Market Overview

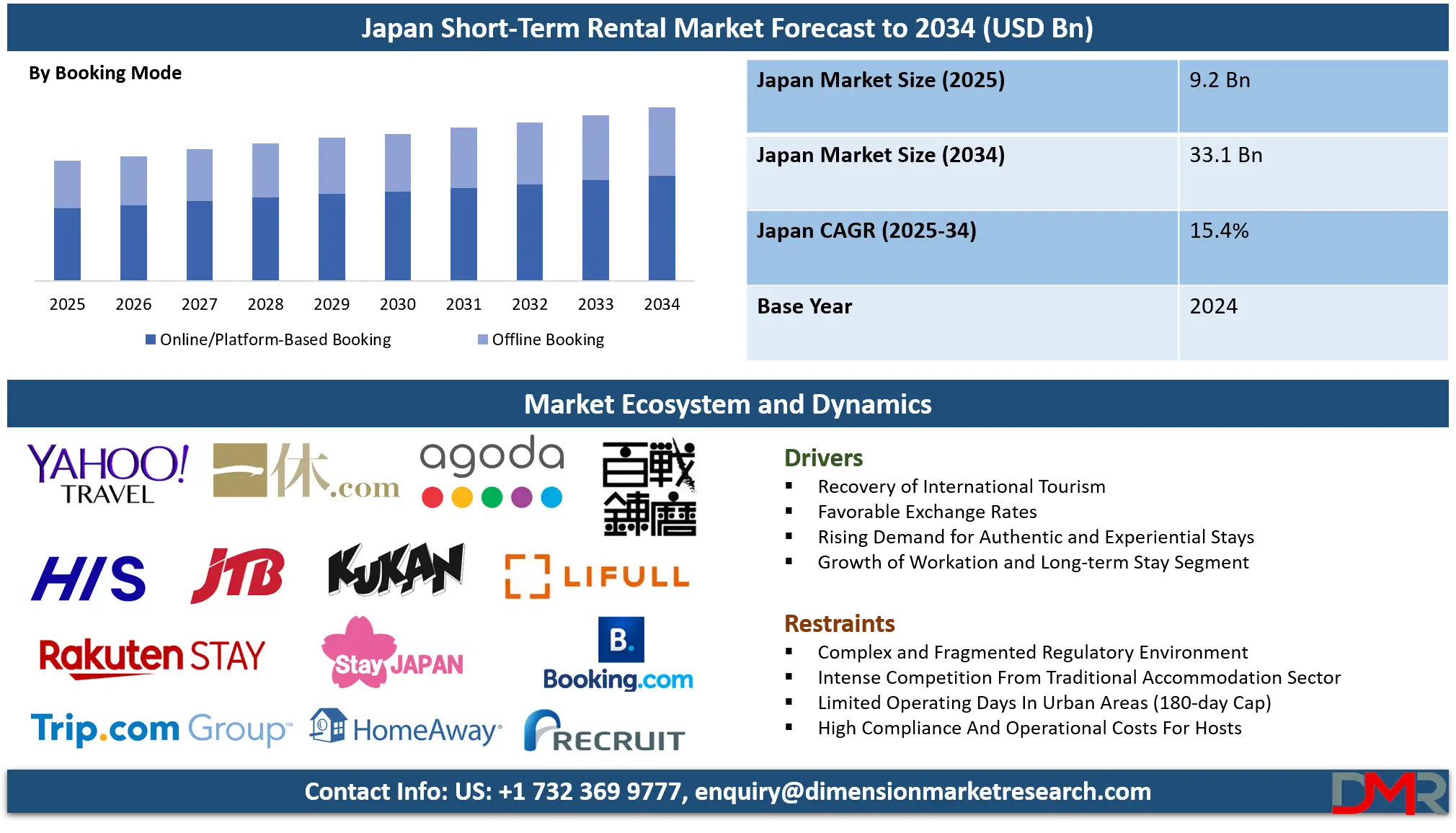

The Japan Short-Term Rental Market is projected to attain a valuation of USD 9.2 billion in 2025 and is anticipated to grow at a CAGR of 15.4% from 2025 to 2034, reaching approximately USD 33.1 billion by 2034.

This strong growth is fueled by the surging popularity of vacation rentals, minpaku properties, serviced apartments, and home-sharing platforms across urban and regional Japan. The increasing influx of inbound tourists, coupled with the rising preference for flexible and affordable accommodation options, continues to strengthen the market outlook.

Moreover, the integration of digital booking platforms, AI-driven pricing tools, and contactless check-in technologies is reshaping the landscape of Japan’s hospitality and travel sector, driving higher occupancy rates and operational efficiency across the short-term rental ecosystem.

The Japan short-term rental market has experienced a significant transformation since the 2018 enforcement of the Minpaku Law, which established a national framework for legal operations. This regulation initially tempered the explosive growth seen in previous years by imposing a 180-day annual rental cap in many municipalities.

Despite this, the market has stabilized and is now on a controlled growth trajectory, particularly in major tourist destinations. The post-pandemic resurgence of international tourism has been a primary catalyst, with visitor numbers swiftly recovering towards pre-2020 levels. This returning demand, coupled with a strategic shift from traditional hotel stays, underscores the market's resilience and potential for sustained expansion in a regulated environment.

The market's primary restraint remains the complex and often fragmented regulatory landscape. While the national Minpaku Law sets a baseline, local governments, including special wards in Tokyo, have enacted stricter ordinances, with some areas banning minpaku entirely or reducing permissible operating days. This creates operational uncertainty and high compliance costs.

Additionally, intense competition from a recovering hotel sector, which offers extensive services and brand loyalty programs, pressures pricing and occupancy rates for short-term rentals. The persistent labor and material costs for property management and maintenance further squeeze profit margins, making efficient operations paramount for success.

Growth prospects for the market are strong, driven by Japan's unwavering commitment to tourism as a core economic pillar. Ambitious government targets to attract 60 million annual visitors by 2030 will provide a steady stream of potential guests. The upcoming World Expo 2025 in Osaka is expected to create a massive, temporary surge in demand, highlighting the market's capacity for handling large-scale events.

Long-term growth will be fueled by the continued professionalization of hosts and managers, who are leveraging technology and data analytics to optimize pricing, improve guest experiences, and navigate regulatory challenges, ensuring the market evolves into a mature and integral part of Japan's accommodation sector.

Japan Short-Term Rental Market: Key Takeaways

- Market Scale & Growth: The Japan Short-Term Rental Market is projected to be valued at USD 9.2 billion in 2025 and is further expected to reach USD 33.1 billion by 2034, growing at a CAGR of 15.4%, reflecting strong expansion potential.

- Demand Drivers: The market growth is primarily fueled by the recovery of international tourism, a weaker Japanese Yen boosting spending power, and rising domestic travel, driving higher occupancy and revenues.

- Accommodation & Booking Mix: Apartments are poised to dominate the market due to versatility and affordability, while online/platform-based bookings account for over 80% of reservations, overshadowing traditional offline channels.

- Technology & Operations: AI technologies, including dynamic pricing, personalized recommendations, automated customer support, and fraud detection, enhance revenue management, guest satisfaction, and operational efficiency for hosts and property management companies (PMCs).

- Regulatory Headwinds: A complex regulatory environment with local variations (e.g., Minpaku Law, 180-day caps, zone restrictions) increases compliance costs and limits short-term rental supply, particularly in Tokyo, Kyoto, and other urban hotspots.

- Strategic Opportunities: Emerging growth avenues include leveraging vacant houses (akiya) for short-term rentals and capitalizing on the workation and long-term stay segment, especially in scenic rural areas and regional cities.

Japan Short-Term Rental Market: Use Cases

- Urban Workation Hub: Professionals on extended workations seek Tokyo apartments with dedicated offices and high-speed fiber internet. These rentals, located in residential neighborhoods like Shimokitazawa, offer a local living experience. Hosts provide portable Wi-Fi and information on nearby co-working spaces, catering to the growing demand for blending productivity with exploration in a dynamic city environment.

- Cultural Immersion in a Machiya: International families rent a restored machiya (traditional wooden townhouse) in Kyoto. They experience sleeping on futons, enjoying a private rock garden, and participating in a tea ceremony arranged by the host. This use case provides an authentic, deep cultural connection that standard hotel accommodations cannot match, fulfilling the desire for unique and memorable travel.

- Ski Chalet Rental: A group of Australian skiers books a modern chalet in Niseko for a week. The property features ski-in/ski-out access, a private onsen, and a fully equipped kitchen. The host partners with a local rental shop for equipment discounts, creating a seamless, all-inclusive winter sports experience that leverages Japan's world-class snow and hospitality.

- Rural Wellness Retreat: A couple from Singapore escapes to a renovated kominka (old farmhouse) in the Japanese Alps for a wellness retreat. The property offers yoga mats, access to a private river, and recommendations for local organic farms. This use case meets the demand for digital detox, reconnection with nature, and immersive rural tranquility.

- Event-Based Accommodation: During a major summer festival in Aomori, a host rents out spare rooms in their home to tourists facing sold-out hotels. This not only provides affordable lodging but also allows guests to interact directly with a local family, offering an insider's view of the festival and home-cooked meals, creating a personalized and community-integrated visit.

Japan Short-Term Rental Market: Stats & Facts

Japan Tourism Agency (JTA)

- As of December 2023, there were 13,327 legally registered minpaku properties across Japan.

- The total number of overnight guests at registered minpaku in 2022 was approximately 4.32 million.

- The average occupancy rate for registered minpaku in 2022 was 24.4%.

- The average expenditure per person per night at a minpaku was 12,000 yen in 2022.

- In 2022, 67.8% of minpaku guests were domestic travelers, while 32.2% were international.

- The top prefecture for registered minpaku properties as of 2023 is Hokkaido.

Japan National Tourism Organization (JNTO)

- In 2023, Japan welcomed over 25 million international visitors.

- The total number of international visitors to Japan in 2023 represented a recovery of approximately 79% of the 2019 pre-pandemic level.

- The top three source markets for visitors to Japan in 2023 were South Korea, Taiwan, and China.

- The Japanese government has set a target of attracting 60 million international tourists annually by 2030.

Ministry of Land, Infrastructure, Transport and Tourism (MLIT)

- The number of private lodging facilities (minpaku and simple accommodations) reported under the Hotel Business Law was 18,208 as of 2022.

- The average room rate for vacation rental properties in designated areas was 21,000 yen per night in 2022.

Tokyo Metropolitan Government

- The special wards of Tokyo have a cap of 180 days per year for minpaku operations.

- As of 2023, several dense residential wards in Tokyo, such as Suginami, have effectively banned minpaku in residential zones.

Osaka City Government

- Osaka City allows minpaku operations throughout the city but maintains the standard 180-day annual cap.

- The city has a specific registration system for minpaku operators separate from the national notification.

Kyoto City Government

- Kyoto City restricts minpaku operations to designated areas, primarily in residential-commercial mixed zones, and prohibits them in purely residential districts.

- The permitted operating days for minpaku in Kyoto are limited to a maximum of 180 days per year.

SAPPORO City Government

- The number of registered minpaku properties in Sapporo has been steadily increasing, with a significant concentration in the central entertainment districts.

Japanese Inn Group (Ryokan) Association

- The total number of ryokan (traditional Japanese inns) in Japan has been on a long-term decline, falling below 40,000 establishments.

Statistics Bureau of Japan

- The number of vacant houses (akiya) in Japan reached a record high of 8.49 million units in 2018, representing a national vacancy rate of 13.6%.

- The population of Japan is projected to decline from 125 million in 2022 to 106 million by 2050.

Bank of Japan

- The Yen reached a 30-year low against the U.S. dollar in 2023, significantly increasing the purchasing power of international tourists.

Japan Association of New Economy

- A survey of over 1,000 companies found that over 30% have introduced or are considering introducing a workation program for their employees.

Niseko Tourism

- The Niseko area in Hokkaido consistently records over 15 meters of annual snowfall, making it a premier global destination for winter sports tourists.

Hakuba Valley Tourism

- The Hakuba Valley ski resort hosted over 500 skier visits during the 2022-2023 winter season.

Fukuoka City Government

- Fukuoka City has been promoting itself as a startup hub and has seen a corresponding increase in demand for mid-term rental accommodations.

Okinawa Prefectural Government

- Okinawa prefecture has a distinct set of guidelines for minpaku, encouraging their use to accommodate tourists visiting its remote islands.

Japan Short-Term Rental Market: Market Dynamics

Trends in the Japan Short-Term Rental Market

Demand for Authentic and Experiential Stays

A dominant trend is the pronounced consumer shift towards seeking unique and authentic travel experiences, moving beyond standardized hotel rooms. Travelers, particularly international visitors, are increasingly drawn to properties that offer a sense of place and cultural immersion.

This manifests in high demand for stays in traditional accommodations like Kyoto's machiya (townhouses) or rural kominka (farmhouses), which have been modernized while retaining their historical character. These properties allow guests to live like a local, often featuring tatami mat rooms, private gardens, and traditional baths. This trend forces hosts and property managers to differentiate their listings not just on price and location, but on the uniqueness of the experience and the story the property tells, elevating the market from mere accommodation to experiential travel.

Geographical Diversification into Regional Areas

Another defining trend is the strategic geographical diversification of short-term rental supply away from saturated urban cores. While Tokyo and Osaka remain crucial, operators are actively expanding into suburban areas, regional cities, and the countryside. This is a direct response to two factors: the stringent 180-day annual cap enforced in many major city wards and the growing tourist interest in exploring destinations beyond the classic golden route.

This dispersion aligns perfectly with the Japanese government's tourism strategy to alleviate overtourism in hotspots and stimulate economic activity in regional areas. Properties in these locations can often operate with fewer restrictions and cater to niches like nature, wellness, and long-term workations, opening up new, sustainable growth avenues for the market.

Growth Drivers in the Japan Short-Term Rental Market

Resurgence of International Tourism and Favorable Exchange Rates

The most powerful growth driver is the robust recovery and projected expansion of international tourism to Japan. The country has successfully rebounded from the pandemic travel hiatus, with visitor numbers swiftly approaching and expected to surpass pre-2020 records. Government initiatives, such as the target of 60 million annual visitors by 2030, ensure a consistent and growing influx of potential guests.

The prolonged weakness of the Japanese Yen against major currencies like the US dollar dramatically increases the purchasing power of these international tourists, making Japan a highly attractive and relatively affordable destination. This favorable exchange rate not only boosts overall travel numbers but also allows guests to spend more on accommodation, supporting higher average daily rates for short-term rentals and directly fueling market revenue growth.

Market Formalization and Professionalization

A second critical driver is the formalization and professionalization of the market, spurred by the 2018 Minpaku Law. While initially disruptive, this regulation has provided a necessary legal framework that legitimizes the industry. It has increased consumer confidence, as guests can now book registered properties with the assurance of meeting safety and hygiene standards. For serious operators, this has created a more level and predictable playing field, weeding out non-compliant actors.

This professionalization is evident in the rise of sophisticated property management companies that leverage technology for dynamic pricing, automated check-ins, and professional cleaning services. This enhances operational efficiency, improves the overall guest experience, and builds trust with both consumers and local communities, establishing short-term rentals as a reliable and professional segment of the accommodation industry.

Growth Opportunities in the Japan Short-Term Rental Market

Capitalizing on the Workation and Long-Term Stay Segment

A substantial growth opportunity lies in capitalizing on the emerging workation and long-term stay segment. The global normalization of remote work, combined with Japan's push to promote workations to revitalize regions, creates a perfect market niche. Travelers are no longer limited by short vacations and are seeking stays of several weeks or months that blend work and leisure.

Properties that can cater to this demand by offering robust, high-speed internet, dedicated workspaces, and amenities for longer stays, like fully-equipped kitchens and laundry facilities, are poised for success. This trend is particularly viable in scenic rural areas and on islands, where hosts can partner with local co-working spaces and experience providers to create all-inclusive workation packages, tapping into a demographic with higher disposable income and a desire for an improved quality of life.

Activation of the Vast Akiya (Vacant House) Stock

Another significant opportunity is the activation of the vast akiya (vacant house) stock across Japan. With millions of empty properties in regional and rural areas, there is immense potential for conversion into short-term rentals. This addresses a critical national issue of property decay and population decline while simultaneously expanding tourism infrastructure.

Entrepreneurs and local governments can collaborate to renovate these traditional homes, preserving cultural heritage and offering unique accommodations that are highly sought after by tourists. This model not only creates a new revenue stream for property owners but also stimulates local economies by bringing visitors to areas they would otherwise not visit, supporting nearby shops, restaurants, and service providers, and fostering community-based, sustainable tourism.

Restraints in the Japan Short-Term Rental Market

Complex and Fragmented Regulatory Environment

The most formidable restraint is the complex, multi-layered, and often restrictive regulatory environment. The national Minpaku Law provides a baseline, but it grants significant autonomy to local municipalities, leading to a patchwork of regulations that are difficult to navigate. Key urban areas like Tokyo's special wards and Kyoto have implemented some of the strictest rules, including outright bans in residential zones and the universal 180-day annual cap.

This fragmentation creates high compliance costs and operational uncertainty for hosts, who must constantly monitor and adapt to local ordinances. The threat of further regulatory tightening in response to neighborhood complaints about noise or garbage remains a persistent risk, potentially rendering investments non-viable overnight and stifling market growth in the most high-demand locations.

Intense Competition from the Traditional Accommodation Sector

A second major restraint is the intense competition from a highly developed and recovering traditional accommodation sector. Japan's hotel industry, encompassing everything from luxury international chains to ubiquitous business hotels and deeply cultural ryokans, offers fierce competition. These establishments provide consistent service standards, strong brand recognition, and extensive loyalty programs.

Furthermore, the recent resurgence of tourism has led to a hotel construction boom, increasing supply and competitive pressure. For short-term rentals, this means contending for guests not only on the basis of price but also on perceived value, as they must overcome challenges related to standardized service, 24/7 guest support, and the lack of amenities like daily cleaning or on-site restaurants that many travelers expect.

Japan Short-Term Rental Market: Research Scope and Analysis

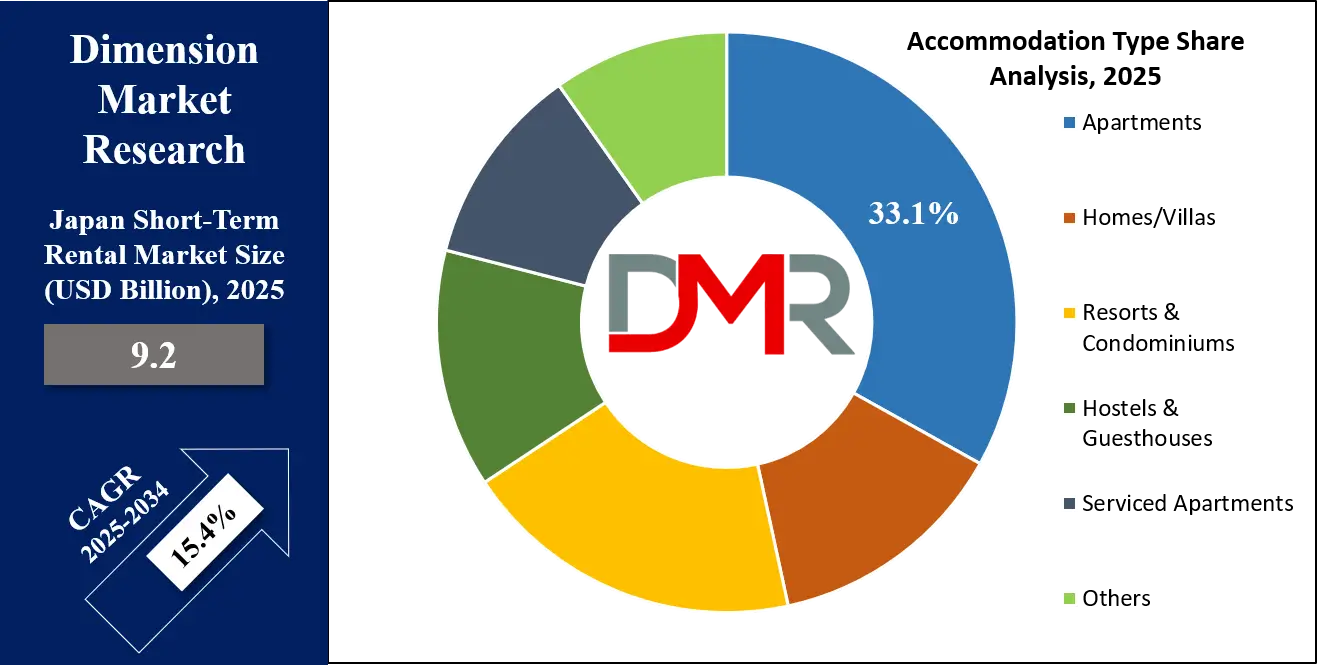

By Accommodation Type Analysis

Apartments are projected to be the dominant accommodation type in the Japan Short-Term Rental Market, holding the largest market share in 2024 and continuing to lead through 2034. This dominance is driven by their versatility, affordability, and strong appeal among domestic and international travelers, especially in major cities such as Tokyo, Osaka, Kyoto, and Fukuoka.

Apartments offer privacy, convenience, and home-like comfort, making them ideal for both short- and medium-term stays among leisure and business travelers. The rising number of digital nomads and remote professionals also contributes to sustained demand for well-furnished apartment rentals equipped with modern amenities and workspaces.

Leading platforms such as Rakuten LIFULL STAY, Airbnb, Booking.com Japan, and STAY JAPAN feature thousands of apartment listings that cater to diverse traveler preferences across urban and suburban regions.

Furthermore, the Minpaku (private lodging) regulatory framework has strengthened the legal and safety standards for apartment-based rentals, enhancing consumer confidence and supporting market stability. The scalability and cost efficiency of apartment properties also attract professional hosts and property management companies leveraging AI-driven pricing tools and occupancy optimization systems. With increasing urbanization, rising inbound tourism, and a growing preference for personalized, self-contained lodging options, apartments are set to remain the cornerstone of Japan’s short-term rental market, particularly in high-demand tourist and business hubs.

By Booking Mode Analysis

Online or platform-based bookings dominate the Japanese short-term rental market, accounting for more than 80% of total reservations in 2024 and projected to maintain their lead through the forecast period. The widespread use of digital booking channels driven by Japan’s high internet penetration, smartphone adoption, and reliance on platforms such as Airbnb, Rakuten LIFULL STAY, Agoda, Expedia Japan, and Booking.com has revolutionized how travelers plan their stays. These platforms offer real-time availability, transparent pricing, verified reviews, and secure payment systems, increasing trust and ease of use for both domestic and inbound travelers.

Technological innovation, including AI-based property recommendations, predictive pricing, and virtual property tours, has further enhanced user experience and convenience. Following the post-pandemic digital shift, both Japanese and foreign tourists increasingly prefer contactless booking and check-in solutions, making online systems the dominant choice. For hosts and operators, digital platforms enable dynamic pricing, occupancy management, and automated guest communications, improving profitability and efficiency.

Although offline bookings through traditional travel agencies or direct host arrangements still exist, their share continues to decline. As Japan strengthens its position as a global travel destination, online platform-based bookings will remain the driving force behind the market’s expansion, shaping traveler expectations and operational practices nationwide.

By End User Analysis

Leisure travelers represent the largest end-user segment in the Japan Short-Term Rental Market, accounting for more than 60% of total bookings and expected to retain their dominance through 2034. The rise in domestic tourism, coupled with the influx of international visitors from China, South Korea, the U.S., and Southeast Asia, has intensified demand for flexible, experience-driven accommodation.

Leisure travelers prefer apartments, homes, and villas for their comfort, privacy, and local immersion, often located near cultural landmarks, shopping districts, and natural attractions such as Kyoto’s temples, Hokkaido’s ski resorts, and Okinawa’s beaches.

Moreover, the growing trend of “workations”, where travelers blend leisure with remote work, is fueling longer stays in leisure-oriented properties equipped with Wi-Fi, kitchens, and workspace amenities. The influence of social media, influencer campaigns, and experience-based travel marketing also shapes preferences toward authentic and aesthetic stays.

Platforms like Airbnb, Rakuten LIFULL STAY, and Booking.com Japan actively tailor listings and experiences to meet leisure travelers’ evolving needs. As Japan’s tourism rebounds and cultural experiences gain global appeal, leisure travelers will continue to be the primary demand drivers, influencing property types, digital innovations, and service personalization across the nation’s short-term rental ecosystem.

The Japan Short-Term Rental Market Report is segmented on the basis of the following:

By Accommodation Type

- Apartments

- Homes/Villas

- Resorts & Condominiums

- Hostels & Guesthouses

- Serviced Apartments

- Others

By Booking Mode

- Online/Platform-Based Booking

- Vacation Rental Platforms

- Travel Aggregator Websites

- Property Management Platforms

- Offline Booking

- Direct Bookings (Walk-ins, Phone Reservations)

- Travel Agencies & Tour Operators

By End User

- Leisure Travelers

- Business Travelers

- Group Travelers

- Solo Travelers

Impact of Artificial Intelligence on the Japan Short-Term Rental Market

- Dynamic Pricing and Revenue Optimization: In Japan’s short-term rental market, AI-driven dynamic pricing algorithms are revolutionizing how hosts and property managers set room rates. By analyzing real-time data such as seasonal demand, local festivals (e.g., Kyoto’s Gion Matsuri), major events like the Tokyo Marathon, and competitor listings, AI systems optimize nightly prices to balance occupancy and profitability. This intelligent automation allows operators in high-demand destinations such as Tokyo, Osaka, and Kyoto to maximize yield, minimize vacancy, and respond instantly to market fluctuations.

- Personalized Guest Experiences: Artificial Intelligence is enabling personalized travel experiences for domestic and international visitors in Japan. Platforms like Airbnb Japan, Rakuten LIFULL STAY, and Booking.com Japan use AI to analyze guest preferences, past booking patterns, and language preferences to curate customized property recommendations. For example, a business traveler in Tokyo may receive suggestions for serviced apartments near Shinjuku, while a family traveling to Okinawa may be shown beachfront villas. This personalization enhances guest satisfaction and fosters repeat bookings.

- Predictive Analytics for Market Insights: AI-powered predictive analytics tools are helping Japanese property managers and investors anticipate tourism trends and traveler behaviors. These systems analyze datasets from booking platforms, tourism agencies, and macroeconomic indicators to forecast demand surges in specific prefectures such as Hokkaido during winter or Okinawa during summer. Such insights enable rental operators to adjust their marketing, expand listings strategically, and plan for fluctuations in domestic and inbound travel demand, particularly from China, Korea, and Western markets.

- Automated Customer Support and Operations: Given Japan’s high inbound tourist volume and multilingual traveler base, AI-enabled chatbots and virtual assistants have become essential for improving operational efficiency. These systems handle inquiries in Japanese, English, Chinese, and Korean, offering 24/7 multilingual support for booking changes, check-in guidance, and issue resolution. This automation not only reduces labor costs in a country facing workforce shortages but also ensures faster, more consistent guest communication, boosting customer satisfaction and operational scalability for hosts.

- Enhanced Fraud Detection and Security: AI enhances fraud prevention and digital security across Japan’s short-term rental platforms by detecting irregular booking patterns, identifying fraudulent payment activities, and flagging fake reviews. With Japan’s strict Minpaku (private lodging) regulations, ensuring compliance and maintaining trust are critical. AI systems cross-verify host registration, identity validation, and transaction histories, fostering a safe and transparent rental ecosystem that builds credibility among both domestic hosts and international visitors.

Japan Short-Term Rental Market: Competitive Landscape

The Japan Short-Term Rental Market is becoming increasingly competitive, shaped by a mix of global booking platforms, domestic service providers, and technology-driven property managers. Airbnb Japan leads the sector, leveraging its strong brand and extensive inventory spanning metropolitan apartments to traditional machiya townhouses in Kyoto. Rakuten LIFULL STAY, a joint venture between Rakuten and LIFULL, serves as the key domestic competitor, offering localized expertise and regulatory compliance under Japan’s Minpaku framework.

Booking.com Japan and Expedia Japan maintain strong positions through integration with hotels and vacation rentals, catering to both inbound and domestic travelers. Meanwhile, STAY JAPAN and Hyakusenrenma Co., Ltd. focus on regional tourism, promoting authentic local stays aligned with Japan’s “rural revitalization” goals.

The competitive environment is further defined by the rise of professional property management companies (PMCs) such as H2O Hospitality, MetroResidences Japan, and Hosty, which manage large-scale portfolios and apply AI-driven tools for pricing, channel management, and guest communication. These firms bridge hospitality professionalism with the flexibility of short-term rentals.

Moreover, B2B software providers like Guesty, Hostaway, and Beyond Pricing are empowering Japanese hosts and PMCs to streamline operations, automate guest messaging, and optimize revenues. Competition now extends beyond listing volume; it revolves around AI integration, data analytics, regulatory adherence, sustainability practices, and guest experience excellence.

Japan’s market is transitioning from fragmented, small-scale hosts toward a professionalized, tech-enabled ecosystem that balances innovation with Japan’s emphasis on quality, trust, and hospitality (omotenashi).

Some of the prominent players in the Japan Short-Term Rental Market are:

- Rakuten LIFULL STAY, Inc.

- Recruit Holdings Co., Ltd.

- STAY JAPAN Co., Ltd.

- Hyakusenrenma Co., Ltd.

- Glocalbnb Co., Ltd.

- Kukan Inc.

- LIFULL Co., Ltd.

- HomeAway Japan (Kabu Yushi Mochiai)

- Agoda Company Pte Ltd

- Booking.com Japan K.K.

- Expedia Group, Inc.

- Trip.com Group Ltd.

- Ikyu Corporation

- JTB Corp.

- H.I.S. Co., Ltd.

- ANA X Inc.

- Yahoo! Travel

- Voyagin Inc.

- DID GLOBAL Co., Ltd.

- Tokyo Family Stays G.K.

- Other Key Players

Recent Developments in the Japan Short-Term Rental Market

2024

- May 2024: The Japan Tourism Agency (JTA) announces new draft guidelines encouraging prefectures to create "Specific Sightseeing Area" plans, which can include relaxed minpaku rules to promote tourism in regional areas, signaling a potential long-term regulatory shift.

- April 2024: Airbnb reports a significant surge in listings and searches for regional areas like Okinawa and Hokkaido, correlating with the yen's weakness, and highlights a 30% year-on-year increase in guest demand for "unique stays" such as traditional houses.

- March 2024: Rakuten Group, Inc. and Kenedix, Inc. form a capital and business alliance to strengthen their shared office and accommodation businesses, aiming to integrate Rakuten's customer base with Kenedix's real estate asset management expertise, potentially impacting the property supply for rentals.

2023

- October 2023: The Japan Workation Fair 2023 is held in Tokyo, featuring numerous regional municipalities and property managers promoting their destinations and accommodations specifically tailored for remote workers, highlighting the formalization of this niche.

- September 2023: Mercari, Inc., the flea market app giant, launches a real estate division and begins trialing the use of its vacant corporate housing for short-term rentals, signaling a potential new entrant exploring the market.

- June 2023: Global travel site Booking.com reports a major increase in listings for "entire homes" in Japan, as it aggressively competes with Airbnb for market share post-reopening, leading to more marketing and host acquisition efforts.

2022

- October 2022: Japan's border fully reopens to individual, visa-free tourism, marking the most significant market catalyst since the pandemic began and triggering an immediate surge in booking inquiries and platform activity for short-term rentals.

- June 2022: Expedia Group hosts its "Explore Japan" partner conference in Tokyo, one of the first major in-person industry events post-pandemic, focusing on rebuilding host and property manager relationships for its Vrbo and Hotels.com platforms.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 9.2 Bn |

| Forecast Value (2034) |

USD 33.1 Bn |

| CAGR (2025–2034) |

15.4% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Accommodation Type (Apartments, Homes/Villas¸ Resorts & Condominiums, Hostels & Guesthouses, Serviced Apartments, and Others), By Booking Mode (Online/Platform-Based Booking, and Offline Booking), By End User (Leisure Travelers, Business Travelers, Group Travelers, and Solo Travelers)

|

| Regional Coverage |

Japan |

| Prominent Players |

Rakuten LIFULL STAY Inc., Recruit Holdings Co. Ltd., STAY JAPAN Co. Ltd., Hyakusenrenma Co. Ltd., Glocalbnb Co. Ltd., Kukan Inc., LIFULL Co. Ltd., HomeAway Japan, Agoda Company Pte Ltd, Booking.com Japan K.K., Expedia Group Inc., Trip.com Group Ltd., Ikyu Corporation, JTB Corp., H.I.S. Co. Ltd., ANA X Inc., Yahoo! Travel Japan, Voyagin Inc., DID-GLOBAL Co. Ltd., Tokyo Family Stays G.K, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Japan Short-Term Rental Market size is estimated to have a value of USD 9.2 billion in 2025 and is expected to reach USD 33.1 billion by the end of 2034.

The market is growing at a CAGR of 15.4 percent over the forecasted period of 2025.

Some of the major key players in the Japan Short-Term Rental Market are Rakuten LIFULL STAY Inc., Recruit Holdings Co. Ltd., STAY JAPAN Co. Ltd., Hyakusenrenma Co. Ltd., Glocalbnb Co. Ltd., Kukan Inc., LIFULL Co. Ltd., and many others.