Logistics outsourcing is a modern practice in which companies delegate logistics and supply chain functions to third-party logistics providers (3PLs). This includes transportation, warehousing, inventory management, order fulfillment, and distribution services. By offloading these responsibilities, companies can focus on core business operations, reduce operational costs, and gain access to specialized logistics expertise and advanced technology.

Outsourcing logistics services is especially beneficial for businesses looking to increase efficiency, scalability, and supply chain flexibility. The external logistics provider manages the logistics network, helping to improve delivery times, enhance customer service, and optimize overall supply chain performance. E-commerce businesses and online retailers rely heavily on 24/7 dispatch and last-mile delivery services offered by logistics outsourcing firms, particularly in fast-growing segments like E-Commerce Apparel, where timely delivery is essential to customer satisfaction.

The Logistics Outsourcing Market continues to show robust growth, fueled by businesses' ongoing need for cost savings and operational efficiency. With supply chains becoming increasingly complex, organizations are turning to 3PL companies for assistance in streamlining inventory control, shipping logistics, and distribution management—especially in the retail, e-commerce, and manufacturing sectors.

Emerging technologies like automation,

Artificial Intelligence (AI), and data analytics have transformed third-party logistics services. These technologies enable real-time shipment tracking, predictive analytics, and supply chain optimization, increasing the demand for tech-enabled 3PL partners that ensure visibility, accuracy, and efficiency in logistics operations.

With the global expansion of e-commerce platforms and cross-border trade, the demand for faster delivery solutions continues to grow. At the same time, businesses are increasingly seeking eco-friendly transportation and green logistics solutions, creating new opportunities for sustainable 3PL services.

According to 3PLWorldWide, logistics providers are increasingly leveraging technology for load planning, warehouse slotting, and network design. Research shows that 93% of shippers consider strong IT capabilities a must-have when selecting a logistics partner; yet only 55% are satisfied with the technology offered by their current 3PL.

Between 2016 and 2017, the global 3PL market saw an 8.1% revenue increase, reaching $869 billion, with Russia alone experiencing 17.5% growth. This surge was driven by increased shipping capacity, data-driven logistics solutions, and more shippers planning to use outsourced logistics services—with 63% indicating intent to increase outsourcing.

Despite this growth, 28% of shippers now consider insourcing logistics, while 36% of 3PL providers agree that more customers are exploring in-house logistics management (down from 42% the previous year). Still, 86% of 3PLs report that outsourced logistics usage among clients has increased.

The US Logistics Outsourcing Market

The US Logistics Outsourcing Market is projected to reach USD 256.5 billion by the end of 2024 and grow substantially to an expected USD 378.5 billion market by 2033 at an anticipated CAGR of 4.4 %.

The US logistics outsourcing market is fueled by the growing need for cost savings and improved operational efficiency. The increase in e-commerce and the demand for quicker deliveries in this region are also key factors driving the growth of this market. Furthermore, the increasing complexity of global supply chains has led companies to outsource logistics to expert providers, who can manage cross-border shipments and ensure compliance with international standards.

Major trends influencing the US logistics outsourcing market include the growing use of cutting-edge technologies such as automation, artificial intelligence, and data analytics to enhance efficiency.

Logistics Outsourcing Market Key Takeaways

- Market Growth: The global Logistics Outsourcing market is projected to grow by USD 506.8 billion, with a CAGR of 4.7%.

- Market Definition: Logistics Outsourcing involves hiring third-party service providers, known as third-party logistics companies, to manage and execute various supply chain functions.

- Type Analysis: Supply Chain Management is expected to account for the largest revenue share, by 2024.

- Transportation Analysis: Highway is likely to lead the market with the highest revenue share based on transportation by 2024.

- End User Analysis: E-commerce is predicted to dominate the market, accounting for the largest revenue of market revenue by 2024.

- Regional Analysis: Asia Pacific is expected to lead the global logistics outsourcing market with a market share of 35.5% by 2024.

Logistics Outsourcing Market Use Cases

- Cost Reduction: Logistics outsourcing enables significant cost reduction for businesses by allowing them to leverage the economies of scale offered by third-party logistics providers. These providers can often operate more efficiently, reducing transportation and warehousing costs for their clients.

