Market Overview

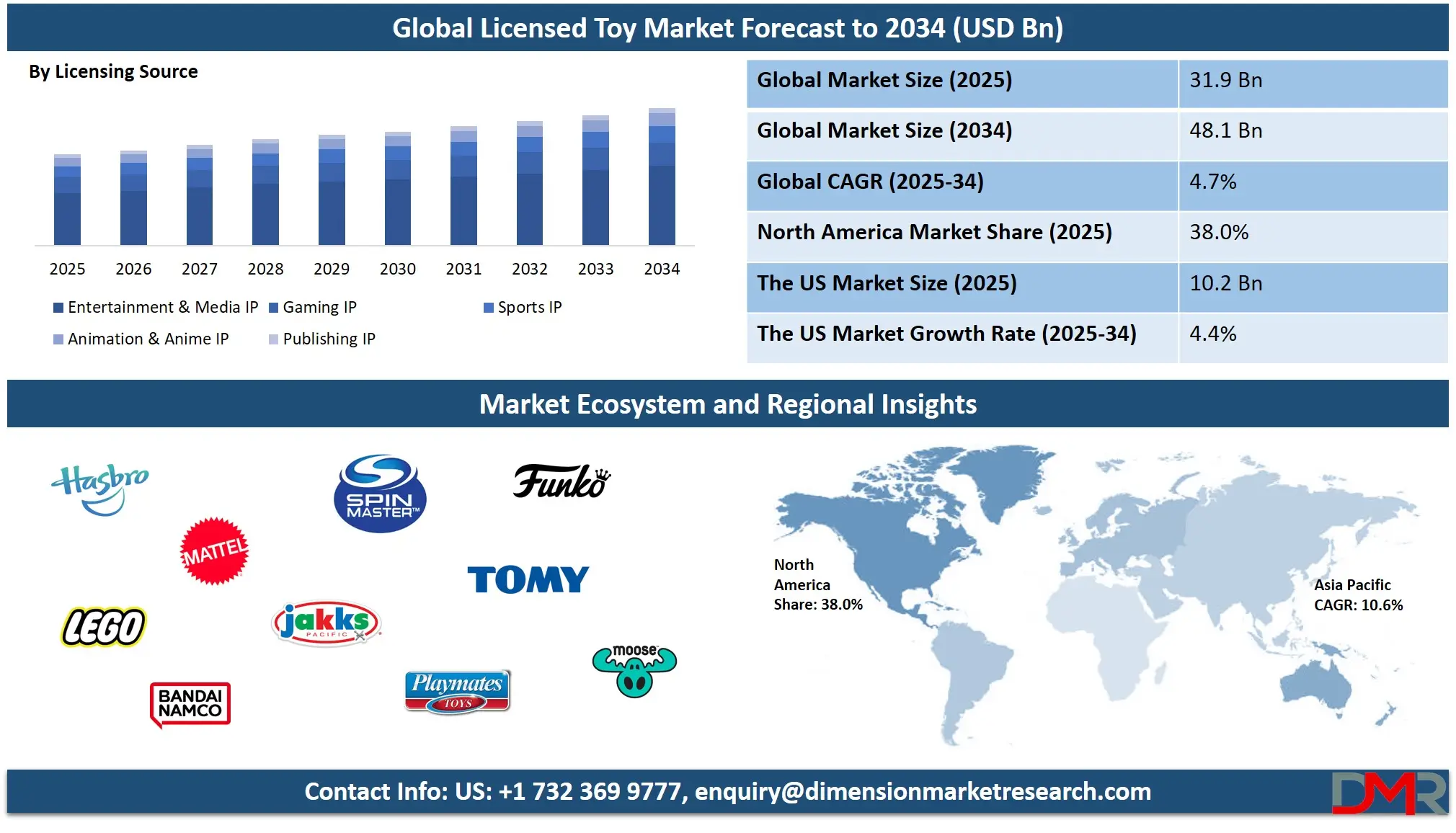

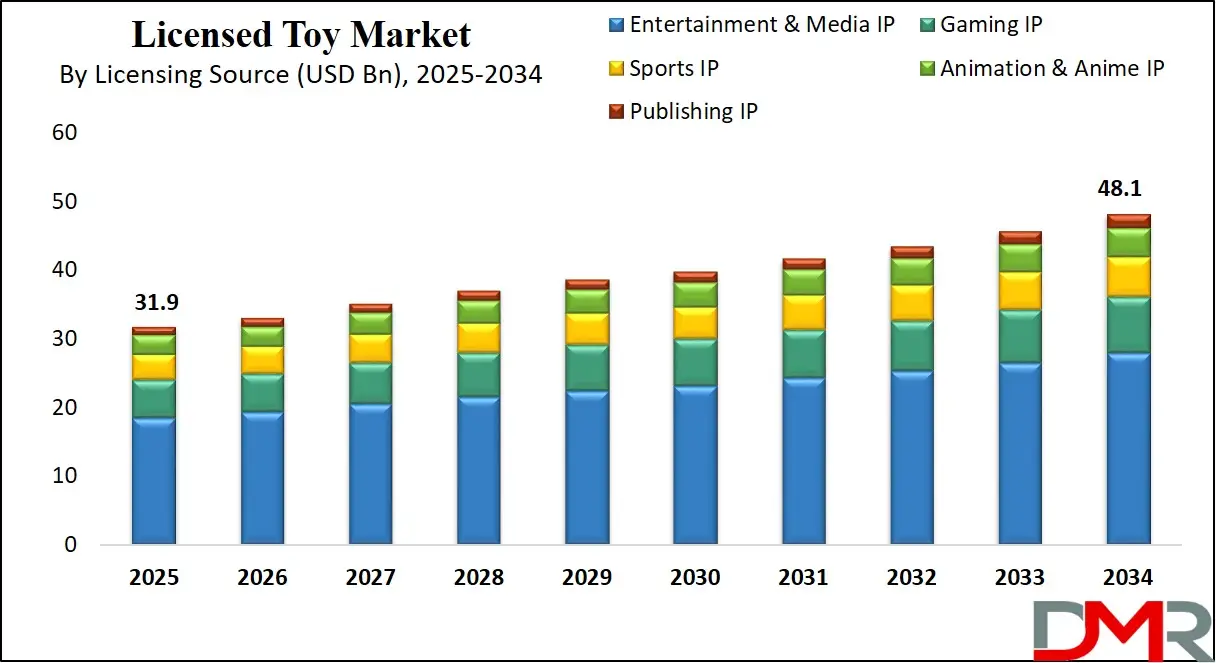

The global licensed toy market was valued at USD 31.9 billion in 2025 and is projected to reach USD 48.1 billion by 2034, expanding at a CAGR of 4.7%, driven by rising demand for character based toys, strong entertainment and media licensing, growing collectibles adoption, and expanding e commerce distribution channels.

A licensed toy refers to a play product manufactured and sold using legally authorized intellectual property owned by a third party. These toys are developed under licensing agreements that allow manufacturers to use well known characters brands logos or themes from movies television shows animation series video games sports franchises and comics. Licensed toys leverage existing brand recognition and emotional attachment among consumers especially children and collectors which significantly enhances product appeal and demand. Common examples include character action figures dolls plush toys construction sets and games based on popular entertainment and media properties.

The global licensed toy market represents a dynamic segment of the toy industry driven by strong linkages with the entertainment media and gaming ecosystems. The market benefits from continuous content creation across films streaming platforms animation studios and video game publishers which fuels recurring demand for character based toys. Rising popularity of franchise driven storytelling growing influence of global media brands and increasing engagement of children with digital content have strengthened the commercial value of licensed merchandise worldwide. The market also gains traction from nostalgia driven purchases among adult consumers and collectors.

Additionally the global licensed toy market is supported by expanding e commerce penetration diversified retail distribution and increasing consumer spending on branded play products. Toy manufacturers are increasingly focusing on premium collectibles innovative playsets and interactive licensed toys to enhance margins and brand loyalty. Emerging markets in Asia Pacific and Latin America are contributing to growth due to rising urbanization higher exposure to global entertainment content and expanding middle class populations. Strategic collaborations between licensors and toy companies continue to shape product innovation and long term market expansion.

The US Licensed Toy Market

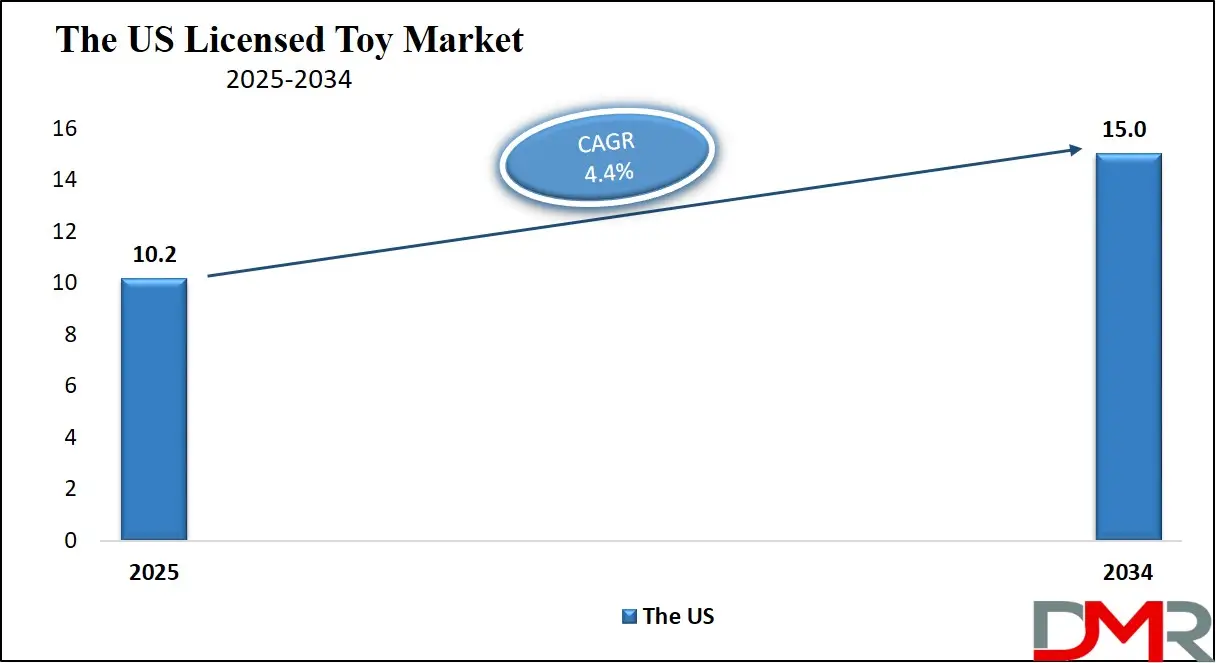

The U.S. Licensed Toy market size was valued at USD 10.2 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 15.0 billion in 2034 at a CAGR of 4.4%.

The US licensed toy market represents the largest national market globally, supported by a mature entertainment ecosystem and strong consumer affinity for character driven products. High penetration of movie franchises, television series, streaming platforms, and video game brands continues to fuel consistent demand for licensed action figures, dolls, collectibles, and construction toys. The presence of major licensors and toy manufacturers, combined with high per capita spending on toys and gifts, reinforces market stability. Adult collectors and nostalgia based purchasing further contribute to sustained revenue generation across multiple product categories.

Growth in the US licensed toy market is increasingly shaped by digital engagement and omnichannel retail strategies. E commerce platforms and direct to consumer channels play a critical role in expanding product accessibility and supporting limited edition and premium licensed toys. Seasonal movie releases, franchise renewals, and cross media marketing campaigns stimulate recurring purchase cycles. Additionally, innovation in interactive and technology enabled toys, along with sustainability focused materials and packaging, is gaining importance as consumer preferences evolve toward value driven and environmentally conscious purchasing decisions.

Europe Licensed Toy Market

The European licensed toy market was valued at USD 8.0 billion in 2025, reflecting steady demand across countries such as the United Kingdom, Germany, France, and Italy. Growth in this region is largely driven by strong consumer affinity for character based toys, dolls, action figures, and collectibles tied to popular movies, television series, animation, and gaming franchises. Established entertainment ecosystems and frequent content releases help sustain demand, while brand loyalty and franchise recognition among children and adult collectors continue to reinforce market stability.

The market in Europe is expected to grow at a moderate CAGR of 4.3%, supported by expanding e‑commerce penetration, innovative product launches, and seasonal promotional campaigns. Retailers are increasingly leveraging omnichannel strategies to reach diverse consumer segments, while manufacturers focus on premium collectibles, interactive playsets, and licensed merchandise aligned with popular media content. Additionally, growing interest in sustainable and eco‑friendly toys is shaping product offerings, reflecting evolving consumer preferences and creating new opportunities for market expansion across the region.

Japan Licensed Toy Market

The Japanese licensed toy market was valued at USD 2.5 billion in 2025, driven by strong consumer interest in character based toys, anime franchises, and gaming IP merchandise. Popularity of domestic animation and gaming content, along with international entertainment franchises, fuels demand for action figures, dolls, collectibles, and interactive playsets. Japanese consumers, including children and adult collectors, show high engagement with limited edition and premium licensed products, contributing to consistent market revenue and making Japan a key regional hub for licensed toy consumption.

The market is expected to grow at a CAGR of 4.0%, supported by innovative product launches, seasonal promotions, and increasing e‑commerce adoption. Retailers and manufacturers are focusing on integrating digital and interactive features into licensed toys to enhance play experiences and appeal to tech‑savvy consumers. Additionally, the growing awareness of sustainable and eco‑friendly materials is influencing product development, while partnerships with entertainment studios continue to expand the availability of popular licensed merchandise across both domestic and international IPs.

Global Licensed Toy Market: Key Takeaways

- Strong Franchise Influence Drives Sales: Licensed toys continue to benefit from popular movies, TV shows, streaming content, and gaming franchises. Consumers are drawn to familiar characters, making action figures, dolls, and collectibles highly desirable across age groups.

- E‑Commerce Expands Market Reach: Online retail dominates distribution, offering convenience, exclusive launches, and direct-to-consumer engagement. Digital platforms are accelerating adoption of limited edition and interactive licensed toys worldwide.

- Adult Collectors and Nostalgia Fuel Premium Segments: Teenagers and adult collectors are increasingly driving demand for high-end collectibles and limited-edition products, supporting profitability and reinforcing brand loyalty in mature markets.

- Emerging Markets Offer Growth Potential: Asia Pacific and Latin America are expanding rapidly due to rising disposable incomes, urbanization, and exposure to global entertainment content, creating new opportunities for licensed toy adoption.

- Innovation and Sustainability Shape Product Development: AI-enabled interactive toys, digital integration, and eco-friendly materials are influencing product design. Manufacturers are focusing on smarter play experiences and environmentally conscious production to meet evolving consumer expectations.

Global Licensed Toy Market: Use Cases

- Entertainment Franchise Merchandise: Licensed toys are used to extend the reach of movies television shows and streaming content into physical products. Character based action figures dolls and playsets support brand visibility and generate recurring merchandise revenue aligned with media releases.

- Gaming IP Commercialization: Video game franchises leverage licensed toys to convert digital characters into physical collectibles. These products connect virtual gaming experiences with real world play and appeal strongly to teens and adult collectors.

- Sports Licensing and Youth Engagement: Sports teams and leagues use licensed toys to build early fan loyalty. Team themed figures and mascots help expand merchandise sales and strengthen long term brand association among younger consumers.

- Collectibles and Adult Consumer Demand: Licensed collectibles target adult fans driven by nostalgia and fandom. Premium figures and limited edition toys support higher margins and sustained demand across global markets.

Global Licensed Toy Market: Stats & Facts

- European Commission — Toys Sector Facts and Figures (EU Official)

- The EU toy industry employs about 51,000 workers for production value around €5.8 billion.

- 99% of EU toy manufacturing companies are small and medium enterprises (SMEs).

- SMEs account for 61% of total employment in the EU toy industry.

- China is the world’s largest exporter of toys with more than 86% of global toy exports.

- The EU exported about €50 million worth of toys to China.

- The toy trade between EU countries is worth about €4.2 billion annually.

- U.S. Government / Federal Safety Data

- The U.S. Consumer Product Safety Commission estimates around 240,000 emergency room visits annually are due to toy‑related injuries.

- 70% of these toy‑related injuries involve children under 15 years of age.

- Under U.S. law, over 15,000 toy products require annual third‑party safety compliance testing.

- India — Toy Industry Trade Policy Impact (Government Study)

- India’s toy exports rose from USD 131.5 million in 2019 to USD 166.8 million in 2024.

- Indian toy imports declined from USD 318.9 million in 2018 to USD 40 million in 2021 after Quality Control Orders were implemented.

- India’s toy trade balance shifted from deficit to surplus by 2024.

- Japan — Government / Public Toy Industry Data

- Japan’s toy market reached record high sales of 1,019.3 billion yen in fiscal 2023 (government‑based survey).

- Toy sales growth in Japan outpaced some other consumer goods categories due to increased spending (government survey).

Impact of Artificial Intelligence on the global Licensed Toy market

Artificial intelligence is reshaping the global licensed toy market by enhancing product innovation, personalization, and operational efficiency across the value chain. AI-enabled design tools and predictive analytics help toy manufacturers identify emerging trends in entertainment and media IP demand, enabling faster development of character-driven toys that resonate with target audiences. Machine learning models also improve demand forecasting and inventory optimization, reducing excess stock and ensuring popular licensed toys are available during peak sales periods such as franchise releases and holiday seasons.

On the consumer side, AI is driving smarter and more interactive play experiences through voice-activated features, adaptive learning capabilities, and augmented reality integration. Licensed toys embedded with AI can respond to user behavior, personalize interactions based on age or interest, and sync with digital platforms to extend engagement beyond physical play. Additionally, AI-powered e-commerce systems enhance product discovery and personalized recommendations for licensed toys, increasing conversion rates and customer satisfaction. Overall, artificial intelligence supports growth, enhances consumer experiences, and strengthens competitive advantage in the global licensed toy market.

Global Licensed Toy Market: Market Dynamics

Global Licensed Toy Market: Driving Factors

Growing Media Franchise Popularity

The proliferation of blockbuster movies, television series, and animation content, and video game franchises fuels strong demand for licensed toys globally. Consumers increasingly seek characters and story worlds they recognize, driving sales of action figures, dolls, and branded playsets that reinforce emotional connection and ongoing engagement with entertainment properties.

Expansion of E-commerce and Digital Retail Channels

Rising penetration of online marketplaces and direct-to-consumer platforms has transformed how licensed toys are marketed and purchased. Digital retail enables broader geographic reach, personalized recommendations, and targeted promotions that boost product discoverability and accelerate revenue growth across diverse consumer segments.

Global Licensed Toy Market: Restraints

High Licensing and Royalty Costs

Securing rights to premium intellectual property involves substantial licensing fees and royalty obligations that can compress manufacturer margins. These costs often lead to higher retail prices for licensed toys, potentially limiting affordability and slowing adoption among price-sensitive consumers.

Seasonality and Demand Volatility

Licensed toy sales are closely tied to entertainment release cycles and seasonal peaks such as holidays and movie premieres. Fluctuations in consumer interest during off-peak periods can create inventory challenges and uneven revenue streams for manufacturers and retailers, affecting long-term planning and production schedules.

Global Licensed Toy Market: Opportunities

Integration of Smart and Interactive Technology

There is a growing opportunity to develop AI-enabled and interactive licensed toys that connect physical play with digital experiences. Toys equipped with voice recognition, adaptive learning, and augmented reality integration can attract tech-savvy consumers and differentiate product portfolios in a competitive market.

Emerging Markets and Global Media Exposure

Expanding middle class populations in Asia-Pacific, Latin America, and the Middle East are accessing global entertainment content more than ever before. This increased exposure to international characters and storytelling creates new demand for licensed products and opens untapped revenue streams for global toy manufacturers and licensors.

Global Licensed Toy Market: Trends

Collectible and Premium Toy Segments

Adult fandom and nostalgia-driven purchases are elevating demand for high-end licensed collectibles and limited-edition products. This trend enhances profitability and cultivates long-term brand loyalty among older consumers who value display quality, exclusivity, and franchise attachment.

Sustainable and Eco-Friendly Toy Manufacturing

Environmental awareness is influencing consumer preferences toward sustainable licensed toys made from recycled or biodegradable materials. Manufacturers are responding with greener production practices and eco-conscious packaging, aligning product offerings with broader consumer expectations for responsible consumption.

Global Licensed Toy Market: Research Scope and Analysis

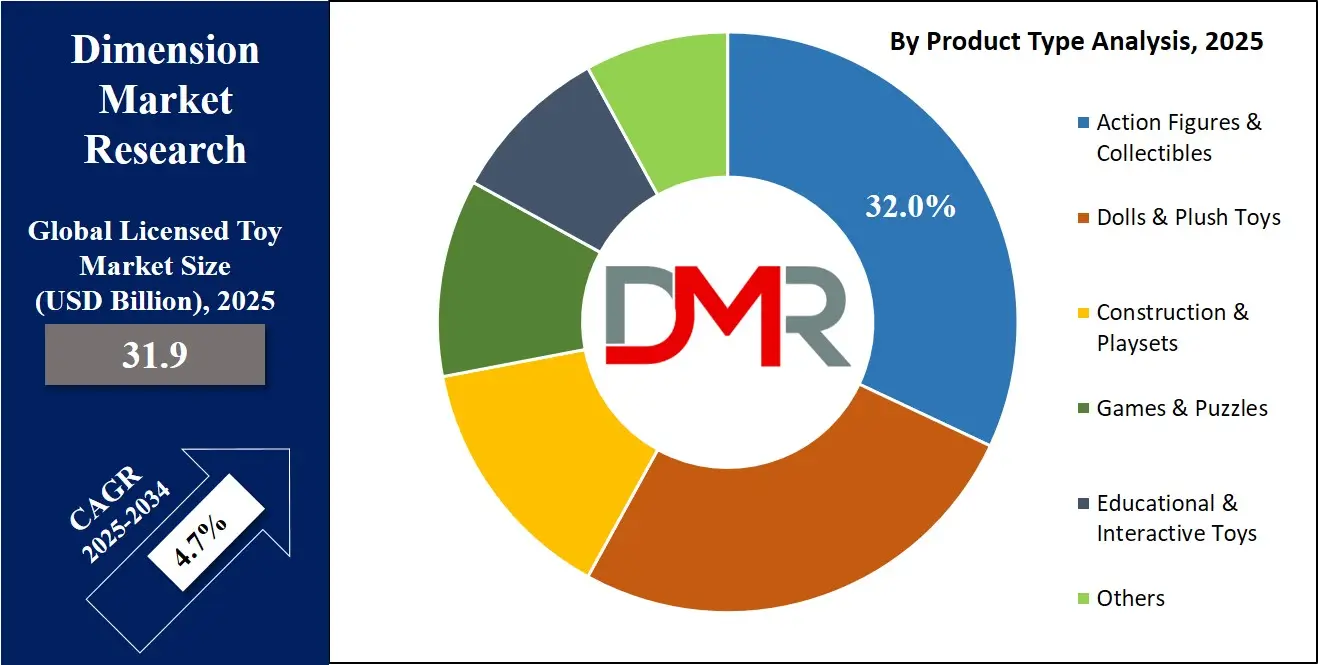

By Product Type Analysis

Action figures and collectibles are anticipated to dominate the product type segment of the global licensed toy market, capturing 32.0% of the total market share in 2025, driven by strong demand for character based merchandise linked to movies television series gaming franchises and comic universes. These products appeal not only to children but also to teenagers and adult collectors, supported by nostalgia driven purchasing and the rising popularity of premium and limited edition collectibles. Frequent franchise renewals, cinematic releases, and streaming content launches sustain continuous demand, while higher price points and strong brand loyalty contribute significantly to overall revenue generation within this segment.

Dolls and plush toys represent another significant product category within the licensed toy market, supported by consistent demand from younger age groups and gift purchases. Character dolls and soft toys based on animated series and family oriented entertainment franchises remain popular due to their emotional appeal safety features and suitability for early age play. This segment benefits from repeat purchases, broad retail availability, and strong seasonal sales performance, particularly during holidays. Increasing focus on quality materials sustainability and recognizable characters continues to strengthen the role of dolls and plush toys in overall market growth.

By Licensing Source Analysis

Entertainment and media intellectual property are anticipated to dominate the licensing source segment of the global licensed toy market, capturing 58.0% of the total market share in 2025, due to the strong influence of movies television series animation content and streaming platforms on consumer purchasing behavior. Globally recognized characters and storylines create immediate brand familiarity and emotional attachment, which significantly boosts demand for licensed action figures dolls playsets and collectibles. Continuous content releases franchise expansions and cross media marketing strategies ensure sustained product relevance and recurring sales across multiple age groups.

Gaming intellectual property represents a rapidly expanding licensing source within the licensed toy market, driven by the growing popularity of console PC and mobile games. Iconic gaming characters and immersive virtual worlds are increasingly being translated into physical toys and collectibles, appealing to both younger gamers and adult fans. This segment benefits from strong community engagement esports exposure and long lifecycle franchises, enabling steady demand beyond traditional entertainment windows. The convergence of digital gaming culture with physical merchandise continues to strengthen the role of gaming IP in overall market growth.

By Age Group Analysis

The 5–12 years age group is anticipated to dominate the global licensed toy market, capturing 38.0% of the total market share in 2025, as this segment represents the core consumer base for character driven play products. Children in this age range actively engage with movies television series animation content and video games, which strongly influences their toy preferences. High demand for action figures playsets construction toys and licensed games is supported by frequent media exposure school age social interaction and gift driven purchases, making this group the most commercially significant for licensed toy manufacturers.

The 12+ years segment comprising teenagers and adult consumers plays an increasingly important role in the licensed toy market, driven by collectibles fandom and nostalgia based purchasing behavior. This group shows strong preference for premium licensed figures limited edition products and display oriented collectibles tied to entertainment and gaming franchises. Higher disposable income and emotional attachment to long running intellectual properties support higher price points and repeat purchases, contributing meaningfully to overall market value despite lower unit volumes compared to younger age groups.

By Distribution Channel Analysis

Online retail is anticipated to dominate the distribution channel segment of the global licensed toy market, capturing 42.0% of the total market share in 2025, driven by increasing consumer preference for convenient shopping and wider product accessibility. E commerce platforms enable consumers to browse extensive assortments of licensed toys compare prices and access exclusive or limited edition products that may not be available in physical stores. Strong digital marketing personalized recommendations and direct to consumer brand strategies further support higher conversion rates and repeat purchases across both children and adult consumer segments.

Mass merchandisers continue to play a critical role in the licensed toy market by offering broad product visibility and high volume sales through hypermarkets and large retail chains. These stores benefit from strong foot traffic competitive pricing and prominent in store displays tied to major entertainment releases and seasonal promotions. Mass merchandisers remain especially important for impulse buying and gift purchases, ensuring steady demand for licensed toys among families and price conscious consumers while complementing the growth of online retail channels.

By Price Tier Analysis

Mass market licensed toys are anticipated to dominate the price tier segment of the global licensed toy market, capturing 48.0% of the total market share in 2025, due to their affordability and wide accessibility across diverse consumer groups. These products typically include character based action figures dolls and basic playsets that cater to children and families seeking recognizable brands at competitive prices. High volume production, broad retail distribution, and alignment with popular media franchises ensure consistent demand and make mass market toys the backbone of overall licensed toy sales worldwide.

Mid‑priced licensed toys represent a significant portion of the market, offering enhanced features, better quality materials, and more intricate designs compared to mass market products. These toys appeal to parents and gift buyers looking for a balance between affordability and premium experience. Mid‑priced items often include interactive playsets, collectible figures, and branded construction kits that tie closely to movies, TV shows, and gaming franchises. This segment benefits from repeat purchases, seasonal demand spikes, and strong brand loyalty among children and teenagers.

By End User Analysis

Individual consumers are anticipated to dominate the end user segment of the global licensed toy market, capturing 91.0% of the total market share in 2025, as households and parents remain the primary buyers of character based toys, dolls, action figures, and playsets. Purchases are largely driven by children’s preferences, gifting occasions, and personal collections, with strong influence from movies, television series, animation content, and gaming franchises. The segment benefits from repeat buying, seasonal demand during holidays and movie releases, and growing online retail penetration, which makes licensed toys highly accessible to a broad consumer base worldwide.

Commercial buyers represent a smaller but important portion of the licensed toy market, accounting for the remaining share through bulk purchases for theme parks, promotional campaigns, corporate gifting, and entertainment venues. These buyers typically seek branded merchandise that reinforces brand engagement and enhances visitor experiences. Licensed toys purchased for commercial purposes often include limited edition or display products tied to entertainment franchises, helping companies generate additional revenue streams and maintain brand visibility beyond individual consumer sales.

The Licensed Toy Market Report is segmented on the basis of the following:

By Product Type

- Action Figures & Collectibles

- Dolls & Plush Toys

- Construction & Playsets

- Games & Puzzles

- Educational & Interactive Toys

- Others

By Licensing Source

- Entertainment & Media IP

- Movies

- TV & Streaming Content

- Gaming IP

- Console & PC games

- Mobile game franchises

- Sports IP

- Animation & Anime IP

- Global animation franchises

- Publishing IP

- Comics & children’s books

By Age Group

- 0-2 Years

- Soft & safe licensed toys

- 3-5 Years

- 5-12 Years

- Action figures

- Playsets & games

- 12+ Years

- Collectibles

- Premium licensed toys

By Distribution Channel

- Online Retail

- Marketplaces

- Brand-owned stores

- Mass Merchandisers

- Hypermarkets & supermarkets

- Specialty Toy Stores

- Others

By Price Tier

- Mass Market Licensed Toys

- Mid-Priced Licensed Toys

- Premium & Collector Toys

By End User

- Individual Consumers

- Parents

- Gift Buyers

- Adult Collectors

- Commercial Buyers

- Theme parks

- Promotional usage

Global Licensed Toy Market: Regional Analysis

Region with the Largest Revenue Share

North America is anticipated to lead the global licensed toy market in 2025, accounting for 38.0% of total market revenue, driven by a mature entertainment industry, high consumer spending, and strong brand loyalty toward popular media franchises.

The region experiences robust demand for action figures, dolls, collectibles, and interactive playsets tied to movies, television series, and video games. Well‑established retail networks, including e‑commerce platforms and mass merchandisers, combined with frequent franchise releases and seasonal promotions, ensure consistent sales growth and make North America a key hub for licensed toy consumption and innovation.

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the global licensed toy market, fueled by rapid urbanization, rising disposable incomes, and increasing exposure to global entertainment franchises. Expanding middle class populations in countries like China, India, and Southeast Asia are driving strong demand for action figures, dolls, collectibles, and interactive playsets. The proliferation of e‑commerce platforms and improving retail infrastructure further enhance accessibility, while growing interest in digital media, animation, and gaming content among children and teens accelerates adoption of licensed toys, making Asia Pacific a key emerging market with high growth potential.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Licensed Toy Market: Competitive Landscape

The global licensed toy market is highly competitive, characterized by continuous innovation, strategic partnerships, and aggressive marketing to capture consumer attention across age groups. Companies focus on developing diverse product portfolios that include action figures, dolls, collectibles, and interactive playsets linked to popular entertainment, gaming, and sports franchises. Intense competition drives frequent content collaborations, limited edition releases, and technology integration such as AI and augmented reality to differentiate products. Additionally, players leverage omnichannel distribution, e‑commerce expansion, and brand loyalty initiatives to maintain market share and respond quickly to evolving consumer trends and seasonal demand fluctuations.

Some of the prominent players in the global Licensed Toy market are:

- Hasbro

- Mattel

- LEGO Group

- Bandai Namco Holdings

- Spin Master

- Jakks Pacific

- Funko

- Tomy Company

- Playmates Toys

- Moose Toys

- Just Play

- VTech Holdings

- Ravensburger

- McFarlane Toys

- Jazwares

- Mega Brands

- Simba Dickie Group

- Schleich

- Basic Fun!

- ZURU

- Other Key Players

Global Licensed Toy Market: Recent Developments

- December 2025: JAKKS Pacific announces a sweet new licensing partnership with The Hershey Company to bring confectionery‑themed mini‑doll and collectible products to market, with launches timed for holiday season visibility.

- October 2025: Netflix forges master toy partnerships to produce a new range of products tied to the cultural phenomenon KPOP Demon Hunters, expanding licensed toy offerings set to launch in 2026 in response to strong fan demand.

- September 2025: Temasek leads major strategic funding into TOP TOY, valuing the trendy toy market player at USD 1.28 Billion and signaling investor confidence in licensed and lifestyle toy expansion.

- September 2025: Brave Toys finalizes the full acquisition of My Creative Box, reinforcing its footprint in the play and educational toy space and expanding its portfolio.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 31.9 Bn |

| Forecast Value (2034) |

USD 48.1 Bn |

| CAGR (2025–2034) |

4.7% |

| The US Market Size (2025) |

USD 10.2 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Action Figures & Collectibles, Dolls & Plush Toys, Construction & Playsets, Games & Puzzles, Educational & Interactive Toys, Others), By Licensing Source (Entertainment & Media IP, Gaming IP, Sports IP, Animation & Anime IP, Publishing IP), By Age Group (0-2 Years, 3-5 Years, 5-12 Years, 12+ Years), By Distribution Channel (Online Retail, Mass Merchandisers, Specialty Toy Stores, Others), By Price Tier (Mass Market Licensed Toys, Mid-Priced Licensed Toys, Premium & Collector Toys), and By End User (Individual Consumers, Commercial Buyers) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Hasbro, Mattel, LEGO Group, Bandai Namco Holdings, Spin Master, Jakks Pacific, Funko, Tomy Company, Playmates Toys, Moose Toys, Just Play, VTech Holdings, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Licensed Toy market?

▾ The global Licensed Toy market size was valued at USD 31.9 billion in 2025 and is expected to reach USD 48.1 billion by the end of 2034.

What is the size of the US Licensed Toy market?

▾ The US Licensed Toy market was valued at USD 10.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 15.0 billion in 2034 at a CAGR of 4.4%.

Which region accounted for the largest global Licensed Toy market?

▾ North America is expected to have the largest market share in the global Licensed Toy market, with a share of about 38.0% in 2025.

Who are the key players in the global Licensed Toy market?

▾ Some of the major key players in the global Licensed Toy market are Hasbro, Mattel, LEGO Group, Bandai Namco Holdings, Spin Master, Jakks Pacific, Funko, Tomy Company, Playmates Toys, Moose Toys, Just Play, VTech Holdings, and Others.