powered telescopic boom crane. Additionally, it is equipped with outriggers and stabilizers, extending from its sides like legs, to provide an increased working radius and facilitate the efficient lifting of heavy loads for the crane operator.

Further, the market's growth is expected to generate significant moments for OEMs as well. Selecting to rent equipment is prioritized by customers, as it allows them to cut down on expenses related to both acquisition and upkeep, thereby lowering the expenses of the overall project. This trend is closely linked with the rising demand in

Construction Equipment Rental, which is helping expand the reach of mobile cranes across multiple sectors.

Governments worldwide are increasing infrastructure spending, driving demand for construction machinery and equipment. Notable investments include Indonesia's National Medium-term Development Plan ($460 billion), Vietnam's Socio-Economic Development Plan ($61.5 billion), and the Philippines' "Build, Build, Build" initiative ($71.8 billion), all of which are expected to boost construction machinery demand in these regions.

In March 2020, the UK government announced plans to invest €640 billion ($825 billion) between 2020 and 2025, with €10.9 billion allocated for constructing one million new homes by 2025.

In July 2021, Canada committed over $33 billion to infrastructure projects and an additional $180 billion over the next 12 years. Meanwhile, in 2020, 97 U.S. cities initiated 304 infrastructure projects valued at $25.6 billion. In July 2021, the federal government announced $550 billion in projects, covering roads, bridges, water infrastructure, and more.

Key Takeaways

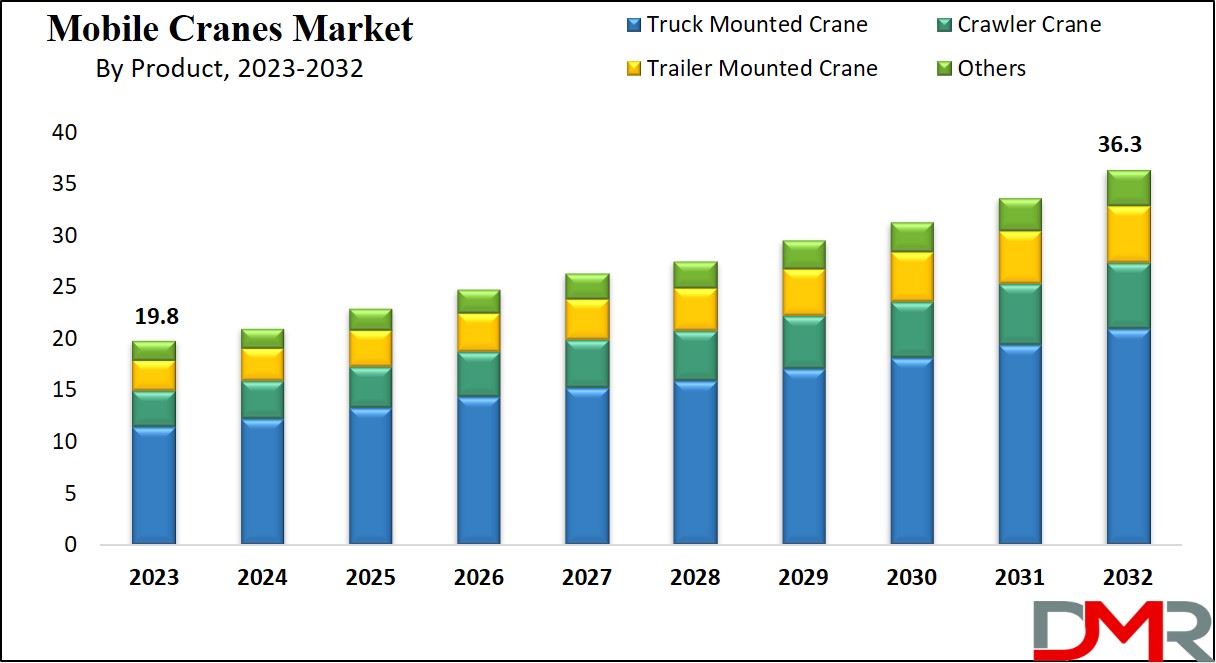

- Market Size: Global Mobile Cranes Market is expected to reach a value of USD 19.8 billion in 2023, and it is further anticipated to reach a market value of USD 36.3 billion by 2032 at a CAGR of 7.0%.

