The US Morphine Market

The US Morphine Market is projected to be valued at USD 6,191.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 10,918.8 million in 2034 at a CAGR of 6.5%.

The US market for morphine is amongst the largest in the world, underpinned by high medical outlays, state-of-the-art medical infrastructure, and high disease susceptibility for long-term painful ailments. High disease susceptibility in an aging population for ailments such as cancer and arthritis continues to drive demand for effective drugs for controlling pain even in the face of increased concerns over the abuse of drugs. Regulatory bodies have increased prescription controls and abuse tracking programs in a move to ensure responsible prescribing, even when such controls have moderated use and spurred abuse-deterrent drugs and alternative forms of therapy for pain.

Nevertheless, the US continues to be an important market for morphine, underpinned by its technology potential and dedication to patient security. High consciousness about pain administration and technological advancement in electronic capabilities in digital wellness allows medical professionals to optimize therapy efficiency.

Telehealth platforms, remote patient tracking, and electronic prescription programs allow efficient distribution, tracking, and compliance.

Industry data validates sustained growth, indicative of ongoing demand in hospitals, clinics, and in-home care settings. National prioritization of studies in safer types of opioid therapies and alternative delivery methods has fueled new types and delivery platforms, taking offerings even deeper. As ongoing reform in policies and medical care continues, the US market will remain a global leader in the consumption of morphine, weighing patient needs, public welfare, and technological improvements in care for pain. Continuing educational programs and evidence-based protocols add to ongoing responsible use and patient improvement even deeper.

Global Morphine Market: Key Takeaways

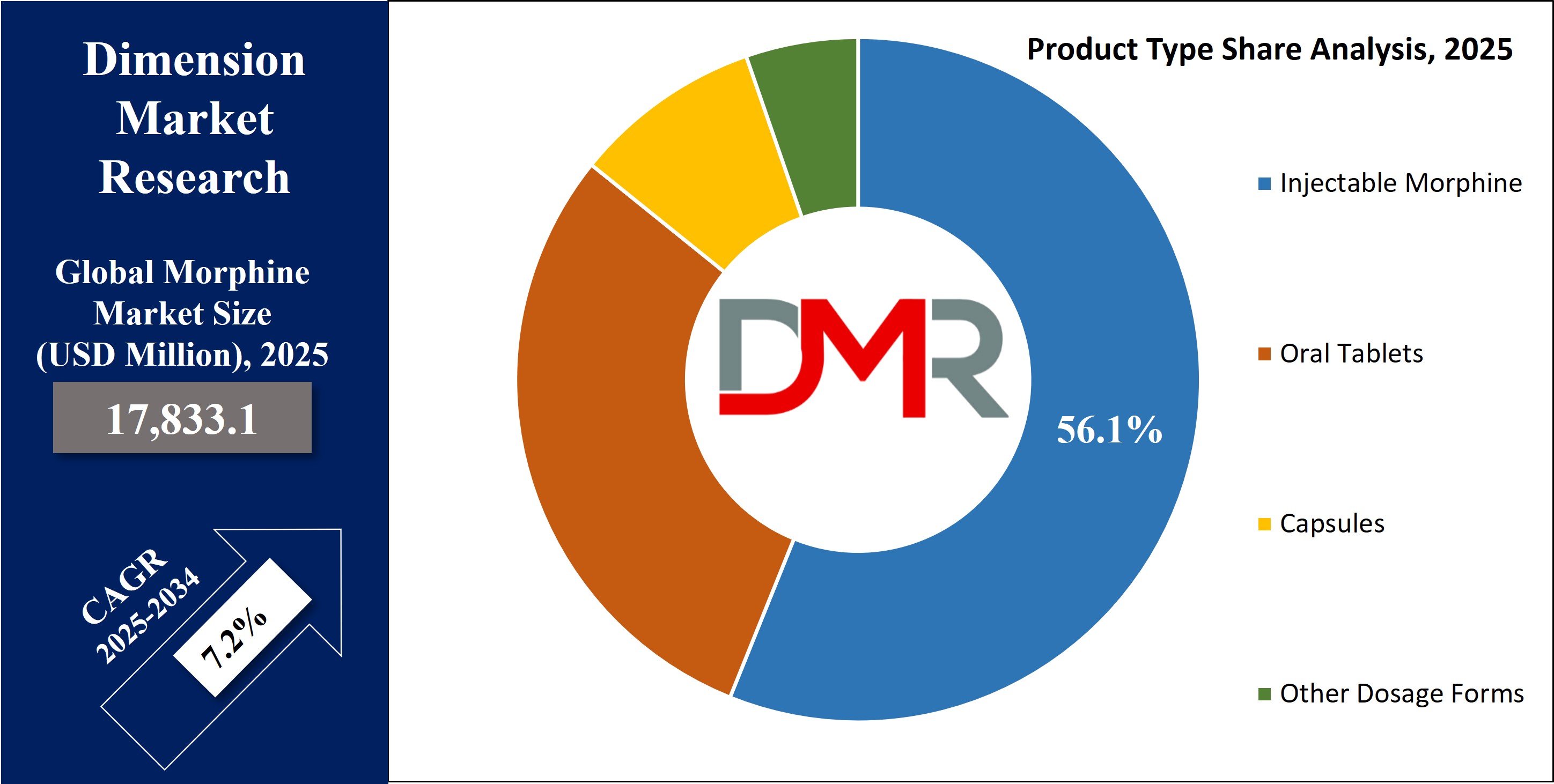

- Global Growth Rate: The Global Morphine Market size is estimated to have a value of USD 17,833.1 million in 2025 and is expected to reach USD 33,224.8 million by the end of 2034.

- The US Growth Rate: The US Morphine Market is projected to be valued at USD 6,191.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 10,198.8 million in 2035 at a CAGR of 7.2%.

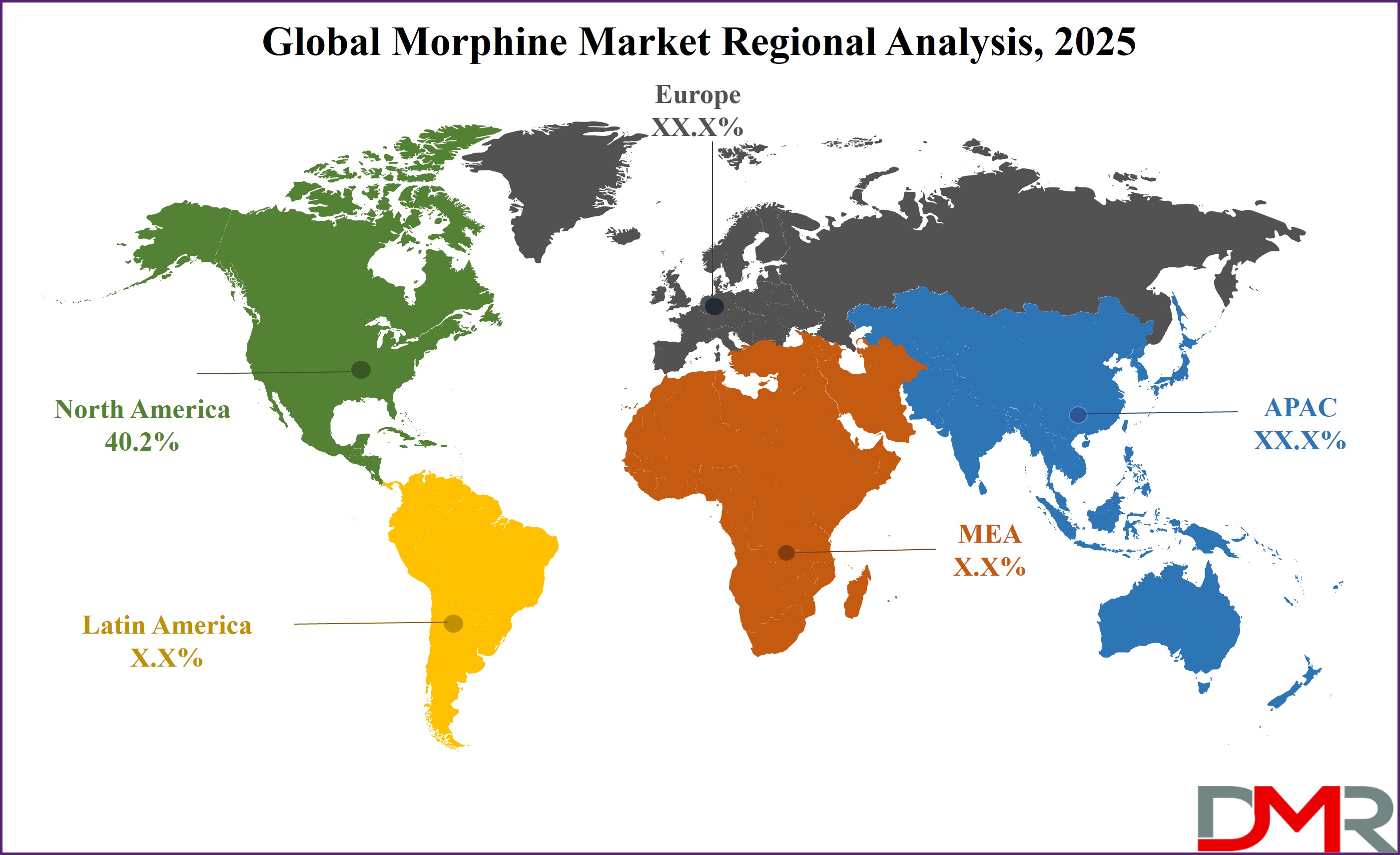

- Regional Analysis: North America is expected to have the largest market share in the Global Morphine Market with a share of about 40.2% in 2025.

- Key Players: Some of the major key players in the Global Morphine Market are Pfizer Inc., Johnson & Johnson, Mylan N.V. (Viatris), Teva Pharmaceutical Industries Ltd., Mallinckrodt Pharmaceuticals, Sun Pharmaceutical Industries Ltd., and many others.

- Global Growth Rate: The market is growing at a CAGR of 7.2 percent over the forecasted period.

Global Morphine Market: Use Cases

- Chronic Pain Therapy: Morphine effectively controls severe and long-standing pain in disease processes such as cancer, arthritis, and neuropathy, and aids in enhancing overall patient life through continuous and assured pain relief.

- Post-Surgical Pain Management: Administered during and following surgical intervention, morphine controls acute pain, providing comfort, minimizing complications, and enhancing rapid recovery in both clinic and in-patient settings.

- Palliative Care: Morphine is an important part of palliative care, offering comfort and ease for dying patients, improving their dying, and minimizing misery.

- Emergency Medicine: In trauma and critical care, morphine effectively controls acute pain, stabilizes critical care, and enables timely medical intervention.

Global Morphine Market: Stats & Facts

- Origin and Classification: Morphine, a naturally occurring opioid extracted from poppy (Papaver somniferum), is renowned for its powerful analgesia (anesthetic property). It is included in the Model List of Essential Medicine (22nd List, 2021) of the World Health Organization (WHO) for use in medical practice worldwide.

- Primary Medical Use: According to the 22nd Model List of Essential Medicines (2021, WHO), morphine is effective in treating severe and moderate pain, most often for postoperative surgical use, for controlling cancer pain, and for use in palliative care, offering life-saving relief when alternative analgesics are not effective enough.

- Essential Medicine Status: Morphine’s classification as an essential medicine by the WHO (22nd List, 2021) attests to its key role in delivering care in nations worldwide. Despite its criticality, inequality in access continues to represent a global challenge, with a significant impact in low- and middle-income countries.

- Global Consumption Disparity: The WHO’s Program for Access to Controlled Medicines reveals 92% of the world’s use of morphine a 17% consumption, predominantly in rich nations, and an expression of profound inequity in access to simple pain care.

- Barriers in Low-Income Nations: According to the WHO’s Program for Access to Controlled Medicaments, low and middle-income countries have a range of barriers in accessing morphine availability, regulatory controls, and stigma that hinder access and deprive many patients of proper options for care for pain.

- U.S. Prescription Trends: The U.S. DEA ARCOS Reports and "CDC’s 'Understanding the Epidemic" report 13–15 million U.S. annual prescriptions for morphine, but with shrinking statistics in an age of increased awareness of abuse potential for opioids.

- Regulatory Classification: Morphine is a Schedule II controlled substance under U.S. federal laws, under DEA ARCOS Reports and CDC protocols. That is a reflection of its high abuse potential, and its prescription and distribution, therefore, have strong controls placed over them.

- Abuse and Dependence Risk: The National Institute for Drug Abuse (NIDA) considers high abuse and addiction potential for morphine a top concern. Rapid tolerance can occur, with increased dosages being required for an equivalent impact, with addiction potentials when not appropriately handled.

- Opioid Use Disorder Rates: The American Society of Addiction Medicine (ASAM) estimates that 4–26% of long-term use of drugs including morphine can cause the development of opioid use disorder and prudent prescribing and careful observation are therefore warranted.

- Overdose Risks: The Centers for Disease Control and Prevention (CDC) informs that a life-threatening depression of the respirator can occur with an overdose of morphine. Overdoses can be reversed and lives can be saved with immediate medical intervention and administration of naloxone.

- Opioid-Related Deaths: According to the National Institute on Drug Abuse (NIDA), U.S. deaths from overdoses of opioid-related drugs reached over 80,000 in 2021. As a single entity, morphine alone isn't responsible for contributing to that count, but it's part of a larger scenario with prescription and illicit opioids driving the epidemic.

- Pharmacological Profile: The British National Formulary (BNF) and Goodman & Gilman’s The Pharmacologic Basis of Therapeutics report that its 4–6-hour duration of activity and 2–4-hour half-life orally make it a benchmark for comparison with any other opioid analgesic, its efficacy earning it such a role.

Global Morphine Market Dynamic

Driving Factors in the Global Morphine Market

Rising Prevalence of Chronic Pain ConditionsWith an increased prevalence of chronic diseases, such as cancer, arthritis, and neuropathy, a strong growth driver for the global morphine market, a growing population worldwide with an aging population will mean a rise in such cases and with them, a sustained demand for effective pain management will follow. As an effective analgesic, morphine will remain a go-to in managing severe pain, particularly in postoperative and hospice care settings. With a growing patient pool and development in delivery systems, such demand will fuel growth in the market.

Expansion of Healthcare Infrastructure in Emerging Economies

Healthcare infrastructure development in emerging economies, particularly in Asia-Pacific and Latin America, is driving demand for morphine. Expanded access to medical care, growing medical expenses, and increased awareness about managing pain drive increased use of morphine in these economies. Government investments in healthcare reform and the availability of key drugs for underprivileged communities will drive demand for morphine in these economies, with emerging economies becoming key drivers for global demand for morphine.

Restraints in the Global Morphine Market

Stringent Regulatory Frameworks

Stringent regulatory frameworks in the global morphine market form a significant constraint for its development, with governments and regulators having strong prescribing protocols, tracking programs, and restrictions in distributing morphine in a move to counteract the abuse of opioids. As much as such restrictions have been a necessity for public welfare, they have become a constraint for market development, most prominently in nations with high abuse rates of opioids. Meeting such requirements raises operational costs for pharmaceutical companies and limits access to the market, becoming a challenge for market participants.

Social Stigma and Misuse Concerns

Social use addiction and misuse issues are strong restraints for the morphine market. Despite its effectiveness in controlling pain, morphine is, however, surrounded with poor connotations, and under-prescribing and patient reluctance follow suit. The opioid epidemic fueled these concerns, and medical professionals have begun looking for alternative therapies for controlling pain. Changing practices in prescribing, in addition to public awareness programs for the peril of use, is impacting development in the market. Resolution of such concerns entails a balanced approach to offering access to effective pain relief while mitigating the risks of misuse.

Opportunities in the Global Morphine Market

Development of Novel Drug Delivery Systems

The development of new delivery forms, such as transdermal delivery, implantable delivery, and extended-release delivery, possesses high growth potential for the market for morphine. All such new delivery forms have enhanced efficacy, ease of administration, and safety, overcoming most of the downfalls in the conventional delivery of morphine. For instance, extended-release delivery introduces an extended duration of activity, reduced dosing, and abuse potential. With continuous investments in R&D in pharmaceuticals, such new delivery forms will expand the therapeutic use of morphine and capture new patient segments.

Increasing Focus on Personalized Medicine

There is a new opportunity for the morphine market with increased focus being placed on personalized medicine. Personalized approaches to pain management, in terms of individual patient needs, with consideration of genetic, environmental, and life factors, can maximize therapeutic effectiveness and minimize toxicity. Advances in pharmacogenomics and biomarker studies are enabling clinicians to individualize the use of morphine, delivering the right dose for the right patient. Not only is this improving patient satisfaction, but it is in concert with regulators' actions in driving responsible prescribing, and hence driving growth in the market.

Trends in the Global Morphine Market

Adoption of Abuse-Deterrent Formulations

A significant trend in the global morphine market is the development and adoption of abuse-deterrent formulations (ADFs). These formulation Products have been developed and implemented that make misuse, including abuse through solvating and crushing for illicit use, impossible. The North American epidemic of prescription opioid abuse, in part, fueled demand for safer alternatives to prescription opioids, and investments in ADF technology have been made in reaction, according to pharmaceutical companies. Regulatory efforts to curtail abuse and enable access to effective pain therapy for patients have facilitated such development, and ADFs have become increasingly embraced, altering market dynamics and prescription practice worldwide.

Integration of Digital Health Tools

The integration of electronic prescribing technology and telemedicine is transforming the market for morphine. With electronic tools, providers can remotely monitor, and track prescription trends, and therapy compliance. Patient compliance and effective patient instruction can even be facilitated through electronic tools, lessening misuse. In high-opioid-regulation environments, such trends can become increasingly significant, offering heightened transparency and accountability for the use of morphine. As the growing use of electronic health tools takes off, it will make pain management easier and boost patient care, driving market development.

Research Scope and Analysis

By Product Type

Injectable morphine is projected to dominate this market for its preference over the rapid onset of activity and acute and surgical settings. Unlike its orally administered counterparts, whose metabolization is a little delayed, injectable morphine induces rapid relief, a demand for severe pain, trauma, and postoperative use. Emergency departments, surgical, and intensive care rely almost exclusively on intravenous (IV) morphine for its bioavailability and reliable absorption, with little variation in its anesthetic and analgesic effectiveness.

The demand for injectable morphine is fueled not only by its application in palliative care, in which terminally ill, and even advanced, cancer patients demand immediate-release analgesics, but also in preoperative environments, in which anesthetic departments prefer IV morphine for controlling pain both preceding and following operations, and even during them.

According to market reports, injectable morphine holds a dominant position in the global market for opioids. The increasing prevalence of cancer, chronic illnesses, and post-surgical pain cases further drives the demand for injectable morphine. The largest consumer, the hospital segment, witnesses a constant growth in its consumption with an increase in complex operations and trauma-related inpatient admissions. Regulatory approval and efficacy proven for injectable morphine validate its sustained leadership in this market.

By Formulation

Semi-synthetic morphine derivatives will play an integral part in the global market for opioids in 2025, by serving as a bridge between natural morphine and fully synthetic opioids. Such semi-synthetic opioids include oxycodone and hydromorphone which derive from natural morphine but undergo chemical modifications for increased potency, bioavailability and therapeutic efficacy. Due to growing demand for pain management solutions including post-surgical recovery and cancer treatments as well as reduced side effects compared to natural morphine derivatives this segment has grown considerably over recent years.

Market expansion within this segment is being driven by rise in medical applications and regulatory approvals of semi-synthetic opioids for pain relief. Pharmaceutical companies are investing heavily in research and development efforts to produce more effective formulations with controlled-release mechanisms that lower risk while maintaining analgesic effectiveness. Semi-synthetic morphine production also benefits from advances in drug delivery technologies, like extended-release capsules and transdermal patches, which enhance patient compliance and treatment outcomes.

Furthermore, this segment is becoming more prominent due to restrictive natural morphine cultivation restrictions and stringent opioid regulations, pushing manufacturers toward more controlled production methods.

Even with its benefits, semi-synthetic morphine drug segment faces challenges, including worries over opioid dependency and stringent government policies aimed at curbing opioid abuse. Furthermore, regulatory authorities often impose tight controls over production and distribution limiting market growth; yet through continuing innovations focusing on safer opioid formulations the semi-synthetic morphine market continues to become an integral component of healthcare pain management solutions.

By Application

Pain management is its most prevalent application, with its unparalleled effectiveness in controlling severe and moderate pain. It is most frequently prescribed for administration in postoperative healing, trauma wounds, and in hospice, and cancer pain, and it is an important drug in medical practice.

According to global medical statistics, over 70% of prescription opiates for medical use are for pain management, and morphine remains a gold standard for severe pain relief. Progress in cases of cancer, arthritis, and neuropathic disease has stimulated a growing demand for morphine, with its use becoming a part of routine medical practice, according to the World Health Organization (WHO), a key medication for pain relief.

Hospitals, clinics, and pain management clinics have ranked first in utilizing morphine for its efficacy, reliable kinetics, and ease of administration via a variety of routes. With both immediate-release and extended-release forms, flexible dosing is supported, and both acute and long-term cases can utilize it effectively. Palliative care programs, in fact, rely a lot on morphine for improving terminally ill patient's life quality.

With an increasingly aging population in the world and an increased concern for improving pain management protocols, demand for morphine will remain high in future years. Despite addiction concerns regarding its use, morphine is a necessity in medical practice, ensuring its dominance in the pain management segment.

By Distribution Channel

Hospital pharmacies are poised to dominate the distribution channel in the morphine market with the highest market share in 2025. Hospital pharmacies have a strong grasp over the channel for dispensing morphine with its high level of controls over dispensation and medical administration under supervision. As a Schedule II controlled substance in most countries, morphine entails sophisticated care and careful observation, and its distribution channel is best addressed through hospital pharmacies.

Hospitals account for a considerable proportion of the consumption of morphine, with high volumes of in-patients necessitating postoperative care, surgical care, and emergency care, for whom in-patient and in-penetrating administration of morphine is most often delivered through in-patient pharmacy dispensation. In-penetrating and in-patient administration of morphine, in particular, is most often delivered through in-patient pharmacy dispensation, with in-patient and in-penetrating administration of in-penetrating and in-penetrating forms of morphine, respectively.

According to medical reports, a high proportion of global sales of opioids are through hospital pharmacies. Besides, rising surgical cases, trauma cases, and long-term disease admissions fuel the demand for the distribution of morphine through hospitals even more. Regulatory agencies, moreover, have stricter dispensing requirements for drugs, lending justification for a first preference role for hospital pharmacies as a channel for distribution.

As the global infrastructure for medical care keeps developing, the distribution of drugs will increasingly depend on them for use in hospitals. With controls, compliance, and expert consultation in use, they become a channel of distribution for morphine over any other channel of distribution.

By End User

Hospitals and clinics are projected to dominate the end-user segment of the morphine market with the highest market share in 2025. Hospitals and clinics dominate the base of end-users for morphine, with strong demand for its administration in surgical, emergency, and hospice settings. In a controlled environment, such as a hospital, safe administration of an opioid can be facilitated, with reduced misuse and effective pain management. Surgeries, trauma, and chemotherapy for cancer produce a high level of in-patient consumption of morphine.

In-patient postoperative regimens for pain rely almost exclusively on morphine, with both injectable and orally administrated forms in practice. Clinics, including pain and oncology clinics, consume a high level of morphine, as well, for long-term therapy for long-term-painful patients. According to medical statistics, over 60% of use occurs in hospitals, with a demand for administration under control. There is a growing demand for complex operations, a growing burden of long-term disease, and a growing development of programs for pain management driving demand for morphine in hospitals and clinics even further.

The Morphine Market Report is segmented on the basis of the following

By Product Type

- Injectable Morphine

- Oral Tablets

- Capsules

- Other Dosage Forms

By Formulation

- Synthetic Morphine

- Natural Morphine

- Semi-Synthetic Morphine

By Application

- Pain Management

- Diarrhea Suppressant

- Palliative Care

- Myocardial Infarction

- Cold & Cough Suppressant

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By End User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Home Healthcare Settings

- Rehabilitation Centers

Regional Analysis

Region With Highest Market Share

North America is projected to be in a commanding position in the global morphine market as it

holds 40.2% of the market share in 2025 with its developed infrastructure for medical care, high medical expenses per capita, and well-established distribution channels. North America, and America in specific, is in a commanding position with regard to developed techniques for pain management and a high patient pool in demand for opioid therapy. America alone consumes

over 30% of global consumption of morphine, reports say, with growing cases of chronic and cancer-related pain and its demand for management. Stringent regulating regimes, such as America’s U.S. FDA regimes, make high-quality drugs of morphine available, and North America’s position is even strengthened with such a regulating environment in its midst.

Additionally, strong private and government institution support for development and research helps drive continuous innovation in the form of morphine. North America’s big pharma, with North America headquarters, invests a lot in funding for trials and differentiation in terms of products, and in the bargain, expands North America’s base of operations. Having a high level of medical expertise and high use of sophisticated delivery systems for drugs, including extended-release morphine, consolidate North America’s position. Consistent efforts towards stemming the tide of the opioid epidemic through stricter prescription controls have not lowered morphine’s use in acute pain, and demand stays at a constant level in regulated quantities.

Region With the Highest CAGR

Asia Pacific exhibits the highest growth rate of 9.1% the morphine market, boosted by a growing population, a rise in cases of cancer, and heightened awareness regarding pain management. Healthcare infrastructure in countries like India and China is becoming increasingly sophisticated, and access to opioid drugs is becoming easier, and demand for morphine is growing. Government actions in terms of developing palliative care and updating laws regarding controlled drugs have eased access restrictions for morphine.

Economic development in emerging economies boosted medical costs, and, in consequence, access to high-tech medical care for a larger group of patients. Greater collaborations between multinational and local companies have strengthened distribution channels for morphine, as well. With supportive policy realignments, growing expansion in hospitals, and an aging population, Asia Pacific will have the largest CAGR in the global morphine market over the decade to come.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global market for morphine is competitive, with multinational and regional companies competing for position in the market. Product leaders in terms of innovation, purchase of patents, and bulk production include multinational companies such as Pfizer Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., and Mallinckrodt Pharmaceuticals. Product portfolio diversity, with an emphasis on extended-release drugs and combination therapy, for compliance and patient safety, is a concern for such leaders.

Strategic collaborations, acquisitions, and mergers prevail, with companies competing to expand geographically and consolidate distribution networks. Manufacturers in emerging economies at a domestic level increasingly become successful by providing inexpensive generic drugs for morphine. Perpetuated competition spurs continued investments in development and research in a quest to make drugs even safer and less apt to cause secondary complications.

Regulatory compliance is critical in securing a position in the market, with morphine being a scheduled compound with high requirements in most countries. Manufacturers with a track record of compliance with Good Manufacturing Practices (GMP) and efficient supply chain management have a competitive advantage. With the increased demand for effective pain management, the future of the morphine market is positive for mature and emerging economies with growing consolidation and innovation.

Some of the prominent players in the Global Morphine Market are

- Pfizer Inc.

- Sun Pharma Inds

- Fresenius (Fresenius Kabi)

- Teva Pharmaceutical Industries Ltd.

- Mallinckrodt Pharmaceuticals

- Hikma Pharmaceuticals USA Inc

- EuroAPI

- Piramal Critical Care

- Mundipharma

- Other Key Players

Recent Developments

- December 2024 – Pfizer Inc. Investment