Market Overview

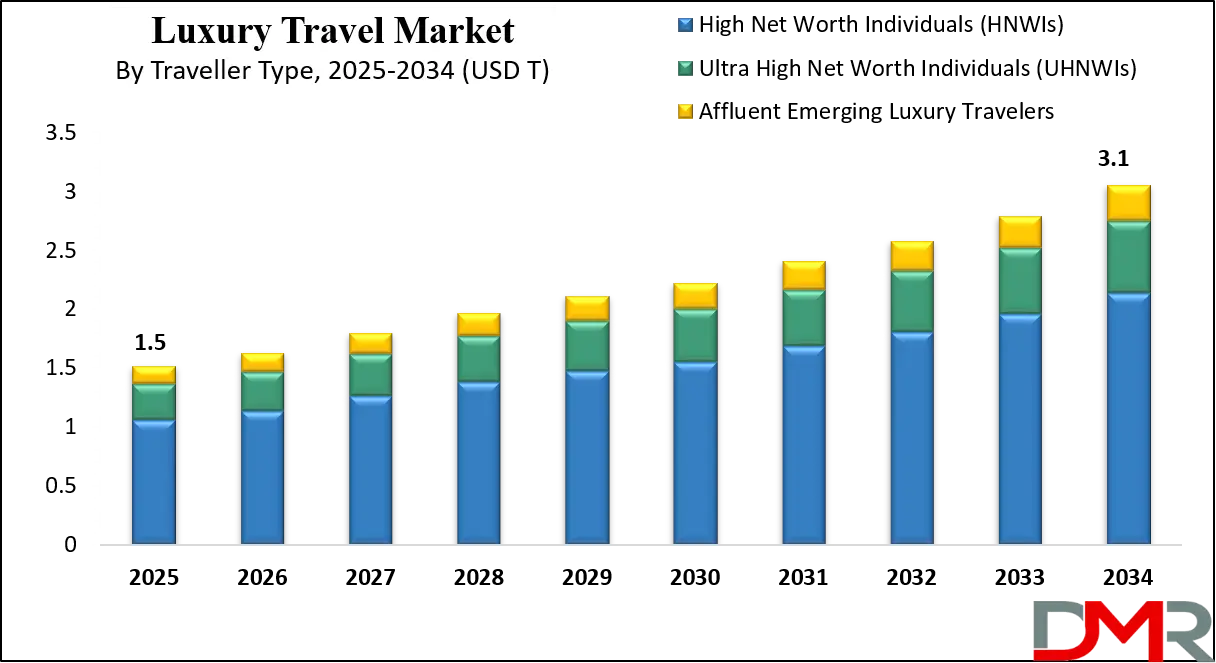

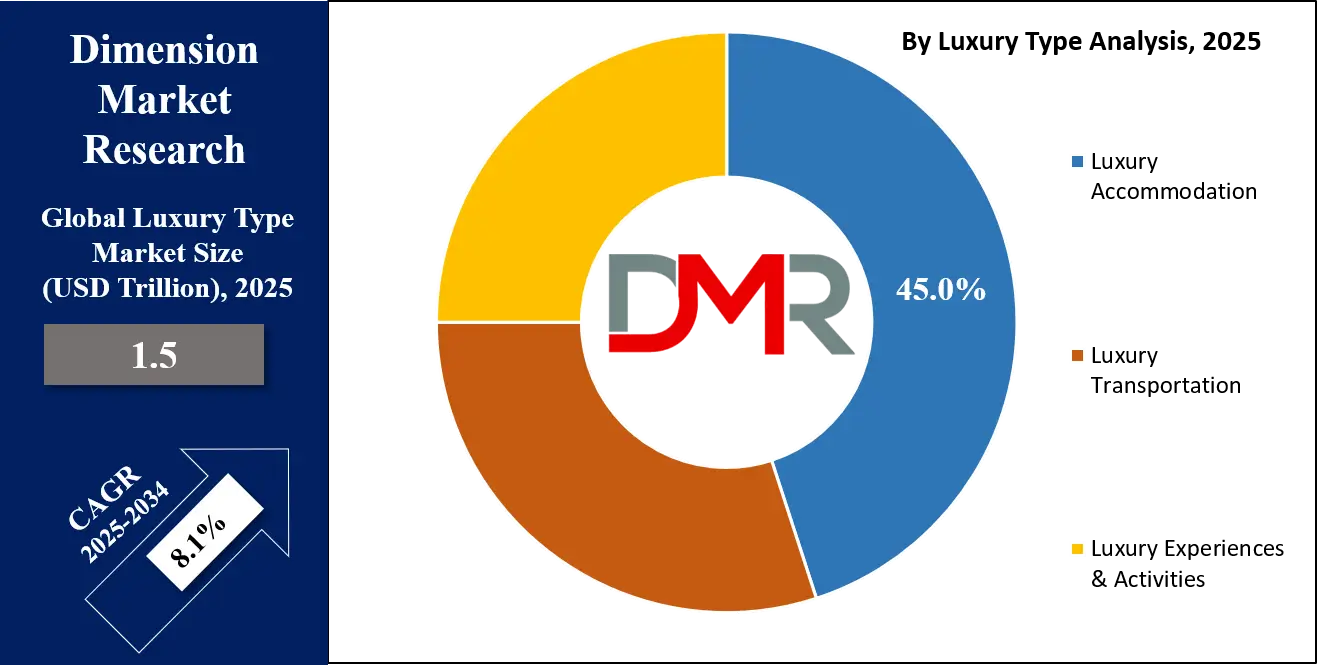

The Global Luxury Travel Market is projected to reach USD 1.5 trillion in 2025 and is expected to grow at a CAGR of 8.1%, hitting USD 3.1 trillion by 2034. Driven by rising HNWI populations, demand for personalized travel experiences, and growth in luxury tourism services, the market continues to expand across segments such as luxury accommodations, bespoke tours, private aviation, and ultra-luxury cruises.

