Market Overview

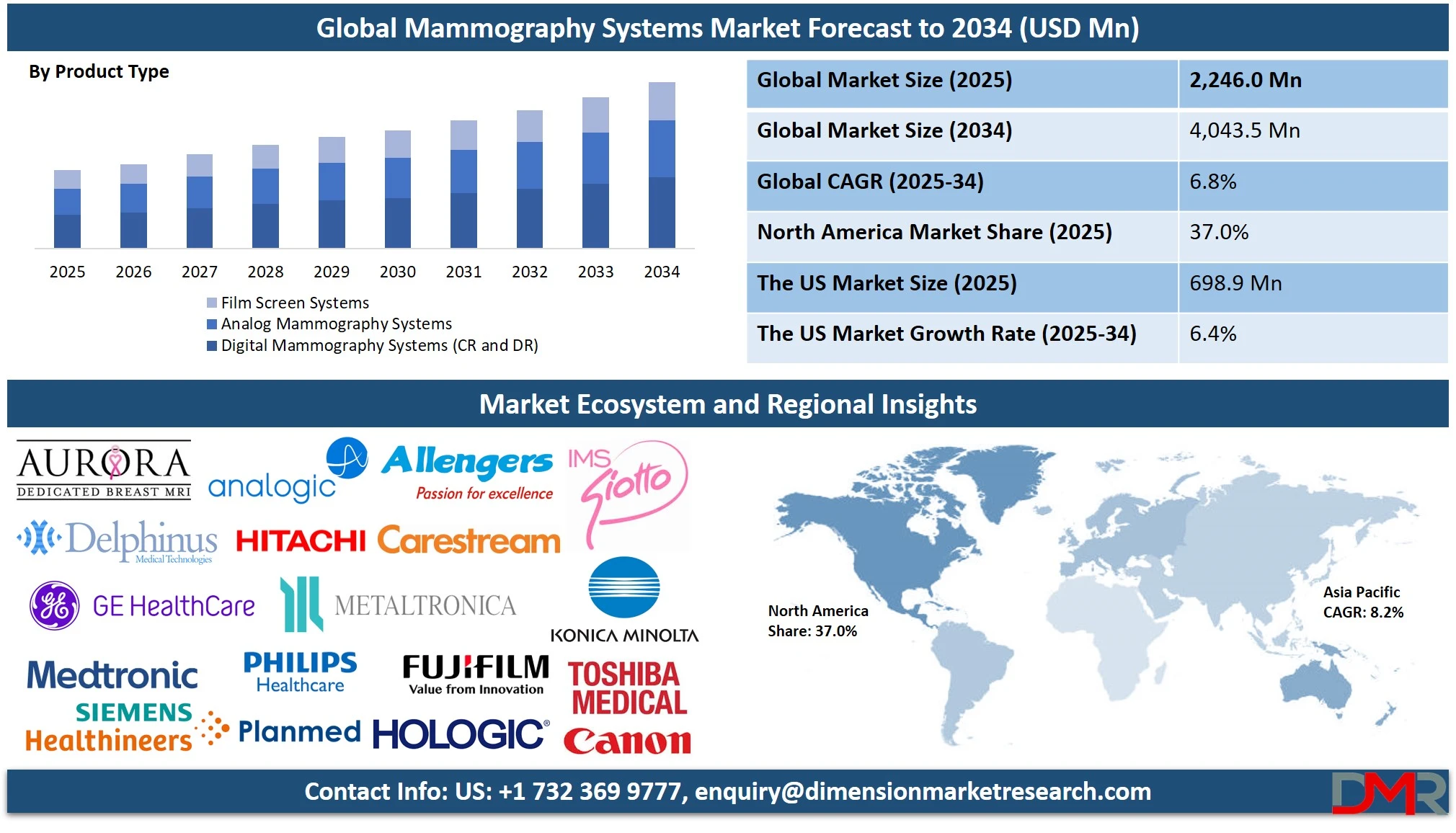

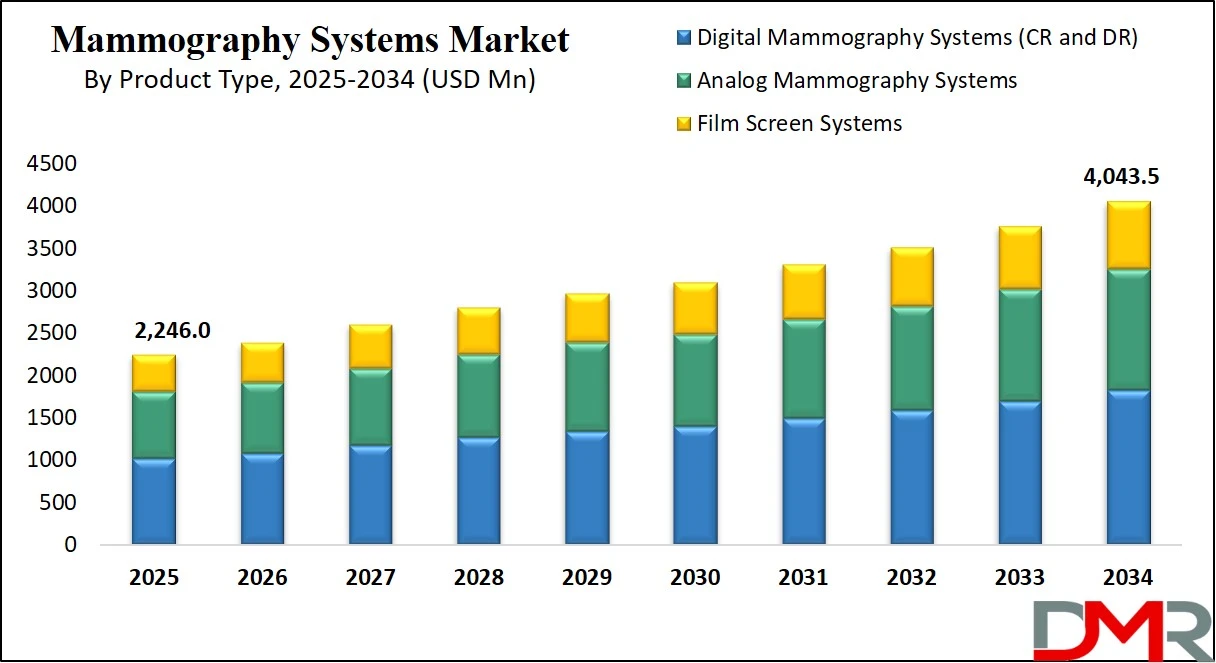

The Global Mammography Systems Market is projected to reach USD 2,246.0 million in 2025 and grow at a compound annual growth rate of 6.8% from there until 2034 to reach a value of USD 4,043.5 million.

The global mammography systems market is witnessing a transformative shift driven by rising breast cancer prevalence, rapid technological evolution, and expanding awareness campaigns. According to the World Health Organization (WHO), breast cancer is the most common cancer globally, contributing to 12% of all new annual cancer cases. This significant burden is pushing healthcare systems to adopt early detection technologies, propelling the demand for advanced mammography solutions like 3D tomosynthesis, digital mammography, and computer-aided detection systems.

A major trend driving growth is the widespread transition from analog to digital systems. Digital mammography systems, including CR and DR formats, offer superior image clarity, lower radiation doses, and compatibility with artificial intelligence algorithms that aid radiologists in identifying microcalcifications and subtle lesions. Integration of AI-based diagnostic platforms enhances early-stage cancer detection and reduces false positives, improving workflow efficiency and clinical outcomes.

However, the market faces restraints in terms of high installation and maintenance costs, especially in low-resource settings. Additionally, a shortage of trained radiologists and regulatory barriers in some regions impede the swift adoption of novel mammography equipment. The disparity in access to mammography screening between urban and rural populations also remains a challenge.

Despite these limitations, lucrative growth opportunities exist in emerging economies and underserved regions. Governments and non-governmental organizations are increasingly investing in mobile mammography units to expand reach in rural and remote areas. Furthermore, the adoption of portable and point-of-care systems is on the rise, facilitating screening beyond hospitals and imaging centers.

Looking forward, the mammography systems market is projected to expand robustly, supported by favorable reimbursement policies, increasing female population aged 40 and above, and global health initiatives aimed at improving breast cancer screening rates. As healthcare systems prioritize preventive diagnostics, the role of mammography will become even more integral in the global cancer care continuum.