- Key Applications: Used in construction, shipping yards, oil & gas, power plants, and mining industries.

- Technological Advancements: Integration of telematics, automation, and fuel-efficient hybrid cranes is gaining traction.

- Regional Dominance: Asia-Pacific leads due to high construction activity, with North America and Europe following.

- Challenges: High initial costs, maintenance expenses, and fluctuating raw material prices.

- Future Outlook: Increasing adoption of electric and hybrid mobile cranes to meet sustainability goals.

Use Cases

- Construction Projects: Mobile cranes are widely used for lifting and positioning heavy materials in high-rise buildings, bridges, and infrastructure projects.

- Oil & Gas Industry: Employed in offshore and onshore drilling sites for lifting heavy equipment, pipeline installation, and maintenance operations.

- Shipping & Ports: Used for loading and unloading cargo, container stacking, and shipbuilding operations in ports and dockyards.

- Power Plants & Renewable Energy: Essential for installing wind turbines, lifting heavy components in thermal and nuclear power plants, and maintaining power transmission lines.

- Mining & Quarrying: Utilized for heavy material handling, equipment transportation, and excavation support in mining sites.

Market Dynamic

The global mobile crane market is seeing an increasing trend of opting for equipment rentals, which is creating a path for manufacturers to look for partnerships with rental equipment firms, with the aim of increasing their sales. Along with it, rental companies are concentrating on acquiring fresh equipment and expanding their inventory to meet the growing rental demand.

Further, the rise in the need for new equipment by rental companies is projected to be a driving factor for the rising need for mobile cranes throughout the forecast period. Interestingly, this shift toward flexible rentals has also been seen across other industries, such as

Pickleball Equipment and

Energy Drinks, where consumers prefer affordable access and variety rather than heavy upfront investment.

However, factors such as the high expenses linked to acquiring and operating the mobile cranes, changing customer needs, and varying compliance and specification demands across different regions are also anticipated to act as a major challenge in the market's growth.

Driving Factors

The global mobile crane market is driven by rapid infrastructure development worldwide. Urbanization, government investments in smart cities, transportation and energy projects as well as renewable energy developments all play a part.

Cranes play an essential role in large scale construction activities like high rise buildings, bridges and power plants with their flexible lifting capability making them the go to choice in these environments. Expanding wind farms also increase demand for heavy duty mobile cranes while advancements in technology such as improved fuel efficiency and automation features further driving this market forward.

Trending Factors

A key trend in the mobile crane market is incorporating advanced technologies, such as IoT, telematics and automation, into smart cranes equipped with real time monitoring systems to enhance operational safety and efficiency by providing data on load weights, boom angles and maintenance needs.

Furthermore, hybrid and electric mobile cranes are increasingly adopted as industries seek sustainable and eco friendly solutions; AR applications in operator training and crane operation is revolutionizing this sector; thus improving productivity while decreasing downtime while meeting customer expectations for smarter equipment.

Restraining Factors

The mobile crane market faces hurdles stemming from high initial investment requirements when purchasing and deploying these machines, as well as rising maintenance expenses that add further expenses to operating them. Modern mobile cranes with advanced features often come at steep costs that make them less accessible for small and medium sized enterprises.

Furthermore, expenses related to replacement parts replacement, regular servicing costs, skilled operator and technician support and complex systems may require skilled operators further increasing spending. Market growth may also be limited by fluctuating raw material prices as well as economic uncertainties which negatively influence construction activities and investment decisions particularly prevalent among emerging economies.

Opportunities

Emerging markets present immense opportunities for the mobile crane industry due to rapid industrialization and urbanization. Countries across Asia Pacific, Latin America and Africa are witnessing an upsurge in infrastructure projects like roadways, railways and energy facilities that will bring immense opportunities. As renewable energy projects, particularly wind and solar, drive demand for mobile cranes with specialized capabilities, this has resulted in rising market growth.

Government initiatives supporting large scale construction and industrial development create an ideal environment for market expansion. Rental services of mobile cranes have become more cost effective solutions for businesses to expand market penetration while creating long term growth prospects.

Research Scope and Analysis

By Product

In 2023, truck-mounted cranes emerged as the major driving product for the global mobile crane market in terms of

market share by contributing 57.7% of the total revenue of the global market. This growth can be attributed to the increasing demand for mobile machinery across different sectors, including power & utilities, construction, and various industry verticals.

The truck-mounted equipment offers significant loading capacity and facilitates the efficient transportation of goods between locations. These products find a range of applications in construction endeavors like bridge construction, railway projects, and hydropower initiatives.

Further, over the forecasted period, there is expected high growth in the crawler cranes. Crawler cranes are gaining popularity due to their compact design and improved portability, making them specifically well-suited for small construction sites, mainly in urban environments.

They are recognized as the go-to choice for tackling projects involving heavy industrial materials & large-scale construction projects. However, both crawler cranes and trailer-mounted cranes hold a smaller market share compared to truck-mounted cranes due to their restricted operational capacities.

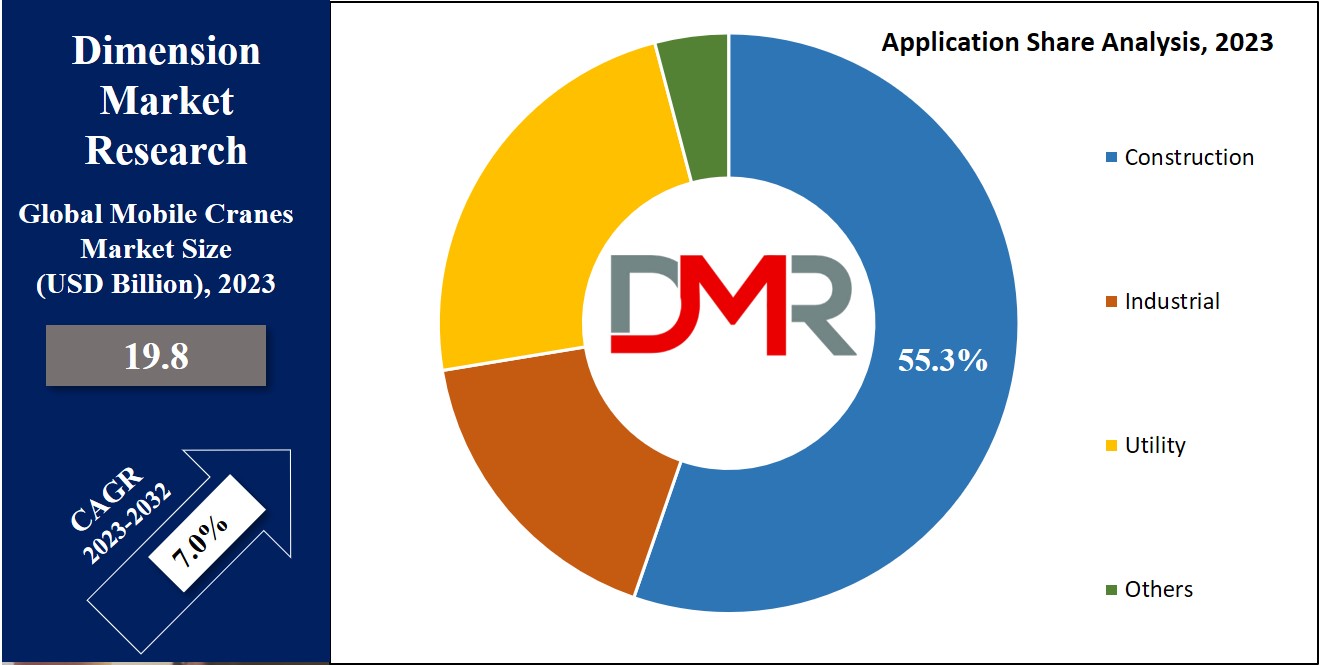

By Application

In 2023, the construction sector dominates the global mobile crane market by contributing 55.3% of the total global revenue and is further expected to uphold its lead throughout the forecast period. The segment's strength is driven by the ongoing development of residential & commercial infrastructure projects across the globe.

As, tower cranes, once erected, remain stationary until project completion. However, builders engaged in multiple projects often favor mobile cranes for their mobility advantages. The deployment of such equipment not only minimizes equipment downtime but also contributes to higher operational efficiency.

Moreover, the utility sector is also noticing significant growth which will prevail during the forecasted period. The growth is anticipated to be majorly driven by the higher adoption of these products in important projects like oil & gas projects, power initiatives, and utility projects, mainly those having underground construction. Further, utility corporations also find these products useful not only at their construction sites but also within their respective storage yards.

The Global Mobile Cranes Market Report is segmented on the basis of the following

By Product

- Truck Mounted Crane

- Crawler Crane

- Trailer Mounted Crane

- Others

By Application

- Construction

- Industrial

- Utility

- Others

How Does Artificial Intelligence Contribute To Improve Mobile Cranes Market ?

- Predictive Maintenance: AI-powered sensors monitor crane components in real time, predicting failures and reducing downtime through proactive maintenance.

- Autonomous & Semi-Autonomous Operations: AI enhances crane automation, enabling precision lifting, remote control operations, and minimizing human error.

- Optimized Fleet Management: AI-driven analytics help manage crane fleets efficiently, improving scheduling, utilization rates, and cost savings.

- Enhanced Safety Features: AI integrates real-time hazard detection, collision avoidance systems, and fatigue monitoring for operators, reducing workplace accidents.

- Smart Load Management: AI assists in optimizing load distribution and balance, ensuring stability and efficiency in lifting operations.

Regional Analysis

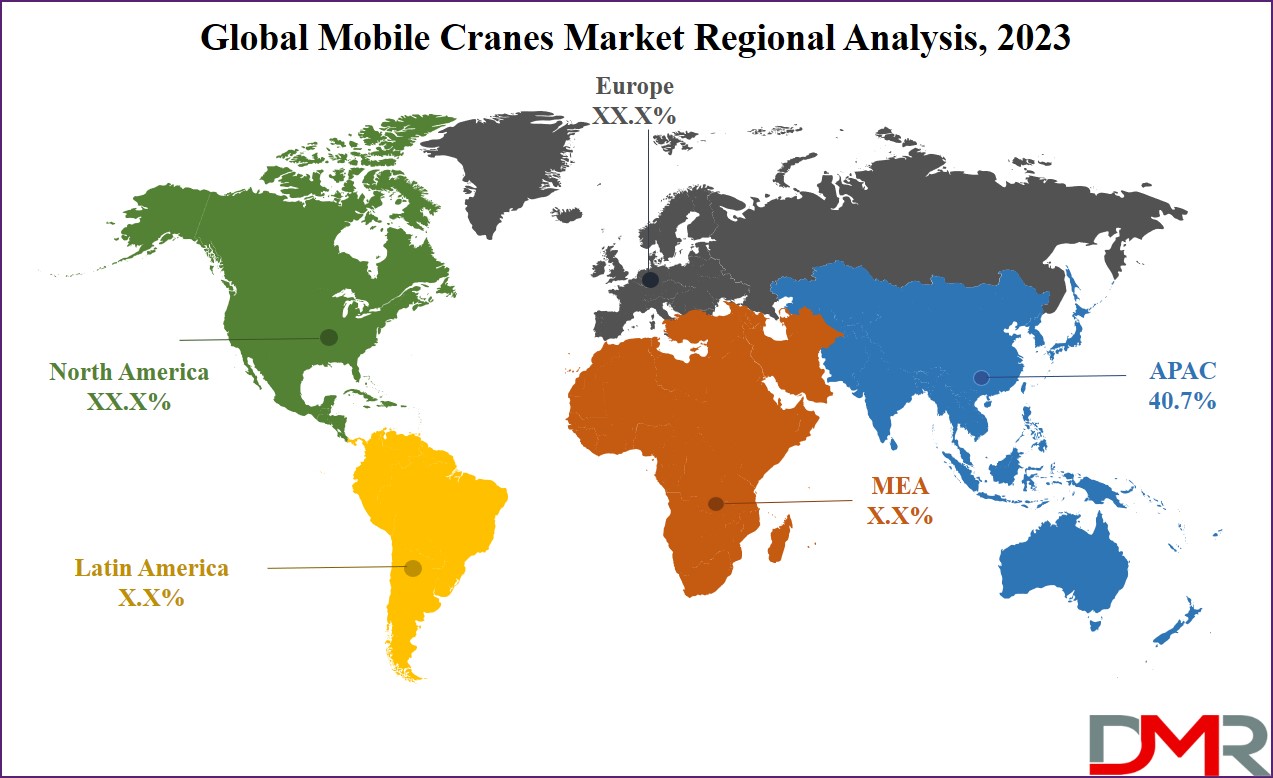

In 2023, the Asia Pacific region secures a significant market share, contributing more than

40.7% of the total revenue in the Global Mobile Cranes Market. Due to the increasing construction projects in emerging economies like China, India, and the Philippines, there is a notable growth in demand for mobile cranes in the region.

Further, the anticipated growth in infrastructure development and manufacturing industries is fueling the need for the adoption of mobile cranes in China. Furthermore, the government is also taking initiatives like the Belt and Road Initiative (BRI) are anticipated to spur substantial investments in novel development ventures. All these factors and trends are further anticipated to drive the market in the region for the forecasted period as well.

Further, the North American construction sector is also showing a higher growth rate due to strong economic backup as well as government emphasis on infrastructure development, and the tightening of monetary policy. These factors are anticipated to boost significant capital inflows from both domestic & external markets.

Additionally, the rising demand for cargo & maritime trade at United States ports is allowing manufacturers & port operators to allocate significant funds towards acquiring mobile cranes for efficient goods transportation, further fueling this trend.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The major players operating in the mobile crane market strategically utilize the demand for dependable cranes within the construction, mining, and industrial sectors. Within the tier-2 and tier-3 supply chains, catering to smaller and medium-sized applications, the market sees a relatively consolidated landscape, characterized by the presence of regional players.

Mainly, leading players have significantly increased their investment in research & development, in order to seamlessly integrate innovation with improved performance. The rising demand for high-performance, exceptionally efficient, and safety-centric equipment is anticipated to intensify competition and strengthen the dynamism in the market throughout the forecast period.

For instance, in April 2022, Associated British Ports announced its strategic commitment to invest EUR 32 million in improving the infrastructure of the Humber port. This investment is made for the upgrading of port cranes & related equipment, along with the ongoing strategy for the Humber to control two key areas: the investment in mobile harbor cranes and hydraulic cranes.

Some of the prominent players in the Global Mobile Cranes Market are

- Zoomlion

- Konecranes

- Terex Corp

- Cargotec Corp

- Bauer AG

- XCMG Group

- Tadano Ltd

- Manitowoc

- Palfinger AG

- Sumitomo Heavy Industries Ltd

- Other Key Players

Recent Developments

- April 2025 At Bauma 2025, several major players unveiled innovative, eco-friendly mobile cranes: Liebherr introduced a five-axle all-terrain crane with an electric drive for the upper section, alongside the MK120-5.1 E mobile construction crane that runs via electric operations and can connect to shore power, all aimed at zero-emission construction sites.

- June 2024 Liebherr launched the LTM 1400-6.1, a six-axle mobile crane boasting a 400-ton lifting capacity and a 70-meter telescopic boom, featuring streamlined setup to enhance performance and efficiency.

- December 2024 Tadano Ltd. made a strategic move by acquiring its Japanese aerial platform manufacturer, Nagano Industry, broadening its technology and product offerings in the aerial work equipment segment.

- May 2025 Construction Opportunities reports that India’s mobile crane market is poised for rapid expansion, with an expected 7–8% CAGR driven by smart city initiatives, metro rail projects, and port construction. Innovations like Stage V/Bharat Stage VI engines, idle stop-start systems, and hybrid diesel-electric drives are accelerating adoption toward greener operations.

- January 2025 A report by Straits Research highlights a significant acquisition trend in the market—PTML, the largest RoRo multipurpose terminal in Nigeria, purchased an LHM 600 mobile harbor crane worth over €7 million, reinforcing infrastructure modernization and lifting capacities in maritime logistics.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 19.8 Bn |

| Forecast Value (2032) |

USD 36.3 Bn |

| CAGR (2023-2032) |

7.0% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Truck Mounted Crane, Crawler Crane, Trailer Mounted Crane, and Others), By Application (Construction, Industrial, Utility, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Zoomlion, Konecranes, Terex Corp, Cargotec Corp, Bauer AG, XCMG Group, Tadano Ltd, Manitowoc, Palfinger AG, Sumitomo Heavy Industries Ltd, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |