Market Overview

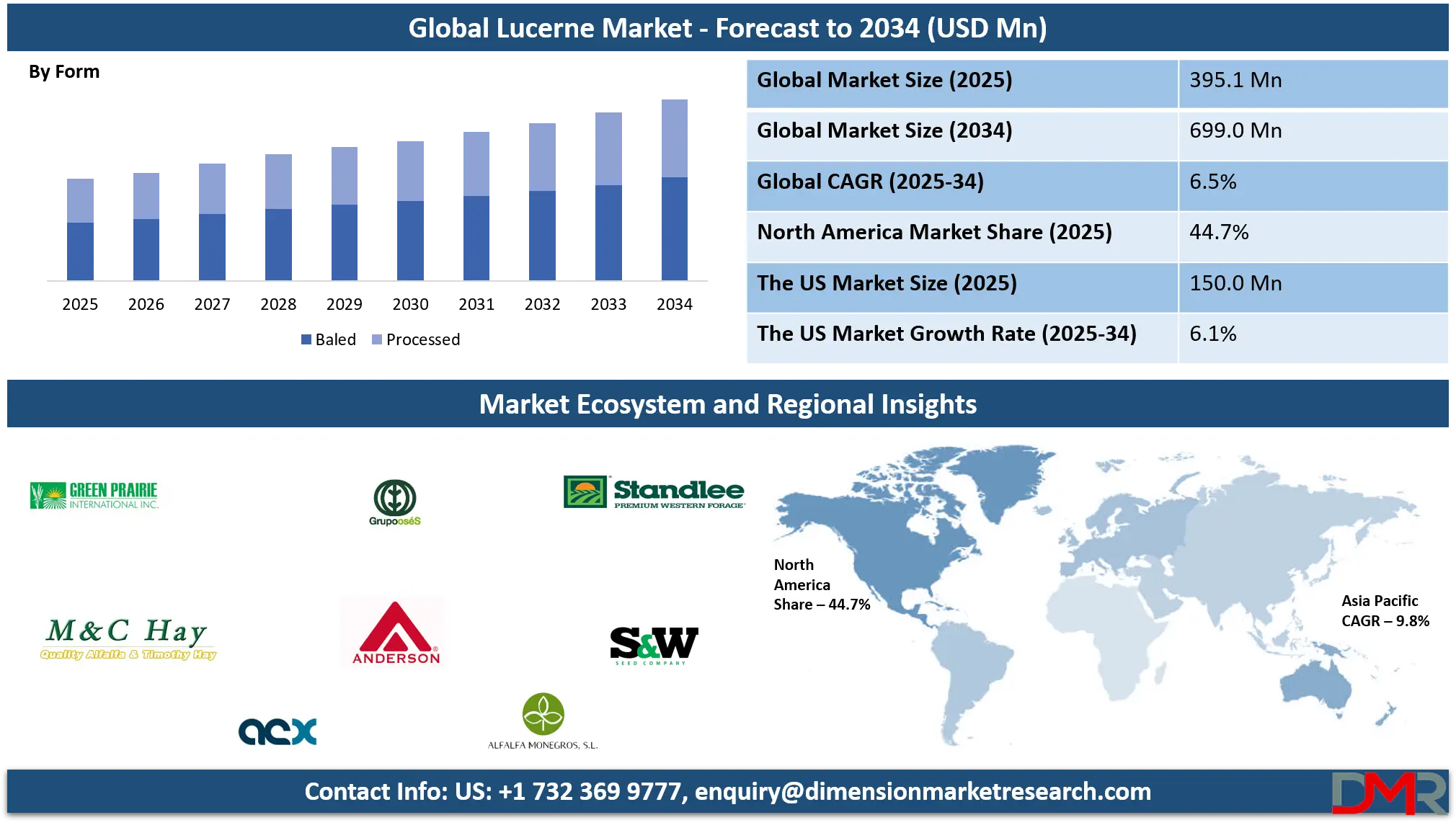

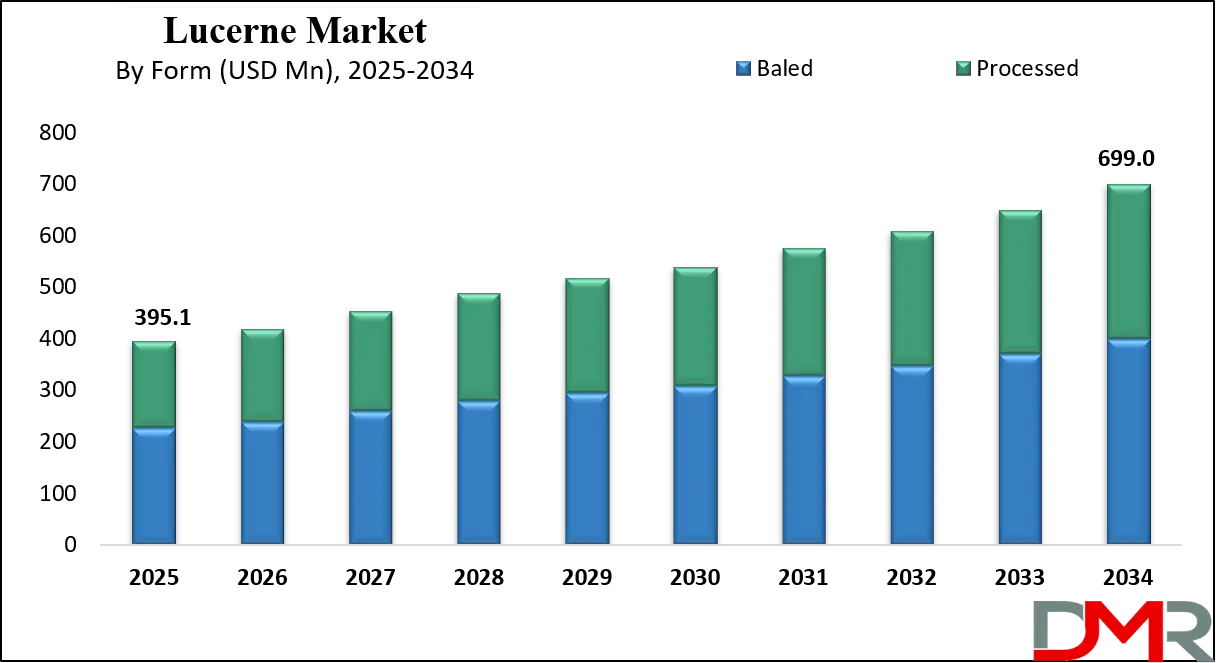

The Global Lucerne Market size is projected to reach USD 395.1 million in 2025 and grow at a compound annual growth rate of 6.5% to reach a value of USD 699.0 million in 2034.

Lucerne, also known as alfalfa, is a perennial leguminous forage crop widely cultivated for its high protein content, excellent digestibility, and rich mineral profile. It is commonly used as animal feed in various forms, including hay, pellets, cubes, and meal, to support the nutritional requirements of dairy cattle, beef cattle, horses, and small ruminants. Lucerne is valued for its deep root system and nitrogen-fixing ability, which enhance soil fertility and reduce the need for synthetic fertilizers. Its adaptability to varied climatic conditions and repeated harvesting cycles makes it one of the most important forage crops globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Market growth is driven by increasing demand for high-quality forage as livestock populations expand and dairy and meat production intensifies. Improvements in seed genetics, irrigation efficiency, and harvesting techniques have enhanced yield stability and nutritional quality. Supportive agricultural policies focused on sustainability and soil health have further encouraged adoption. The market has gradually shifted from conventional baled hay toward processed and value-added formats, indicating rising specialization and maturity.