Luxury travel refers to high-end, exclusive travel experiences that prioritize personalized service, premium comfort, and exceptional quality at every stage of the journey. It is characterized by bespoke itineraries, private transportation, upscale accommodations, gourmet dining, and access to unique and culturally rich experiences that are often unavailable to the general public.

Luxury travelers seek more than just opulence; they value authenticity, privacy, and the ability to immerse themselves in destinations in a refined and meaningful way. From private island escapes to curated heritage tours and ultra-luxury cruises, this segment appeals to affluent individuals who place a premium on time, service excellence, and distinctive travel experiences.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global luxury travel market represents a dynamic and expanding segment of the luxury travel industry, driven by rising disposable incomes, growing numbers of high-net-worth individuals, and a growing appetite for experiential and meaningful travel. Unlike traditional tourism, luxury travel is defined by a deeper level of exclusivity and personalization.

Destinations across Europe, North America, and the Asia-Pacific region are particularly popular, offering a blend of iconic landmarks, cultural richness, and luxurious infrastructure that caters to sophisticated tastes. The market is also shaped by trends like sustainable luxury, where affluent travelers opt for eco-conscious experiences without compromising on comfort and elegance.

Technological advancements and digital platforms are playing a pivotal role in transforming the luxury travel landscape, enabling seamless booking experiences and the customization of travel packages through AI and big data. Luxury travel agencies, concierge services, and high-end hospitality brands are leveraging these tools to curate immersive journeys that go beyond conventional itineraries. Whether it’s a stay in a heritage palace converted into a boutique hotel or an expedition to a remote location with every amenity in tow, technology is helping tailor experiences that meet the nuanced demands of the luxury segment.

Additionally, changing consumer behavior post-pandemic has heightened demand for privacy, wellness travel, and off-the-beaten-path destinations, further fueling innovation in the luxury travel ecosystem. Ultra-luxury options like private jet charters, secluded villas, and personalized wellness retreats are witnessing a surge in popularity. The global luxury travel market is evolving rapidly, as it balances the expectations of traditional elite clientele with the preferences of a younger, experience-driven generation of affluent travelers seeking transformational and indulgent journeys.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Luxury Travel Market

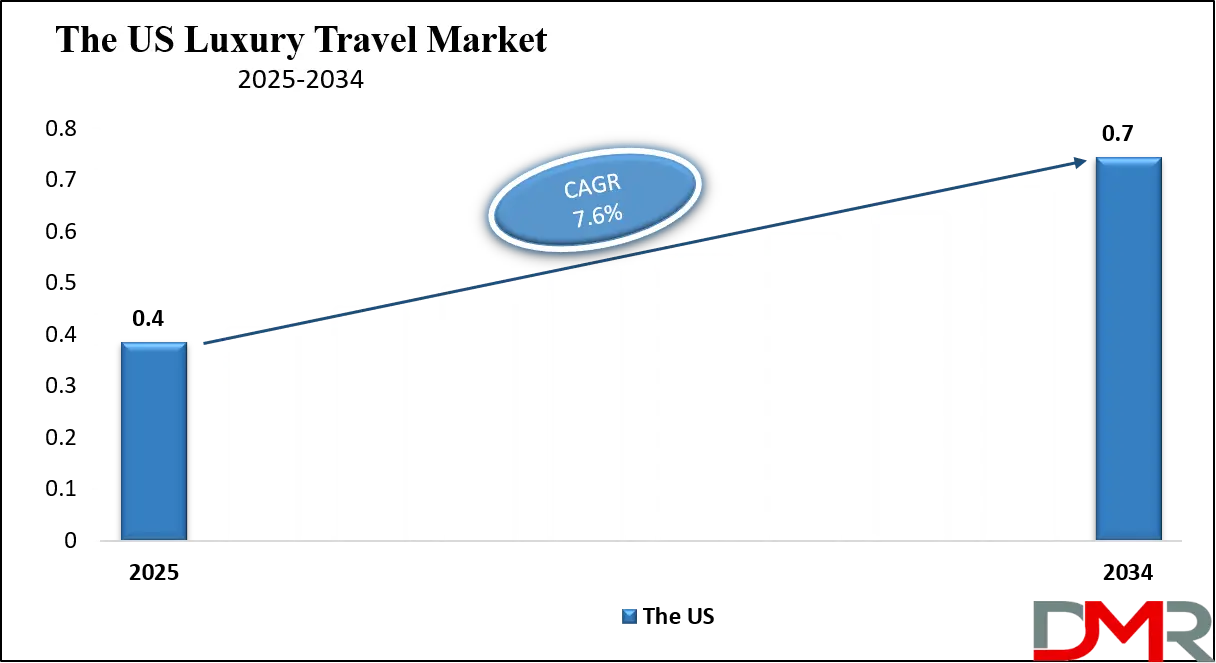

The U.S. Luxury Travel Market size is projected to be valued at USD 0.4 trillion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 0.7 trillion in 2034 at a CAGR of 7.6%.

