The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well. With increasing applications in conversational AI solutions and intelligent virtual assistants, the NLP industry is becoming a core enabler of digital transformation across multiple sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Natural language Processing, or NPL, is the branch of computer science and especially, the branch of artificial intelligence (AI), that operates with computers by providing them with the ability to recognize text & spoken words in a similar way to a human being.

Further, the growing digitization and the use of tools like

chatbots and others across various industries and businesses, allowing organizations to change & upgrade, are some of the few major driving factors for the Global Natural Language Processing Market across the globe.

In May 2023, Argilla, an open source data curation tool, introduced support for Large Language Models (LLMs). This update seeks to aid users in overseeing the full lifecycle of Natural Language Processing (NLP) models from initial experimentation through production deployment.

Argilla allows efficient creation, evaluation, and refinement by combining human expertise and machine input its data curation capabilities streamline this process for faster development with greater performance robustness organizations using this tool can build LLMs that meet diverse applications as quickly as they accelerate adoption and success of NLP technologies across industries.

The adoption of NLP technologies varies across industries. Recent data indicates that approximately 1.4% of businesses have implemented or tested NLP applications, whereas voice recognition software has a higher adoption rate of 2.7%. This highlights a clear opportunity for expanding NLP within enterprise AI solutions, particularly for businesses aiming to enhance customer engagement and operational efficiency.

