged 65–74 use smartphones, and just 7.2% of people over 80 are digitally connected. IoT systems in Japan often integrate microcontrollers with simplified interfaces tailored for elderly users.

International & Technical Data Sources

- Internet Access in Japan: Nearly 97.1% of Japanese households have internet connectivity, and over 81% have personal computers, supporting the infrastructure required for seamless adoption of IoT ecosystems using microcontroller units.

- U.S. Smart Grid Economic Forecast: Smart grid-related expenditures were forecast to rise from USD 21.4 billion in 2009 to USD 42.8 billion by 2014 in the United States, reflecting rapid integration of microcontroller-based smart meters and load management systems.

- Smart Grid ROI Estimate: The Electric Power Research Institute (EPRI) estimates that an investment of USD 476 billion over 20 years in smart grid systems, much of it powered by MCUs, could yield customer benefits totaling up to USD 2 trillion.

- IEA Grid Upgrade Outlook: According to the International Energy Agency, the depreciated value of the U.S. electric grid exceeds USD 1 trillion. A full upgrade to a next-generation, sensor-rich smart grid could cost USD 4 trillion but save up to USD 130 billion annually through energy efficiency and predictive maintenance.

Global IOT Microcontroller Market: Market Dynamics

Driving Factors in the Global IOT Microcontroller Market

Explosion of Smart Consumer Electronics Adoption

The rapidly expanding ecosystem of smart consumer electronics is a critical driver for the global IoT microcontroller market. Devices like smart speakers, connected thermostats, wearable fitness trackers, digital locks, and intelligent lighting systems have seen widespread consumer adoption across developed and developing economies.

Each of these devices relies on compact, energy-efficient microcontrollers to manage inputs, process data, control outputs, and communicate with other networked devices. According to government and public datasets, broadband penetration in countries like the U.S., Germany, Japan, and South Korea exceeds 85%, which provides a solid foundation for the seamless functioning of smart home ecosystems.

Additionally, rising disposable incomes and lifestyle digitization are encouraging consumers to invest in personalized, voice-controlled, and app-integrated devices. Microcontrollers, especially 32-bit and integrated wireless variants, enable these devices to offer real-time processing, enhanced security, and remote configurability. Furthermore, tech brands are now differentiating products based on responsiveness, power efficiency, and connectivity, all of which hinge on the capabilities of embedded MCUs.

As device interoperability becomes a priority and ecosystems like Apple HomeKit, Google Home, and Amazon Alexa expand, demand for sophisticated, programmable microcontrollers continues to rise. The ongoing miniaturization and cost reduction in MCU production further fuel this demand, creating a virtuous cycle of adoption and innovation in smart consumer electronics globally.

Adoption of Industry 4.0 and Smart Manufacturing

The growing implementation of Industry 4.0 principles is a powerful growth driver for the IoT microcontroller market, particularly in sectors like automotive, logistics, energy, and industrial manufacturing. Industry 4.0 calls for connected machinery, real-time analytics, predictive maintenance, and autonomous decision-making, each requiring robust edge computing solutions powered by microcontrollers.

Embedded MCUs in sensors, actuators, and machine controllers facilitate seamless data acquisition, control logic, and low-latency communication in highly automated environments. Governments in regions such as the European Union, the U.S., and Japan are actively funding smart factory initiatives and offering tax incentives for IoT integration, which accelerates microcontroller adoption.

For instance, the German government’s “Industrie 4.0” program has mobilized both public and private capital to modernize factory systems with embedded intelligence. Moreover, MCUs play a vital role in enabling machine-to-machine (M2M) communication and implementing security protocols that protect operational networks from cyber threats.

They also support remote diagnostics and configuration, reducing downtime and maintenance costs. As more industrial players migrate from legacy systems to cloud-connected platforms, the demand for low-power, high-performance microcontrollers capable of operating in harsh environments is surging. This trend is expected to deepen as global supply chains become smarter, more automated, and increasingly dependent on sensor-rich infrastructures powered by embedded MCUs.