The U.S. luxury travel market stands as a benchmark for premium travel experiences, driven by a blend of high-net-worth individuals, sophisticated preferences, and an evolving appetite for bespoke, immersive journeys. American luxury travelers seek more than opulence, they pursue curated experiences that offer privacy, exclusivity, and deep cultural or emotional resonance. This demand fuels growth across segments like private jet charters, luxury safari tours, and exclusive wellness retreats. Personalized service, seamless itineraries, and high-end accommodations, ranging from heritage resorts to designer boutique hotels, form the core of the U.S. luxury travel ecosystem.

Additionally, the prominence of ultra-luxury cruise lines and experiential getaways in remote or off-the-grid locations reflects the rising inclination toward transformational travel rather than traditional indulgence.

Luxury travel providers in the U.S. are focused on integrating sustainability and authenticity into their offerings. Eco-luxury resorts, green aviation solutions, and culturally immersive travel are gaining traction among affluent consumers who value purpose alongside comfort. Technology plays a vital role, with AI-driven personalization and mobile concierge services becoming standard in tailoring luxury itineraries.

Moreover, niche trends like culinary travel, art-focused trips, and adventure-based luxury tours continue to reshape the expectations of elite travelers. The U.S. market’s emphasis on individuality, premium service quality, and innovation positions it as a global leader in high-end travel, influencing trends across the international luxury tourism industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Luxury Travel Market

Europe luxury travel market is projected to reach an estimated value of USD 405 billion in 2025. The region’s dominance is anchored in its rich cultural heritage, world-renowned landmarks, and an extensive network of luxury accommodations, fine dining, and high-end experiences. Countries like France, Italy, Switzerland, the UK, and Spain continue to attract affluent travelers seeking immersive cultural journeys, gourmet tourism, fashion-forward city breaks, and picturesque countryside escapes. Europe's long-standing reputation for refined hospitality and its seamless integration of historical charm with modern luxury services position it as a key pillar in the global luxury tourism ecosystem.

With an expected CAGR of 7.5% from 2025 to 2034, Europe is poised for steady growth in this market segment. This upward trajectory is being driven by a growing demand for sustainable and experiential luxury travel, as well as the rising influence of Gen Z and Millennial HNWIs who prioritize authenticity, exclusivity, and wellness in their travel preferences.

Additionally, Europe is benefiting from increased intra-regional travel, the development of luxury rail experiences, and investment in eco-luxury resorts and heritage restorations. Strategic partnerships between local tourism boards and luxury travel operators are also fostering bespoke experiences that cater to evolving expectations of high-end travelers, ensuring Europe remains a magnet for luxury tourism well into the next decade.

The Japan Luxury Travel Market

Japan luxury travel market is projected to be valued at approximately USD 25 billion in 2025. This relatively modest share reflects a focused yet high-potential segment, driven by Japan’s unique cultural appeal, exceptional service standards, and growing inbound tourism. Cities like Tokyo and Kyoto are global magnets for luxury travelers seeking a mix of ancient traditions and futuristic experiences, while rural retreats such as Hakone, Niseko, and Okinawa offer exclusive escapes with premium onsen resorts and nature-centric luxury. The Japanese philosophy of omotenashi (deep-rooted hospitality) further enhances the country’s value proposition for high-net-worth individuals looking for thoughtful, detail-oriented travel experiences.

With a projected CAGR of 9.2% from 2025 to 2034, Japan is one of the fastest-growing luxury travel markets globally. This robust growth is fueled by growing demand from Asia-Pacific travelers, favorable government initiatives promoting high-end tourism, and rising interest in wellness, culinary, and cultural tourism. Japan’s investments in premium hospitality infrastructure ahead of global events and its strategic efforts to attract affluent tourists from China, South Korea, the U.S., and Europe are paying off.

Moreover, the country’s focus on sustainability, luxury rail travel (e.g., Shiki-shima), and personalized experiences is positioning it as a top destination for both traditional and contemporary luxury travelers seeking depth, privacy, and authenticity.

Global Luxury Travel Market: Key Takeaways

- Market Value: The global luxury travel market size is expected to reach a value of USD 3.1 trillion by 2034 from a base value of USD 1.5 trillion in 2025 at a CAGR of 8.1%.

- By Travel Purpose Segment Analysis: Leisure & Vacation purpose is poised to consolidate its dominance in the travel purpose segment, capturing 70.0% of the total market share in 2025.

- By Luxury Type Segment Analysis: Luxury Accommodations are expected to dominate the luxury type segment, capturing 45.0.0% of the total market share in 2025.

- By Traveler Type Segment Analysis: High Net Worth Individuals (HNWIs) are anticipated to maintain their dominance in the traveler type segment, capturing 70.0% of the total market share in 2025.

- By Destination Type: Urban Luxury Destinations will lead the destination type segment, capturing 50.0% of the market share in 2025.

- By Booking Channel Segment Analysis: Travel Agencies & Luxury Tour Operators are projected to lead the booking channel segment, capturing 50.0% of the total market share in 2025.

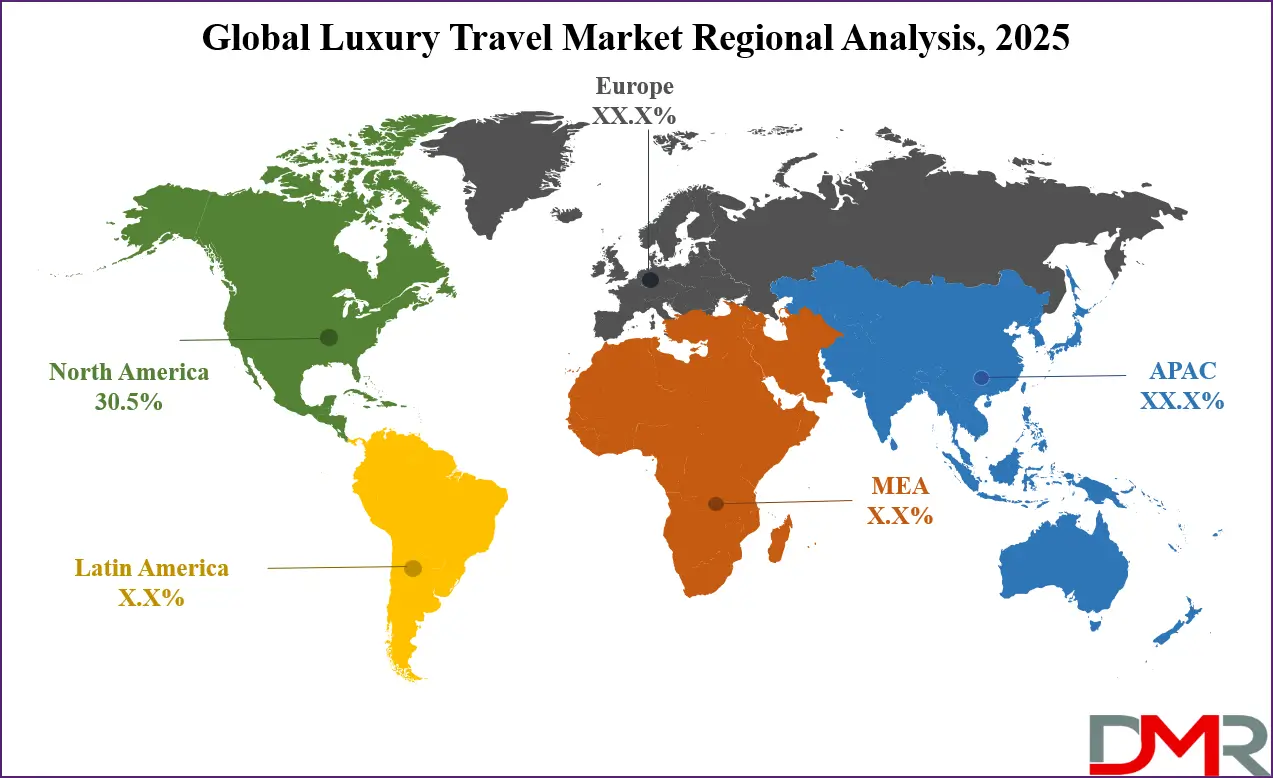

- Regional Analysis: North America is anticipated to lead the global luxury travel market landscape with 30.5% of total global market revenue in 2025.

- Key Players: Some key players in the global luxury travel market are Abercrombie & Kent, Belmond, Four Seasons, Aman Resorts, The Ritz-Carlton, Rosewood, Virtuoso, Black Tomato, TCS World Travel, and other key players.

Global Luxury Travel Market: Use Cases

- Private Jet Travel for Ultra-High-Net-Worth Individuals (UHNWIs): Private aviation represents a pinnacle of luxury travel for UHNWIs, offering unmatched privacy, flexibility, and exclusivity. This segment caters to individuals who prioritize time efficiency and a seamless end-to-end travel experience. Whether for business or leisure, private jet travelers expect concierge-level service, gourmet in-flight dining, and customized travel itineraries. Charter services and fractional ownership providers such as NetJets and XO have redefined how elite travelers access aviation luxury. Operators also offer bespoke travel packages that begin and end at private terminals, avoiding traditional commercial travel hassles. This segment thrives on personalized luxury, with onboard amenities mirroring 5-star hotel suites and tailored in-air experiences for maximum comfort.

- Experiential Luxury Travel for Cultural Immersion and Authenticity: High-end travelers are shifting from material indulgence to experiential luxury, seeking travel that immerses them in local culture, history, and traditions. Tour operators like Abercrombie & Kent and Black Tomato curate culturally rich journeys, like private guided tours of ancient ruins, hands-on craft sessions with local artisans, and exclusive access to UNESCO World Heritage Sites. This segment appeals to affluent millennials and Gen Xers who value authenticity over opulence. Whether it’s a culinary journey through Tuscany or a curated art tour in Kyoto, the focus is on storytelling, heritage, and human connection. The growth of cultural tourism, experiential getaways, and tailored luxury itineraries underscores a new era of meaningful travel.

- Ultra-Luxury Wellness Retreats and Sustainable Travel: Wellness tourism is emerging as a cornerstone of the global luxury travel market, with demand for transformational travel that blends health, mindfulness, and indulgence. Resorts like Six Senses and Aman provide holistic healing retreats featuring yoga, spa therapies, nutrition programs, and digital detox experiences in serene, eco-conscious settings. These experiences are often hosted in secluded natural landscapes, beaches, mountains, and rainforests, where travelers can rejuvenate both physically and mentally. This trend aligns with growing preferences for eco-luxury and sustainable tourism, where affluent travelers are willing to pay a premium for experiences that align with their wellness goals and environmental values.

- Luxury Cruises and Expedition Travel for Exclusive Leisure: The luxury cruise segment has evolved beyond traditional leisure cruising into a domain of ultra-luxury expedition travel. Cruise lines like Silversea, Seabourn, and Explora Journeys offer small-ship voyages to remote destinations such as Antarctica, the Galápagos Islands, or the Norwegian fjords. These experiences combine the sophistication of high-end hotels with the thrill of off-the-grid exploration. Guests enjoy personalized butler service, gourmet cuisine, and expert-led excursions, all while surrounded by pristine environments. Expedition cruises are appealing to seasoned travelers seeking exclusive adventures, wildlife experiences, and intimate encounters with nature, without compromising on luxury standards.

Global Luxury Travel Market: Stats & Facts

United Nations World Tourism Organization (UNWTO)

- International tourist arrivals reached 1.3 billion in 2023, recovering 88% of pre-pandemic levels.

- Global tourism receipts amounted to USD 1.4 trillion in 2023, indicating a strong rebound in travel spending.

U.S. Department of Commerce – National Travel and Tourism Office (NTTO)

- International visitors spent USD 155 billion in the U.S. in 2023, a 28% increase from the previous year.

- Travelers from China, the UK, and Germany were among the highest spenders in the U.S.

European Travel Commission (ETC)

- Europe welcomed over 700 million international tourists in 2023, nearing pre-pandemic levels.

- High-income travelers showed increased interest in personalized and sustainable travel experiences.

Japan Tourism Agency (JTA)

- Japan recorded 25 million international visitors in 2023, recovering 80% of 2019 levels.

- There was a notable increase in bookings for high-end ryokans and luxury hotels.

Australian Trade and Investment Commission (Austrade)

- Australia attracted 1.2 million high-spending international visitors in 2023, contributing significantly to tourism revenue.

- Demand for premium wine tours and exclusive wildlife experiences increased by 15%.

Singapore Tourism Board (STB)

- Singapore's tourism receipts reached SGD 20 billion in 2023, with luxury shopping and accommodations being major contributors.

- High-spending visitors accounted for 30% of total tourism receipts.

Ministry of Tourism, Government of India

- India saw a 20% increase in luxury travel bookings in 2023, driven by heritage tourism and wellness retreats.

- The number of high-net-worth international tourists visiting India grew by 12%.

South African Tourism

- Bookings for luxury safari experiences increased by 18% in 2023 compared to the previous year.

- The average spend per luxury traveler was USD 5,000, higher than the general tourist average.

Tourism New Zealand

- High-value visitor arrivals grew by 25% in 2023, with significant interest in exclusive nature and adventure experiences.

- Occupancy rates in luxury lodges reached 85% during peak seasons.

Canadian Tourism Commission (Destination Canada)

- Canada experienced a 15% increase in luxury travel bookings in 2023, particularly in wilderness and cultural tourism.

- The average expenditure of luxury travelers was CAD 4,500 per trip.

Global Luxury Travel Market: Market Dynamics

Global Luxury Travel Market: Driving Factors

Rise in Global High-Net-Worth and Ultra-High-Net-Worth Individuals

The growing number of HNWIs and UHNWIs across developed and emerging economies continues to fuel demand for ultra-luxury travel experiences. Affluent travelers are seeking bespoke itineraries that offer exclusivity, safety, and customized service, hallmarks of luxury travel. From private jet charters to secluded island getaways, the financial capacity and lifestyle expectations of this demographic drive innovation and spending across the high-end tourism landscape.

Growing Preference for Personalized and Experiential Travel

Luxury travelers are no longer content with standardized offerings; they are seeking tailor-made travel experiences that reflect personal interests, passions, and values. Whether it’s a curated wine tour in Bordeaux or a private yoga retreat in Bali, the demand for immersive travel has surged. Tour operators and hospitality brands are responding with personalized luxury services and thematic journeys that enhance emotional and cultural connections with destinations.

Global Luxury Travel Market: Restraints

High Cost of Luxury Services and Limited Accessibility

The very nature of luxury travel, featuring private transport, high-end accommodations, and concierge-level experiences, means it is significantly more expensive than mainstream tourism. This limits the market size to a niche clientele and makes it highly sensitive to economic downturns or geopolitical disruptions. Additionally, remote luxury destinations often face infrastructure challenges, making access difficult for even affluent tourists.

