Market Overview

The

Kingdom of Saudi Arabia's Manufacturing Market size is expected to reach a value of

USD 90.4 billion in 2024, and it is further anticipated to reach a market value of

USD 143.8 billion by 2033 at a

CAGR of 5.3%.

The manufacturing market in the Kingdom of Saudi Arabia is growing at a good pace owing to strategic economic diversification under Vision 2030. From an economy historically reliant on exporting oil, the country is rapidly changing into a manufacturing powerhouse with massive investments in infrastructure, industrial projects, and renewable energy. To this effect, the government has issued funds to sectors like petrochemicals, pharmaceuticals, construction materials, and automotive production that are improving local manufacturing capabilities.

The Saudi Arabian Industrial Cities, like Jubail and Yanbu, have become the cornerstone for manufacturing operations, attracting investors both locally and internationally. With the rise in urbanization and higher demand for sustainable construction materials and industrial products, opportunities are created for manufacturers to innovate and expand.

At such a high level, technological adoptions in the manufacturing industry of the country have resulted in a scenario where the traditional hub of manufacturing continues to rule but is emerging with smart technologies and automation. Then comes Industry 4.0 with the concepts of robotics, IoT, and data-driven manufacturing, signaling a transformed phase that will go all the way for a sector transformation. The National focus on attaining Sustainability in Saudi Arabia translated to the Green Manufacturing thrust where energy efficiency would be at its highest while carbon emission goes low. Major sectors that are continuously driving demand, like petrochemicals, food & beverage, pharmaceuticals, and construction materials, are huge growth opportunities both for the local and export markets.

Yet, challenges facing the sector include dependence on foreign machinery, the limited expertise of the labor force, and disrupted supply chains. While opportunities abound, addressing these challenges is very key for long-term growth. Manufacturing investments have increased, and the sector significantly contributes to the country's GDP. The drive of the government for the localization of production through the "Made in Saudi" program aims at increasing competitiveness and reducing reliance on imports, further propelling domestic manufacturing capabilities.

Saudi Arabia's manufacturing growth prospects look good, considering its good geographic location that allows the easy export of goods into Asia, Europe, and Africa. New industrial zone investments and free trade agreements reinforce its position as one of the global manufacturing destinations. Increased spending on infrastructure, advanced technologies, and industrial diversification drive the growth rate of this market. The growth in population and changing consumption habits of Saudi Arabia give an additional thrust, especially to the food and beverage industry. These factors, coupled with favorable government policies, form a very good foundation for continuous expansion.

Key Takeaways

- Market Growth: The manufacturing market in the Kingdom of Saudi Arabia is expected to grow from USD 90.4 billion in 2024 to USD 143.8 billion by 2033.

- Growth Rate: The manufacturing market in Saudi Arabia is anticipated to grow at a CAGR of 5.3% between 2024 and 2033.

- By Product Type Segment Analysis: The finished goods are projected to command this segment with 43.7% of the market share in 2024.

- By Technology Adoption Segment Analysis: Traditional manufacturing is projected to be the dominant production system with 36.0% of the market share in 2024

- Technology Integration: Saudi manufacturing is integrating smart manufacturing technologies, including AI, robotics, and IoT to enhance efficiency and reduce costs.

- Foreign Investment: Pro-business policy and strategic trade agreements attract a lot of multinational companies, especially in petrochemicals, food processing, and construction material manufacturing.

- Workforce Challenges: Skilled labor shortages are still a problem in especially advanced areas like robotics and automation for the manufacturing industry in Saudi Arabia.

- Vision 2030 Impact: The impact of Vision 2030 can be seen in large projects in industrial zones and infrastructure, catalyzing further diversification and addition to the industrial ecosystem for economic resilience.

- Key Players: Major key players in the Kingdom of Saudi Arabia's Manufacturing Market are Saudi Aramco, SABIC (Saudi Basic Industries Corporation), Saudi Arabian Mining Company (Ma’aden), Saudi Steel Pipe Company, and many others.

Use Cases

- Oil & Gas Equipment Production: Domestic production of vital oil and gas equipment saves the country from depending on imported ones while guaranteeing efficiency in the processes of exploration and refining.