Restraints in the Global IOT Microcontroller Market

Semiconductor Supply Chain Disruptions and Cost Volatility

A key restraint in the IoT microcontroller market is the persistent disruption in the global semiconductor supply chain, which affects production timelines, pricing, and vendor reliability. The COVID-19 pandemic exposed critical vulnerabilities in chip manufacturing logistics, with production slowdowns in key regions like Taiwan, South Korea, and the U.S. causing cascading delays.

Additionally, geopolitical tensions such as U.S.-China trade restrictions, sanctions on chip exports, and regional power outages continue to pose risks to uninterrupted supply. As a result, OEMs and device manufacturers have faced challenges in sourcing sufficient MCU inventory, leading to increased lead times and unexpected price hikes. These disruptions disproportionately affect smaller device makers and emerging IoT startups that lack the purchasing power of large-scale buyers.

Moreover, the shift to advanced fabrication nodes (like 7nm and below) increases development costs and dependency on high-end foundries. Although companies are investing in localized fabs to mitigate supply risks, building and certifying these facilities takes years. For now, persistent instability in the semiconductor ecosystem limits the growth pace of microcontroller-based IoT deployments, especially in consumer and automotive sectors where cost sensitivity is high.

Security Vulnerabilities and Interoperability Challenges

Security concerns represent a substantial restraint on the adoption of IoT microcontrollers, particularly in mission-critical applications like healthcare, automotive, and industrial systems. MCUs, when deployed in the field without robust encryption and authentication protocols, become potential entry points for cyberattacks.

Firmware vulnerabilities, unsecured communication protocols, and insufficiently updated devices pose risks to data integrity and system functionality. High-profile incidents such as IoT botnet attacks and ransomware targeting embedded systems have eroded end-user confidence, especially in regulated industries. Despite advances in hardware security (e.g., secure boot, on-chip crypto engines), standardization remains fragmented across vendors.

This lack of interoperability also complicates development, as engineers must design firmware and drivers tailored to each hardware-software combination. Additionally, integrating MCUs into legacy infrastructure often results in compatibility issues, requiring custom middleware and gateways. These challenges not only delay deployment timelines but also increase engineering overhead and compliance costs. Without universal security standards and greater ecosystem alignment, the market may face adoption bottlenecks, especially from risk-averse sectors that demand certified, secure, and interoperable microcontroller platforms.

Opportunities in the Global IOT Microcontroller Market

Healthcare Transformation and Wearable Medical Devices

One of the most promising growth opportunities for the IoT microcontroller market lies in the healthcare industry, particularly through wearable and remote patient monitoring devices. As healthcare systems worldwide seek to reduce costs and improve care accessibility, there is a growing emphasis on continuous health monitoring outside of traditional clinical settings. Microcontrollers are critical in enabling compact, energy-efficient wearable devices that measure parameters like heart rate, blood oxygen levels, blood glucose, ECG, and more.

These devices depend on MCUs for sensor interfacing, signal processing, data encryption, and wireless communication. Government-backed programs, such as the U.S. Department of Veterans Affairs’ remote monitoring initiatives or Japan’s smart eldercare strategies, are increasingly integrating wearable technologies to manage chronic illnesses and aging populations.

Additionally, the COVID-19 pandemic accelerated demand for contactless, telemedicine-enabled systems, many of which continue to gain relevance. As AI becomes embedded into wearable MCUs, real-time anomaly detection and patient alerts will become more precise and autonomous. The integration of Bluetooth Low Energy (BLE) and other low-power protocols ensures continuous operation without frequent recharging. These advancements not only address pressing healthcare delivery challenges but also create expansive new markets for MCU manufacturers targeting health-tech startups and established medical device OEMs alike.

Expansion of Smart Cities and Infrastructure Projects

The global push toward smart cities presents a wide-reaching growth opportunity for the IoT microcontroller market. Governments and municipal bodies are increasingly deploying interconnected infrastructure traffic lights, parking sensors, waste management systems, energy meters, and surveillance devices that rely on microcontrollers to function efficiently.

These MCUs enable localized data processing, reduce latency, and facilitate power management in devices that must operate autonomously for years. Countries like Singapore, the UAE, India, and the Netherlands have launched large-scale smart city programs integrating thousands of IoT nodes into public systems. Microcontrollers with built-in LoRa, NB-IoT, or Zigbee connectivity provide the necessary long-range, low-power communication backbone for these deployments.

