Market Overview

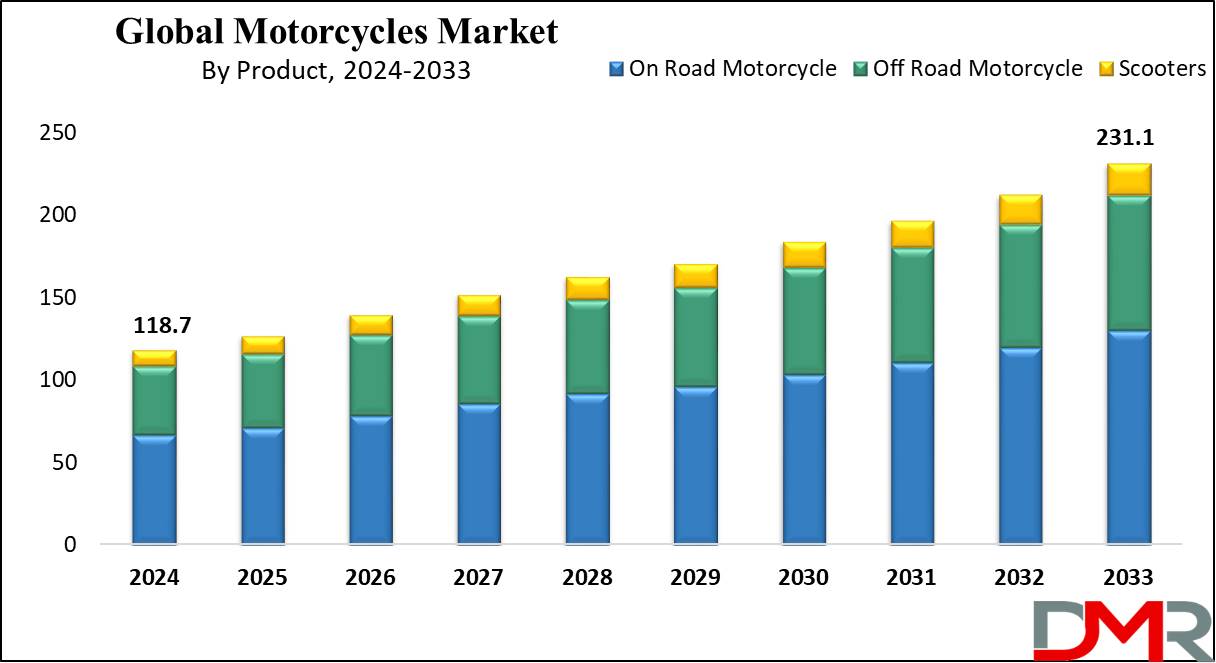

The Global Motorcycle Market is anticipated to be valued at USD 118.7 billion in 2024 and is further expected to reach USD 231.1 billion by 2033, at a CAGR of 7.7%.

Motorcycle is a two-wheeled vehicle that is controlled from a saddle-style seat using a handlebar which is typically powered by an internal combustion engine. It is designed to carry one or two passengers and is operated by a rider who controls the vehicle using handlebars.

They come in different designs based on purpose such as sports bike is used for high speed and cruisers are built to provide comfortable long rides in remote terrain. They are popular for daily transportation purposes due to their high speed, efficiency, and affordability.

According to Housegrail, the motorcycle market is undergoing significant shifts in both rider demographics and safety behaviors. Around 71% of motorcycle accident fatalities involve males, emphasizing the urgent need to focus on male rider safety. When it comes to engine sizes, nearly 35% of riders now use motorcycles exceeding 1400cc, a steep rise from under 10% two decades ago. Alongside this, the growing popularity of the

Electric Bicycle segment is further reshaping the two-wheeler landscape, offering a safer, eco-friendly, and more accessible alternative for modern riders.

Safety improvements are evident, with helmets reducing the risk of death by 37% and head injuries by 69%. Additionally, in states with stringent helmet laws, helmet usage exceeds 90%, while regions with more lenient regulations see only 60% compliance, underscoring the impact of local regulations on rider safety practices.

Key Takeaways

- The global motorcycle market is predicted to value USD 118.7 billion by 2024 and is forecasted to grow to USD 231.1 billion by 2033, with a CAGR of 7.7%.

- Based on product, the on-road motorcycle segment is expected to dominate the market with a revenue share of 56.3% in 2024.

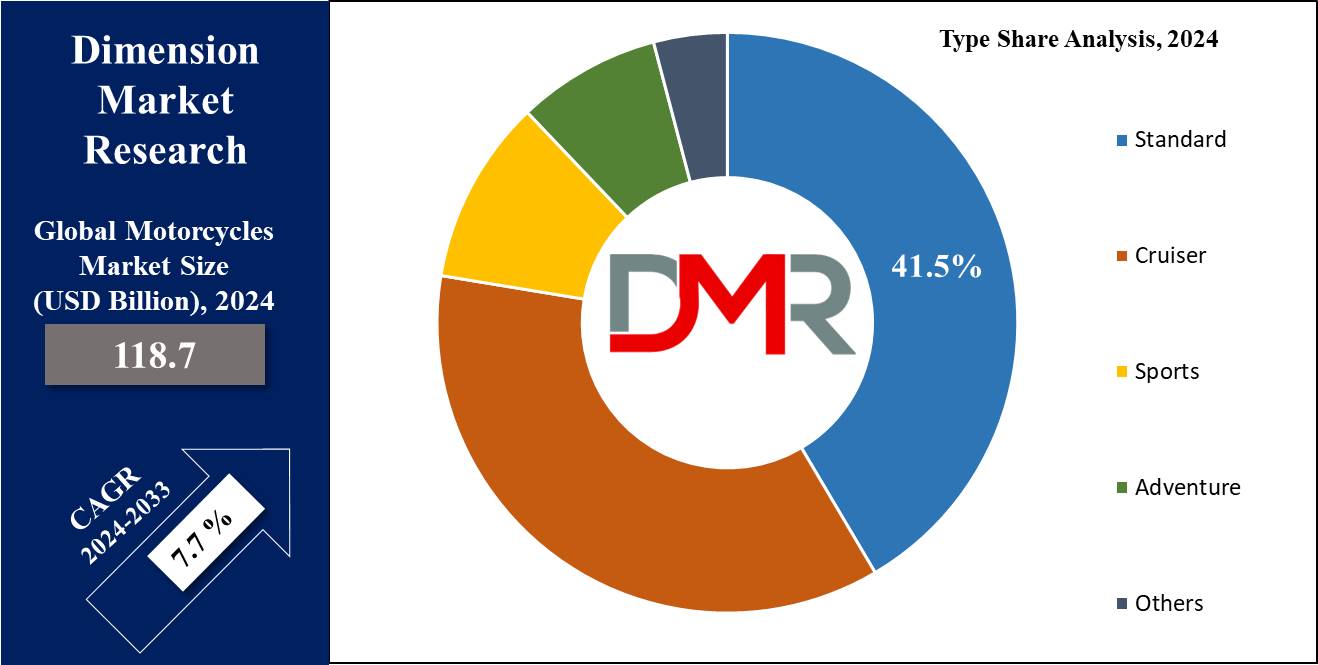

- In the context of type, the standard segment is expected to dominate the largest revenue share of 41.5% in 2024.

- In terms of propulsion type, the ICE segment is predicted to lead the market with the highest revenue share in 2024.

- Based on capacity, motorcycles above 1200 CC are expected to dominate the market with a high CAGR in 2024.

- The low-priced segment is anticipated to lead the market with the highest revenue share in 2024.

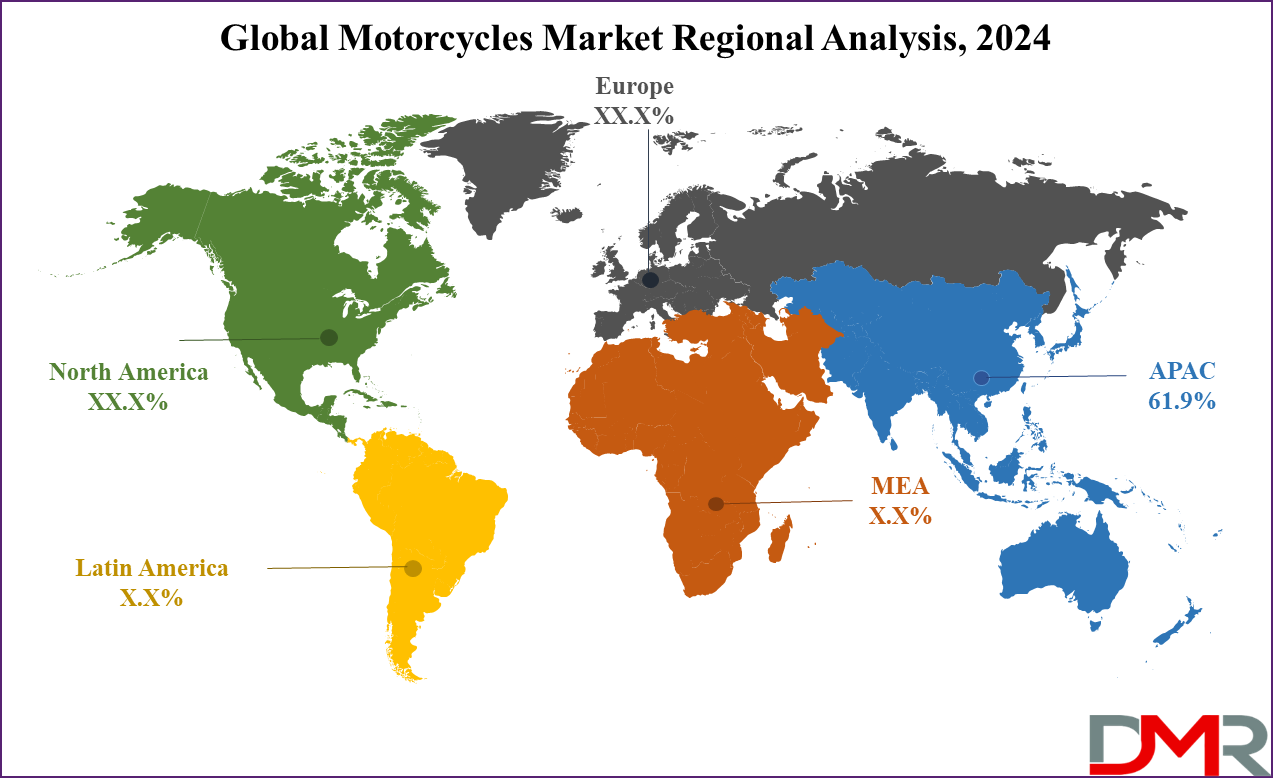

- Asia Pacific region is expected to account for the revenue share of 61.9% in 2024.

Use Cases

- Motorcycles are commonly used for commuting due to their flexibility, fuel efficiency, and easy parking as they can navigate in traffic jams and narrow streets more efficiently than other four-wheeler vehicles.

- Consumers enjoy riding a motorcycle as it gives a sense of freedom and adventure which is appealing to riders as they enjoy exploring places and different routes.

- Touring Motorcycles are used for long-distance travel as they are equipped with comfortable seating, large storage, and wind protection.

- Racing bicycles are designed for participating in events, competing against each other to demonstrate skill, speed, and endurance on tracks.

- These are used for commercial purposes in different parts of the globe as they work as delivery vehicles for courier services, food platforms, and postal services.

Market Dynamic

The motorcycle market is growing due to the introduction of economical products, the increasing number of sport motorcycle users, and the growing trend of customized service. People prefer these instead of public transport due to improved living standards and convenient options, which drives the growth of this market.

The increase in middle-class consumer is expected to drive the demand for these in the future years due to their affordable and effective form of commute. Further, this market is predicted to expand in rural areas due to the lack of public transportation and accessibility. Also, the market is ready to grow in the future due to the rapid development of motorcycle technology, and an increasing number of young users.

However, increasing safety issues associated with motorcycle riding are expected to limit the growth of this market. Also, an increasing number of motorcycle accidents are hindering the growth of this market.

Research Scope and Analysis

By Product

The motorcycle market is divided into three segments namely on-road motorcycles, off-road motorcycles, and Scooters based on product. The on-road motorcycle segment is expected to dominate the market with a revenue share of 56.3% in 2024 as they are mainly designed to ride on paved roads.

The demand for cruisers, the increase in sport bike users, and the growing trend of customization are some of the factors increasing the demand for this segment and driving the growth of the market. Off-road motorcycles are designed particularly for off-road racing competitions held on irregularly surfaced.

The scooters are anticipated to lead the market in the upcoming future due to their large storage capacity compared to regular motorcycles. These are famous among women due to their lightweight, easy-to-ride motorcycles.

These are getting favored among

bicycle user due to their comfortable ride with the gearless driving system and low operating costs as compared to others. Also, the demand for scooters is boosting further due to their easy accessibility of petrol, remarkable mileage, and safe long-distance travel.

By Type

The standard segment is expected to dominate the largest revenue

share of 41.5% in 2024 due to its advanced technology and classic design to comfort riders, also they are the oldest type of motorcycle. Cruisers are known for their low seat height, and relaxed riding style as it is used for comfortable cruising on highways and urban streets.

Major market players are coming with improved cruiser bike designs and low fuel efficiency which are expected to boost the growth of this segment. Further, there is a rising popularity of long-distance touring on bikes which boosts the growth of the adventure segment.

By Propulsion Type

The ICE segment is expected to dominate the market with the highest revenue share due to the rising integration of ICE with fuel-efficient systems and advancement in IC engine technologies with more adjustable components. Also, they provide a vast range of options like engine displacement, power output, and riding styles. They are also available in many configurations like singles, twins, triples, and fours, serving different performance and riding preferences.

The electric segment is getting popular due to rapidly growing emission concerns and rising air pollution produced by conventional engines. Also, government institutes are constantly investing in the development of

electric vehicles which creates more opportunity for this segment. Companies are working to develop electric models by introducing maximum torque and high-power adaptability to expand the market.

By Capacity

Motorcycles above

1200 CC are expected to lead the market with a high CAGR which is commonly used for their high performance. These are equipped with powerful engines, advanced technology, good services, and strong components. It is used for those riders who prefer performance, comfort, and power.

This segment includes cruisers, sport bikes, luxury touring motorcycles, and heavy adventure bikes. Also, 800-1200 CC motorcycles provide increased performance capabilities, advanced technology, and improved comfort features compared to smaller-displacement motorcycles.

Furthermore, Motorcycles with engine capacity between 400- 800 CC provide good performance, versatility, and affordability.

By Price

The low-priced segment is expected to drive the motorcycle market with the highest revenue share in 2024 due to its budget-friendly options designed to appeal to low-income consumers. They are affordable, simple, and equipped with basic features, which boost the growth of this market.

They include small-displacement bikes, entry-level cruisers, and basic commuter models which are aimed at entry-level riders, commuters, and riders searching for economical transportation solutions. The mild price segment includes motorcycles which provide a balance between affordability and features.

The Motorcycles Market Report is segmented based on the following:

By Product

- On-road Motorcycles

- Off-road Motorcycles

- Scooters

By Type

- Standard

- Cruiser

- Sports

- Adventure

- Others

By Propulsion Type

- Internal combustion Engine (ICU)

- Electric

By Capacity

- Under 400 CC

- 400-800 CC

- 800-1200 CC

- Above 1200CC

By Price

Regional Analysis

Asia Pacific is expected to account for the

revenue share of 61.9% in 2024 due to rapid urbanization along with a large base of Chinese and Indian customers. According to Infineum International Limited, countries like Vietnam, China, India, and Indonesia are the highest revenue-generating regions in the Asia-Pacific market.

Some Asian countries like China possess abundant raw materials and great processing capacities, making them ideal places to manufacture these motorcycles. The motorcycle market is growing in this region due to the increase in technological advancement in the automobile industry, the rising focus on quality performance and comfort, and the growing preference of customers towards premium motorcycles.

Europe is the second-largest market growing with a high

CAGR due to the presence of advanced production units, manufacturing hubs, and demand for different types of motorcycles.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The motorcycle market is defined by the presence of both new and existing businesses. The majority of significant companies are expanding their manufacturing operations globally to satisfy the demand for motorbikes. Also, policies are made for the growth of the motorcycle market such as joint ventures and the introduction of new products.

For example, Japanese producers, as Honda, Yamaha, Suzuki, and Kawasaki, have started their electric scooter production and established new competitors within the Asian market. The major brands in this market are Harley-Davidson Corporation, Honda Motor, and others. In addition, some firms are focused on the development of the electric market by starting with building production plants and converting existing motorbikes and scooters into electric ones.

Some of the prominent players in the global motorcycle market are

- Harley-Davidson Incorporation

- Yamaha Motor Co., Ltd.

- Yadea Group Holdings Ltd.

- Honda Motor Co., Ltd.

- Piaggio & C. SpA

- BMW AG

- Suzuki Motor Corporation

- Hero MotoCorp Limited

- Bajaj Auto Ltd.

- TVS Motor Company

- Others

Recent Development

- In February 2023, Japanese motorcycle manufacturer Yamaha announced to update its entire two-wheeler range in India to the OBD-II system in which the company is going to introduce a traction control system in its 150 CC providing, the FZS-Fi V4 Deluxe, FZ-X, and MT-15 V2 Deluxe models, as a standard safety equipment.

- In March 2023, Hero MotoCorp collaborated with Zero Motorcycles, investing up to USD 60 million to develop power trains with the scale of manufacturing, sourcing, and marketing.

- In January 2023, Hero MotoCorp announced to start of trial production of e20 fuel two-wheelers capable of taking a combination of e10 and e20.

- In December 2022, Royal Enfield announced the launch of a new CKD plant in Brazil which offers a capacity of 15000 units per year and will focus on the local assembly of the entire line-up of Royal Enfield motorcycles.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 118.7 Bn |

| Forecast Value (2033) |

USD 231.1 Bn |

| CAGR (2023-2032) |

7.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (On-road Motorcycles, Off-road Motorcycles, and Scooters), By End User (Standard, Cruiser, Sports, Adventure, and Others), By Propulsion Type (ICE, Electric), By Capacity (Under 400 CC, 400-800 CC, 800-1200 CC, and Above 1200CC), By Price (Low, Medium, and High) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Harley-Davidson Incorporation, Yamaha Motor Co., Ltd., Yadea Group Holdings Ltd., Honda Motor Co., Ltd., Piaggio & C. SpA, BMW AG, Suzuki Motor Corporation, Hero MotoCorp Limited, Bajaj Auto Ltd., TVS Motor Company, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Motorcycles Market size is estimated to have a value of USD 118.7 billion in 2024 and is

expected to reach USD 231.1 billion by the end of 2033.

Asia Pacific has the largest market share for the Global Motorcycles Market with a share of about 61.9%

in 2024.

Some of the major key players in the Global motorcycle market are Harley-Davidson Incorporation,

Yamaha Motor Co., Ltd., Honda Motor Co., Ltd., and many others.

The market is growing at a CAGR of 7.7 percent over the forecasted period.