Market Overview

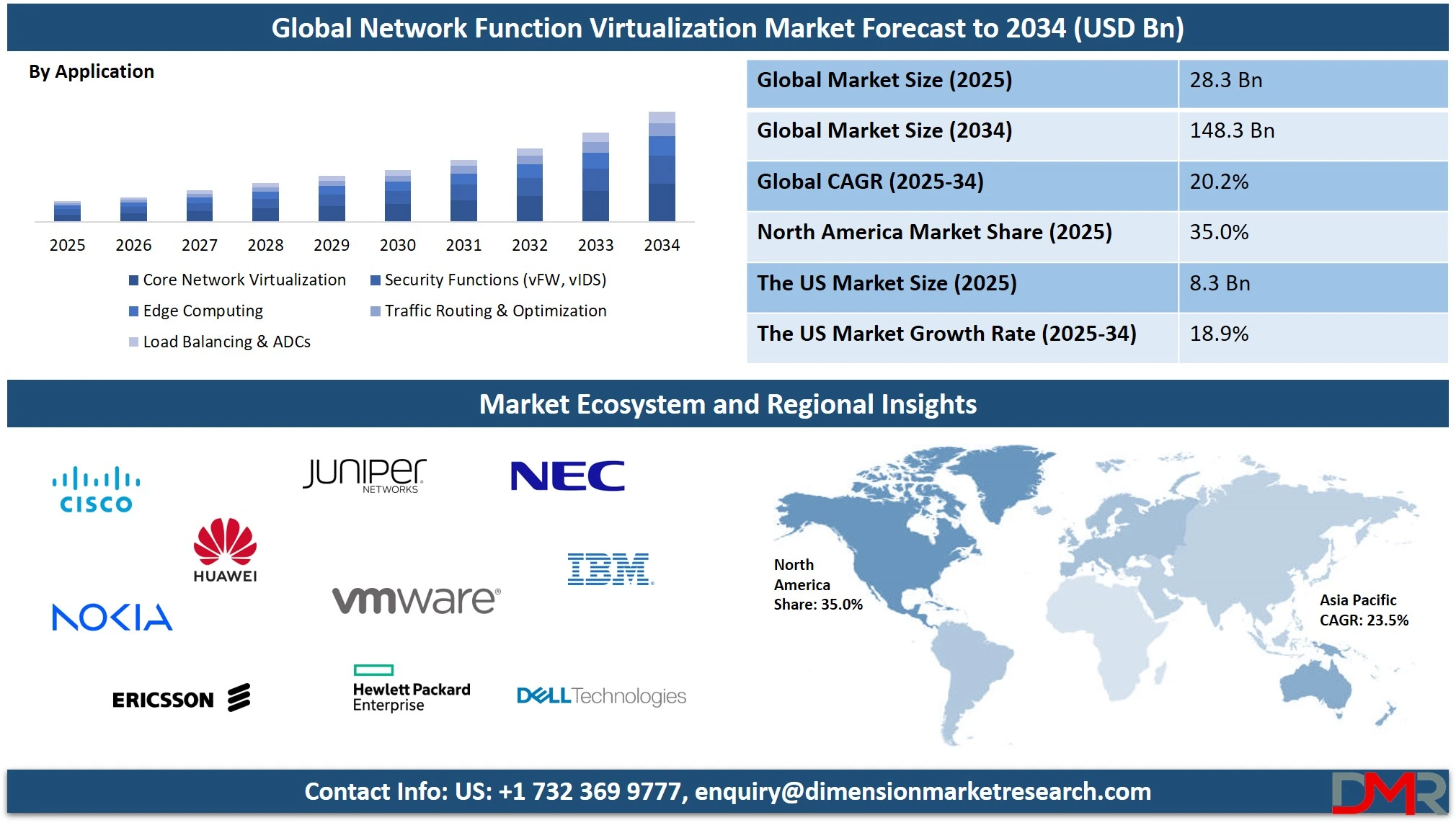

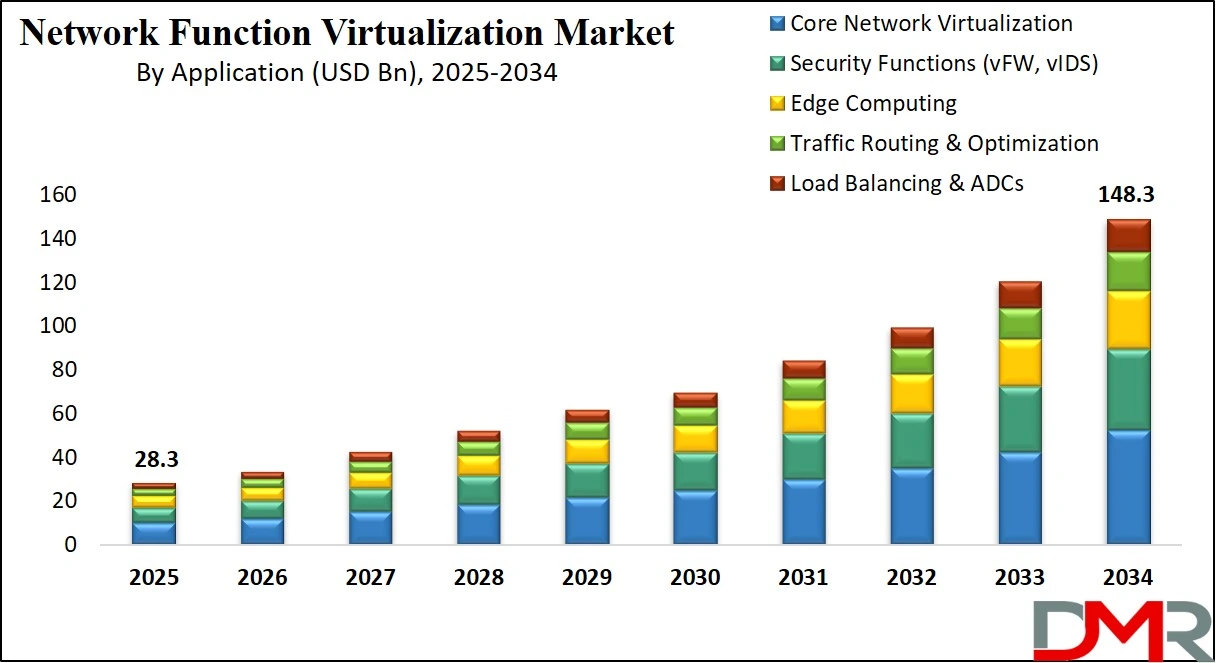

The Global Network Function Virtualization (NFV) Market is projected to grow from USD 28.3 billion in 2025 to USD 148.3 billion by 2034, expanding at a CAGR of 20.2%. This growth is driven by growing demand for virtualized network services, 5G infrastructure, SDN integration, and cloud-native network functions across telecom and enterprise sectors.

Network Function Virtualization (NFV) refers to a modern approach in network architecture where traditional network services that once ran on proprietary, dedicated hardware are now hosted on virtual machines over standard commercial servers. This virtualized framework enables the deployment of network functions such as firewalls, load balancers, and intrusion detection systems as software, thereby reducing hardware dependency, growing scalability, and enhancing operational efficiency.

NFV leverages virtualization technologies to decouple network functions from physical devices, allowing for a more flexible, agile, and cost-effective network infrastructure. It plays a crucial role in enabling service providers and enterprises to dynamically scale network services based on demand, improve resource utilization, and accelerate time to market for new applications and services.

The global Network Function Virtualization (NFV) market is experiencing rapid growth, driven by the widespread adoption of 5G technology, growing demand for software-defined networking (SDN), and the shift toward cloud-native infrastructure. Telecommunications service providers are leveraging NFV to reduce capital and operational expenses while gaining the agility needed to support dynamic service delivery.

Additionally, the integration of NFV with edge computing and the Internet of Things (IoT) is further expanding its use cases across various sectors, including manufacturing, automotive, and smart cities. NFV enables operators to roll out virtual network functions (VNFs), such as virtual evolved packet cores (vEPC), virtual firewalls (vFW), and virtual routers (vRouters), without the need for costly hardware upgrades.

Moreover, the NFV market is benefiting from the rise of open-source frameworks and collaborative standards that promote interoperability and vendor neutrality. Enterprises and cloud service providers are adopting NFV to modernize their network infrastructure and meet the growing demand for real-time data processing, cybersecurity, and network automation.

With advancements in artificial intelligence, machine learning, and orchestration tools, NFV is transforming how networks are managed, optimized, and secured. The ongoing evolution of digital transformation strategies across both developed and emerging economies continues to fuel the global expansion of the NFV market, making it a key pillar in next-generation network ecosystems.

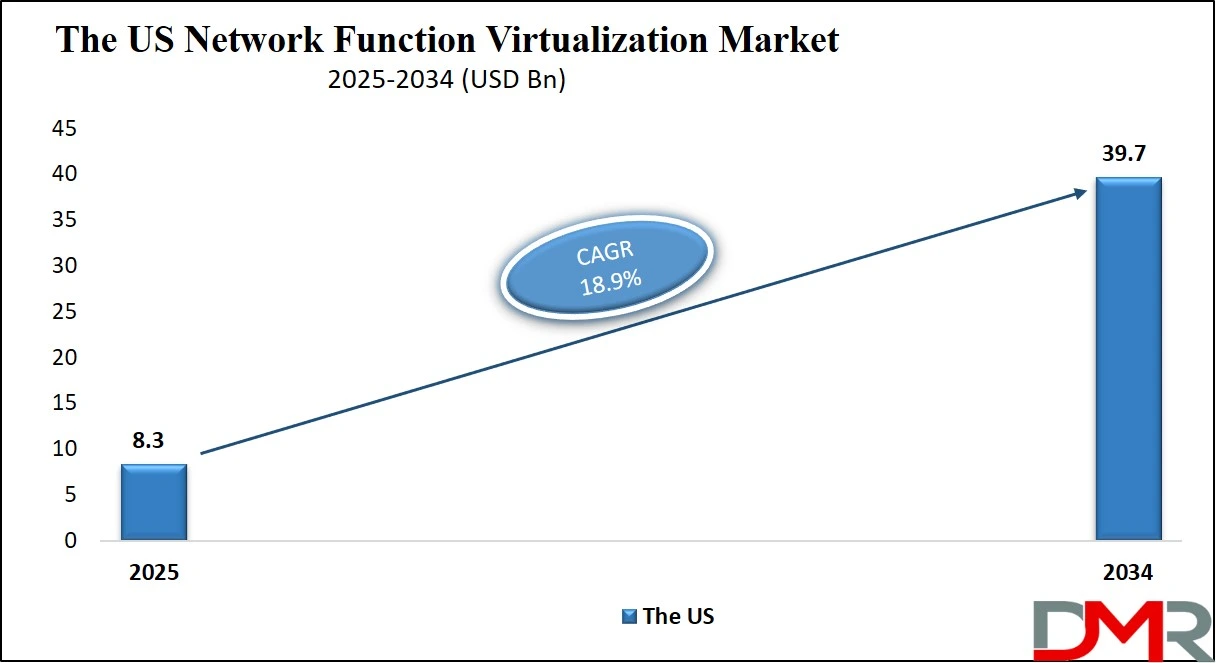

The US Network Function Virtualization Market

The U.S. Network Function Virtualization (NFV) market size is projected to be valued at USD 8.3 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 39.7 billion in 2034 at a CAGR of 18.9%.

The United States Network Function Virtualization (NFV) market stands as a critical driver of the global virtualization landscape, propelled by the early adoption of cloud computing, robust 5G infrastructure rollout, and the growing demand for software-defined networking solutions. US telecom operators and hyperscale cloud providers are leading the shift from hardware-centric network architecture to flexible, scalable virtualized network environments.

