Military wearable technology is the electronic devices and equipment worn by soldiers or other military personnel as part of their uniforms or gear. These devices include navigation systems, communication systems, various types of sensor systems, and different types of technology that can improve soldiers' ability to perform their duties, enhancing the military wearables market growth. As defense wearable technology becomes more sophisticated, its role in modern combat continues to expand.

The US Military Wearables Market

The US Military Wearables Market is projected to reach USD 3.4 billion in 2024 at a compound annual growth rate of 25.5% over its forecast period.

The US military wearables market provides growth opportunities through better defense spending on advanced technologies, like AI and IoT integration. The modernization of armed forces, aiming at better soldier safety and performance, drives the need for innovative wearables. Collaborations between defense contractors and tech firms also support the development of advanced solutions tailored to military needs.

Further, the market is driven by significant defense investments aimed at advancing soldier technology, and enhancing safety and operational efficiency. However, high development costs & technical challenges, like ensuring durability and reliability in harsh conditions, act as major restraints. Balancing innovation with budget constraints remains crucial for the successful adoption of military wearables in the US.

Key Takeaways

- Market Growth: The Military Wearables Market size is expected to grow by 75.0 billion, at a CAGR of 27.2% during the forecasted period of 2025 to 2033.

- By Type: The headwear segment is anticipated to get the majority share of the military wearable market in 2024.

- Technology: The communication & computing segment is expected to be leading the market in 2024

- By End User: The Land force is expected to get the largest revenue share in 2024 in the Military Wearables Market.

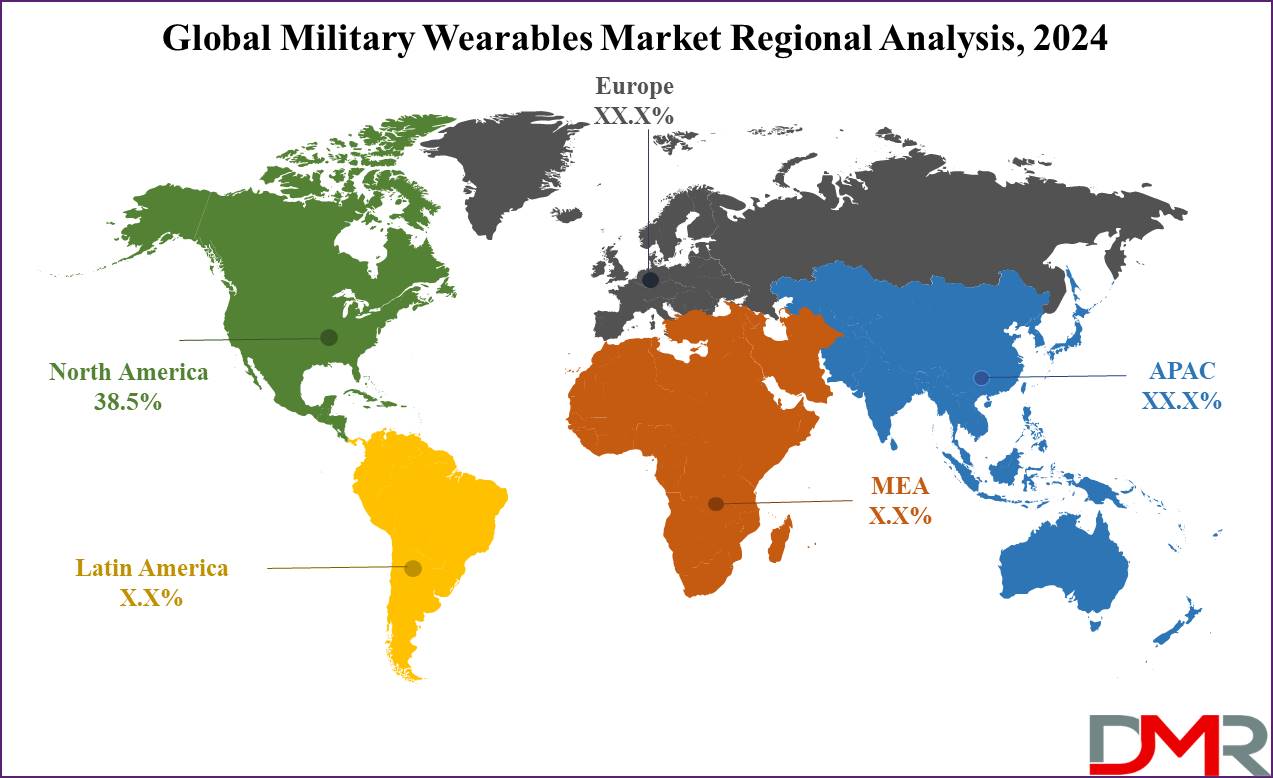

- Regional Insight: North America is expected to hold a 38.5% share of revenue in the Global Military Wearables Market in 2024.

- Use Cases: Some of the use cases of Military Wearables include biometric monitoring, situational awareness, and more.

Use Cases

- Enhanced Communication: Wearable devices incorporated with advanced communication systems allow soldiers to stay connected to life on the battlefield, enhancing coordination, information sharing, and operational efficiency.

- Situational Awareness: Augmented Reality (AR) integrated wearables provide soldiers with live battlefield data, such as enemy positions, navigation details, and mission-critical information, improving situational awareness and decision-making.

- Biometric Monitoring: Wearables with biometric sensors track soldiers' vital signs to ensure their well-being and readiness during missions, providing early warnings for medical interventions. These advanced systems function much like modern medical devices, offering continuous monitoring and rapid detection of health anomalies to enhance soldier safety and operational effectiveness.

- Smart Body Armor and Gear: Lightweight and durable wearables, like body armor and helmets with integrated cameras and sensors, provide better protection and mobility while offering enhanced visibility and tactical advantages in combat situations.

Market Dynamic

Driving Factors

Technological Advancements

The integration of advanced technologies like Augmented Reality (AR), biometric monitoring, and smart textiles in wearables is driving demand. These innovations enhance soldier performance, safety, and situational awareness, making them important for modern military operations.

Rising Defense Investments

Increasing defense budgets, mainly in countries like the US, China, and India, are driving the adoption of next-generation military wearables. Governments are investing largely in R&D to modernize armed forces, looking at lightweight, durable, and high-tech wearable solutions.

Restraints

High Costs

The development and implementation of advanced military wearables, using technologies like AR, smart textiles, and biometric sensors, come with major costs, which limits broad adoption, mainly for countries with smaller defense budgets.

Technical Challenges

Ensuring reliable performance of wearables in harsh & unpredictable environments creates major technical challenges. Issues like battery life, durability, and smooth integration with existing systems can impacts the full deployment of wearable technologies in military operations.

Opportunities

Integration with AI and IoT

The integration of military wearables with artificial intelligence (AI) & the Internet of Things (IoT) provides higher potential. These technologies allow predictive maintenance, real-time data analysis, and better decision-making, making soldiers more efficient and responsive on the battlefield.

Rising Demand for Soldier Modernization

As global militaries drive for modernization, there is a higher demand for wearable systems that improve protection, mobility, and communication. Countries seeking to upgrade their armed forces provide significant opportunities for the development and deployment of advanced wearable technologies.

Trends

Smart Textiles

The growth in the utilization of smart textiles embedded with sensors for monitoring soldiers' health, environmental conditions, and body movements is gaining momentum. These textiles enhance performance by delivering real-time data on soldier well-being and operational efficiency, while the integration of

Health Informatics enables smarter analysis, improved decision-making, and more accurate health assessments in mission-critical environments.

Augmented Reality (AR) Integration

AR-based wearables are becoming more prevalent, providing soldiers with real-time battlefield intelligence, navigation helps, and target identification, which is transforming situational awareness, allowing soldiers to make faster and more informed decisions in combat scenarios.

Research Scope and Analysis

By Type

The headwear segment is anticipated to lead the military wearables market in 2024 and is also expected to maintain its dominance throughout the forecast period due to its integration with advanced technologies like Augmented Reality (AR) and Virtual Reality (VR). Further, there is an increase in the demand for headwear that improves a soldier’s capabilities on the battlefield. Modern military headgear like advanced features like fire control systems, integrated cameras, and displays that enhance visibility in low-light conditions.

These technological improvements allow soldiers to have better situational awareness & increase their effectiveness in critical situations. Moreover, the bodywear segment is set to get the fastest growth of the military wearables market during the forecast period. The increase in the use of advanced technologies in bodywear is driving major growth in this area. Companies are investing largely in R&D to create gear that improves a soldier’s mobility, comfort, and protection in tough environments.

These developments in bodywear focus on providing tactical advantages to soldiers, helping them stay safe and perform better in challenging conditions. The constant innovation and focus on developing more advanced, durable, and efficient bodywear are expected to be key factors in driving the market’s growth.

By Technology

In terms of technology, the communication and computing segment is expected to be the biggest segment in the military wearables market during the forecast period. The growth in utilization of communication technology in wearable devices is driving market growth. These devices allow soldiers to stay connected on the battlefield, making it easy for them to communicate and access important information quickly.

By enhancing communication, these wearables allow soldiers' efficiency and coordination, which is important in combat situations. Further, the vision and surveillance segment is anticipated to grow at the fastest rate, which is driven by the growth in the use of high-tech equipment created to protect military personnel and provide live situational awareness in the field. Leading companies are incorporating technologies like

artificial intelligence, smart sensors in textiles, and advanced eyewear into these devices.

These innovations allow for the monitoring of soldiers’ health and body conditions, along with improving their communication and navigation capabilities. As a result, military forces are highly adopting these advanced systems to boost performance and safety in the field.

By End User

The military wearables market is categorized by end users into land forces, naval forces, and air forces. Among these, the land forces segment is anticipated to hold the largest share of the market in 2024, which is primarily due to the growth in the adoption of next-generation military gear, like advanced body armor, lightweight wearables, helmets, and eyewear by land forces.

These developments assist enhance the safety, mobility, and effectiveness of soldiers on the ground, making the segment a key driver of market growth. Further, the air forces segment is expected to be the fastest-growing during the forecast period. The growth in the utilization of advanced technology by aircraft pilots is driving this growth.

Advanced wearable systems are being integrated into pilot gear to enhance navigation, communication, and situational awareness during missions. These innovations are enhancing the capabilities and performance of air forces, leading to a fast growth in the demand for high-tech military wearables in this segment.

The Military Wearables Market Report is segmented on the basis of the following

By Type

- Headwear

- Eyewear

- Wristwear

- Hearables

- Bodywear

By Technology

- Communication & Computing

- Network & Connectivity Management

- Vision & Surveillance

- Exoskeleton

- Navigation

- Power & Energy Source

- Smart Textiles

By End User

- Land Forces

- Naval Forces

- Air Forces

Regional Analysis

North America is anticipated to lead the Military Wearables Market in 2024,

holding a 38.5% share and maintaining this dominance throughout the forecast period. The US as the world’s largest defense spender, plays a vital role in driving this market by largely investing in the R&D of advanced wearable technologies. These investments are focused on enhancing soldier performance, safety, and situational awareness through innovations like biometric monitoring, smart textiles, and augmented reality (AR) systems.

The partnership between technology companies, the military, and academic institutions further accelerates the development and deployment of these advanced wearables. In addition, North America's focus on modernizing its military forces and integrating wearable technologies with current systems reinforces its leadership in the market.

Further, the Asia-Pacific region is anticipated to experience the fastest growth in the military wearables market during the forecast period. Countries like China, India, Japan, and South Korea are making major investments in advanced military technologies to upgrade their armed forces.

The growth in the use of smart textiles, AR devices, and biometric monitoring systems is enhancing the performance, safety, and situational awareness of soldiers in the region. The partnership between defense agencies, local technology firms, and international companies is driving innovation and speeding up the development of advanced military wearables. Furthermore, the region's focus on integrating these wearables with current military systems is contributing to the rapid expansion of the market in Asia-Pacific.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the military wearables market is characterized by a mix of established defense contractors &innovative tech companies. These players are investing highly in R&D to create advanced wearable technologies that improve soldier performance and safety.

Collaboration between industry and military organizations fosters innovation, while ongoing partnerships with academic institutions help drive technological advancements. Companies are also aiming to integrate features like biometric monitoring, augmented reality, and smart textiles to meet the evolving needs of armed forces worldwide, increasing competition in the market.

Some of the prominent players in the Global Military Wearables are

- BAE System

- Thales Group

- General Dynamics Corporation

- Aselsan A.S.

- Lockheed Martin Corporation

- L3 Harris Corporation

- SAAB

- Rheinmetall

- Elbit System

- Teledyne Flir

- Other Key Players

Recent Developments

- In September 2024, Anduril Industries Inc. announced a partnership with Microsoft Corp. to enhance the performance of new combat goggles for the US Army, which may generate as much as USD 21.9 billion from the service over a decade. The goggles, based on virtual reality headsets, are intended to give soldiers everything from night-vision capability to warnings of incoming airborne threats.

- In July 2024, Viasat Inc. introduced Viasat’s Secure Wireless Hub (SWH), a wearable tactical gateway solution for dismounted soldiers that is easy to carry and smooth use. The SWH solution was made as part of a multi-phase effort with the U.S. Special Operations Command (USSOCOM) to identify and develop advanced tactical communications capabilities for mobile ground forces.

- In June 2024, the software solution named Divya Drishti was launched by Ingenious Research Solutions, a startup backed by DRDO, an agency tasked with military research and development. Further, the Indian army also announced that it’s preparing an AI roadmap for the next 20 to 25 years.

- In May 2024, Amprius Technologies, Inc. announced it will supply its advanced SiMaxx safe cells to complete the development & qualification for the U.S. Army’s next-generation wearable Battery pack. The U.S. Army has been working to transform power solutions for dismounted soldiers by launching next-generation battery packs with comparatively higher energy density than current solutions.