Lubricant Additive Market Overview

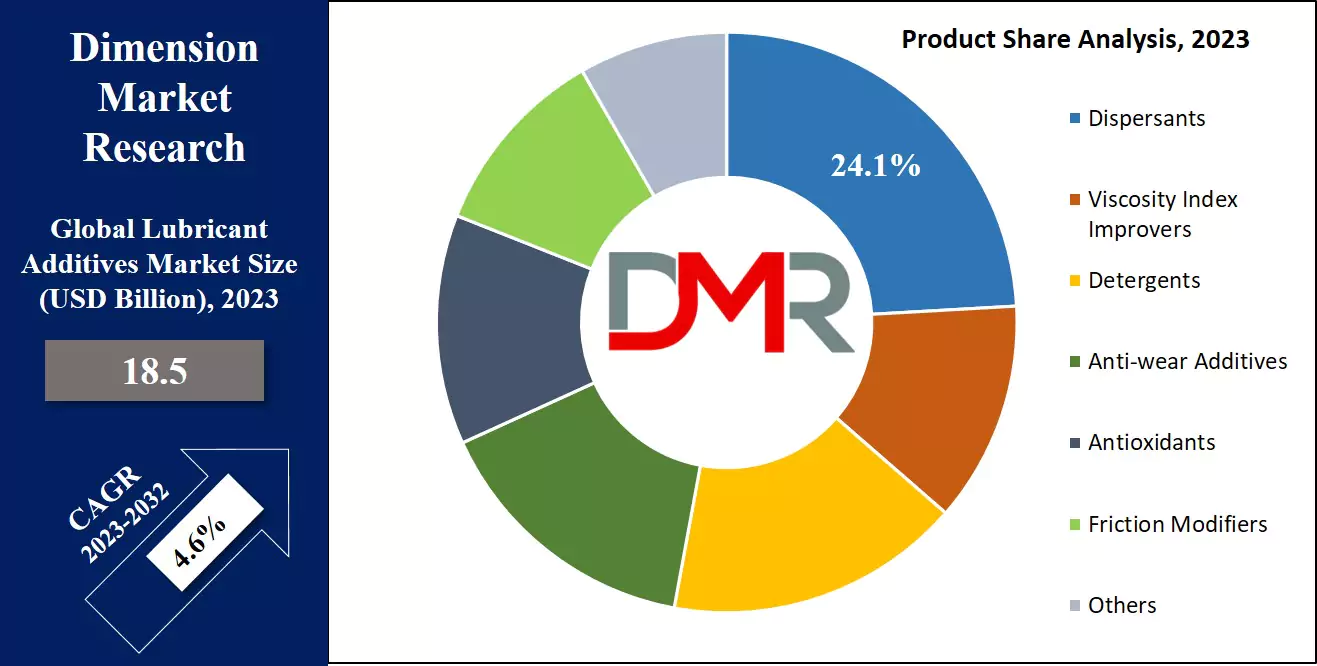

The Global Lubricant Additive Market is projected to hold a market value of USD 18.5 billion in 2023 and is further anticipated to reach a market value of USD 27.7 billion by 2032 at a CAGR of 4.6%.

The global lubricant additive market refers to the enterprise that is engaged in the production and distribution of chemical compounds that are designed to enhance the performance and properties of lubricants, which are ordinarily used to reduce friction in automobiles

These components are in the main used within the business and automotive sectors. Lubricant components are combined with base oil to improve their properties, such as better viscosity management, oxidation resistance, and anti-wear properties.

The lubricant additives industry is currently undergoing an unprecedented transformation driven by technological innovations and changing industrial practices. Automotive production saw a 6% surge to 85 million units by 2022.

Thus, generating demand for high-performance engine oil additives designed to increase efficiency and longevity of engine oil, as well as demand for

electric vehicles (EVs) sold in China, where sales reached 5.67 million units during 2022 this has spurred innovation of specialty additives designed specifically to manage thermal management and electrical conductivity within electric vehicle powertrains.

Sustainability has become a priority, with manufacturers investing in eco-friendly and bio-based lubricant additives. The food and beverage industries have an increasing consumer base, demanding food-grade lubricants that comply with stringent safety regulations. This was evident during India's food industry revenue peak of USD 866 billion in 2022, creating demand for NSF H1-certified additives as innovative, safe lubrication solutions were developed for food processing applications.

Lubricant Additive Market Key Takeaways

- Market Size & Share: Lubricant Additive Market is projected to hold a market value of USD 18.5 billion in 2023 and is further anticipated to reach a market value of USD 27.7 billion by 2032 at a CAGR of 4.6%.

- Product Analysis: In terms of product, dispersants dominate this market as they held a 24.1% market share in 2023

- Application Analysis: The automotive sector holds 63.4% of the market share in 2023.

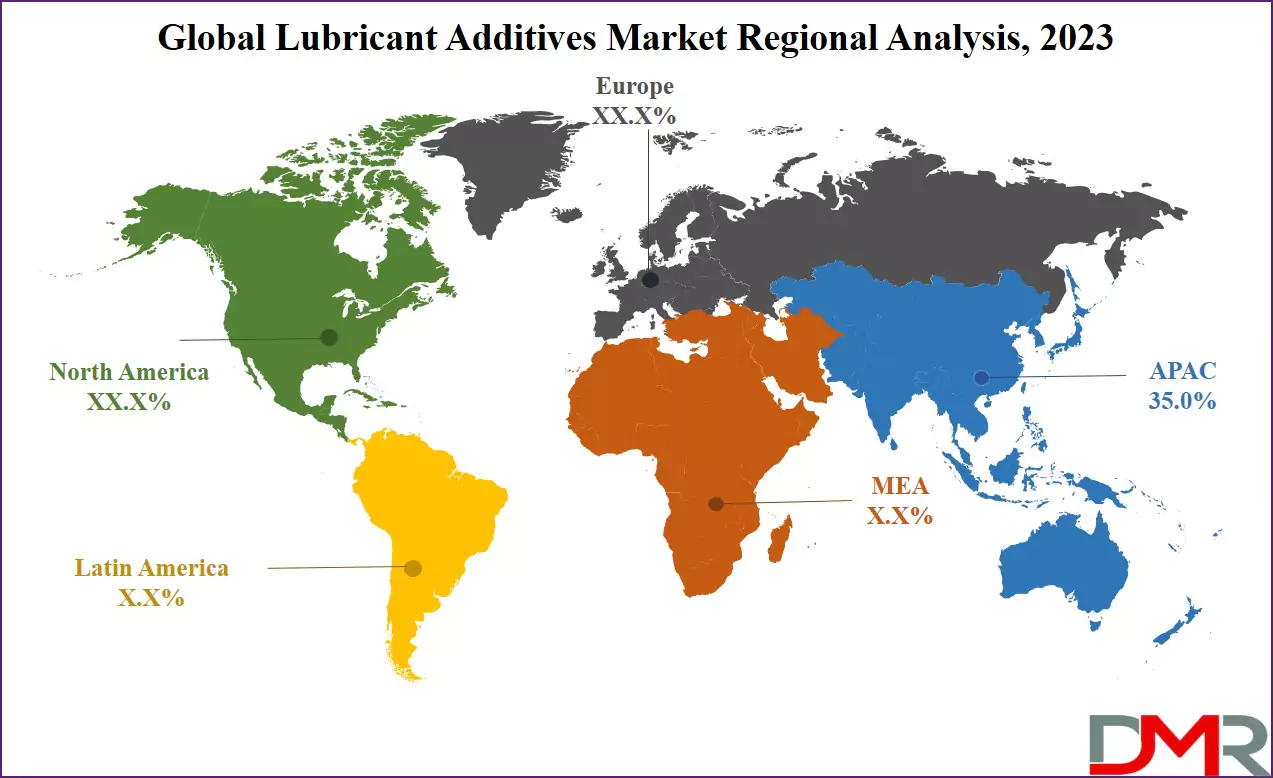

- Regional Analysis: The Asia-Pacific region not only emerged as the dominant consumer of lubricant additives but also dominated this market in manufacturing as it held 35.0% of the market share in 2023.

Lubricant Additive Market Use Cases

- Automotive Engine Oils: Lubricant additives enhance engine oil performance by providing anti-wear protection, friction reduction, and thermal stability. They help improve fuel efficiency, extend engine life, and reduce emissions, making them essential in modern passenger and commercial vehicles.

- Industrial Machinery & Equipment: In industrial applications, lubricant additives ensure smooth operation of machinery, compressors, and hydraulic systems by reducing oxidation, corrosion, and sludge formation. This enhances equipment durability, minimizing downtime and maintenance costs.

- Aviation & Aerospace Lubrication: Lubricant additives in the aviation sector enhance high-temperature stability, anti-wear properties, and oxidation resistance. They ensure optimal engine performance and safety, making them crucial for aircraft engines and hydraulic systems.

- Marine & Shipping Industry: Marine lubricants containing detergents, dispersants, and anti-corrosion additives help protect ship engines and propulsion systems from saltwater corrosion, oxidation, and heavy-duty wear, ensuring reliable performance in harsh marine environments.

Lubricant Additive Market Dynamics

In the prospect of this market, it's essential to recognize and adapt to the converting market dynamic. Companies need to adapt their strategies to the changing tendencies, as those factors determine which way the market will develop. The international lubricant additive market in general seeks to improve the efficiency and sturdiness of machinery & vehicles, which is the major driver behind the growing demand for high-performing lubricants.

New advances in this market, such as the development of more effective anti-wear agents, antioxidants, and friction modifiers, directly impact the growth of this market. Economic growth in various industries like automotive, manufacturing & construction influences the demand for lubricant additives. The expansion of these sectors creates more growth opportunities for this market.

As consumers are becoming more conscious about the environment and eco-friendly products, they are shifting their preference towards lubricants with biodegradable and sustainable additives. This shift in consumer preference influences the growth of the Global Lubricant Additive Market.

Lubricant Additive Market Research Scope and Analysis

By Product

In terms of product, dispersants dominate this market, holding a 24.1% market share in 2023 and are projected to continue growing in the upcoming years. The reason dispersants dominate this market is that they play a vital role in improving the performance and longevity of lubricants.

Dispersants are chemical compounds that is added to the lubricant to prevent the chemical reaction where they form harmful deposits and sludge. Dispersants work by keeping insoluble contaminants such as soot, oxidation products, and other impurities, finely suspended particles in the lubricant from sedimenting otherwise, this will cause engine failure.

By Application

The segmentation of the global lubricant additive market by application highlights various uses of lubricant additives in different sectors, where the automotive sector holds 63.4% of the market share in 2023 and is expected to show significant growth in the forthcoming years as well. In the automotive industry, based on their usage on different vehicles, lubricant additives are categorized as heavy-duty motor oil & passenger car motor oil. Heavy-duty motor oil is used on heavy-duty vehicles like trucks and buses whose engines are larger and more powerful.

These additives reduce friction, protect the engine, and ensure that the engine meets emission standards by controlling its carbon footprint. As for Passenger car motor oil, it is formulated for smaller and lighter vehicle engines like cars. This motor oil is formulated with specific lubricant additives that maintain engine efficiency and extend engine life. These lubricants also help to minimize carbon emissions in vehicles that align with the environmental standards set by the government.

The Global Lubricant Additive Market Report is segmented based on the following:

By Product

- Dispersants

- Viscosity Index Improvers

- Detergents

- Anti-wear Additives

- Antioxidants

- Friction Modifiers

- Others

By Application

- Automotive Lubricant

- Heavy Duty Motor Oil

- Passenger Car Motor Oil

- Others

How Does Artificial Intelligence Contribute To Improving the Lubricant Additive Market?

- Optimized Additive Formulation: AI-driven simulations analyze vast datasets to create advanced lubricant additive formulations that enhance efficiency, durability, and environmental sustainability. Machine learning helps develop low-emission and high-performance lubricants tailored to specific applications.

- Predictive Maintenance & Performance Monitoring: AI-powered sensors monitor lubricant condition in real-time, predicting degradation, contamination, and wear patterns. This proactive approach helps industries prevent machinery failures, reduce downtime, and extend equipment lifespan.

- Quality Control & Process Optimization: AI streamlines quality control in lubricant additive production, ensuring consistent performance and compliance with environmental and industry standards. Automated analysis detects anomalies early, reducing waste and improving efficiency.

- Customized Lubricant Solutions: AI enables data-driven lubricant customization by assessing operating conditions, temperature variations, and mechanical stress. This allows industries to fine-tune lubricants for specific applications, enhancing performance.

- Sustainability & Eco-Friendly Innovations: AI supports the development of biodegradable and energy-efficient lubricant additives by analyzing alternative raw materials and sustainable chemical compositions, helping reduce environmental impact.

Lubricant Additive Market Regional Analysis

Asia-Pacific region not only emerged as the dominant consumer of lubricant additives but also dominated this market in manufacturing as it held 35.0% of the market share in 2023. The reason behind the growth of this market is attributed to its continuous growth and engagement in the economic and industrial sectors.

Asia-Pacific harbors the largest and fastest-growing automobile industry, as this sector is a significant consumer of lubricant additives, especially

passenger cars, commercial vehicles, and two-wheelers. Major Asian countries like China, India, South Korea, and Japan act as prominent manufacturing hubs for lubricant additives. Many leading manufacturing companies have opened their production facilities in these countries as they offer cost-efficient labor and raw materials that cater to the growing demand for lubricant additives and give this market a new prospect to grow.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Lubricant Additive Market Competitive Landscape

The competitive landscape of the global lubricant components marketplace is marked by the aid of intense competition the various main players competing with each other to gain a competitive edge over others. The growth of this market is driven by multinational organizations, regional players, and startups. Multinational organizations like BASF SE and Infineum International Ltd dominate this industry as they provide an extensive variety of lubricant additives, fulfilling the needs of automotive and different manufacturing industries.

These groups are competing with each other to benefit from a competitive aspect in this market that is driven by the growing call for sustainable and fee-efficient merchandise. Continuous studies and development efforts are vital in this enterprise. Companies that put money into research and improvement create more increase opportunities and gain an area. The main key gamers in this market are BASF SE, LANXESS, Chevron Oronite Company, Croda International, Evonik Industries, Lubrizol Corporation, Tianhe Chemical Group, Hornett Brothers & Co. Ltd., MidContinental Chemical Co., and others.

Some of the prominent players in the Global Lubricant Additive Market are:

- BASF SE

- LANXESS

- Chevron Oronite Company

- Croda International

- Evonik Industries

- Lubrizol Corporation

- Tianhe Chemical Group

- Hornett Brothers & Co. Ltd.

- Midcontinental Chemical Co.

- Other Key Players

Recent Developments

- In February 2025, Univar Solutions acquired Brad-Chem Holdings, a UK-based leader in corrosion control products and lubricant additives. This acquisition strengthened Univar’s specialty chemicals portfolio and expanded its reach in high-performance lubricant solutions.

- In July 2025, Lubrication Engineers acquired SWEPCO, a well-established supplier of advanced lubricants and additives. The deal enhanced Lubrication Engineers’ product range and bolstered its market position in industrial lubrication solutions.

- In March 2025, D-A Lubricant Company™ acquired Crystal Packaging, a contract packager and blender of lubricants and specialty fluids. This move improved D-A’s blending and packaging capabilities while diversifying its service offerings.

- In July 2025, RelaDyne acquired Santie Oil Company, a fuel and lubricant distributor based in Missouri. The acquisition supported RelaDyne’s strategy to expand its distribution network and strengthen its footprint in the Midwest.

Lubricant Additive Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 18.5 Bn |

| Forecast Value (2032) |

USD 27.7 Bn |

| CAGR (2023-2032) |

4.6% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Dispersants, Viscosity Index Improvers, Detergents, Anti-wear Additives, Antioxidants, Friction Modifiers and Others), By Application (Automotive Lubricant and Industrial Lubricant) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

BASF SE, LANXESS, Chevron Oronite Company, Croda International, Evonik Industries, Lubrizol Corporation, Tianhe Chemical Group, Hornett Brothers & Co. Ltd., Midcontinental Chemical Co., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Lubricant Additive Market is projected to hold a market value of USD 18.5 billion in 2023 and

is further anticipated to reach a market value of USD 27.7 billion by 2032 at a CAGR of 4.6%.

Lubricant Additives are used to reduce friction in machines and automobiles.

Asia-Pacific region not only emerged as the dominant consumer of lubricant additives but also placed

itself first in manufacturing as it holds 35.0% of the market share in 2023.

The major key players in the Global Lubricant Additive Market are BASF SE, LANXESS, Chevron Oronite

Company, Croda International, Evonik Industries, Lubrizol Corporation, Tianhe Chemical Group, Hornett

Brothers & Co. Ltd., MidContinental Chemical Co., and others.