The emphasis on sustainable urban planning, energy conservation, and intelligent mobility further amplifies the demand for embedded control units. Additionally, these infrastructure systems require a high level of device security, which MCUs now provide through secure boot, hardware encryption, and firmware authentication.

As 5G and edge computing capabilities mature, smart city systems will increasingly rely on localized decision-making, necessitating microcontrollers that can handle AI workloads and real-time control. This market will continue to grow as climate change, population growth, and urban congestion drive cities to adopt intelligent, connected infrastructure powered by resilient microcontrollers.

Trends in the Global IOT Microcontroller Market

Integration of AI and ML Capabilities at the Edge

A significant trend reshaping the IoT microcontroller market is the integration of artificial intelligence (AI) and machine learning (ML) directly into microcontrollers to enable edge-based intelligence. This movement is driven by the need for real-time analytics, faster decision-making, and bandwidth conservation. Instead of sending raw data to the cloud, smart MCUs can now process information locally, which improves system responsiveness and reduces latency.

Companies like STMicroelectronics, NXP Semiconductors, and Ambiq Micro are developing ultra-low-power AI MCUs capable of running ML algorithms for tasks like voice recognition, anomaly detection, and predictive maintenance. These devices are particularly useful in industrial automation, healthcare wearables, and autonomous systems.

The trend aligns with the broader movement toward decentralization in IoT architectures, often referred to as "TinyML." By empowering edge devices with intelligent decision-making capabilities, microcontrollers are transitioning from simple control units to dynamic, context-aware computing engines. This paradigm shift is not only optimizing power consumption but also enhancing security by limiting external data transmission.

Additionally, firmware updates over-the-air (OTA) are becoming standard, ensuring continuous improvement in deployed AI capabilities. This evolution is expected to fundamentally redefine microcontroller design philosophies, prioritizing high-performance computing within ultra-constrained power and memory environments critical for the future of scalable, intelligent IoT networks.

Rise of Multi-Protocol Wireless Microcontrollers

Another major trend shaping the IoT microcontroller landscape is the growing demand for multi-protocol wireless MCUs that can support Bluetooth Low Energy (BLE), Zigbee, Wi-Fi, Thread, and LoRa simultaneously or interchangeably. As IoT applications expand across smart homes, industrial settings, and connected healthcare, interoperability becomes critical.

Devices are increasingly expected to connect seamlessly across diverse ecosystems, home automation systems, wearable gadgets, and industrial IoT platforms, all use different wireless standards. To support this, MCU manufacturers are now embedding multiple radio stacks within a single chip, minimizing the need for external communication modules. This integration not only reduces size and cost but also lowers power consumption and simplifies device design.

The ability to switch or coexist between multiple protocols makes these microcontrollers flexible for future-proof deployments, especially as connectivity standards evolve. Nordic Semiconductor and Silicon Labs are among the frontrunners in producing multi-protocol MCUs optimized for battery-powered applications.

Moreover, this trend is encouraging software-defined radios and configurable hardware stacks, where firmware updates can redefine device behavior in the field. As more countries and industries adopt smart infrastructure standards, the role of adaptable, multi-protocol MCUs becomes central to achieving scalable, global IoT rollouts. The rise of multi-radio MCUs reflects the market’s pivot toward platform-agnostic, interoperable devices with seamless connectivity capabilities.

Global IOT Microcontroller Market: Research Scope and Analysis

By Product Analysis

The projected dominance of 32-bit microcontrollers in the IoT microcontroller market is largely attributed to their superior processing capabilities, optimal power efficiency, and broad applicability across both consumer and industrial IoT systems. These microcontrollers offer an ideal balance between computational performance and power consumption, making them suitable for complex, real-time tasks such as edge analytics, sensor fusion, wireless communication management, and AI inference at the device level.

Unlike 8-bit or 16-bit MCUs, which are restricted in memory addressing and instruction sets, 32-bit microcontrollers can support advanced protocols like Wi-Fi, Bluetooth LE, and LoRa with greater ease, enabling seamless connectivity in smart environments.

