Market Overview

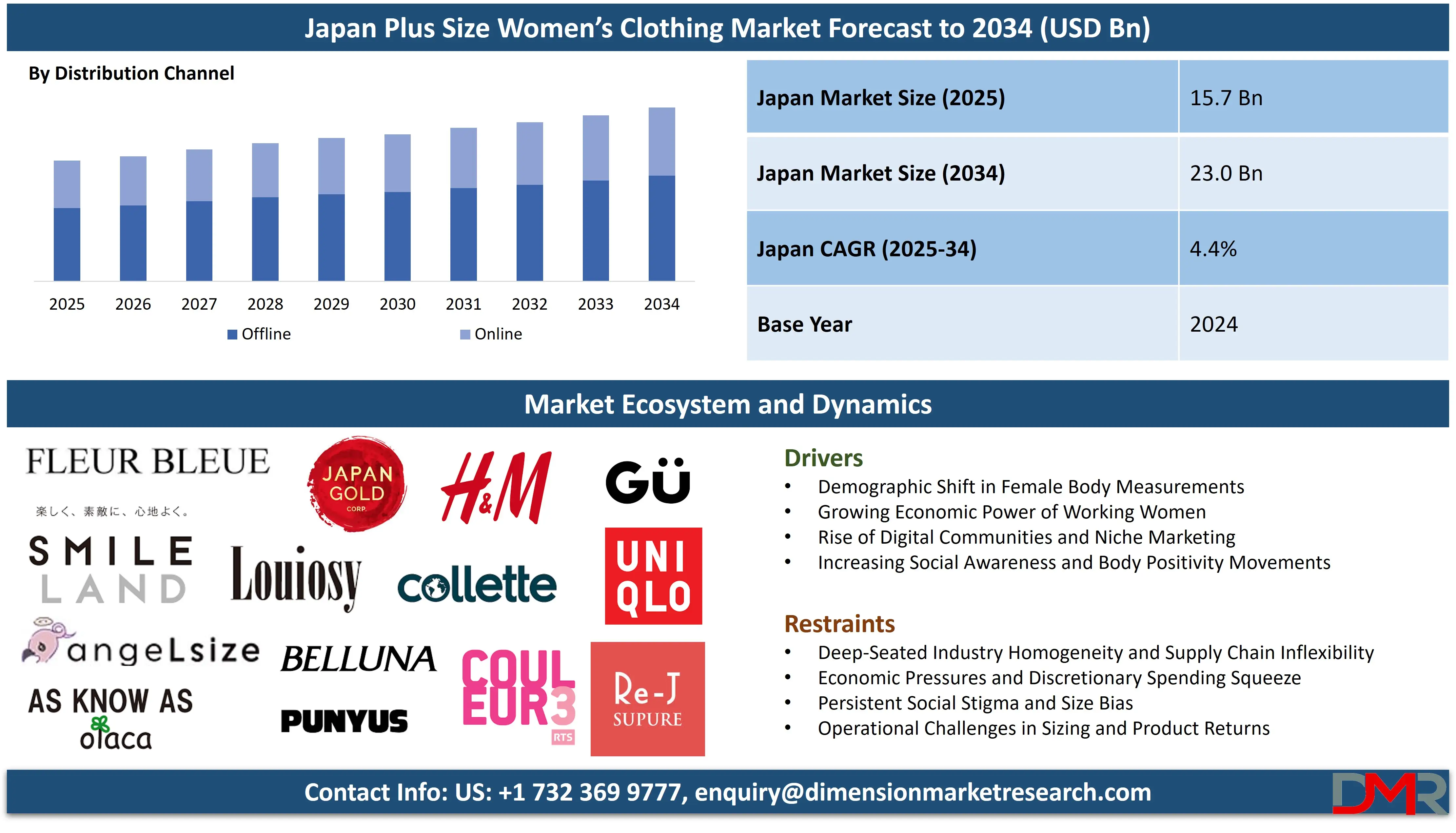

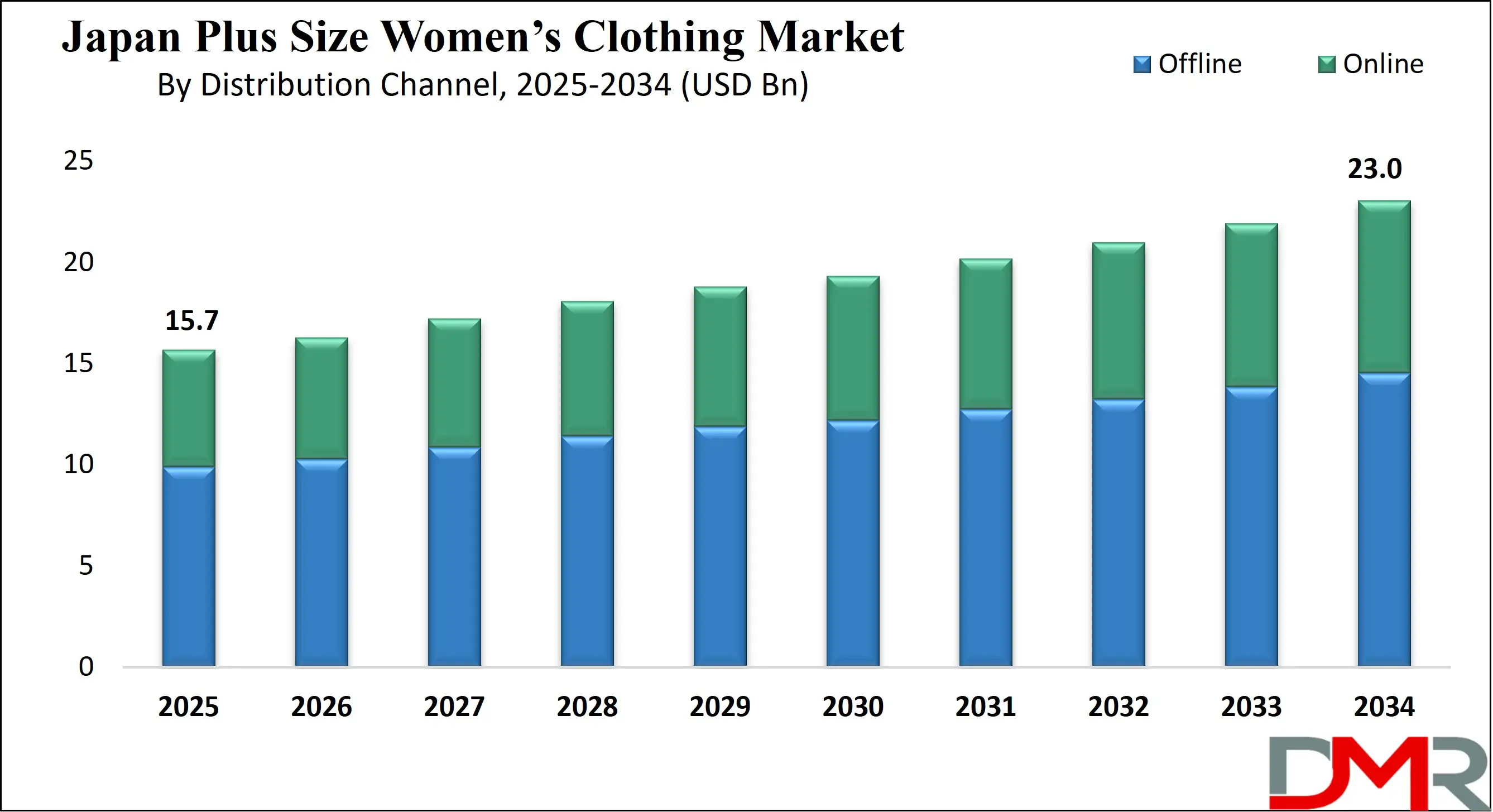

The Japan Plus-Size Women’s Clothing Market is anticipated to reach USD 15.7 billion by 2025 and is forecasted to grow at a steady CAGR of 4.4% from 2025 to 2034, ultimately achieving a market valuation of USD 23.0 billion by 2034.

This growth is driven by the rising acceptance of body positivity, expansion of inclusive fashion lines, increasing online retail penetration, and growing demand for size diversity in apparel. Leading fashion brands are focusing on plus-size apparel collections featuring enhanced fit, premium fabrics, and contemporary designs. Moreover, Japan’s evolving consumer attitudes toward self-expression and inclusivity are fostering significant opportunities for domestic and international fashion retailers, reinforcing the country's position as a rapidly developing hub for plus-size fashion, body-positive branding, and inclusive clothing innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Japan plus-size women's clothing market represents a significant and largely untapped demographic opportunity. Historically underserved by the domestic fashion industry, this segment is gaining recognition due to shifting societal attitudes and compelling government data. The Ministry of Health, Labour and Welfare's National Health and Nutrition Survey indicates a gradual but consistent increase in average body sizes among the Japanese female population over recent decades.

This demographic shift creates a tangible demand for larger clothing sizes that the mainstream market has been slow to address. Furthermore, the Cabinet Office's statistics on women's advancement highlight a growing cohort of financially independent, working women who possess the purchasing power to seek out apparel that fits their needs and expresses their personal style.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

This convergence of physiological data and socioeconomic empowerment is compelling both existing retailers and new entrants to re-evaluate their product lines and marketing strategies. The market is now seeing increased activity from specialized e-commerce platforms and select domestic brands aiming to cater to this discerning customer base, moving beyond basic functionality to offer fashionable, high-quality, and well-fitting plus-size options.

Japan Plus Size Women’s Clothing Market: Key Takeaways

- Substantial and Growing Market Value: The market represents a significant financial opportunity, projected to grow from an estimated USD 15.7 billion in 2025 to USD 23.0 billion by 2034, demonstrating a steady compound annual growth rate (CAGR) of 4.4%.

- A Market Driven by Demographic Reality: Growth is fundamentally underpinned by official data showing a consistent increase in the average body size of Japanese women. This creates a tangible and growing consumer base that the traditional fashion industry can no longer overlook.

- Fragmented Competitive Landscape with Key Segments: The market features a mix of global fast-fashion giants (Uniqlo, H&M), domestic online specialists (Punyus, AngeLsize), and niche brands (Clette, Louiosy). This indicates the market is served by players targeting different segments, from budget basics to fashion-forward styles.

- Digital Natives and Communities as Catalysts: Growth is being accelerated by digitally-native brands and active online communities. These platforms are crucial for building consumer trust, sharing styling advice, and creating the demand that pressures mainstream retailers to expand their offerings.

- The Critical Role of the Economically Empowered Woman: The rising labor force participation and disposable income of Japanese women are key drivers. This demographic has the financial power and professional need to demand stylish, well-fitting plus-size clothing, transforming the segment into a commercially attractive one.

- Significant White-Space Opportunities Remain: Despite the growth, major opportunities are still untapped, particularly in catering to the inbound tourism market and adapting traditional Japanese apparel (e.g., kimonos, yukata) for larger body sizes, representing high-value niche segments.

Japan Plus Size Women’s Clothing Market: Use Cases

- Inclusive Fashion Retail Expansion: Japanese fashion retailers like Uniqlo and GU are launching dedicated plus-size lines both online and in-store, allowing customers to access inclusive size ranges, improved fitting options, and style diversity, boosting retail inclusivity and consumer engagement.

- AI-Driven Virtual Fitting Solutions: Brands are integrating AI-based body scanning and virtual try-on tools to help plus-size consumers visualize fit and style before purchase, enhancing the online shopping experience and reducing return rates in Japan’s e-commerce-driven fashion landscape.

- Customized Plus-Size Apparel Design: Manufacturers are adopting data-driven pattern making and customization technologies to create tailored fits for different body shapes, improving comfort and aesthetics while promoting personalization in the plus-size segment.

- Body Positivity Marketing Campaigns: Japanese brands are increasingly leveraging social media and influencer partnerships to promote body-positive campaigns, encouraging self-confidence among plus-size women and reshaping beauty standards in Japan’s fashion culture.

- Sustainable Plus-Size Clothing Production: Fashion houses are focusing on sustainable fabrics and ethical production processes for plus-size lines, aligning with Japan’s eco-conscious consumer base and the global movement toward sustainable and inclusive fashion practices.

Japan Plus Size Women’s Clothing Market: Stats & Facts

Ministry of Health, Labour and Welfare (MHLW)

- The average height of Japanese women aged 20-29 was 158.0 cm in 2021, compared to 154.5 cm in 1975.

- The average weight of Japanese women aged 20-29 was 51.6 kg in 2021, compared to 50.5 kg in 1975.

- The average height of Japanese women aged 30-39 was 158.3 cm in 2021.

- The average weight of Japanese women aged 30-39 was 53.2 kg in 2021.

- The prevalence of obesity (BMI ≥ 25) among Japanese women in their 30s was 12.5% according to the latest National Health and Nutrition Survey.

- The prevalence of obesity (BMI ≥ 25) among Japanese women in their 40s was 15.5%.

- The prevalence of obesity (BMI ≥ 25) among Japanese women in their 50s was 18.2%.

- The prevalence of obesity (BMI ≥ 25) among Japanese women in their 60s was 22.5%.

Statistics Bureau of Japan

- As of 2023, there are approximately 64.5 million women in Japan.

- The female population aged 15 and over is approximately 54 million.

- The number of women in the labor force reached 30.15 million in 2022.

- The labor force participation rate for women aged 15-64 was 74.6% in 2022.

- The percentage of female employees among all employees has steadily increased to 45.8%.

Cabinet Office, Government of Japan

- The average annual income for female regular employees in 2021 was approximately 3.06 million yen.

- The percentage of women in management positions in Japan reached 8.9% in 2022.

- The government's "Womenomics" policy set a target for 30% of leadership positions to be held by women by 2020, which was later revised, highlighting a focus on female economic empowerment.

Japan Consumer Affairs Agency

- Reports and consumer feedback have highlighted "lack of size variation" as a recurring issue in the apparel industry complaints.

- The agency has recognized "diversity and inclusion" in business services as a growing area of consumer interest and corporate social responsibility.

Japan Apparel and Fashion Industry Council

- The council has identified the "silver market" and "diverse body types" as key future growth areas for the domestic industry.

- It acknowledges a structural shift in the industry from mass-production to small-lot, high-variety production to meet diverse needs.

Japan Department Stores Association

- The women's clothing category represents one of the largest segments within department store sales.

- There is an observed trend of customers seeking "comfort-oriented" and "size-inclusive" apparel post-pandemic.

Tokyo Metropolitan Government

- Surveys on living conditions in Tokyo have indicated a higher-than-national-average cost of living, influencing discretionary spending on apparel.

- The government's "Smile Plus" initiative promotes universal design and inclusive services, which can encompass retail and apparel.

Japan Tourism Agency

- The number of inbound tourists to Japan in 2023 was approximately 25 million, recovering post-pandemic.

- Surveys of inbound tourists have identified shopping as a top activity, with clothing being a popular purchase.

- The average expenditure per inbound tourist includes a significant portion allocated to shopping.

Japanese Organization for Employment of the Elderly and Persons with Disabilities

- The employment rate of people with disabilities in Japan is steadily increasing, promoting diversity and inclusion in the workforce and consumer base.

- This focus on inclusion indirectly supports the demand for apparel suitable for diverse body types.

Japan Plus Size Women's Clothing Market: Market Dynamics

Trends in Japan Plus Size Women's Clothing Market

Digital Community-Driven Demand and Niche Brand Proliferation

The most powerful trend is the organic, bottom-up formation of vibrant online communities where plus-size women share styling tips, review brands, and discuss their challenges. Platforms like Twitter, Instagram, and specialized forums have become incubators for demand, creating collective pressure on the industry. This has led to the proliferation of niche, digitally-native vertical brands that are highly responsive to this community feedback.

These brands often focus on specific sub-segments—such as plus-size office wear, traditional wear like kimonos, or youth street fashion—that large retailers ignore. They leverage social media for direct marketing, building loyal followings by showcasing diverse body types and fostering a sense of belonging and validation that was previously absent from the Japanese fashion landscape.

The "Uruoii" (Moist) Aesthetic and Fabric Innovation

Moving beyond basic functionality, there is a growing trend towards integrating plus-size clothing into the core Japanese fashion sensibility, particularly the "uruoii" or "moist" aesthetic which values quality, texture, and subtle elegance. Consumers are demanding the same high-quality fabrics—such as premium Japanese cotton, linen, and silk blends—found in standard-size fashion.

This drives innovation in fabric development and garment construction to ensure that plus-size clothing is not only larger but also offers drape, comfort, and breathability for the Japanese climate. The focus is on creating pieces that are aesthetically pleasing, emotionally comforting, and durable, aligning with the values of discerning consumers who seek long-term value over fast fashion.

Growth Drivers in Japan Plus Size Women's Clothing Market

Demographic Inevitability and the Data-Driven Reassessment

The primary growth driver is the undeniable demographic shift confirmed by official government health surveys. The longitudinal data from the MHLW clearly shows a trend of increasing average body sizes and higher obesity prevalence across successive female age cohorts. For apparel manufacturers and retailers, this data provides a concrete, quantifiable basis for strategic reassessment. It is no longer a niche social issue but a fundamental shift in the physical dimensions of the consumer base.

This empirical evidence is compelling conservative corporate planning departments to recognize that their traditional size ranges are becoming misaligned with the market reality, making expansion into plus-size not just a moral imperative but a financial necessity for long-term relevance and survival.

The Economic Empowerment of the Working Woman

The sustained increase in female labor force participation, as tracked by the Statistics Bureau, coupled with rising incomes and a growing, albeit slow, presence in management roles, creates a powerful economic driver. This cohort of working women possesses significant discretionary income and a professional need for a versatile, stylish, and well-fitting wardrobe.

Their economic clout gives them the power to demand that the market cater to them. Unlike previous generations, they can and will spend on brands that provide solutions, turning the plus-size segment from a low-margin, low-priority category into an attractive, high-value market segment characterized by customers with both the need and the means to invest in quality apparel.

Growth Opportunities in Japan Plus Size Women's Clothing Market

Inbound Tourism and the "Omotenashi" (Hospitality) Expansion

The recovery of inbound tourism presents a massive, untapped opportunity. Many international visitors, particularly from Western countries where average body sizes are larger, face extreme difficulty shopping in Japan. This represents a significant leakage in potential tourism revenue. Brands that develop plus-size lines can strategically position themselves to capture this market by offering "Omotenashi" through inclusive sizing.

Marketing these collections via travel agencies, airport retail, and multi-language e-commerce platforms can attract tourists pre-arrival and during their stay. Creating a reputation as a plus-size-friendly shopping destination can become a unique competitive advantage for specific retailers or even shopping districts, turning a market weakness into a national strength.

Adaptation of Traditional and Cultural Apparel

A significant white-space opportunity lies in the adaptation of traditional Japanese clothing, such as kimonos, yukatas, and jinbeis, for larger body types. The current market for these items is severely limited in its size range, excluding a substantial portion of the domestic population and nearly all larger-framed tourists. There is high potential for brands to specialize in made-to-order or extended-size traditional wear, using adjustable designs and innovative cutting patterns. This caters not only to daily life and festivals but also to the wedding and formal event market, where the desire to participate in cultural traditions is strong, and the lack of suitable attire is acutely felt, creating a high-value, high-margin niche.

Restraints in Japan Plus Size Women's Clothing Market

Deep-Seated Size Homogeneity and Industry Inflexibility

The most profound restraint is the deeply ingrained cultural and industrial preference for size homogeneity. The entire Japanese apparel supply chain, from pattern-making and grading to manufacturing and retail buying, is optimized for a narrow range of small sizes. This system is highly efficient and cost-effective for mass production but is structurally inflexible. Retooling for a wider size spectrum requires significant investment in new technical skills, pattern engineering to ensure flattering fits for different proportions, and a shift away from the low-risk, high-volume business model. This institutional inertia, combined with a lingering unconscious bias that equates "larger" with "unfashionable" among older industry executives, creates a powerful barrier to widespread adoption and innovation.

Economic Pressures and Discretionary Spending Squeeze

The Japanese economy has faced prolonged stagnation and recent inflationary pressures, which squeeze household disposable income. Apparel is a highly discretionary purchase, and plus-size clothing often carries a price premium due to the higher material costs and more complex manufacturing. In a tight economic environment, consumers may prioritize essentials or extend the life of their existing wardrobe, delaying purchases.

Furthermore, the average income for women, while growing, still lags behind that of men, creating a ceiling on purchasing power. This economic pressure makes it challenging for new brands to achieve scale and for consumers to consistently invest in the emerging plus-size market, potentially stifling its growth trajectory.

Japan Plus Size Women’s Clothing Market: Research Scope and Analysis

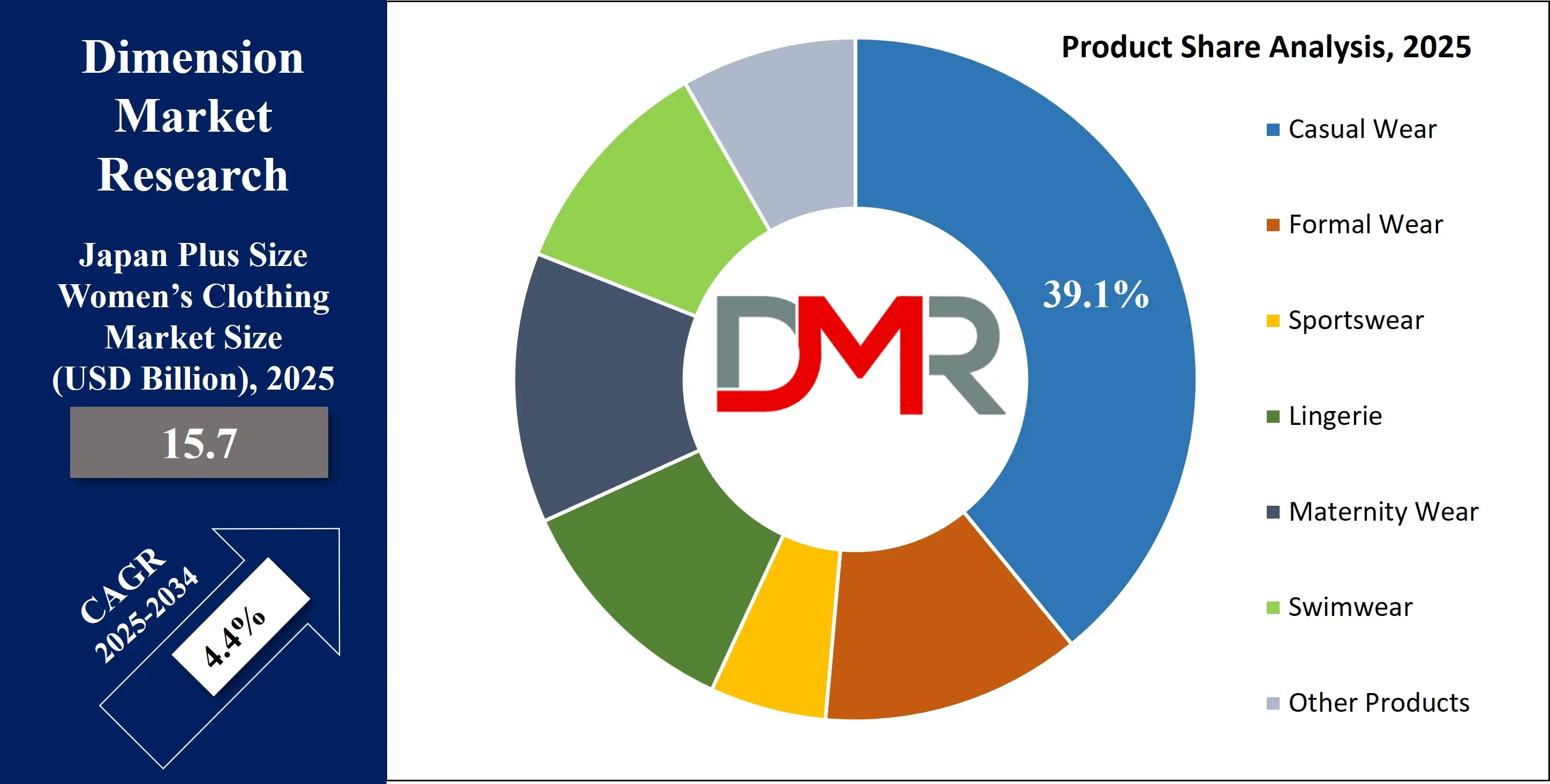

By Product Analysis

In the Japan Plus Size Women’s Clothing Market, casual wear is projected to dominate the product segment, holding the largest market share by the end of 2025. The growing preference for relaxed, functional, and stylish apparel reflects Japan’s evolving lifestyle trends emphasizing comfort, inclusivity, and aesthetic versatility. The rise of hybrid work environments, shifting fashion norms, and the influence of athleisure have made casual fashion an everyday essential.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Japanese women increasingly favor oversized tops, leggings, loungewear, joggers, and easy-fit dresses that merge comfort with elegance. This shift parallels Japan’s expanding cultural acceptance of body diversity and self-expression within the fashion sector.

Domestic brands such as Punyus, Eur3, and Re-J & Supure, alongside global players like Uniqlo and H&M Japan, are leading inclusive design movements. Furthermore, social media influencers and body-positive creators on platforms such as Instagram, TikTok, and LINE are promoting confidence through authentic fashion representation. As Japanese consumers increasingly value comfort, identity, and inclusivity, the casual wear segment is expected to remain the core growth driver of Japan’s plus-size apparel industry through 2034.

By Age Group Analysis

Within the Japan Plus Size Women’s Clothing Market, the 31–45 years age group is expected to lead the market due to its financial stability, modern lifestyles, and strong fashion awareness. Women in this age range balance work, family, and social activities, creating sustained demand for versatile and premium plus-size fashion that offers both comfort and sophistication. Their higher purchasing power allows investment in quality, well-fitted garments suitable for professional and casual settings.

Japanese and international brands are targeting this demographic with collections that emphasize functionality, sustainability, and fit precision. The growing influence of e-commerce and digital fashion communities further strengthens engagement, as women aged 31–45 actively participate in style-based social platforms and online shopping ecosystems. This demographic is shaping Japan’s fashion landscape by prioritizing authenticity, body confidence, and sustainable consumption, reinforcing its role as a key force driving inclusivity and innovation in Japan’s plus-size clothing market.

By Raw Material Analysis

Cotton is expected to remain the dominant raw material in Japan’s plus-size women’s clothing market by 2025, valued for its comfort, breathability, and eco-conscious characteristics. Japanese consumers are highly attentive to fabric quality, texture, and sustainability, preferring natural fibers that ensure durability and softness for diverse body types. Cotton’s versatility across casual wear, workwear, and homewear makes it a staple material, aligning with Japan’s demand for seasonal adaptability and minimalist comfort. With a rising focus on ethical manufacturing and eco-friendly fashion, the popularity of organic and sustainably sourced cotton has surged. Japanese brands are integrating organic cotton blends and recycled fibers to align with national sustainability goals and consumer expectations.

Cotton’s hypoallergenic and breathable nature also suits Japan’s humid climate, offering lasting comfort. As the Japanese fashion industry pivots toward sustainable production and material innovation, cotton will continue to symbolize the nation’s commitment to high-quality, environmentally responsible, and inclusive fashion.

By Pricing Analysis

The mid-priced segment is expected to lead the Japan Plus Size Women’s Clothing Market in 2025, reflecting the consumer preference for a balance of affordability, quality, and contemporary design. Japanese consumers are value-driven yet brand-conscious, seeking fashionable clothing that provides comfort, durability, and fit without excessive expense. The mid-range segment bridges premium styling and mass-market accessibility, appealing strongly to the urban middle-class demographic.

Brands such as GU, Nissen (SmileLand), Eur3, and Re-J & Supure have positioned themselves within this category by offering trendy yet affordable plus-size collections tailored for the Japanese market. The segment’s appeal lies in its consistent size inclusivity, dependable quality, and fashion relevance, which foster brand trust and long-term loyalty among consumers. As inclusivity and practicality continue to define consumer purchasing behavior, the mid-priced category will remain the backbone of Japan’s plus-size apparel market, offering the ideal balance of style, value, and inclusivity.

By Distribution Channel Analysis

Offline retail continues to dominate the Japan Plus Size Women’s Clothing Market, driven by consumers’ preference for in-person fitting, fabric assessment, and personalized service. Japanese shoppers place high importance on comfort, fit precision, and tactile experience before purchasing apparel. Major retailers such as Isetan Clover Shop, AOKI, and Avail have enhanced their in-store plus-size sections, creating inclusive spaces with trained stylists and body-positive atmospheres that boost consumer confidence.

While online retail is growing rapidly through platforms like Rakuten, ZOZOTOWN, and Amazon Japan, offline stores continue to thrive due to their personal touch and experiential shopping. Many brands are adopting omnichannel strategies, integrating virtual fitting rooms, appointment-based styling, and BOPIS (Buy Online, Pick Up In Store) to enhance accessibility. Offline retail’s sustained dominance stems from its ability to provide trust, guidance, and emotional connection, ensuring that brick-and-mortar stores remain central to Japan’s plus-size fashion ecosystem, complementing the rise of digital retail channels through 2034.

Japan Plus Size Women’s Clothing Market Report is segmented on the basis of the following

By Product

- Casual Wear

- T-shirts

- Jeans

- Casual Dresses

- Leggings

- Hoodies

- Formal Wear

- Office Suits

- Blazers

- Trousers

- Formal Dresses

- Skirts

- Sportswear

- Activewear

- Gym Wear

- Yoga Pants

- Joggers

- Sports Bras

- Lingerie

- Everyday Bras

- Shapewear

- Panties

- Sleepwear

- Maternity Wear

- Maternity Dresses

- Nursing Bras

- Maternity Leggings

- Swimwear

- One-Piece

- Tankinis

- Swim Dresses

- Beachwear Accessories

- Other Products

By Age Group

- 15–30 Years

- 31–45 Years

- 46–60 Years

- 60+ Years

By Raw Material

- Cotton

- Wool

- Silk

- Chemical

- Others

By Pricing

- Low-Priced

- Mid-Priced

- Premium

By Distribution Channel

- Online

- E-commerce Platforms

- Official Websites

- Offline

- Department Stores

- Specialty Stores

- Hypermarkets and Supermarkets

- Fashion Boutiques

- Outlet Stores

Impact of Artificial Intelligence in Japan Plus-Size Women’s Clothing Market

- AI-Powered Virtual Fitting and Body Scanning: Artificial Intelligence is revolutionizing the shopping experience in Japan’s plus-size women’s clothing market through 3D body scanning and virtual fitting technologies. Retailers such as ZOZOTOWN and Uniqlo are using AI-driven sizing algorithms to recommend precise fits, helping consumers visualize how garments will look and feel, thereby reducing return rates and increasing satisfaction.

- Personalized Fashion Recommendations: AI-based recommendation engines analyze a shopper’s body type, size history, and style preferences to suggest tailored clothing options. This personalization enhances the customer journey for plus-size women, ensuring better product discovery, inclusivity, and repeat purchases on both e-commerce and mobile platforms in Japan.

- AI-Driven Design and Trend Forecasting: Japanese fashion designers are leveraging AI tools to analyze social media trends, body data, and consumer feedback to create collections that better fit diverse body types. This allows brands to stay ahead of seasonal trends while offering inclusive and size-accurate designs that resonate with modern Japanese consumers.

- Inventory Optimization and Smart Supply Chains: AI is being deployed for predictive inventory management, allowing retailers to forecast demand for specific sizes and styles accurately. This reduces overproduction and waste, helping brands maintain sustainability goals while efficiently serving Japan’s plus-size apparel segment.

- Enhanced Customer Engagement through Chatbots and AI Styling Assistants: Fashion retailers in Japan are integrating AI chatbots and virtual stylists to provide plus-size shoppers with real-time assistance, outfit coordination tips, and confidence-building advice. These intelligent systems improve the online shopping experience, ensuring inclusivity and accessibility across Japan’s growing digital fashion ecosystem.

Japan Plus Size Women’s Clothing Market: Competitive Landscape

The competitive landscape of Japan's plus-size women's clothing market is highly fragmented, characterized by a dynamic mix of global fast-fashion giants, traditional domestic retailers, and a burgeoning wave of specialized niche brands. Global players like Uniqlo and H&M Japan leverage their extensive supply chains and brand recognition to offer basics and trendy pieces in extended sizes, primarily through their e-commerce channels.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

They represent the mainstream's gradual acknowledgment of this segment. In contrast, dedicated online-first brands such as Punyus (founded by popular entertainer Naomi Watanabe) and AngeLsize are market pioneers. They succeed by building strong community engagement, using inclusive marketing with diverse models, and creating fashion-forward designs that resonate deeply with a previously ignored audience. These brands are highly responsive to consumer feedback and trends emerging from social media platforms. Furthermore, the market includes mail-order and e-commerce specialists like Belluna (through its Re-J & Supure and Clette lines) which cater to a broad demographic, often focusing on practicality and comfort.

The landscape is rounded out by smaller, hyper-niche players like Louiosy and eur3 that target specific subcultures and aesthetics, from minimalist to streetwear. This diversity indicates a market transitioning from a one-size-fits-all approach to a more segmented, consumer-centric model where brand identity and community are key competitive advantages.

Some of the prominent players in Japan Plus Size Women’s Clothing Market are:

- Uniqlo

- GU

- H&M Japan

- Belluna

- Punyus

- Re-J & Supure

- Clette

- Louiosy

- Eur3

- As Know As olaca

- AngeLsize

- Gold Japan

- Isetan Clover Shop

- Nissen (SmileLand)

- Avail

- Cecil Plump

- Fleur by Mint Breeze

- GEVS.

- Taberunosky

- AOKI

- Other Key Players

Recent Developments in Japan Plus-Size Women’s Clothing Market

- May 2024: GU, a subsidiary of Fast Retailing (Uniqlo's parent company), announces the expansion of its online-exclusive larger size range, focusing on incorporating more trend-led pieces and seasonal colors alongside its core basics, indicating a commitment to growing its digital share in this segment.

- February 2024: The popular niche brand Louiosy hosts a pop-up shop in the Harajuku area of Tokyo, showcasing its latest collection and focusing on direct customer engagement, a strategy increasingly used by online-native brands to build brand loyalty and gather real-time feedback.

- November 2023: Several plus-size fashion influencers and models collaborate with brands like Punyus and AngeLsize for special styling campaigns on social media, promoting "Body Positivity Week" in Japan and highlighting holiday season outfits.

- September 2023: H&M Japan features a dedicated plus-size section in its flagship Shibuya store for a limited-time campaign, integrating extended sizes more visibly into its physical retail space to test customer response and increase inclusivity in brick-and-mortar.

- July 2023: The online platform Shoplift hosts a virtual "Plus-Size Fashion Fair," featuring collections from over 15 domestic niche brands, including Clette and eur3, providing a centralized digital space for consumers to discover new labels.

- April 2023: Belluna reports in its fiscal year results a steady sales increase in its Re-J & Supure brand, attributing part of the growth to targeted digital marketing campaigns aimed at women in their 30s and 40s seeking professional and casual wear.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 15.7 Bn |

| Forecast Value (2034) |

USD 23.0 Bn |

| CAGR (2025–2034) |

4.4% |

| Historical Data |

2019 – 2024 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Casual Wear, Formal Wear, Sportswear, Lingerie, Maternity Wear, Swimwear, and Other Products), By Raw Material (Cotton, Wool, Silk, Chemical, Other Raw Materials), By Age Group (15–30 Years, 31–45 Years, 46–60 Years, and 60+ Years), By Pricing (Low-Priced, Mid-Priced, and Premium), By Distribution Channel (Online, and Offline). |

| Regional Coverage |

Japan |

| Prominent Players |

Uniqlo, GU, H&M Japan, Belluna, Punyus, Re-J & Supure, Clette, Louiosy, Eur3, As Know As olaca, AngeLsize, Gold Japan, Isetan Clover Shop, Nissen (SmileLand), Avail, Cecil Plump, Fleur by Mint Breeze, GEVS, Taberunosky, AOKI., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is Japan plus-size women’s Clothing Market?

▾ Japan plus-size women’s Clothing Market size is estimated to have a value of USD 15.7 billion in 2025 and is expected to reach USD 23.0 billion by the end of 2034.

What is the growth rate in Japan Plus Size Women’s Clothing Market in 2025?

▾ The market is growing at a CAGR of 4.4 percent over the forecasted period of 2025.

Who are the key players in Japan Size Women’s Clothing Market?

▾ Some of the major key players in Japan Plus Size Women’s Clothing Market are Uniqlo, GU, H&M Japan, Belluna, Punyus, Re-J & Supure, Clette, Louiosy, Eur3, As Know As olaca, AngeLsize, Gold Japan, and many others.