Market Overview

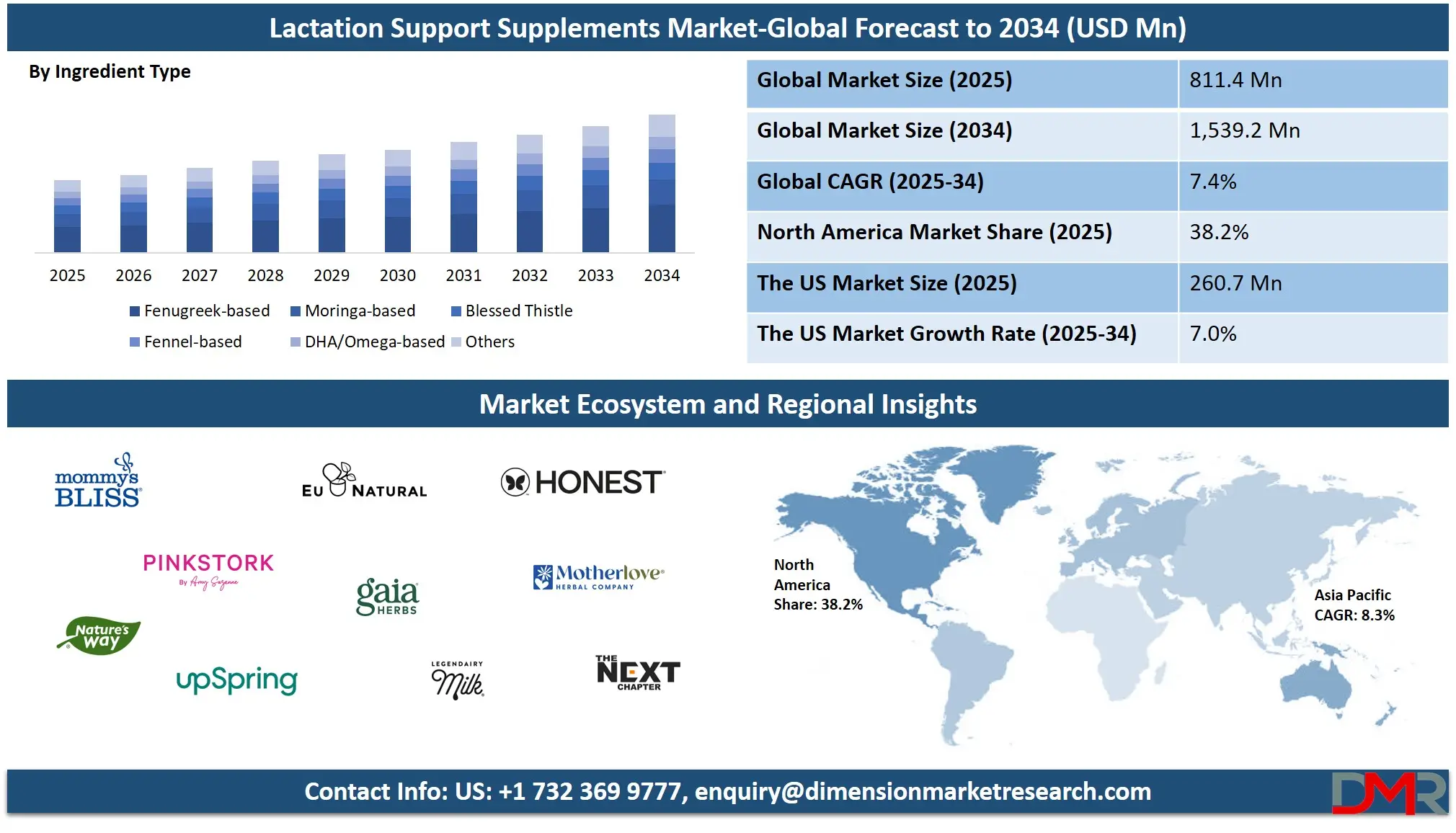

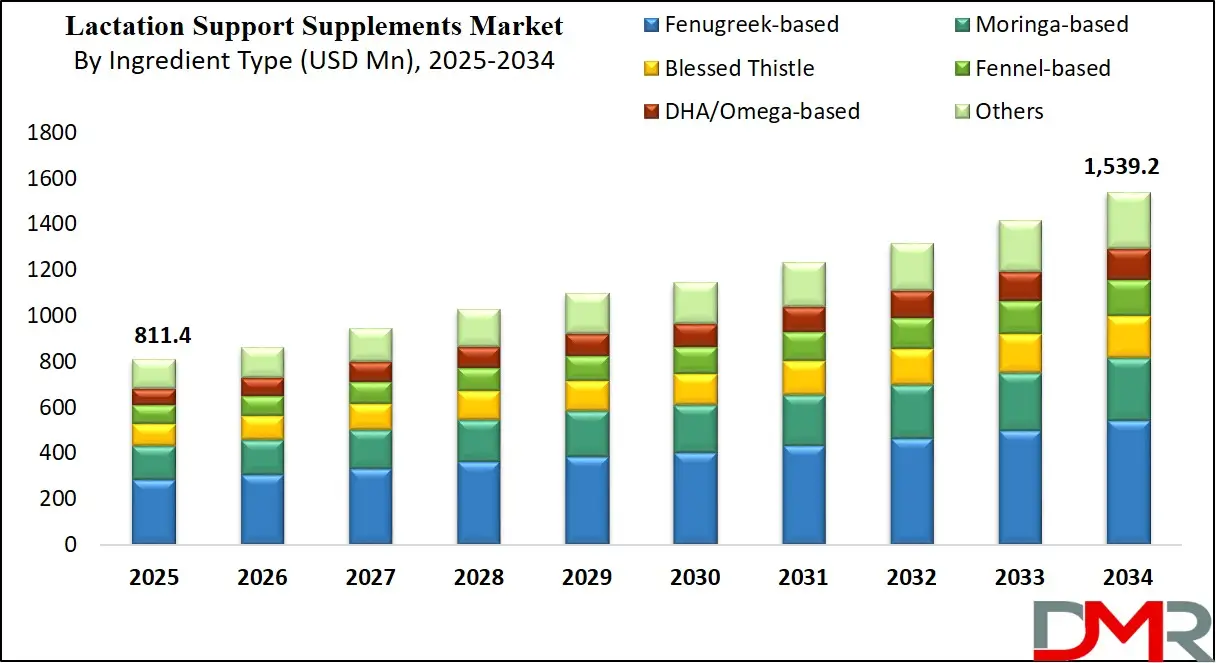

The Global Lactation Support Supplements Market is projected to reach USD 811.4 million by 2025 and is expected to grow to USD 1,539.2 million by 2034, expanding at a CAGR of 7.4%.

This growth is driven by growing demand for breastfeeding support products, rising awareness around postpartum nutrition, and the growing adoption of herbal galactagogues and natural milk boosters across emerging and developed markets. The increasing overlap between nutraceuticals and dietary supplements has further strengthened the positioning of lactation aids within holistic maternal nutrition portfolios.

Lactation support supplements are specialized dietary products that enhance and sustain breast milk production in nursing mothers. These supplements often include a blend of herbal supplements such as fenugreek, moringa, blessed thistle, and fennel, as well as essential vitamins, minerals, omega-3 fatty acids, and protein ingredients that are vital for both maternal health and infant development.

They are available in various forms, including capsules, powders, teas, gummies, and liquid extracts, making them accessible and convenient for diverse consumer preferences. By helping to regulate hormonal balance and optimize nutrient intake, lactation supplements not only support adequate milk supply but also contribute to postpartum recovery and overall maternal well-being, especially during the early months of breastfeeding when nutritional demands are significantly higher.

The global lactation support supplements market has gained significant momentum in recent years, driven by rising awareness around breastfeeding benefits and growing incidences of lactation-related challenges such as low milk supply and hormonal imbalances. Market growth is further propelled by the growing number of working mothers who seek natural solutions to maintain breastfeeding while managing busy lifestyles.

The growing preference for plant-based and clean-label supplements has encouraged manufacturers to innovate using organic, non-GMO, and gluten-free ingredients that align with evolving consumer health trends.

Additionally, campaigns led by government and non-governmental organizations promoting breastfeeding practices have positively influenced demand, especially in developing economies. Increasing investment in women’s & maternal health and the integration of healthcare analytics into maternal nutrition programs are also shaping market evolution.

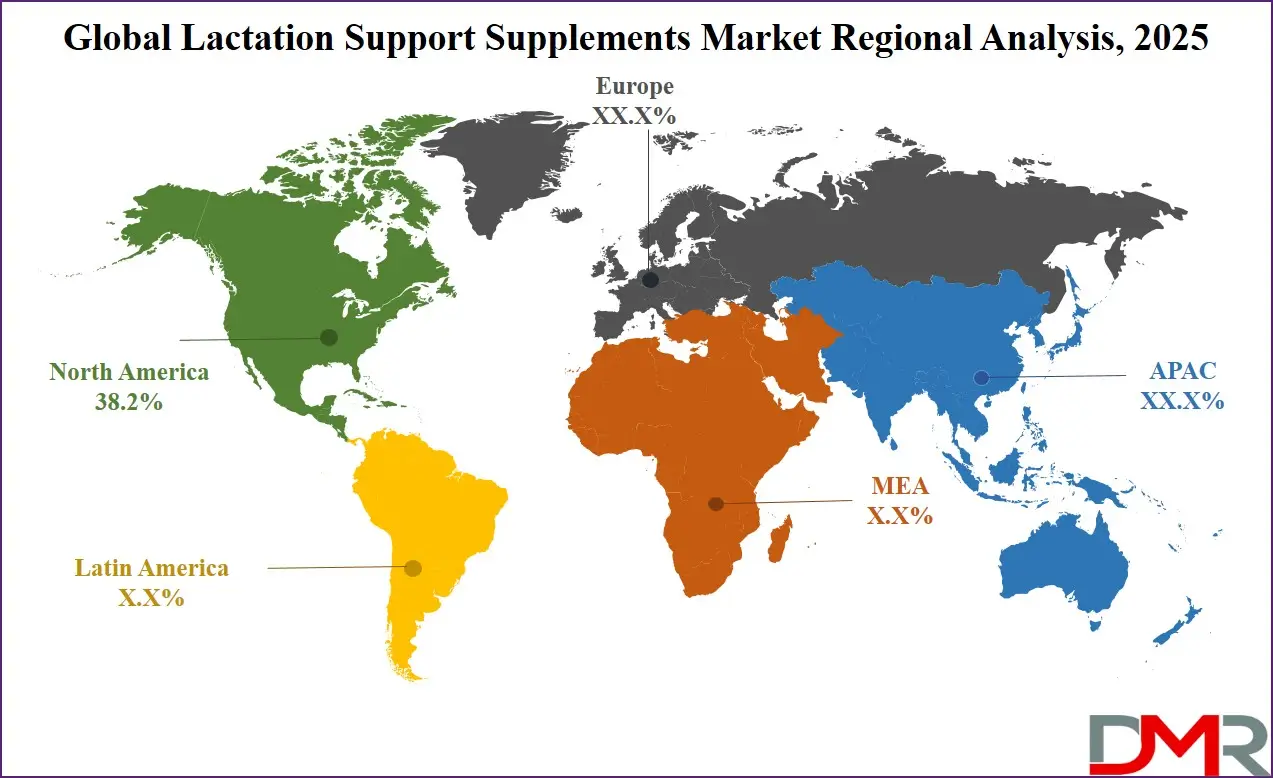

E-commerce penetration and direct-to-consumer distribution models have redefined how consumers access lactation supplements, allowing personalized buying experiences and greater product visibility. North America dominates the market due to its high healthcare awareness, robust retail infrastructure, and availability of clinically supported products.

However, the Asia-Pacific is emerging as a high-potential region owing to rising birth rates, traditional use of herbal galactagogues, and expanding access to postpartum care products. With the growing intersection of functional nutrition and maternal health, the lactation supplements market is poised for sustained growth, driven by innovation, consumer education, and a broader focus on holistic postpartum wellness.

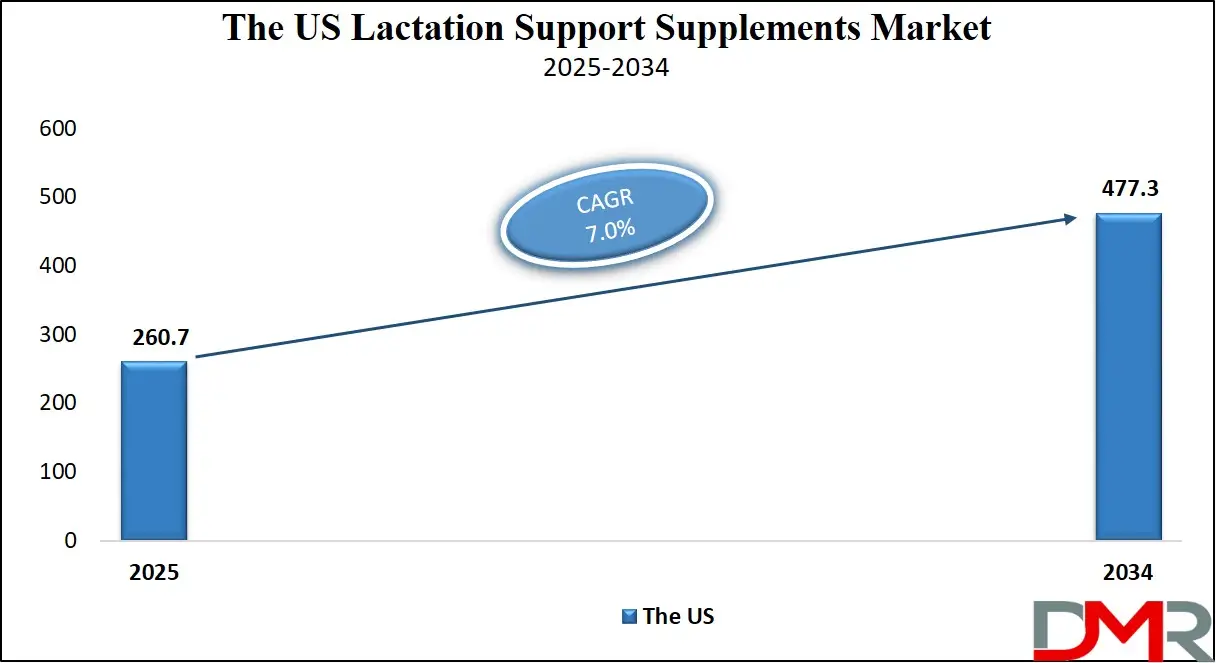

The US Lactation Support Supplements Market

The U.S. Lactation Support Supplements Market size is projected to be valued at USD 260.7 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 477.3 million in 2034 at a CAGR of 7.0%.

The United States lactation support supplements market is experiencing steady expansion, fueled by rising awareness of maternal health, growing acceptance of natural remedies, and a proactive approach to postpartum care.

American mothers are more frequently seeking lactation aids as part of their breastfeeding journey, especially in the early postpartum weeks when milk supply regulation is critical. This demand is further supported by healthcare professionals recommending herbal lactation supplements and nutrient-rich formulations to address insufficient milk production and ensure optimal infant nutrition.

Additionally, cultural shifts favoring breastfeeding and the growing popularity of plant-based galactagogues such as fenugreek, moringa, and blessed thistle are driving innovation in supplement formulation and delivery formats.

Consumer preference in the U.S. is strongly skewed toward clean-label, organic, and allergen-free supplements that support both convenience and safety. Major brands are leveraging this trend by offering gluten-free, non-GMO, and dairy-free options in formats like capsules, drink mixes, and lactation teas, often customized to vegan and sensitive diets.

Direct-to-consumer brands are thriving in the digital landscape by providing personalized product recommendations, subscription models, and access to lactation consultants. In parallel, retail pharmacies and wellness-focused chains are growing shelf space for breastfeeding support supplements.

With enhanced product availability, supportive healthcare ecosystems, and growing emphasis on maternal wellness, the U.S. remains a key driver in shaping global trends in lactation nutrition and postpartum supplementation.

The European Lactation Support Supplements Market

Europe is projected to account for USD 202.8 million in the global lactation support supplements market in 2025, reflecting its strong position as one of the leading regional contributors. The market is largely driven by growing consumer awareness of the importance of postpartum nutrition, rising breastfeeding support initiatives, and a well-established dietary supplements industry.

European consumers, particularly in countries like Germany, France, and the UK, have shown a growing preference for clean-label, organic, and plant-based galactagogue formulations such as fenugreek, moringa, and blessed thistle.

The strong regulatory environment in the European Union also ensures high product quality and safety, which contributes to greater consumer trust and market stability. In addition, healthcare professionals and midwives in Europe frequently recommend lactation supplements as part of routine maternal care, further fueling market penetration.

The market in Europe is expected to grow at a steady CAGR of 6.7% from 2025 to 2034, driven by innovation in product formulations and a broader cultural shift toward holistic maternal wellness. The growing number of women returning to work shortly after childbirth has also created demand for effective and convenient lactation aids that support milk supply without compromising lifestyle.

Companies operating in this region are investing in e-commerce channels, subscription-based distribution models, and awareness campaigns that align with European consumer values around sustainability and ingredient transparency.

Moreover, the rise of personalized nutrition and functional health supplements is opening new opportunities for brands to cater to niche segments, including vegan, allergen-free, and gluten-free lactation support products. These factors collectively position Europe as a mature yet steadily expanding market with long-term growth potential in the global lactation support supplements landscape.

The Japan Lactation Support Supplements Market

Japan’s lactation support supplements market is estimated to reach USD 48.6 million in 2025, representing a modest yet stable share of the global landscape. This reflects Japan’s conservative but quality-focused approach to maternal health products.

Japanese consumers prioritize safety, clinical validation, and premium-quality formulations, which has led to the dominance of pharmaceutical-grade supplements and scientifically supported galactagogues. The market is largely driven by recommendations from healthcare professionals, with postpartum nutrition typically managed within a medicalized framework.

While herbal lactation aids like fenugreek and shatavari are not as commonly used as in Western or Asian traditional medicine markets, Japan shows growing interest in nutraceutical blends fortified with vitamins, DHA, and key minerals essential for lactation and infant development.

With a forecasted CAGR of 4.9% from 2025 to 2034, Japan’s market growth is expected to remain steady, shaped by a combination of slow demographic expansion and evolving consumer behavior. While the country continues to experience low birth rates, the rising focus on maternal wellness, functional nutrition, and self-care is creating opportunities for niche lactation support solutions.

Urban mothers are becoming more proactive in seeking out supplements that can enhance breastfeeding performance while aligning with their lifestyle and dietary preferences. Moreover, digital health platforms and premium retail pharmacies are helping drive awareness and availability of specialized products.

As Japan leans toward high-quality, personalized health solutions, the lactation supplement market is likely to expand gradually, supported by innovation in delivery formats and integration of postpartum care into broader wellness routines.

Global Lactation Support Supplements Market: Key Takeaways

- Market Value: The global lactation support supplements market size is expected to reach a value of USD 1,539.2 million by 2034 from a base value of USD 811.4 million in 2025 at a CAGR of 7.4%.

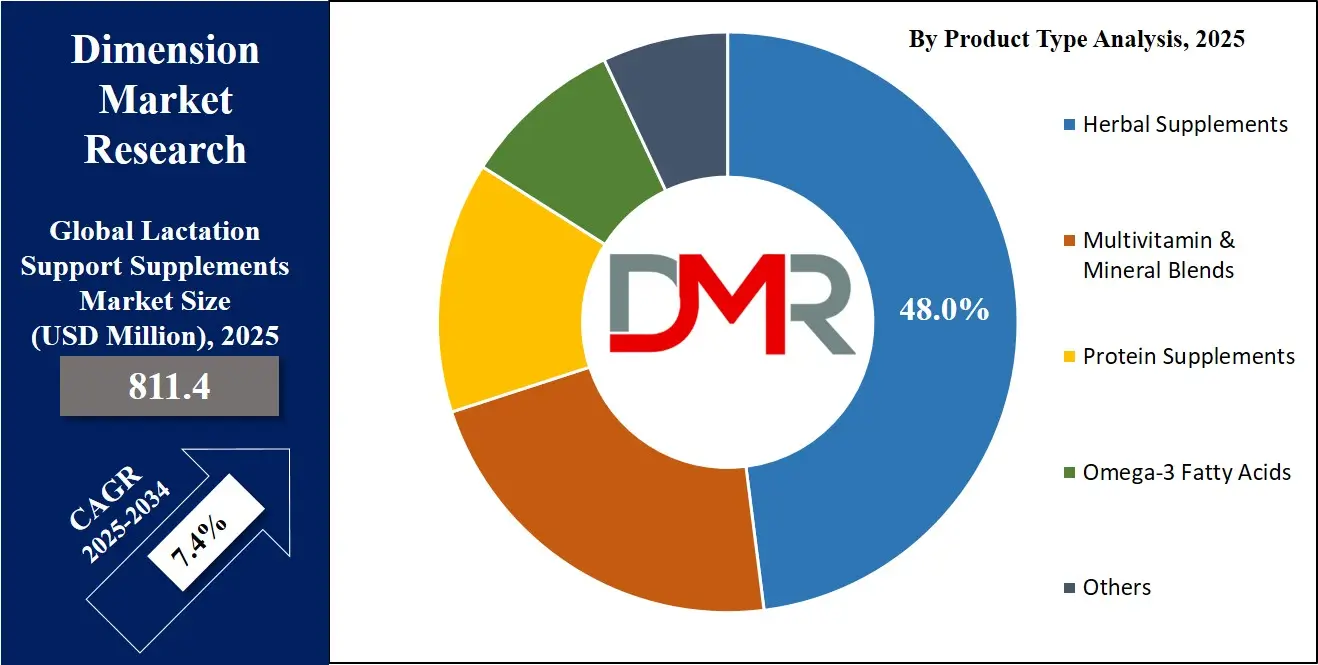

- By Product Type Segment Analysis: Herbal Supplements are anticipated to dominate the product type segment, capturing 48.0% of the total market share in 2025.

- By Form Segment Analysis: Capsules/Tablets are poised to consolidate their dominance in the form segment, capturing 40.0% of the total market share in 2025.

- By Ingredient Type Segment Analysis: Fenugreek-based ingredients will lead in the ingredient type segment, capturing 35.0% of the market share in 2025.

- By Distribution Channel Segment Analysis: Pharmacies/Drug Stores are expected to maintain their dominance in the distribution channel segment, capturing 36.0% of the total market share in 2025.

- By End Use Segment Analysis: Home Use will dominate the end use segment, capturing 64.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global lactation support supplements market landscape with 38.2% of total global market revenue in 2025.

- Key Players: Some key players in the global lactation support supplements market are Mommy's Bliss, Pink Stork, Nature's Way, UpSpring, Eu Natural, Gaia Herbs, Legendary Milk, Majka, The Honest Company, Motherlove Herbal Company, New Chapter, Frida Mom, Pure Encapsulations, MegaFood, Herb Pharm, and Others.

Global Lactation Support Supplements Market: Use Cases

- Postpartum Recovery and Milk Supply Enhancement for First-Time Mothers: First-time mothers often experience hormonal imbalances and physiological stress post-delivery, which can impact breast milk production. Lactation support supplements help bridge this nutritional gap by offering key galactagogues like fenugreek, moringa, and blessed thistle, proven to support milk let-down and stimulate prolactin levels. These supplements also offer essential vitamins and minerals such as iron, B12, and calcium, which are often depleted during childbirth. As more new mothers turn to plant-based, clean-label solutions for breastfeeding support, manufacturers are designing easy-to-consume products like lactation teas, protein mixes, and herbal capsules specifically customized for early postpartum recovery. This use case drives demand in both developed and emerging regions where maternal care initiatives promote breastfeeding-friendly practices.

- Support for Working Mothers Balancing Career and Breastfeeding: With more women returning to work shortly after childbirth, the need for practical, reliable lactation solutions has surged. Supplements that enhance and maintain breast milk production, especially during pumping schedules, are critical for working mothers aiming to continue breastfeeding. Galactagogue supplements, particularly those with DHA, flaxseed, and shatavari, help sustain milk output during times of stress or irregular feeding. Brands are offering discreet formats like single-serve powders, gummies, and shelf-stable snacks to meet the needs of mobile mothers. Direct-to-consumer channels and personalized subscription services further cater to this demographic, reflecting how workplace wellness trends and parental support policies influence purchasing behavior in the lactation support supplements market.

- Therapeutic Use in Lactation Consultations and Hospital Settings: Lactation consultants and maternity care providers recommend supplements as part of holistic breastfeeding management plans. In cases of delayed lactogenesis, infant failure to thrive, or post-cesarean recovery, professionally guided supplementation can play a critical role. Hospitals and maternity clinics stock pharmaceutical-grade lactation supplements that include safe herbal formulations and essential fatty acids known to improve milk quality. Supplements used in medical settings are often third-party tested for purity and are part of broader postnatal nutrition protocols. This use case reflects growing institutional trust in herbal and functional nutrition products, especially in markets with advanced healthcare infrastructure like the U.S., Germany, Japan, and the UAE.

- Preventive Nutritional Support in High-Risk Pregnancies and Low Milk Supply Cases: Women with a history of low milk supply, hormonal disorders, polycystic ovary syndrome (PCOS), or thyroid issues are often prescribed lactation supplements as a preventive measure. Preemptive supplementation during the late third trimester or immediately post-birth can promote healthy mammary gland function and prepare the body for sustained lactation. Formulas rich in adaptogens, phytoestrogens, and micronutrients play a role in reducing the risk of early weaning. This application is gaining ground among obstetricians and midwives globally, especially in high-risk pregnancy cases or in women undergoing IVF or multiple births. This proactive use case illustrates the role of lactation-enhancing supplements in maternal health strategies beyond reactive treatment.

Impact of Artificial Intelligence on Lactation Support Supplements Market

Artificial intelligence is beginning to make inroads into the lactation support supplements market by enabling more personalized nutrition solutions and data-driven maternal care. AI-powered platforms can analyze user input such as diet, health history, lactation output, and baby growth patterns to recommend custom supplement blends tailored to individual needs.

Machine learning models also help optimize formulation processes, predicting ingredient interactions and bioavailability, enhancing efficacy, and reducing side effects. On the production side, AI-driven quality control and supply chain analytics improve consistency and safety. Overall, AI is paving the way for smarter, evidence-based supplement development and personalized maternal wellness strategies.

Global Lactation Support Supplements Market: Stats & Facts

- CDC (Maternal Diet & Breastfeeding Guidelines)

- Breastfeeding women need 290 µg iodine/day and 550 mg choline/day

- Multivitamin supplementation is recommended when the diet is insufficient, especially for vegetarian/vegan mothers

- CDC Breastfeeding Report Card 2022

- 83.2% of infants born in 2019 received any breast milk

- At 1 month: 78.6%, at 6 months: 55.8%, exclusively at 6 months: 24.9%

- Washington State Department of Health (WIC data)

- Breastfeeding initiation: 81.9%

- Continued breastfeeding at 6 months: 60.6%

- Exclusive breastfeeding at 3 months: 42.6%, at 6 months: 25.5%

- Worksite lactation support programs in 38% of employers

- Hospitals with recommended breastfeeding care: 8.1%

- FDA & NIH research report

- 90% of women take at least one medication during pregnancy; 50% take 3–4 medications

- For breastfeeding mothers: 47.9% of drug labels show no data, 42.7% have animal data, and only 4.7% include human data on drug safety

- EPA Exposure Factors Handbook

- In developing countries, 96.6% of infants 0–6 months receive breast milk; formula feeding accounts for just 11.9%

- Examples of exclusive breastfeeding: Bangladesh 99.6%, India 98.1%, Nigeria 99.1%

- NIH PMC Germany Cohort Study

- 94.6% of women in Germany take dietary supplements during pregnancy; lactating women likely follow a similar trend

- USAID on vitamin A supplementation

- High-dose vitamin A supplementation post-delivery increases vitamin A concentration in breast milk and improves infant nutrition

- HRSA Maternal & Child Health Bureau

- Launched employer, doula, and lactation education programs

- Awarded 40 Certified Lactation Counselor scholarships in 2022

Global Lactation Support Supplements Market: Market Dynamics

Global Lactation Support Supplements Market: Driving Factors

Rising Awareness of Breastfeeding Benefits and Postpartum Nutrition

Increasing global awareness of the long-term health benefits of breastfeeding for both infants and mothers is a major growth driver for lactation support supplements. Health organizations such as the WHO and UNICEF advocate exclusive breastfeeding for the first six months, leading to higher adoption of breastfeeding support products. Mothers are now more informed about the importance of postpartum nutrition, especially in maintaining a healthy milk supply. This has led to increased consumption of galactagogue supplements and herbal lactation boosters to aid natural milk production and maternal recovery.

Shift toward Natural and Herbal Formulations

There is a growing consumer shift toward herbal and clean-label formulations containing plant-based galactagogues such as fenugreek, moringa, and milk thistle. Consumers prefer non-GMO, organic, and gluten-free lactation support products that align with wellness-focused lifestyles. Brands that offer vegan lactation capsules, organic teas, and additive-free milk supply enhancers are gaining strong traction in both online and retail markets. This trend is further reinforced by increased trust in traditional medicine systems such as Ayurveda and Traditional Chinese Medicine.

Global Lactation Support Supplements Market: Restraints

Limited Clinical Evidence and Regulatory Scrutiny

Despite widespread usage, many herbal lactation supplements lack robust clinical trials proving their safety and efficacy. The limited scientific validation of certain galactagogues and inconsistent regulation across countries raise concerns about standardization and dosage. Regulatory bodies like the FDA categorize most lactation supplements as dietary products, limiting oversight. This restraint affects consumer confidence and restricts adoption in highly regulated pharmaceutical and hospital channels.

Allergy Risks and Sensitivities

Some commonly used galactagogue ingredients, including fenugreek and blessed thistle, may cause allergic reactions or interact with medications. Lactating mothers with thyroid imbalances, diabetes, or digestive issues may be hesitant to use supplements without medical advice. The lack of personalized formulations and the risk of side effects in sensitive individuals pose barriers to broader market penetration, particularly in populations with pre-existing health conditions.

Global Lactation Support Supplements Market: Opportunities

Expansion into Emerging Economies and Rural Healthcare

Emerging markets in Asia, Africa, and Latin America offer vast untapped potential due to rising birth rates, improved access to maternal care, and growing awareness about breastfeeding nutrition. Governments and NGOs are actively promoting maternal wellness programs, creating opportunities for lactation supplement brands to collaborate on public health initiatives. Affordable, locally sourced herbal lactation products can gain a strong foothold in rural areas where traditional remedies are already culturally accepted.

Personalization and Subscription-Based DTC Models

The rise of direct-to-consumer (DTC) channels offers a significant growth opportunity for companies to deliver personalized lactation plans. Through digital health platforms and mobile apps, brands can offer product bundles based on user data such as age, dietary restrictions, and breastfeeding challenges.

Subscription services that provide monthly supply kits, access to lactation consultants, and real-time tracking of milk supply performance enhance user loyalty and build long-term brand engagement. The growing integration of healthcare IT systems and partnerships with CDMO service providers enable cost-effective, scalable supplement production and digital tracking solutions.

Global Lactation Support Supplements Market: Trends

Innovation in Delivery Formats and Functional Blends

Manufacturers are innovating beyond traditional capsule forms to include lactation granola bars, protein shakes, flavored drink mixes, and dissolvable strips. These user-friendly formats appeal to modern mothers seeking convenience and portability. Many new products combine lactation support with mood enhancers, digestive enzymes, or postpartum recovery nutrients, creating multifunctional maternal health supplements that meet broader nutritional needs.

Integration of Digital Lactation Support with Product Ecosystems

The integration of lactation supplements with digital wellness tools, such as mobile apps that track breastfeeding schedules, nutrient intake, and baby growth, is transforming the consumer experience. This trend reflects the growing intersection of femtech and maternal care. Companies that offer not just products but full-service ecosystems, combining lactation aids, educational content, and telehealth consultations, are gaining a competitive advantage and reshaping the market landscape.

Global Lactation Support Supplements Market: Research Scope and Analysis

By Product Type Analysis

Herbal supplements are expected to lead the product type segment of the global lactation support supplements market, accounting for approximately 48.0% of the total market share in 2025. This dominance is largely driven by the growing consumer preference for natural, plant-based solutions that are perceived as safer and more aligned with traditional postpartum care practices.

Ingredients such as fenugreek, moringa, blessed thistle, fennel, and goat’s rue have long been used in various cultures as effective galactagogues to stimulate breast milk production. The growing popularity of herbal remedies in both developed and emerging economies is supported by a wider acceptance of holistic wellness trends and a shift toward chemical-free, clean-label supplementation.

Moreover, the availability of these herbal lactation boosters in diverse formats such as teas, capsules, and liquid extracts has made them accessible and convenient for modern mothers seeking non-invasive ways to manage low milk supply and support their breastfeeding journey.

Multivitamin and mineral blends form another significant segment within the lactation support supplements market, catering to the nutritional demands of breastfeeding mothers. These formulations typically include a combination of essential nutrients like calcium, vitamin D, vitamin B-complex, zinc, and iron, nutrients that are critical for maintaining maternal health and ensuring high-quality breast milk.

Postpartum women often face deficiencies due to the physiological strain of childbirth and nursing, making these supplements a necessary part of their recovery and daily nourishment. Multivitamin blends not only enhance maternal energy levels and immune function but also indirectly support consistent lactation by replenishing vital stores depleted during pregnancy.

As more healthcare providers recommend integrated nutritional support during the breastfeeding phase, the demand for comprehensive multivitamin and mineral-based lactation products continues to grow, particularly in clinical and pharmacy-based channels.

By Form Analysis

Capsules and tablets are expected to retain their dominant position within the form segment of the global lactation support supplements market, securing around 40.0% of the total market share in 2025.

Their popularity is largely attributed to ease of use, precise dosing, long shelf life, and wide availability across both retail and online platforms. These solid dosage forms are especially favored by healthcare professionals for their standardized formulations, which simplify prescribing and intake schedules for new mothers.

Additionally, capsules and tablets are often preferred by women who require discreet and portable options that fit seamlessly into their daily routines, especially in the workplace or travel settings. The ability to incorporate concentrated herbal extracts, multivitamins, and galactagogues into a single dose adds to their appeal among postpartum women seeking convenient solutions to support milk supply and nutritional recovery.

Powder-based lactation supplements also hold a notable share in the market and continue to gain traction due to their versatility and ease of integration into daily diets. These products are typically formulated as drink mixes, protein supplements, or smoothie blends that can be added to water, milk, or food.

They appeal to mothers looking for functional and customizable options that can deliver both hydration and targeted nutrition. Some modern blends are positioned as healthy snacks, integrating galactagogues with dietary proteins and micronutrients to support postpartum energy and satiety.

Powder forms often contain a combination of milk-boosting herbs, essential amino acids, and nutrient-rich ingredients like oat flour, flaxseed, and brewer’s yeast. Their growing popularity is driven by health-conscious consumers who prefer clean-label, additive-free formulas with high bioavailability.

Additionally, flavored variants and customizable packaging have made powder supplements attractive in direct-to-consumer and online wellness channels, particularly among mothers seeking more natural, food-based lactation solutions.

By Ingredient Type Analysis

Fenugreek-based ingredients are expected to dominate the ingredient type segment of the global lactation support supplements market, capturing approximately 35.0% of the total market share in 2025.

Fenugreek has long been recognized as one of the most effective and widely used herbal galactagogues, particularly for its ability to stimulate prolactin levels and enhance breast milk production within a short timeframe. Its popularity is rooted in both traditional medicine practices and modern clinical usage, making it a preferred choice for new mothers dealing with low milk supply.

Fenugreek is also supported by anecdotal evidence and recommendations from lactation consultants, which has significantly boosted its credibility and demand. It is commonly found in various supplement formats, including capsules, teas, and powdered drink mixes. Its affordability, wide availability, and proven efficacy have contributed to its strong market presence, particularly in North America, Europe, and parts of Asia where herbal postpartum care is highly valued.

Moringa-based ingredients are also gaining significant momentum in the lactation support supplements market, emerging as a potent alternative to traditional galactagogues. Moringa is valued for its high nutritional density, offering an abundant supply of iron, calcium, potassium, vitamin A, and essential amino acids, all of which contribute to maternal health and improved milk quality.

Unlike fenugreek, moringa also supports overall energy levels and immune function, making it a multifunctional ingredient for postpartum recovery. Its appeal is especially strong among vegan and plant-based consumers who seek organic and natural milk supply enhancers.

Moringa supplements are featured in powdered mixes, capsules, and fortified snacks, with growing popularity across Southeast Asia, India, and Africa, regions where moringa is native and culturally accepted. As consumer preferences continue to shift toward nutrient-rich superfoods and clean-label lactation aids, moringa-based formulations are expected to expand their footprint within the global market.

By Distribution Channel Analysis

Pharmacies and drug stores are anticipated to maintain a dominant position in the distribution channel segment of the global lactation support supplements market, holding around 36.0% of the total market share in 2025. This dominance is primarily due to the high level of trust that consumers place in pharmacist-recommended products and the accessibility of over-the-counter lactation aids in retail pharmacy chains.

Pharmacies often carry clinically vetted, physician-endorsed brands that are preferred by postpartum mothers seeking medically reliable options. The presence of professional guidance at the point of sale also encourages cautious buyers, especially first-time mothers, to choose supplements with greater confidence.

Moreover, physical pharmacies serve as critical access points in both urban and semi-urban regions where digital literacy or internet connectivity may still be limited, thereby reinforcing their strong foothold in the market. These outlets often work closely with hospitals and maternity clinics to stock popular galactagogue formulations, including herbal blends and multivitamin-based lactation aids.

Online retail and e-commerce platforms are rapidly reshaping the landscape of lactation supplement distribution, accounting for a growing share of the market and expected to be the second-largest channel.

E-commerce allows new mothers to conveniently browse a wide range of products, compare ingredients, read user reviews, and make informed purchasing decisions from the comfort of their homes. The rise of direct-to-consumer (DTC) brands offering subscription models, personalized supplement packs, and digital consultations has made online channels highly appealing to modern consumers.

Moreover, online platforms provide access to niche and premium products such as organic, vegan, or allergen-free lactation supplements that may not be widely available in traditional retail outlets. With growing smartphone penetration and growing digital awareness among postpartum women, particularly in North America, Europe, and parts of Asia-Pacific, the online segment is expected to witness robust growth and play a pivotal role in shaping future market dynamics.

By End Use Analysis

Home use is projected to dominate the end-use segment of the global lactation support supplements market, accounting for approximately 64.0% of the total market share in 2025. This strong preference for at-home supplementation reflects a growing trend of home healthcare and self-managed maternal wellness. Many women integrate these supplements into home healthcare services that emphasize nutrition, lactation monitoring, and postpartum recovery guidance.

The convenience, privacy, and accessibility of using lactation supplements at home make it the most popular choice, especially among new mothers balancing childcare responsibilities and recovery. The wide availability of herbal galactagogues, multivitamin blends, and functional powders through retail and online channels has further empowered mothers to incorporate these products into their daily wellness routines.

With growing awareness about postpartum nutrition and breastfeeding challenges, many women now view lactation support supplements as an essential part of their self-care toolkit during the breastfeeding phase.

Hospitals also play a vital role in the lactation support supplements market, particularly during the initial postpartum period when professional guidance is most needed. In many healthcare facilities, lactation consultants and maternity care providers recommend or administer supplements to mothers facing delayed lactation, low milk supply, or nutritional deficiencies following childbirth.

Hospital-grade supplements are typically standardized, third-party tested, and aligned with clinical protocols, ensuring safety and efficacy for postpartum patients. These institutions often introduce mothers to trusted supplement brands during their stay, which can influence long-term purchasing decisions once they transition to home care.

The hospital segment is especially significant in regions with advanced healthcare infrastructure, such as North America and Western Europe, where evidence-based postpartum care is a priority. Additionally, government and NGO-supported maternal health programs in emerging economies are incorporating lactation supplements into hospital-based breastfeeding support initiatives, further contributing to the growth of this segment.

The Lactation Support Supplements Market Report is segmented based on the following

By Product Type

- Herbal Supplements

- Multivitamin & Mineral Blends

- Protein Supplements

- Omega-3 Fatty Acids

- Others

By Form

- Capsules/Tablets

- Powder

- Liquid

- Softgels

- Others

By Ingredient Type

- Fenugreek-based

- Moringa-based

- Blessed Thistle

- Fennel-based

- DHA/Omega-based

- Others

By Distribution Channel

- Pharmacies/Drug Stores

- Online Retail/E-commerce

- Supermarkets/Hypermarkets

- Health & Specialty Stores

- Direct-to-Consumer (DTC) Brands

By End Use

- Home Use

- Hospitals

- Maternity Clinics & Lactation Centers

- Others

Global Lactation Support Supplements Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global lactation support supplements market in 2025, capturing approximately 38.2% of the total market revenue. This dominance is driven by high levels of awareness around breastfeeding health, widespread availability of premium lactation products, and a well-established healthcare infrastructure that actively supports postpartum nutrition.

The presence of leading brands, strong retail penetration, and growing demand for clean-label, plant-based galactagogue supplements further contribute to the region’s market strength.

Additionally, the rise of direct-to-consumer wellness platforms and the growing adoption of lactation aids among working mothers have fueled consistent market growth across the United States and Canada.

Region with significant growth

Asia Pacific is projected to witness the most significant growth in the global lactation support supplements market over the forecast period, fueled by rising birth rates, growing awareness of maternal health, and increased acceptance of traditional herbal remedies like moringa, fennel, and shatavari.

Countries such as India, China, Indonesia, and Vietnam are seeing rapid urbanization and expanding access to maternal care services, which is driving demand for affordable and culturally familiar lactation solutions.

The region’s strong heritage in natural medicine, combined with rising disposable income and e-commerce penetration, is encouraging both local and international brands to invest in customized formulations and region-specific marketing strategies, positioning Asia Pacific as a key growth engine in the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Lactation Support Supplements Market: Competitive Landscape

The global competitive landscape of the lactation support supplements market is characterized by a mix of established nutraceutical brands, specialized maternal wellness companies, and emerging direct-to-consumer startups, all competing to capture the growing demand for breastfeeding nutrition solutions.

Key players such as Mommy’s Bliss, Pink Stork, UpSpring, Gaia Herbs, and Motherlove Herbal Company have built strong brand loyalty through clean-label, herbal-based formulations and targeted marketing campaigns focused on postpartum recovery. Meanwhile, global health and wellness companies like Nature’s Way, Garden of Life, and GNC leverage expansive distribution networks and diversified supplement portfolios to maintain a competitive advantage.

The market is also witnessing increased innovation through functional blends, personalized supplement plans, and digital health integrations that cater to evolving consumer preferences. Competition is intensifying as new entrants introduce regionally customized products, particularly in Asia-Pacific and Latin America, where demand for culturally relevant, affordable, and natural lactation aids is on the rise.

Some of the prominent players in the global lactation support supplements market are

- Mommy's Bliss

- Pink Stork

- Nature's Way

- UpSpring

- Eu Natural

- Gaia Herbs

- Legendary Milk

- Majka

- The Honest Company

- Motherlove Herbal Company

- New Chapter

- Frida Mom

- Pure Encapsulations

- MegaFood

- Herb Pharm

- Fairhaven Health

- Garden of Life

- NutraBlast

- Vitanica

- GNC (General Nutrition Centers)1

- Other Key Players

Global Lactation Support Supplements Market: Recent Developments

- April 2025: A leading provider unveiled an AI-powered virtual queuing solution specifically designed for healthcare facilities, combining advanced analytics and contactless queue management to streamline patient flow and improve operational efficiency.

- March 2025: A major retail chain implemented a cloud-based virtual queuing system across all its outlets, enhancing customer experience by enabling mobile queueing and real-time wait time updates.

- February 2025: A new European product launch introduced a virtual queue management system integrated with facial recognition technology, offering seamless, secure, and personalized queuing experiences in high-traffic venues.

- January 2025: A global queuing technology company secured a significant funding round aimed at expanding its footprint in the Asia-Pacific region, enabling accelerated deployments and product development.

- December 2024: A major transportation authority adopted a virtual queuing system to better manage passenger flow in airports, reducing congestion and improving travel efficiency.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 811.4 Mn |

| Forecast Value (2034) |

USD 1,539.2 Mn |

| CAGR (2025–2034) |

7.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 260.7 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Herbal Supplements, Multivitamin & Mineral Blends, Protein Supplements, Omega-3 Fatty Acids, and Others), By Form (Capsules/Tablets, Powder, Liquid, Softgels, and Others), By Ingredient Type (Fenugreek-based, Moringa-based, Blessed Thistle, Fennel-based, DHA/Omega-based, and Others), By Distribution Channel (Pharmacies/Drug Stores, Online Retail/E-commerce, Supermarkets/Hypermarkets, Health & Specialty Stores, and Direct-to-Consumer (DTC) Brands), and By End Use (Home Use, Hospitals, Maternity Clinics & Lactation Centers, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Mommy's Bliss, Pink Stork, Nature's Way, UpSpring, Eu Natural, Gaia Herbs, Legendary Milk, Majka, The Honest Company, Motherlove Herbal Company, New Chapter, Frida Mom, Pure Encapsulations, MegaFood, Herb Pharm, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global lactation support supplements market size is estimated to have a value of USD 811.4 million in 2025 and is expected to reach USD 1,539.2 million by the end of 2034.

The US lactation support supplements market is projected to be valued at USD 260.7 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 477.3 million in 2034 at a CAGR of 7.0%.

North America is expected to have the largest market share in the global lactation support supplements market, with a share of about 38.2% in 2025.

Some of the major key players in the global lactation support supplements market are Mommy's Bliss, Pink Stork, Nature's Way, UpSpring, Eu Natural, Gaia Herbs, Legendary Milk, Majka, The Honest Company, Motherlove Herbal Company, New Chapter, Frida Mom, Pure Encapsulations, MegaFood, Herb Pharm, and Others.

The market is growing at a CAGR of 7.4 percent over the forecasted period.