Japan's Generative AI market is growing at an incredible rate due to advances in

artificial intelligence technologies and their increasing adoption across various industries. As of 2024, the market has become characterized by strong government backing, extensive research and development activities, and the integration of AI solutions into key sectors like healthcare, automotive manufacturing, and finance.

Japan's initiatives such as Society 5.0 play an instrumental role in encouraging artificial intelligence innovation—specifically generative AI development that improves social and economic results. These efforts highlight the nation’s commitment to AI innovation in Japan, reinforcing its leadership in advanced automation technologies. Major companies such as Sony, Fujitsu, NEC Corporation, and Hitachi are at the forefront of this transformation process and investing heavily in developing AI-powered solutions tailored specifically to Japanese market demands.

Companies such as Sony, Fujitsu, and NEC Corporation specialize in key areas like natural language processing (NLP), computer vision, and content generation that have applications across industries spanning media & entertainment to banking & financial services (BFSI).

NVIDIA, an industry leader in AI hardware and software solutions, has strengthened its presence in Japan through partnerships with well-known universities like the University of Tokyo to advance its AI research. Their partnership aims to produce AI models tailored specifically for Japanese enterprises' unique requirements, further expanding Japan's generative AI market and contributing to ongoing Japan AI sector growth.

Furthermore, companies like OpenAI offer platforms specifically tailored for Japanese enterprises including tools for content production, predictive analytics, and automation as well as other services tailored towards improving operational efficiencies as well as user experiences across various sectors.

Retail companies such as Seven-Eleven Japan are also adopting generative AI to increase customer engagement and streamline operations, using AI-powered

chatbots in stores as one example of its revolutionary use in disrupting traditional business models.

Japan is expected to see a compound annual growth rate reflecting this increased adoption across various sectors playing an essential part in shaping its future of AI-powered innovation and automation within Japan itself.

As per Salesforce's survey found that 51% of over 1,000 marketers are already using or experimenting with generative AI, and another 22% plan to adopt it soon. The most common uses include content creation (76%), writing copy (76%), inspiring creative thinking (71%), analyzing market data (63%), and generating image assets (62%).

Marketers believe generative AI will allow them to focus more on strategic work, with 71% expecting it to reduce busy work. They anticipate saving five hours a week, adding up to over a month annually. However, concerns about accuracy, quality, trust, and job safety remain, with 39% needing better training.

In the sales sector, only one-third of salespeople are using or planning to use generative AI, but 61% believe it will help them serve customers and sell more efficiently. While 53% of sales professionals don’t know how to get the most value from AI, early adopters report significant success, with 84% saying it improved sales through faster, enhanced customer interactions.

Key Takeaways

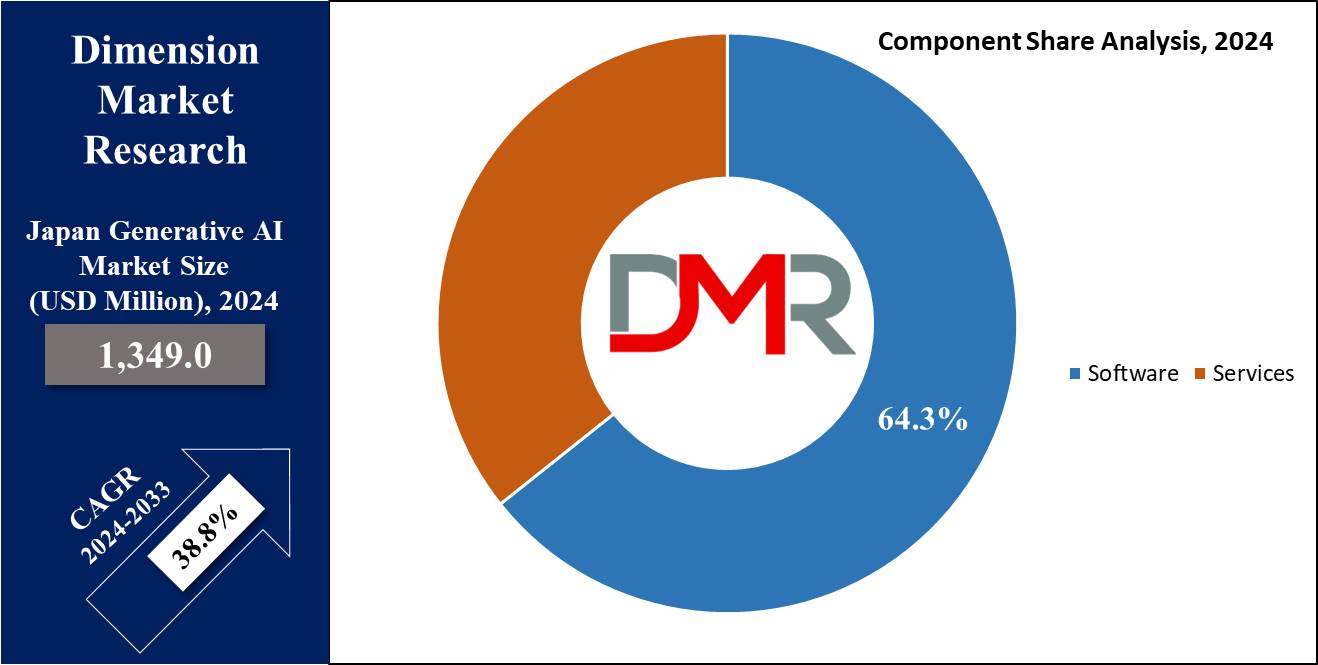

- The Japan Market Value: The Japan Generative AI Market t size is estimated to have a value of USD 1,349.0 million in 2024 and is expected to reach USD 25,796.2 million by the end of 2033.

- By Component Segment Analysis: In the context of component software dominate this market as it holds 64.3% of market share in 2024.

- By Technology Segment Analysis: GAN is projected to dominate this market based on technology as it will hold 64.3% of the market share in 2024.

- By Model Outlook Segment Analysis: Large Language Models (LLMs) dominate the model outlook segment in the Japan generative AI market as it holds the highest market share in 2024.

- By Application Segment Analysis: Natural Language Processing (NLP) dominates the application segment in the Japan generative AI market as it holds the highest market share in 2024.

- Competitive landscape: Some of the major key players in the Japan Generative AI Market are Preferred Networks, Abeja, Cinnamon, Ubie, Ascent Robotics, LeapMind, and many others.

- Growth Rate: The market is growing at a CAGR of 38.8 percent over the forecasted period.

Use Cases

- Content Generation: AI-powered content generation tools allow Japanese companies to quickly generate engaging, personalized marketing material at scale.

- Healthcare Diagnostics: Generative AI models analyze medical imaging data, providing early diagnoses and personalized treatment plans to patients across Japan's healthcare industry and improving patient outcomes overall.

- Retail Customer Interaction: AI-powered virtual assistants enhance customer experiences in retail by offering tailored shopping recommendations and efficient support services.

- Automotive Design: The automotive industry in Japan utilizes AI models for streamlining vehicle design processes and optimizing the aesthetic and functionality of prototype vehicles through artificial intelligence models.

- Media Production: Japan has witnessed AI-powered video editing and deepfake models revolutionize media and entertainment sectors by producing highly realistic visual content with extremely creative flair. These technologies have given rise to highly realistic and creative visual content.

Market Dynamic

Trends

Integration of AI into Traditional Industries

Traditional industries like manufacturing, retail, and transport are increasingly integrating

generative AI solutions aimed at enhancing operational efficiency and innovation. Companies such as Toyota and Mitsubishi Electric are developing AI-enabled solutions to enhance their production processes, optimize their supply chains, and improve the quality of their products. This trend is propelled by strong manufacturing in Japan and the need to bring out more competitiveness in the international market.

Increasing Collaboration between Academia and Industry

Notable trends that are going to make a difference in the generative AI Japan market would include increasing academics and industry collaboration. For instance, universities such as the University of Tokyo and Kyoto University have partnership relations with companies like NEC Corporation and Fujitsu, among others for advancement in research and development concerning AI. These are focused on developing top-of-the-line AI technologies, especially in NLP and computer vision, with key applications in the healthcare, automotive, and finance sectors.

Growth Drivers

Government Initiatives to Boost AI Adoption

The proactive stance of the Japanese government on the adoption of AI is among the key growth drivers of the generative AI market. It has brought out initiatives such as the Society 5.0 vision, through which it plans to integrate AI, along with other advanced technologies, into various walks of life. This has meant more investments in AI research and development, particularly in self-driving vehicles, smart cities, and health. Companies such as Hitachi and Panasonic have already moved to the forefront in developing AI-driven solutions fully aligned with this vision.