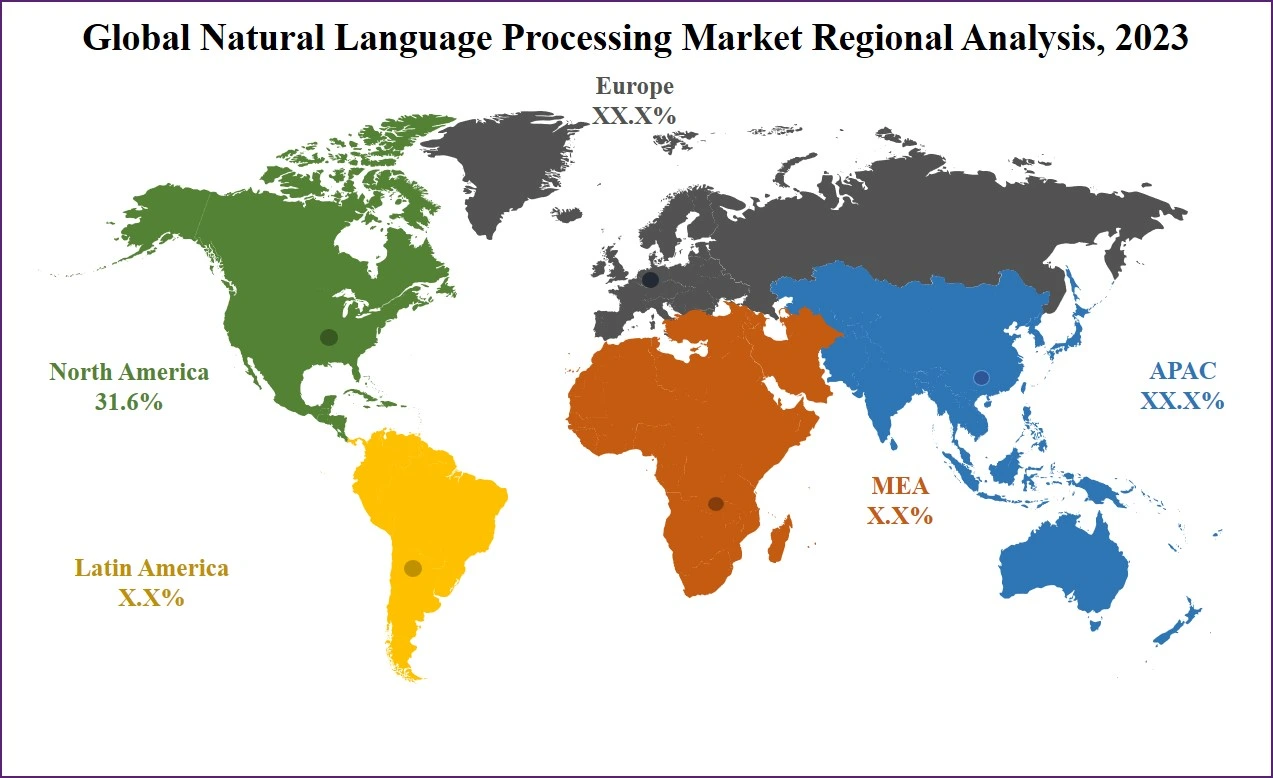

Regionally, North America dominated the NLP market with a valuation of $8.6 billion in 2022. The high-tech and telecom sectors accounted for over 31.6% of the market share, while the healthcare segment represented 10% during the same year.

Natural Language Processing Market Key Takeaways

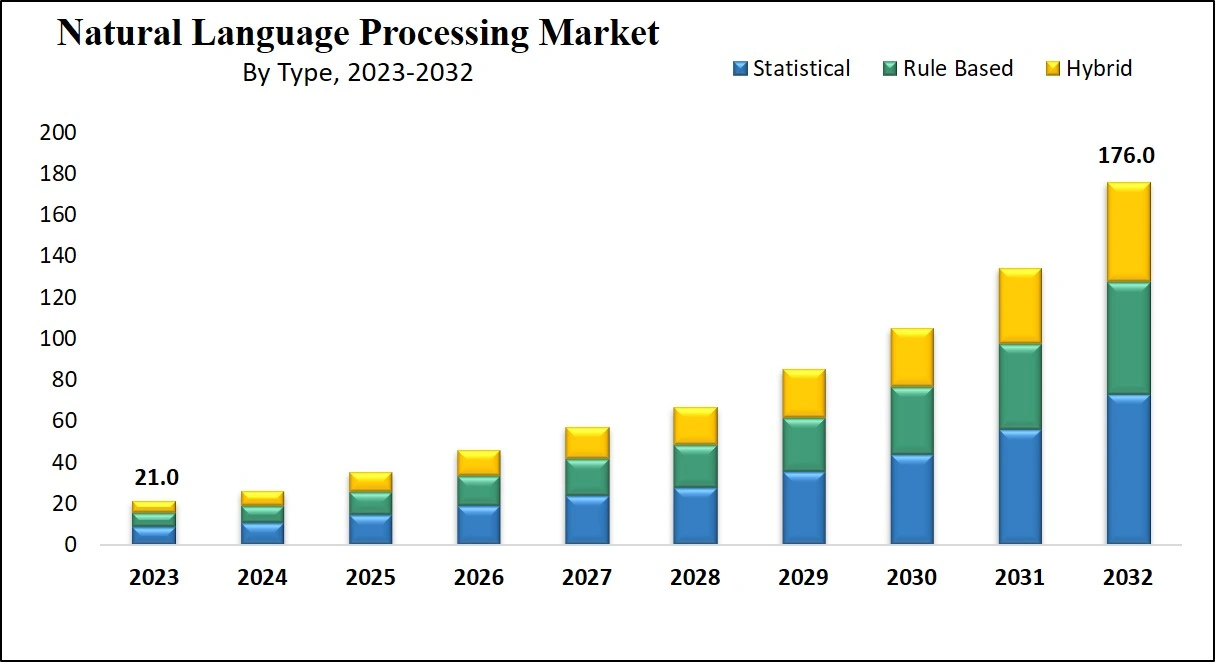

- Market Size & Share: Natural Language Processing Market is expected to reach a value of USD 21.0 billion in 2023, and it is further anticipated to reach a market value of USD 176.0 billion by 2032 at a CAGR of 26.6%.

