Market Overview

The Global Medical 3D Printing Market is anticipated to reach USD 10.8 billion in 2025, driven by advancements in patient-specific implants, surgical guides, and bioprinting technologies. The market is expected to expand at a robust compound annual growth rate (CAGR) of 19.7% from 2025 to 2034, reaching a projected value of USD 54.6 billion by 2034. Growth is fueled by the increasing adoption of AI-enabled design and workflow automation, rising demand for customized prosthetics and anatomical models, and the integration of bioprinting in tissue engineering and regenerative medicine.

Additionally, expanding applications in dental, orthopedic, and surgical planning sectors, coupled with the growing availability of advanced polymers, metals, and bio-inks, are expected to further accelerate market expansion globally.

The global landscape for medical 3D printing is experiencing a profound transformation, moving beyond prototyping into the core of patient-specific care and complex manufacturing. A significant trend is the shift towards point-of-care printing, where hospitals are establishing in-house facilities to create anatomical models for surgical planning and custom guides. This decentralization of manufacturing accelerates procedural timelines and improves surgical outcomes by providing surgeons with tangible, patient-specific references.

Concurrently, the technology is advancing into bioprinting, where research focuses on creating living tissues, such as skin grafts and vascular structures, though this remains largely in the developmental and regulatory phase. The integration of artificial intelligence with 3D printing design software is also emerging, optimizing structures for implants and automating the model creation process from medical scan data.

The market's expansion is fueled by substantial opportunities in personalized medicine, particularly in crafting custom prosthetics and orthotics that offer unparalleled comfort and functionality compared to standard off-the-shelf solutions. The dental industry has become a major adopter, leveraging the technology for the precise and rapid production of crowns, bridges, and clear aligners, which has revolutionized dental workflows.

Furthermore, the ongoing development of novel, biocompatible printing materials, including advanced polymers and resorbable metals, opens new avenues for creating implants that integrate better with the human body. These innovations are poised to address complex clinical challenges in craniomaxillofacial and orthopedic surgeries, providing solutions that were previously unimaginable.

The US Medical 3D Printing Market

The US Medical 3D Printing Market is projected to reach USD 3.5 billion in 2025 at a compound annual growth rate of 18.5% over its forecast period.

The United States maintains a leadership position in the medical additive manufacturing landscape, a status fortified by substantial federal investment and a robust regulatory framework. Agencies like the National Institutes of Health (NIH) actively foster innovation through initiatives such as the NIH 3D Print Exchange, which provides a repository of bioscientific and medical models to accelerate research and education. The U.S. Food and Drug Administration has pioneered specific regulatory pathways for 3D-printed devices, providing clarity for manufacturers and having already cleared over 100 such devices for use in recent years.

This proactive stance from federal bodies creates a stable environment for technological advancement and commercial investment in the sector. The presence of world-leading academic and medical institutions, including the Mayo Clinic and the Cleveland Clinic, further drives clinical adoption through cutting-edge research and the establishment of on-site, point-of-care printing facilities that directly improve patient care.

A significant demographic advantage for the U.S. market is its large and aging population, a trend documented by the U.S. Census Bureau. This demographic shift predicts a substantial increase in the prevalence of chronic conditions such as osteoarthritis and cardiovascular disease, which in turn drives demand for personalized medical solutions. The need for patient-specific knee and hip implants, surgical guides for complex procedures, and anatomical models for pre-surgical planning is rising in direct correlation.

Furthermore, the high healthcare expenditure per capita, as reported by the Centers for Medicare & Medicaid Services (CMS), indicates a system capable of adopting advanced, albeit sometimes costly, technologies. This financial capacity, combined with a growing body of clinical evidence demonstrating the value of 3D-printed solutions in improving outcomes and reducing operating room time, is encouraging more hospitals to integrate this technology into their standard of care, ensuring continued market growth.

The Europe Medical 3D Printing Market

The Europe Medical 3D Printing Market is estimated to be valued at USD 1.6 billion in 2025 and is further anticipated to reach USD 6.4 billion by 2034 at a CAGR of 15.0%.

The European medical 3D printing ecosystem is characterized by strong collaboration between public research institutions and industry, guided by a comprehensive regulatory framework. The European Medicines Agency (EMA) and the new European Union Medical Device Regulation (MDR) provide a stringent set of requirements for the certification and clinical use of 3D-printed medical devices, ensuring high standards of safety and performance across member states.

This is supported by significant funding from Horizon Europe, the EU’s key research and innovation program, which has allocated resources to projects focused on additive manufacturing for healthcare, including the development of personalized implants and biofabrication. National health services, such as the NHS in the United Kingdom, are exploring the cost-benefit analysis of deploying 3D printing for specific applications, which is critical for guiding widespread adoption and reimbursement policies.

Europe's demographic structure, as analyzed by Eurostat, presents a clear driver for the medical additive manufacturing sector. The region has one of the world's most rapidly aging populations, leading to a higher incidence of age-related musculoskeletal and cardiovascular diseases. This creates a pressing need for innovative, patient-specific treatments that can improve the quality of life for elderly citizens.

The strong public healthcare systems prevalent across the continent are increasingly focused on value-based care, seeking technologies that can reduce long-term hospitalization and improve surgical efficiency. The presence of a highly skilled engineering workforce and a dense network of specialized clinical centers facilitates the development and application of complex 3D-printed solutions, from custom cranial implants in Germany to patient-specific surgical guides in France, positioning Europe as a critical and advanced market for medical 3D printing innovation.

The Japan Medical 3D Printing Market

The Japan Medical 3D Printing Market is projected to be valued at USD 648 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2,911 million in 2034 at a CAGR of 17.6%.

Japan's foray into medical additive manufacturing is heavily influenced by its status as the world's most aged society, a demographic reality extensively documented by the Japanese Ministry of Health, Labour and Welfare. This has created an urgent and growing demand for regenerative medicine and personalized surgical solutions, particularly in orthopedics and dentistry.

In response, the Japanese government has strategically prioritized 3D printing and robotics through national initiatives, with the Japan Agency for Medical Research and Development (AMED) funding projects that bridge the gap between academic research and clinical application. The Pharmaceuticals and Medical Devices Agency (PMDA), Japan's regulatory body, has been working to establish clear approval pathways for 3D-printed medical devices, providing a structured, though rigorous, environment for manufacturers to bring new products to market, ensuring they meet the highest safety standards.

The demographic advantage for Japan lies in its technologically proficient society and its urgent need to maintain the quality of life for its senior citizens. This drives innovation in creating lightweight, custom-fit prosthetics and implants that cater to the specific physiological needs of an older patient cohort.

The National Institute of Advanced Industrial Science and Technology (AIST) is actively involved in research on advanced materials and bio-inks suitable for these applications. Furthermore, the high density of advanced medical institutions in urban centers like Tokyo and Osaka serves as an early adopter and testing ground for new 3D printing applications. This combination of demographic pressure, strong governmental support for technology, and a culture of precision engineering positions Japan as a unique and highly advanced market focused on leveraging 3D printing to address the challenges of a super-aged society.

Global Medical 3D Printing Market: Key Takeaways

- Global Market Size Insights: The Global Medical 3D Printing Market size is estimated to have a value of USD 10.8 billion in 2025 and is expected to reach USD 54.6 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 19.7 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Medical 3D Printing Market is projected to be valued at USD 3.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 15.9 billion in 2034 at a CAGR of 18.5%.

- Regional Insights: North America is expected to have the largest market share in the Global Medical 3D Printing Market with a share of about 38.0% in 2025.

- Key Players: Some of the major key players in the Global Medical 3D Printing Market are 3D Systems Corporation, Stratasys Ltd., Materialise NV, EOS GmbH, GE Additive, SLM Solutions Group AG, EnvisionTEC GmbH (ETEC), Formlabs Inc., and many others.

Global Medical 3D Printing Market: Use Cases

- Surgical Planning Models: Surgeons use patient-specific 3D-printed anatomical models derived from CT scans to meticulously plan complex procedures, such as separating conjoined twins, reducing operative time and improving precision.

- Customized Prosthetics: Highly personalized prosthetic limbs and sockets are 3D printed, offering a perfect fit for the patient's unique anatomy, which dramatically improves comfort, functionality, and user acceptance, especially for children.

- Patient-Specific Implants: For complex cranial or facial reconstructions following trauma or cancer surgery, surgeons can implant 3D-printed titanium plates designed to match the patient's exact bone structure for optimal restoration.

- Dental Applications: The dental industry widely adopts 3D printing to manufacture crowns, bridges, surgical guides for implant placement, and clear aligners, streamlining workflows and enabling mass customization.

- Bioprinting Tissues: Researchers are pioneering the 3D printing of living cells, known as bioprinting, to create tissue constructs like skin grafts and vascular networks for drug testing and future therapeutic transplantation.

Global Medical 3D Printing Market: Stats & Facts

National Institutes of Health (NIH) — NIH 3D / NIH 3D Print Exchange

- NIH 3D Print Exchange (NIH 3DPX) lists 15,084 discoverable 3D models in its repository.

U.S. Food and Drug Administration (FDA)

- FDA published “Technical Considerations for Additive Manufactured Medical Devices” guidance (initial final guidance date: 5 December 2017).

- FDA 3D-printing page content was last marked “content current as of 12 May 2023.”

- During the COVID response the NIH/FDA/VA collaboration reported 685 models published in the NIH COVID collection (as of 3 Aug 2020).

- The same FDA COVID update reported 95,743 file downloads from the NIH 3DPX (huge increase vs. prior period).

- FDA reported 493,000 unique visitors to the NIH 3D Print Exchange (COVID response period reporting).

- FDA reported the interagency effort matched 943,678+ 3D-printed pieces (e.g., face shields and masks) to providers (as of Aug 3, 2020).

- FDA reported 480 manufacturers submitted capabilities information to the America Makes hub (as of June 9, 2020).

- FDA reported 33 NIH-badge “clinically reviewed” models (as of Aug 3, 2020).

- FDA records confirm the first FDA-approved 3D-printed drug (Spritam®) was approved in 2015 (approval documents dated mid-2015).

National Institute for Occupational Safety and Health (NIOSH) / CDC

- NIOSH evaluated emissions from simultaneous operation of up to 20 desktop 3D printers in workplace studies.

- NIOSH published an advisory/report “Approaches to safe 3D printing” (summary guidance published Nov 8, 2023).

- NIOSH has highlighted ultrafine particle (UFP) and VOC exposure risks associated with some 3D printing processes and recommended controls for workplaces.

Organisation for Economic Co-operation and Development (OECD)

- OECD analysis reported that an increase of ~USD 14,000 in imports of 3D printers is associated (on average) with an increase of about USD 3.3 million in exports of 3D-printable goods.

- OECD found that a 1% increase in the value of imports of 3D printers corresponds to approximately a +0.02% increase in exports of 3D-printable items.

International Medical Device Regulators Forum (IMDRF)

- IMDRF is composed of 11 founding member jurisdictions/authorities (formal IMDRF membership structure).

- IMDRF published the “Personalized Medical Devices — Regulatory Pathways” (N58) guidance as a final document (published 14 September 2023, Edition 2).

- IMDRF’s 2021–2025 strategic work program recorded the release of several PMD/production verification guidance documents in 2023 to address personalized (including 3D-printed) devices.

National Health Service (NHS, UK) / Medicines & Healthcare products Regulatory Agency (MHRA)

- A UK Freedom-of-Information / survey-based study reported 53 NHS trusts (≈25% of trusts) were using 3D printing (mainly for surgical guides and anatomical models).

- The UK regulator (MHRA / GOV.UK guidance) issued explicit guidance on 3D printing of medical devices / PPE during the COVID-19 pandemic (published 4 June 2020).

World Health Organization (WHO)

- WHO published “Imagining futures of 3D bioprinting” (publication date 1 February 2024) addressing public-health implications, regulation, equity, and ethics for 3D bioprinting.

- WHO COVID-response reporting noted that in an Africa innovation snapshot ~25% of listed COVID-response technologies in a regional sample were based on 3D printing (reported in WHO country/summary reporting).

International Organization for Standardization (ISO) / ASTM F42 (standards bodies)

- ISO’s membership comprises 167 national member bodies (context for ISO standardization activities).

- ISO’s catalog shows tens of thousands of standards globally (ISO often reports ~24,362 total published standards across all domains.

- Recent literature/standards reviews reported ~35 additive-manufacturing (AM) standards under development across ISO/ASTM working groups (AM standardization pipeline).

- ASTM F42 (Additive Manufacturing Technologies committee) surpassed the 1,000-member mark (membership of working group reported over 1,000 members in late 2020), reflecting standards activity including medical/biological subcommittees.

Therapeutic Goods Administration (TGA, Australia)

- TGA guidance pages for personalised medical devices (including 3D-printed devices) were published and last updated in 2024 (guidance maintained and updated; example update Oct 17, 2024).

- An Australian regulatory impact assessment estimated ~5%–20% market penetration for medical devices that might utilise 3D printing (range estimate used in policy analysis).

European Commission (EC) / EU policy

- The EU Medical Device Regulation (MDR) which applies to 3D-printed medical devices marketed in the EU entered into application in May 2021 (regulatory milestone relevant to 3D-printed devices).

Global Medical 3D Printing Market: Market Dynamic

Driving Factors in the Global Medical 3D Printing Market

Demographic Shift towards Aging Populations

The global demographic trend of an increasingly elderly population is a primary driver for the medical 3D printing market. Older demographics have a higher prevalence of chronic conditions such as osteoarthritis, cardiovascular disease, and dental deterioration, which necessitate interventions like joint replacements, dental implants, and personalized surgical care. 3D printing technology is uniquely positioned to address these needs through the cost-effective mass customization of implants, prosthetics, and surgical guides that are tailored to the individual's anatomy, offering superior fit and functionality compared to standard devices and improving the quality of life for aging patients.

Supportive Regulatory Frameworks and Government Funding

The establishment of clearer regulatory pathways by major agencies like the U.S. FDA and the EU's MDR has provided the necessary clarity and confidence for manufacturers to invest heavily in the sector. These frameworks validate the safety and efficacy of 3D-printed devices, accelerating their time-to-market. Furthermore, substantial government and institutional funding, such as from the NIH in the U.S. and Horizon Europe in the EU, directly fuels foundational research and development in bioprinting, new material science, and clinical applications. This financial and regulatory support de-risks innovation and catalyzes the transition of 3D printing from a niche technology to a mainstream clinical tool.

Restraints in the Global Medical 3D Printing Market

High Capital and Operational Costs

The significant initial investment required for high-end, medical-grade 3D printers, along with the ongoing costs for specialized materials, software, and maintenance, presents a major barrier to entry, particularly for smaller hospitals and clinics. Beyond the hardware, the total cost of ownership includes the need for a controlled environment, post-processing equipment, and skilled personnel. This financial hurdle can slow down widespread adoption, as healthcare providers must conduct rigorous cost-benefit analyses to justify the investment, often requiring demonstrable proof of reduced surgical times or improved patient outcomes to secure funding and achieve a positive return on investment.

Shortage of Specialized Workforce and Training Gaps

The effective implementation of medical 3D printing requires a unique, interdisciplinary skill set that combines expertise in medical anatomy, imaging, engineering design, and additive manufacturing principles. There is a pronounced shortage of professionals trained in this niche intersection, creating a significant human resource bottleneck. The lack of standardized training programs and certifications further exacerbates this challenge. Without a larger pool of qualified biomedical engineers and technicians who can operate the systems, manage the digital workflow, and ensure quality control, the scalability of point-of-care manufacturing and the pace of industrial innovation are critically hampered.

Opportunities in the Global Medical 3D Printing Market

Expansion in the Dental Sector

The dental industry represents one of the largest and most rapidly expanding opportunities for 3D printing adoption. The technology is ideal for producing a wide array of dental appliances with high precision and efficiency, including crowns, bridges, dentures, surgical guides for implants, and clear orthodontic aligners. The shift from traditional analog methods to digital workflows, driven by intraoral scanning and 3D printing, offers dental labs and clinics significant gains in productivity, cost reduction, and the ability to offer mass customization. This digital disruption positions 3D printing as a cornerstone technology for the future of digital dentistry.

Pharmaceutical and Drug Delivery Applications

A nascent but high-potential growth frontier lies in the pharmaceutical industry, where 3D printing is being explored for fabricating personalized dosage forms. This technology enables the creation of polypills, single tablets with multiple active ingredients, each with tailored release profiles. It allows for the production of drugs with precise dosages calibrated for individual patient needs, such as for pediatric or geriatric populations. This capability for precision medicine in pharmacology could revolutionize drug adherence and therapeutic efficacy, opening a completely new and substantial market segment for medical additive manufacturing beyond devices and implants.

Trends in the Global Medical 3D Printing Market

Point-of-Care Manufacturing

A dominant trend is the migration of 3D printing directly into hospital settings, establishing decentralized manufacturing hubs. This shift enables the rapid production of patient-specific anatomical models, surgical guides, and custom instruments on demand. The benefits are profound, leading to reduced lead times for complex surgeries, decreased overall procedural costs, and significantly improved surgical outcomes by allowing for meticulous preoperative planning. This model fosters a closer collaboration between clinicians and engineers, transforming traditional medical device supply chains and placing the power of manufacturing directly in the hands of healthcare providers to better serve their immediate patient needs.

Advanced Material Development

The industry is witnessing rapid innovation in the development of novel, high-performance printing materials tailored for medical applications. This includes the creation of biocompatible resins with advanced properties, resorbable metals like magnesium alloys that dissolve in the body after healing, and specialized polymers for durable, long-term implants. Concurrently, significant research is focused on bio-inks, which are materials containing living cells used in bioprinting. These advancements are expanding the application horizon from passive implants to active, bioactive constructs that can promote tissue regeneration and integration, pushing the boundaries of regenerative medicine and personalized therapeutic solutions.

Global Medical 3D Printing Market: Research Scope and Analysis

By Component Analysis

The Hardware segment, comprising the 3D printers themselves, is projected to represent the foundational and currently dominant component in terms of capital investment and market revenue. This dominance is driven by the high cost of industrial-grade systems required for producing medical and dental devices. Precision stereolithography (SLA) printers for dental models and surgical guides, selective laser melting (SLM) systems for manufacturing titanium orthopedic implants, and multi-material PolyJet machines for creating highly detailed, multi-tissue anatomical models all command significant prices. The initial purchase of this hardware by medical device manufacturers, large dental laboratories, and pioneering hospitals constitutes a major portion of the market's financial activity.

However, the Consumables & Materials segment is not only the fastest-growing but is also poised to become the most substantial in the long term. It represents a continuous, recurring revenue stream that locks in customers after the initial hardware purchase. The critical need for specific, certified, and often proprietary materials for each application creates a robust market.

This includes biocompatible Class I and II resins for surgical guides, medical-grade titanium and cobalt-chrome powders for permanent implants, specialized flexible polymers for prosthetic sockets, and the rapidly evolving field of bio-inks for tissue engineering research. The performance, safety, and regulatory clearance of any 3D-printed medical device are intrinsically tied to the material used, making this segment both highly profitable and critically important for technological advancement and clinical adoption.

By Technology Analysis

Fused Deposition Modeling (FDM/FFF) is anticipated to dominate the medical 3D printing landscape in terms of unit volume and accessibility, particularly within point-of-care hospital settings. Its dominance stems from its low operating cost, ease of use, and the wide availability of biocompatible and sterilizable thermoplastics like ABS and PLA. Hospitals heavily utilize FDM for creating low-cost, tactile anatomical models for complex surgical planning, as well as for producing custom jigs, guides, and non-sterile instrument handles.

For the production of high-performance, end-use medical devices, Selective Laser Sintering (SLS) and Selective Laser Melting (SLM) are the industrial workhorses. SLS dominates the production of durable, complex plastic components without the need for support structures, ideal for creating custom surgical instruments.

SLM is the undisputed leader for manufacturing permanent, load-bearing metal implants, such as spinal cages, hip acetabular cups, and patient-specific cranial plates, thanks to its ability to fuse fine layers of titanium and cobalt-chrome alloys into incredibly strong and biocompatible structures. In the dental and high-detail model sector, Stereolithography (SLA) and Digital Light Processing (DLP) technologies are leaders due to their superior resolution, smooth surface finish, and speed, making them the gold standard for producing dental surgical guides, clear aligners, and highly accurate anatomical models.

By Material Type Analysis

Polymers and Plastics are poised to be widely used materials in the medical 3D printing space by volume and diversity of application. This segment encompasses a vast range of photopolymer resins for vat polymerization (SLA/DLP) and thermoplastic filaments/powders for FDM and SLS. Their dominance is fueled by the massive demands of the dental industry for crowns, bridges, and models, the need for clear surgical guides in hospitals, and the cost-effective production of anatomical models for education and pre-surgical planning.

The versatility of polymers, including transparent, flexible, and biocompatible grades, ensures their continued prevalence. For load-bearing, permanent implants that require exceptional strength and integration with human bone, Metals & Alloys are the dominant and most critical material class. Medical-grade Titanium (Ti-6Al-4V) and its alloys are the gold standard, favored for their high strength-to-weight ratio, corrosion resistance, and excellent osseointegration properties.

These metals are essential for manufacturing orthopedic implants like spinal cages, hip and knee replacements, and patient-specific craniomaxillofacial plates using powder bed fusion technologies like SLM and EBM. While Bio-inks & Cell-based materials currently represent a niche segment in terms of commercial revenue, they are the focal point of the most cutting-edge research, holding the highest growth potential for revolutionary applications in tissue engineering and regenerative medicine.

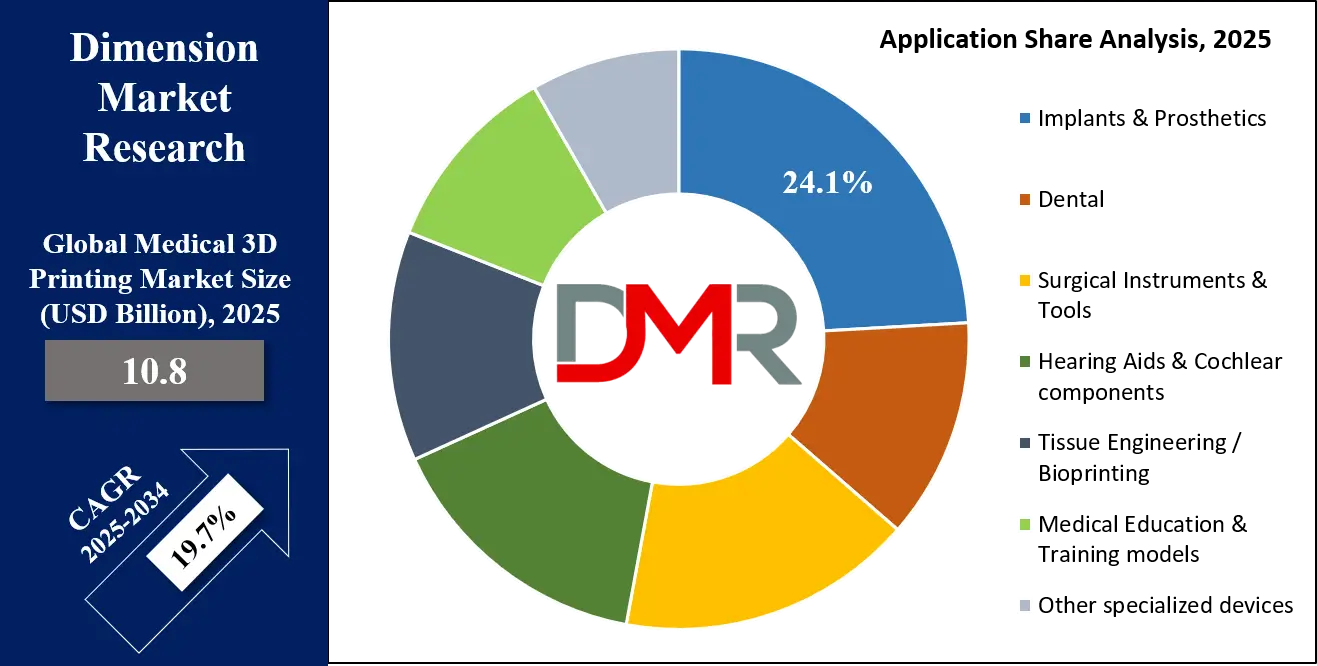

By Application Analysis

The Dental application segment is expected to be the undisputed leader in terms of commercial adoption, market revenue, and technological integration. 3D printing has revolutionized digital dentistry, moving from a niche prototyping tool to a core production technology. It dominates the mass customization of a wide array of dental appliances, including permanent restorations like crowns and bridges, removable dentures, precise surgical guides for dental implant placement, and the entire clear aligner industry. The speed, accuracy, and cost-effectiveness of producing patient-specific parts have made 3D printing indispensable in modern dental laboratories and clinics.

The Implants & Prosthetics segment is a major and critically important application area, driven by the profound clinical benefits of patient-specific devices. This includes custom titanium cranial plates for neurosurgery, patient-specific instruments for complex joint replacements, and socket interfaces for limb prosthetics. The ability to create implants that perfectly match a patient's unique anatomy, based on CT or MRI data, leads to significantly improved surgical outcomes, reduced operation times, and better long-term patient comfort and functionality. This segment demonstrates the highest value proposition of 3D printing in creating life-changing medical devices that are impossible to manufacture using traditional subtractive methods.

By End-User Analysis

Medical Device Manufacturers and Dental Laboratories & Clinics are projected to be the dominant commercial end-users driving the production side of the market. Established medical device companies leverage 3D printing for both rapid prototyping and, increasingly, for the direct digital manufacturing of FDA-cleared and CE-marked end-use devices, such as orthopedic implants and surgical instruments. Dental labs have fully integrated the technology into their digital workflows, using it to produce a high volume of patient-specific appliances daily. Meanwhile, Hospitals & Surgical Centers are the fastest-growing and most transformative end-user segment.

They are rapidly establishing point-of-care 3D printing facilities, often in collaboration with radiology or biomedical engineering departments. This allows them to produce patient-specific anatomical models for pre-surgical rehearsal and custom surgical guides and cutting jigs on demand. This internal capability fundamentally changes surgical workflows, reducing time in the operating room and improving precision, thereby solidifying the hospital's role not just as a consumer but as an active manufacturer of patient-specific solutions.

The Global Medical 3D Printing Market Report is segmented on the basis of the following:

By Component

- Hardware

- 3D Printers

- Fused Deposition Modeling (FDM) Printers

- Stereolithography (SLA) Printers

- Selective Laser Sintering (SLS) Printers

- PolyJet / MultiJet Printers

- Electron Beam Melting (EBM) Printers

- Binder Jetting Printers

- Bioprinters (inkjet/extrusion-based)

- Printing Accessories & Components

- Build Platforms and Chambers

- Laser and Optical Systems

- Control Units & Calibration Equipment

- Embedded Sensors and Monitoring Modules

- Print Heads and Nozzles

- Post-Processing Equipment

- Cleaning & Curing Systems

- Surface Finishing & Polishing Units

- Sterilization Chambers

- Software

- Design and Modeling Software

- Computer-Aided Design (CAD) Tools

- Anatomical Modeling and Segmentation Tools

- Prosthetic and Implant Design Platforms

- Imaging and Conversion Software

- DICOM-to-3D Conversion Tools

- Medical Image Processing and Reconstruction Software

- Virtual Surgical Planning Tools

- Workflow and Print Management Software

- Printer Control & Optimization Platforms

- Quality Assurance and Compliance Software

- Cloud-based Collaboration and File Management Systems

- Services

- Contract Manufacturing Services

- Custom Implant & Prosthetic Fabrication

- Anatomical Model Production

- Tooling & Device Prototyping

- 3D Scanning and Modeling Services

- Patient-Specific Data Capture

- Reverse Engineering and Model Reconstruction

- Post-Processing & Finishing Services

- Surface Treatment and Assembly

- Sterilization, Quality Testing, and Certification

- Maintenance & Support

- Printer Installation and Calibration

- On-site Maintenance & Troubleshooting

- Technical Training and Consulting

- Consumables & Materials

- Filaments

- Resins

- Metal Powders

- Bio-Inks

By Technology

- Stereolithography (SLA) / Digital Light Processing (DLP)

- Fused Deposition Modeling / Fused Filament Fabrication (FDM/FFF)

- Selective Laser Sintering (SLS) / Selective Laser Melting (SLM)

- Electron Beam Melting (EBM)

- PolyJet / MultiJet

- Binder Jetting

- Inkjet Bioprinting / Extrusion Bioprinting (bio-inks)

- Other

By Material Type

- Polymers / Plastics

- Medical-Grade Resins

- PEEK

- PEKK,

- PLA

- ABS

- Metals & Alloys

- Titanium

- Cobalt-Chrome

- Stainless Steel

- Ceramics

- Zirconia

- Alumina

- Composites

- Bio-inks & Cell-based materials

- Support materials & post-processing media

By Application

- Implants & Prosthetics

- Custom Orthopedic Implants

- Cranio-Maxillofacial Implants

- Dental

- Crowns

- Bridges

- Surgical Guides

- Dentures

- Orthodontic Aligners

- Surgical Instruments & Tools

- Hearing Aids & Cochlear components

- Tissue Engineering / Bioprinting

- Medical Education & Training models

- Other specialized devices

By End-User

- Hospitals & Surgical Centers

- Dental Laboratories & Clinics

- Pharmaceutical & Biotechnology Companies

- Medical Device Manufacturers

- Research Institutes & Universities

- Contract Manufacturing Organizations (CMOs)

- Diagnostic Labs

Impact of Artificial Intelligence in the Global Medical 3D Printing Market

- Enhanced Customization & Precision: AI algorithms analyze patient-specific medical imaging (CT, MRI, DICOM data) to generate highly accurate 3D models for implants, prosthetics, and surgical guides, reducing errors and improving clinical outcomes.

- Optimized Printing Workflow: AI-driven software automates design optimization, support structure placement, and print path generation, reducing material wastage, print time, and post-processing requirements.

- Predictive Maintenance & Performance Monitoring: AI-powered sensors in 3D printers detect anomalies, predict maintenance needs, and monitor performance in real-time, increasing uptime and reliability in hospitals and production facilities.

- Accelerated Bioprinting & Tissue Engineering: AI assists in modeling complex tissue architectures, optimizing bio-ink formulations, and controlling cell placement during extrusion or inkjet bioprinting, enhancing success rates in regenerative medicine.

- Data-Driven Decision Making & R&D Acceleration: AI analyzes large datasets from past prints, clinical outcomes, and material properties to guide R&D, enable faster prototyping, and support regulatory compliance in medical device development.

Global Medical 3D Printing Market: Regional Analysis

Region with the Largest Revenue Share

North America, led by the United States, is projected to command the largest share of the global medical 3D printing market with 38.0% of market share by the end of 2025, due to a powerful confluence of technological leadership, regulatory clarity, and a favorable healthcare ecosystem. The region is home to many of the world's leading additive manufacturing companies, such as Stratasys, 3D Systems, and Carbon, which continuously drive innovation in both hardware and advanced, biocompatible materials. This technological edge is complemented by a proactive and sophisticated regulatory framework. The U.S. Food and Drug Administration (FDA) has established clear pathways for the approval of 3D-printed medical devices, having already cleared over a hundred such products.

This regulatory predictability de-risks investment for medical device manufacturers and encourages rapid commercialization. Furthermore, the presence of a robust healthcare infrastructure with high per-capita spending enables hospitals and research institutions to invest in cutting-edge technology. Pioneering medical centers, including the Mayo Clinic and the Cleveland Clinic, have integrated 3D printing into their standard of care, establishing in-house facilities for surgical planning and custom device creation.

High levels of funding from organizations like the National Institutes of Health (NIH) fuel foundational research in bioprinting and new applications. This synergy between established industry players, a supportive regulatory body, advanced clinical end-users, and strong R&D funding creates a virtuous cycle that solidifies North America's dominant market position.

Region with the Highest CAGR

The Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) in the medical 3D printing market, fueled by massive healthcare modernization, government-led initiatives, and compelling demographic pressures. Countries like China, Japan, and India are making substantial public and private investments in advanced manufacturing technologies as a core part of their industrial and health policies.

Initiatives such as "Made in China 2025" explicitly prioritize the development and adoption of 3D printing, creating a powerful tailwind for the domestic industry. This is coupled with a rapidly expanding and upgrading healthcare infrastructure aimed at serving a vast and increasingly affluent population. The region also faces a pronounced demographic challenge with a swiftly aging population, particularly in Japan and South Korea, which is driving demand for personalized orthopedic and dental solutions that 3D printing is uniquely suited to provide.

To address the needs of this large population base, there is a strong focus on developing cost-effective medical solutions, and 3D printing offers a path to affordable customization for implants, prosthetics, and surgical instruments. The growing presence of local manufacturers offering competitive hardware and materials is making the technology more accessible than ever. This combination of strong governmental support, urgent healthcare needs, a growing patient pool, and increasing cost-competitiveness creates an explosive growth environment, positioning the Asia Pacific as the fastest-growing market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Medical 3D Printing Market: Competitive Landscape

The competitive landscape of the global medical 3D printing market is fragmented and highly dynamic, characterized by a mix of established 3D printing giants, specialized medical device firms, and a vibrant ecosystem of innovative startups. Dominant players like Stratasys Ltd., 3D Systems Corporation, and Materialise NV leverage their extensive portfolios of patented technologies, advanced materials, and sophisticated software platforms to maintain a stronghold, particularly in the realms of surgical planning, dental applications, and custom guides.

These companies compete not only on technology but also on the strength of their regulatory expertise and global clinical support networks. A significant trend is the deep foray of traditional medical device conglomerates, such as Stryker and Johnson & Johnson, which are aggressively investing in and integrating 3D printing to manufacture their own proprietary implants, most notably in the spinal and orthopedic segments.

This vertical integration allows them to control the entire production chain from design to finished device. Simultaneously, the market sees intense competition from specialized and regional players, including EnvisionTEC (now part of Desktop Metal) in dental and bioprinting, and Arcam AB (within GE Additive) in electron beam melting for metal implants. The landscape is further energized by startups focusing on disruptive applications like point-of-care bioprinting and AI-driven design software, ensuring continuous innovation and intensifying competition across all segments.

Some of the prominent players in the Global Medical 3D Printing Market are:

- 3D Systems Corporation

- Stratasys Ltd.

- Materialise NV

- EOS GmbH

- GE Additive (General Electric)

- SLM Solutions Group AG

- EnvisionTEC GmbH

- Formlabs Inc.

- Renishaw plc

- HP Inc.

- Carbon, Inc.

- Desktop Metal, Inc.

- Organovo Holdings, Inc.

- Prodways Group

- Oxford Performance Materials, Inc.

- Cyfuse Biomedical K.K.

- CELLINK (BICO Group AB)

- Rapid Shape GmbH

- regenHU Ltd.

- BioBots (Alchemy 3D)

- Other Key Players

Recent Developments in the Global Medical 3D Printing Market

- May 2024: The Radiological Society of North America (RSNA) announces the launch of a new special interest group focused on the clinical integration of 3D printing and point-of-care manufacturing in hospital radiology departments.

- April 2024: Stratasys Ltd. and Ricoh USA, Inc. announce a strategic collaboration to accelerate the adoption of 3D-printed anatomical models for surgical planning within U.S. hospital systems.

- March 2024: The FDA announces a new pilot program for the "Quality Management System for Additive Manufacturing" aimed at streamlining the regulatory review process for 3D-printed medical devices.

- February 2024: 3D Systems Corporation completes its acquisition of Kumovis, a developer of high-performance 3D printing systems for medical implants, enhancing its portfolio in regulated manufacturing.

- January 2024: The "Additive Manufacturing in Medicine" conference (AMM 2024) is held in Basel, Switzerland, featuring keynotes on the regulatory pathway for bioprinted tissues.

- November 2023: Formlabs launches the "Fuse 1+ 30W," a more powerful selective laser sintering (SLS) printer aimed at making in-house production of durable medical devices and instruments more accessible to dental labs and clinics.

- October 2023: CELLINK (now BICO) and a major European research university announce a collaboration to develop 3D-bioprinted cartilage tissue for reconstructive surgery applications.

- September 2023: The International Manufacturing Technology Show (IMTS) in Chicago features a dedicated pavilion for medical additive manufacturing, highlighting new materials from BASF and HP Inc. for healthcare applications.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 10.8 Bn |

| Forecast Value (2034) |

USD 54.6 Bn |

| CAGR (2025–2034) |

19.7% |

| The US Market Size (2025) |

USD 3.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component/Product (Hardware, Software, Services, Consumables & Materials), By Technology (Stereolithography (SLA)/Digital Light Processing (DLP), Fused Deposition Modeling/Fused Filament Fabrication (FDM/FFF), Selective Laser Sintering/Selective Laser Melting (SLS/SLM), Electron Beam Melting (EBM), PolyJet/MultiJet, Binder Jetting, Inkjet Bioprinting/Extrusion Bioprinting, and Other), By Material Type (Polymers/Plastics, Metals & Alloys, Ceramics, Composites, Bio-inks & Cell-based Materials, and Support Materials & Post-Processing Media), By Application (Implants & Prosthetics, Dental, Surgical Instruments & Tools, Hearing Aids & Cochlear Components, Tissue Engineering/Bioprinting, Medical Education & Training Models, and Other Specialized Devices), By End-User (Hospitals & Surgical Centers, Dental Laboratories & Clinics, Pharmaceutical & Biotechnology Companies, Medical Device Manufacturers, Research Institutes & Universities, and Contract Manufacturing Organizations (CMOs), Diagnostic Labs) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

3D Systems Corporation, Stratasys Ltd., Materialise NV, EOS GmbH, GE Additive, SLM Solutions Group AG, EnvisionTEC GmbH (ETEC), Formlabs Inc., Renishaw plc, HP Inc., Carbon Inc., Desktop Metal Inc., Organovo Holdings Inc., Prodways Group, Oxford Performance Materials Inc., Cyfuse Biomedical K.K., CELLINK (BICO Group AB), Rapid Shape GmbH, regenHU Ltd., and BioBots (Alchemy 3D), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Medical 3D Printing Market size is estimated to have a value of USD 10.8 billion in 2025 and is expected to reach USD 54.6 billion by the end of 2034.

The market is growing at a CAGR of 19.7 percent over the forecasted period of 2025.

The US Medical 3D Printing Market is projected to be valued at USD 3.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 15.9 billion in 2034 at a CAGR of 18.5%.

North America is expected to have the largest market share in the Global Medical 3D Printing Market with a share of about 38.0% in 2025.

Some of the major key players in the Global Medical 3D Printing Market are 3D Systems Corporation, Stratasys Ltd., Materialise NV, EOS GmbH, GE Additive, SLM Solutions Group AG, EnvisionTEC GmbH (ETEC), Formlabs Inc., and many others.