Recent market evolution includes increased investment in processing facilities, the growth of export-focused production centers, and enhanced logistics for pelleted and compressed lucerne products. Collaboration among growers, feed manufacturers, and exporters has strengthened supply chains and improved consistency. At the same time, rising emphasis on traceability, quality assurance, and phytosanitary compliance is transforming trade practices, positioning lucerne as a premium forage commodity in global markets.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

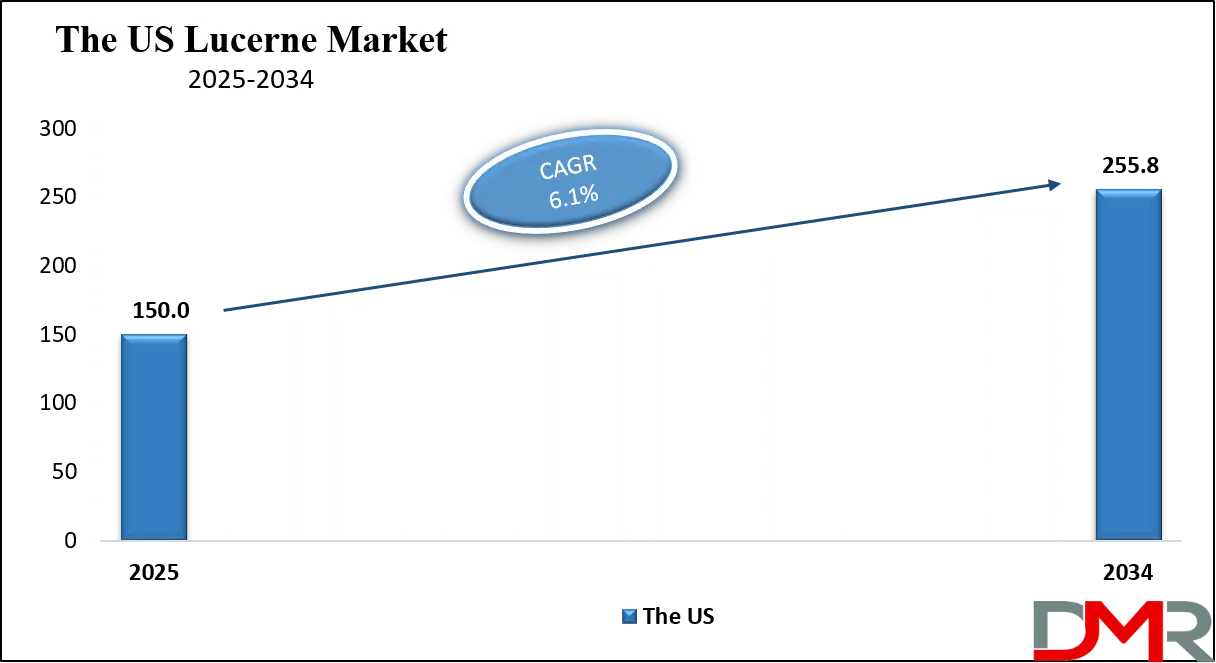

The US Lucerne Market

The US Lucerne Market size is projected to reach USD 150.0 million in 2025 at a compound annual growth rate of 6.1% over its forecast period.

The United States represents one of the most established lucerne markets globally, supported by extensive acreage, advanced mechanization, and a strong dairy and beef industry base. The presence of large commercial farms and integrated feed manufacturers drives consistent demand for both baled and processed lucerne products. Federal and state-level agricultural support programs, irrigation infrastructure, and research-backed seed innovation further enhance productivity. Export-oriented production, particularly to Asia and the Middle East, has strengthened the market’s resilience. Additionally, sustainability-focused farming practices and soil conservation initiatives continue to reinforce lucerne’s role in US forage systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Lucerne Market

Europe Lucerne Market size is projected to reach USD 98.8 million in 2025 at a compound annual growth rate of 6.4% over its forecast period.

Europe’s Lucerne market is shaped by sustainability-driven agricultural policies and a strong emphasis on reducing dependency on imported protein feed. Regional regulations promoting crop rotation, soil health, and low-emission livestock systems have accelerated lucerne cultivation. The European Green Deal has indirectly supported lucerne adoption due to its nitrogen-fixing properties and reduced fertilizer requirements. France, Spain, and Italy lead production, while Central and Eastern Europe show rising adoption. Processed lucerne formats are gaining traction due to space efficiency and export suitability, supporting steady innovation and modernization across the region.

Japan Lucerne Market

Japan Lucerne Market size is projected to reach USD 19.8 million in 2025 at a compound annual growth rate of 6.7% over its forecast period.

Japan’s lucerne market is largely import-dependent, driven by limited arable land and high-quality feed requirements for dairy and beef cattle. Demand is concentrated in premium forage imports, particularly dehydrated pellets and cubes that meet strict quality and phytosanitary standards. Government support for livestock productivity, coupled with a focus on feed efficiency, sustains market demand. Challenges include high import costs and supply chain vulnerability, but opportunities exist through long-term supply agreements and quality differentiation. Urbanization and technological integration in livestock farming continue to support stable consumption patterns.

Lucerne Market: Key Takeaways

- Market Growth: The Lucerne Market size is expected to grow by USD 280.7 million, at a CAGR of 6.5%, during the forecasted period of 2026 to 2034.

- By Form: The baled segment is anticipated to get the majority share of the Lucerne Market in 2025.

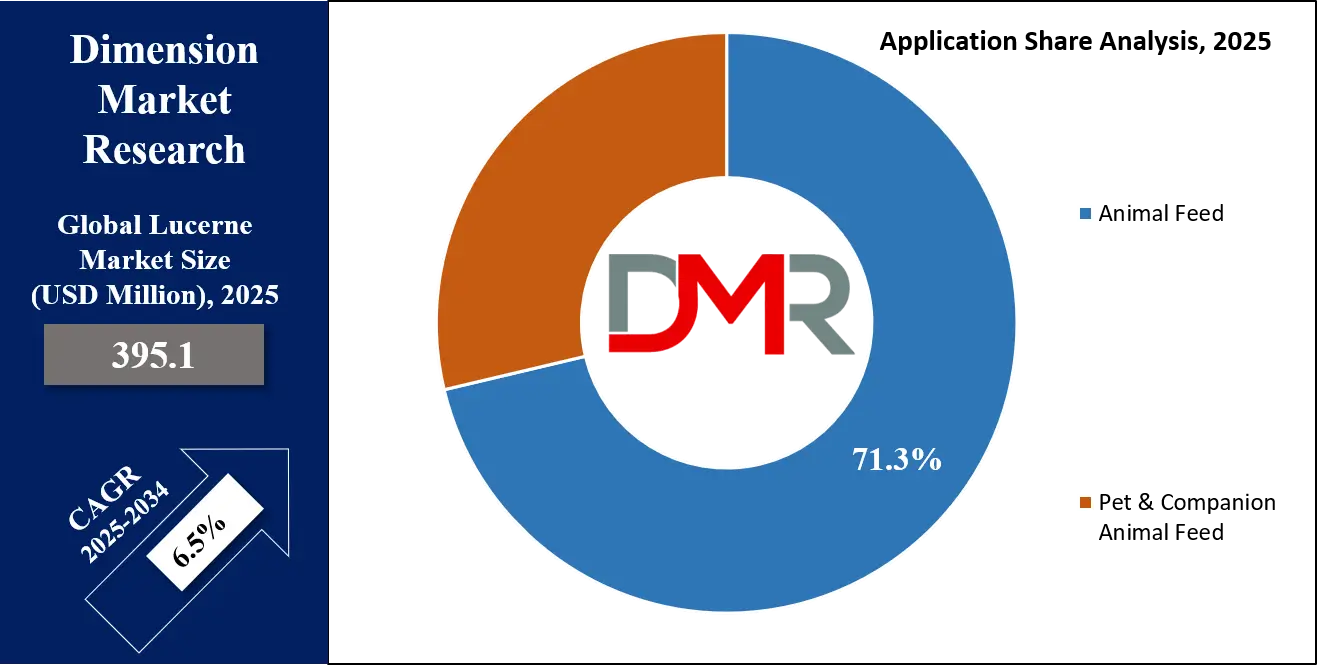

- By Application: The animal feed segment is expected to get the largest revenue share in 2025 in the Lucerne Market.