Additionally, 32-bit MCUs often come equipped with integrated peripheral functions, digital signal processing (DSP), hardware accelerators, and multi-threaded operating system support. These capabilities are essential in modern applications such as autonomous vehicles, wearable medical devices, and industrial control systems that require real-time responsiveness, security, and scalability. The affordability of 32-bit MCUs has also improved due to manufacturing advancements and economies of scale, allowing them to penetrate low-cost segments previously dominated by 8-bit chips.

Major semiconductor manufacturers like STMicroelectronics, NXP, and Microchip are focusing R&D on 32-bit platforms to support emerging demands in AI, voice control, and sensor-rich environments. As IoT solutions become more sophisticated and decentralized, the requirement for high-throughput, energy-efficient microcontrollers with flexible architecture ensures that 32-bit variants remain the backbone of IoT innovation across multiple industry verticals.

By Application Analysis

Industrial automation is anticipated to dominate the IoT microcontroller market due to the sector’s accelerated adoption of Industry 4.0 principles and its reliance on real-time control, monitoring, and machine-to-machine (M2M) communication. Smart factories and connected production environments require a dense network of sensors, actuators, human-machine interfaces (HMIs), and robotics, all of which depend on embedded microcontrollers for precise operation.

These MCUs manage critical tasks such as real-time process control, motion regulation, predictive maintenance, and energy optimization, making them indispensable components in modern manufacturing.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

As global industries face labor shortages and rising demand for production efficiency, automation is no longer optional; it is essential. Governments across Europe, the U.S., China, and Japan are providing incentives for digital transformation in manufacturing. For instance, Germany’s “Industrie 4.0” initiative and Japan’s “Society 5.0” promote sensor-enabled automation infrastructure, fueling demand for low-power, high-performance microcontrollers with robust connectivity and security features.

Furthermore, industrial settings require MCUs with extended temperature tolerance, electromagnetic compatibility, and fault tolerance to operate reliably in harsh environments. 32-bit MCUs, in particular, are favored in automation due to their ability to support advanced functionalities like Ethernet-based communication (e.g., PROFINET, Modbus TCP), local data processing, and cybersecurity compliance.

The ability of microcontrollers to integrate real-time analytics, edge decision-making, and intelligent sensing within compact modules directly supports industrial goals such as zero downtime, lean manufacturing, and operational safety. As manufacturing ecosystems evolve toward smart, autonomous networks, the strategic role of microcontrollers in enabling this transformation cements industrial automation as the leading application segment in the IoT MCU market.

The Global IOT Microcontroller Market Report is segmented on the basis of the following

By Product

By Application

- Industrial Automation

- Automotive & Transportation

- Healthcare

- Consumer Electronics

- Smartphones

- Wearables

- Others

Impact of Artificial Intelligence on Global IoT Microcontroller Market

- Enhanced Edge Processing Capabilities: AI integration enables microcontrollers to perform advanced data analysis at the edge, reducing latency and dependence on cloud processing. This improves real-time decision-making, power efficiency, and performance across diverse IoT applications.

- Smarter Device Autonomy: AI empowers IoT devices to learn user behavior and adapt automatically without constant external input. Microcontrollers integrated with AI algorithms facilitate this intelligence, enhancing system responsiveness and personalization across smart homes, wearables, and automotive systems.

- Improved Predictive Maintenance: AI-enabled microcontrollers enhance predictive maintenance in industrial IoT by analyzing sensor data and forecasting equipment failures. This reduces downtime, extends asset lifespan, and lowers operational costs in manufacturing, energy, and logistics sectors.

- Security Strengthening at the Hardware Level: AI boosts embedded security in microcontrollers by identifying anomalies and preventing threats in real time. This hardware-level intelligence is vital for securing connected ecosystems, especially in healthcare, defense, and critical infrastructure applications.

- Optimized Energy Management: AI algorithms on microcontrollers help dynamically manage energy consumption by adjusting operations based on usage patterns. This leads to increased battery life and energy efficiency in applications like remote sensors, wearables, and smart meters.

- Faster Development of Adaptive Applications: AI shortens development cycles for adaptive IoT applications by enabling real-time learning and decision-making within microcontrollers. Developers can build smarter, more responsive solutions with fewer updates and reduced reliance on external processing resources.

Global IOT Microcontroller Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is projected to lead the global IoT microcontroller market with 42.0% of the revenue share by the end of 2025, due to its strong manufacturing base, extensive electronics ecosystem, and growing investments in smart infrastructure. Countries like China, Japan, South Korea, and Taiwan are major hubs for semiconductor fabrication, embedded systems design, and IoT hardware production.

These nations not only house leading MCU manufacturers but also support vast OEM networks that integrate these chips into a variety of consumer and industrial devices. The availability of low-cost labor and robust supply chains makes the region attractive for large-scale electronics production, which increases the volume demand for microcontrollers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In addition, the rapid expansion of smart cities in China and India, coupled with the rising adoption of connected vehicles, smart homes, and industrial automation, continues to push IoT deployment. Government-led initiatives like “Made in China 2025,” India’s “Digital India,” and South Korea’s “Intelligent Manufacturing Innovation Strategy” have further boosted R&D in microcontroller-powered IoT solutions.

Furthermore, Asia Pacific has a massive and digitally connected consumer base with increasing demand for smart consumer electronics and wearables. This combination of demand, supply-side capabilities, and supportive policy infrastructure firmly establishes Asia Pacific as the dominant region in the global IoT microcontroller market.

Region with the Highest CAGR

North America is poised to register the highest compound annual growth rate (CAGR) in the IoT microcontroller market due to its strong innovation pipeline, advanced infrastructure, and increased enterprise-level adoption of IoT solutions. The United States, in particular, is a global leader in smart home technologies, connected healthcare, and industrial IoT, all of which heavily depend on high-performance microcontrollers for control and communication.

The presence of key players such as Texas Instruments, Microchip Technology, and Analog Devices, who are actively investing in next-gen embedded technologies, has accelerated product innovation and commercialization. Moreover, the widespread roll-out of 5G and edge computing platforms across the U.S. and Canada is enhancing demand for smart devices that operate with low latency and high responsiveness, tasks ideally managed by advanced MCUs.

Regulatory frameworks supporting secure data transmission and energy efficiency standards also encourage manufacturers to integrate intelligent MCUs into infrastructure and utility systems. In addition, significant investments in healthcare digitization, remote patient monitoring, and autonomous vehicles in the region are boosting MCU adoption. The region’s deep focus on cybersecurity, especially in industrial and government IoT deployments, is leading to higher demand for microcontrollers with integrated security features, further fueling market growth at a rapid pace.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global IOT Microcontroller Market: Competitive Landscape

The IoT microcontroller market is moderately consolidated, with global semiconductor giants and niche embedded solution providers competing on innovation, power efficiency, and wireless integration. Leading players such as Texas Instruments, STMicroelectronics, NXP Semiconductors, and Microchip Technology dominate the high-performance MCU segment with expansive portfolios catering to consumer electronics, automotive, and industrial IoT applications. These companies leverage their robust R&D capabilities and global distribution networks to stay ahead in product development, particularly in the 32-bit and multi-protocol wireless MCU space.

Companies like Nordic Semiconductor, Silicon Labs, and Espressif Systems focus on ultra-low-power microcontrollers with integrated wireless features tailored for smart homes and wearables. Meanwhile, Renesas Electronics and Infineon Technologies are capitalizing on automotive-grade microcontrollers for advanced driver-assistance systems (ADAS) and electric vehicle architectures. Startups such as Ambiq Micro and GreenWaves Technologies are gaining attention for AI-capable and energy-efficient MCUs targeting edge intelligence.

Partnerships with IoT platform providers, software integration ecosystems, and foundry collaborations remain key strategic moves. As demand for secure, scalable, and programmable IoT solutions grows, competition intensifies in areas like hardware-based encryption, OTA update support, and compatibility with cloud services. Innovation and flexibility in design will define market leadership in the evolving IoT MCU landscape.

