This growth is primarily fueled by the rising desire for durable products & the expansion of activities in trade, remarkably in emerging nations throughout the Asia Pacific region. Within North America, the U.S. stands out as the largest consumer of marine lubricants, holding a maximum share of revenue in the North American region, in 2024. In the market of the United States, marine engine oils take center stage.

The increasing production of high-demand goods for emerging markets has resulted in heightened exports from the United States, and given the limitations of air transport, waterways have become vital for goods transportation. In this context, marine and

play a crucial role in the shipping sector, ensuring the efficiency and protection of engines and equipment.

These high-performance lubricants are perfectly designed to perform well in several operations, providing better characteristics like component protection at high temperatures, extended engine lifespan, better machinery performance & reliability, and mitigation of cold corrosion. Their economical nature further enhances fuel efficiency, making them a better choice in the long term. Moreover, with biodegradable & low-toxicity properties—similar to the sustainable benefits seen in biodegradable plastic—they contribute to reducing environmental impact, which is further driving their growing demand in the sector.

Lubricants play a crucial role in protecting hydraulic pumps by incorporating antiwear additives, corrosion and oxidation inhibitors, foam and aeration suppressants, and shear-stable viscosity index improvers. These formulations ensure optimal performance and durability of key hydraulic components, including vane pumps, piston pumps, and gear pumps.

Typically, lubricants are offered in multiviscosity ISO grades such as 15, 22, 32, 46, 68, and 100. The multiviscosity property enables seamless power transmission across a broad range of conditions, delivering minimal shudder and maximum precision in operations, making them essential for maintaining efficient and reliable hydraulic systems.

Marine Lubricants Market Key Takeaways

- Based on base oil, mineral-based oil is anticipated to standout as the most widely used raw material for marine lubricant production in 2024.

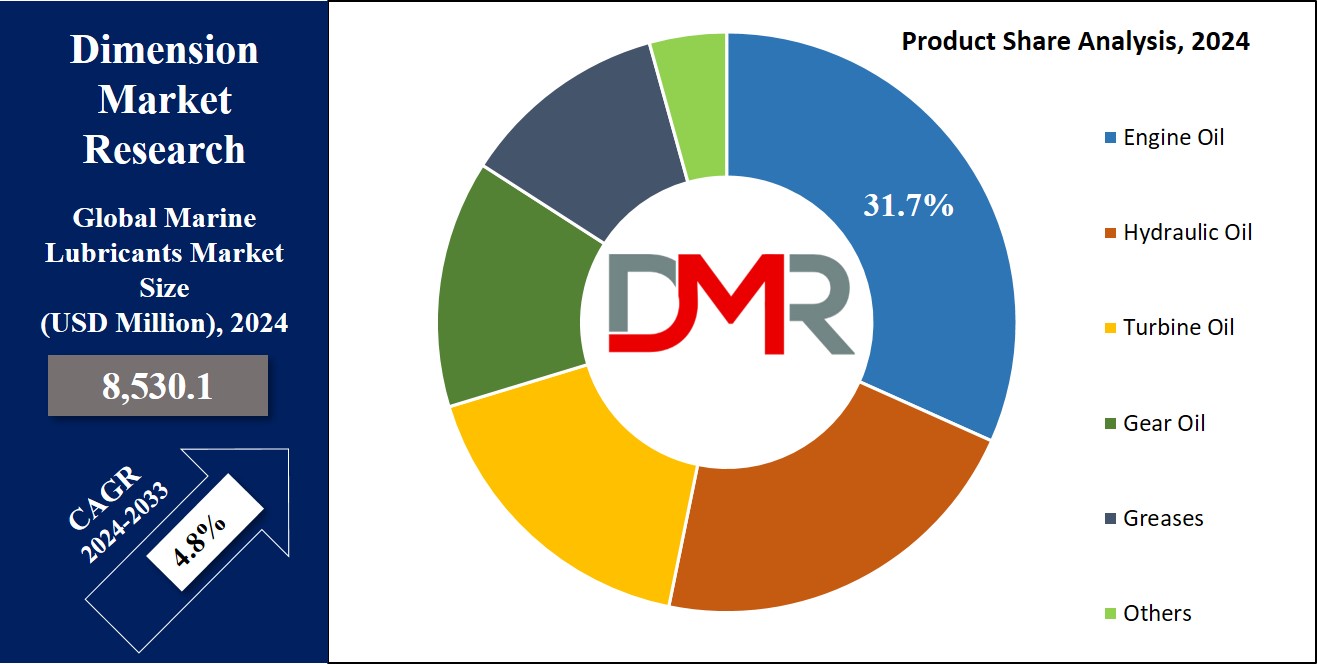

- In the context of product, engine oil is projected to take the lead, contributing the maximum share of the total revenue, with expectations of continued growth in the upcoming years.