- Regional Insight: North America is expected to hold a 44.7% share of revenue in the Global Lucerne Market in 2025.

- Use Cases: Some of the use cases of Lucerne include dairy nutrition, equine feed and more.

Lucerne Market: Use Cases

- Dairy Nutrition: Lucerne provides high protein and fiber, supporting milk yield and animal health in dairy cattle.

- Equine Feed: Its digestibility and mineral profile make it suitable for performance and breeding horses.

- Export Forage Supply: Processed lucerne pellets and cubes are widely used in forage-deficit regions.

- Soil Health Management: Lucerne is used in crop rotations to improve soil fertility and structure.

Stats & Facts

- US Department of Agriculture reported over 16 million hectares under lucerne cultivation in 2024, maintaining stable output levels.

- Eurostat indicated that lucerne and forage legumes contributed nearly 18% of total EU forage crop output in 2024.

- Ministry of Agriculture, Forestry and Fisheries Japan recorded forage import volumes exceeding 2.5 million metric tons in 2024.

- Food and Agriculture Organization highlighted a 6.2% increase in global forage trade value between 2023 and 2025.

- Australian Bureau of Agricultural and Resource Economics noted lucerne export growth of 8.1% in 2024–2025.

Market Dynamic

Driving Factors in the Lucerne Market

Rising Demand for High-Quality Forage

Increasing livestock intensification has heightened demand for nutritionally dense and consistent forage across commercial farming systems. Lucerne’s high protein concentration, superior fiber quality, and digestibility make it a preferred choice for dairy, beef, and equine nutrition. As producers focus on improving feed conversion efficiency, milk yield, and weight gain, lucerne delivers measurable performance benefits. In addition, growing awareness of balanced rations and forage-based feeding programs, supported by advisory services and feed formulation advancements, continues to drive adoption across both developed and emerging livestock regions.

Sustainability and Soil Health Benefits

Lucerne’s nitrogen-fixing capability significantly reduces reliance on synthetic fertilizers, supporting environmentally responsible farming practices. Governments and agricultural organizations increasingly promote crops that improve soil structure, enhance microbial activity, and increase biodiversity. This environmental value has positioned lucerne as a strategic crop within regenerative and conservation-based farming systems. Its perennial growth habit also helps reduce soil erosion, improve water retention, and stabilize yields over multiple seasons, reinforcing its long-term agronomic and economic appeal.

Restraints in the Lucerne Market

High Production and Processing Costs

Lucerne cultivation requires substantial upfront investment in irrigation systems, harvesting machinery, and post-harvest drying or dehydration infrastructure. Weather dependency during cutting and curing phases increases operational uncertainty and potential yield losses. Energy-intensive processing, particularly for pellets and cubes, further elevates production costs. These financial and operational challenges can limit scalability for small and medium producers and discourage new entrants, especially in regions facing high energy prices or water scarcity.

Logistical and Storage Challenges

The bulky nature and moisture sensitivity of lucerne complicate storage, handling, and transportation. Inadequate storage conditions can result in mold growth, nutrient degradation, and reduced feed quality. Export-oriented supply chains face additional hurdles related to strict phytosanitary regulations, fumigation requirements, and rising freight costs. These logistical constraints can impact delivery timelines, reduce competitiveness in international trade, and increase overall supply chain risk.