Environmental Concerns and Regulatory Scrutiny

As global focus on climate change intensifies, luxury tourism faces growing pressure to adopt sustainable practices. Private aviation, mega-yachts, and exclusive resorts often draw criticism for their environmental impact. Moreover, regulatory bodies are pushing for greener alternatives and carbon offset programs, adding complexity and cost to business operations. Balancing indulgence with eco-responsibility is becoming a delicate challenge for the industry.

Global Luxury Travel Market: Opportunities

Expansion in Emerging Markets and Second-Tier Cities

Rising wealth in regions like Asia-Pacific, the Middle East, and Latin America is creating new demand hubs for luxury travel. Cities such as Doha, Ho Chi Minh City, and Medellín are transforming into emerging luxury travel destinations, offering unique cultural experiences combined with upscale hospitality. These untapped markets offer immense growth potential, especially as local infrastructure and tourism policies evolve.

Integration of Technology in Personalized Travel Experiences

Advancements in AI, big data, and mobile apps are enabling brands to create hyper-personalized luxury itineraries. From predictive analytics in booking preferences to virtual concierge services, technology is reshaping how high-end travel experiences are curated and delivered. This opens opportunities for luxury providers to enhance customer loyalty and streamline premium service delivery across the traveler’s journey.

Global Luxury Travel Market: Trends

Sustainable and Eco-Luxury Travel on the Rise

Luxury travelers are becoming conscious of their environmental footprint, prompting demand for eco-friendly resorts, carbon-neutral transportation, and conservation-led experiences. Brands are adopting green certifications, sourcing local materials, and integrating sustainability into the travel experience without compromising comfort or exclusivity, aligning with the broader shift toward responsible tourism.

Wellness and Transformational Travel Experiences

Post-pandemic travel preferences have shifted toward well-being, mindfulness, and purposeful travel. From digital detox retreats to spiritual journeys in sacred landscapes, the demand for wellness-driven luxury getaways has surged. Resorts are offering personalized health programs, integrative therapies, and nature-based wellness experiences, redefining luxury as inner fulfillment and balance rather than just material comfort.

Global Luxury Travel Market: Research Scope and Analysis

By Travel Purpose Analysis

Leisure and vacation travel is the most dominant purpose within the global luxury travel market, expected to account for 70.0% of the total market share in 2025. This dominance is driven by the growing demand for exclusive, immersive, and personalized travel experiences. Affluent travelers are seeking more than just luxurious accommodations, they want private, curated journeys that offer relaxation, cultural exploration, and memorable moments. From private yacht charters and ultra-luxury cruises to bespoke safaris and wellness retreats, leisure-focused luxury travel continues to evolve in line with changing consumer preferences.

The rise of experiential and sustainable tourism has further boosted this segment, as travelers prioritize privacy, comfort, and authenticity. This segment appeals strongly to high-net-worth individuals and families looking to disconnect, rejuvenate, and experience destinations in a more meaningful and exclusive way.

In contrast, business and corporate luxury travel represents a smaller but important segment of the market. It includes executive travel, corporate retreats, incentive programs, and high-level meetings, often involving first-class flights, private jets, luxury hotel stays, and premium concierge services. While the segment faced some challenges during the pandemic due to the shift toward remote work and virtual meetings, it is gradually recovering as companies resume in-person events and strategic travel.

A notable trend within this category is “bleisure” travel, where executives extend business trips for personal leisure, blending work with high-end relaxation. Business travelers expect efficiency, seamless planning, and premium service throughout their journey, making them a valuable customer base despite their smaller volume.

By Luxury Type Analysis

Luxury accommodations are set to dominate the luxury travel market’s luxury type segment, capturing an estimated 45.0% of the total market share in 2025. This dominance reflects the central role that high-end lodging plays in the overall luxury travel experience. Travelers seek unique and personalized stays, ranging from exclusive five-star hotels and heritage resorts to private villas, boutique lodges, and eco-friendly retreats. The emphasis is on exceptional comfort, privacy, and tailored services such as private pools, personal chefs, and bespoke wellness programs.

Luxury accommodations are also evolving to include immersive experiences that connect guests to local culture and environment, blending opulence with authenticity. As affluent travelers prioritize exclusivity and customization, properties that offer seamless integration of luxury with personalized attention are becoming key drivers of market growth.

In contrast, luxury transportation constitutes another crucial segment of the market, encompassing premium modes such as private jets, luxury yachts, chauffeur-driven limousines, and high-end car rentals. This segment appeals to travelers who value convenience, privacy, and efficiency while maintaining the highest standards of comfort and style. Private aviation, in particular, has seen strong growth fueled by demand for flexible scheduling, direct routes, and exclusive in-flight services.

Similarly, luxury cruises and yacht charters offer bespoke itineraries and personalized on-board experiences that elevate travel beyond the ordinary. Together, luxury accommodations and transportation form the backbone of the high-end travel ecosystem, ensuring that every aspect of a luxury journey, from arrival to departure, is defined by exclusivity, comfort, and personalized service.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Traveler Type Analysis

High Net Worth Individuals (HNWIs) are expected to continue dominating the traveler type segment in the luxury travel market, capturing around 70.0% of the total market share in 2025. HNWIs, defined as individuals with investable assets typically between USD 1 million and USD 30 million, represent the largest group of affluent travelers globally. Their travel preferences emphasize personalized and exclusive experiences that offer comfort, privacy, and cultural richness.

This segment frequently opts for luxury accommodations, curated tours, private dining, and bespoke itineraries that cater to their unique tastes and lifestyles. The HNWI traveler values seamless service, convenience, and access to premium amenities, making them a key driver of demand in luxury resorts, five-star hotels, and high-end travel services globally.

On the other hand, Ultra-High Net Worth Individuals (UHNWIs), who possess investable assets exceeding USD 30 million, form a smaller but extremely influential segment within the luxury travel market. UHNWIs seek the pinnacle of exclusivity and indulgence, often opting for ultra-premium experiences such as private jet charters, luxury yacht cruises, and stays at the world’s most prestigious resorts and villas.

Their travel decisions are driven by a desire for privacy, security, and unparalleled personalized service that goes beyond typical luxury offerings. UHNWIs often engage travel concierges and luxury travel advisors to craft highly customized journeys that may include access to private events, remote destinations, and unique cultural experiences unavailable to the general public. While smaller in number, their significant spending power and demand for ultra-luxury travel services make UHNWIs a critical segment shaping market trends and innovations.

By Destination Type Analysis

Urban luxury destinations are expected to lead the destination type segment in the luxury travel market, capturing approximately 50.0% of the market share in 2025. These destinations include major metropolitan cities known for their upscale hotels, fine dining, luxury shopping, cultural landmarks, and world-class entertainment. Affluent travelers are drawn to cities like New York, Paris, Tokyo, and Dubai, where they can enjoy a blend of sophisticated urban experiences combined with personalized luxury services.

Urban destinations offer access to exclusive events, art galleries, designer boutiques, and gourmet restaurants, making them ideal for travelers seeking both leisure and cosmopolitan lifestyles. The convenience of well-developed infrastructure and premium business facilities also enhances the appeal for luxury travelers who combine business with leisure, fueling demand for high-end urban tourism.

In contrast, resort and beach destinations form a vital segment focused on relaxation, privacy, and natural beauty. These locations, ranging from the Maldives and Seychelles to the Amalfi Coast and Bora Bora, attract luxury travelers looking for serene escapes in stunning environments. Resorts and beach destinations emphasize exclusivity through private villas, overwater bungalows, personalized spa treatments, and water-based activities such as yachting and scuba diving.

The appeal of these destinations lies in their ability to offer tranquil, immersive experiences away from urban hustle, catering to those seeking rejuvenation and privacy. With a growing trend toward wellness tourism and sustainable luxury, resort and beach destinations continue to evolve by integrating eco-friendly practices and wellness amenities, further strengthening their position in the luxury travel market.

By Booking Channel Analysis

Travel agencies and luxury tour operators are projected to lead the booking channel segment in the luxury travel market, capturing about 50.0% of the total market share in 2025. These intermediaries play a critical role in designing and managing bespoke travel experiences that cater to the highly specific needs of affluent travelers. Their expertise in crafting personalized itineraries, securing exclusive access to high-end accommodations, and arranging luxury transportation makes them invaluable partners for luxury travelers seeking seamless and unique journeys.

Additionally, travel agencies and operators often provide concierge services, 24/7 support, and insider knowledge, which greatly enhance the overall travel experience. Their ability to bundle services and create all-inclusive luxury packages appeals to discerning clients who value convenience, exclusivity, and expert guidance.

On the other hand, direct bookings, where travelers book their flights, hotels, or experiences directly through service providers, also represent a significant segment, especially as digital platforms and brand websites become more sophisticated. Direct bookings offer travelers more control and flexibility, often with access to exclusive offers or loyalty program benefits.

Luxury hotels and airlines invest in personalized online booking platforms enhanced with AI-driven recommendations and virtual concierge services to attract high-end customers directly. While direct bookings may lack the personalized touch of luxury tour operators, they are gaining traction among tech-savvy travelers who prefer to curate their own experiences while still expecting premium service standards and seamless digital interactions.

The Luxury Travel Market Report is segmented on the basis of the following:

By Travel Purpose

- Leisure & Vacation

- Business & Corporate

- Special Occasion Travel

By Luxury Type

- Luxury Accommodation

- Luxury Transportation

- Luxury Experiences & Activities

By Traveler Type

- High Net Worth Individuals (HNWIs)

- Ultra-High Net Worth Individuals (UHNWIs)

- Affluent Emerging Luxury Travelers

By Destination Type

- Urban Luxury Destinations

- Resort & Beach Destinations

- Adventure & Nature Luxury Destinations

By Booking Channel

- Travel Agencies & Tour Operators

- Direct Bookings

- Others

Global Luxury Travel Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global luxury travel market in 2025, accounting for approximately 30.5% of the total market revenue. This dominance is driven by a large population of high-net-worth individuals, strong economic conditions, and a well-established luxury travel infrastructure. The region boasts a diverse range of luxury travel options, from vibrant urban centers like New York and Los Angeles to exclusive resort destinations such as Aspen and Miami.

Additionally, North American travelers show a growing preference for personalized, experiential, and wellness-focused luxury trips, further fueling market growth. Advanced digital platforms, robust private aviation networks, and premium hospitality services also contribute to North America’s leading position in the global luxury travel landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is projected to register the highest CAGR in the global luxury travel market over the coming years. Rapid economic growth, growing wealth accumulation among high-net-worth individuals, and rising urbanization are key factors driving this robust expansion. Emerging luxury travel hubs such as China, India, Japan, and Southeast Asian countries are witnessing growing demand for exclusive experiences, personalized services, and premium accommodations.

Additionally, the rising middle-class population aspiring for luxury travel and growing investments in luxury hospitality infrastructure further accelerate market growth in the region, positioning Asia-Pacific as the fastest-growing luxury travel market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Luxury Travel Market: Competitive Landscape

The global luxury travel market is characterized by a highly competitive landscape dominated by well-established, prestigious brands and specialized service providers that focus on delivering exceptional, personalized experiences. Key players include luxury hotel chains, private jet and yacht operators, high-end tour operators, and exclusive travel concierge services.

These companies continuously innovate by integrating advanced technologies such as AI-driven personalization and seamless digital booking platforms to enhance customer experience and loyalty. Strategic partnerships, mergers, and acquisitions are common as firms seek to expand their geographic footprint and diversify their luxury offerings.

Additionally, there is a growing emphasis on sustainability and responsible tourism, prompting competitors to adopt eco-friendly practices to meet the evolving expectations of discerning luxury travelers. This dynamic and fragmented competitive environment fuels ongoing innovation and elevates service standards across the global luxury travel industry.

Some of the prominent players in the global luxury travel industry are:

- Abercrombie & Kent

- Belmon

- Four Seasons Hotels and Resorts

- Aman Resorts

- The Ritz-Carlton

- Rosewood Hotels & Resorts

- Virtuoso

- Black Tomato

- TCS World Travel

- Scott Dunn

- XO

- NetJets

- Emirates

- Etihad Airways

- Mandarin Oriental Hotel Group

- Six Senses Hotels Resorts Spas

- Seabourn Cruise Line

- Silversea Cruises

- Explora Journeys

- Ker & Downey

- Other Key Players

Global Luxury Travel Market: Recent Developments

Product Launches

- April 2025: Kensington Tours introduced "Kensington Villas," a dedicated division offering private villa rentals tailored for multigenerational families. This initiative responds to the growing demand for exclusive, family-centric luxury accommodations.

- March 2025: Accor, in collaboration with LVMH, launched the "La Dolce Vita Orient Express," a luxurious sleeper train experience traversing Italy. This modern revival of the iconic Orient Express brand offers curated off-train excursions and gourmet dining, enhancing the luxury rail travel segment.

Mergers and Acquisitions

- May 2024: Singapore-based private equity firm Wilson & Hughes acquired the historic travel brand Cox & Kings through an insolvency process. The acquisition aims to revitalize the brand by focusing on leisure, business, specialized travel, and travel technology segments.

- May 2024: The Travel Portfolio was formed through the merger of Heavens Portfolio and The Travel Collection, two prominent luxury travel representation firms. This consolidation aims to enhance their presence in the luxury travel market, particularly in the Gulf Cooperation Council (GCC) region.

Funding Events

- November 2024: CellPoint Digital, a travel payments software provider, secured USD 30 million in funding from Toscafund and Penta Capital. The investment will support the launch of an airline retail platform and the expansion of its client base.

- November 2024: Tourlane, a Berlin-based booking platform specializing in multi-leg vacation packages, raised USD 26.2 million in Series D funding led by Sequoia Capital. The funds will be used to enhance the platform's AI capabilities and pursue international growth.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.5 T |

| Forecast Value (2034) |

USD 3.1 T |

| CAGR (2025–2034) |

8.1% |

| The US Market Size (2025) |

USD 0.4 T |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Travel Purpose (Leisure & Vacation, Business & Corporate, Special Occasion Travel), By Luxury Type (Luxury Accommodation, Luxury Transportation, Luxury Experiences & Activities), By Traveler Type (HNWIs, UHNWIs, Affluent Emerging Luxury Travelers), By Destination Type (Urban Luxury Destinations, Resort & Beach Destinations, Adventure & Nature Luxury Destinations), and By Booking Channel (Travel Agencies & Tour Operators, Direct Bookings, Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Abercrombie & Kent, Belmond, Four Seasons, Aman Resorts, The Ritz-Carlton, Rosewood, Virtuoso, Black Tomato, TCS World Travel, and other key players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global luxury travel market?

▾ The global luxury travel market size is estimated to have a value of USD 1.5 trillion in 2025 and is expected to reach USD 3.1 trillion by the end of 2034.

What is the size of the US luxury travel market?

▾ The US luxury travel market is projected to be valued at USD 0.4 trillion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 0.7 trillion in 2034 at a CAGR of 7.6%.

Which region accounted for the largest global luxury travel market?

▾ North America is expected to have the largest market share in the global luxury travel market, with a share of about 30.5% in 2025

Who are the key players in the global luxury travel market?

▾ Some of the major key players in the global luxury travel market are Abercrombie & Kent, Belmond, Four Seasons, Aman Resorts, The Ritz-Carlton, Rosewood, Virtuoso, Black Tomato, TCS World Travel, and other key players.

What is the growth rate of the global luxury travel market?

▾ The market is growing at a CAGR of 8.1 percent over the forecasted period.