Market Overview

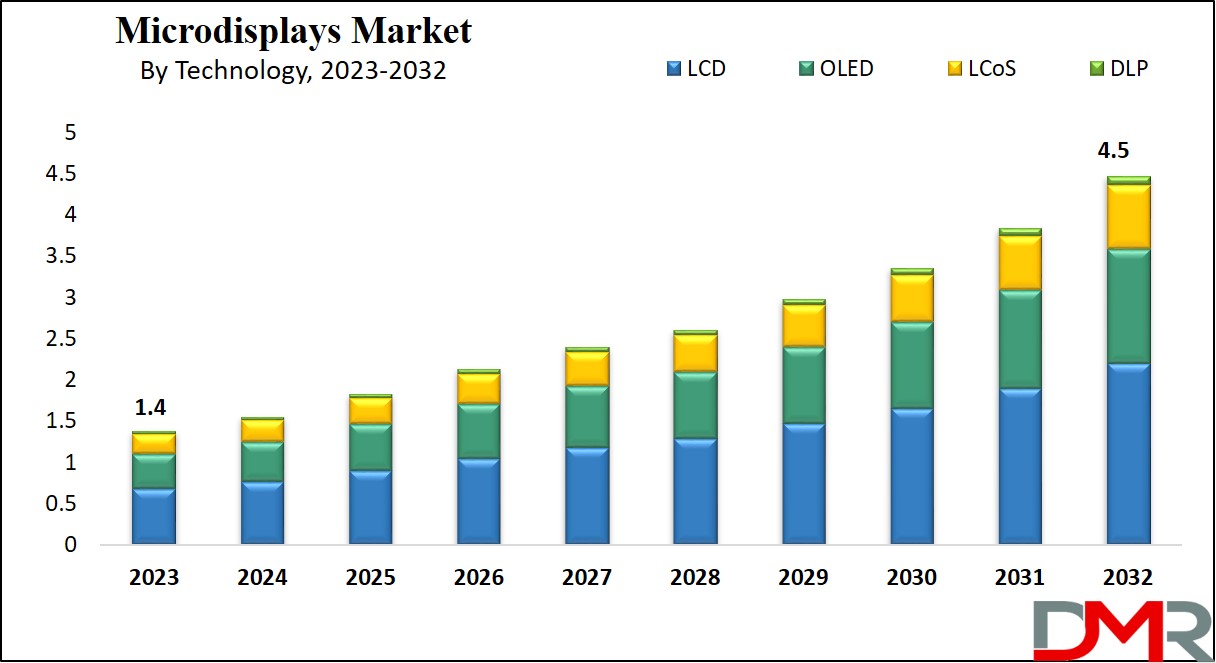

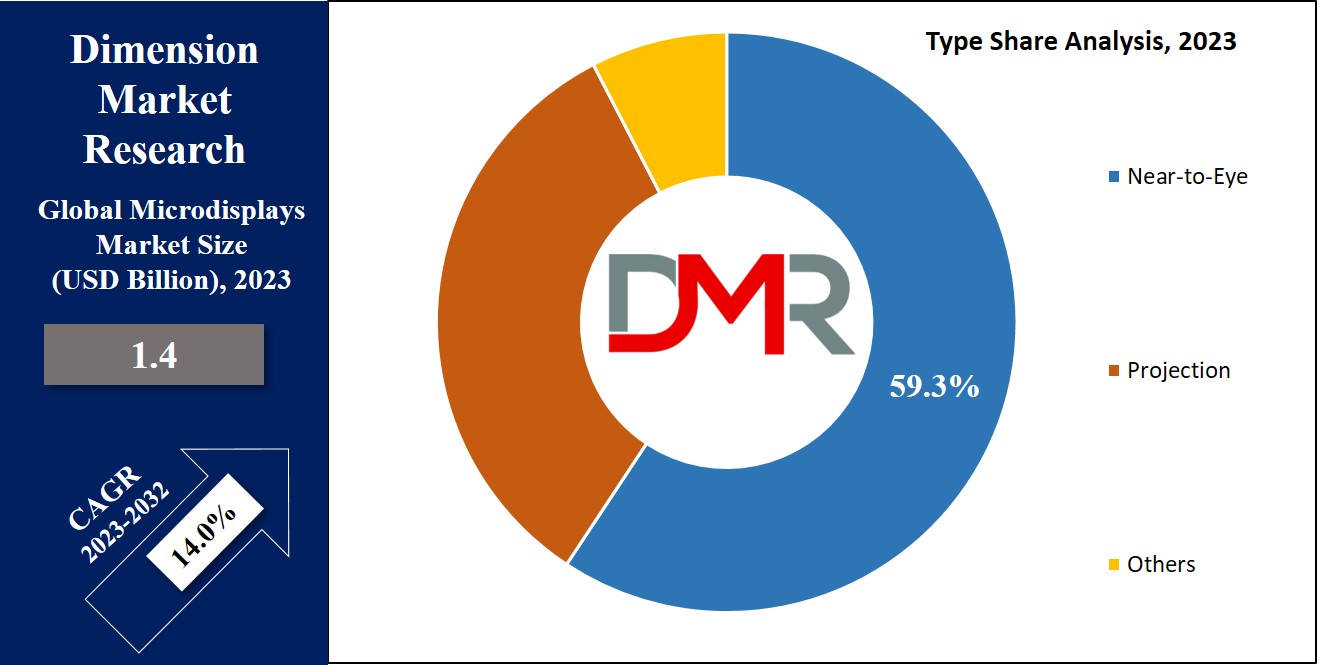

The Global Microdisplays Market is expected to reach a value of USD 1.4 billion in 2023, and it is further anticipated to reach a market value of USD 4.5 billion by 2032 at a CAGR of 14.0%. The market has seen a significant increase in the recent past and is predicted to grow significantly during the forecasted period as well.

Microdisplays are the displays, often featuring a screen size of less than two inches diagonally, that find applications in rear-projection TVs, data projectors, head-mounted displays (HMDs), & digital camera viewfinders.

The Global Microdisplays Market is witnessing rapid expansion as demand for compact yet high-resolution displays increases. Microdisplays have found widespread usage across various sectors including augmented reality (AR), virtual reality (VR), wearable devices and consumer interest in immersive technologies increases - driving demand for microdisplays within headsets, smart glasses and other compact devices to skyrocket.

Recent advances in OLED and LCD microdisplays have resulted in improvements to their brightness, resolution, energy efficiency, making them perfect for applications in

medical imaging, military systems, entertainment devices and consumer electronics. This transition towards high-performing microdisplays is creating new opportunities both consumer and industrial sectors thereby expanding market potential further.

Opportunities for innovation are emerging with the incorporation of microdisplays into automotive heads-up displays, smart eyewear and gaming systems. Connected devices and the rise in smart home technologies further drive demand. Furthermore, microdisplay technologies will continue to advance user experiences, creating a dynamic market with tremendous growth potential across various applications.

Upcoming conferences in the Microdisplays Market will focus on the latest innovations in AR, VR, and wearable technologies. Notable events like Display Week and SID (Society for Information Display) Annual Symposium will showcase advancements in microdisplay technologies, providing a platform for industry leaders to discuss trends, challenges, and opportunities. These events are vital for networking and exploring emerging applications.

The microdisplays market is witnessing rapid adoption across multiple industries, with the demand for AR and VR applications significantly contributing to its growth. In 2023, the market saw an increase in shipments of microdisplays, with a year-over-year growth rate of approximately 36%. The demand is being driven by the rise of wearable devices, which account for over 30% of the market share globally.

Key Takeaways

- Market Growth: The global microdisplays market is set to reach USD 4.5 billion by 2032, growing at a CAGR of 14.0% due to high demand for compact, high-resolution displays.

- Technology Trends: LCD microdisplays hold the largest market share in 2023, with OLED gaining traction for VR due to better power efficiency, resolution, and faster response times.

- Application Insights: Military & defense lead revenue, driven by low-power OLED microdisplays for thermal imaging, simulation, and night-vision goggles; consumer electronics show fastest growth.

- Wearables Impact: Wearable devices like AR/VR headsets and fitness trackers account for over 30% of market share, significantly boosting shipment volume and adoption rates globally.

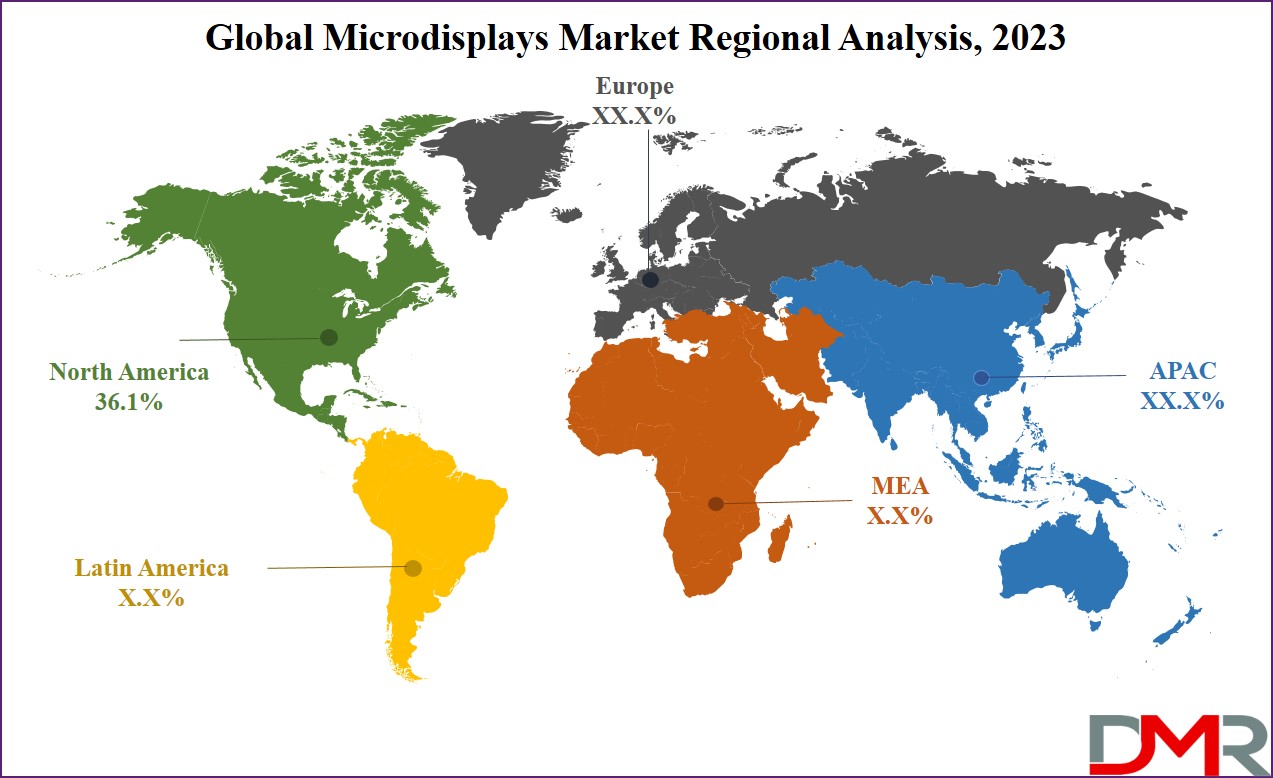

- Regional Leaders: North America contributes 36.1% of market revenue, led by the U.S. ICT adoption and military investments. Asia Pacific is expected to grow rapidly due to active industry players.

- Competitive Landscape: Leading companies such as Sony, eMagin, LG Display, and Samsung invest heavily in R&D for AR/VR features; collaborations and new entrants indicate intense competition.

- Innovation Opportunities: Growing integration of microdisplays into automotive heads-up displays, smart eyewear, and gaming systems opens new market avenues and enhances user experience.

- Market Challenges: High manufacturing and R&D costs remain key barriers, but ongoing research into low-cost technologies aims to drive future competitiveness.

Use Cases

- AR Training Glasses: Used in industrial settings for real-time on-job training, warehouse inventory management, and maintenance tasks, enhancing workforce efficiency and productivity.

- Military Imaging Devices: Applied in night-vision goggles, thermal weapon sights, and simulation gear for defense, improving situational awareness, safety, and operational effectiveness.

- Medical Imaging Tools: Integrated into devices for surgical visualization and diagnostics, enabling precise imagery and improved decision-making in healthcare environments.

- Automotive HUDs: Incorporated within heads-up displays in vehicles to provide drivers with safety, navigation, and infotainment data directly onto the windshield.

- VR Gaming Headsets: Used in consumer electronics for immersive gaming experiences, catering to a growing demand for compact, high-resolution, and portable entertainment devices.

- Smart Wearable Devices: Embedded in smartwatches, fitness trackers, and consumer gadgets, allowing health monitoring, communication, and lifestyle support through vibrant, information-rich displays.

Market Dynamic

The increasing popularity of fitness trackers and smartwatches among consumers, meeting various needs like lifestyle support, health monitoring, entertainment, & fitness tracking, is set to drive the need for microdisplays in the coming future. In addition, the introduction of microdisplay-based holographic displays is anticipated to have significant growth as well as drive the market.

Also, the increasing adoption of Virtual Reality (VR) headsets that are compatible with smartphones & other devices, mainly among younger audiences seeking for better gaming experience, is on the growth as many smartphone manufacturers like Samsung & HTC are bundling VR headsets with new phone purchases, further boosting market growth.

However, the market growth may be hindered by the high manufacturing and research and development (R&D) costs associated with microdisplays. Yet, manufacturers are actively exploring low-cost technologies to reduce these expenses & enhance market competitiveness.

Research Scope and Analysis

By Technology

In terms of technology, the LCD technology commands the largest market share in terms of overall revenue in 2023 & is expected to maintain its dominance throughout the forecasted period. This segment's growth is mainly driven by the high utilization of LCD microdisplays in applications like

Head-Mounted Displays (HMDs),

Heads-Up Displays (HUDs), and Electronic Viewfinders (EVFs). Also, the Liquid Crystal on Silicon (LCoS) segment is anticipated for substantial growth due to its compact size & enhanced efficiency, meeting the evolving market demands.

Further, key industry players are constantly integrating new OLED microdisplay technology to provide enhanced visual performance to consumers., with the growth in the demand for OLED microdisplays, mainly in VR headset displays, is said to be due to their superior power efficiency, higher resolutions, faster response times, and affordability. The growth in awareness of the advantages associated with OLED technology is expected to positively impact the overall market.

By Type

Near-Eye Displays (NTE) segment leads the overall global microdisplay market in 2023, driven by growing demand for Augmented Reality (AR) glasses in industrial settings. These AR glasses find application in warehouse management, giving on-the-job training to field workers, & facilitating maintenance & inspection tasks, contributing significantly to segment growth. Additionally, the segment benefits from the growth in the use of Heads-Up Displays (HUDs) in high-end automobiles, further driving its expansion throughout the forecasted period.

By Application

The military & defense sector emerges as the leading contributor to the overall market revenue, which is mainly driven by the growth in demand for low-power OLED microdisplays in applications like thermal imaging, simulation, situational awareness, & training.

In addition, industry leaders like eMagin Corp & others are actively developing a range of microdisplay products, including night-vision goggles & thermal weapon sights, designed for military purposes, thereby delivering an enhanced visual experience.

Moreover, the consumer electronics segment is expected to experience the most significant growth in the coming future, which is fueled by the growth in the adoption of consumer gadgets like smartwatches, smartphones, & smart glasses.

Moreover, the rising popularity of VR gaming headsets, along with consumer preferences shifting toward compact & portable electronic devices, is also expected to further boost the segment's growth along with the market during the forecasted period.

The Microdisplays Market Report is segmented on the basis of the following

By Technology

By Type

- Near-to-Eye

- Projection

- Others

By Application

- Military & Defense

- Consumer Electronics

- Medical

- Automotive

- Industrial

- Others

Regional Analysis

North America leads the global microdisplays market,

contributing 36.1% of the total revenue, which is attributed to the growth in the adoption of Information and Communication Technology (ICT) solutions in the education sector, which is reshaping traditional teaching methods. In addition, the high military fundings by the US government is fueling investments in microdisplay applications, including night vision Heads-Up Displays (HUDs) &

thermal imaging technologies.

Furthermore, the Asia Pacific region is anticipated to experience high growth during the forecast period, which is supported by the presence of major industry players like Samsung, Sony Corp, LG Display, and more. Their active involvement in the market is expected to further bolster the industry's expansion in the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global microdisplays market features intense competition with key players such as Sony, eMagin, and more dominating the field, as these companies invest heavily in R&D to enhance display technology for applications like AR &VR. The market also witnesses new entrants & collaborations as it continues to expand.

In October 2022, Samsung Display initiated an OLED microdisplay project focused on supplying microdisplays to Apple & other augmented reality (AR) developers, as the company is currently in the starting phases of development & intends to commence limited-scale display production by 2024.

Some of the prominent players in the global Microdisplays Market are:

- eMagin Corp

- Micron Technology Inc

- AU Optronics Corp

- LG Display

- Sony Corp

- Microvision Inc

- Himax Technology Inc

- Universal Display Corp

- Kopin Corp Inc

- Syndiant Inc

- Other Key Players

Recent Developments

- In early 2024, Samsung Electronics announced development of a high-end VR headset (Project Moohan) integrating advanced microdisplay technologies, signaling new competition with Apple and Meta.

- In March 2025, Tata Electronics partnered with Himax and Powerchip to develop integrated low-power AI and display manufacturing capabilities, diversifying global supply chains for microdisplays.

- In June 2025, JBD secured Pre-B funding to extend market leadership in compact AR engines, launching the new “Hummingbird mini II” microdisplay light engine.

- In December 2024, Sitan Technology raised over 150 million yuan in a Series B funding round to support mass production of Micro LED displays.

- In December 2023, Hon Hai Technology Group (Foxconn) announced plans to start limited-scale production of OLED microdisplays for AR partners, fueling industry expansion.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 1.4 Bn |

| Forecast Value (2032) |

USD 4.5 Bn |

| CAGR (2023–2032) |

14.0% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (LCD, OLED, LCoS, and DLP), By Type (Near-to-Eye, Projection, and Others), By Application (Military & Defense, Consumer Electronics, Medical, Automotive, Industrial, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

eMagin Corp, Micron Technology Inc, AU Optronics, LG Display, Sony Corp, Microvision Inc, Himax Technology Inc, Universal Display Corp, Kopin Corp Inc, Syndiant Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Microdisplays Market is estimated to reach USD 1.4 billion in 2023, which is further expected

to reach USD 4.5 billion by 2032.

North America dominates the Global Microdisplays Market with a share of 36.1% in 2023.

Some of the major key players in the Global Microdisplays Market are eMagin Corp, LG Display, Sony

Corp, and many others.

The market is growing at a CAGR of 14.0 percent over the forecasted period.