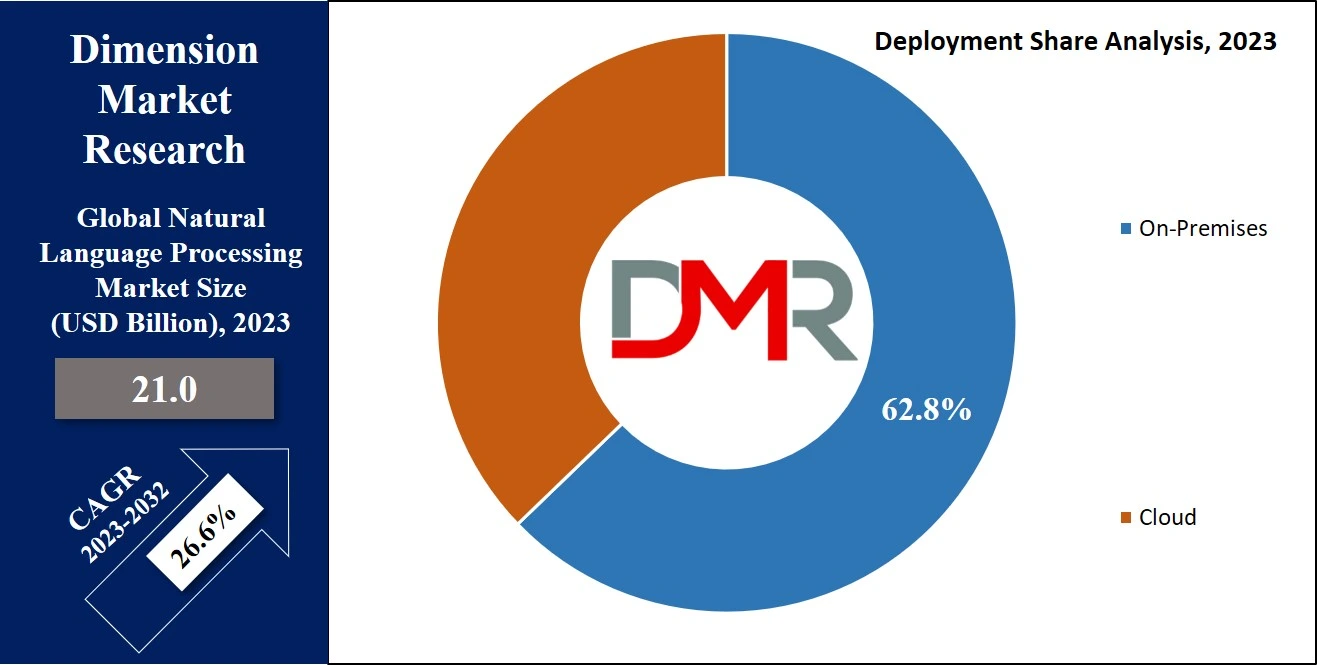

- Deployment Analysis: In 2023, the on-premise segment dominates with a share of over 62% of the overall global market.

- Type Analysis: The statistical NLP segment secures the largest revenue share, accounting for over 41% of the total revenue in 2023.

- Regional Analysis: In 2023, the solution segment dominates with a significant share of over 76% of the overall global revenue.

- Rising Demand for Multilingual Solutions: Global businesses increasingly adopt multilingual NLP systems to improve customer engagement and accessibility across diverse languages and regions.

- Data Privacy Concerns: Issues related to data security and compliance with regulations like GDPR and CCPA present challenges for wider adoption of NLP technologies.

- Healthcare Opportunities: NLP's role in medical transcription, electronic health records (EHRs), and telemedicine highlights significant growth potential in the healthcare sector.

Natural Language Processing Market Use Cases

- Chatbots & Virtual Assistants – Used in customer service and support for automated responses, enhancing user experience in banking, e-commerce, and healthcare.

- Sentiment Analysis – Helps businesses analyze customer feedback, social media trends, and market sentiments for better decision-making.

- Machine Translation – Powers real-time language translation tools like Google Translate, enabling seamless global communication.

- Speech Recognition & Voice Assistants – Used in smart devices (e.g., Alexa, Siri, Google Assistant) for hands-free interactions and voice-controlled applications.

- Healthcare & Medical Documentation – Automates clinical documentation, medical coding, and patient data analysis, improving efficiency in healthcare systems.

Natural Language Processing Market Dynamic

In the past few years, deep learning & algorithms have shown major development in image recognition & speech processing. The use of natural language processing (NLP) has made major contributions, providing excellent outcomes in complex NLP tasks. This growth aligns with advancements across the broader

Automated Data Processing, where NLP-powered analytics are increasingly integrated.

The domain of NLP has been under significant growth over recent years, mainly driven by the accessibility of cost-effective, scalable computational power, the growing digitization of data, and the integration of NLP with deep learning (DL) &

machine learning (ML).

Further, the market is growing due to the increasing demand for sentiment analytics & content management, which allows organizations to give customized deals based on recent trends, important for understanding consumer behavior. Social media platforms, particularly significant for retail & e-commerce, serve as major sources of data for sentiment analytics, demand prediction, and enhancing the consumer experience. These trends are also reshaping industries such as the

AI in Food Processing, where real-time analysis of consumer feedback is critical.

Driving Factors

Natural Language Processing (NLP) market growth is being propelled by advances in artificial intelligence (AI) and machine learning (ML). Complex algorithms powering NLP systems enable them to process, interpret, and respond more accurately to human language than ever before.

Deep learning techniques like GPT and BERT transformer models have significantly enhanced NLP applications such as chatbots, sentiment analysis and language translation; furthermore their growing adoption across industries like healthcare, finance and customer service has increased demand while their technological evolution provides a solid base for NLP market expansion.

Trending Factors

One notable trend in the NLP market is the increasing need for multilingual solutions to serve global businesses. E commerce, international collaborations and cross border customer interactions all necessitate multilingual NLP systems supporting multiple languages and dialects. Advancements in neural machine translation as well as pre trained multilingual models make accurate translations and cultural context easier to provide than ever.

Accessibility tools for differently abled individuals is driving innovation as organizations use these solutions to increase customer engagement while broaden their global presence making multilingual NLP an integral market trend!

Restraining Factors

Data Privacy and Security Concerns Privacy and security issues pose major restraints on the growth of the NLP market. NLP systems rely on large volumes of user data for training and operation, raising issues around confidentiality, compliance with regulations like GDPR and CCPA, misuse, vulnerabilities in cloud based NLP services as well as misuse.

Organizations often refrain from adopting NLP solutions due to breaches and legal repercussions arising from breaches in encryption, data processing security standards and evolving privacy standards; which requires dedicated resources as well as resources devoted by smaller enterprises to address.

Opportunities

Healthcare provides immense potential for NLP markets. NLP technologies are being increasingly employed for medical transcription, patient record analysis, and to draw insights from unstructured data such as clinical notes. Accelerated diagnosis, tailored treatment plans, and efficient management of electronic health records (EHRs).

Furthermore, the growth of telemedicine and virtual assistants powered by NLP is revolutionizing patient interactions. With the goal of improving healthcare outcomes and cutting costs in mind, organizations are increasingly investing in AI powered solutions. As research in biomedical NLP advances, its market is expected to expand by meeting critical healthcare system challenges head on.

Research Scope and Analysis

By Deployment

In 2023, the on-premise segment dominates with a share of over

62% of the overall global market. On-premises NLP deployment provides complete control, visibility, & robust security measures for data. Moreover, it enables easy scalability to meet corporate demands and improves efficiency through built-in redundancy. The growing adoption of cloud-based NLP solutions is anticipated to propel market growth, with the cloud segment expected to experience fast expansion during the forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Type

The statistical NLP segment secures the largest revenue share, accounting for over

41% of the total revenue in 2023. However, significant growth is projected for the rule-based NLP and hybrid NLP segments during the forecast period.

Rule-based NLP places a strong emphasis on pattern matching, particularly valuable in healthcare for enhancing the electronic health record (EHR) process. This facilitates the identification of specific phrases and improves the effectiveness of data management.

The hybrid approach integrates rule-based & machine-learning methods, merging natural language processing, machine learning, & human input. Human expertise ensures accurate analysis, while machine learning simplifies scalability. By adopting this hybrid strategy, organizations can capitalize on the advantages of both rule-based and statistical NLP technologies to enhance data management and accelerate business decisions.

By Component

In 2023, the solution segment dominates with a significant share of over

76% of the overall global revenue. NLG programs, composed of engines, platforms, tools, and interfaces, played a crucial role in translating computer code into human-readable language.

Deep learning served as a tool not only for data analysts but also for individuals without technical expertise, aiding in information comprehension. Moreover, natural language processing software played a key role in extracting actionable insights from digital data, contributing to a better overall understanding. This is especially relevant for the

Natural Language Generation, which focuses on turning data into contextualized narratives for business intelligence.

By Technology

In 2023 text analysis holds a significant position within the technology segment for the growth and expansion of the global market. Employing NLP to derive valuable insights from written content. It evaluates market sentiments through sources like news and social media, effectively combating false information.

In healthcare, it identifies potential drug candidates, while in business, it aids brand monitoring and product refinement through feedback, culminating in impactful e-commerce recommendations. Moreover, it plays a role in understanding intricate political discussions. In the expansive realm of technology, text analysis stands as a foundational tool, unveiling essential insights from various textual sources.

By Organization Size

In 2023, the large enterprise segment dominates the overall revenue share of over 64%, driven by the need for anticipated security measures. Businesses adopted cloud-based NLP tools for data processing due to accessibility. However, smaller businesses showed less adoption of NLP generation due to high costs and limited awareness.

Affordable cloud-based NLP tools and the growing cloud service market are expected to boost small and medium-sized enterprises (SMEs). SMEs are likely to focus on process integration. COVID-19 prompted them to enhance customer satisfaction and global competitiveness by enhancing business strategies.

By End-user Industry

In 2023, the healthcare sector secured a major share of over 24% of the global NPL market. This achievement resulted from the progressive integration of advanced technologies, including predictive analytics, NLP tools, automation, and cloud-based software. Notably, the healthcare field adeptly harnessed online comment boards to gauge consumer concerns during the COVID-19 pandemic, further reinforcing its impact.

Meanwhile, the IT & telecommunications segment thrived, exhibiting the highest growth rate across the forecasted period. Through strategic utilization of natural language processing, communication received a significant boost. This involved the automatic rectification of grammar errors in messaging applications and the proficient analysis of multiple languages. This strategic approach paved the way for establishing a comprehensive system skilled at parsing texts across a spectrum of languages.

The Global Natural Language Processing Market Report is segmented on the basis of the following

By Deployment

By Type

- Statistical

- Rule-based

- Hybrid

By Component

By Technology

- Interactive Voice Response

- Optical Character Recognition

- Speech Analysis

- Text Analysis

- Pattern and Image Recognition

- Others

By Organization Size

- SMEs (Small and Medium Enterprises)

- Large Enterprises

By End-user Industry

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Automotive

- Manufacturing

- Others

How Does Artificial Intelligence Contribute To Improve Natural Language Processing (NLP) Market ?

- Enhanced Language Understanding – AI-powered deep learning models, like GPT and BERT, improve context recognition, enabling more accurate text processing and interpretation.

- Improved Chatbots & Virtual Assistants – AI enhances NLP-driven bots with better conversation flow, sentiment detection, and human-like interactions for customer support and automation.

- Real-Time Translation & Multilingual Support – AI-driven NLP models enable more accurate and context-aware translations, bridging language gaps for global communication.

- Automated Content Generation & Summarization – AI assists in generating high-quality text, summarizing lengthy documents, and automating report writing across industries.

- Advanced Sentiment & Emotion Analysis – AI-powered NLP can analyze social media, reviews, and customer feedback to gauge sentiment and predict consumer behavior trends.

Regional Analysis

In 2023, North America is leading the overall global market with a substantial

share of over 31% of the global revenue. Renowned for its dominance in AI and machine learning, the region emerged as a pivotal hub for advancing natural language processing (NLP). The concentration of major players, notably in the U.S., fueled innovation, propelling NLP market growth.

Regional governments endorsing AI, ML, and NLP further spurred expansion, empowering industry players to extend their influence. North America's strategic positioning, technological dominance, and government support collectively underscore its pivotal role in shaping the NLP landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The key market players strategically broaden their consumer base for a competitive edge, employing actions like mergers, acquisitions, tech partnerships, and collaborations. Stakeholders look into product innovation and tech advancements. Such efforts, spanning organic and inorganic growth, drive market expansion into untapped territories.

For instance, SAP SE acquired Askdata in July 2022, enhancing AI-driven natural language searches. Likewise, Apple Inc. acquired Inductiv Inc. in May 2020 to bolster Siri's performance. These steps highlight the industry's dynamic pursuit of innovation and competitiveness.

Some of the prominent players in the Global Natural Language Processing Market are

- Google

- IBM Corp.

- Microsoft

- SAP

- 3M

- AWS (Amazon Web Service)

- SAS

- Oracle

- Apple

- Baidu

- Other Key Players

Recent Developments

- July 2025 Meta acquired voice-AI startup PlayAI to enhance its human-like voice synthesis capabilities and strengthen its conversational AI offerings across platforms.

- June 2025 Indian AI startup Krutrim launched Kruti, an agentic AI assistant capable of independently handling tasks like ordering food, booking rides, and making payments in multiple Indian languages.

- January 2025 S&P Global acquired ProntoNLP, a provider of Generative AI tooling, to boost its textual data analytics by integrating NLP and large language models into its Market Intelligence division.

- November 2024 InMoment launched an AI-powered Journey Insights Tool that uses NLP and large language models to map customer touchpoints across channels and stages—helping organizations identify friction and enhance satisfaction.

- August 2025 AI startup Cohere was valued at $6.8 billion following a $500 million funding round led by Radical Ventures and Inovia Capital; it also appointed Meta’s former VP of AI Research, Joelle Pineau, as Chief AI Officer, and Francois Chadwick (formerly Uber CFO) as its CFO.

- August 2025 Swedish AI firm Lovable, known for its “vibe coding” app development tool via natural language, received funding offers valuing it at over $4 billion, only weeks after raising $200 million at a $1.8 billion valuation.

- May 2025 Israeli LLM developer AI21 Labs is raising a $300 million Series D round, bringing its total funding to $636 million. Its Maestro orchestration system promises to reduce hallucinations by 50% and improve reasoning accuracy to over 95%.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 21.0 Bn |

| Forecast Value (2032) |

USD 176.0 Bn |

| CAGR (2023-2032) |

26.6% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Deployment(On-Premises and Cloud), By Type(Statistical, Rule-based and Hybrid), By Component (Solutions, Services and Others), By Technology(Interactive Voice Response, Optical Character Recognition, Speech Analysis, Text Analysis, Pattern and Image Recognition and Others), By Organization Size (Small & Medium-sized Enterprises and Large Enterprises), By End-user Industry(Retail, Healthcare, Automotive, Manufacturing IT & Telecommunication, BFSI, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Google, Microsoft, IBM Corp., SAP, SAS, 3M, Oracle, Apple, AWS, Baidu and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |