Market Overview

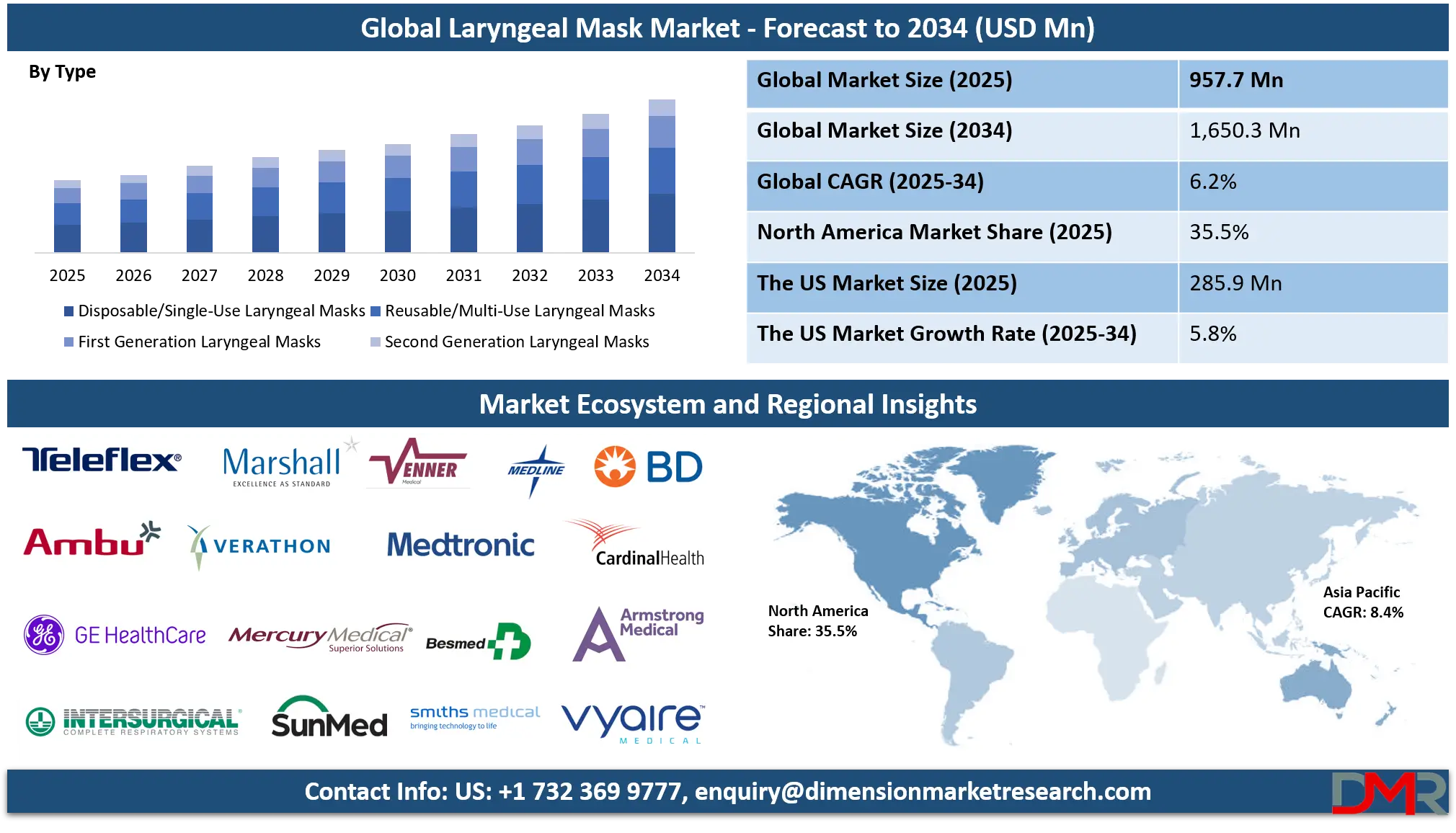

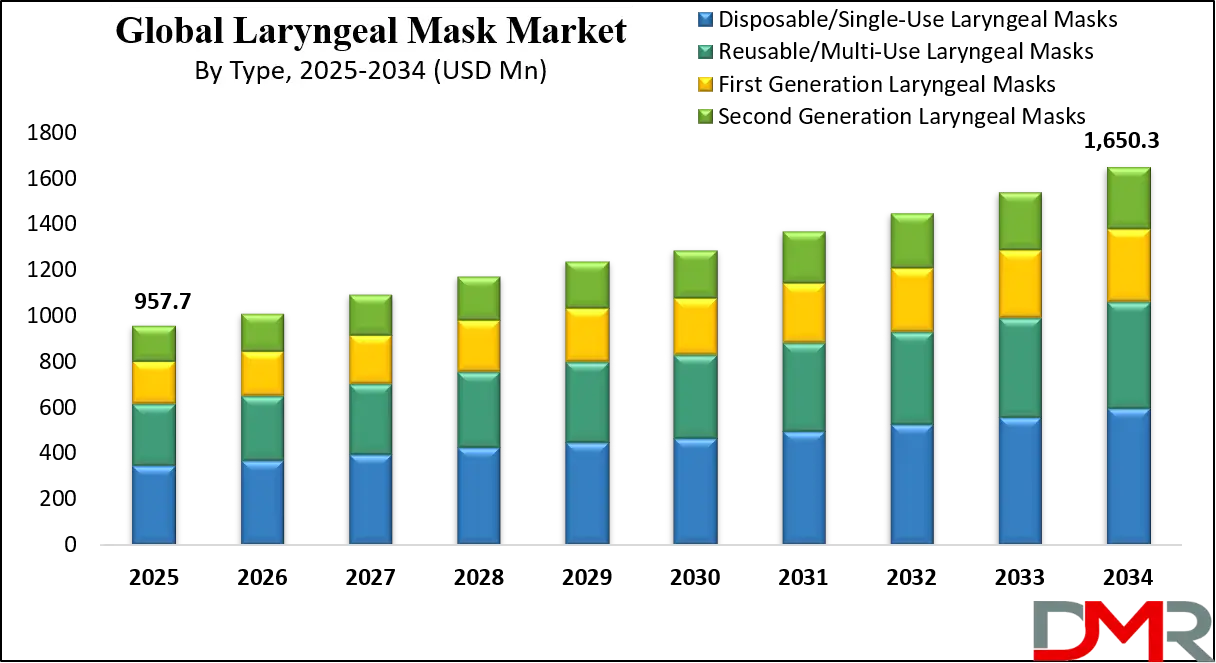

The Global Laryngeal Mask Market is expected to reach USD 957.7 million in 2025 and is projected to grow at a CAGR of 6.2% during 2025–2034, reaching an estimated USD 1,650.3 million by 2034, driven by rising surgical volumes, increasing adoption of advanced airway management devices, and growing demand across hospital and ambulatory care settings.

This steady and robust growth trajectory is fundamentally driven by a global surge in surgical procedure volumes, a pronounced and enduring clinical shift towards minimally invasive airway management solutions over traditional endotracheal intubation, and the rapidly accelerating adoption of laryngeal masks across diverse and expanding healthcare settings such as emergency medicine, ambulatory surgical centers (ASCs), and critical care units.

The laryngeal mask airway (LMA) has evolved from an alternative device to a cornerstone of modern airway management protocols, prized for its ability to provide a secure airway with markedly reduced laryngeal trauma, a lower incidence of post-operative complications such as sore throat and hoarseness, and a simplified placement technique that can be effectively utilized by a broader range of healthcare providers, including non-anesthesiologists in emergency scenarios.

