Market Overview

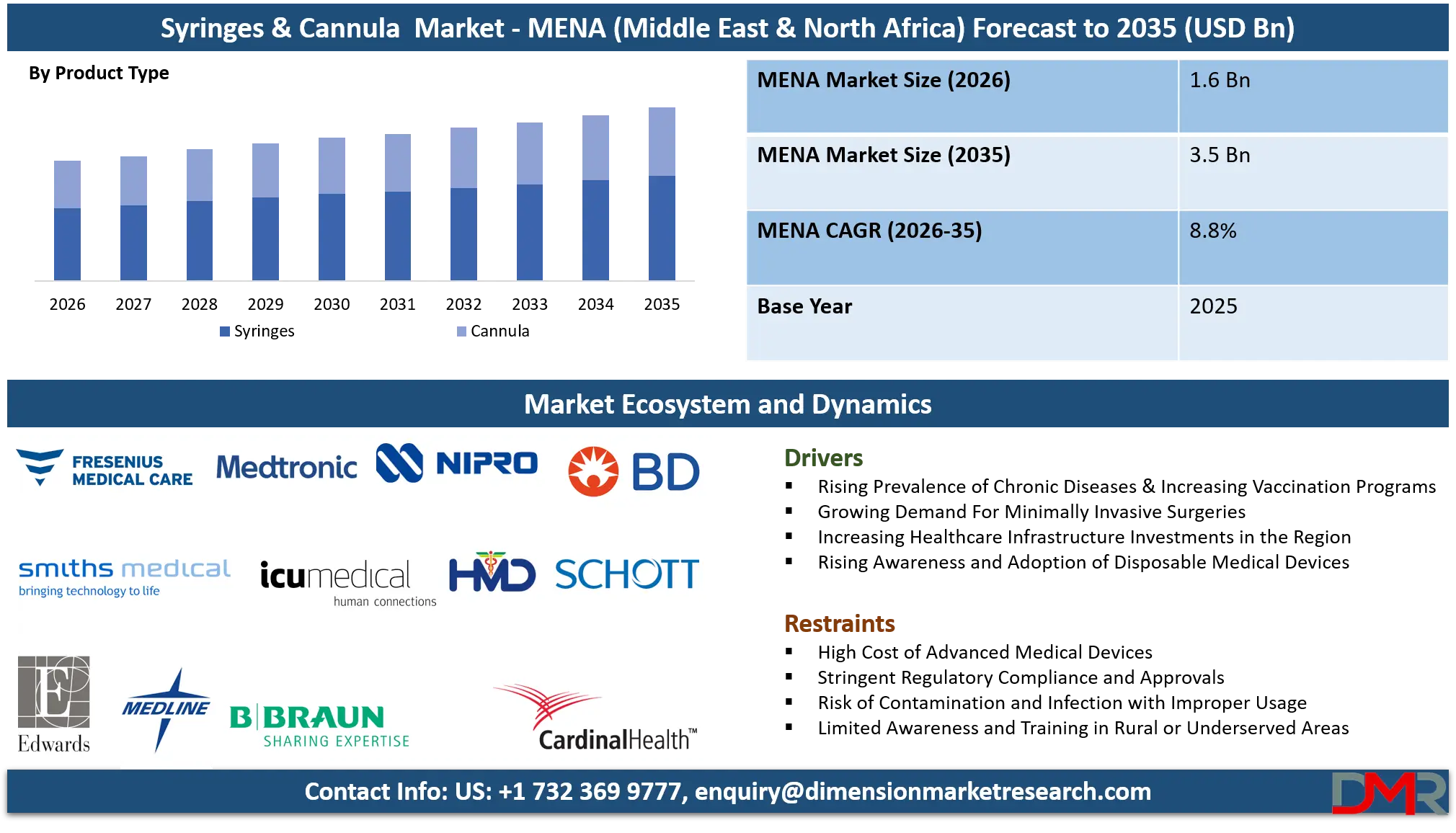

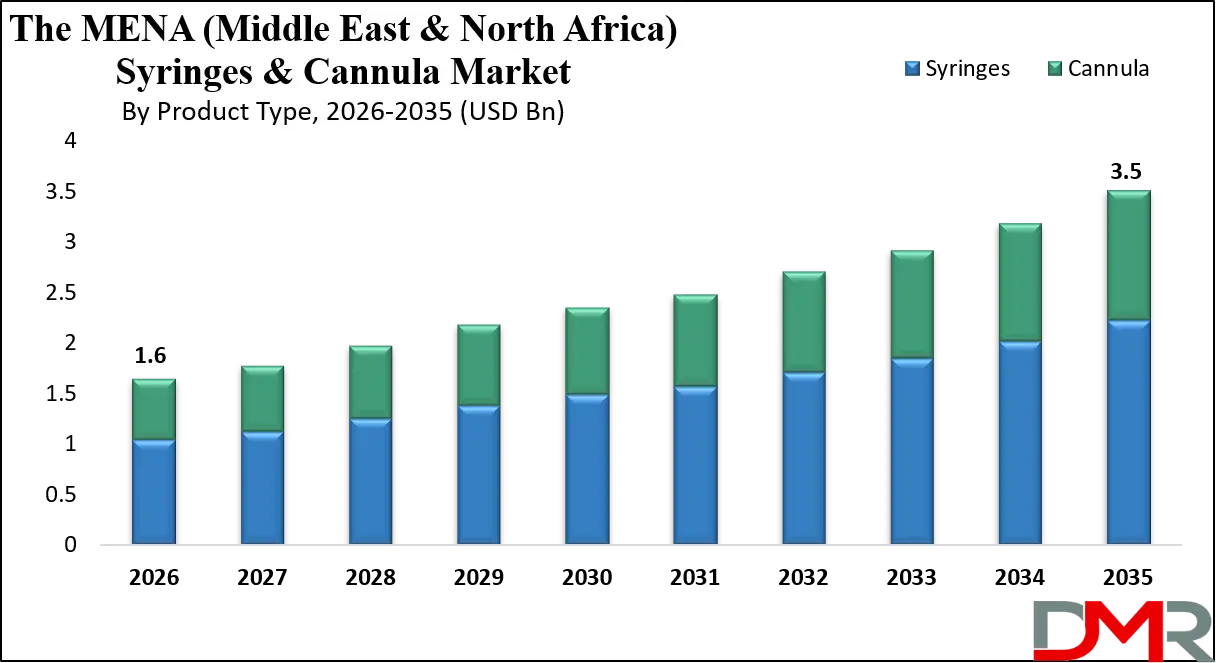

The MENA (Middle East & North Africa) Syringes & Cannula market is projected to reach USD 1.6 billion in 2026 and is expected to expand at a compound annual growth rate (CAGR) of 8.8% from 2026 to 2035, reaching an estimated USD 3.5 billion by 2035.

This steady growth trajectory is fueled by the region's imperative to strengthen its healthcare infrastructure, respond to a rising burden of chronic and infectious diseases, and meet the goals of ambitious national health sector transformation plans. Syringes and cannulas represent fundamental, high-volume consumables in medical practice, with demand directly linked to healthcare accessibility, surgical volumes, and immunization coverage.

The market's expansion is underpinned by a powerful confluence of drivers: government-led healthcare modernization initiatives, a growing and aging population increasing the prevalence of chronic conditions requiring long-term care, rising surgical procedure volumes, and a heightened focus on infection prevention and safety-engineered devices. The post-pandemic era has further cemented the strategic importance of resilient medical supply chains and domestic manufacturing capabilities for these critical devices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The evolution of the market is characterized by a shift towards higher-value, safer products. Innovations such as active and passive safety-engineered syringes to reduce needlestick injuries, ultra-sharp, pain-reducing cannulas, and specialty syringes for advanced drug delivery systems (e.g., prefilled, auto-injectors) are gaining prominence. Concurrently, digitalization through smart inventory management systems and integration with Electronic Health Records (EHR) for tracking device usage is enhancing efficiency and traceability in healthcare settings.

While the market faces headwinds from price sensitivity in certain segments, regulatory heterogeneity across countries, and dependency on raw material imports, the long-term demand fundamentals are robust. Supported by robust public health agendas like Saudi Arabia's Vision 2030 Health Sector Transformation Program and the UAE's Centennial 2071, alongside increasing health insurance penetration, the market for syringes and cannulas is transitioning from a basic commodity segment to a strategic healthcare component, positioning itself as a critical pillar of the region's medical preparedness and quality care delivery through 2035.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The MENA (Middle East & North Africa) Syringes & Cannula Market: Key Takeaways

- Market Growth from Healthcare Expansion: The market is set to more than double from USD 1.6 billion in 2026 to USD 3.5 billion by 2035 (CAGR 8.8%), primarily driven by national health transformation visions (Vision 2030, UAE Centennial 2071) and universal health insurance schemes expanding access to care.

- GCC as the Premium & Innovation Hub: The GCC sub-region will exhibit the highest value share and strong CAGR, fueled by mega-hospital projects, high healthcare spending, and early adoption of safety-engineered and specialty devices.

- Product Mix Shift Towards Safety & Specialty: While standard disposable syringes and cannulas maintain volume dominance, safety-engineered devices (SEDs) and specialty products (prefilled, auto-injectors, fine-gauge cannulas) are gaining share due to regulatory pushes and clinical benefits.

- From Commodity to Strategically Sourced Essential: The procurement dynamic is shifting from fragmented purchases to national tenders, group purchasing organizations (GPOs), and local manufacturing partnerships, emphasizing supply security and cost management.

- The Rise of Localization & Supply Chain Resilience: Leading governments are increasingly incentivizing local manufacturing and regional logistics hubs for essential medical disposables, responding to lessons from global supply chain disruptions.

The MENA (Middle East & North Africa) Syringes & Cannula Market: Use Cases

- Mass Vaccination Campaigns: National immunization programs across MENA, including routine EPI and pandemic preparedness, drive massive, periodic demand for single-use, auto-disable (AD) and safety syringes, often sourced through UNICEF and WHO pooled procurement.

- Chronic Disease Management in Homecare: The growing prevalence of diabetes and other chronic conditions is increasing the use of insulin syringes, pen needles, and specialized cannulas in homecare settings, supported by patient education initiatives.

- Advanced Surgical Procedures in Tertiary Centers: Expansion of cardiac, orthopedic, and laparoscopic surgeries in GCC and major North African cities drives demand for specialized cannula sets, irrigation syringes, and high-precision delivery devices.

- Dialysis Treatment Growth: The rising incidence of renal failure necessitates regular hemodialysis, creating a consistent, high-volume demand for large-bore cannulas and specialized syringes used in dialysis centers across the region.

- Emergency & Trauma Care: Hospital emergency departments and ambulance services maintain high stocks of general-purpose syringes and various IV cannulas for rapid response, a critical need given regional traffic accident rates and conflict-related injuries in certain areas.

The MENA (Middle East & North Africa) Syringes & Cannula Market: Stats & Facts

World Health Organization (WHO), Regional Office for the Eastern Mediterranean (EMRO)

- The WHO EMRO region, which largely corresponds to MENA, administers over 500 million therapeutic and immunization injections annually, creating foundational demand for syringes.

- Needlestick injuries among healthcare workers in the region are estimated to account for approximately 40% of hepatitis B and C infections of occupational origin, highlighting the need for safety devices.

- As part of the Global Vaccine Action Plan, MENA countries have achieved a regional average childhood immunization (DPT3) coverage of 85%, requiring tens of millions of syringes annually for routine programs.

UNICEF Supply Division

- In 2022-2023, UNICEF procured and supplied over 750 million auto-disposable (AD) syringes globally for COVID-19 vaccination, with MENA countries being major recipients.

- For routine immunization, UNICEF procures an estimated half a billion syringes and safety boxes annually worldwide, with significant volumes destined for MENA national immunization programs.

- UNICEF's market-shaping work has contributed to a 40% reduction in the global price of AD syringes over the past decade, impacting procurement costs for MENA ministries of health.

Gavi, the Vaccine Alliance

- Through Gavi support, over 100 million doses of various vaccines are funded annually for eligible MENA countries, each dose requiring at least one syringe.

- Gavi's injection safety policy stipulates that 100% of syringes used in Gavi-supported programs must be auto-disabled (AD) or come with reuse prevention features.

Saudi Food and Drug Authority (SFDA)

- The SFDA reports issuing over 120 new regulatory licenses for medical device local manufacturers since the launch of Vision 2030's health sector transformation, covering products including syringes and infusion sets.

- As part of its Medical Devices National Registry, the SFDA has over 2,500 registered medical device models in the category of "syringes, needles, and catheters" approved for the Saudi market.

Egyptian Ministry of Health and Population (MoHP)

- Under the nationwide "100 Million Health" initiative, Egypt screened over 60 million citizens for hepatitis C, a campaign that involved millions of blood collection syringes and cannulas.

- The rollout of the Universal Health Insurance System aims to cover all of Egypt's population (over 105 million) by 2030, systematically increasing demand for medical consumables in formal healthcare channels.

UAE Ministry of Health and Prevention (MoHAP)

- The UAE's National Immunization Program provides 11 essential vaccines free of charge to all citizens and residents, requiring a sustained, high-volume supply of vaccination syringes.

- MoHAP data indicate that over 95% of healthcare facilities in the UAE reported using safety-engineered sharps devices as per federal preventive measures.

International Diabetes Federation (IDF) Diabetes Atlas

- The IDF estimates there are 73 million adults (20-79 years) living with diabetes in the Middle East and North Africa region as of 2021, representing one of the highest prevalence rates globally.

- This diabetic population drives continuous demand for insulin syringes, pen needles, and lancets, with the number projected to increase to 136 million by 2045.

Saudi Central Board for Accreditation of Healthcare Institutions (CBAHI)

- CBAHI standards require accredited hospitals to have a comprehensive needle-stick injury prevention program, which directly influences procurement policies towards safety-engineered devices.

Egyptian Drug Authority (EDA)

- The EDA has licensed over 30 local pharmaceutical and medical device manufacturers to produce sterile injectables and related disposables, supporting the domestic supply of essential syringes.

GCC Health Ministers' Council

- Council resolutions have emphasized the harmonization of medical device regulations across GCC states, aiming to streamline the approval process for syringes and cannulas.

- The Council's strategic health plan notes non-communicable diseases (NCDs) like cardiovascular disease and cancer account for over 70% of mortality in the GCC, driving demand for chronic care and associated medical devices.

Jordan Food and Drug Administration (JFDA)

- The JFDA manages a mandatory registration list for medical devices, with hundreds of syringe and cannula products from international and regional suppliers listed for the Jordanian market.

King Abdullah International Medical Research Center (KAIMRC)

- KAIMRC studies on infection control in KSA hospitals have shown that compliance with standard injection safety protocols varies between 70-85%, indicating room for improvement through training and better device design.

Dubai Health Authority (DHA)

- DHA mandates that all invasive procedures across its facilities must utilize sharps with engineered injury protection devices where available, creating a regulatory push for safety syringes.

Moroccan Ministry of Health

- The Ministry's national health strategy includes a target to increase the rate of births attended by skilled health personnel to 90%, which involves increased use of sterile syringes and IV cannulas in maternal care.

The Gulf Health Council for the Cooperation Council States

- The Council's epidemiological reports note a rising annual incidence of surgical procedures across member states, correlating directly with increased consumption of surgical cannulas and specialty syringes.

International Council of Nurses (ICN), MENA Region

- ICN surveys in the region indicate that over 60% of nurses have experienced at least one needlestick injury during their career, underscoring the occupational health driver for safety device adoption.

The MENA (Middle East & North Africa) Syringes & Cannula Market: Market Dynamics

Driving Factors in the MENA Syringes & Cannula Market

Government-led Healthcare Infrastructure Development

National transformation agendas such as Saudi Vision 2030, UAE Centennial 2071, Qatar National Vision 2030, and Egypt’s healthcare reform programs are driving unprecedented investments in healthcare infrastructure. Large-scale development of public hospitals, medical cities, specialty centers, military hospitals, and primary healthcare networks directly expands procedural capacity. As syringes and cannulas are foundational consumables across nearly all clinical workflows, including immunization, diagnostics, drug delivery, and surgery, this infrastructure expansion translates into consistent, volume-driven demand, particularly through centralized government tenders.

Rising Disease Burden and Surgical Volumes

The MENA region faces a disproportionately high burden of non-communicable diseases, including diabetes (especially in GCC countries), cardiovascular disorders, oncology indications, and chronic kidney disease. These conditions require frequent injections, IV access, dialysis, and diagnostic sampling. Simultaneously, improving access to care and expanding insurance coverage are increasing elective surgical volumes, trauma care, and interventional procedures. Together, these dynamics create structural, non-cyclical demand for syringes and cannulas across inpatient, outpatient, and emergency care settings.

Restraints in the MENA Syringes & Cannula Market

Price Sensitivity and Reimbursement Limitations

Despite rising healthcare spending, procurement decisions, especially in public systems, remain highly price-driven. Tenders often prioritize unit cost over total cost of ownership, which limits the rapid adoption of premium safety-engineered syringes, specialty cannulas, and prefilled systems. In many markets, reimbursement frameworks do not explicitly reward the use of safer or higher-quality devices, making it challenging for suppliers to justify higher prices despite long-term benefits such as reduced needlestick injuries and lower infection risk.

Fragmented Regulatory Landscape and Import Dependency

The regulatory environment across MENA is heterogeneous, with varying approval timelines, documentation requirements, and local conformity standards (e.g., SFDA in Saudi Arabia, MOHAP in the UAE, EDA in Egypt). This fragmentation increases time-to-market and compliance costs for manufacturers. Additionally, heavy reliance on imported finished devices and raw materials (medical-grade polymers, stainless steel tubing) exposes the market to currency volatility, logistics disruptions, and geopolitical risks, as seen during global supply chain shocks.

Opportunities in the MENA Syringes & Cannula Market

Local Manufacturing and Technology Transfer

Governments across the region are actively promoting local manufacturing, localization of medical supplies, and technology transfer to reduce import dependency and enhance supply security. Incentives include preferential procurement, tax benefits, industrial zones, and public–private partnerships. Establishing local assembly lines or full-scale manufacturing plants for syringes and cannulas, particularly high-volume disposables, offers suppliers cost advantages, faster tender access, and alignment with national industrialization goals.

Expansion of Homecare and Ambulatory Care

Healthcare delivery in MENA is gradually shifting toward ambulatory surgery centers, day-care hospitals, and home-based chronic care, driven by cost efficiency and patient preference. This transition supports growing demand for user-friendly, safety-focused syringes, insulin syringes, pen needles, and peripheral cannulas suited for self-administration or caregiver use. Retail pharmacies, homecare providers, and e-commerce medical platforms are emerging as important secondary distribution channels alongside hospitals.

Trends in the MENA Syringes & Cannula Market

Mandate for Safety-Engineered Devices (SEDs)

In line with WHO recommendations, occupational safety frameworks, and ISO 23907 standards, several GCC countries are increasingly mandating or strongly favoring safety-engineered syringes in public-sector tenders. Ministries of Health and large hospital groups are prioritizing devices with passive or automatic needle protection to reduce needlestick injuries among healthcare workers. While adoption is currently strongest in government facilities, private hospitals are gradually following, driven by accreditation requirements and risk management considerations.

Smart Packaging and Traceability

There is a growing emphasis on supply chain transparency, anti-counterfeiting measures, and digital inventory control. Manufacturers and distributors are increasingly adopting barcoding, RFID-enabled packaging, serialization, and tamper-evident seals. These features help hospitals integrate syringes and cannulas into electronic inventory systems, improve demand forecasting, reduce wastage, and enable efficient recall management, an increasingly important factor for large healthcare networks and centralized procurement bodies.

The MENA (Middle East & North Africa) Syringes & Cannula Market: Research Scope and Analysis

By Product Type Analysis

Within the MENA syringes & cannula market, syringes are projected to dominate overall volume, driven by mass immunization programs, chronic disease management, and routine inpatient care. Conventional syringes still account for a large share in North Africa and price-sensitive public hospitals, where procurement is largely cost-driven. However, their dominance is gradually declining in favor of safer alternatives.

Safety-engineered syringes (SES) including auto-disable, retractable, and shielded variants are the fastest-growing and dominant segment in GCC public healthcare systems. Auto-disable syringes dominate vaccination and national immunization tenders, particularly in Saudi Arabia, the UAE, and Qatar, due to WHO-aligned safety mandates. Retractable and shielded syringes are increasingly preferred in tertiary hospitals and high-acuity settings to reduce occupational exposure risks.

Insulin syringes are strongly dominated by diabetes care pathways, especially in GCC countries with high diabetes prevalence. Demand is driven by hospitals, clinics, and increasingly by retail pharmacies serving homecare patients. Prefilled syringes, while smaller in volume, are dominant in oncology, biologics, and emergency medicine due to dosing accuracy and reduced preparation time.

On the cannula side, IV cannulas and peripheral IV catheters dominate due to universal use in inpatient and emergency care. Central venous catheters are concentrated in critical care, dialysis, and oncology units. Nasal cannulas dominate oxygen therapy in emergency and homecare settings.

By Usage Analysis

The disposable segment overwhelmingly is expected to dominate the MENA syringes & cannula market, accounting for the vast majority of consumption across all countries. This dominance is driven by infection control regulations, patient safety standards, and government procurement policies, particularly in public healthcare systems. Single-use syringes and cannulas are mandated in vaccination programs, inpatient care, diagnostics, dialysis, and surgery, making disposables the default choice across hospitals and clinics.

In the GCC region, disposable usage is nearly universal due to stricter regulatory oversight, accreditation requirements (e.g., JCI), and strong enforcement of occupational safety standards. Public hospitals and large private hospital groups procure disposables in high volumes through centralized tenders, reinforcing scale-driven dominance.

Reusable syringes and cannulas represent a small and declining niche, primarily limited to specific applications in resource-constrained settings, certain diagnostic laboratories, or legacy practices in parts of North Africa. Even in these markets, reusables are gradually being phased out due to rising awareness of healthcare-associated infections (HAIs), improved access to disposables, and donor-funded healthcare programs.

Additionally, the expansion of homecare, ambulatory surgery, and outpatient services further reinforces disposable dominance, as these settings lack sterilization infrastructure. Overall, disposables are not only the dominant segment today but are expected to strengthen their position further, with reusables continuing to lose relevance across the MENA healthcare ecosystem.

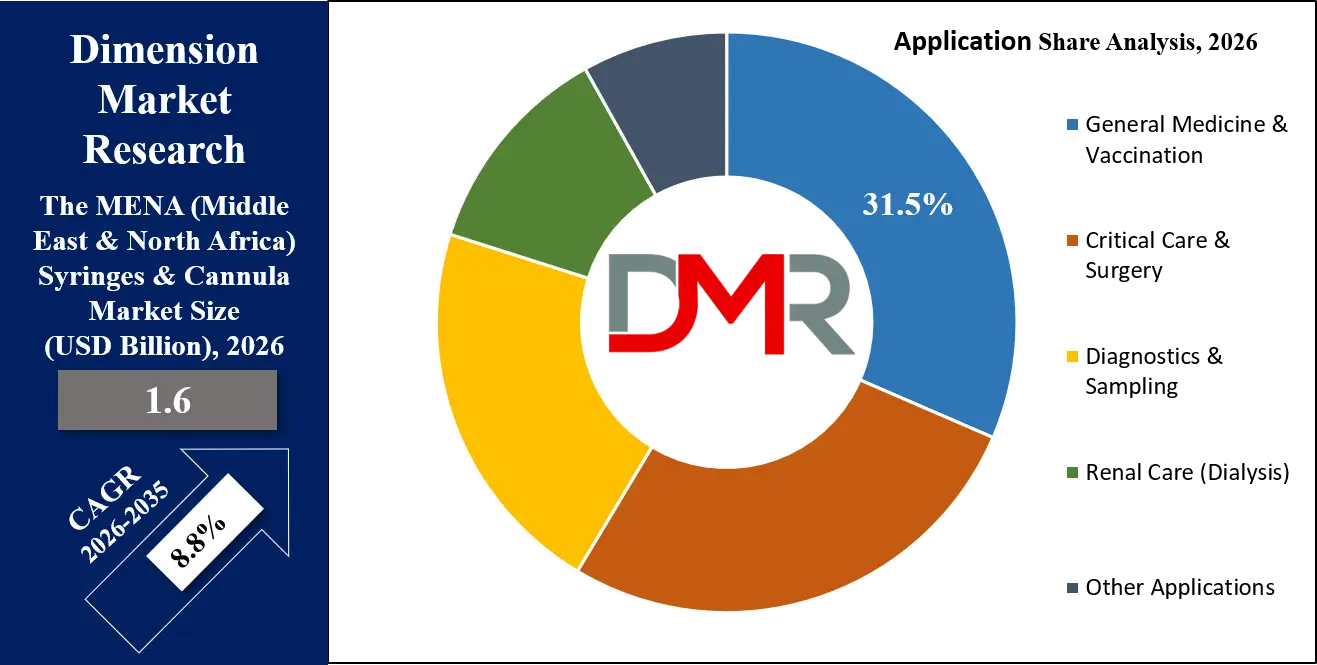

By Application Analysis

General medicine & vaccination is poised to dominate application-based demand in volume terms, driven by routine injections, national immunization programs, and primary care services. Ministries of Health and public hospitals are the largest users, particularly for auto-disable and safety syringes used in large-scale vaccination initiatives.

Critical care & surgery is the most value-intensive application segment. ICUs, operating theaters, and emergency departments drive high usage of IV cannulas, peripheral IV catheters, central venous catheters, and safety-engineered syringes. This segment is dominated by tertiary hospitals and medical cities, especially in GCC countries, where advanced surgical capacity and trauma care are expanding.

Diagnostics & sampling represents a steady and recurring demand segment, led by hospitals, diagnostic laboratories, and imaging centers. Blood collection, contrast administration, and interventional diagnostics rely heavily on specialized syringes and cannulas, with growing demand from private diagnostic chains.

Renal care (dialysis) is a highly concentrated but critical segment, dominated by dialysis centers and hospital nephrology units. High prevalence of chronic kidney disease in MENA ensures consistent demand for cannulas and specialized access devices.

Other applications, including oncology, pain management, and home-based therapies, are smaller in volume but growing rapidly, particularly with the shift toward outpatient and long-term disease management.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Analysis

Hospitals (public and private) are the anticipated to dominate the end users across all segments, accounting for the majority of syringe and cannula consumption in MENA. Public hospitals, in particular, drive large-volume procurement through centralized tenders, especially for vaccination, inpatient care, surgery, and emergency services. Private hospitals contribute significantly to high-value segments such as safety syringes, central venous catheters, and specialty cannulas.

Clinics and ambulatory surgical centers (ASCs) represent a fast-growing segment, especially in urban GCC markets. These facilities rely heavily on disposable syringes, IV cannulas, and peripheral catheters for same-day procedures, outpatient infusions, and minor surgeries.

Diagnostic and imaging centers dominate usage related to diagnostics and contrast administration. The growth of private diagnostic chains in Saudi Arabia, the UAE, and Egypt is strengthening this segment’s contribution.

Homecare settings are an emerging but increasingly influential end-user group. Demand is driven by insulin syringes, pen needles, nasal cannulas, and safety-focused devices for self-administration. Retail pharmacies and homecare providers are key distribution points.

Other end users, including military hospitals, NGO-supported facilities, and occupational health centers, contribute niche but stable demand, particularly during public health initiatives and emergency response programs.

The MENA (Middle East & North Africa) Syringes & Cannula Market Report is segmented on the basis of the following:

By Product Type

- Syringes

- Conventional Syringes

- Specialized Syringes

- Safety-Engineered Syringes

- Auto-Disable

- Retractable

- Shielded

-

- Insulin Syringes

- Prefilled Syringes

- Other Specialized

- Cannula

- Nasal Cannula

- Intravenous (IV) Cannula

- Peripheral IV Catheters

- Central Venous Catheters

- Other Cannulas

By Usage

By Application

- General Medicine & Vaccination

- Critical Care & Surgery

- Diagnostics & Sampling

- Renal Care (Dialysis)

- Other Applications

By End User

- Hospitals (Public & Private)

- Clinics & Ambulatory Surgical Centers (ASCs)

- Diagnostic & Imaging Centers

- Homecare Settings

- Other End Users

By Country

- Saudi Arabia

- Turkey

- UAE

- Egypt

- Morocco

- Qatar

- Kuwait

- Iran

- Rest of MENA

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Impact of Artificial Intelligence in the MENA (Middle East & North Africa) Syringes & Cannula Market

- E-Procurement and Tender Platforms: National and hospital-level electronic tender platforms are digitizing procurement, making processes more transparent, efficient, and competitive, allowing for better price discovery and supplier qualification.

- Smart Inventory Management with IoT: Internet of things-enabled smart bins and cabinets in hospital storerooms and wards can automatically track syringe and cannula usage, triggering restocking orders and minimizing stock-outs or expiries.

- Blockchain for Supply Chain Integrity: Pilot projects are exploring blockchain technology to create immutable records for the logistics of medical disposables, from factory to patient, enhancing anti-counterfeiting measures and recall precision.

- Integration with Electronic Health Records (EHR): Scanning barcodes of used devices at the point of care can link specific product batches to patient records, aiding in adverse event reporting and clinical supply chain analytics.

- Digital Training Modules for Healthcare Workers: Online platforms and VR simulations are being deployed to train nurses and doctors on the correct use of new safety-engineered and specialized devices, improving compliance and outcomes.

The MENA (Middle East & North Africa) Syringes & Cannula Market: Competitive Landscape

The competitive landscape in the MENA syringes and cannula market is highly dynamic and shaped by the coexistence of multinational manufacturers, powerful regional distributors, and an expanding base of local producers. Global medical device leaders such as BD (Becton, Dickinson and Company), Cardinal Health, B. Braun, and Terumo dominate the premium segment by leveraging strong brand equity, broad product portfolios, and continuous investment in R&D.

Their offerings are particularly well positioned in tertiary hospitals and medical cities, where demand is higher for safety-engineered syringes, specialty cannulas, and devices aligned with international quality and safety standards. These players benefit from long-standing relationships with ministries of health and large private hospital groups, though they often face pricing pressure in public tenders.

Alongside them, established regional groups such as Mohamed & Obaid AlMulla Group (MOM Group), Ghassan Aboud Group, and Biologix play a critical role in market access. Their strength lies in extensive distribution networks, deep familiarity with country-specific regulatory and tender processes, and the ability to respond quickly to local demand fluctuations. Many of these companies act as exclusive distributors for multinational brands while simultaneously developing private-label or co-branded products to address mid-priced market segments.

Some of the prominent players in the MENA (Middle East & North Africa) Syringes & Cannula Market are:

- Becton, Dickinson and Company (BD)

- B. Braun Melsungen AG

- Terumo Corporation

- Cardinal Health, Inc.

- Nipro Corporation

- Medline Industries, Inc.

- Hindustan Syringes & Medical Devices Ltd.

- SCHOTT AG

- Medtronic plc

- Edwards Lifesciences

- ICU Medical, Inc.

- Smiths Medical

- Teleflex Incorporated

- Vygon Group

- Baxter International Inc.

- Fresenius Medical Care

- Biologix FZCO

- Mohamed & Obaid AlMulla Group

- Ghassan Aboud Group

- Arab Medical Manufacturing Company (ArabMed)

- Other Key Players

Recent Developments in the MENA (Middle East & North Africa) Syringes & Cannula Market

- March 2026: BD Announces New Manufacturing Line in Saudi Arabia. The investment, aligned with Vision 2030, focuses on local production of safety-engineered syringes and IV catheters for the GCC market.

- February 2026: Saudi FDA Mandates Safety Syringes for All Immunizations. The new regulation requires the exclusive use of auto-disable or safety-engineered syringes in all public and private sector vaccination activities, effective 2026.

- January 2026: Egyptian Universal Health Insurance Expands to New Governorates. The rollout of the UHI system to additional millions of citizens triggers a major national tender for essential medical disposables, including syringes and cannulas.

- December 2024: Regional GPO Formed by Major UAE Hospital Groups. Three leading UAE hospital chains established a joint Group Purchasing Organization to consolidate procurement of medical consumables, aiming to reduce costs for items including syringes.

- November 2024: WHO and UNICEF Prequalify New Regional Syringe Manufacturer. A North African manufacturer received WHO PQ status for its auto-disable syringes, allowing it to supply UN-backed vaccination programs globally.

- October 2024: Joint Venture for Cannula Manufacturing in Abu Dhabi. A local investment firm partners with a European medtech company to establish a plant for high-quality IV cannulas, targeting GCC and export markets.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.6 Bn |

| Forecast Value (2034) |

USD 3.5 Bn |

| CAGR (2025–2034) |

8.8% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Syringes, Cannula), By Usage (Disposable, Reusable), By Application (General Medicine & Vaccination, Critical Care & Surgery, Diagnostics & Sampling, Renal Care (Dialysis), Other Applications, By End User (Hospitals, Clinics & Ambulatory Surgical Centers, Diagnostic & Imaging Centers, Homecare Settings, Other End Users) |

| Regional Coverage |

Saudi Arabia, Turkey, UAE, Egypt, Morocco, Qatar, Kuwait, Iran, and Rest of MENA |

| Prominent Players |

Becton, Dickinson and Company (BD), B. Braun Melsungen AG, Terumo Corporation, Cardinal Health, Inc., Nipro Corporation, Medline Industries, Inc., Hindustan Syringes & Medical Devices Ltd., SCHOTT AG, Medtronic plc, Edwards Lifesciences, ICU Medical, Inc., Smiths Medical, Teleflex Incorporated, Vygon Group, Baxter International Inc., Fresenius Medical Care, Biologix FZCO, Mohamed & Obaid AlMulla Group, Ghassan Aboud Group, Arab Medical Manufacturing Company (ArabMed), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the MENA Syringes & Cannula Market?

▾ The MENA Syringes & Cannula Market size is estimated to have a value of USD 1.6 billion in 2026 and is expected to reach USD 3.5 billion by the end of 2035.

What is the growth rate in the MENA Syringes & Cannula Market?

▾ The market is growing at a CAGR of 8.8 percent over the forecasted period of 2026 to 2035.

Who are the key players in the MENA Syringes & Cannula Market?

▾ Some of the major key players in the MENA Syringes & Cannula Market are BD (Becton, Dickinson and Company), Cardinal Health, B. Braun Melsungen AG, Terumo Corporation, and Mohamed & Obaid AlMulla Group (MOM Group), among others.