Opportunities in the Lucerne Market

Expansion of Export-Oriented Production

Growing forage shortages in regions such as Asia and the Middle East are creating strong demand for imported lucerne products. Investments in compression technology, pelleting facilities, and port-based infrastructure enable producers to supply distant markets efficiently. Long-term supply agreements with overseas buyers and adherence to quality and safety standards further strengthen export potential. This export-driven growth offers opportunities for producers to diversify revenue streams and reduce reliance on domestic demand cycles.

Value-Added Processed Products

Rising preference for processed lucerne products such as pellets, cubes, and meal presents significant opportunities for value creation. These formats offer advantages including ease of transport, precise nutrient delivery, and extended shelf life. Demand is increasing from commercial feed manufacturers, equine facilities, and companion animal segments. Ongoing innovation in processing efficiency, packaging solutions, and customized formulations supports product differentiation and higher margins across the value chain.

Trends in the Lucerne Market

Shift Toward Processed Formats

Processed lucerne products are gaining momentum due to improved handling efficiency, reduced storage space requirements, and consistent nutritional quality. This shift reflects evolving buyer preferences, particularly among large-scale livestock operations and export markets. The trend is encouraging investment in modern processing facilities and automation technologies. As logistics and quality consistency become increasingly important, processed formats are expected to account for a growing share of overall demand.

Traceability and Quality Certification

Demand for certified and traceable lucerne is rising, especially in premium dairy, equine, and export-focused markets. Buyers are increasingly seeking assurance related to origin, nutrient composition, and compliance with safety standards. Quality certification programs, supported by digital tracking and data management systems, are becoming integral to supply chains. This trend enhances transparency, strengthens buyer confidence, and supports long-term supplier relationships.

Impact of Artificial Intelligence in Lucerne Market

- Precision Farming: Artificial Intelligence-driven analytics optimize irrigation, fertilization, and harvesting schedules.

- Yield Prediction: Machine learning models forecast crop yields and quality outcomes.

- Supply Chain Optimization: AI improves logistics planning and inventory management.

- Quality Assessment: Image recognition tools detect moisture levels and contamination risks.

- Market Forecasting: AI enhances demand forecasting and pricing strategies.

Research Scope and Analysis

By Product Type Analysis

Lucerne hay remains the dominant product type, accounting for 52.4% share in 2025, largely due to its extensive use in dairy and beef cattle feeding systems. Its low processing requirements, cost efficiency, and long-standing familiarity among farmers sustain strong demand across major producing regions. Lucerne hay is widely preferred for on-farm consumption and regional trade, particularly in areas with established storage, baling, and transportation infrastructure.

Advances in harvesting methods, improved baling technology, and better moisture management have enhanced product consistency and reduced spoilage risks. Despite the growing availability of processed alternatives, lucerne hay continues to anchor overall volume because of its versatility, availability, and direct nutritional benefits.

Lucerne pellets represent the fastest-growing product type, driven by increasing export demand and the need for space-efficient, easy-to-handle forage solutions. Their standardized nutrient composition, low moisture content, and extended shelf life make them highly suitable for commercial feed manufacturing and long-distance transportation. Pellets are increasingly used in equine nutrition, pet food formulations, and intensive livestock operations where precision feeding is required.

Urbanization and limited storage capacity in import-dependent regions further support pellet adoption. Additionally, advancements in pelleting technology and packaging have improved product durability and quality retention, positioning lucerne pellets as a high-growth segment within the overall product landscape.yes

By Livestock Type Analysis

Dairy cattle account for the largest share of lucerne consumption, holding 38.6% of total demand in 2025, driven by the crop’s high protein content and digestible fiber that support milk yield and quality. Lucerne is a core component of dairy rations due to its positive impact on rumen function and feed efficiency. Large commercial dairies rely heavily on lucerne hay and pellets for consistent nutritional performance throughout production cycles. Rising global demand for milk and dairy products, combined with nutrition-focused herd management practices, continues to reinforce the dominance of this segment.

The equine segment is the fastest-growing livestock category, supported by increased investment in performance horses, leisure riding, and breeding operations. Lucerne is valued in equine diets for its palatability, mineral balance, and digestibility. Processed forms such as pellets and cubes are preferred for dust reduction and controlled feeding. Growth is particularly strong in developed regions with rising demand for premium equine nutrition products.

By Form Analysis

Baled lucerne represents the leading form, accounting for 57.1% of total volume in 2025, due to its affordability and suitability for on-farm feeding. Small, large square, and round bales are widely used across dairy and beef operations, particularly in producing regions with established handling equipment. Baled lucerne offers flexibility in feeding practices and minimal processing requirements. Improvements in baling density, wrapping materials, and moisture control have enhanced storage life and quality retention. Despite increasing interest in processed forms, baled lucerne remains dominant due to widespread availability and cost advantages.

Processed lucerne, including pellets, cubes, and meal, is the fastest-growing form, driven by export demand and precision feeding systems. These formats offer consistent nutritional profiles, extended shelf life, and reduced transport costs. Adoption is strongest in regions with limited storage space or strict quality requirements.

By Application Analysis

Animal feed remains the dominant application segment, accounting for 71.3% of total usage in 2025, supported by extensive use of lucerne as both forage feed and nutritional supplementation. Its protein-rich composition improves livestock productivity across dairy, beef, and small ruminants. Lucerne is widely incorporated into total mixed rations to enhance fiber balance and intake efficiency. Rising livestock intensification and growing demand for feed efficiency continue to sustain this segment’s leadership.

Pet and companion animal feed is the fastest-growing application, particularly in equine and specialty pet nutrition. Lucerne is increasingly used in premium formulations due to its natural fiber and plant-based protein profile. Growth is strongest in urban and high-income regions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Distribution Channel Analysis

Direct sales account for 44.8% of total distribution in 2025, making it the leading channel for lucerne products. Large farms and commercial buyers prefer direct sourcing to ensure quality consistency, supply reliability, and pricing transparency. This channel supports bulk purchasing and long-term contracts while reducing intermediary costs. Direct relationships also enable customized product specifications, particularly for export-oriented buyers.

Online channels are the fastest-growing distribution segment, driven by increasing digital adoption in agricultural trade. Standardized packaging and improved logistics have supported rapid growth, especially among smaller buyers.

By End User Analysis

Commercial livestock farms dominate lucerne consumption, accounting for 49.5% of total demand in 2025. These operations require consistent, high-volume forage inputs to sustain intensive dairy and meat production systems. Bulk procurement, integrated feeding programs, and focus on productivity reinforce reliance on lucerne. Adoption of modern nutrition management practices further strengthens this segment’s leadership.

Feed manufacturers represent the fastest-growing end-user segment, supported by rising demand for formulated feeds and value-added nutrition products. Increased incorporation of lucerne pellets and meal into compound feeds continues to drive growth.

The Lucerne Market Report is segmented on the basis of the following:

By Product Type

- Lucerne Hay

- Lucerne Pellets

- Lucerne Cubes

- Lucerne Meal

By Livestock Type

- Dairy Cattle

- Beef Cattle

- Equine

- Sheep & Goats

- Others

By Form

- Baled

- Small Bales

- Large Square Bales

- Round Bales

- Processed

By Application

- Animal Feed

- Forage Feed

- Nutritional Supplement

- Pet & Companion Animal Feed

By Distribution Channel

- Direct Sales

- Distributors & Traders

- Retail Feed Stores

- Online Channels

By End User

- Commercial Livestock Farms

- Feed Manufacturers

- Export Buyers

- Individual Farmers

Regional Analysis

Leading Region in the Lucerne Market

North America remains the leading region in the lucerne sector, accounting for 44.7% of global share in 2025, supported by extensive cultivation acreage, advanced farming practices, and a strong livestock industry base. The United States plays a central role due to large-scale dairy and beef operations, high mechanization levels, and well-developed irrigation infrastructure. Strong domestic consumption is complemented by a robust export network supplying Asia and the Middle East. Government-backed agricultural research, improved seed varieties, and sustainability-focused practices further strengthen regional output. The presence of efficient logistics, processing facilities, and quality assurance systems continues to reinforce North America’s dominant position.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Lucerne Market

Asia-Pacific is the fastest-growing region, driven by rising livestock populations, increasing protein consumption, and widening forage deficits across key economies. Rapid growth in dairy and beef production in countries such as China, Japan, and South Korea has increased dependence on imported lucerne products. Urbanization, limited arable land, and constrained domestic forage production further accelerate demand for pellets and cubes. Government initiatives aimed at improving livestock productivity and feed efficiency also support growth. Expanding trade partnerships with major exporting regions and investments in port and storage infrastructure position Asia-Pacific as a key growth engine through the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The lucerne market is characterized by moderate entry barriers due to land, water, and processing requirements. Market participants focus on yield optimization, cost efficiency, and quality differentiation rather than price competition alone. Strategic investments in processing facilities, export logistics, and certification programs strengthen competitive positioning. Long-term supply agreements, vertical integration, and R&D in seed varieties and drying technologies are common strategies used to sustain market presence and expand regional reach.

Some of the prominent players in the global Lucerne are:

- Anderson Hay & Grain Co.

- ACX Global

- Alfalfa Monegros

- Haykingdom

- S&W Seed Company

- Cubeit Hay Company

- M&C Hay

- Standlee Premium Western Forage

- Border Valley Trading

- Gruppo Carli

- Bailey Farms

- Aldahra Fagavi

- Grupo Osés

- Huishan Dairy

- Green Prairie International

- Hay USA Inc.

- Knight AG Sourcing

- Western Alfalfa Milling Co.

- SL Follen Company

- Sacate Pellet Mills

- Other Key Players

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 395.1 Mn |

| Forecast Value (2034) |

USD 699.0 Mn |

| CAGR (2025–2034) |

6.5% |

| The US Market Size (2025) |

USD 150.0 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Lucerne Hay, Lucerne Pellets, Lucerne Cubes, Lucerne Meal), By Livestock Type (Dairy Cattle, Beef Cattle, Equine, Sheep & Goats, and Others), By Form (Baled and Processed), By Application (Animal Feed and Pet & Companion Animal Feed), By Distribution Channel (Direct Sales, Distributors & Traders, Retail Feed Stores, and Online Channels), By End User (Commercial Livestock Farms, Feed Manufacturers, Export Buyers, and Individual Farmers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Anderson Hay & Grain Co., ACX Global, Alfalfa Monegros, Haykingdom, S&W Seed Company, Cubeit Hay Company, M&C Hay, Standlee Premium Western Forage, Border Valley Trading, Gruppo Carli, Bailey Farms, Aldahra Fagavi, Grupo Osés, Huishan Dairy, Green Prairie International, Hay USA Inc., Knight AG Sourcing, Western Alfalfa Milling Co., SL Follen Company, Sacate Pellet Mills, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Lucerne Market?

▾ The Global Lucerne Market size is expected to reach USD 395.1 million by 2025 and is projected to reach USD 499.0 million by the end of 2034.

Which region accounted for the largest Global Lucerne Market?

▾ North America is expected to have the largest market share in the Global Lucerne Market, with a share of about 44.7% in 2025.

How big is the Lucerne Market in the US?

▾ The US Lucerne market is expected to reach USD 150.0 million by 2025.

Who are the key players in the Lucerne Market?

▾ Some of the major key players in the Global Lucerne Market include M&C Hay, Anderson Hay, Alfalfa, and others

What is the growth rate in the Global Lucerne Market?

▾ The market is growing at a CAGR of 6.5 percent over the forecasted period.