Market Overview

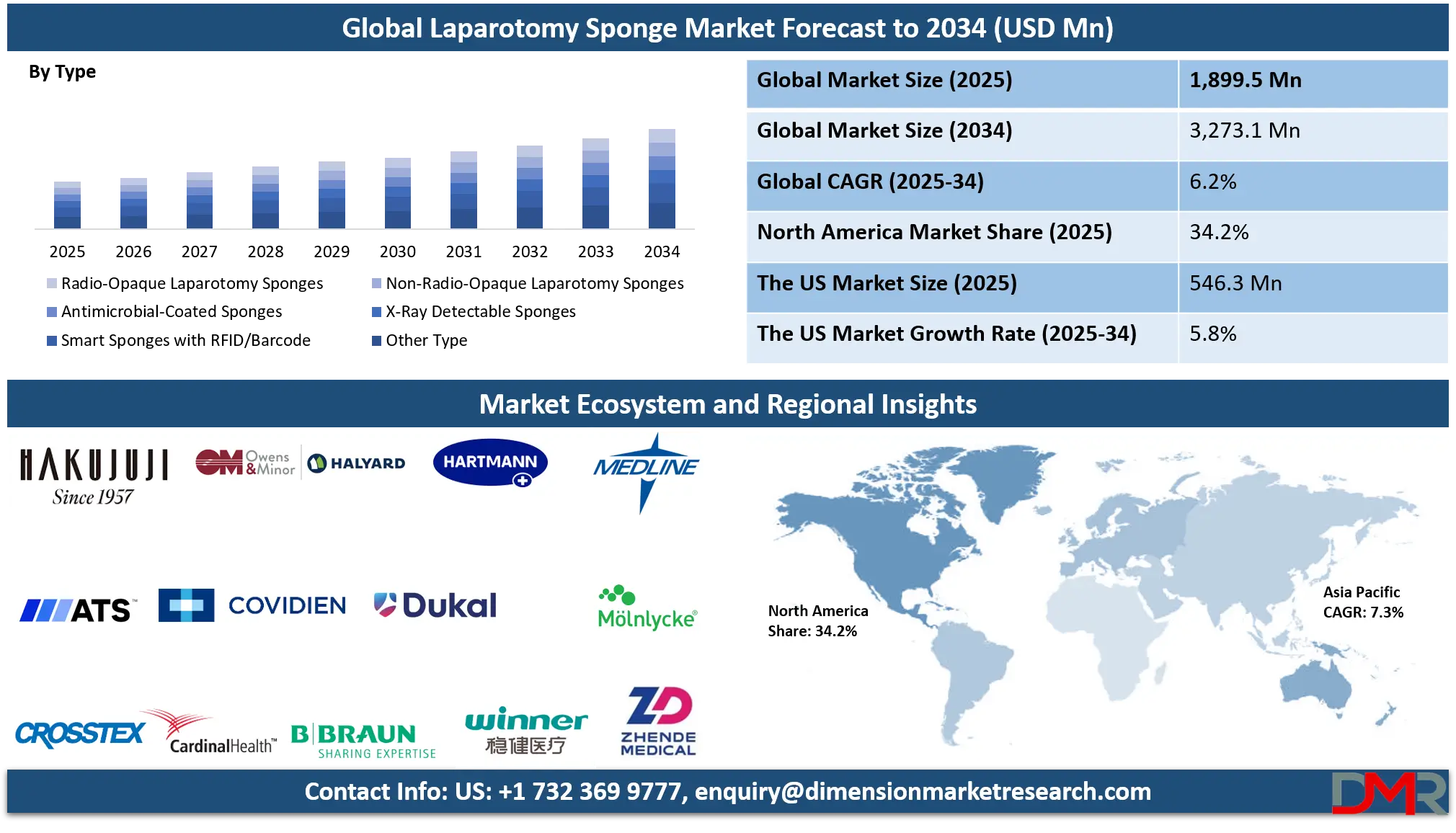

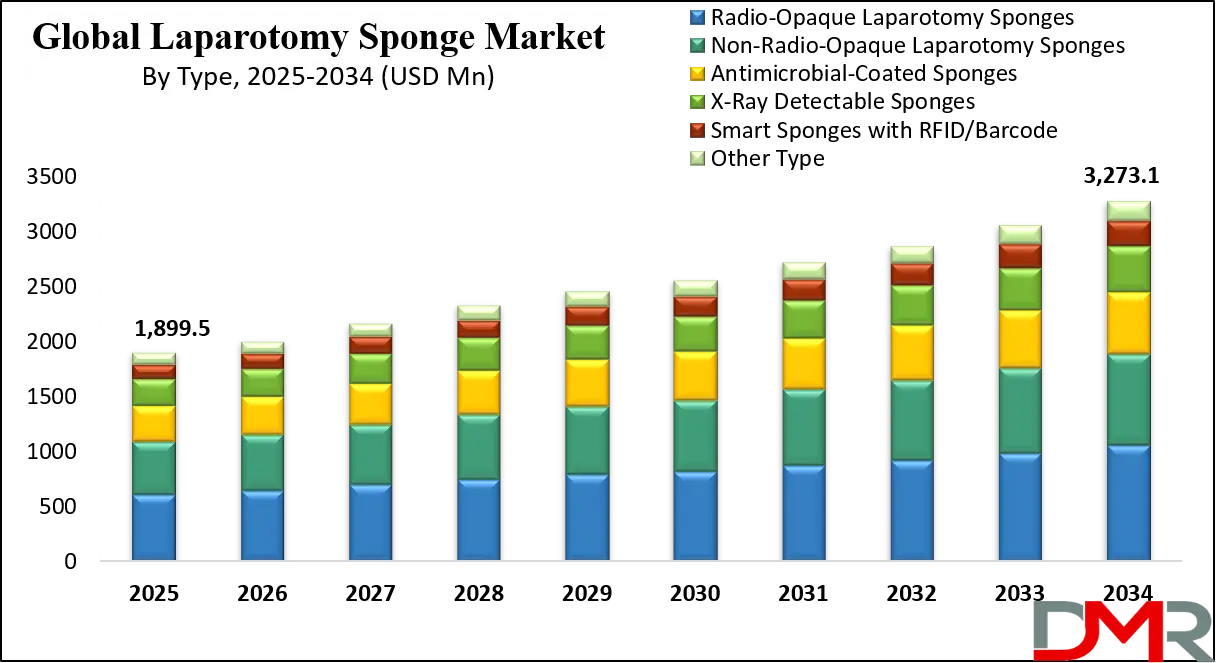

The Global Laparotomy Sponge Market is projected to reach USD 1,899.5 million in 2025 and is expected to grow at a CAGR of 6.2% from 2025 to 2034, attaining a value of USD 3,273.1 million by 2034. The market's steady growth is driven by the rising volume of surgical procedures globally, increasing focus on patient safety to prevent retained surgical items (RSIs), and stringent regulatory mandates for sponge traceability and counting protocols.

Laparotomy sponges are essential absorbent materials used to manage bleeding, maintain a clear surgical field, and protect tissues during abdominal and other major surgeries. The market is evolving with the integration of radio-opaque markers, barcode/RFID tracking systems, and antimicrobial coatings to minimize the risk of surgical site infections (SSIs) and preventable complications. These advancements address critical surgical safety challenges, as retained surgical sponges contribute to significant morbidity and legal repercussions worldwide.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Technological innovations, including smart sponges with embedded

sensors, cloud-based sponge counting systems, AI-assisted inventory tracking, and single-use sterile packaging enhancements, are transforming the market into a more accountable and safety-oriented ecosystem. Integration of real-time tracking technologies for surgical consumables is reshaping operating room efficiency and patient outcomes.

Growing regulatory emphasis on sponge accountability, coupled with hospital accreditation standards and rising surgical volumes in emerging economies, further accelerates global adoption. However, barriers such as high cost of advanced tracking systems, variability in hospital compliance protocols, and limited awareness in low-resource settings remain. Despite these limitations, the convergence of surgical safety initiatives, technological innovation, and healthcare digitization positions the laparotomy sponge market as a critical component of modern surgical care through 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Laparotomy Sponge Market

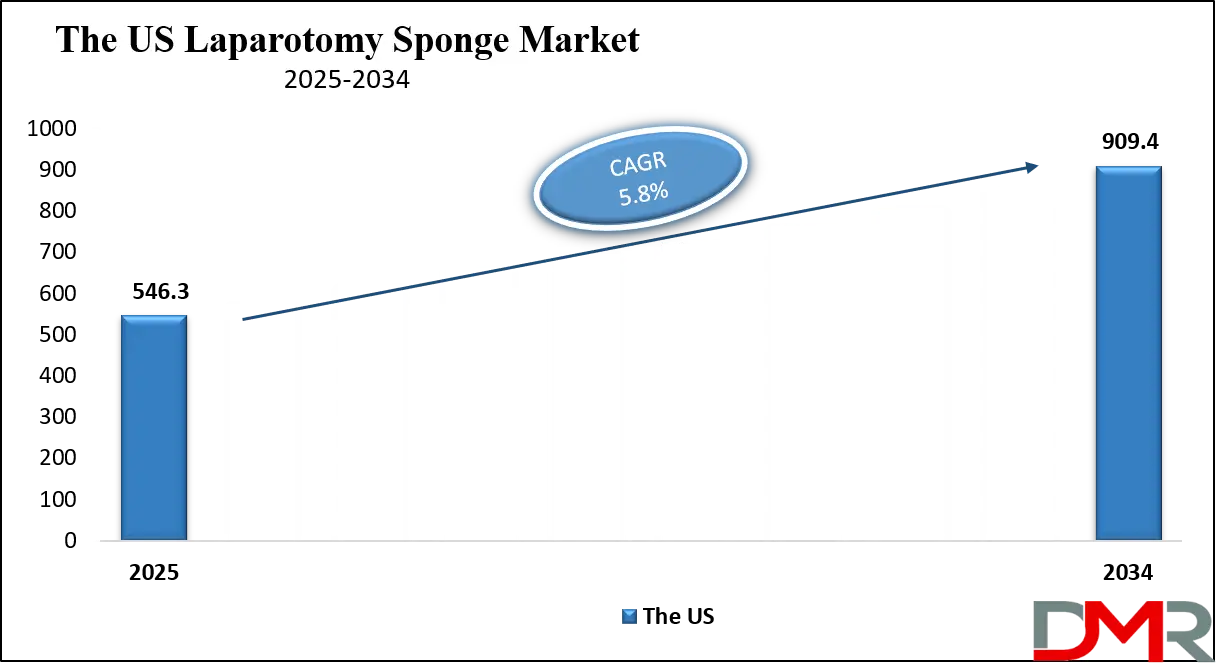

The U.S. Laparotomy Sponge Market is projected to reach USD 546.3 million in 2025 and grow at a CAGR of 5.8%, reaching USD 909.4 million by 2034. The U.S. leads global adoption due to its advanced healthcare infrastructure, high surgical procedure volumes, and stringent regulatory frameworks from the FDA and The Joint Commission mandating sponge counting and prevention of retained surgical items.

With over 50 million surgical procedures performed annually in the U.S., the demand for safety-enhanced laparotomy sponges is significant. Major health systems such as Mayo Clinic, Cleveland Clinic, and HCA Healthcare have implemented barcoded sponge systems and RFID-enabled tracking to enhance OR safety. Reimbursement policies and value-based care models increasingly incentivize the adoption of safety technologies to avoid costly complications.

The rapid adoption of radio-opaque and X-ray detectable sponges, alongside electronic sponge-counting devices and EHR-integrated tracking software, continues to redefine the U.S. surgical supplies landscape, positioning the country as a global leader in surgical safety innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Laparotomy Sponge Market

The Europe Laparotomy Sponge Market is projected to be valued at approximately USD 450 million in 2025 and is projected to reach around USD 820 million by 2034, growing at a CAGR of about 6.7% from 2025 to 2034. Europe's leadership is anchored by strong regulatory oversight, high surgical standards, and widespread adoption of patient safety protocols under EU MDR and national health service guidelines.

Countries such as Germany, the U.K., France, and the Nordic region have widely adopted standardized sponge counting procedures and detectable sponge technologies. Initiatives by the WHO Surgical Safety Checklist and national health agencies further drive compliance. Europe’s aging population and increasing volume of elective and emergency abdominal surgeries sustain market growth.

Funding through EU health programs and hospital investments in digitized OR systems support the adoption of smart sponge solutions and tracking platforms. With strong clinical governance and emphasis on surgical outcomes, Europe remains one of the most advanced regions in laparotomy sponge safety penetration.

The Japan Laparotomy Sponge Market

The Japan Laparotomy Sponge Market is anticipated to be valued at approximately USD 120 million in 2025 and is expected to attain nearly USD 220 million by 2034, expanding at a CAGR of about 7.2% during the forecast period. Japan's rapidly aging population and high volume of gastrointestinal and oncological surgeries drive demand for advanced surgical sponges with safety features.

The Ministry of Health, Labour and Welfare (MHLW) promotes surgical safety through guidelines and technology adoption. Japan's leadership in medical device innovation accelerates the integration of QR-coded sponges, RFID tracking systems, and antimicrobial materials in routine surgical practice. Hospitals in urban centers such as Tokyo and Osaka are early adopters of smart OR technologies.

Japan's focus on precision, infection prevention, and operational efficiency positions the country as a high-growth innovator in the advanced laparotomy sponge segment.

Global Laparotomy Sponge Market: Key Takeaways

- Stable Global Market Growth Outlook: The Global Laparotomy Sponge Market is expected to be valued at USD 1,899.5 million in 2025 and is projected to reach USD 3,273.1 million by 2034, showcasing consistent expansion supported by rising surgical volumes and safety regulations.

- Moderate CAGR Driven by Safety Regulations: The market is expected to grow at a CAGR of 6.2% from 2025 to 2034, fueled by mandated sponge counting protocols, adoption of detectable sponges, and technological integration in operating rooms.

- Strong Growth Trajectory in the United States: The U.S. Laparotomy Sponge Market stands at USD 546.3 million in 2025 and is projected to reach USD 909.4 million by 2034, expanding at a CAGR of 5.8% due to regulatory pressure and high surgical activity.

- North America Maintains Regional Dominance: North America is expected to capture approximately 34.2% of the global market share in 2025, supported by advanced healthcare systems, strict accreditation standards, and early adoption of tracking technologies.

- Innovation in Sponge Safety Technologies: Advancements including RFID-tagged sponges, barcode counting systems, antimicrobial coatings, and disposable sponge kits are significantly improving surgical safety and inventory management.

- Growing Surgical Volumes Boost Adoption: Rising global incidence of abdominal surgeries, trauma interventions, and oncological resections is driving sustained demand for reliable and safe laparotomy sponges.

Global Laparotomy Sponge Market: Use Cases

- Abdominal Surgery: Used to absorb fluids, protect organs, and maintain a clear field during open abdominal procedures such as colectomies, hysterectomies, and trauma surgery.

- Prevention of Retained Surgical Items (RSIs): Radio-opaque and detectable sponges enable post-operative X-ray verification, preventing serious complications and mediological issues.

- Infection Control: Antimicrobial-coated sponges reduce the risk of surgical site infections (SSIs) in contaminated or dirty surgical cases.

- Emergency and Trauma Surgery: Sterile, highly absorbent sponges are critical in controlling hemorrhage and managing emergent surgical situations.

- Teaching and High-Volume Hospitals: Standardized, countable sponge systems streamline OR workflows and enhance safety in environments with frequent staff turnover or high case loads.

Global Laparotomy Sponge Market: Stats & Facts

World Health Organization (WHO)

- An estimated 313 million surgical procedures are performed globally each year.

- Abdominal surgeries account for a significant share of global operative volume.

- Retained surgical items are classified as “never events” under WHO patient-safety guidance.

- Surgical sponges are identified as the most frequently retained foreign objects worldwide.

- WHO promotes mandatory sponge counts as a core surgical safety practice.

The Joint Commission (United States)

- Unintended retained surgical items (RSIs) are consistently among the top 10 sentinel events annually.

- Sponges account for approximately one-third of all reported RSIs.

- Most retained sponge events occur during abdominal and pelvic surgeries.

- Emergency procedures show a higher incidence of retained sponges than elective surgeries.

- Incorrect or falsely correct sponge counts are documented in most RSI cases.

Agency for Healthcare Research and Quality (AHRQ)

- RSIs occur at an estimated rate of 1.3–1.5 per 10,000 surgeries.

- Surgical sponges are the most common retained item, exceeding instruments and needles.

- Retained sponges often result in re-operation, infection, or prolonged hospitalization.

- RSIs increase hospital costs by tens of thousands of dollars per case due to corrective care.

- Use of standardized counting protocols significantly reduces sponge retention events.

National Institutes of Health / PubMed-Indexed Studies

- Over 50% of retained surgical sponge cases involve laparotomy sponges.

- Abdomen and pelvis are the most common retention sites.

- Retained sponges may remain undetected for months to several years.

- More than 70% of cases lead to additional medical intervention.

- Radiopaque markers are present in most retained laparotomy sponges.

Global Laparotomy Sponge Market: Market Dynamic

Driving Factors in the Global Laparotomy Sponge Market

Escalating Global Surgical Volumes and Stringent Safety Regulations

The relentless increase in the number of surgical procedures worldwide spanning elective, emergency, and oncology segments forms the fundamental demand driver for laparotomy sponges. Concurrently, regulatory bodies and hospital accreditation organizations globally are mandating rigorous protocols to eliminate preventable errors. Standards from The Joint Commission, ACS, and WHO, which enforce sponge counting and the use of detectable materials, create a non-discretionary compliance-driven demand for safety-enhanced products, compelling hospital procurement.

Technological Integration and Product Innovation

The market is being revolutionized by the integration of digital tracking technologies (RFID, barcodes), smart materials science (advanced antimicrobials, super-absorbent polymers), and connectivity with OR management software. The shift from manual counts to automated, data-driven systems reduces human error, improves OR efficiency, and provides auditable trails. Innovations like single-use procedural kits that include pre-counted sponges and biodegradable sponge options catering to sustainability trends further stimulate market renewal and premium product adoption.

Restraints in the Global Laparotomy Sponge Market

High Capital Cost of Advanced Tracking Systems

The significant initial investment required for RFID readers, scanning stations, software licenses, and the recurring cost of tagged sponges presents a major barrier, particularly for small community hospitals, standalone ASCs, and healthcare systems in developing economies. This cost sensitivity can slow the adoption rate of the most advanced safety technologies, despite their proven benefits.

Variability in Implementation and Protocol Adherence

While standards exist, their implementation is inconsistent across regions and even within hospital networks. In many low-resource settings, awareness of RSI risks is lower, training on new protocols is limited, and there is resistance to changing established, albeit risky, manual practices. This variability fragments the market and delays universal adoption of best practices.

Opportunities in the Global Laparotomy Sponge Market

Significant Expansion Potential in Emerging Economies

Rapidly improving healthcare infrastructure, rising medical tourism, increasing government health expenditure, and growing surgical capacities in countries across Asia-Pacific (especially India, China, ASEAN), Latin America, and the Middle East present immense, untapped growth opportunities. Local manufacturing and cost-optimized product offerings tailored to these markets can drive substantial volume growth.

Deep Integration with the Digital Operating Room Ecosystem

The overarching trend toward fully digitized, data-integrated ORs creates a pivotal opportunity. Laparotomy sponge systems that seamlessly connect with surgical robotics platforms, real-time inventory management systems, predictive analytics for supply chain, and patient-specific EHRs will transition from standalone safety tools to core components of intelligent surgical environments, creating new value propositions and vendor lock-in potential.

Trends in the Global Laparotomy Sponge Market

Accelerating Adoption of RFID and Barcode Tracking Systems

The transition from manual counting to technology-assisted counting is a dominant, irreversible trend. Hospitals are increasingly deploying systems where every sponge has a unique identifier scanned at point-of-use and reconciliation. This trend enhances accountability, provides data for process improvement, and is becoming the expected standard in medium and large hospitals globally.

Rise of Specialty and Value-Added Sponge Formulations

Beyond basic detectability, the market is seeing growth in specialized products: sponges with hemostatic agents for bleeding control, dual-layer sponges for different absorption needs, and eco-friendly sponges made from biodegradable materials in response to environmental concerns. This trend reflects a move from commoditized products to differentiated, solution-based offerings.

Global Laparotomy Sponge Market: Research Scope and Analysis

By Type Analysis

Radio-Opaque Laparotomy Sponges are projected to dominate the global market throughout the forecast period. This dominance is non-negotiable, rooted in their status as the minimum regulatory standard for preventing RSIs in most developed healthcare systems. The segment benefits from continuous incremental innovation, such as improved radiopaque thread patterns for better X-ray visibility, reduced linting designs to minimize tissue irritation, and compatibility with various counting systems. Their essential role in mandatory safety protocols across thousands of hospitals worldwide ensures sustained, inelastic demand. The segment is further bolstered by its role as the base product onto which more advanced features (like RFID tags) are often added, making it the cornerstone of the entire product category.

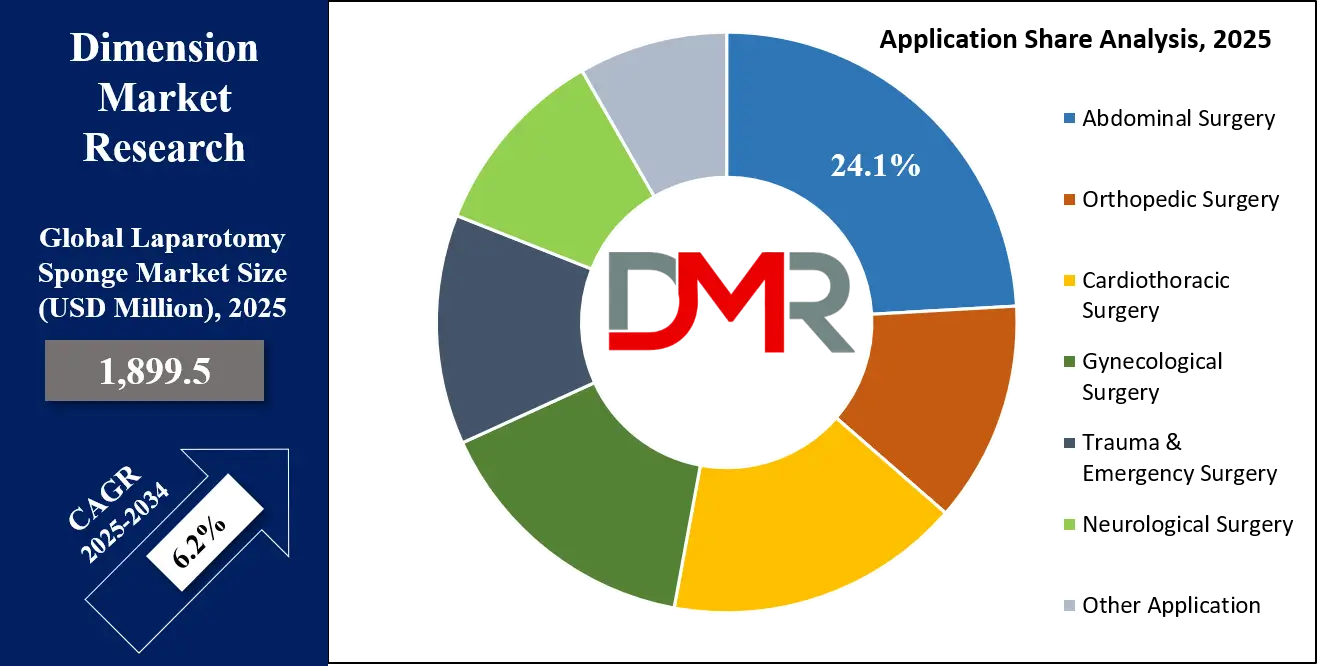

By Application Analysis

Abdominal Surgery is poised to be the largest and most dominant application segment, accounting for the highest global revenue share. This is a direct function of procedure volume; open and laparoscopic-assisted abdominal surgeries (including gastrointestinal, hepatobiliary, urological, and gynecological oncology procedures) represent a massive and growing segment of global surgical activity. The fundamental need for effective fluid management, tissue protection, and bleeding control in the abdominal cavity makes laparotomy sponges a consumable with very high utilization rates per case. This segment’s dominance is reinforced by procedural growth in key areas like bariatric surgery, complex cancer resections, and trauma laparotomies, all of which are intensive users of sponge products.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Analysis

Hospitals & Ambulatory Surgical Centers (ASCs) are anticipated to dominate the market as the primary and essential end-users. These facilities are the exclusive sites where major surgeries requiring laparotomy sponges are performed. They operate under the strictest accreditation standards, driving procurement of compliant products. Hospitals, as large centralized hubs, are the first adopters of advanced tracking systems and bulk purchasers. The ongoing global shift of elective surgeries from inpatient hospitals to ASCs for cost and efficiency reasons is a powerful secondary driver, as ASCs also require standardized, safe, and efficient sponge systems. This dual-channel demand from both traditional hospitals and growing ASC networks solidifies their collective position as the market's backbone.

The Global Laparotomy Sponge Market Report is segmented on the basis of the following:

By Type

- Radio-Opaque Laparotomy Sponges

- Non-Radio-Opaque Laparotomy Sponges

- Antimicrobial-Coated Sponges

- X-Ray Detectable Sponges

- Smart Sponges with RFID/Barcode

- Other Type

By Application

- Abdominal Surgery

- Orthopedic Surgery

- Cardiothoracic Surgery

- Gynecological Surgery

- Trauma & Emergency Surgery

- Neurological Surgery

- Other Application

By End User

- Hospitals & Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Emergency Care Centers

- Military & Field Hospitals

- Others End Users

Impact of Artificial Intelligence in the Global Laparotomy Sponge Market

- RFID & Barcode Tracking Systems: These technologies automate the sponge count, providing a digital audit trail from opening to final reconciliation. They virtually eliminate human counting errors, reduce OR time spent on manual counts, and integrate data into EHRs for compliance reporting and analytics, fundamentally transforming sponge accountability.

- Electronic Sponge-Counting Devices: Dedicated hardware scanners and software platforms (e.g., SurgiCount) provide a systematic, step-by-step counting process that is less prone to distraction. They often include alert systems for discrepancies, improving communication among the surgical team and preventing procedural delays or errors.

- Advanced Antimicrobial & Coated Technologies: Incorporation of agents like silver, chlorhexidine, or polyhexamethylene biguanide (PHMB) into sponge matrices creates a sustained antimicrobial effect at the surgical site. This is particularly impactful in reducing bacterial colonization in contaminated surgeries, directly addressing the costly problem of SSIs.

- Smart Packaging & Dispensing Systems: Packaging innovations include sponges bundled in standardized counts (e.g., 5s or 10s) with easy-scan labels, sterile dispensing systems that maintain organization, and kits that combine sponges with other procedure-specific supplies. This enhances OR workflow efficiency and reduces the risk of contamination.

- Integration with Surgical Planning & Analytics Software: Data from sponge tracking systems can feed into larger perioperative analytics platforms. This allows for analysis of sponge usage patterns, predictive restocking, cost-per-procedure calculations, and broader surgical workflow optimization, adding a layer of strategic intelligence to a previously transactional item.

Global Laparotomy Sponge Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the Global Laparotomy Sponge Market, holding an estimated 34.2% share by the end of 2025. This leadership is attributable to a powerful confluence of factors: the world's highest per-capita healthcare spending, the most rigorous and enforced surgical safety regulations, a vast and technologically advanced hospital network, and the presence of virtually all leading global manufacturers. The U.S. market, in particular, sets the global benchmark for safety protocols, driven by a legal and regulatory environment that imposes severe penalties for preventable errors like RSIs. High surgical procedure volumes and favorable reimbursement for safety technologies create a fertile environment for premium, technology-integrated sponge products, ensuring North America's revenue dominance throughout the forecast period.

Region with the Highest CAGR

Asia-Pacific is poised to register the highest CAGR during the forecast period and is rapidly gaining overall market share. This explosive growth is fueled by the region's massive population base, rapidly expanding healthcare infrastructure, burgeoning medical tourism industry, and increasing government focus on improving hospital safety standards. Countries like China, India, Japan, and South Korea are investing heavily in new hospitals and ASCs. The diabetic and aging populations in APAC are driving a surge in surgical volumes. While starting from a lower base of technology adoption, the region is leapfrogging in many areas, with new hospitals often installing digital tracking systems from inception. Government-led initiatives to reduce surgical complications and the growing influence of international hospital accreditation bodies are accelerating the shift from basic to safety-enhanced sponges, making APAC the engine of global market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Laparotomy Sponge Market: Competitive Landscape

The Global Laparotomy Sponge Market exhibits a moderately consolidated structure, characterized by the dominance of a few large, diversified medical device conglomerates alongside several strong specialized and regional players. The market is competitive, with rivalry based on product innovation (especially in safety tech), regulatory compliance, cost-effectiveness, global distribution reach, and the ability to offer integrated solutions.

Leading multinational corporations such as Medtronic (Covidien), Cardinal Health, 3M, B. Braun, and Molnlycke Health Care command significant shares through their extensive portfolios that span from basic radio-opaque sponges to complete RFID-enabled safety systems. These giants benefit from economies of scale, entrenched relationships with large Group Purchasing Organizations (GPOs), and robust R&D capabilities for continuous product line extensions.

The competitive landscape is also being shaped by technology-focused companies that provide the software and hardware for tracking systems (e.g., Stryker's SurgiCount, RF Surgical's Detectorm system), which often form partnerships with sponge manufacturers. Furthermore, aggressive regional and private-label players in Asia and Europe compete effectively on price for the volume-driven, basic product segments, particularly in cost-sensitive markets.

Some of the prominent players in the Global Laparotomy Sponge Market are:

- Medtronic plc (Covidien)

- Cardinal Health, Inc.

- 3M Company

- B. Braun Melsungen AG

- Molnlycke Health Care AB

- Owens & Minor, Inc. (Halyard Health)

- Medline Industries, Inc.

- Paul Hartmann AG

- Winner Medical Co., Ltd.

- Dukal Corporation

- Zhende Medical Co., Ltd.

- Crosstex International, Inc.

- ATS Corporation (Absorbent Technology Solutions)

- Hakujuji Co., Ltd.

- Kawamoto Corporation

- Stryker Corporation (SurgiCount)

- RF Surgical Systems, Inc.

- Medica Europe BV

- Lohmann & Rauscher GmbH & Co. KG

- Baxter International Inc.

- Other Key Players

Recent Developments in the Global Laparotomy Sponge Market

- November 2025: Molnlycke launches BioSecure+ Line

Molnlycke Health Care introduced its 'BioSecure+' line of laparotomy sponges, featuring a fully biodegradable substrate combined with a broad-spectrum, sustained-release antimicrobial coating. The launch targets hospitals with strong environmental, social, and governance (ESG) goals and those seeking to reduce SSIs in sustainable surgery programs.

- October 2025: 3M unveils next-gen "SmartSponge Connect" platform at AORN Global Expo

At the AORN Expo, 3M demonstrated its integrated "SmartSponge Connect" system, featuring sponges with embedded NFC tags, a network of smart dispensers/scanners, and a cloud analytics dashboard. The platform promises real-time inventory, automated reconciliation, and predictive supply chain insights for hospital systems.

- September 2025: Cardinal Health completes strategic acquisition of TrackSurg Inc.

Cardinal Health strengthened its surgical safety division by acquiring TrackSurg, a developer of AI-powered computer vision software for automated sponge counting via OR video systems. This move aims to offer a camera-based, non-RFID counting alternative to the market.

- August 2025: Updated Joint Commission standards mandate technology-assisted counting

The Joint Commission issued revised accreditation standards strongly recommending (and effectively mandating for top ratings) the use of assistive technology (barcode or RFID) for sponge counting in all ORs performing major cavity surgery, triggering a new wave of procurement in U.S. hospitals.

- July 2025: B. Braun announces partnership with Cerner (Oracle Health)

B. Braun entered a strategic partnership to achieve deep, bidirectional integration between its "SecureCount" sponge management system and the Cerner Millennium EHR platform. This allows sponge count data and alerts to flow directly into the surgical record and nursing workflow.

- March 2025: Landmark study in JAMA Surgery confirms ROI of RFID systems

A multi-center, prospective study published in JAMA Surgery provided Level I evidence that hospitals implementing RFID sponge tracking achieved a net positive return on investment within 18 months by virtually eliminating retained sponge incidents and associated legal-defense costs.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,899.5 Mn |

| Forecast Value (2034) |

USD 3,273.1 Mn |

| CAGR (2025–2034) |

6.2% |

| The US Market Size (2025) |

USD 546.3 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Radio-Opaque Laparotomy Sponges, Non-Radio-Opaque Laparotomy Sponges, Antimicrobial-Coated Sponges, X-Ray Detectable Sponges, Smart Sponges with RFID/Barcode, Other Types), By Application (Abdominal Surgery, Orthopedic Surgery, Cardiothoracic Surgery, Gynecological Surgery, Trauma & Emergency Surgery, Neurological Surgery, Other Applications), By End User (Hospitals & Ambulatory Surgical Centers (ASCs), Specialty Clinics, Emergency Care Centers, Military & Field Hospitals, Other End Users) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Medtronic plc (Covidien), Cardinal Health, Inc., 3M Company, B. Braun Melsungen AG, Mölnlycke Health Care AB, Owens & Minor, Inc. (Halyard Health), Medline Industries, Inc., Paul Hartmann AG, Winner Medical Co., Ltd., Dukal Corporation, Zhende Medical Co., Ltd., Crosstex International, Inc., ATS Corporation (Absorbent Technology Solutions), Hakujuji Co., Ltd., Kawamoto Corporation, Stryker Corporation |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Laparotomy Sponge Market?

▾ The Global Laparotomy Sponge Market size is estimated to have a value of USD 1,899.55 million in 2025 and is expected to reach USD 3,273.1 million by the end of 2034.

What is the growth rate in the Global Laparotomy Sponge Market in 2025?

▾ The market is growing at a Compound Annual Growth Rate (CAGR) of 6.2 percent over the forecasted period from 2025 to 2034.

What is the size of the US Laparotomy Sponge Market?

▾ The US Laparotomy Sponge Market is projected to be valued at USD 546.3 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 909.4 million in 2034 at a CAGR of 5.8%.

Which region accounted for the largest Global Laparotomy Sponge Market?

▾ North America is expected to have the largest market share in the Global Laparotomy Sponge Market with a share of about 34.2% in 2025.

Who are the key players in the Global Laparotomy Sponge Market?

▾ Some of the major key players in the Global Laparotomy Sponge Market are Medtronic plc, Cardinal Health, Inc., 3M Company, B. Braun Melsungen AG, Molnlycke Health Care AB, Owens & Minor, Inc., Medline Industries, Inc., and many others.