This device addresses one of the most critical challenges in modern medicine: securing a patient's airway safely and efficiently across a continuum of care, from routine elective surgeries in operating rooms to high-stakes, time-sensitive interventions in pre-hospital emergency care and difficult airway situations. Continuous technological refinement remains a key market accelerant, with significant advancements including the integration of dedicated gastric access channels in second-generation devices to mitigate aspiration risk, innovative cuff designs utilizing advanced polymers that optimize seal pressure and mucosal safety, and the widespread commercialization of single-use, disposable models that virtually eliminate cross-contamination risks and streamline hospital logistics.

The global emphasis on enhancing patient safety metrics, reducing hospital-acquired infections, and improving perioperative outcomes synergizes perfectly with the value proposition of modern laryngeal masks. Concurrently, widespread educational initiatives and simulation-based training programs by anesthesia societies and medical device companies are increasing clinician proficiency and confidence in LMA use, further embedding these devices into standard practice.

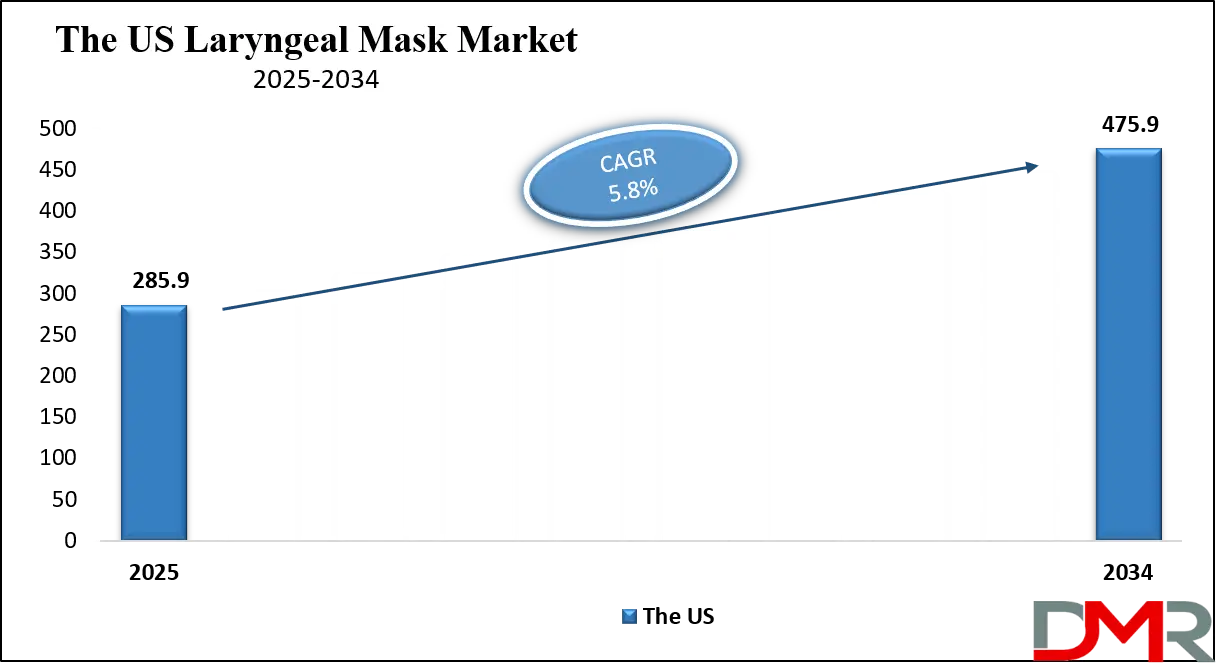

The US Laryngeal Mask Market

The U.S. Laryngeal Mask Market, a critical and dominant segment of the global landscape, is projected to reach USD 285.9 million in 2025 and grow at a CAGR of 5.8%, reaching a substantial USD 475.9 million by 2034. The United States' leadership is underpinned by the world's highest per-capita surgical procedure volume, an exceptionally advanced and digitized healthcare infrastructure, and the formidable presence of both global and domestic key market players who drive innovation and competition.

A powerful structural shift within the U.S. healthcare delivery model specifically, the massive migration of surgical procedures from inpatient hospital settings to freestanding Ambulatory Surgical Centers (ASCs) acts as a primary growth engine. ASCs prioritize operational efficiency, rapid patient turnover, and minimized recovery times, clinical needs that align perfectly with the laryngeal mask's profile of easy insertion, minimal airway stimulation, and quick recovery.

This adoption is strongly reinforced by a favorable and well-defined reimbursement environment. Medicare, Medicaid, and private insurers in the U.S. generally provide clear coverage for procedures utilizing supraglottic airways, making their adoption financially viable and attractive for healthcare providers. Furthermore, influential medical institutions and professional societies, most notably the American Society of Anesthesiologists (ASA), actively develop and promote evidence-based clinical practice guidelines that explicitly endorse the use of laryngeal masks as a first-choice airway for a wide array of appropriate surgical scenarios.

The Europe Laryngeal Mask Market

The Europe Laryngeal Mask Market is projected to be valued at approximately USD 291.2 million in 2025 and is projected to reach around USD 501.3 million by 2034, growing at a steady CAGR of about 6.2% from 2025 to 2034.

Europe's market is a paradigm of mature, quality-driven healthcare, characterized by well-established, universally accessible healthcare systems, exceptionally high standards of anesthetic training and practice, and some of the world's most stringent medical device regulatory frameworks governed by the EU Medical Device Regulation (MDR). These regulations ensure rigorous standards for safety, efficacy, and quality, fostering high trust in approved devices. Major economies such as Germany, the U.K., France, and Italy are the primary revenue contributors, with laryngeal masks seeing ubiquitous adoption in hospital operating theaters, day-surgery units, and increasingly in pre-hospital emergency medical services (EMS).

Two powerful demographic and clinical forces are propelling the market forward. Firstly, Europe's rapidly aging population is leading to a corresponding increase in the number of surgical interventions for age-related conditions, ranging from cataracts and joint replacements to oncological resections. Secondly, there is a clear and sustained clinical preference across the continent for less invasive techniques that enhance patient recovery and satisfaction; the laryngeal mask is a prime example of this philosophy in airway management.

European anesthesia guidelines, such as those from the European Society of Anaesthesiology and Intensive Care (ESAIC), strongly advocate for the use of supraglottic airways as first-line management in appropriate, low-risk procedures, providing a powerful framework for consistent clinical use. Furthermore, environmental and economic considerations are driving nuanced procurement strategies, with a balance sought between the safety benefits of single-use devices and the cost-saving and environmental appeal of reprocessed high-quality reusable LMAs in certain systems, particularly where robust central sterilization services exist.

The Japan Laryngeal Mask Market

The Japan Laryngeal Mask Market is anticipated to be valued at approximately USD 47.9 million in 2025 and is expected to attain nearly USD 82.5 million by 2034, expanding at a robust CAGR of about 6.2% during the forecast period, one of the highest among developed regions.

Japan's market dynamics are uniquely shaped by its status as the world's most aged society, with nearly 30% of its population over 65 years old. This demographic reality translates into an extraordinarily high volume of surgical procedures per capita, creating sustained, underlying demand for safe, reliable, and efficient medical devices, including airway management tools. The Japanese healthcare system is characterized by very high standards of care, significant national healthcare expenditure, and a cultural emphasis on precision, safety, and excellent post-operative outcomes values that align seamlessly with the advanced design of modern laryngeal masks.

Japanese anesthesiologists and clinicians are recognized as early adopters and sophisticated users of advanced medical technology. There is a particularly strong uptake of second-generation laryngeal masks featuring gastric drainage capabilities, as these devices address the paramount concern of aspiration risk while facilitating their use in a broader spectrum of procedures and patient types. Japan's leadership in precision engineering, robotics, and advanced material science also feeds into the market, with domestic and international companies often introducing their latest, most technologically refined devices in this demanding market.

The concept of "super-aging" societies driving healthcare innovation is vividly illustrated here, with continuous R&D focused on creating devices that are even safer for frail, elderly patients with potentially difficult airways or co-morbidities. Government-led initiatives to improve surgical outcomes and patient safety further reinforce the integration of best-practice airway management techniques, ensuring the laryngeal mask market remains on a high-growth trajectory.

Global Laryngeal Mask Market: Key Takeaways

- Stable Global Market Growth Outlook: The Global Laryngeal Mask Market is expected to be valued at USD 957.7 million in 2025 and is projected to reach USD 1,650.3 million by 2034, showcasing consistent expansion supported by rising surgical volumes and clinical preference for supraglottic airways.

- Moderate CAGR Driven by Clinical Adoption: The market is expected to grow at a CAGR of 6.2% from 2025 to 2034, fueled by the proven clinical benefits of laryngeal masks, growth in outpatient surgeries, and expanding applications beyond traditional operating rooms.

- Steady Growth Trajectory in the United States: The U.S. Laryngeal Mask Market stands at USD 285.9 million in 2025 and is projected to reach USD 475.9 million by 2034, expanding at a CAGR of 5.8% due to high procedure volume and established clinical guidelines.

- North America Maintains Regional Leadership: North America is expected to capture the 35.5% of the global market share, supported by advanced healthcare infrastructure, high surgical rates, and favorable reimbursement policies.

- Advancement in Laryngeal Mask Designs: Innovations including integrated gastric access ports, PVC-free and latex-free materials, enhanced cuff designs for better sealing and lower mucosal pressure, and single-use disposable models are improving safety, efficacy, and adoption rates.

- Growing Surgical Burden Boosts Adoption: The global increase in surgical procedures, particularly in day-case surgery, ENT, gynecology, and emergency medicine, is driving sustained demand for reliable and easy-to-use airway management devices.

Global Laryngeal Mask Market: Use Cases

- General Anesthesia for Short Procedures: Laryngeal masks are routinely used to maintain airways during short-duration surgical procedures under general anesthesia, providing a less invasive alternative to endotracheal tubes.

- Emergency Airway Management: Used by emergency medical services (EMS) and in emergency departments as a rescue airway device or primary airway in difficult intubation scenarios.

- Pediatric Anesthesia: Specially designed pediatric-sized laryngeal masks are widely used for airway management in children undergoing surgery, offering advantages in reduced airway trauma.

- Obese Patient Management: Second-generation laryngeal masks with gastric drainage channels are increasingly used in obese patients to manage the risk of aspiration.

- Cardiopulmonary Resuscitation (CPR): Employed during CPR by trained personnel to provide a secure airway, allowing for continuous chest compressions and ventilation.

Global Laryngeal Mask Market: Stats & Facts

National Institutes of Health (NIH) / PubMed-Indexed Clinical Studies

- Laryngeal masks were used in approximately 10–30% of general anesthesia cases in large hospital-based surgical studies.

- Clinical studies report >99% success rates for successful LMA placement in elective surgeries.

- LMA-related airway complications occurred in 15–17% of cases, mostly minor and transient.

- In large cohorts (>39,000 cases), LMAs were used in nearly one-third of airway management procedures.

- Positive pressure ventilation through LMAs was used in ~44% of cases.

- Conversion from LMA to endotracheal intubation was required in <1% of cases.

- In tracheal surgery patients, LMA success rates exceeded 96%.

- Pediatric anesthesia studies show LMA reduces coughing compared to endotracheal tubes.

- Postoperative sore throat incidence is 20–30% lower with LMAs than endotracheal tubes.

- Randomized trials show no significant difference in oxygenation between LMAs and endotracheal tubes for surgeries longer than 2 hours.

- LMA-associated laryngospasm risk is significantly lower in adult elective surgery.

- Blind intubation through certain LMAs has reported success rates of 60–99%, depending on device design and operator skill.

World Health Organization (WHO)

- An estimated 313 million surgical procedures are performed globally each year.

- More than 4 million deaths occur within 30 days of surgery annually.

- Surgical care accounts for approximately 13% of global disability-adjusted life years (DALYs).

- About 5 billion people worldwide lack access to safe surgical and anesthesia care.

- Only 6% of global surgeries occur in low-income countries, despite representing one-third of the world’s population.

- WHO estimates an additional 143 million surgical procedures per year are needed to meet global demand.

- Postoperative mortality in some regions is as high as 1 in 100 patients.

Centers for Disease Control and Prevention (CDC)

- Over 50 million inpatient surgical procedures are performed annually in the United States.

- Respiratory complications remain among the top five postoperative adverse events.

- Airway-related complications contribute significantly to anesthesia-associated morbidity.

National Health Service (NHS – United Kingdom)

- Day-case surgeries account for over 70% of elective surgical procedures.

- LMAs are widely preferred in day-case and short-duration surgeries due to faster recovery times.

- Supraglottic airway devices are standard in routine elective anesthesia practice.

NCBI Bookshelf / Government-Backed Medical Education Sources

- LMAs were first introduced into clinical practice in the 1980s.

- LMAs are now standard airway devices in operating rooms, emergency departments, ICUs, and pre-hospital settings.

- Single-use LMAs are increasingly preferred due to infection control and sterilization concerns.

- LMAs require less training time compared to endotracheal intubation for basic airway management.

- LMAs are recommended as rescue airway devices in difficult or failed intubation scenarios.

Global Surgical Safety & Training Programs

- Surveys show over 70% of neonatal healthcare providers report limited hands-on experience with LMAs.

- Less than 20% of neonatal clinicians consider LMAs a primary alternative to endotracheal intubation.

- Airway management training gaps remain significant in low- and middle-income countries.

Global Laryngeal Mask Market: Market Dynamic

Driving Factors in the Global Laryngeal Mask Market

The Unrelenting Rise in Global Surgical Procedure Volumes

The most powerful and fundamental driver is the relentless increase in the number of surgical interventions performed globally. This is propelled by a confluence of aging populations requiring more interventions (joint replacements, cataract surgery, cancer resections), the growing burden of lifestyle diseases necessitating surgery, and significant global efforts to improve access to essential and elective surgical care as a component of universal health coverage, particularly in emerging economies. Each of these millions of additional procedures represents a potential use-case for a laryngeal mask, creating a directly proportional and expansive demand base.

Superior Clinical and Operational Advantages Over Endotracheal Intubation

The clinical evidence base for laryngeal masks is deep and compelling, driving their preference. Key advantages include a dramatically reduced risk of laryngeal and dental trauma, a significantly lower incidence of post-operative complications like sore throat and hoarseness (directly linked to higher patient satisfaction scores), minimal hemodynamic response (blood pressure and heart rate spikes) upon insertion, and the ability to be placed reliably without the need for direct laryngoscopy or deep muscle relaxation.

Operationally, they enable faster induction and emergence from anesthesia, contributing to more efficient operating room turnover a critical metric for hospital economics. Furthermore, the learning curve for proficient LMA placement is generally shorter and less technically demanding than for direct laryngoscopy, broadening the pool of capable providers.