Rapid Advancements in AI Technology

The rapid pace of technological development for artificial intelligence, precisely in generative adversarial networks and transformers, propels the pace of growth in the generative AI market of Japan. Tech giants such as Sony and SoftBank are some big Japanese investors in AI research to develop pioneering solutions to the specific needs of the Japanese market. Be it media and entertainment, gaming, or advertising, this area is seeing increasingly realistic AI-generated content that can enhance user experience.

Growth Opportunities

Expanding AI Applications in Healthcare

The growth possibilities for generative AI solutions are promising in Japan's healthcare sector. AI is gaining momentum in clinical diagnosis related to imagery, drug discovery, and preparation of personalized treatment plans so crucial for Japan's aging population.

Companies such as Olympus Corporation and Canon Medical Systems create AI-driven tools for early diagnosis and treatment options that could have great impacts on the industry. The integration of generative AI in healthcare should be such that it ensures better outcomes for patients and makes operations more efficient, hence driving the growth of the market.

Growing demand for AI-driven content generation

The industry demands are increasing towards AI-driven content generation in the media and entertainment sectors of Japan. With innovation and creativity inherent in the culture, Japanese companies are leading from the front in leveraging generative AI to create full automation of creative processes, including the creation of music, graphics, and video editing. That will no doubt dramatically alter how content is created and consumed, with great growth opportunities ahead.

Restraints

Cultural and Ethical Challenges

The uniqueness of the Japanese cultural context provides many challenges to wide adoption in the area of generative AI. The main aspects restraining AI growth concern ethical issues, mostly in areas such as deepfakes and privacy. Japanese companies will have to be very considerate of cultural sensitivities, balancing innovation with ethics.

Above all, public confidence in AI technologies is the most important aspect. Companies like Rakuten and LINE Corporation are indeed working toward ensuring that AI use in products and services offered is being transparently deployed and used in ways that can be considered ethical.

High Cost of Development and Implementation

This forms the main restraint toward which the generative AI market is leaning in Japan because generative AI solutions require high development and implementation costs. While the adoption of AI requires much investment and therefore is not affordable for many Japanese SMEs, maintenance and replacement costs are expensive, especially for industries with a lower margin on their products.

To negotiate this specific challenge, companies such as NTT Data and Toshiba have been looking into more cost-effective solutions and offering support to SMEs to facilitate wide considerations toward the use of AI technology.

Research Scope and Analysis

By Component

In the context of components, software dominates this market as it holds 64.3% of the market share in 2024. In the generative AI market of Japan, the software dominates the component segment because generative AI platforms, APIs, SDKs, and pre-trained models are considered fundamental in developing and deploying AI solutions for deployment across industries.

It forms the backbone of AI applications, offering the necessary tools and frameworks to an enterprise for building, customizing, and scaling efficient AI models. Generative AI platforms are integrated environments to design, train, and deploy AI models. They make it easy for companies to realize breakthroughs from AI with or without deep technical expertise in the domain.

Many of them come out of the box with pre-trained models, which greatly reduce time and costs in developing AI applications and, therefore, democratize the use of AI for a wider range of enterprises. And those APIs and SDKs take that dominance a step further because now, developers are capable of bringing in AI capabilities seamlessly within their systems and apps. That integration capability keeps industries like health, finance, media, etc., where automation with the help of AI and advanced analytics is transforming operations.

With the continuous advancement in AI software solutions, including the integration of new technologies like transformers and GANs, the software component will keep leading the innovation curve. The demand for robust and versatile AI software solutions would hence rise, further reinforcing dominance in the market as the practice of AI by businesses in Japan becomes more mainstreamed for improved efficiency and to develop cutting-edge competitive differentiators.

By Technology

GAN is projected to dominate this market based on technology as it will hold 64.3% of the market share in 2024. GANs have emerged as the apparent leader in this technology segment of the Japan generative AI market owing to their unique ability to generate highly realistic data.

Characterized by a couple of neural network generators and a discriminator that competes in a zero-sum game, each is independently capable of generating synthetic data almost indistinguishable from real data. But one of the main reasons GANs are dominating is because of their capability to create realistic images, videos, and audio applications, which a wide range of media, entertainment, and gaming industries have a high reliance on.

Deepfakes, video enhancement, and realistic avatars and environment applications of GAN-therefore push innovation in content creation.

Apart from that, media, this technology has its potential usage in the healthcare sector: GAN is going to play a crucial role in medical imaging to avoid data dearth and hence in drug discovery. Synthetic medical images of GAN will help in training the AI model for better diagnosis and better treatment of the patients.

Further, GANs find their important applications in data augmentation, where they synthesize artificial data for machine learning models that are to be used in tasks with limited real data. This is one of the very important drivers for AI research and development in Japan since high-quality data is often limited.

As a result, industries are in dire need of more AI-driven solutions, and the demands for GANs are expected to increase even more. Thus, this would position the segment as the highly dominant technology in Japan's generative AI market.

By Model Outlook

LLMs are expected to dominate the model outlook segment of the generative AI market in Japan because they possess an unparalleled ability to understand, generate, and manipulate human language. LLMs, such as those with transformer architectures, have indeed brought about a revolution in NLP, wherein AI systems are now able to execute higher-order language tasks both with high accuracy and fluency.

Some of the major reasons for LLMs' dominance include versatility in applications text generation and machine translation to conversational AI and sentiment analysis. These models are widely used in customer service automation, powering chatbots and virtual assistants to provide personalized interactions efficiently. In Japan, where customer experience has been at the forefront of businesses, there has been increased adoption of LLMs.

Another core use of the LLMs is content creation, which enables companies to generate automated yet high-quality text from marketing, journalism, and creative writing. This capability therefore increases demand for LLMs across a wide range of verticals, from media and advertising through to e-commerce. Again, this comes through continuous improvement in LLM through continuous new developments in AI research and access to enormous datasets, keeping them at the bleeding edge of generative AI technologies.

By Application

NLP leads the application segment in the generative AI market of Japan due to its wide applicability across various industries for which enriched language processing capability has become imperative. Hence, for value addition in communications between humans and machines, it is highly sought after in sectors such as BFSI, healthcare, and IT & telecommunications.

Key applications such as machine translation, text summarization, and sentiment analysis become critical for customer service improvement, automation of content creation, and efficient data analysis. It is also accredited to the dominance of NLP because, through NLP, it powers chatbots and intelligent virtual assistants that are being increasingly used by various Japan-based organizations to provide personalized customer support and optimize their operations with greater efficiency.

The ability of the

Natural Language Processing models to process a huge volume of texts and provide meaningful insight makes them highly essential for any industry looking to improve user experiences and operational efficiency. While AI-enabled solution development is imminent in Japan, demand related to NLP applications can be further expected to rise, thus helping them retain their leading position in the application segment within the generative AI market in Japan.

By End User

Based on the end-user segment, it is the Banking, Financial Services, and Insurance segment that is dominated in the Japan generative AI market, owing to the rich demand for AI-driven solutions, that improve security, operational efficiency, and customer service in this industry.

The BFSI industry in Japan is applying generative AI technologies for fraud detection, risk assessment, and personalized financial services, among their core applications, keeping it competitive in such a heavily regulated market.

Evidence of this may be seen in the fact that generative AI models are also being used extensively to automate complex processes along with customer onboarding, document processing, and due to regulatory compliances within the BFSI industry. These AI-driven solutions not only help reduce the operational costs for the BFSI sector but also bring about considerable hikes in terms of precision and speed.

AI in predictive analytics also helps financial institutions assess market trends, handle the risks associated, and provide appropriate products and services to customers. These are some of the major reasons behind the increasing dependence on generative AI for such applications and make the BFSI sector the significant end-user segment in the Japan generative AI market.

The Japan Generative AI Market Report is segmented on the basis of the following

By Component

- Software

- Generative AI Platforms

- API & SDKs

- Pre-trained Models

- Services

- Consulting & Advisory Services

- Implementation & Integration Services

- Training & Support

By Technology

- Generative Adversarial Networks (GANs)

- Transformers

- Variational Auto-Encoders

- Diffusion Networks

- Recurrent Neural Networks (RNNs)

By Model Outlook

- Large Language models

- Text-based Models

- Code Generation Models

- Image & Video generative models

- Style Transfer Models

- Deepfake Models

- Animation & Video Editing Models

- Multi-modal generative models

- Text-to-Image Models

- Text-to-Speech Models

- Image-to-Text Models

- Audio Generative Models

- Speech Synthesis

- Music Generation

- Others

By Application

- Natural Language Processing (NLP)

- Machine Translation

- Text Summarization

- Sentiment Analysis

- Language Modeling

- Computer Vision

- Image Recognition & Enhancement

- Object Detection & Classification

- Facial Recognition

- Robotics and Automation

- Autonomous Navigation

- Human-Robot Interaction

- Process Automation

- Content Generation

- Text & Copywriting

- Creative Writing

- Graphic Design

- Chatbots and Intelligent Virtual Assistants

- Customer Support Automation

- Personalized Recommendations

- Conversational AI

- Predictive Analytics

- Demand Forecasting

- Risk Assessment

- Anomaly Detection

- Others

By End User

- Media & Entertainment

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecommunication

- Healthcare

- Automotive & Transportation

- Gaming

- Others

Competitive Landscape

Japan's generative AI market is marked by fierce competition between key players, each striving to develop and deploy advanced solutions across various industries. Major companies like OpenAI, NVIDIA, and Google lead this effort with cutting-edge AI platforms and tools tailored specifically for Japanese enterprises' diverse needs.

Furthermore, each player invests heavily in research and development to bolster the capabilities of generative AI models like natural language processing (NLP), computer vision (CV), content generation, etc. Not to be outdone by global giants, Japan also features several domestic companies making significant strides in the generative AI market.

These domestic firms focus on providing customized AI-powered solutions tailored to Japanese language processing requirements and cultural nuances; further competition comes from startups innovating niche AI areas by offering services and solutions specialized for specific industry requirements; competition is expected to intensify further with continued market expansion driving advances in generative AI technologies in Japan.

Some of the prominent players in the Japanese generative AI Market are

- Preferred Networks

- Abeja

- Cinnamon

- Ubie

- Ascent Robotics

- LeapMind

- Stockmark

- Studio Ousia

- Heroz

- Autify

- Other Key Players

Recent Developments

- August 2024: NVIDIA's AI Research Collaboration with the University of Tokyo NVIDIA announced a strategic partnership with the University of Tokyo to advance AI research, particularly in the fields of natural language processing (NLP) and computer vision. This collaboration aims to develop AI-driven solutions tailored to the needs of Japanese industries, such as healthcare, automotive, and finance.

- July 2024: OpenAI Expands Presence in Japan with New AI Platform OpenAI launched a new AI platform in Japan, designed to offer advanced tools for content generation, predictive analytics, and automation. The platform is tailored to meet the specific needs of Japanese enterprises, with a focus on enhancing operational efficiency and user experiences.

- June 2024: Seven-Eleven Japan Implements AI-Driven Chatbots Seven-Eleven Japan, the country's leading convenience store chain, integrated AI-driven chatbots across its retail operations to enhance customer service and streamline store management. The chatbots, powered by generative AI, provide personalized recommendations, handle customer inquiries, and assist with inventory management.

- April 2024: Mitsubishi UFJ Financial Group (MUFG) Deploys AI for Fraud Detection Mitsubishi UFJ Financial Group (MUFG), one of Japan's largest financial institutions, deployed a generative AI-based solution for fraud detection and risk management. The AI system uses advanced machine learning algorithms to analyze transaction data in real time, identifying and mitigating potential fraud risks.

- March 2024: METI's AI Initiative in the Automotive Sector Japan's Ministry of Economy, Trade, and Industry (METI) launched a new initiative aimed at promoting AI research and development within the automotive sector. The initiative focuses on autonomous driving technologies, leveraging generative AI for tasks such as route planning, obstacle detection, and driver assistance systems.

- February 2024: Shueisha Adopts AI for Content Creation in Publishing Shueisha, one of Japan's largest publishing companies, adopted generative AI technology to automate content creation processes, including graphic design and text generation for its manga and magazines. The AI system helps streamline the creative process, allowing artists and writers to focus on higher-level creative tasks.

- January 2024: NTT Data and Toshiba's Collaboration for AI-Driven Telecommunications NTT Data and Toshiba announced a collaboration to develop AI-driven solutions for the telecommunications industry in Japan. The focus is on network optimization, customer engagement, and predictive maintenance, leveraging generative AI technologies to enhance service quality and operational efficiency.