Some of the prominent players in the Global IOT Microcontroller Market are

- Broadcom

- Espressif Systems

- Holtek Semiconductor

- Infineon Technologies

- Microchip Technology

- Nuvoton Technology

- NXP Semiconductors

- Silicon Laboratories

- STMicroelectronics

- Texas Instruments

- Renesas Electronics

- Analog Devices

- Raspberry Pi Foundation

- Nordic Semiconductor

- CML Microcircuits

- ARM (design/IP licensing)

- Airoha Technology

- Ambiq Micro

- Arduino LLC

- Semtech

- Other Key Players

Recent Developments in Global IOT Microcontroller Market

June 2024

- Qualcomm’s USD 60M in Silicon Labs: Funds will accelerate production of the BG27 series ultra-low-power MCUs, targeting smart meters and wearables with 10-year battery life.

- Samsung’s USD 30M in Espressif: Focused on ESP32-C6 WiFi 6/Bluetooth 5.3 MCUs with on-device AI for voice recognition (competing with Nordic’s nRF54).

- NXP × AWS: The new MCX A14x dev kit combines NXP’s Cortex-M33 MCUs with AWS IoT Greengrass for edge-to-cloud security.

- STMicro × Azure RTOS: STM32U5 MCUs now support Azure RTOS ThreadX, enabling real-time OTA updates for industrial sensors.

- Embedded World 2024: Renesas showcased the RA8T1 MCU (480 MHz Cortex-M85) for motor control with AI-based predictive maintenance.

- CES 2024: Microchip’s PIC32CZ CA MCUs debuted with hardware-based post-quantum cryptography for IoT security.

May 2024

- Renesas’ USD 4.2B Dialog Deal: Expands wireless MCU offerings (WiFi 6E, BLE 5.3) for smart home and medical devices.

- Ambiq’s USD 50M Funding: Targets Apollo510 MCUs with 30 µA/MHz power draw for solar-powered IoT nodes.

April 2024

- TI × TensorFlow Lite: Enables MSP430FR5994 MCUs to run ML models under 1mW for predictive maintenance.

- IoT Tech Expo Berlin: Highlighted PSA Certified Level 3 security in NXP’s LPC55S69 MCU for automotive V2X.

November 2023

- Nordic’s USD 100M Funding: Accelerated nRF54H20 (multi-protocol) MCUs with 2.4x performance boost over nRF53.

- Microchip’s Microsemi Buy: Combined PolarFire FPGAs with PIC MCUs for edge AI vision systems.

September 2023

- IOTSWC Barcelona: NXP’s i.MX RT1180 (1 GHz Cortex-M7) demoed for PLC gateways with TSN support.

July 2023

- ARM × TSMC 4nm: Cortex-M85 MCUs achieved 6 CoreMark/MHz (vs. M7’s 4.2), ideal for AR/VR headsets.

March 2023

- GigaDevice’s USD 200M Round: Funded GD32VW553 (RISC-V + WiFi 6) MCUs, undercutting ARM by 20%.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.0 Bn |

| Forecast Value (2034) |

USD 28.0 Bn |

| CAGR (2025–2034) |

16.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (32 Bit, 16 Bit, 8 Bit), By Application (Industrial Automation, Automotive & Transportation, Healthcare, Consumer Electronics, Other Application) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Broadcom, Espressif Systems, Holtek Semiconductor, Infineon Technologies, Microchip Technology, Nuvoton Technology, NXP Semiconductors, Silicon Laboratories, STMicroelectronics, Texas Instruments, Renesas Electronics, Analog Devices, Raspberry Pi Foundation, Nordic Semiconductor, CML Microcircuits, ARM, Airoha Technology, Ambiq Micro, Arduino LLC, Semtech., and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global IOT Microcontroller Market?

▾ The Global IOT Microcontroller Market size is estimated to have a value of USD 5.8 billion in 2023 and is

expected to reach USD 21.1 billion by the end of 2032.

Which region accounted for the largest Global IOT Microcontroller Market?

▾ Asia Pacific has the largest market share for the Global IOT Microcontroller Market with a share of about

41.2% in 2023.

Who are the key players in the Global IOT Microcontroller Market?

▾ Some of the major key players in the Global IOT Microcontroller Market are Infineon Technologies,

STMicroelectronics, Broadcom, and many others.

What is the growth rate in the Global IOT Microcontroller Market?

▾ The market is growing at a CAGR of 15.5 percent over the forecasted period.