- Pharmaceutical Drug Production: The local production of essential drugs enables Saudi Arabia to meet the demand internally and export pharmaceutical products into the region.

- Automotive Assembly Plants: Vehicle and automotive component manufacturing is done to meet domestic consumption and to strengthen the nation's exports to global markets.

- Construction Materials: Production of cement, glass, and ceramics for the main infrastructure projects in this region contributes to sustainable building solutions.

Market Dynamic

Trends in the Kingdom of Saudi Arabia Manufacturing Market

Transition to Smart Manufacturing

Saudi Arabia is increasingly integrating such Industry 4.0 technologies as automation, robotics, AI, and IoT into its manufacturing processes. These advances give way to real-time monitoring, predictive maintenance, and increased supply chain management to meet the driving forces of higher production efficiency and cost reduction.

For instance, some companies are implementing smart factories with IoT sensors and robotics in a bid to minimize human factor intervention and optimize resource management. Advanced data analytics give organizations the capability now to predict machinery failure and associated production downtime for their ultimate operational excellence.

Large petrochemical and construction-manufacturing industries have been leading these transitions in shaping best practices for industries that follow. This added to the capacity of manufacturers, working as digital twins, and enabled their testing of production processes while reducing errors to improve quality with AI-driven simulations.

Focus on Sustainability

The Saudi manufacturing sector is fast changing its approach to adapt to green and sustainable methods of manufacturing in consideration of the country's own Vision 2030 and Sustainable Development Goals at large. Companies become concerned with renewable energy, efficient equipment, and waste-handling systems that reduce carbon output.

For example, the integration of solar and wind energy resources into factory operations allows companies to abandon traditional fossils. Other companies are already open to the circular economic model characterized by waste material recycling, reutilization of by-products, and reduction in the total intake of resources. The attention paid to sustainability enhances not only ecological advantages but also economic competitiveness because one reaches international standards, attracting transnational investors interested in this type of eco-friendly installation.

Growth Drivers in the Kingdom of Saudi Arabia Manufacturing Market

Vision 2030 Diversification Plan

Saudi Arabia's Vision 2030 is the framework and acts as the most important driver for its manufacturing sector. The initiative aims to reduce the Saudi Arabian economy's dependence on oil exports by way of developing non-oil industries, including manufacturing, logistics, and technology. This has consequently been able to develop the industrial infrastructure through new industrial zones, transportation networks, and energy supply systems.

Major projects like the National Industrial Development and Logistics Program support manufacturing offering value for investors, both domestic and foreign. Moreover, investments in pharmaceuticals, automotive, and electronics are leading to a diversified industrial ecosystem that increases economic resilience and ensures long-term employment opportunities.

Foreign Investments and Trade Partnerships

The pro-business policies, free trade zones, and bilateral trade agreements of Saudi Arabia attract many multinational companies to set up their operations within the country. Petrochemicals, construction materials, and food processing have been the sectors where FDI has largely benefited. Companies like BASF and SABIC from around the world are scaling up their production facilities within Saudi Arabia by increasing the capacity and technological capabilities of the manufacturing units.

The strategic geographical location of the Saudi Arabian state between Asia Europe and Africa creates a particular advantage in logistics concerning global trading. This makes Saudi Arabia an attractive candidate to host manufacturing firms there. These initiatives drive outputs not only in increased ways but also in ways relevant to economic growth, gaining job opportunities, and increasing the rate of technology transfer among nationals.

Growth Opportunities in the Kingdom of Saudi Arabia Manufacturing Market

Development of Industrial Zones

The Saudi Arabian government is committed to investing in a series of industrial towns like Jubail, Yanbu, and Ras Al Khair into major centers for manufacturing activity. Such zones offer world-class infrastructures that boast highly developed logistics supports, along with attractive tax incentives, to attract world-class and domestic manufacturers. Located near the principal trade ports, these strategic industrial zones enjoy easy access, which facilitates the smooth processing of import and export cargo.

The reduced operational costs, coupled with a good workforce within these zones, also entice companies to scale up production. Companies from all over the world are being lured by such benefits; an example is Jubail Industrial City, one of the largest industrial complexes in the world, which has developed into a global hub for petrochemical manufacturing.

Technological Advancements

With the increasing adoption of advanced technologies like automation, robotics, and artificial intelligence, much potential opens up for Saudi manufacturers to enhance their efficiency of production and cut costs. Smart technologies enable real-time data collection that helps manufacturers optimize processes and minimize resource wastage.

For example, AI-powered quality control systems in automotive and electoustries ensure defect-free products by reducing production errors. On a parallel note, 3D printing technologies are also making their presence felt in manufacturing high-value products: medical devices, spare parts, and consumer electronics.

Restraints in the Kingdom of Saudi Arabia Manufacturing Market

Dependence on Imports for Machinery

Despite some efforts towards establishing a national manufacturing sector, Saudi Arabia remains dependent on imported machinery, equipment, and raw materials from other countries. This brings several drawbacks in its wake, including delays in procurement due to the disruption in supply chains, increased costs according to import tariffs, and fluctuations in the foreign currency exchange rate.

For example, critical equipment related to industries such as petrochemicals, construction, and food processing comes from Europe, the United States, or China, involving long lead times and cost inflation. It is this very dependence that binds production efficiency, scalability, and overall profitability. This challenge can be overcome only through strategic statements in domestic machinery manufacturing capabilities and localization of the supply chain.

Skilled Workforce Shortage

A shortage of skilled labor is still one of the key factors obstructing the sustained development of the Saudi Arabian manufacturing industry. While it tries to make workforces, development plans are a priority of the government, such as the Saudi Human Resources Development Fund (HRDF), what has come out in several is this shortage of technicians delays skilled labor or vocational training. High-skill industries such as robotics, automation, and electronics require very skilled labor that can manage and maintain high-level machinery, which remains in shortage among local talent.

Therefore, firms rely on expatriate labor which increases operational costs and makes them dependent on foreign expertise. The gap would, therefore, need to be overcome through a combination of efforts in government, educational institutions, and private enterprises in developing technical training, reskilling workforces, and building future talent pipelines in manufacturing.

Research Scope and Analysis

By Product Type

The finished goods are projected to dominate the product type segment with 43.7% of the market share in the manufacturing market in the Kingdom of Saudi Arabia by the end of 2024. These products dominate this segment and they are crucial to meet demand both domestically and internationally, whether for consumer or industrial purposes. The move towards high-value finished goods manufacture is in line with the country's aspiration to become one of the leading manufacturing bases under the Vision 2030 program. Production in priority sectors like construction materials, pharmaceuticals, food, and automotive parts has been growing strongly.

The finished goods are basically in great demand for the rapid development of infrastructure projects, urbanization, and changing lifestyle preferences in Saudi Arabia. The strategic geographic location enables the country to reach the main international markets of Europe, Asia, and Africa with ease, thereby giving it a competitive edge in international trade. Besides, the "Made in Saudi" initiative is also crucial for building the manufacturing capability of the country, enabling local production, and substituting dependence on imports.

Through their focus on quality finished goods, Saudi industries are widening their production capacity in areas such as oil & gas, electronics, and textiles to meet regional and international demand. The finished goods have become the backbone of Saudi Arabia's manufacturing sector in meeting demand and further strengthening the economic self-sufficiency of the country.

By Technology Adoption

Traditional manufacturing in Saudi Arabia is anticipated to remain the dominant production system with 36.0% of the market share in 2024 in the manufacturing sector for long-standing industries like construction, petrochemical processing, and metals. The traditional ways are mainly preferred because they make sense with the overall industrial infrastructure and resource capabilities of the country, being relatively much more affordable and reliable.

Most other enterprises have continued to adapt to traditional manufacturing techniques whereby, through large-scale production output standardization, they continue to meet the demands of industries such as the chemical or cement industries that need mass production. Besides, the labor force in Saudi Arabia still has a high level of competence in conventional methods of manufacturing, which ensures there is little disruption to day-to-day operations. While automation and IoT are some of the most finding wider acceptance in Industry 4.0 technologies, their initial investment costs are very high, and the heavy training requirement makes their quick diffusion hard.

Traditional modes of manufacturing remain quite practical, feasible, and cost-effective for SMEs, in particular for meeting the production demand of high volume produced in local markets. Hence, this dominance of traditional manufacturing may just reflect a transition period wherein Saudi Arabia relies on more established practices and only slowly pursues more advanced technology adoption.

By Manufacturing Process

The Saudi Arabian manufacturing landscape is expected to dominated by discrete manufacturing, with leading positions in industries such as automotive, electronics, machinery, and equipment. Discrete manufacturing can be defined as the manufacturing of countable, distinct products like vehicles, appliances, and electronic components that are needed by both domestic and international markets. These products are essential to meet the Kingdom's growing demand for machinery and automotive parts, especially in industries such as oil & gas and construction.

It is a flexible manufacturing process; therefore, it enables Saudi manufacturers to shift between mass and customized production with ease to respond to fluctuating market demand. Saudi Arabia's Vision 2030 has pushed for the development of such industries that rely on discrete manufacturing processes in the production of construction equipment, electrical products, and machinery.

The growth in discrete manufacturing is further being fueled by changes in technology, that allow manufacturers to employ automated and semi-automated systems in the production process. These systems raise the level of precision, raise productivity, and lower manufacturing costs, thus maintaining the lead in discrete manufacturing processes in the country.

By Enterprise Size

In Saudi Arabia, the manufacturing sector has large companies projecting to dominate because of their financial capability, technological power, and infrastructural strength. They are highly involved in those industries requiring large-scale production and heavy investments such as petrochemicals, oil & gas, automotive, and pharmaceuticals. Saudi giants such as Saudi Aramco, SABIC, and Ma'aden make use of advanced technologies and international partnerships to retain top positions in the market.

Large enterprises have the means to invest in smart manufacturing technologies, such as automation and AI, which have been driving operational efficiency, improving sustainability, and opening up avenues for more innovative product development. Besides, there are huge incentives and tax benefits under government initiatives such as Vision 2030, making large enterprises' dominance almost a fait accompli.

These companies are highly contributory to export-oriented manufacturing, making Saudi Arabia a leading industrial hub and ensuring a continued supply of high-quality finished goods. These enterprises are the key drivers of domestic production and expansion into global markets due to their size and financial capability.

By Industry Vertical

The leading position of the oil & gas industry in the manufacturing sector of Saudi Arabia is largely predetermined by the Kingdom's position in the world regarding hydrocarbon production. Being the world's largest exporter of oil, Saudi Arabia's oil & gas sector is right at the very heart of its economic structure, fuelling demand for a wide array of manufacturing products, from pipes and refineries to drilling equipment and petrochemicals.

This drives such manufacturing needs through Saudi Aramco, the state-owned oil giant, which continuously needs production and supply of specialized equipment, chemicals, and maintenance parts. The demand for such products is across the value chain, starting from exploration to refining and distribution. Besides, Saudi Arabia's further expansion of its refining and petrochemical capacity and emphasis on diversification into its energy base, a boost through initiatives like the National Industrial Development and Logistics Program, has been another fillip to the oil & gas industry in the manufacturing landscape of the Kingdom.

Not only has the IKTVA government program been focused on the localization of production and reducing reliance on imports, but it also has been working on securing high-value jobs and fostering an indigenous industry to support oil & gas. This acts as a driver for increased investments in manufacturing related to oilfield technologies, chemicals, and equipment, benefiting both the downstream and upstream elements of the industry. All these initiatives ensure sustained growth and further, reinforce the oil & gas industry as the backbone of Saudi Arabia's industrial capability.

By End User Demand

Given that the country's strategic geography is supported by natural resources and a positive trading policy, export-oriented manufacturing can easily become the main driver of the Saudi Manufacturing Sector. Due to its potential on the merchandise international trade crossroads, the Kingdom keeps every merit to become a partner for the export of finished commodity, semifinished, industrial needs to primary world markets with different geopolitics-aspects for Europe, Asia, and Africa in particular.

Saudi Arabia's export sectors, especially the petrochemicals, pharmaceuticals, and building materials industries, are among the fastest-growing in the Kingdom, with international demand for Saudi-made goods continuing to rise. The manufacturing exports of the Kingdom meet not only the demands of traditional markets but also new markets in emerging economies, which provide an opening to increase its economic influence.

Saudi Arabia's Vision 2030 further underlines the diversification of the economy, especially regarding non-oil manufacturing industries. This has involved government investments in industrial parks, free trade agreements, and export-oriented projects to raise its competitive edge on the international frontier. As a result of creating special economic zones and business-friendly environments, it has secured more domestic and international investors, and Saudi Arabia has strengthened itself as a manufacturing hub.

The "Made in Saudi" program also plays a very important role in exporting high-quality, locally manufactured goods to the international market to improve the share of Saudi Arabia in world trade. Such an export-oriented approach not only increases the revenue generation of the Kingdom but also places it among the leading manufacturing nations across the world.

By focusing on high-quality product exports, Saudi Arabia will be able to reduce its dependence on exports of oil and its products in favor of diversifying export revenues, enhancing GDP growth, and promoting private enterprise. Thus, the Kingdom shall have a sustainable and competitive modern manufacturing ecosystem that will form the bedrock for continuous long-term economic growth.

The Kingdom of Saudi Arabia Manufacturing Market Report is segmented on the basis of the following

By Product Type

- Finished Goods

- Semi-Finished Goods

- Raw Materials

By Technology Adoption

- Traditional Manufacturing

- Smart Manufacturing

- Industry 4.0

- IoT-enabled Manufacturing

- Additive Manufacturing (3D Printing)

- Robotics & Automation

- Lean Manufacturing

- Green Manufacturing

- Sustainable Production Techniques

- Renewable Energy Integration

By Manufacturing Process

- Discrete Manufacturing

- Small Batch Production

- Mass Production

- Process Manufacturing

- Continuous Process

- Batch Process

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- Oil & Gas

- Petrochemicals

- Refining & Distribution

- Automotive

- Vehicle Manufacturing

- Automotive Parts & Components

- Food & Beverage

- Dairy

- Packaged Food

- Beverages & Soft Drinks

- Metals & Mining

- Steel Production

- Aluminum Manufacturing

- Copper & Other Metals

- Chemicals

- Industrial Chemicals

- Specialty Chemicals

- Fertilizers

- Pharmaceuticals

- Drug Production

- Nutraceuticals

- Textiles & Apparel

- Textile Production

- Apparel Manufacturing

- Electronics & Electricals

- Consumer Electronics

- Industrial Electronics

- Construction Materials

- Machinery & Equipment

- Industrial Equipment

- Robotics & Automation

By End User Demand

- Domestic Consumption

- Export-Oriented Manufacturing

Competitive Landscape

The Saudi Arabian manufacturing market is highly competitive, with dominant domestic and international players in every segment. Major local players include Saudi Aramco, SABIC, and Ma'aden, leading the petrochemical and oil & gas industries. These giants leverage advanced technologies and robust financial resources to maintain their market leadership. The large investments in research and development enable them to continue driving operational efficiency, ensure product innovation, and stay updated on the latest happening in the industry.

These are some of the core reasons behind its continuous upgrade to modern manufacturing processes through investment in R&D. Excluding the oil & gas sector, other key players comprise Almarai in food & beverages and SPIMACO in pharmaceuticals; thus, these are a part of the diversification process within Saudi Arabia's manufacturing market. These companies lower the dependency on oil exports in their country and raise the country's stature among the list of countries in non-oil industries.

Companies like Zamil Industrial and Arabian Cement are expanding their production capacity to meet the growing demand for construction and infrastructure. Riyadh Cables Group represents one of the leading names in the electronics and electrical component sector, heavily investing in automation and innovation to further increase productivity.

In particular, international manufacturers are finding the Saudi competitive advantage in the country's trade policy, government incentives, and strategic location at the crossroads of Europe, Asia, and Africa-of particular appeal. Add to this the push the Kingdom has given toward sustainable manufacturing and green technologies, enhancing the competitive landscape. More than anything else, it is Vision 2030 that will keep encouraging growth in such indicators as innovation, technology partnership, and access to larger global markets, enabling the manufacturing sector in Saudi Arabia to be more competitive and resilient.

Some of the prominent players in the Kingdom of Saudi Arabia manufacturing market are

- Saudi Aramco

- SABIC (Saudi Basic Industries Corporation)

- Saudi Arabian Mining Company (Ma’aden)

- Saudi Electricity Company (SEC)

- Almarai

- Saudi Ceramics

- Tasnee (National Industrialization Company)

- Saudi Steel Pipe Company

- Advanced Petrochemical Company

- Zamil Industrial Investment Company

- Riyadh Cables Group

- Arabian Cement Company

- Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO)

- Other Key Players

Recent Developments

- March 2024: Saudi Aramco announced new investments in petrochemical manufacturing, aiming to expand its downstream production capacity by 15% over the next three years to meet growing market demands.

- January 2024: SABIC unveiled a partnership with a European firm to establish a sustainable manufacturing plant focused on producing green chemicals, supporting the company’s commitment to environmental responsibility and sustainability.

- November 2023: SPIMACO expanded its pharmaceutical production capacity with the launch of a new manufacturing facility in Riyadh, enhancing its ability to meet the increasing demand for healthcare products.

- August 2023: Ma'aden secured a strategic agreement to export mining-related products to Asian markets, significantly increasing its production capacity in metals and boosting its global export presence.

- June 2023: Riyadh Cables Group launched advanced manufacturing operations in electrical components, investing heavily in automation technologies to increase efficiency and improve product quality within the competitive electrical industry.

- February 2023: Almarai expanded its food and beverage manufacturing operations to meet growing regional demand, improving production efficiency and enhancing product availability across the Middle East and North Africa.

Report Details

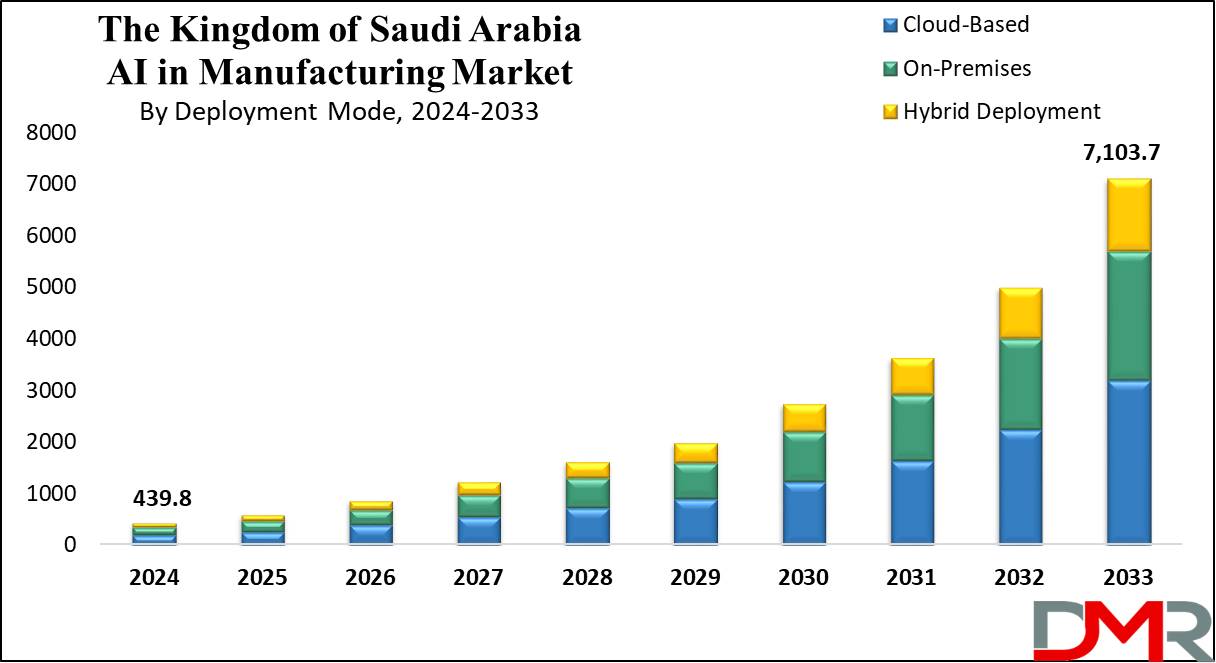

| Report Characteristics |

| Market Size (2024) |

USD 439.8 Mn |

| Forecast Value (2033) |

USD 7,103.7 Mn |

| CAGR (2024-2033) |

36.2% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

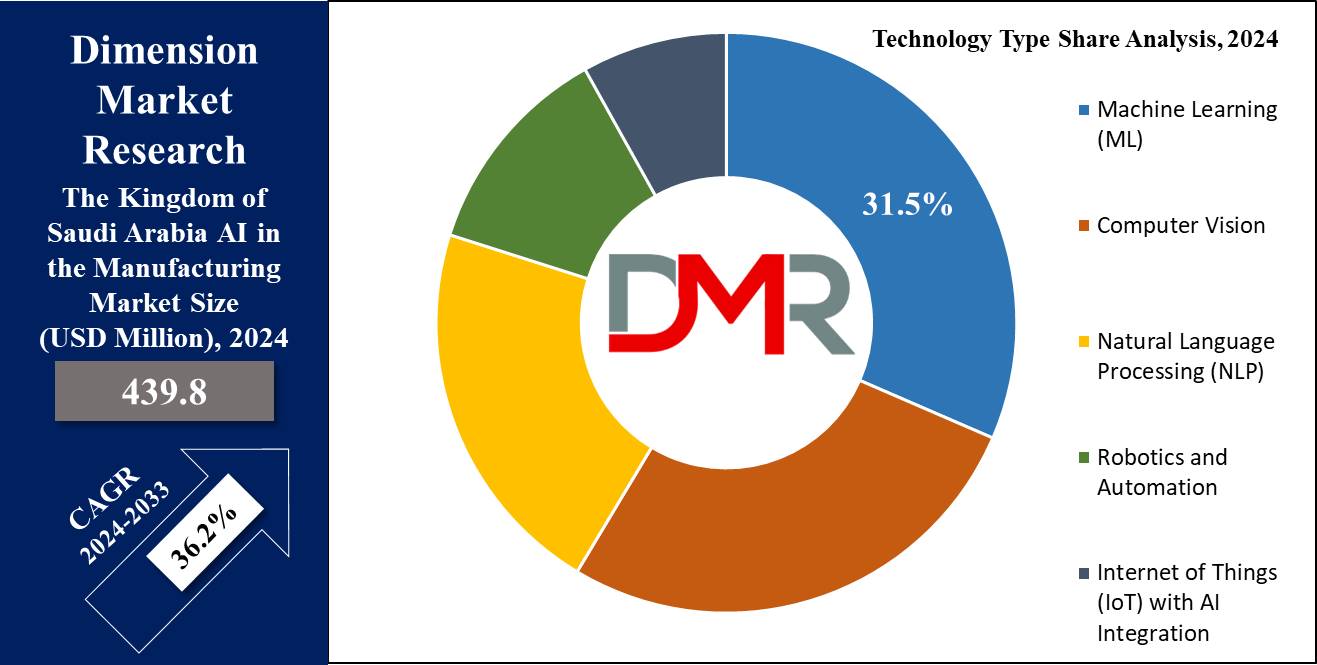

| Segments Covered |