- Focus on Core Competencies: By outsourcing logistics, companies can concentrate on their core competencies, such as product development, marketing, and customer service. This strategic focus allows businesses to allocate their resources and attention.

- Scalability and Flexibility: Outsourcing logistics offers businesses the scalability and flexibility needed to adapt to changing market demands. Companies can quickly scale their logistics operations up or down based on fluctuations in demand, allowing for efficient management of seasonal peaks.

- Improved Delivery Times and Customer Satisfaction: Collaborating with third-party logistics providers enhances delivery efficiency due to their established networks and optimized routing. This results in improved delivery times, which is crucial in today’s fast-paced market.

Logistics Outsourcing Market Dynamic

Drivers

Needs for Better Logistic Services

The explosively fast growth of e-commerce rapidly changed its logistics industry as e-sellers, and marketplaces’ platforms require efficient and easy-solution logistics to process the orders and deliver products fast and reliably. Logistics outsourcing providers work with e-commerce fulfillment, last-mile delivery, & returns that drive the growth of the market. Customers expect faster & accurate delivery of products and hence outsourcing of logistics is compulsory to manage the supply chain to meet their required expectations.

Need for In-house Expertise in International Logistics

The supply chain networks are becoming more complex because the operation is expanding to increasing numbers of businesses around the world. Most businesses do not possess the internal resources that would enable them to deal with international logistics adequately. Third-party logistics service providers take with them the global reach & expertise that qualify them to address cross-border movement, customs laws, & international business.

Companies have slowly begun to realize the importance of outsourcing their central value activities. They can save resources, and time and focus on segments since they can outsource logistics activities in the area where they are strong while leaving it in the hand of professionals to deal with the supply chain.

Restraints

Data Security Risks

The logistics outsourcing market depends heavily on digital data for operations such as shipment tracking, inventory management, and optimizing supply chains. However, sharing this sensitive data with third-party logistics providers poses substantial security risks, similar to the data privacy challenges seen in

digital health, where secure information exchange is equally critical.

Companies must transmit supply chain data, customer information, and proprietary business details, which makes them vulnerable to potential data breaches or cyberattacks. Unauthorized access to this data could lead to significant financial losses, regulatory penalties, and damage to brand reputation, which restraints the growth of the market.

Opportunities

Increase in E-commerce

The global e-commerce sector has experienced remarkable growth over the last decade, with an increasing number of businesses shifting to online sales. This trend has significantly amplified the need for effective and efficient logistics services, presenting a substantial opportunity for the logistics outsourcing market.

E-commerce companies rely on comprehensive logistics solutions, including warehousing,

transportation services, inventory management, and last-mile delivery, to provide a seamless customer experience. As online sales continue to rise, the complexity of logistics operations increases, prompting many businesses to outsource these functions to specialized service providers who can manage them more effectively.

Flexibility and Global Expansion

E-commerce businesses also require logistics operations that are highly flexible and responsive to manage fluctuating demand and customer expectations for rapid deliveries. Outsourced logistics providers, equipped with advanced technologies and expertise, are well-positioned to meet these evolving requirements, making them an appealing option for e-commerce companies.

Additionally, the rise of cross-border e-commerce offers another significant opportunity for logistics outsourcing. As businesses look to expand their global footprint, the demand for logistics services capable of efficiently handling international shipping and customs procedures is on the rise, further driving the growth of the logistics outsourcing market in the future.

Trends

Growing Emphasis on Sustainable Practices

Sustainability is emerged as a critical focus for businesses across many industries, and the logistics sector. This shift has brought the concept of "Green Logistics" to the forefront, which focuses on reducing the environmental impact of logistics operations, including transportation, warehousing, and packaging. As a result, outsourced logistics providers are increasingly integrating sustainable practices into their operations, marking a significant trend within the market.

Innovative Solutions for Environmental Efficiency

Logistics service providers are adopting various initiatives to advance sustainability, such as utilizing alternative fuels, electric vehicles, and energy-efficient warehouse designs. They are creating innovative packaging solutions that reduce material usage and promote recycling, which contributes to waste minimization. Furthermore, logistics providers leverage data analytics and optimization tools to improve routing efficiency and minimize idle times, which leads to decreased fuel consumption and lower emissions.