- In the term of end users, bulk carriers are expected to hold the largest market share in the marine lubricants industry in 2024.

- The Asia Pacific region is anticipated to take the lead in terms of revenue in the market, accounting for over 42.4% of the total revenue share in 2024.

Marine Lubricants Market Use Cases

- Engine Lubrication: Ensures smooth operation of marine engines by reducing friction and wear, extending engine lifespan.

- Corrosion Protection: Forms a protective layer on engine and machinery components, preventing rust and seawater damage.

- Fuel Efficiency Optimization: Enhances engine performance by minimizing resistance, leading to lower fuel consumption.

- Emission Control Compliance: Helps meet stringent environmental regulations by reducing sulfur and nitrogen oxide emissions.

- Gearbox and Transmission Protection: Reduces friction in ship gear systems, ensuring seamless transmission and reducing mechanical failures.

- Hydraulic System Performance: Maintains stability and efficiency of hydraulic systems in ships, enhancing maneuverability and safety.

- Cold Weather and Extreme Conditions Support: Specialized lubricants prevent freezing and maintain viscosity in extreme marine environments.

Marine Lubricants Market Dynamic

Extensive research & development efforts are underway in the global marine industry to cater to the changing requirements of better-performance shipping sectors. This drive fosters to creation of products that need low maintenance, extend oil life, & enhance machinery performance.

Recent years have seen longer oil-change intervals & less oil consumption in inland & coastal shipping, creating supply and demand challenges. However, key players are actively involved in developing better-quality oils for several marine engines, utilizing better-developed technologies for consistently high performance.

Protection of the environment is a priority as the increasing number of ships raises concerns regarding emissions & waste. The IMO (International Marine Organization) continuously updates rules to deal with emissions & pollution that come from oil use, dumping, & exhaust.

The region of Asia Pacific, with an emphasis on nations such as Indonesia & Philippines, serves a pivotal role in the global market because of the enhanced spending in manufacturing & industry. Singapore's container business propels the shipping sector in the area, as Singapore works to transform its port into a global hub & a prominent maritime center.

To retain its competitive advantage, the Maritime & Port Authority is actively championing R&D initiatives, especially in offshore engineering & shipping. However, changing crude oil prices & oversupply of vessels amid the economic slowdown pose challenges to market growth. Overall, the strategic partnerships in developed countries including the United Kingdom are anticipated to open up new growth avenues for the market.

Driving Factors

The primary force propelling marine lubricants market growth is increased global maritime trade and shipping activities. With international trade expanding exponentially, demand for reliable, high quality marine lubricants has skyrocketed. Lubricants enhance engine performance, reduce wear and tear damage and enhance fuel efficiency essential factors in minimizing operational costs.

Stringent regulations from organizations like the International Maritime Organization (IMO) on sulfur emissions have further incentivized advanced, eco friendly lubricants. Their reliability in extreme marine environments makes innovative lubricants essential to supporting market expansion across both commercial shipping and recreational boating sectors.

Trending Factors

Trending One key trend in marine lubricants market is moving toward eco friendly and bio based lubricants. Increased environmental awareness has inspired innovation of non toxic lubricants with biodegradability properties that meet emission regulations. Manufacturers are investing heavily in R&D to produce formulations that meet performance standards while simultaneously having minimal environmental impacts.

Digitization in fleet management through IoT enabled monitoring systems has also influenced lubricant consumption patterns as operators prioritize predictive maintenance. Furthermore, LNG (Liquefied Natural Gas) as marine fuel has spurred an unprecedented transformation within the industry, necessitating special lubricants compatible with dual fuel engines further signalling significant change.

Restraining Factors

The marine lubricants market faces restraints due to fluctuating raw material prices and economic uncertainties impacting shipping demand. Crude oil price fluctuations directly impact production costs, leading to reduced profit margins.

Furthermore, higher costs associated with developing eco friendly formulations deter smaller manufacturers while stricter environmental regulations impose penalties upon non compliance geopolitical tensions or trade disruptions further slow market development resulting in consistent market development being hindered. Such barriers ultimately hinder market expansion.

Opportunity

One key opportunity in the marine lubricants market lies in creating region specific solutions tailored to diverse maritime environments. Emerging markets in Asia Pacific and Latin America represent an immense potential growth area as their trade and shipping activities flourish. Collaboration between lubricant manufacturers and vessel operators for customized product development may create market differentiation.

Advancements in additive technologies present opportunities for improved lubricant performance, including carbon footprint reduction. Furthermore, employing

artificial intelligence for predictive maintenance can further boost lubricant efficiency and vessel uptime providing innovative companies a competitive advantage in an ever evolving market.

Driving Factors

The primary force propelling marine lubricants market growth is increased global maritime trade and shipping activities. With international trade expanding exponentially, demand for reliable, high quality marine lubricants has skyrocketed. Lubricants enhance engine performance, reduce wear and tear damage and enhance fuel efficiency essential factors in minimizing operational costs.

Stringent regulations from organizations like the International Maritime Organization (IMO) on sulfur emissions have further incentivized advanced, eco friendly lubricants. Their reliability in extreme marine environments makes innovative lubricants essential to supporting market expansion across both commercial shipping and recreational boating sectors.

Trending Factors

Trending One key trend in marine lubricants market is moving toward eco friendly and bio based lubricants. Increased environmental awareness has inspired innovation of non toxic lubricants with biodegradability properties that meet emission regulations. Manufacturers are investing heavily in R&D to produce formulations that meet performance standards while simultaneously having minimal environmental impacts.

Digitization in fleet management through IoT enabled monitoring systems has also influenced lubricant consumption patterns as operators prioritize predictive maintenance. Furthermore, LNG (Liquefied Natural Gas) as marine fuel has spurred an unprecedented transformation within the industry, necessitating special lubricants compatible with dual fuel engines; further signalling significant change.

Restraining Factors

The marine lubricants market faces restraints due to fluctuating raw material prices and economic uncertainties impacting shipping demand. Crude oil price fluctuations directly impact production costs, leading to reduced profit margins.

Furthermore, higher costs associated with developing eco friendly formulations deter smaller manufacturers while stricter environmental regulations impose penalties upon non compliance; geopolitical tensions or trade disruptions further slow market development resulting in consistent market development being hindered. Such barriers ultimately hinder market expansion.

Opportunity

One key opportunity in the marine lubricants market lies in creating region specific solutions tailored to diverse maritime environments. Emerging markets in Asia Pacific and Latin America represent an immense potential growth area as their trade and shipping activities flourish. Collaboration between lubricant manufacturers and vessel operators for customized product development may create market differentiation.

Advancements in additive technologies present opportunities for improved lubricant performance, including carbon footprint reduction. Furthermore, employing artificial intelligence for predictive maintenance can further boost lubricant efficiency and vessel uptime providing innovative companies a competitive advantage in an ever evolving market.

Marine Lubricants Market Research Scope and Analysis

By Base Oil

The Marine Lubricants Market is anticipated to categorize by its base oil into three segments: mineral, synthetic, & bio-based base oils. Among these, mineral-based oil stands as the most widely used raw material for marine lubricant production.

Mineral-based oil dominates the segment with the maximum shares in the market in 2024. However, looking ahead, the synthetic base oil is all set for robust growth, propelled by its superior properties when compared to mineral oil.

Synthetic base oils provide significant benefits including resilience across several operating temperatures, high flash points, environmental friendliness, & a doubled machine service life in comparison to mineral oil.

Furthermore, synthetic marine lubricants contribute to enhanced vessel efficiency, foster fuel economy, & decrease overall operational expenses by extending oil change intervals & decreasing costs of maintenance.

By Product

The Marine Lubricants Market is categorized into product segments such as hydraulic oil, engine oil, gear oil, greases, turbine oil, and others. Engine oil takes the lead, contributing the maximum share of the total revenue, with expectations of continued growth, propelled by factors such as the growing global population & elevated consumer incomes fueling the desire for commercial goods. The fastest-growing category in the forecast period is hydraulic oils.

These oils are very important in lengthening the life of a pump under harsh conditions while also enabling cleanliness and filterability with air release that can be trusted. Moreover, the acceptance of environmentally friendly technologies has led to lower toxicity levels, aligning with environmental norms & benefiting marine life.

By End Use

The End-use segment is divided into five categories: bulk carriers, tankers, container ships, general cargo, and others. In 2024, bulk carriers are projected to hold the largest market share in the marine lubricants industry, holding a maximum revenue share. They are anticipated to maintain this leadership throughout the projected period.

This is majorly accredited to the increasing fleet of bulk carrier ships, which uses a substantial quantity of lubricants for several maintenance purposes, such as lubricating rolling bearings, hinges, threaded spindles, & engines. Factors like the continuous growth in trade via waterways, urbanization expansion, & enhanced investments by developing nations to foster their shipping sectors are driving the elevated demand for bulk carrier ships.

The Marine Lubricants Market Report is segmented on the basis of the following

By Base Oil

- Mineral Based Oil

- Synthetic Based Oil

- Bio-Based Oil

By Product

- Engine Oil

- Hydraulic Oil

- Gear Oil

- Turbine Oil

- Greases

- Others

By End-Use

- Bulk Carriers

- Tankers

- Container Ships

- General Cargo

- Others

How Does Artificial Intelligence Contribute To Improve Marine Lubricants Market ?

- Predictive Maintenance: AI-driven analytics monitor engine performance and predict lubricant degradation, reducing downtime and optimizing maintenance schedules.

- Optimized Lubricant Formulation: AI accelerates research and development by analyzing molecular compositions to create high-performance, environmentally friendly marine lubricants.

- Supply Chain Efficiency: AI-powered logistics and demand forecasting ensure timely lubricant availability while reducing inventory costs and supply chain disruptions.

- Condition Monitoring & Real-Time Analysis: AI sensors track lubricant condition in real time, enabling proactive replenishment and reducing operational risks.

- Energy Efficiency & Emission Reduction: AI optimizes lubrication strategies to enhance fuel efficiency and minimize carbon emissions, supporting sustainability initiatives.

- Automated Quality Control: AI-driven systems detect inconsistencies in lubricant production, ensuring higher quality and compliance with maritime regulations.

- Enhanced Customer Support: AI chatbots and predictive insights provide ship operators with recommendations on lubricant selection and maintenance best practices.

Marine Lubricants Market Regional Analysis

The Asia Pacific region is anticipated to take the lead in terms of revenue in the market,

accounting for over 42.4% of the total revenue share in 2024. This robust performance can be attributed to several major factors.

This region is abundant in ports and its shipbuilding sector continues to grow at a very promising rate. The marine sectors in countries like China, India, and Singapore will witness significant growth within the region that can further increase their consumptions of Marine lubricant.

In addition, Asia Pacific has emerged as a favorite destination for various industries due to the cheap labor and also easily accessible raw materials that further drive the market growth. Furthermore, the region has seen growing investments in manufacturing that are primarily attributed to the increased trade activities especially in China augmenting the marine lubricants market in Asia Pacific.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Marine Lubricants Market Competitive Landscape

The sector is known for the prevalence of a few multinational corporations that cater to the worldwide majority demand. The volatile price movements especially, due to the unwavering and increasing crude oil prices also force companies to look for novel alternatives to boost overall revenue generation. Businesses engage in many mergers and also partnerships to maintain their market position.

For instance, in February 2019 Lukoil Marine Lubricants Middle East signed a three-year contract with the Oman Shipping Company (OSC). In this agreement, Lukoil will supply the lubricants to service OSC’s large fleet of 39 vessels including extremely big VLCCS (very liquid crude carriers), chemical tankers, product tanks, and also LPG trucks.

Some of the prominent players in the Global Marine Lubricants Market are

- Quaker Chemical Corp.

- Repsol

- Kluber Lubrication

- Phillips 66

- Pennzoil

- Petrobras

- Bel-Ray Co. Inc.

- Innospec

- UniMarine Inc.

- Quepet Lubricants LLC

- Blaser Swisslube AG

- Gulf Oil International

- Other Key Players

Marine Lubricants Market Recent Developments

- In February 2023, Luberef introduced that increasing its base oil plant in Yanbu' al Bahr, Saudi Arabia will increase capacity via 230,000 metric lots yearly. The refiner, a subsidiary of Saudi Aramco, said the assignment would additionally upgrade the ability, allowing it to make API Group III base shares.

- In January 2023, CESPA came into an agreement with Total Energies SE, according to which CASPA’s United Arab Emirates (UAE) based upstream business assets will be acquired by Total Energies SE.

- In June 2022, China released its 0.33 advanced air service Fujian from Shanghai's Jiangnan Shipyard. The Fujian is China's first regionally designed and built catapult plane carrier.

- In April 2022, Chevron Global Energy Inc., an owned subsidiary of Chevron Corporation, completed the formerly announced acquisition of Neste Corporation's NEXBASE brand, associated qualifications and approvals, and related income and marketing operations from Neste Corporation.

- In March 2022, PANOLIN Group a subsidiary of Environmentally Considerate Lubricants (ECLs) was acquired by Shell Plc which aimed to improve its product formula, market position, and market expansion by utilizing the product portfolio of the ECL.

Marine Lubricants Market Report Details