The US Mammography Systems Market

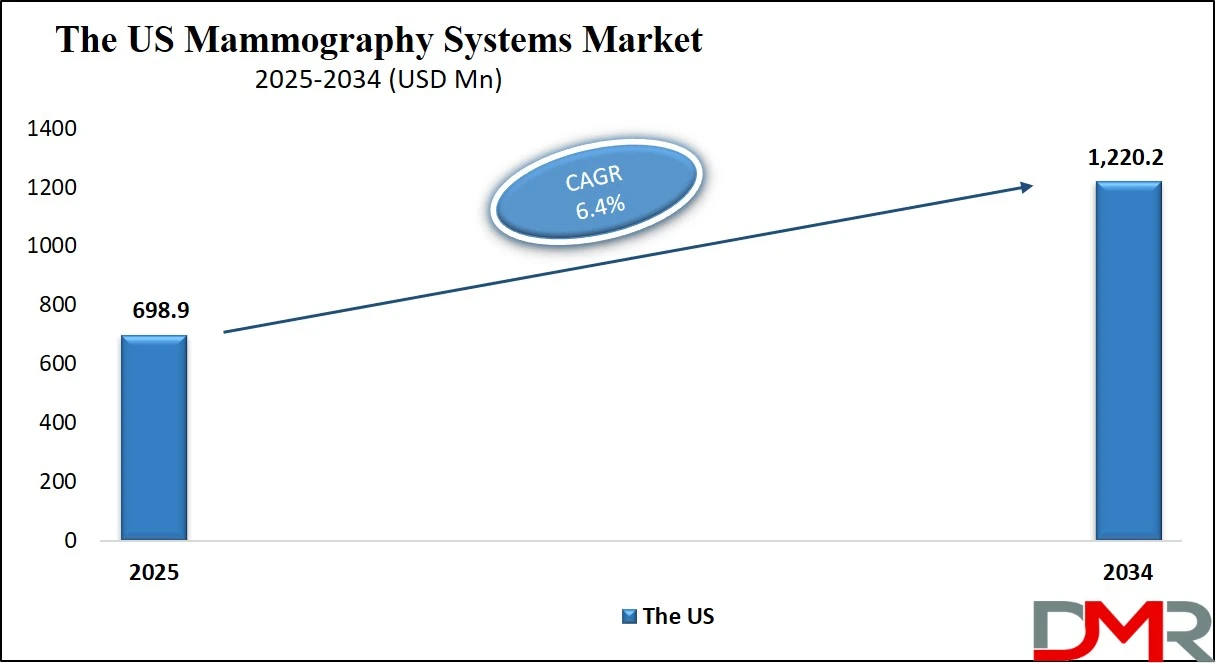

The US Mammography Systems Market is projected to reach USD 698.9 million in 2025 at a compound annual growth rate of 6.4% over its forecast period.

The U.S. mammography systems market benefits significantly from strong public health infrastructure, government-led screening programs, and a large at-risk population. According to the Centers for Disease Control and Prevention (CDC), breast cancer is the second leading cause of cancer deaths among women in the U.S., with more than 264,000 diagnoses annually. The U.S. Preventive Services Task Force (USPSTF) recommends biennial screening mammography for women aged 40 to 74, which has been adopted widely through insurance coverage under the Affordable Care Act.

The Medicare program, managed by the Centers for Medicare & Medicaid Services (CMS), fully covers screening mammograms once every 12 months for eligible female beneficiaries, ensuring high accessibility for the aging population. The American Cancer Society and the National Cancer Institute (NCI) also conduct awareness campaigns and fund community-level initiatives to increase mammogram participation.

Demographically, the U.S. has over 70 million women aged 40 and above, according to the U.S. Census Bureau, representing a large screening-eligible population. This demographic advantage, combined with high health awareness and established radiology networks, drives consistent demand for advanced mammography technologies, including 3D breast tomosynthesis and AI-integrated diagnostic tools.

The FDA, through its Mammography Quality Standards Act (MQSA), regulates and monitors mammography facilities, ensuring quality assurance and uniform standards. Additionally, the National Institutes of Health (NIH) supports ongoing research into improving imaging technologies for early breast cancer detection.

The U.S. market is poised for sustained growth as policy support, technological innovation, and patient awareness converge, making mammography a cornerstone of preventive women's health across the nation.

The Europe Mammography Systems Market

The Europe Mammography Systems Market is estimated to be valued at USD 336.9 million in 2025 and is further anticipated to reach USD 569.1 million by 2034 at a CAGR of 6.0%.

The European mammography systems market is underpinned by strong national screening programs, well-established healthcare systems, and a steadily aging population. The European Commission's "Europe’s Beating Cancer Plan" emphasizes early detection, with the aim of offering breast cancer screening to 90% of eligible EU citizens by 2025. Most EU countries offer organized, population-based screening programs, which drive consistent demand for high-performance mammography systems across the continent.

According to Eurostat, nearly 20% of Europe’s population is aged 65 and older, increasing the urgency for effective cancer screening infrastructure. Countries like Germany, France, Sweden, and the Netherlands have high participation rates in biennial screening programs, which are often fully reimbursed under public health insurance systems. The use of digital mammography and 3D tomosynthesis has grown significantly in Western Europe due to technological readiness and access to radiology expertise.

National health authorities across Europe, such as the UK's NHS Breast Screening Programme and France’s National Cancer Institute (INCa), play a crucial role in standardizing screening guidelines and promoting early detection awareness. Moreover, data protection laws under GDPR have driven the development of secure, compliant mammography IT solutions across EU markets.

Despite disparities in access between Eastern and Western Europe, initiatives funded by the European Social Fund and regional ministries aim to bridge these gaps, especially through mobile screening units. The European market continues to embrace innovation in AI-assisted imaging and cloud-based archiving to enhance diagnostic accuracy and accessibility.

Europe remains a leading region in adopting advanced mammography technologies, supported by public policy and a health-conscious aging demographic.

The Japan Mammography Systems Market

The Japan Mammography Systems Market is projected to be valued at USD 134.7 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 229.6 million in 2034 at a CAGR of 6.1%.

Japan’s mammography systems market is shaped by a combination of demographic realities, governmental health policies, and strong domestic medical technology capabilities. According to Japan’s Ministry of Health, Labour and Welfare (MHLW), breast cancer is the most common cancer among Japanese women and has been increasing steadily in incidence. In response, the government has incorporated breast cancer screening into national cancer control strategies, recommending biennial mammograms for women aged 40 and over.

Japan’s rapidly aging society significantly influences the market, with over 28% of its population aged 65 and above, as reported by the Statistics Bureau of Japan. This age group is highly susceptible to breast cancer, creating sustained demand for screening technologies. Local governments and municipalities often subsidize mammography exams, enhancing accessibility across both urban and rural areas.

The National Cancer Center Japan promotes public awareness and screening participation, especially through educational campaigns and collaborative programs with prefectural governments. Japan’s screening coverage rate has been rising, though it still lags behind some Western countries, creating growth opportunities for outreach and mobile imaging solutions.

Technologically, Japan is home to advanced manufacturers and a robust R&D environment. Innovations in low-radiation digital mammography, tomosynthesis, and AI-enhanced diagnostics are increasingly adopted in large hospital networks and specialty clinics. Regulatory bodies like the Pharmaceuticals and Medical Devices Agency (PMDA) oversee rigorous testing and approval processes to maintain high standards.

Global Mammography Systems Market: Key Takeaways

- Global Market Size Insights: The Global Mammography Systems Market size is estimated to have a value of USD 2,246.0 million in 2025 and is expected to reach USD 4,043.5 million by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 6.8 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Mammography Systems Market is projected to be valued at USD 698.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,220.2 million in 2034 at a CAGR of 6.4%.

- Regional Insights: North America is expected to have the largest market share in the Global Mammography Systems Market with a share of about 37.0% in 2025.

- Key Players: Some of the major key players in the Global Mammography Systems Market are Hologic, Inc., Siemens Healthineers, GE HealthCare, Fujifilm Holdings Corporation, Canon Medical Systems Corporation, Philips Healthcare, and many others.

Global Mammography Systems Market: Use Cases

- AI-Powered Breast Cancer Detection: Hospitals and imaging centers are deploying AI-integrated mammography systems to analyze digital scans and highlight areas of concern. These systems assist radiologists in detecting early-stage tumors, reducing diagnostic errors, and improving workflow efficiency, particularly in facilities facing radiologist shortages.

- Mobile Mammography Units in Rural Areas: Mobile clinics equipped with portable mammography systems are extending breast cancer screening services to remote and underserved communities. These units help overcome geographic barriers, enhance early detection rates, and support public health outreach programs in rural regions.

- Tomosynthesis for Dense Breast Tissue: Digital breast tomosynthesis is being used in patients with dense breast tissue to produce 3D-like images that reveal overlapping structures. This improves lesion visibility, leading to higher diagnostic accuracy and fewer false positives compared to traditional 2D mammography.

- National Screening Programs in Public Hospitals: Public healthcare facilities are integrating mammography systems as part of nationwide cancer screening initiatives. These programs, often backed by government funding, increase access to routine mammograms and drive large-scale implementation of standardized imaging protocols.

- Cloud-Based Image Archiving and Review: Healthcare systems are adopting cloud-enabled mammography solutions to store, retrieve, and review imaging data across institutions. This facilitates multi-site consultations, supports second opinions, and enhances collaborative diagnostics while ensuring secure patient data management.t

Global Mammography Systems Market: Stats & Facts

World Health Organization (WHO)

- Breast cancer is the most common cancer among women globally, with 2.3 million new cases diagnosed in 2020.

- WHO reports 685,000 breast cancer deaths globally in 2020.

- Mammography is listed by WHO as a primary screening method for early detection of breast cancer in women aged 50 to 69 years.

- The WHO Global Breast Cancer Initiative (GBCI) targets 50% of eligible women to be screened by 2025 in LMICs.

Centers for Disease Control and Prevention (CDC), U.S.

- In 2022, 70.1% of U.S. women aged 50–74 reported having a mammogram within the past two years.

- Breast cancer is the second most common cancer among women in the U.S., following skin cancer.

- The National Breast and Cervical Cancer Early Detection Program (NBCCEDP) has provided over 15 million screening exams since its inception.

- In the U.S., the breast cancer incidence rate is approximately 129.5 per 100,000 women.

National Cancer Institute (NCI), U.S.

- The lifetime risk of a woman in the U.S. being diagnosed with breast cancer is about 1 in 8.

- Over 297,790 new cases of invasive breast cancer are estimated to occur in U.S. women in 2023.

- More than 43,000 U.S. women are expected to die from breast cancer in 2023.

- Early detection through mammography can reduce mortality by up to 40%.

European Commission / Eurostat

- In the EU, around 500,000 new breast cancer cases are diagnosed annually.

- Mammography screening participation among EU women aged 50–69 varies, with some countries above 70% uptake.

- EU-wide screening programs are available in 25 out of 27 member states.

- Organized breast cancer screening programs began as early as 1990 in some European countries.

Japan Ministry of Health, Labour and Welfare

- Japan sees approximately 90,000 new breast cancer cases annually.

- Breast cancer has become the leading cancer in Japanese women since 1999.

- The Ministry encourages biennial mammography screening for women aged 40–74.

- Mammography screening rate in Japan is 44.9%, below the OECD average.

Organisation for Economic Co-operation and Development (OECD)

- The average breast cancer screening rate among OECD countries is 61.3% for eligible age groups.

- Countries like the Netherlands and Finland report rates over 75%, while others remain below 50%.

- Screening rates correlate with national health infrastructure and awareness programs.

Indian Ministry of Health & Family Welfare / National Health Portal

- In India, breast cancer accounts for 27.7% of all cancers in women.

- India lacks a nationwide mammography-based screening program but has pilot initiatives in urban regions.

- Mortality-to-incidence ratio for breast cancer in India is 0.51, indicating late diagnosis.

- Government cancer control programs include awareness drives to increase early screening.

Australian Institute of Health and Welfare (AIHW)

- In Australia, 55% of women aged 50–74 participated in mammography screening through BreastScreen Australia in 2021.

- Breast cancer remains the most commonly diagnosed cancer in Australian women.

- Survival rate for breast cancer exceeds 91% over 5 years, owing in part to early screening.

Health Canada / Canadian Task Force on Preventive Health Care

- Breast cancer is the second leading cause of cancer death in Canadian women.

- Mammography screening is recommended every 2–3 years for women aged 50–74.

- National screening participation rate is about 64% among eligible Canadian women.

Global Mammography Systems Market: Market Dynamics

Driving Factors in the Global Mammography Systems Market

Rising Breast Cancer Incidence Worldwide

Breast cancer remains the most frequently diagnosed cancer among women worldwide. According to the World Health Organization (WHO), there were over 2.3 million new breast cancer cases globally in 2020. This growing incidence is compelling governments and healthcare organizations to invest heavily in early detection infrastructure, including mammography systems.

Public screening programs in regions such as North America, Europe, and parts of Asia are being expanded to cover wider age groups and rural populations, driving the demand for both fixed and mobile mammography units. Additionally, awareness campaigns led by government health agencies are encouraging more women to undergo regular screenings, creating a steady rise in patient volumes and system utilization rates.

Government-Funded Screening Initiatives

Governments across the globe are implementing nationwide breast cancer screening programs to lower mortality rates through early diagnosis. For instance, the U.S. Preventive Services Task Force and similar national bodies in Europe recommend biennial or annual mammograms for women aged 40 to 74. These guidelines form the basis for reimbursement frameworks that make screening affordable or free.

In countries like the UK, Australia, and Japan, public healthcare systems provide mammography as part of routine women’s health check-ups. The steady financial backing and supportive healthcare policies contribute to increased installations of mammography systems in public hospitals and community health centers, fostering market expansion.

Restraints in the Global Mammography Systems Market

High Cost of Advanced Mammography Systems

While technological advancements such as 3D imaging and AI integration have improved the diagnostic capabilities of mammography systems, they have also significantly increased equipment costs. Premium systems with advanced features can be prohibitively expensive for small hospitals, standalone clinics, and facilities in low- and middle-income countries.

Additionally, ongoing maintenance, calibration, and software upgrades further elevate operational expenses. Budget constraints and limited healthcare funding in certain regions hinder the adoption of state-of-the-art systems. Even in developed markets, cost-benefit assessments can delay procurement decisions, particularly when funding depends on governmental or institutional approvals.

Concerns Over Radiation Exposure

Although mammography is generally considered safe, repeated exposure to ionizing radiation, especially in annual screening programs, raises concerns among patients and healthcare providers. These concerns are amplified among younger women or those at low risk of developing breast cancer. Despite technological efforts to reduce radiation doses, public perception and fear of radiation risks may deter some individuals from participating in screening programs.

Moreover, these concerns also influence regulatory policies, sometimes leading to stricter screening guidelines that may reduce imaging volumes. Manufacturers must continuously innovate to offer ultra-low-dose systems that maintain image clarity while addressing patient safety apprehensions.

Opportunities in the Global Mammography Systems Market

Untapped Potential in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and Africa present significant growth opportunities due to rapidly improving healthcare infrastructure and rising awareness about breast cancer. These regions have historically low screening rates due to limited access to diagnostic facilities and cultural barriers.

However, government-led health missions and increasing collaborations with international health organizations are introducing mobile screening units and digital mammography to remote populations. Growing middle-class populations, urbanization, and rising disposable incomes also contribute to demand for better healthcare services, including breast imaging. Companies entering these markets with low-cost, compact, and portable mammography systems tailored for resource-constrained settings are likely to gain a competitive edge.