Logistics Outsourcing Market Research Scope and Analysis

By Type

Supply Chain Management is expected to lead the logistics outsourcing market based on the type with the largest revenue share due to the rise in international trade, the expanding e-commerce sector, & significant growth in the retail industry. Facilitating operations enhances overall supply chain management because they provide integrated & full spectrum services.

SCM facilitates the improvement of all aspects of the supply chain since it can link supply chain management, procurement, production, inventory & transportation. This manner enables the businesses to move with efficiency, cost reduction, and deliver within the right time. Third-party logistics providers outsourcing SCM, have the tools, infrastructure, and knowledge required that firms can source from whenever they lack them in managing complex supply chains.

These partners provide business intelligence & analytics, operation tracking & monitoring, & sophisticated software tools while enabling an organization to manage business flows, avoid logjams, & make informed decisions. Outsourcing also provides numerous advantages such as economy of scale to businesses besides enabling them to maximize flexibility in responding to changes in market forces or the occurrence of other contingencies.

This paper acknowledges that the supply chain has become more complex today than ever before due to the globalization of trade and the expansion of e-commerce. Business organizations today have to handle complex supply chain that involves multiple sites, multiple sourcing of supply from multiple suppliers, manufacturers, and distributors based all over the world.

Companies choose to outsource SCM services for this reason since the outsourcing arrangement allows firms to deal with these complexities and grow or shrink their operations as market circumstances change.

Meanwhile, the distribution management segment is projected to grow considerably during the forecast period. This management in logistics outsourcing provides cost-saving benefits for companies. It ensures smooth logistics movement, offering a dependable solution for businesses using outsourcing methods.

By Transportation

The highway transportation segment is expected to dominate the logistics outsourcing market during the forecast period, largely due to the extensive and well-established road transport network, which plays a key role in its market share. These modes of transportation are widely regarded as the most cost-effective and reliable option for managing logistics services, further driving the segment’s growth.

They allow door-to-door delivery as compared to air, sea, or rail, which provides a more direct and efficient connection between suppliers and customers. They are majorly beneficial for e-commerce and retail businesses, where timely and precise deliveries are important. The growth of online shopping has significantly increased the demand for flexible shipping solutions, and highway transport offers the adaptability to handle many shipment sizes and locations.

Further, highways provide access to remote areas that are not always reachable by rail or air. Trucks and other road-based vehicles can navigate complex routes and provide last-mile delivery services, making highway transportation indispensable for logistics networks. Additionally, the costs associated with highway transport tend to be lower compared to air freight, which makes it an attractive option for businesses looking to balance cost and efficiency.

Meanwhile, railway transportation is the second largest dominating segment in scenarios where cost efficiency and large-scale movement of goods are essential. Rail transport is famous for its capacity to move bulk goods over long distances at a lower cost per ton, making it an ideal choice for industries like mining, manufacturing, & agriculture.

By End User

E-commerce is projected to lead the logistics outsourcing market with the highest revenue share by 2024 due to rapid online shopping growth and the need for efficient supply chains with flexible supply networks.

E-commerce platforms have significantly accelerated shipping activity, necessitating faster and more dependable logistics solutions to scale their operations without investing heavily in-house. Logistics outsourcing allows e-commerce businesses to scale without incurring excessive expenses for developing extensive in-house capabilities.

Third-party logistics (3PL) providers specialize in transport, storage, and distribution to allow online retailers to focus on what matters - their core business. E-commerce also demands high levels of operational efficiency, including real-time tracking, inventory control, and last-mile delivery services. Logistics providers play an essential role in meeting customer demands for timely deliveries that meet cost and quality standards, with swift shipping times and seamless returns now expected by consumers.

Due to consumer behaviors shifting increasingly towards online shopping, demand for outsourced logistics solutions is steadily on the rise and E-Commerce continues its dominance of the logistics outsourcing market. Automobile production involves procuring components from multiple suppliers worldwide. Therefore, logistics providers ensure parts arrive on time in sequence to reduce downtime in manufacturing lines and assembly lines.

The Global Logistics Outsourcing Market Report is segmented on the basis of the following:

By Type

- Supply Chain Management

- Distribution Management

- Material Management

- Shipment Packaging

- Channel Management

By Transportation

- Highway Transportation

- Air Transportation

- Sea Transportation

- Railway Transportation

By End User

- E-commerce

- Automotive

- Consumer packaged goods

- Aerospace, and government

- Food & beverages

- Others

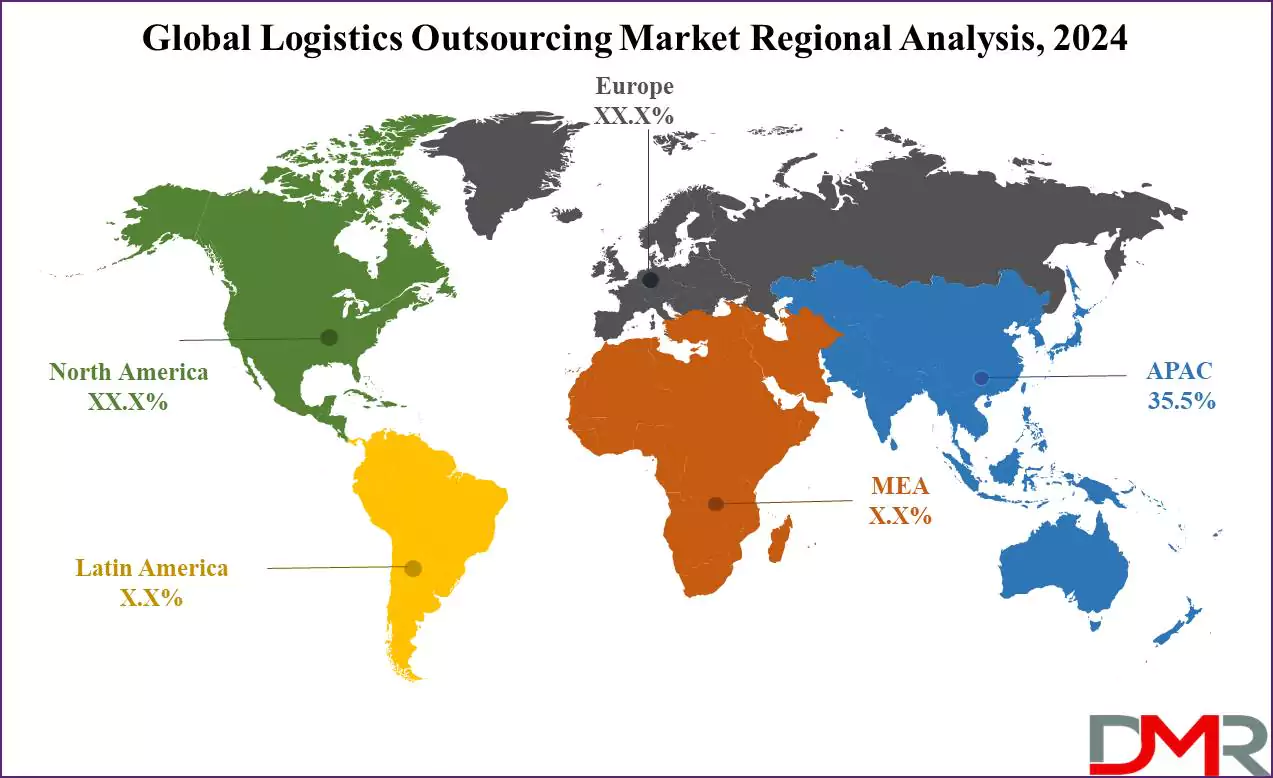

Logistics Outsourcing Market Regional Analysis

Asia Pacific is predicted to dominate the logistics outsourcing market with the largest revenue share of

35.5% in 2024. This region is growing due to a rapidly transforming economy, characterized by robust industrialization and urbanization, which leads to increased demand for logistics services.

The rapid growth of e-commerce in this region is a key driver of the logistics outsourcing market. Businesses are investing in logistics infrastructure to meet consumer expectations for speed and reliability as a large and tech-savvy population increasingly turning to online shopping.

The region's logistics providers are adapting to these trends by offering innovative solutions, like last-mile delivery services and advanced warehousing capabilities, which further boosts market growth. Countries like China and India are experiencing significant growth in manufacturing and export activities, which require efficient logistics solutions to manage the supply chain effectively.

In addition, this region's rapid industrialization and urbanization have created many opportunities for growth in logistics outsourcing. Asia Pacific is the home of many manufacturing companies, which increases the demand for advanced and reliable management solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Logistics Outsourcing Market Competitive Landscape

The global logistics outsourcing market is marked by fierce competition, featuring a diverse array of large and small players providing software and services across both domestic and international markets. Currently, the market is moderately fragmented but is trending towards increased fragmentation. Leading companies are actively collaborating with others to maintain a competitive edge, leveraging partnerships to enhance their service offerings.

Many firms are prioritizing investments in new product launches to diversify and strengthen their product portfolios. Mergers and acquisitions are also key strategies employed by market participants to expand their capabilities and offerings. Major players in the logistics outsourcing sector include Exel Logistics, Menlo Worldwide Logistics, GXO Logistics, Americold, Lineage Logistics, FedEx, Ryder Logistics, and Tibbett and Britten, among others.

To sustain competitiveness, these key players are focusing on product and service innovation while pursuing strategic mergers and acquisitions. This approach not only broadens their product functionality but also positions them favorably within the evolving logistics outsourcing landscape.

Some of the prominent players in the global logistics outsourcing market are

- United Parcel Service of America, Inc.

- Exel Logistics

- XPO Logistics, Inc.

- A.P. Møller - Mærsk A/S

- DHL International GmbH

- Kuehne + Nagel International AG

- Tibbett and Britten

- FedEx Corporation

- Deutsche Bahn AG

- Nippon Express Co., Ltd.

- DSV A/S

- SNCF Group

- Other Key Players

Logistics Outsourcing Market Recent Development

- In October 2023, Foresight Group, a prominent regional private equity and infrastructure investment manager, revealed a USD 5.6 million investment in AmWorld Holdings Limited. This company provides courier, freight, logistics, and storage services to a loyal clientele of about 600 clients across various industries, with significant focus areas including video games, electronics, advertising, marketing, and IT services, both in the UK and internationally.

- In September 2023, Amazon launched an automated solution designed to assist sellers in efficiently shipping products worldwide. This innovation allows sellers to spend less time managing their supply chains and more time focusing on product development, customer satisfaction, and business growth.

- In April 2023, FedEx Corp. announced during its DRIVE Investor Event that it would streamline its operations by consolidating its companies into a single organization. This move aims to create efficiencies that will better address customer needs and ultimately strengthen the company’s profitability.

- In March 2023, Mahindra Logistics Limited (MLL), a provider of integrated logistics solutions, partnered with Ascendas-Firstspace, an industrial real estate developer, to establish a new one million square feet multi-client warehouse park in Talegaon, Pune. The development will be executed in three phases, with the first phase of 0.5 million square feet expected to become operational soon.

- In June 2022, Phonex Group announced its entry into Visakhapatnam Port, aiming to provide high-quality services that enhance efficiency and ensure the smooth delivery of products.

Logistics Outsourcing Market Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 1,085.5 Bn |

| Forecast Value (2033) |

USD 1,637.8 Bn |

| CAGR (2024-2033) |

4.7% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 256.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Supply Chain Management, Distribution Management, Material Management, Shipment Packaging, and Channel Management), By Transportation (Highway Transportation, Air Transportation, Sea Transportation, Railway Transportation), By End User (E-commerce, Automotive, Consumer packaged goods, Aerospace, and government, Food & beverages, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

United Parcel Service of America, Inc., Exel Logistics, XPO Logistics, Inc., A.P. Møller - Mærsk A/S, DHL International GmbH, Kuehne + Nagel International AG, Tibbett and Britten, FedEx Corporation, Deutsche Bahn AG, Nippon Express Co., Ltd., DSV A/S, SNCF Group, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |