Membrane Separation Technology Market Overview

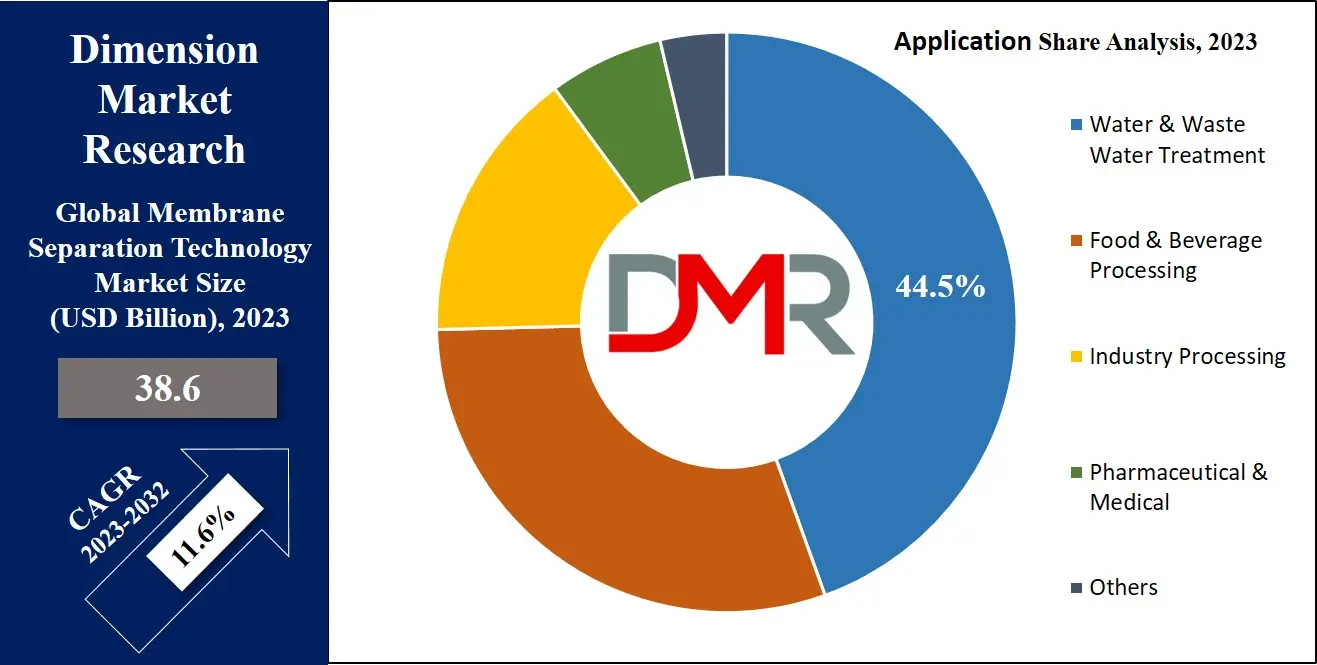

The Global Membrane Separation Technology Market is expected to reach a value of USD 38.6 billion in 2023, and it is further anticipated to reach a market value of USD 103.9 billion by 2032 at a CAGR of 11.6%.

Membrane separation technology involves processes using membranes to filter and separate different substances in mixtures. This technology is crucial in water treatment, food production, pharmaceuticals, and chemicals.

The market for membrane separation includes all activities related to the sale and development of these membranes, such as designing, manufacturing, and applying types like microfiltration, ultrafiltration, nanofiltration, and reverse osmosis.

The membrane separation technology market is set to grow significantly in 2024. Established companies are expected to enhance their technologies and expand their market presence, supported by strong infrastructure and research investments. New and smaller companies have opportunities too, especially by offering customized solutions or focusing on emerging markets where water treatment infrastructure needs development.

In 2020, the UK's municipal wastewater facilities could handle almost 7.3 billion cubic meters annually. However, a World Health Organization and UNICEF report in 2020 found that only 56% of the world’s domestic wastewater was treated safely, showing a large market opportunity for improved technologies.

In the U.S., the capacity of publicly owned treatment works varies significantly, indicating diverse needs that membrane technologies could meet. Also, the technology in this field improves at an estimated annual rate of 10.3%, promising continuous advancements and efficiency.

The market is moving towards more energy-efficient membrane processes, aligning with global sustainability goals. Advances in technology are also making membranes more durable and efficient, which reduces costs and enhances their appeal. This trend is crucial for both large facilities and smaller, specialized applications.

Using these insights in discussions with potential clients can enhance understanding and trust. For example, talking about the large capacities of wastewater facilities and the overall low rate of safe water treatment globally can highlight the need for advanced membrane technologies.

Mentioning the steady improvement in technology reassures potential clients of the reliability and future-proof nature of these solutions. By presenting this information in a straightforward, engaging way, businesses can educate and connect with potential clients, increasing opportunities for growth and collaboration.

Key Takeaways

- The Global Membrane Separation Technology Market is projected to grow from USD 38.6 billion in 2023 to USD 103.9 billion by 2032, with a CAGR of 11.6%.

- Reverse Osmosis leads the market in 2023, favored for its applications in both residential and industrial settings and as an eco-friendlier alternative to thermal desalination.

- The water and wastewater treatment sector is the largest application area in 2023, driven by stringent global regulations on water treatment and environmental protection.

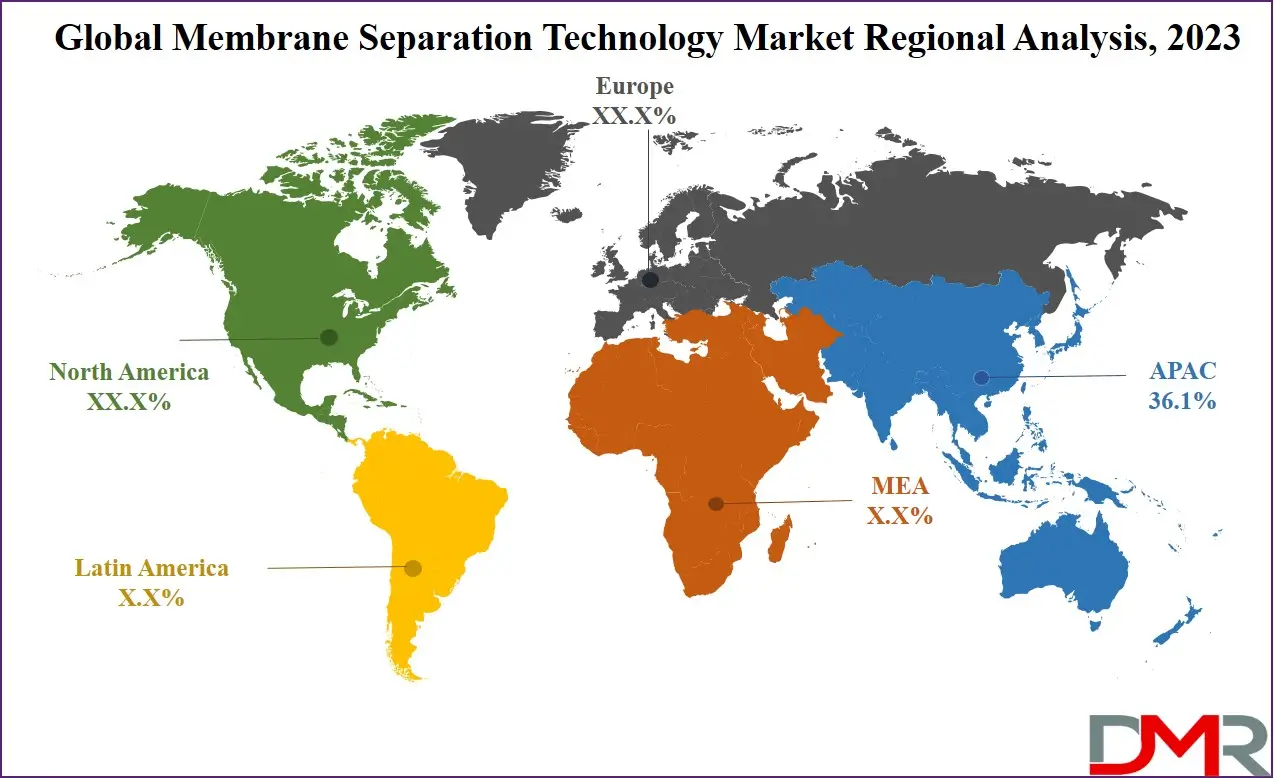

- The Asia Pacific region is the major revenue contributor to the market in 2023, with expected substantial growth due to rapid industrialization and heightened environmental awareness in emerging economies.

Membrane Separation Technology Market Dynamic

The growth of the membrane separation technology market is strongly impacted by the rising awareness of water & wastewater treatment. The key driver of market growth is the rising demand for selective separation technology to meet strict water quality standards, driven by environmental regulations & sustainability policies.

Factors such as growing urbanization, disposable income, & the expanding

biopharmaceutical industry, along with the replacement of operating technologies, contribute to the market's upward momentum.

In addition, the increase in industrial water demand, the requirement for portable water for a growing population, technological development, & ongoing R&D activities provide favorable conditions for market growth. Further, the low energy requirements of membrane separation processes and continuous product innovations contribute to positive market prospects.

However, challenges like the high costs associated with membrane separation technology, expensive equipment, & unfavorable conditions like that of the COVID-19 outbreak. In addition, the increasing lifespan of membranes also acts as a major restraint, posing potential obstacles to the growth rate of the membrane separation technology market.

Membrane Separation Technology Market Research Scope and Analysis

By Technology

The membrane separation technology market is categorized by 4 key technologies, which are Reverse Osmosis, Ultrafiltration, Microfiltration, & Nanofiltration. Among these, Reverse Osmosis takes the lead, claiming the significant revenue share in 2023, as its growing application in both residential & industrial settings contributes to its dominance, with its adoption as an alternative to thermal desalination processes further fueling its growth.

Moreover, Microfiltration is anticipated to grow significantly in coming years, characterized by low-pressure separation and open-pore structures with pore sizes ranging from 0.1 to 1 micron, and finds application in municipal water treatment & desalination pre-treatment plants.

Meanwhile, Ultrafiltration is also showcasing gradual growth, capable of filtering particles 5,000 times minute than human hair, increasing a high recovery rate of around 90-95%, broadly used in wastewater treatment for reuse & as a substitute to reverse osmosis in household water purification, Ultrafiltration provides significant water-saving potential due to its excellent recovery rate.

By Application

The water & wastewater treatment sector emerges as the leading application segment in the membrane separation technology market in 2023, capturing the majority of revenue share.

Strict regulations imposed by governments & regulatory agencies globally on water treatment & disposal, focused on environmental protection, are fueling industries to adopt eco-friendly wastewater treatment methods, which is positively impacting the need for global membrane separation technologies, especially with growth in industrialization in countries like India, China, Vietnam, & Brazil.

Innovations in technology & rise in R&D investments are expected to propel product needs in the industrial processing segment, with new applications like solvent recovery processes contributing to the growth of the market.

Moreover, in regions like North America, there is growth in disposable income is creating an increase in the food & beverage industry. Membrane filtration processes play a vital role in removing contaminants from water, milk, & wine, aligning with government regulations on food safety & pollution control, which is expected to boost the membrane filtration technology market in the food & beverage sector.

In addition, growing investments in healthcare infrastructure, higher per capita income, developments in diagnostic technology, & the rise in prevalence and treatment of chronic diseases are driving the pharmaceutical industry's expansion.

The Membrane Separation Technology Market Report is segmented on the basis of the following

By Technology

- Reverse Osmosis

- Microfiltration

- Ultrafiltration

- Nanofiltration

By Application

- Water & Wastewater Treatment

- Food & Beverage Processing

- Industry Processing

- Pharmaceutical & Medical

- Others

Membrane Separation Technology Market Regional Analysis

The

Asia Pacific region holds a dominant position in the global membrane separation technology industry, contributing to

36.1% of the revenue in 2023. In addition, the market in this region is anticipated to have significant growth due to rapid industrialization & increasing environmental concerns in emerging economies. Initiatives by governments in India & China to establish water & wastewater treatment plants are anticipated to further boost market expansion.

Also, in North America, the adoption of membrane separation technology is growing rapidly, mainly in response to its application in various industries. The need for ultrafiltration in North America is set to grow, driven by strict regulations & industrial standards implemented by the Environmental Protection Agency (EPA) governing water filtration performance.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Membrane Separation Technology Market Competitive Landscape

The membrane separation technology market is characterized by fragmentation, where many players hold relatively small shares of the overall market, as no single player dominates, indicating a diverse landscape with multiple contributors, which shows a competitive environment with opportunities for emerging players to carve out niches and contribute to the overall growth of the market.

In January 2023, DuPont unveiled the installation of its FilmTec & Inge ultrafiltration membranes in a seawater reverse osmosis desalination plant in Gujarat, India. Constructed by Larsen & Toubro, Tecton JV for the GIDC, the plant, now operational, delivers 100 million liters per day of water to the Petroleum, Chemicals & Petrochemicals Investment Regions (PCPIR) industries in Dahej, which addresses a significant portion of local industrial water needs, benefiting over 190 businesses in the PCPIR sector that have historically faced production challenges owing to water scarcity & rising river salinity.

Some of the prominent players in the global Membrane Separation Technology Market are:

- 3M

- DuPont

- SUEZ

- HUBER

- Corning Incorporated

- Asahi Kasei Corp

- GEA Filtration

- TriSep Corp

- Pall Corp

- IDE Technologies

- Other Key Players

Recent Developments

- In February 2023, SepPure Technologies successfully raised $12 million in a Series A funding round, aiming to advance its innovative membrane separation technologies for industrial applications.

- In October 2024, Aqua Membranes secured an additional funding round to expand the development and production of its revolutionary reverse osmosis membrane elements, which feature its unique Printed Spacer Technology®.

- In August 2023, Compact Membrane Systems raised an oversubscribed Series A funding round to support the development of its groundbreaking carbon capture technology, marking a significant step in sustainable industrial practices.

- In August 2023, an affiliate of Sun Capital Partners completed the acquisition of Koch Separation Solutions, a major move aimed at enhancing its portfolio in the separation technology industry.

- In February 2023, Solecta® announced a strategic partnership with Lubrizol® to introduce novel membrane separation solutions to the market, promising enhanced performance and efficiency in various applications.

Membrane Separation Technology Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 38.6 Bn |

| Forecast Value (2032) |

USD 103.9 Bn |

| CAGR (2023-2032) |

11.6% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (Reverse Osmosis, Microfiltration,

Ultrafiltration, and Nanofiltration), By Application

(Water & Wastewater Treatment, Food & Beverage

Processing, Industry Processing, Pharmaceutical &

Medical, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

3M, DuPont, SUEZ, HUBER, Corning Incorporated,

Asahi Kasei Corp, GEA Filtration, TriSep Corp, Pall

Corp, IDE Technologies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Membrane Separation Technology Market size is estimated to have a value of USD 38.6

billion in 2023 and is expected to reach USD 103.9 billion by the end of 2032.

Asia Pacific has the largest market share for the Global Membrane Separation Technology Market with a

share of about 36.1% in 2023.

Some of the major key players in the Global Membrane Separation Technology Market are 3M, DuPont,

SUEZ, and many others.

The market is growing at a CAGR of 11.6 percent over the forecasted period.