By Technology Type (Machine Learning (ML), Computer Vision, Natural Language Processing (NLP), Robotics and Automation, and Internet of Things (IoT) with AI Integration), By Deployment Mode (Cloud-Based, On-Premises, and Hybrid Deployment), By Company Size (Small and Medium Enterprises (SMEs), and Large Enterprises), By Functionality (Planning and Scheduling, Product Design and Customization, Workforce Management), By Application (Predictive Maintenance and Machine Monitoring, Quality Control and Inspection, Supply Chain Optimization, Process Automation, and Energy Management), By Industry Vertical (Automotive Manufacturing, Chemical and Petrochemicals, Food and Beverage, Metals and Machinery, and Electronics and Semiconductor) |

| Regional Coverage |

The Kingdom of Saudi Arabia |

| Prominent Players |

IBM, Microsoft, Siemens, ABB, Honeywell, GE Digital, Schneider Electric, Rockwell Automation, Oracle, SAP, Alat, SAS Institute, PTC., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Kingdom of Saudi Arabia AI in Manufacturing Market size is estimated to have a value of USD 439.8 million in 2024. It is expected to reach USD 7,103.7 million by the end of 2033.

Some of the major key players in The Kingdom of Saudi Arabia's AI Manufacturing Market are IBM, Microsoft, Siemens, ABB, Honeywell, GE Digital, Schneider Electric, Rockwell Automation, and many others.

The market is growing at a CAGR of 36.2 percent over the forecasted period.