Restraints in the Global Laryngeal Mask Market

The Persistent Perception and Reality of Aspiration Risk

Despite the significant safety improvements offered by second-generation devices with gastric drainage ports, the risk of pulmonary aspiration though low is not zero. This perceived and actual risk remains the single most significant clinical restraint. It consciously limits the use of laryngeal masks in patient populations considered high-risk for gastric content regurgitation, such as non-fasted emergency patients, the morbidly obese, pregnant patients, and those with known hiatal hernias or significant gastroesophageal reflux disease. For prolonged surgeries or those requiring specific positions (e.g., steep Trendelenburg in laparoscopic surgery), many anesthesiologists still prefer the definitive airway seal of a cuffed endotracheal tube.

Cost-Pressure Dynamics and Competitive Market Forces

Economic considerations present a tangible restraint, particularly in publicly funded or resource-constrained healthcare systems. While single-use disposable LMAs offer immense sterility and convenience benefits, their recurring per-procedure cost is higher than that of a simple endotracheal tube and can be significant when multiplied across thousands of procedures annually. This creates constant pressure on procurement departments to justify the added expense against clinical benefits.

Furthermore, the market faces competition not only from traditional intubation but also from a growing array of alternative supraglottic airway devices (iGels, laryngeal tubes, etc.) and from advancing video laryngoscopy technology, which is making traditional intubation easier and potentially narrowing the relative advantage of LMAs in some scenarios.

Opportunities in the Global Laryngeal Mask Market

Explosive Growth Potential in Emerging Economies

The most significant greenfield opportunity lies in the rapidly developing healthcare markets of Asia-Pacific (especially China, India, Southeast Asia), Latin America, and parts of Africa. As these regions experience economic growth, they are investing heavily in healthcare infrastructure, building new hospitals and surgical centers, and training more anesthesiologists and nurses. Government initiatives aimed at expanding surgical care access will generate massive new demand for basic and advanced medical devices. Laryngeal masks, with their balance of efficacy, safety, and relative ease of use, are perfectly positioned to become the standard airway device for a vast range of surgeries in these new healthcare ecosystems, representing a multi-decade growth runway.

The Next Frontier: Smart Devices and Sustainable Innovation

Beyond geographic expansion, there is rich opportunity in technological evolution. The development of "smart" laryngeal masks with integrated sensors for continuous, real-time monitoring of cuff pressure (to prevent over-inflation injuries) or even capnography/temperature could open new markets in critical care and prolonged surgery. Innovations in sustainable materials to create high-performance, biodegradable plastics, or more easily recyclable single-use devices could capture market share in environmentally conscious regions like Europe. Finally, there is ongoing opportunity in design refinement for niche applications, such as creating specialized LMAs for use in MRI suites, for patients with unique airway anatomies, or for streamlined use in battlefield or extreme environment medicine.

Trends in the Global Laryngeal Mask Market

The Irreversible Shift Towards Single-Use Disposable Devices

This is the dominant and most impactful trend shaping the competitive landscape. Driven by an uncompromising global focus on hospital-acquired infection (HAI) prevention, stringent regulations from bodies like the FDA and EMA, and the operational desire to eliminate the costs and complexities associated with cleaning, inspecting, packaging, and sterilizing reusable devices, the market is decisively moving toward disposables. For manufacturers, this creates a predictable, recurring revenue stream. For hospitals, it simplifies supply chain logistics, ensures consistent device performance, and provides a clear audit trail for infection control.

Clinical Consolidation Around Second-Generation Safety Devices

There is a clear and accelerating clinical trend favoring second-generation laryngeal masks over their first-generation predecessors. The integrated gastric access channel is no longer viewed as a premium feature but is increasingly considered a standard-of-care safety component for a broad range of procedures. Anesthesiologists are opting for these devices to expand the safety envelope of supraglottic airway management, allowing them to use LMAs with greater confidence in a wider array of cases. This trend is pushing manufacturers to focus their R&D and marketing efforts on their second-generation portfolios, making them the high-growth segment within the market.

Global Laryngeal Mask Market: Research Scope and Analysis

By Type Analysis

The Disposable Laryngeal Mask segment is not only projected to dominate but is actively reshaping the global market. This dominance is the direct result of powerful, non-negotiable drivers in modern healthcare: draconian infection control protocols that leave no room for reprocessing errors, the sheer convenience and guaranteed sterility of a device used straight from its packaging, and the elimination of hidden costs linked to reprocessing (labor, utilities, equipment depreciation, quality control).

Hospitals and ASCs are making strategic, long-term decisions to transition their entire formularies to disposable variants. Manufacturers are responding with scaled production, cost-optimization, and a wide range of disposable options (from basic first-generation to advanced second-generation models), ensuring this segment will command the largest and most defensible market share through 2034.

Concurrently, the Second Generation Laryngeal Mask segment represents the high-value, innovation-driven heart of the market. Its significant and growing share is entirely attributable to its enhanced safety profile, which directly addresses the historic Achilles' heel of supraglottic airways. The dedicated gastric drainage channel is a paradigm-shifting feature that allows for the passive venting or active suctioning of gastric contents, functionally separating the respiratory and digestive pathways.

This engineering solution materially reduces aspiration risk, allowing anesthesiologists to safely employ LMAs in longer procedures, in patients with controlled co-morbidities, and in surgical positions previously deemed contraindicated. As clinical guidelines evolve to recognize this safety improvement, the adoption of second-generation devices is becoming a marker of advanced practice, ensuring its role as the key growth engine within the type segment.

By Patient/Age Group Analysis

The Adult segment dominates the global laryngeal mask market, representing the largest category in terms of both revenue and volume. This dominance is primarily driven by the high frequency of surgical procedures requiring anesthesia in adult patients, as well as widespread use in general airway management across hospitals, surgical centers, and emergency care settings. Adults consistently account for major market demand, making this segment the backbone of revenue generation for major laryngeal mask manufacturers. The extensive clinical adoption, coupled with the availability of a broad range of sizes tailored to adult patients, reinforces its market leadership.

Pediatric and Neonatal segments, although smaller in absolute revenue compared to adults, are considered high-growth niches. The increasing focus on safer airway management practices in infants and children has driven adoption in pediatric anesthesia, emergency care, and surgical procedures. These segments benefit from strong clinical recommendations advocating laryngeal masks as a less invasive alternative to traditional endotracheal intubation, particularly in sensitive patient populations. Despite their lower overall revenue, these segments are expanding rapidly in emerging markets and high-standard healthcare systems.

The Geriatric segment is growing gradually due to aging populations in developed regions such as North America, Europe, and parts of Asia-Pacific. While it remains secondary to adult and pediatric segments, the increasing number of age-related surgical procedures and critical care needs is boosting demand for laryngeal masks specifically designed for elderly patients.

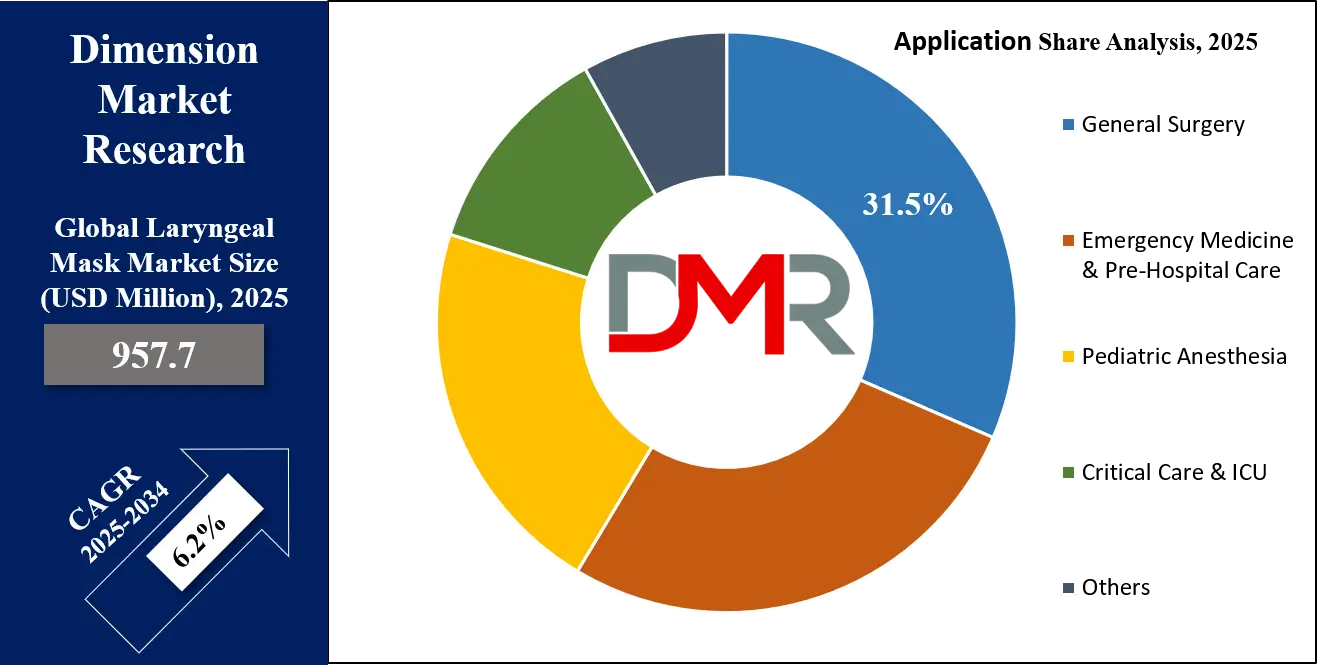

By Application Analysis

General Surgery is poised to remain the largest and most dominant application segment, serving as the bedrock of the LMA market. The term "general surgery" encompasses a vast universe of elective and semi-elective procedures across multiple surgical specialties orthopedics, gynecology, urology, plastic surgery, ENT, and more. For the majority of these procedures, which are of short to moderate duration and performed on fasted, low-risk patients, the laryngeal mask has become the unequivocal gold standard for airway management. Its reliability, superb safety record, and patient-friendly profile make it the default choice. The volume growth in this segment is intrinsically linked to the overall growth in surgical volumes worldwide, providing a stable and massive foundation for the entire market.

Emergency Medicine is critically important as the second-largest and indisputably fastest-growing application segment. The utility of laryngeal masks here is twofold: as a primary advanced airway and as an essential rescue device. In the high-stress, often sub-optimal conditions of pre-hospital care (ambulances, helicopters, battlefields) or a crowded emergency department, achieving rapid endotracheal intubation can be challenging.

LMAs can be inserted quickly, often on the first attempt, by personnel of varying skill levels, securing the airway and allowing for oxygenation and ventilation. Their role in cardiopulmonary resuscitation (CPR) is now codified in international guidelines, as they allow for continuous chest compressions without interruption for ventilation. This expansion beyond the controlled operating room environment into the dynamic world of emergency response represents a major and sustained source of market growth.

By End User Analysis

Hospitals are anticipated to maintain their dominance as the largest end-user segment. They are the comprehensive centers of medical care, handling the most complex, high-risk, and high-volume surgical caseloads. Hospitals house the concentrated expertise of specialist anesthesiologists, manage polytrauma and difficult airway cases, and serve as the referral hub for complications from other settings. Their procurement power is immense, and their adoption decisions set the standard for the wider region.

The integration of laryngeal masks into hospital protocols is now complete for a vast range of procedures, and they form an essential part of difficult airway carts and emergency response kits. Furthermore, as hospitals expand their networks to include outpatient surgery centers, they often standardize device formularies, further entrenching their central role in the market.

Ambulatory Surgical Centers (ASCs) represent the second-largest and most strategically vital end-user segment, characterized by the fastest growth rate. The entire economic and operational model of an ASC is predicated on efficiency, rapid patient throughput, minimal complications, and swift recovery. Laryngeal masks are the ideal tool for this model.

They facilitate a smoother, faster anesthetic induction and emergence, reduce post-operative side-effects that could delay discharge, and minimize the need for more complex airway equipment and the associated specialist skills. The explosive growth in the number of ASCs globally, coupled with the migration of suitable surgical procedures to these settings, creates a direct, powerful, and escalating demand pipeline for laryngeal masks, particularly for disposable second-generation models that align with their efficiency and safety goals.

The Global Laryngeal Mask Market Report is segmented on the basis of the following:

By Type

- Disposable/Single-Use Laryngeal Masks

- Reusable/Multi-Use Laryngeal Masks

- First Generation Laryngeal Masks

- Second Generation Laryngeal Masks

By Patient/Age Group

- Adult

- Pediatric

- Neonatal

- Geriatric

By Application

- General Surgery

- Emergency Medicine & Pre-Hospital Care

- Pediatric Anesthesia

- Critical Care & ICU

- Others

By End User

- Hospitals & Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

- Others

Impact of Artificial Intelligence in the Global Laryngeal Mask Market

- Gastric Access Channel Integration – The Definitive Safety Leap: This is the single most impactful innovation, defining second-generation LMAs. It transforms the device from a simple airway conduit into a dual-lumen system, allowing for the safe passage of a gastric tube. This directly addresses the primary cause of morbidity associated with LMAs silent regurgitation and aspiration by enabling stomach decompression, thereby dramatically expanding the safe use-case scenarios and patient populations.

- Advanced Cuff Design and Material Science for Precision Sealing: Innovation here focuses on optimizing the seal while minimizing harm. New cuff geometries (oval, pear-shaped) better conform to hypopharyngeal anatomy. The use of advanced, softer elastomers like medical-grade silicone and novel thermoplastic polymers allows for effective sealing at much lower intracuff pressures (often below 60 cm H2O), reducing the risk of mucosal ischemia, nerve palsy, and post-operative throat pain.

- The Dominance of Single-Use/Disposable Designs: This innovation is as much about healthcare economics and safety culture as it is about product design. Modern disposable LMAs are engineered for cost-effective mass production while maintaining high performance. They eliminate all risks of prion disease transmission and cross-infection from inadequate cleaning, ensure perfect functional integrity for every use, and free clinical staff from labor-intensive reprocessing duties.

- Enhanced Anatomical Design and Ergonomic Insertion Aids: Continuous refinement of the mask's bowl shape, stem rigidity, and curvature has led to higher first-attempt insertion success rates across diverse patient anatomies. Integrated features like flexible, reinforced stems that resist kinking, and larger, more intuitive inflation valves improve usability. Some models include removable introducers or stabilizers to aid in precise placement, especially for less experienced users.

- Integration with Advanced Monitoring and Safety Systems: The frontier of innovation lies in connectivity. Prototypes and early-market devices now feature ports for attaching auxiliary capnography lines directly to the mask stem. The next generation may include built-in micro-pressure sensors in the cuff linked to wireless monitors, providing real-time data to prevent over-inflation a key step towards "smart" airway management and enhanced patient safety in prolonged use.

Global Laryngeal Mask Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to command and sustain its dominance over the Global Laryngeal Mask Market, accounting for the 35.5% of the total revenue share throughout the forecast period. This hegemony is built upon a formidable foundation of structural advantages. The region possesses the world's most advanced and comprehensive healthcare infrastructure, coupled with the highest per-capita spending on surgical and anesthetic care. The United States, in particular, exhibits an exceptionally high volume of surgical procedures, driven by its large population, high prevalence of conditions requiring surgery, and a healthcare model that incentivizes procedural care.

The rapid proliferation and commercial success of Ambulatory Surgical Centers (ASCs) create a perfect, high-growth niche for disposable laryngeal masks. Crucially, North America's reimbursement landscape, led by the U.S. Centers for Medicare & Medicaid Services (CMS) and major private payers, provides clear and favorable payment pathways for procedures using these devices, removing a significant financial barrier to adoption. Finally, the presence of global market leaders headquartered in the region ensures a constant stream of new product launches and intensive educational support for clinicians, cementing technological leadership.

Region with the Highest CAGR

Asia-Pacific (APAC) is unequivocally poised to register the highest Compound Annual Growth Rate (CAGR) during the 2025-2034 forecast period and is on track to challenge for the largest market share in the long term. This explosive growth is fueled by a constellation of powerful, synergistic factors. The region is home to over 60% of the world's population, including massively populous nations like China and India, creating an immense underlying demand base.

Economically, APAC is experiencing rapid growth in healthcare expenditure, leading to unprecedented investments in hospital construction, surgical capacity, and medical training. Governments across the region, from India's Ayushman Bharat to China's healthcare reforms, are explicitly focused on expanding access to safe surgical care, directly driving demand for essential devices. Furthermore, APAC faces a significant shortage of specialist anesthesiologists, making devices like the LMA which can be effectively used by a broader range of trained personnel a practical necessity for scaling surgical services.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Laryngeal Mask Market: Competitive Landscape

The Global Laryngeal Mask Market structure can be described as moderately consolidated, featuring a mix of dominant, diversified multinational medical technology corporations and several focused, innovative pure-play companies. The market is led by global giants such as Teleflex Incorporated (maker of the iconic LMA® brand), Ambu A/S (a leader in single-use devices), Intersurgical Ltd., and Medtronic plc.

These players compete on a global scale, leveraging vast R&D budgets, extensive clinical evidence portfolios, wide-ranging product lines that cover every segment (from pediatric to double-lumen), and deeply entrenched distribution networks that reach into every major hospital group. Their strategies heavily emphasize innovation in safety features (e.g., gastric access), material science, and the ongoing conversion of the market from reusable to disposable products.

The competitive intensity is high, with rivalry based on product performance, clinical data, price, and the strength of educational support provided to clinicians. Key strategic activities observed in the market include targeted mergers and acquisitions to fill portfolio gaps, partnerships with academic institutions for clinical trials, and significant investment in direct sales forces and training simulators.

Smaller and regional players often compete successfully by offering highly cost-effective alternatives, specializing in niche markets (e.g., very specific pediatric sizes), or by securing tenders in public healthcare systems where price is the primary determinant. The competitive landscape is therefore dynamic, with global leaders defending their share through innovation and branding, while agile smaller companies capture share in specific segments or geographies.

Some of the prominent players in the Global Laryngeal Mask Market are:

- Teleflex Incorporated

- Ambu A/S

- Intersurgical Ltd.

- Medtronic plc

- SunMed

- Cardinal Health

- Vyaire Medical

- Mercury Medical

- Armstrong Medical

- Besmed

- Smiths Medical

- Medline Industries

- Becton, Dickinson and Company (BD)

- Verathon Inc.

- Venner Medical

- Marshall Airway Products

- General Electric (GE) Healthcare

- BLS Systems Ltd.

- KindWell Medical

- Timesco Healthcare

- Other Key Players

Recent Developments in the Global Laryngeal Mask Market

- November 2025: Ambu launches next-generation single-use laryngeal mask with PressureGuard™ technology. Ambu A/S introduced its latest flagship single-use laryngeal mask, the Ambu® AuraGain™ i. The device features the new PressureGuard™ cuff, designed to maintain an effective seal at consistently lower and safer pressures, and includes an integrated bite block and a 90-degree connector for easier circuit management. It is aimed squarely at the high-volume hospital and ASC market prioritizing patient safety and operational efficiency.

- October 2025: Teleflex receives FDA clearance for its new pediatric LMA® Supreme™ with EcoFlex®. Teleflex Incorporated announced FDA 510(k) clearance for a new line of its LMA® Supreme™ airway devices specifically sized for neonates, infants, and small children. The devices incorporate the company's proprietary EcoFlex® material, designed for optimal sealing with minimal pressure, and include the integral gastric access channel, bringing second-generation safety features to the full pediatric spectrum.

- September 2025: Major health economics study validates cost-effectiveness of disposable LMAs in ASCs. A comprehensive study presented at the American Society of Anesthesiologists (ASA) annual meeting demonstrated that the adoption of single-use laryngeal masks in Ambulatory Surgical Centers led to significant net cost savings.

- August 2025: Intersurgical announces major manufacturing capacity expansion in Asia to meet surging demand. Intersurgical Ltd., a key global player, unveiled a significant expansion of its manufacturing facility in Penang, Malaysia. The investment is specifically targeted at increasing production capacity for its i-gel® and other single-use supraglottic airway product lines to meet the rapidly growing demand across the Asia-Pacific region and to serve as an export hub.

- July 2025: New international emergency medicine guidelines reinforce LMA role in cardiac arrest. The International Federation for Emergency Medicine (IFEM), in collaboration with the International Liaison Committee on Resuscitation (ILCOR), released updated guidelines that strengthened the recommendation for the use of second-generation supraglottic airways (like the i-gel or LMA Supreme) as a first-line advanced airway during adult cardiac arrest management for EMS providers, citing evidence for faster insertion times and comparable outcomes to endotracheal intubation in this setting.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 957.7 Mn |

| Forecast Value (2034) |

USD 1,650.3 Mn |

| CAGR (2025–2034) |

6.2% |

| The US Market Size (2025) |

USD 285.9 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (First Generation Laryngeal Masks, Second Generation Laryngeal Masks, Disposable/Single-Use Laryngeal Masks, Reusable/Multi-Use Laryngeal Masks); By Patient/Age Group (Adult, Pediatric, Neonatal, Geriatric); By Application, Emergency Medicine & Pre-Hospital Care, Pediatric Anesthesia, Critical Care & ICU, Others); By End User (Hospitals & Clinics, Ambulatory Surgical Centers (ASCs), Diagnostic Centers, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Teleflex Incorporated, Ambu A/S, Intersurgical Ltd., Medtronic plc, SunMed, Cardinal Health, Vyaire Medical, Mercury Medical, Armstrong Medical, Besmed, Smiths Medical, Medline Industries, Becton, Dickinson and Company (BD), Verathon Inc., Venner Medical, Marshall Airway Products, GE Healthcare, BLS Systems Ltd., KindWell Medical, and Timesco Healthcare., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Laryngeal Mask Market?

▾ The Global Laryngeal Mask Market size is estimated to have a value of USD 957.7 million in 2025 and is expected to reach USD 1,650.3 million by the end of 2034.

What is the growth rate in the Global Laryngeal Mask Market?

▾ The market is growing at a Compound Annual Growth Rate (CAGR) of 6.2 percent over the forecasted period from 2025 to 2034.

What is the size of the US Laryngeal Mask Market?

▾ The US Laryngeal Mask Market is projected to be valued at USD 285.9 million in 2025. It is expected to witness subsequent growth, reaching USD 475.9 million in 2034, expanding at a CAGR of 5.8% during this period.

Which region accounted for the largest Global Laryngeal Mask Market?

▾ North America is expected to have the 35.5% of the market share in the Global Laryngeal Mask Market throughout the forecast period, driven by high surgical volume, advanced infrastructure, and favorable reimbursement.

Who are the key players in the Global Laryngeal Mask Market?

▾ Some of the major key players in the Global Laryngeal Mask Market are Teleflex Incorporated, Ambu A/S, Intersurgical Ltd., Medtronic plc, SunMed, Cardinal Health, and several other significant competitors.