Technological Advancements in Portable Systems

The development of compact and portable mammography systems is creating new avenues for market growth. These systems are especially beneficial for remote or underserved communities where access to fixed imaging centers is limited. Portable devices offer the advantage of mobility without compromising on image quality or performance, and they are being increasingly used in mobile screening vans and temporary health camps.

Recent innovations include battery-operated units, wireless data transfer capabilities, and cloud-based image storage. These systems support early detection initiatives in developing regions and enable point-of-care diagnostics, making them crucial in expanding breast cancer screening coverage and improving public health outcomes.

Trends in the Global Mammography Systems Market

Rising Preference for Digital Breast Tomosynthesis (DBT)

Digital Breast Tomosynthesis (DBT), or 3D mammography, is gaining rapid traction due to its superior diagnostic accuracy compared to traditional 2D mammography. This technology enables layered imaging of breast tissues, minimizing tissue overlap and improving the detection of early-stage cancers, especially in women with dense breast tissue. DBT adoption is further accelerated by favorable reimbursement policies in countries like the U.S. and regulatory approvals across Europe and Asia.

Manufacturers are focusing on incorporating DBT in newer systems, with scalable upgrades for existing 2D mammography devices. Healthcare facilities, particularly cancer screening centers, are increasingly adopting DBT systems to reduce false positives and enhance diagnostic confidence, thereby improving patient throughput and outcomes.

Integration of Artificial Intelligence (AI)

AI integration in mammography systems is transforming diagnostic workflows by enhancing image analysis accuracy, automating repetitive tasks, and supporting clinical decision-making. AI-powered algorithms assist radiologists in identifying abnormalities, reducing reading time, and minimizing diagnostic errors. Recent FDA approvals of AI software for breast cancer detection are paving the way for widespread implementation.

Moreover, AI enhances workflow efficiency in high-volume screening programs by prioritizing high-risk cases and enabling double-reading processes. The increasing volume of breast imaging data from global screening programs necessitates advanced analytics, further pushing AI adoption. As the technology matures, its integration is expected to become a standard feature across mammography systems.

Global Mammography Systems Market: Research Scope and Analysis

By Product Type Analysis

Digital mammography systems are projected to have significantly surpassed traditional analog and film-screen mammography in the global market due to their advanced diagnostic capabilities, operational efficiencies, and compatibility with modern healthcare IT systems. These systems provide superior image resolution, enabling more precise visualization of breast tissues, which is crucial for the early detection of abnormalities, particularly in dense breast tissues.

Among digital variants, Direct Radiography (DR) systems are favored over Computed Radiography (CR) owing to their higher sensitivity, better spatial resolution, and reduced radiation dose. DR systems also offer faster image acquisition, real-time image review, and streamlined workflow, minimizing patient wait times and enhancing throughput in diagnostic settings.

Another critical factor driving the dominance of digital mammography systems is their seamless integration with Picture Archiving and Communication Systems (PACS), allowing for efficient image storage, retrieval, and sharing. This interoperability facilitates multidisciplinary consultations and longitudinal monitoring of patient health.

Furthermore, digital systems support advanced applications such as 3D breast tomosynthesis, which delivers cross-sectional images of breast tissues, enhancing the detection of small lesions and reducing recall rates due to false positives.

Healthcare providers and diagnostic centers increasingly prefer digital systems due to the increasing emphasis on early breast cancer detection and population-wide screening programs. Their adoption is also supported by favorable reimbursement policies in developed markets and government initiatives aimed at upgrading public healthcare infrastructure.

As digital mammography continues to set the standard for clinical accuracy, efficiency, and patient care, it firmly retains its dominant position in the mammography systems market.

By End User Analysis

Hospitals are poised to represent the leading end-user segment in the global mammography systems market, primarily because of their expansive infrastructure, high patient influx, and substantial capital budgets that enable investments in sophisticated diagnostic imaging equipment.

Hospitals typically act as comprehensive hubs for oncology-related services, spanning from initial screening and diagnosis to treatment and follow-up, positioning them as primary purchasers and users of mammography systems. This comprehensive service offering enhances their ability to integrate mammography into broader cancer care pathways, creating significant demand for high-performance systems.

Additionally, hospitals are at the forefront of adopting advanced mammography technologies such as 3D breast tomosynthesis and Computer-Aided Detection (CAD), driven by their commitment to offering accurate and timely diagnoses. These systems significantly improve diagnostic precision and patient outcomes, making them indispensable in tertiary care settings.

Moreover, the availability of radiologists, oncologists, and multidisciplinary teams within hospitals supports the use of technologically advanced imaging systems, which smaller facilities might lack the capacity to operate or afford.

Hospitals also benefit from better access to public and private funding sources for the procurement of cutting-edge diagnostic tools, especially in developed countries where government healthcare spending is substantial.

The presence of national and regional cancer screening programs, many of which are implemented through public hospitals, further propels equipment demand. Their participation in clinical trials and academic research also necessitates continuous upgrades in imaging modalities, including high-resolution mammography.

The Global Mammography Systems Market Report is segmented based on the following:

By Product Type

- Digital Mammography Systems (CR and DR)

- 2D Digital Mammography

- 3D Digital Mammography (Tomosynthesis)

- Film Screen Systems

- Analog Mammography Systems

By End User

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic Centers

- Specialty Clinics

- Research Institutes

- Other End Users

Impact of Artificial Intelligence in the Global Mammography Systems Market

- Enhanced Image Analysis: AI algorithms improve image interpretation accuracy, reducing false positives and negatives, and enabling radiologists to detect subtle abnormalities earlier, which is crucial for effective breast cancer diagnosis.

- Workflow Optimization: AI streamlines mammography workflows by automating image sorting, quality control, and reporting tasks, enabling faster diagnosis turnaround times and allowing radiologists to focus on more complex diagnostic evaluations.

- Decision Support Tools: AI-powered decision support systems assist radiologists by highlighting suspicious regions, offering second-opinion recommendations, and increasing diagnostic confidence, especially in dense breast tissues where detection is typically more challenging.

- Integration with 3D Tomosynthesis: AI enhances 3D mammography (tomosynthesis) by reconstructing images, detecting abnormalities across multiple slices, and reducing reading time, significantly improving accuracy and efficiency in breast cancer screening programs.

- Remote Screening and Teleradiology: AI enables remote interpretation and screening through cloud-based platforms, making quality mammography accessible in underserved or rural regions and supporting global efforts to bridge healthcare disparities in breast cancer care.

Global Mammography Systems Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to hold the dominant share in the global mammography systems market with 37.0% of the total market share by the end of 2025, due to a combination of advanced healthcare infrastructure, strong regulatory frameworks, and early adoption of cutting-edge imaging technologies.

The United States and Canada have implemented extensive breast cancer screening programs supported by organizations such as the American College of Radiology (ACR), the Centers for Disease Control and Prevention (CDC), and Health Canada. These programs mandate regular mammographic screening for women, leading to high procedural volumes annually.

Moreover, the prevalence of breast cancer in the region is significantly high. According to the American Cancer Society, breast cancer remains the most common cancer among women in the U.S., which drives strong demand for early detection and diagnostic tools, including digital and 3D mammography. Favorable reimbursement policies under Medicare, Medicaid, and private insurance also enhance access to mammography screening across socio-economic classes.

The region also benefits from the presence of key market players such as Hologic, GE HealthCare, and FUJIFILM Holdings America Corporation, which continuously invest in R&D and product innovation. These companies are leaders in developing AI-enabled mammography systems, tomosynthesis, and portable imaging devices. Furthermore, a robust network of diagnostic centers, specialized breast clinics, and awareness campaigns promotes routine screening and early diagnosis.

Region with the Highest CAGR

The Asia Pacific region is experiencing the highest compound annual growth rate (CAGR) in the mammography systems market, driven by rising healthcare investments, increasing breast cancer incidence, and expanding awareness of preventive screening. Countries such as China, India, Japan, South Korea, and Australia are seeing growing breast cancer prevalence due to changing lifestyles, aging populations, and urbanization. According to the World Health Organization (WHO), breast cancer is now the most common cancer among women in Asia, necessitating the rapid expansion of diagnostic infrastructure.

Government initiatives and national screening programs are increasingly being implemented across the region. For instance, India’s Ministry of Health and Family Welfare has promoted population-based screening for non-communicable diseases, including breast cancer. Similarly, China’s government has invested in public health outreach and the expansion of mammography services in urban and rural areas alike.

Another critical growth factor is the improving healthcare infrastructure, particularly in middle-income countries. Hospitals and diagnostic centers are adopting digital and 3D mammography to meet the rising demand for accurate and early diagnosis. Additionally, local manufacturers are entering the market with cost-effective imaging solutions, increasing accessibility to mammography in price-sensitive markets.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Mammography Systems Market: Competitive Landscape

The global mammography systems market is highly competitive, characterized by the presence of both multinational giants and emerging regional players focusing on innovation, market expansion, and strategic collaboration. Leading companies such as Hologic, Inc., GE HealthCare, Siemens Healthineers, FUJIFILM Holdings Corporation, and Konica Minolta, Inc. dominate the landscape with comprehensive product portfolios that span 2D, 3D, and digital breast tomosynthesis systems.

These industry leaders consistently invest in research and development to integrate advanced technologies such as artificial intelligence, automated image analysis, and portable mammography units. Hologic, for example, holds a strong foothold in the digital breast tomosynthesis segment and continues to develop AI-powered screening software. Similarly, Siemens Healthineers offers high-end mammography platforms with low-dose capabilities and ergonomic designs.

Strategic partnerships, acquisitions, and regional expansions are also defining competition. For instance, many players are partnering with hospitals and diagnostic chains to expand their footprint in emerging economies. FUJIFILM and GE HealthCare are enhancing their distribution networks across Asia Pacific and Latin America to tap into high-growth markets.

The competitive landscape is further influenced by regulatory compliance and product approvals, particularly from the U.S. FDA and European CE Mark. Additionally, smaller players and startups are gaining traction by offering low-cost and portable solutions to improve breast screening access in low-resource settings.

Overall, competition in this market revolves around innovation, clinical efficacy, cost-effectiveness, and geographic reach, pushing companies to differentiate through quality, AI integration, and market responsiveness.

Some of the prominent players in the Global Mammography Systems Market are:

- Hologic, Inc.

- Siemens Healthineers

- GE HealthCare

- Fujifilm Holdings Corporation

- Canon Medical Systems Corporation

- Philips Healthcare

- Carestream Health

- Planmed Oy

- Konica Minolta, Inc.

- Metaltronica S.p.A.

- Allengers Medical Systems Ltd.

- Analogic Corporation

- IMS Giotto S.p.A.

- Internazionale Medico Scientifica (IMS)

- Medtronic plc

- Hitachi, Ltd.

- Toshiba Medical Systems (now part of Canon)

- Delphinus Medical Technologies, Inc.

- Aurora Imaging Technology, Inc.

- ScreenPoint Medical

- Other Key Players

Recent Developments in the Global Mammography Systems Market

- July 2025: Konica Minolta launched a next-gen AI-integrated mammography workstation at the Radiology Society of North America (RSNA) Japan symposium, enhancing clinical workflow efficiency and early detection capabilities.

- June 2025: Hologic, Inc. announced a strategic investment to expand its 3Dimensions™ mammography system manufacturing unit in the U.S. to meet growing global demand.

- May 2025: GE HealthCare revealed a collaboration with a U.K.-based oncology institute to deploy its Pristina Dueta™ system for patient-assisted compression mammography.

- April 2025: Siemens Healthineers debuted a mobile 3D mammography van equipped with MAMMOMAT Revelation for rural cancer outreach programs in India.

- March 2025: Fujifilm Healthcare introduced an AI-driven AMULET Innovality mammography system at the European Congress of Radiology (ECR) 2025 in Vienna.

- February 2025: ScreenPoint Medical signed a partnership with Philips to integrate Transpara AI software into digital mammography units across the Netherlands.

- January 2025: Planmed Oy completed its merger with an image processing startup to enhance tomosynthesis and contrast-enhanced mammography capabilities for breast cancer screening.

- December 2024: Canon Medical Systems showcased its Soltus 500 digital X-ray platform with upgraded mammography modules at RSNA 2024 in Chicago.

- November 2024: iCAD, Inc. collaborated with the Mayo Clinic to validate the performance of ProFound AI™ for 3D Mammography in multi-ethnic populations.

- October 2024: Delphinus Medical Technologies raised $35 million in a funding round to accelerate the development of SoftVue™ whole breast ultrasound tomography systems.

- September 2024: Carestream Health launched a portable mammography system designed for low-resource settings during the World Cancer Congress 2024.

- August 2024: Agfa HealthCare announced an expansion of its Enterprise Imaging Platform to better support breast imaging data integration and AI algorithms for screening.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2,246.0 Mn |

| Forecast Value (2034) |

USD 4,043.5 Mn |

| CAGR (2025–2034) |

6.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 698.9 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Digital Mammography Systems (CR and DR), Film Screen Systems, and Analog Mammography Systems), By End User (Hospitals, Ambulatory Surgical Centers, Diagnostic Centers, Specialty Clinics, Research Institutes, and Other End Users |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Hologic, Inc., Siemens Healthineers, GE HealthCare, Fujifilm Holdings Corporation, Canon Medical Systems Corporation, Philips Healthcare, Carestream Health, Planmed Oy, Konica Minolta, Inc., Metaltronica S.p.A., Allengers Medical Systems Ltd., Analogic Corporation, IMS Giotto S.p.A., Internazionale Medico Scientifica (IMS), Medtronic plc, Hitachi, Ltd., Toshiba Medical Systems (now part of Canon), Delphinus Medical Technologies, Inc., Aurora Imaging Technology, Inc., ScreenPoint Medical, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Mammography Systems Market size is estimated to have a value of USD 2,246.0 million in 2025 and is expected to reach USD 4,043.5 million by the end of 2034.

The market is growing at a CAGR of 6.8 percent over the forecasted period of 2025.

The US Mammography Systems Market is projected to be valued at USD 698.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,220.2 million in 2034 at a CAGR of 6.4%.

North America is expected to have the largest market share in the Global Mammography Systems Market with a share of about 37.0% in 2025.

Some of the major key players in the Global Mammography Systems Market are Hologic, Inc., Siemens Healthineers, GE HealthCare, Fujifilm Holdings Corporation, Canon Medical Systems Corporation, Philips Healthcare, Carestream Health, Planmed Oy, Konica Minolta, Inc., Metaltronica S.p.A., Allengers Medical Systems Ltd., and many others.