Market Overview

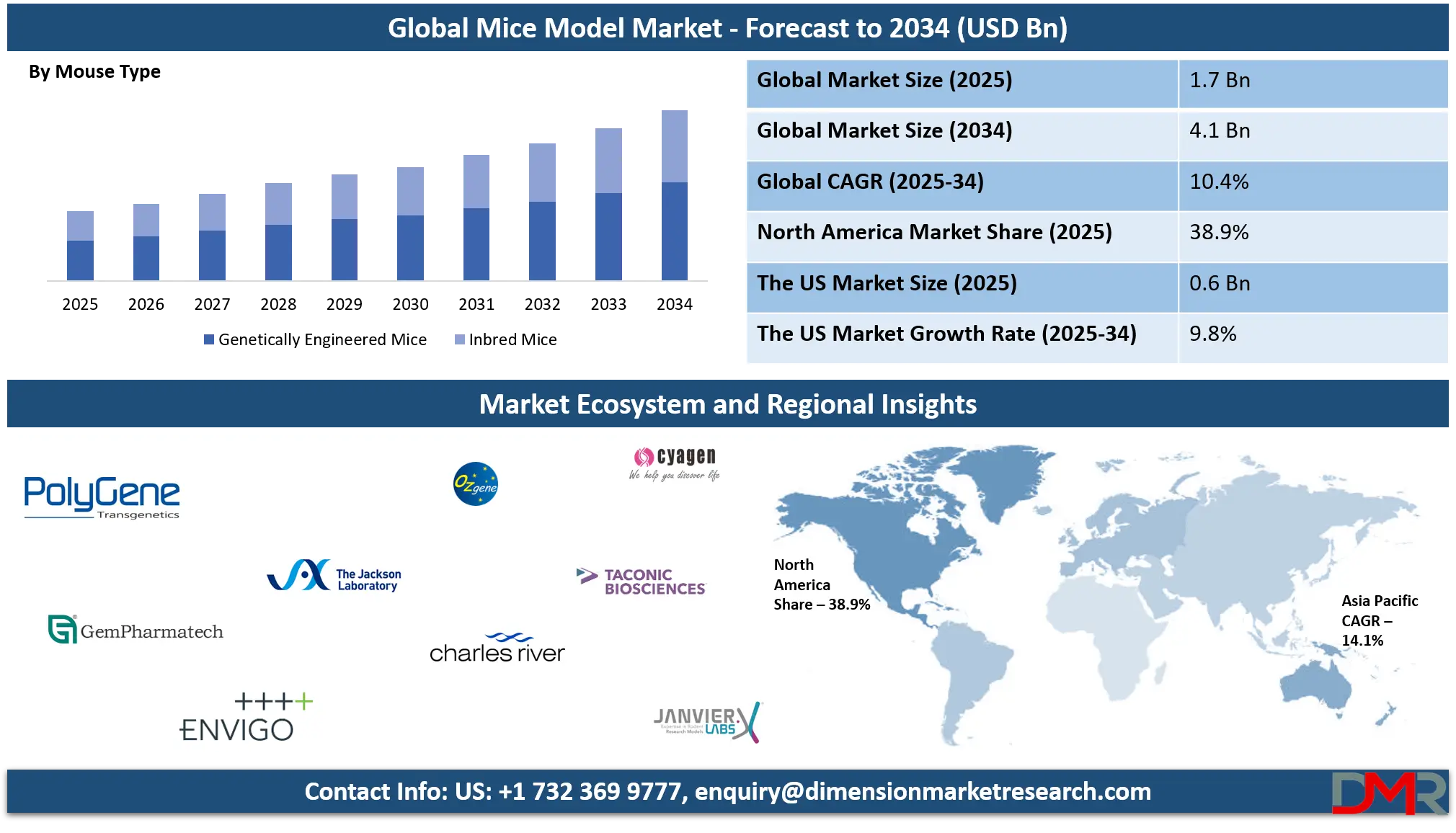

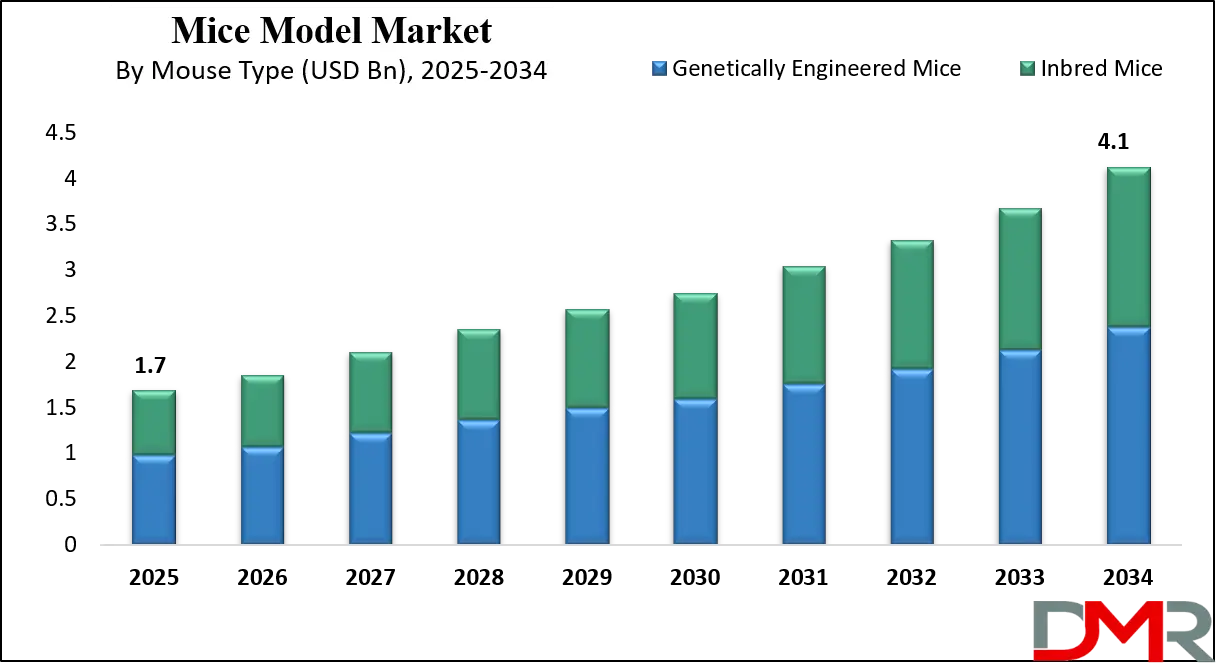

The Global Mice Model Market size is projected to reach USD 1.7 billion in 2025 and grow at a compound annual growth rate of 10.4% to reach a value of USD 4.1 billion in 2034.

The Mice Model refers to the use of laboratory mice as biological systems for studying human diseases, genetic functions, and therapeutic responses. These models include inbred strains, genetically engineered mice, and disease-specific variants used extensively in biomedical research. Mice models are central to preclinical studies due to their genetic similarity to humans, short reproductive cycles, and well-characterized genomes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

They play a critical role in advancing

drug discovery, toxicology testing, and translational research across pharmaceutical, biotechnology, and academic sectors. Emerging shifts toward precision medicine and personalized therapeutics are further increasing reliance on sophisticated mouse models.

The demand for mice models continues to rise due to increased investment in life sciences research and the growing prevalence of chronic and complex diseases. Advances in genetic engineering technologies such as CRISPR-Cas9 have significantly expanded the ability to create precise disease models. Regulatory authorities increasingly emphasize robust preclinical validation, reinforcing the importance of reliable animal models. Additionally, expanding pipelines for oncology, immunology, and rare disease therapies have accelerated adoption across research institutions and commercial laboratories.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Further, the recent growth reflects increased collaboration between biotechnology firms, academic institutes, and contract research organizations to expand model availability and reduce development timelines. Investments in humanized and transgenic mice have grown, supporting immuno-oncology and infectious disease research. Regulatory updates promoting ethical research practices and standardized animal welfare frameworks are shaping operational practices, while technological innovation continues to improve reproducibility and translational accuracy in preclinical research.

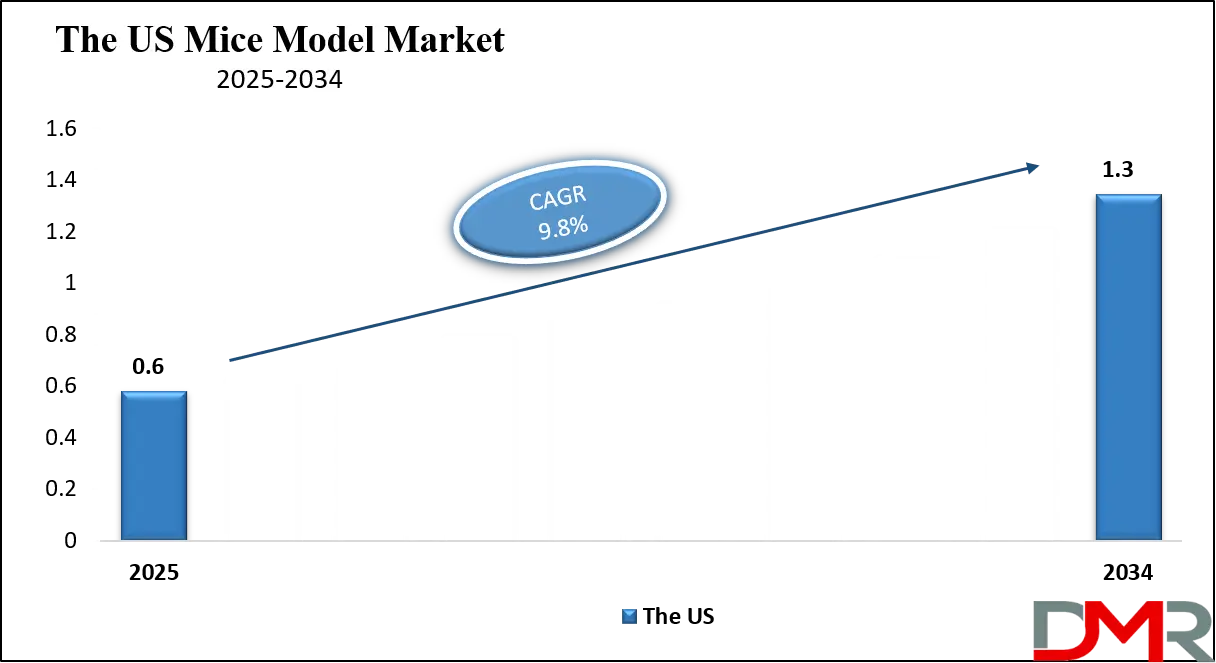

The US Mice Model Market

The US Mice Model Market size is projected to reach USD 600 million in 2025 at a compound annual growth rate of 9.8% over its forecast period.

The US Mice Model market is driven by strong pharmaceutical R&D investment, advanced biomedical infrastructure, and a large concentration of academic research institutions. Federal funding agencies significantly support translational research using mouse models, particularly in oncology and genetic disorders. The presence of major biotechnology clusters encourages early adoption of genetically engineered and humanized mice. Regulatory oversight ensures standardized research protocols, which enhances model reliability and reproducibility, further strengthening market growth across preclinical and drug development applications.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Mice Model Market

Europe Mice Model Market size is projected to reach USD 510 million in 2025 at a compound annual growth rate of 10.0% over its forecast period.

Europe’s Mice Model market benefits from robust public research funding, strong ethical frameworks, and coordinated regulatory policies across member states. Programs aligned with the European Green Deal and Horizon Europe emphasize sustainable and responsible research practices. Countries such as Germany, the UK, and France lead adoption due to established life science ecosystems. Increasing focus on immunology, neuroscience, and rare disease research continues to drive demand for specialized mouse models across academic and commercial laboratories.

Japan Mice Model Market

Japan Mice Model Market size is projected to reach USD 85 million in 2025 at a compound annual growth rate of 10.5% over its forecast period.

Advanced genetic research capabilities and government-backed biomedical innovation initiatives support Japan’s Mice Model market. Rapid growth in oncology and neurodegenerative disease research has increased demand for transgenic and knockout mice. Strong collaboration between universities and pharmaceutical companies accelerates model development and application. Challenges include high development costs and regulatory compliance, but opportunities exist through precision medicine initiatives and aging population-related disease research.

Mice Model Market: Key Takeaways

- Market Growth: The Mice Model Market size is expected to grow by USD 2.2 billion, at a CAGR of 10.4%, during the forecasted period of 2026 to 2034.

- By Mouse Type: The genetically engineered mice segment is anticipated to get the majority share of the Mice Model Market in 2025.

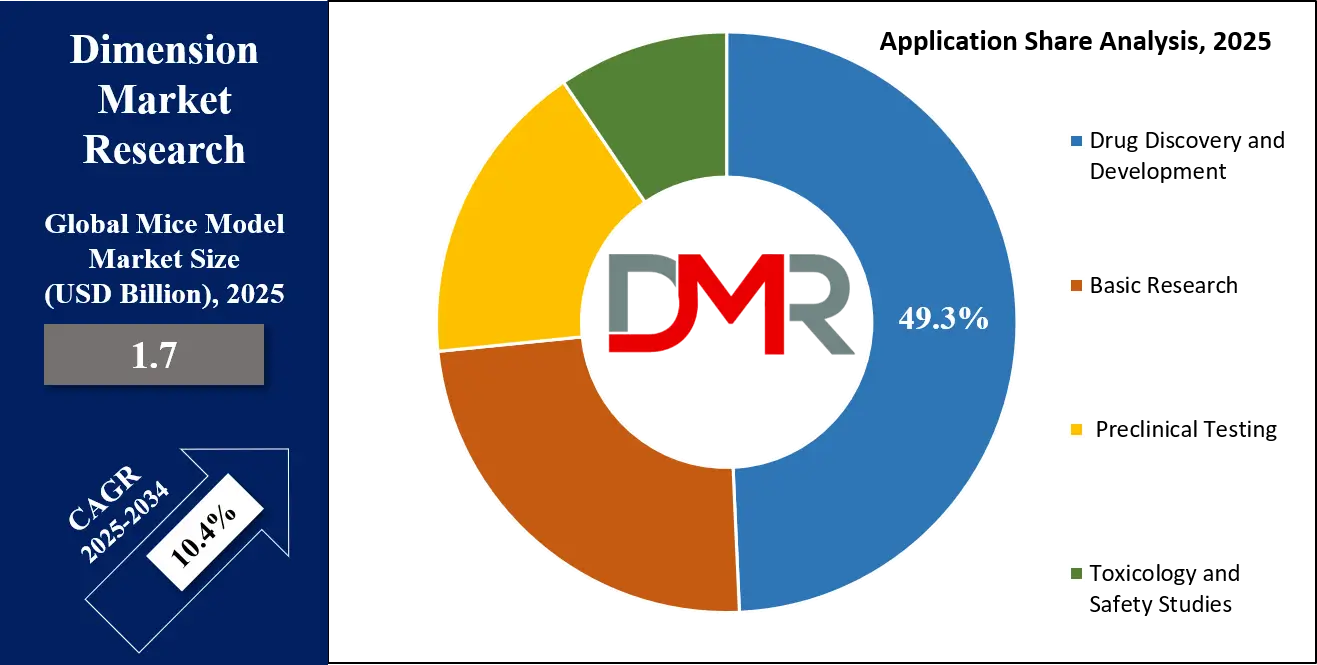

- By Application: The drug discovery & development segment is expected to get the largest revenue share in 2025 in the Mice Model Market.

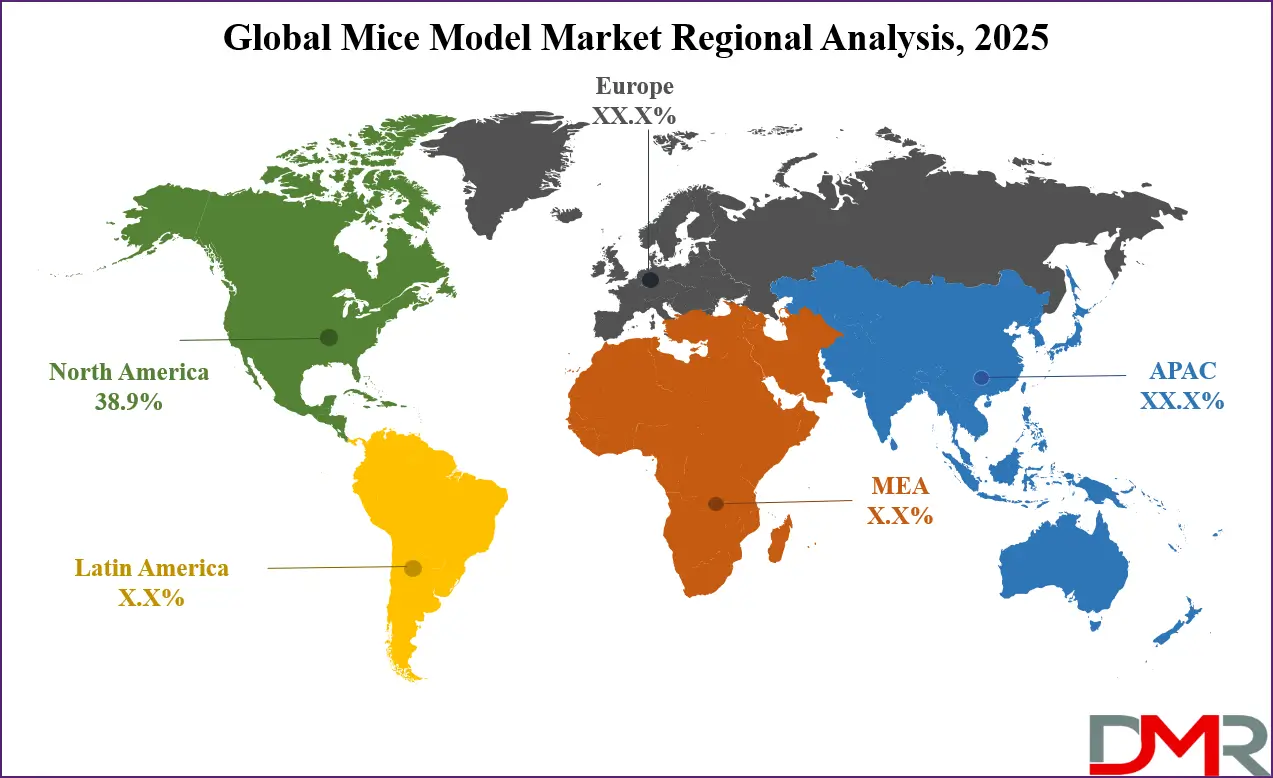

- Regional Insight: North America is expected to hold a 38.9% share of revenue in the Global Mice Model Market in 2025.

- Use Cases: Some of the use cases of mice model include oncology research, neurological studies, and more.

Mice Model Market: Use Cases:

- Oncology Research: Enables tumor biology studies, drug efficacy testing, and immunotherapy evaluation using genetically engineered cancer models.

- Neurological Studies: Supports research on Alzheimer’s, Parkinson’s, and neurodevelopmental disorders through targeted gene modifications.

- Infectious Disease Research: Facilitates pathogen-host interaction studies and vaccine development using humanized immune system mice.

- Toxicology Testing: Assesses drug safety, dosage limits, and long-term effects prior to clinical trials.

Stats & Facts

- National Institutes of Health reported a 6.5% increase in preclinical research grants involving mouse models in 2024.

- U.S. Food and Drug Administration indicated that over 72% of investigational drugs reviewed in 2025 utilized mouse-based preclinical data.

- European Commission recorded a 5.9% rise in funded biomedical projects using genetically engineered mice in 2024.

- Ministry of Health, Labour and Welfare Japan noted an 8.1% increase in neurological research programs employing transgenic mice in 2025.

- OECD documented a 7.4% growth in laboratory animal research compliance audits across member countries in 2024.

Market Dynamic

Driving Factors in the Mice Model Market

Rising Biomedical Research Investment

Growing global investment in pharmaceutical and biotechnology research is a primary driver for the Mice Model market. Governments and private entities are allocating substantial funding toward understanding disease mechanisms and developing innovative therapies. Mouse models provide a reliable platform for early-stage validation, reducing clinical trial risks. Increased focus on cancer, rare genetic disorders, and immune-related diseases has further intensified demand, positioning mice models as indispensable tools in translational research pipelines.

Advancements in Genetic Engineering Technologies

Technologies such as CRISPR-Cas9 have revolutionized the creation of precise and disease-specific mouse models. These advancements allow faster development timelines, higher accuracy, and improved reproducibility. Researchers can now replicate complex human genetic conditions more effectively, enhancing predictive outcomes. As genetic manipulation becomes more efficient and cost-effective, adoption of advanced mice models continues to expand across both academic and commercial research environments.

Restraints in the Mice Model Market

High Development and Maintenance Costs

The creation and maintenance of specialized mouse models involve significant costs related to genetic engineering, breeding, and facility management. Smaller research institutions often face budget constraints that limit access to advanced models. Compliance with animal welfare regulations further increases operational expenses, which can slow adoption despite strong research demand.

Ethical and Regulatory Challenges

Strict ethical regulations governing animal research can delay approvals and increase administrative burden. Public scrutiny and evolving welfare standards require continuous protocol updates. These factors may limit experimental flexibility and extend study timelines, impacting overall research efficiency.

Opportunities in the Mice Model Market

Growth in Personalized Medicine Research

Personalized and precision medicine initiatives create strong opportunities for customized mouse models that mimic individual genetic profiles. These models enable targeted therapy testing and biomarker discovery. Expanding genomic research supports long-term growth potential across oncology and rare disease applications.

Expansion of Contract Research Services

Increasing outsourcing of preclinical studies to contract research organizations presents growth opportunities. CROs invest in diverse mice model libraries to support pharmaceutical pipelines, accelerating market expansion through scalable research services.

Trends in the Mice Model Market

Rising Demand for Humanized Mouse Models

Humanized mice are gaining popularity due to their ability to replicate human immune responses. These models are essential for immunotherapy and infectious disease research, supporting higher translational accuracy and clinical relevance.

Standardization and Reproducibility Focus

Research institutions increasingly emphasize standardized protocols and reproducible results. This trend drives demand for well-characterized, validated mouse models that meet regulatory and publication requirements.

Impact of Artificial Intelligence in Mice Model Market

- Genetic Data Analysis: AI accelerates interpretation of genomic and phenotypic data from mouse studies.

- Disease Modeling Optimization: Machine learning improves selection of optimal mouse strains for specific diseases.

- Drug Response Prediction: AI enhances prediction of therapeutic outcomes based on preclinical data.

- Automated Phenotyping: Computer vision enables faster and more accurate behavioral and physiological analysis.

- Research Workflow Efficiency: AI-driven platforms streamline study design and data management.

Research Scope and Analysis

By Mouse Type Analysis

Genetically engineered mice dominate the market with a 57.8% share in 2025, largely due to their critical role in advanced disease modeling and targeted drug discovery. These models, including knockout, knock-in, transgenic, and humanized mice, allow precise manipulation of specific genes to replicate human disease pathways with high accuracy. Their ability to mimic complex genetic, metabolic, and immunological conditions makes them indispensable in oncology, immunology, and neuroscience research.

Pharmaceutical and biotechnology companies increasingly rely on these models to evaluate drug efficacy, toxicity, and biomarker responses before clinical trials. Continuous advancements in genome-editing technologies such as CRISPR-Cas9 have reduced development timelines and increased customization, further strengthening adoption. As precision medicine gains momentum, genetically engineered mice are expected to maintain strong demand across preclinical research pipelines.

Inbred mice represent the fastest-growing segment due to their genetic uniformity, which ensures reproducibility and consistency across experimental studies. These mice are produced through successive generations of controlled breeding, resulting in nearly identical genetic profiles. This characteristic makes them highly valuable for basic biological research, toxicology studies, and long-term disease investigations where minimizing genetic variability is essential.

Academic institutions and government-funded research laboratories extensively use inbred mice to establish baseline biological responses and conduct comparative studies. Their relatively lower cost and wide availability compared to genetically engineered models further support adoption. Additionally, inbred mice serve as foundational strains for developing more complex genetically modified models. Growing emphasis on standardized research methodologies and reproducible outcomes continues to drive steady expansion of this segment.

By Disease Area Analysis

Oncology accounts for 41.6% of the market share in 2025, making it the largest disease area segment within the mice model market. The high prevalence of cancer globally and the rapid expansion of oncology drug pipelines have significantly increased reliance on mouse tumor models. These models enable detailed study of tumor growth, metastasis, and immune system interactions under controlled conditions.

Genetically engineered and xenograft mouse models are widely used to test targeted therapies, immunotherapies, and combination treatments. Regulatory authorities require robust preclinical oncology data, further reinforcing demand. Additionally, the shift toward personalized cancer therapies has increased the need for patient-derived xenograft models, enhancing translational relevance and strengthening the segment’s dominant position.

The neurology and neurodegenerative disorders segment is expanding rapidly due to the rising global burden of Alzheimer’s disease, Parkinson’s disease, and other neurological conditions. Aging populations and increased awareness of brain health have led to higher research funding allocations. Mouse models play a crucial role in studying disease mechanisms, synaptic function, and neurodegeneration progression. Transgenic and knockout mice are particularly valuable for replicating genetic mutations linked to neurological disorders.

Advances in behavioral phenotyping and neuroimaging techniques have improved the utility of mouse models in this field. As pharmaceutical companies intensify efforts to develop disease-modifying therapies, demand for reliable neurological mouse models continues to grow, positioning this segment as a key driver of future market expansion.

By Application Analysis

Drug discovery and development leads the market with a 49.3% share in 2025, driven by stringent regulatory requirements for preclinical validation and the growing complexity of therapeutic pipelines. Mouse models are essential for evaluating pharmacodynamics, pharmacokinetics, and early safety profiles of drug candidates. Genetically engineered mice enable researchers to assess target engagement and therapeutic efficacy with higher predictive accuracy.

Pharmaceutical and biotechnology companies increasingly integrate mouse studies early in development to reduce late-stage clinical failures. The growing focus on biologics, gene therapies, and immunotherapies has further strengthened reliance on sophisticated mouse models. As R&D spending continues to rise, drug discovery applications are expected to remain the dominant contributor to overall market revenue.

Preclinical testing is the fastest-growing application segment, supported by increasing regulatory scrutiny around drug safety and efficacy. Mouse models are widely used to conduct toxicology, dose-ranging, and long-term safety studies before human trials. Regulatory agencies require comprehensive preclinical data to assess potential risks, driving consistent demand. Advances in phenotyping, imaging, and biomarker analysis have enhanced the value of mouse-based preclinical studies.

Additionally, rising outsourcing of preclinical testing to specialized CROs has accelerated growth in this segment. As pharmaceutical pipelines expand and safety expectations become more rigorous, preclinical testing using mouse models is expected to experience sustained and accelerated adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Analysis

Pharmaceutical and biotechnology companies account for 44.9% of market share in 2025, reflecting their central role in driving demand for mice models. These organizations rely heavily on mouse-based studies throughout drug discovery, development, and regulatory submission stages. Continuous expansion of therapeutic pipelines, particularly in oncology, immunology, and rare diseases, has increased the need for specialized and customized mouse models.

Large companies invest significantly in in-house research facilities and long-term partnerships with model suppliers to ensure consistent access. The push toward precision medicine and biologics has further intensified reliance on advanced genetically engineered mice, reinforcing this segment’s leadership position.

Contract research organizations are expanding rapidly due to the growing trend of outsourcing preclinical research activities. CROs offer specialized expertise, advanced facilities, and cost efficiencies, making them attractive partners for pharmaceutical and biotechnology companies. To remain competitive, CROs are investing in diverse libraries of genetically engineered and disease-specific mouse models.

Increased demand for flexible, scalable research services has accelerated growth in this segment. Additionally, smaller biotech firms increasingly rely on CROs to reduce capital expenditure and speed up development timelines. As outsourcing becomes a standard strategy across the industry, CROs are expected to play an increasingly influential role in the mice model market.

The Mice Model Market Report is segmented on the basis of the following:

By Mouse Type

- Inbred Mice

- Genetically Engineered Mice

- Knockout Mice

- Transgenic Mice

- Knock-in Mice

- Humanized Mice

By Disease Area

- Oncology

- Immunology and Inflammatory Diseases

- Neurology and Neurodegenerative Disorders

- Metabolic and Endocrine Disorders

- Infectious Diseases

By Application

- Drug Discovery and Development

- Basic Research

- Preclinical Testing

- Toxicology and Safety Studies

By End User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations

Regional Analysis

Leading Region in the Mice Model Market

North America leads the mice model market with a 38.9% share in 2025, supported by robust biomedical research funding, advanced laboratory infrastructure, and a well-established regulatory framework. The region benefits from substantial public and private investment in life sciences, particularly through federal research grants and pharmaceutical R&D spending. A high concentration of pharmaceutical and biotechnology companies, along with world-class academic and research institutes, drives sustained demand for advanced mouse models. Regulatory clarity from authorities ensures standardized preclinical testing requirements, reinforcing reliance on validated mice models.

Additionally, early adoption of genetic engineering technologies and strong collaboration between academia, industry, and contract research organizations further strengthen regional leadership. Continuous innovation and large-scale clinical pipelines position North America as the dominant contributor to global market revenue.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Mice Model Market

Asia-Pacific is the fastest-growing region in the mice model market, driven by rising biomedical research investments and rapid expansion of pharmaceutical and biotechnology industries. Governments across China, Japan, and South Korea are actively supporting life sciences through funding programs, infrastructure development, and favorable research policies.

The region is also witnessing a strong increase in contract research organizations, which are investing in diverse mouse model portfolios to serve both domestic and international clients. Growing prevalence of chronic diseases and increased participation in global clinical trials have intensified demand for reliable preclinical models. Additionally, improving regulatory frameworks and cost advantages compared to Western markets make Asia-Pacific an attractive destination for outsourced research. These factors collectively support accelerated regional growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Mice Model market features high entry barriers due to regulatory requirements, technical expertise, and ethical compliance. Participants focus on expanding genetic libraries, improving model accuracy, and forming academic partnerships. Long-term contracts, customization capabilities, and investment in breeding infrastructure strengthen competitive positioning. Continuous R&D ensures differentiation and market sustainability.

Some of the prominent players in the global Mice Model are:

- The Jackson Laboratory

- Charles River Laboratories

- Taconic Biosciences

- Envigo

- Janvier Labs

- GemPharmatech

- Cyagen Biosciences

- Biocytogen

- Shanghai Model Organisms Center

- Crown Bioscience

- Pharmaron

- Hera BioLabs

- Ozgene

- Ingenious Targeting Laboratory

- PolyGene

- genOway

- Trans Genic Inc.

- Harbour BioMed

- Vital River Laboratories

- Axenis

- Other Key Players

Recent Developments

- In October 2024, The Jackson Laboratory announced a strategic partnership with a global biotechnology firm to accelerate the development of CRISPR-based mouse models for rare genetic diseases. The collaboration aimed to reduce model development timelines and improve accessibility for academic and commercial researchers, supporting faster therapeutic validation.

- In April 2024, Charles River Laboratories expanded its genetically engineered mouse portfolio to support oncology and immunology research. The expansion included new knockout and humanized mouse lines designed for immuno-oncology drug testing. This development addressed rising demand for translational accuracy in preclinical studies and strengthened the company’s collaboration with pharmaceutical developers seeking advanced disease models.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.7 Bn |

| Forecast Value (2034) |

USD 4.1 Bn |

| CAGR (2025–2034) |

10.4% |

| The US Market Size (2025) |

USD 0.6 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Mouse Type (Inbred Mice and Genetically Engineered Mice), By Disease Area (Oncology, Immunology and Inflammatory Diseases, Neurology and Neurodegenerative Disorders, Metabolic and Endocrine Disorders, and Infectious Diseases), By Application (Drug Discovery and Development, Basic Research, Preclinical Testing, Toxicology and Safety Studies), By End User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, and Contract Research Organizations) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

The Jackson Laboratory, Charles River Laboratories, Taconic Biosciences, Envigo, Janvier Labs, GemPharmatech, Cyagen Biosciences, Biocytogen, Shanghai Model Organisms Center, Crown Bioscience, Pharmaron, Hera BioLabs, Ozgene, Ingenious Targeting Laboratory, PolyGene, genOway, Trans Genic Inc., Harbour BioMed, Vital River Laboratories, Axenis, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Mice Model Market?

▾ The Global Mice Model Market size is expected to reach a value of USD 1.7 billion in 2025 and is expected to reach USD 4.1 billion by the end of 2034.

Which region accounted for the largest Global Mice Model Market?

▾ North America is expected to have the largest market share in the Global Mice Model Market, with a share of about 38.9% in 2025.

How big is the Mice Model Market in the US?

▾ The Mice Model Market in the US is expected to reach USD 0.6 billion in 2025.

Who are the key players in the Mice Model Market?

▾ Some of the major key players in the Global Mice Model Market include PolyGene, Ozgene, Envigo, and others

What is the growth rate in the Global Mice Model Market?

▾ The market is growing at a CAGR of 10.4 percent over the forecasted period.