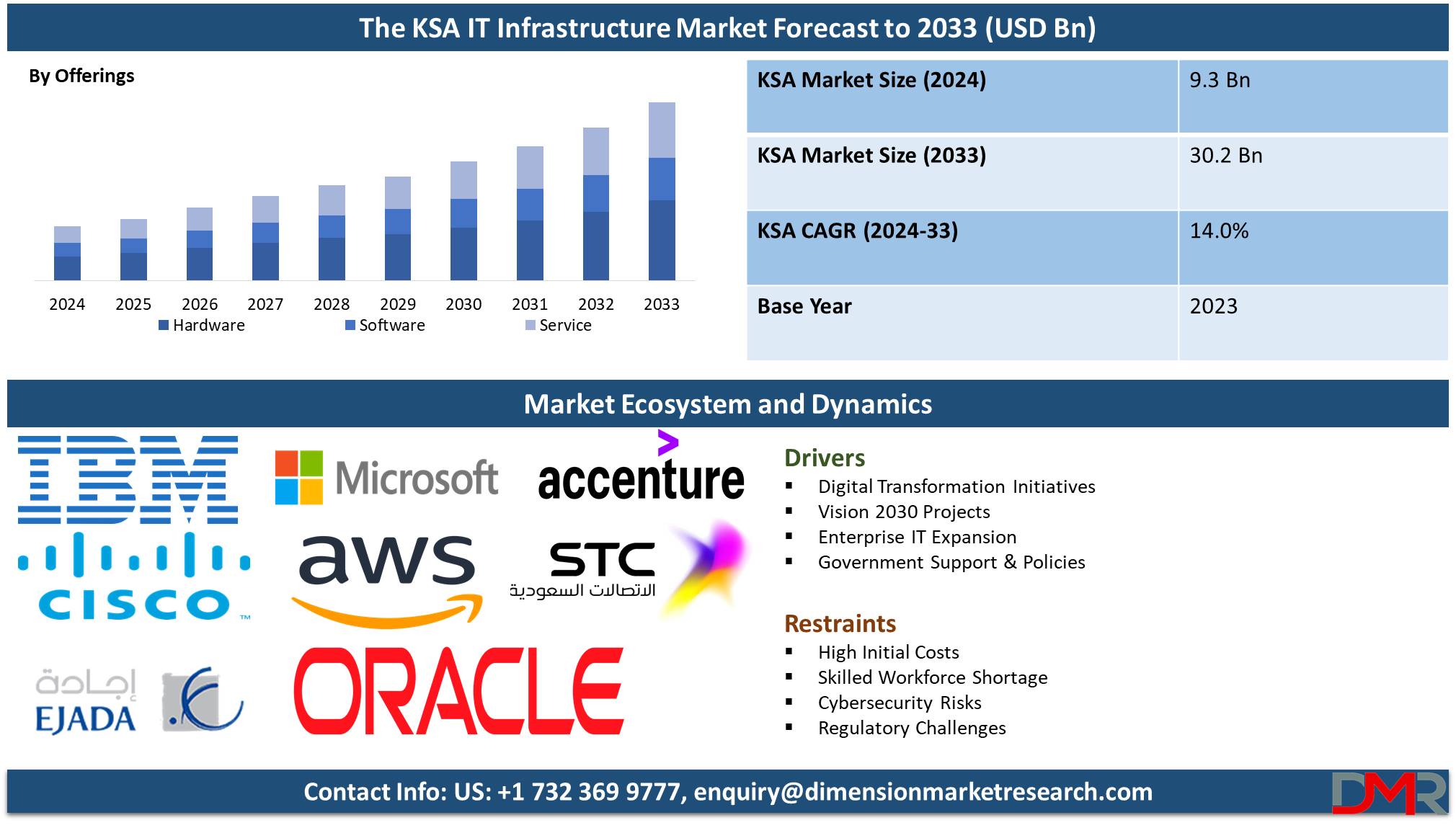

Market Overview

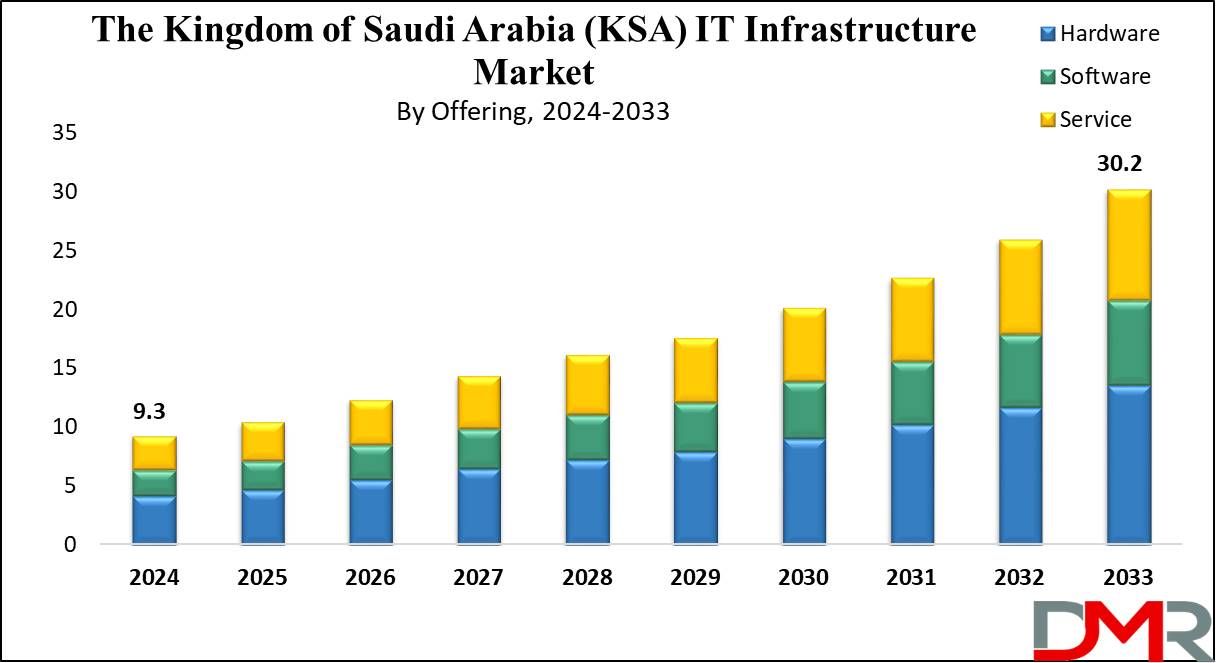

The

Kingdom of Saudi Arabia (KSA) IT Infrastructure Market is projected to reach

USD 9.3 billion in 2024 and grow at a compound annual

growth rate of 14.0% from there until 2033 to reach a

value of USD 30.2 billion.

The Kingdom of Saudi Arabia (KSA) IT infrastructure has seen significant development over recent years, driven by the government's Vision 2030 initiative. The aim has been to modernize digital infrastructure, improve cloud computing, and encourage smart city projects, which are laying the foundation for a more digitalized economy.

The growing demand for advanced IT services is driven by the increasing dependency on digital platforms across sectors like healthcare, education, and finance. Businesses are adopting cloud-based solutions, boosting the demand for scalable IT infrastructure.

Key trends shaping Saudi Arabia’s IT landscape include the growth of artificial intelligence (AI), the Internet of Things (IoT), and blockchain technology. These innovations are driving efficiency, automation, and data security, playing a central role in the nation’s push toward a more sustainable, tech-driven future.

Further, the country is highly investing in cybersecurity frameworks to protect vital infrastructure and sensitive data. As digital transformation accelerates, the demand for skilled IT professionals constantly rises, urging educational reforms and the establishment of local training programs to address the growing talent gap.

Key Takeaways

- Market Growth: The Kingdom of Saudi Arabia (KSA) IT Infrastructure Market size is expected to grow by 19.8 billion, at a CAGR of 14.0% during the forecasted period of 2025 to 2033.

- By Offering: The hardware segment is anticipated to get the majority share of the Kingdom of Saudi Arabia (KSA) IT Infrastructure Market in 2024.

- By Organization Size: The Large enterprise segment is expected to be leading the market in 2024

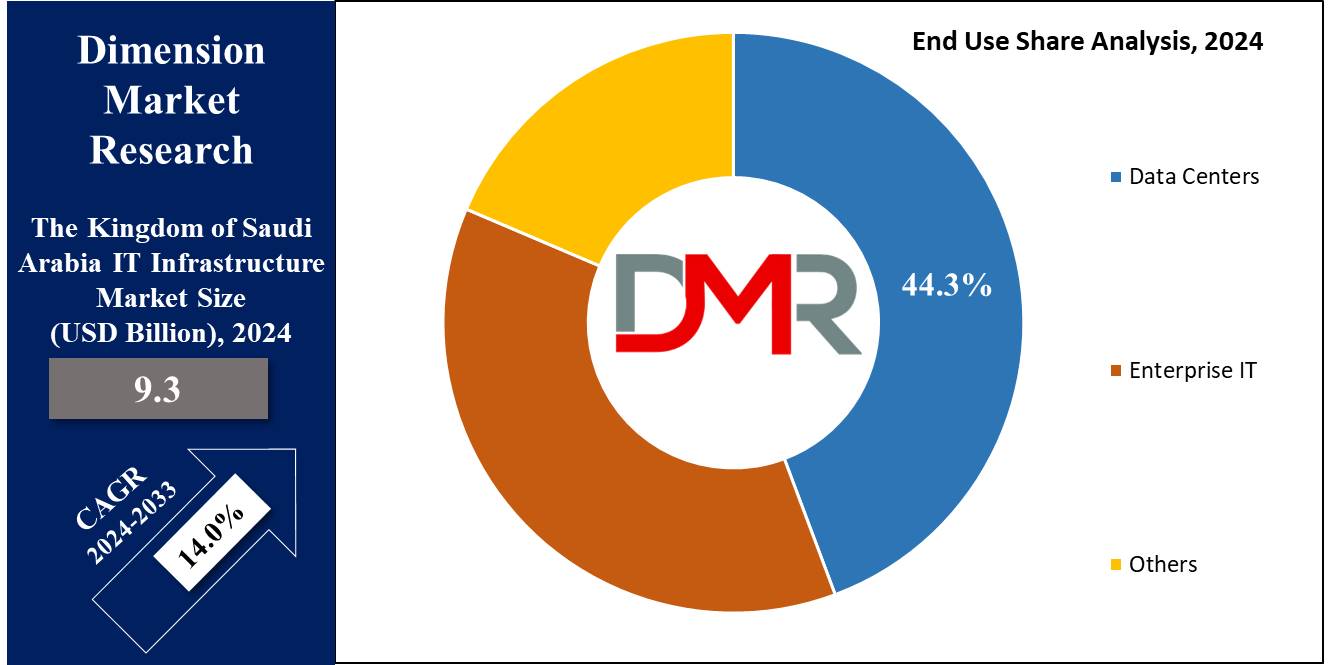

- By End Use: The data center segment is expected to get the largest revenue share in 2024 in the Kingdom of Saudi Arabia (KSA) IT Infrastructure Market.

- Use Cases: Some of the use cases of The Kingdom of Saudi Arabia (KSA) IT Infrastructure include cloud computing adoption, cybersecurity frameworks, and more.

Use Cases

- Smart Cities and Urban Development: Saudi Arabia’s IT infrastructure helps in the development of smart cities like NEOM, which integrate IoT, AI, and big data for efficient management of urban services, enhancing sustainability, traffic management, and public safety.

- Cloud Computing Adoption: With the growing demand for scalable IT solutions, businesses across sectors are migrating to cloud platforms, enhancing operational efficiency, reducing costs, and allowing flexible, remote work environments.

- Digital Healthcare Transformation: The healthcare sector uses IT infrastructure to deploy telemedicine, electronic health records (EHR), and AI-driven diagnostics, enhancing accessibility and quality of healthcare services across the Kingdom.

- Cybersecurity Frameworks: As digital services expand, strong cybersecurity measures are implemented to protect sensitive data and vital infrastructure, ensuring the safety of government, financial, and private sector operations.

Market Dynamic

Driving Factors

Government Initiatives and Vision 2030Saudi Arabia’s Vision 2030 has been a major growth driver for the IT infrastructure market. The government's desire to diversify the economy, promote digital transformation, and develop smart cities has led to major investments in modernizing IT systems, which is promoting demand for advanced technologies like AI, cloud computing, and cybersecurity to help national development goals.

Increasing Digitalization and Demand for Cloud Services

The quick adoption of digital technologies by businesses and government entities in Saudi Arabia is driving the demand for strong IT infrastructure. The shift towards cloud computing, driven by both public and private sector initiatives, is transforming how businesses operate, creating investments in data centers, high-speed internet, and scalable cloud solutions to accommodate the growing volume of digital services.

Restraints

Cybersecurity Concerns

Despite the rise in investments in IT infrastructure, the growth in dependency on digital platforms in Saudi Arabia has built concerns over data security and cyber threats. Ensuring strong cybersecurity frameworks to secure sensitive information remains a challenge, impacting the pace of digital adoption, mainly in sectors like banking, healthcare, and government.

Talent Gap and Skill Shortages

The quick expansion of IT infrastructure in Saudi Arabia experiences a constraint due to a shortage of skilled professionals in emerging technologies like AI, cloud computing, and cybersecurity, which creates difficulties in managing and implementing advanced IT solutions, slowing the pace of digital transformation and innovation.

Opportunities

Expansion of Smart Cities and IoT Applications

The development of smart cities like NEOM provides numerous opportunities for IT infrastructure growth in Saudi Arabia. The integration of IoT devices, AI, and data analytics in urban planning and public services can drive the need for advanced infrastructure, meeting a thriving market for IT solutions focused on sustainability, mobility, and efficiency.

Cloud and Data Center Growth

As more businesses switch to cloud-based platforms, there is a major opportunity for the expansion of data centers and cloud services in Saudi Arabia. The government’s focus on digital transformation, along with growing demand for scalable storage and computing power, positions the country as a key market for international cloud service providers and local data center investments.

Trends

Adoption of 5G and Next-Generation Connectivity

Saudi Arabia is largely deploying 5G networks to improve internet speeds and support the increase in demand for high-bandwidth applications, which is promoting the growth of IoT devices, autonomous vehicles, and smart city infrastructure, further driving the demand for advanced IT infrastructure that can support faster, more reliable connectivity.

Emphasis on AI and Automation

The integration of artificial intelligence (AI) and automation technologies is switching industries across Saudi Arabia, from healthcare to finance. Businesses are highly depending on AI-powered solutions to streamline operations, enhance decision-making, and enhance customer experiences, creating a demand for IT infrastructure capable of supporting these advanced technologies.

Research Scope and Analysis

By Offering

The hardware segment is expected to lead Saudi Arabia’s IT infrastructure market in 2024 by providing the foundation for digital transformation. As the need for data storage, faster processing, and reliable connectivity rises, the demand for high-performance hardware like servers, data centers, storage systems, and networking equipment increases. These hardware components allow businesses and government entities to implement advanced technologies like cloud computing, AI, and IoT.

The Kingdom’s drive for smart cities, digital services, and a diversified economy depends heavily on efficient, scalable hardware solutions to manage large amounts of data and ensure secure, high-speed operations. As the market expands, investing in modern and strong hardware will continue to be a key driver of growth, helping Saudi Arabia build a strong digital infrastructure for the future.

Further, software plays a vital role in the growth of Saudi Arabia's IT infrastructure market by allowing businesses and government services to run efficiently and securely. With the growth of cloud computing, AI, and smart city initiatives, software solutions like enterprise applications, cybersecurity systems, and data management tools are in high demand, which allows organizations to streamline operations, improve decision-making, and improve customer experiences, driving digital transformation across industries. As the Kingdom invests in technology, software becomes a critical enabler of its IT infrastructure development.

By Deployment

Hybrid deployment plays an important role in the growth of Saudi Arabia’s IT infrastructure market, and it is expected to dominate in 2024 as it offers flexibility and scalability to businesses and government entities. Integrating on-premises and cloud-based solutions, hybrid models allow organizations to store sensitive data securely while using the scalability and affordability of the cloud for other operations, which helps businesses in Saudi Arabia meet regulatory requirements and security standards while still benefiting from the agility and innovation of cloud services.

As digital transformation accelerates, hybrid deployment enables businesses to adapt quickly, improve collaboration, and optimize resources, driving growth in many sectors like healthcare, finance, and government services, which is crucial in supporting the Kingdom’s Vision 2030 objectives.

Further, on-premises deployment plays a major role in the growth of Saudi Arabia’s IT infrastructure market by providing greater control and security for organizations handling sensitive data.

With on-premises solutions, businesses can keep their vital applications and data within their facilities, ensuring compliance with local regulations and security standards, which is mainly important for sectors like government, banking, and healthcare, where data privacy and security are top priorities. As companies in Saudi Arabia continue to expand, on-premises deployment provides a reliable and customizable option to help their evolving IT needs.

By Organization Size

Large enterprises play an important role in the growth of Saudi Arabia’s IT infrastructure market by driving the need for advanced technology solutions. These organizations often demand scalable, high-performance systems to help their complex operations, like data centers, cloud services, and networking infrastructure. Their investments in IT infrastructure support setting trends and standards that smaller businesses follow.

With large enterprises using digital transformation, the market experiences a rise in demand for robust solutions, like AI, cybersecurity, and data management tools. In addition, these enterprises mostly lead the way in adopting new technologies, developing a ripple effect that accelerates the growth of the wider IT infrastructure market. Their ongoing expansion and innovation continue to fuel the Kingdom’s digital economy.

Moreover, for Small and medium-sized enterprises (SMEs) the growth in Saudi Arabia’s IT infrastructure market is expected to be significant in the coming years by driving the need for affordable, scalable solutions. As SMEs use digital transformation, they need affordable IT tools, like cloud services, cybersecurity systems, and collaboration software, to improve efficiency and stay competitive, which fuels the growth of the market as service providers provide customized solutions to meet their specific needs. The expansion of SMEs helps diversify and strengthen the Kingdom’s digital economy.

By Industry Vertical

The IT and telecom sector plays a major role in driving the growth of Saudi Arabia’s IT infrastructure market by allowing connectivity and technological development across industries. As the backbone of digital transformation, this sector needs advanced infrastructure, like high-speed internet, data centers, and cloud platforms, to help grow demands for digital services. With the rollout of 5G and the expansion of telecom networks, the sector supports innovations like IoT, AI, and smart city projects.

In addition, IT and telecom companies invest heavily in cybersecurity and advanced solutions, further improving the Kingdom’s overall infrastructure and aligning with Vision 2030's goal of a tech-driven economy. Further, the BFSI (Banking, Financial Services, and Insurance) sector is a major driver of Saudi Arabia’s IT infrastructure market, demanding advanced technologies to improve security, streamline operations, and enhance customer experiences.

With the growth of digital banking, online transactions, and fintech solutions, the sector needs strong data centers, cloud computing, and cybersecurity systems. These investments ensure compliance with regulations and protect sensitive financial data. The BFSI sector’s focus on innovation accelerates the adoption of cutting-edge IT infrastructure, supporting the Kingdom’s digital transformation goals.

By End Use

Data centers in Saudi Arabia’s IT infrastructure market are expected to dominate in 2024 by serving as the backbone for storing, processing, and managing large amounts of digital data. With the growth in the adoption of cloud computing, AI, and IoT, data centers allow businesses and government entities to run applications, store sensitive information securely, and ensure smooth connectivity. The need for data centers is further boosted by smart city initiatives like NEOM and the growing use of digital services.

As organizations prioritize scalability and performance, data centers provide the foundation for reliable IT operations, supporting the Kingdom’s Vision 2030 goal of developing a diversified, tech-driven economy and promoting innovation across industries. Further, enterprise IT is a key contributor to the growth of Saudi Arabia’s IT infrastructure market, as businesses highly depend on advanced technology to optimize operations and stay competitive.

Organizations across industries invest in IT solutions like cloud computing, cybersecurity, and data analytics to improve productivity and decision-making, which drives the need for robust infrastructure like servers, storage, and networking systems. As enterprises adopt digital transformation strategies aligned with Vision 2030, enterprise IT plays a major role in fostering innovation and supporting the Kingdom’s growing digital economy.

The Kingdom of Saudi Arabia (KSA) IT Infrastructure Market Report is segmented on the basis of the following

By Offering

- Hardware

- Software

- Service

By Deployment

- On-Premise

- Cloud-bases

- Hybrid

By Organization Size

By Industry Vertical

- BFSI

- Healthcare

- IT & Telecom

- Retail

- Manufacturing

- Government & Public Sector

- Energy & Utilities

- Education

- Others

By End Use

- Data Centers

- Enterprise IT

- Others

Competitive Landscape

The competitive landscape of Saudi Arabia’s IT infrastructure market is dynamic, with various local and international players driving innovation. Companies aim to offer solutions like cloud computing, data centers, and cybersecurity to meet the growing demands of digital transformation. The market is shaped by partnerships, government collaborations, and investments in advanced technologies like AI and IoT. Increased competition promotes innovation, leading to personalized services for sectors like finance, healthcare, and smart city development, fueling market growth.

Some of the prominent players in the Kingdom of Saudi Arabia (KSA) IT Infrastructure Market are

- IBM Corp

- Microsoft

- Accenture

- Cisco System

- AWS

- Saudi Telecom Company

- Ejada Systems

- National Computer Systems

- Al Moammar Information Systems Co. (MIS)

- Oracle Corp

- Other Key Players

Recent Developments

- In November 2024, Cofense announced a strategic partnership with Security Matterz, which marks the culmination of three years of in-depth discussions and will see Security Matterz combining Cofense's advanced solutions into their product portfolio to expand and improve their email security offering across Saudi Arabia and the wider Gulf.

- In November 2024, Saudi Arabia announced a 100 billion USD initiative focused on establishing itself as a major player in AI, data analytics, and advanced technology, which marks a major push by the Kingdom to develop a strong AI ecosystem that can rival leading tech hubs, like neighboring United Arab Emirates and other global technology centers.

- In November 2024, Appknox announced its official launch in Saudi Arabia at Blackhat MEA 2024, unveiling AI-driven solutions developed to address the distinctive challenges of the Kingdom’s digital economy, which is highly dependent on mobile applications across sectors like banking, government, and retail. Further, Appknox is committed to delivering enterprise-grade security that empowers businesses to protect their mobile app ecosystems proactively.

- In March 2024, Amazon Web Services (AWS) plans to launch the AWS infrastructure region in the Kingdom of Saudi Arabia (KSA) in 2026, which will give developers, startups, entrepreneurs, and enterprises, along with healthcare, education, gaming, and nonprofit organizations, greater choice for running their applications and serving end users from data centers located in the Kingdom of Saudi Arabia (KSA), as it is planning to invest more than USD 5.3 billion in the Kingdom of Saudi Arabia (KSA).

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 9.3 Bn |

| Forecast Value (2033) |

USD 30.2 Bn |

| CAGR (2024-2033) |

14.0% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Hardware, Software, and Service), By Deployment (On-Premise, Cloud-bases, and Hybrid), By Organization Size (SMEs and Large Enterprises), By Industry Vertical (BFSI, Healthcare, IT & Telecom, Retail, Manufacturing, Government & Public Sector, Energy & Utilities, Education, and Others), By End Use (Data Centers, Enterprise IT, and Others) |

| Regional Coverage |

The Kingdom of Saudi Arabia |

| Prominent Players |

IBM Corp, Microsoft, Accenture, Cisco System, AWS, Saudi Telecom Company, Ejada Systems, National Computer Systems, Al Moammar Information Systems Co. (MIS), Oracle Corp, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Kingdom of Saudi Arabia (KSA) IT Infrastructure Market size is expected to reach a value of USD 9.3 billion in 2024 and is expected to reach USD 30.2 billion by the end of 2033.

Some of the major key players in the Kingdom of Saudi Arabia (KSA) IT Infrastructure Market are IBM Corp, Microsoft, Accenture, and others.

The market is growing at a CAGR of 14.0 percent over the forecasted period.