The integration of NFV with technologies like artificial intelligence, edge computing, and automation is enabling real-time network management, dynamic resource allocation, and cost-efficient service delivery. As enterprises embrace digital transformation and prioritize agility, NFV is becoming central to network modernization strategies across industries such as financial services, healthcare, defense, and media.

Moreover, favorable regulatory frameworks, high capital investments, and a strong presence of technology vendors are accelerating the NFV adoption rate in the US. Leading players in the US NFV market are actively collaborating with open-source communities and standards bodies to ensure interoperability and multi-vendor support.

The surge in demand for virtual firewalls (vFW), virtual routers (vRouter), and virtual evolved packet cores (vEPC) is reshaping the traditional network function deployment model. Additionally, the rise of private 5G networks, IoT connectivity, and hybrid cloud deployments is further fueling NFV’s penetration into enterprise and government networks. With a growing emphasis on network automation, scalability, and cybersecurity, the US NFV market is poised for sustained long-term growth.

Europe Network Function Virtualization Market

In 2025, the Europe Network Function Virtualization (NFV) market is projected to reach a valuation of approximately USD 6.2 billion, accounting for a notable portion of the global NFV industry. This growth reflects the region’s continued push toward modernizing its telecom infrastructure through the adoption of virtualization technologies.

Key markets such as Germany, the United Kingdom, and France are leading this transformation, supported by progressive policies, high 5G penetration, and a strong base of telecom equipment manufacturers. The region’s participation in open-source and standardization efforts, particularly through the European Telecommunications Standards Institute (ETSI), has further accelerated NFV adoption. European operators are leveraging NFV to drive down operational costs, boost agility, and enable dynamic service delivery across networks.

The European NFV market is poised for robust expansion with a compound annual growth rate (CAGR) of 18.7% between 2025 and 2034. This upward trajectory is being fueled by the convergence of 5G, edge computing, and software-defined infrastructure across multiple industries. Telecom service providers are virtualizing core functions like firewalls, routers, and EPCs (Evolved Packet Cores), while enterprises are embracing NFV to support hybrid cloud deployments and digital transformation strategies.

Moreover, regional initiatives to foster smart city development and industrial automation are also contributing to the growing demand for scalable and cost-efficient virtual network solutions. As vendors and operators continue investing in interoperable, cloud-native NFV architectures, Europe is expected to remain a highly strategic and technologically advanced region within the global market landscape.

Japan Network Function Virtualization Market

The Network Function Virtualization (NFV) market in Japan is projected to be valued at approximately USD 1.3 billion in 2025, underscoring the country's position as a technologically mature and innovation-driven economy within the global telecom landscape. Japan's NFV adoption is being spearheaded by major telecom operators such as NTT Docomo, KDDI, and Rakuten Mobile, all of which are actively implementing virtualized core networks and cloud-native infrastructures to enhance service delivery.

The nation's early investments in 5G Standalone (SA) networks and open RAN ecosystems have created fertile ground for NFV integration. These operators are virtualizing network functions such as firewalls, EPC, and IMS (IP Multimedia Subsystems) to achieve higher operational efficiency, better scalability, and faster rollout of next-gen digital services.

Over the forecast period, the Japanese NFV market is expected to grow at a CAGR of 17.2%, driven by a combination of government support, private sector innovation, and rising demand for intelligent network orchestration. Enterprises in sectors like manufacturing, automotive, and finance are adopting NFV solutions to support high-performance, low-latency communications required for IoT and edge computing.

Japan’s emphasis on automation, AI-powered network analytics, and digital transformation aligns well with NFV’s core value proposition of network agility and programmability. As the country moves toward full-scale 5G and eventually 6G deployment, the demand for flexible and cost-efficient virtual infrastructure will continue to surge, reinforcing Japan's strategic role in shaping the Asia-Pacific NFV landscape.

Global Network Function Virtualization Market: Key Takeaways

- Market Value: The global network function virtualization market size is expected to reach a value of USD 148.3 billion by 2034 from a base value of USD 28.3 billion in 2025 at a CAGR of 20.2%.

- By Component Segment Analysis: Solution components are anticipated to dominate the component segment, capturing 65.0% of the total market share in 2025.

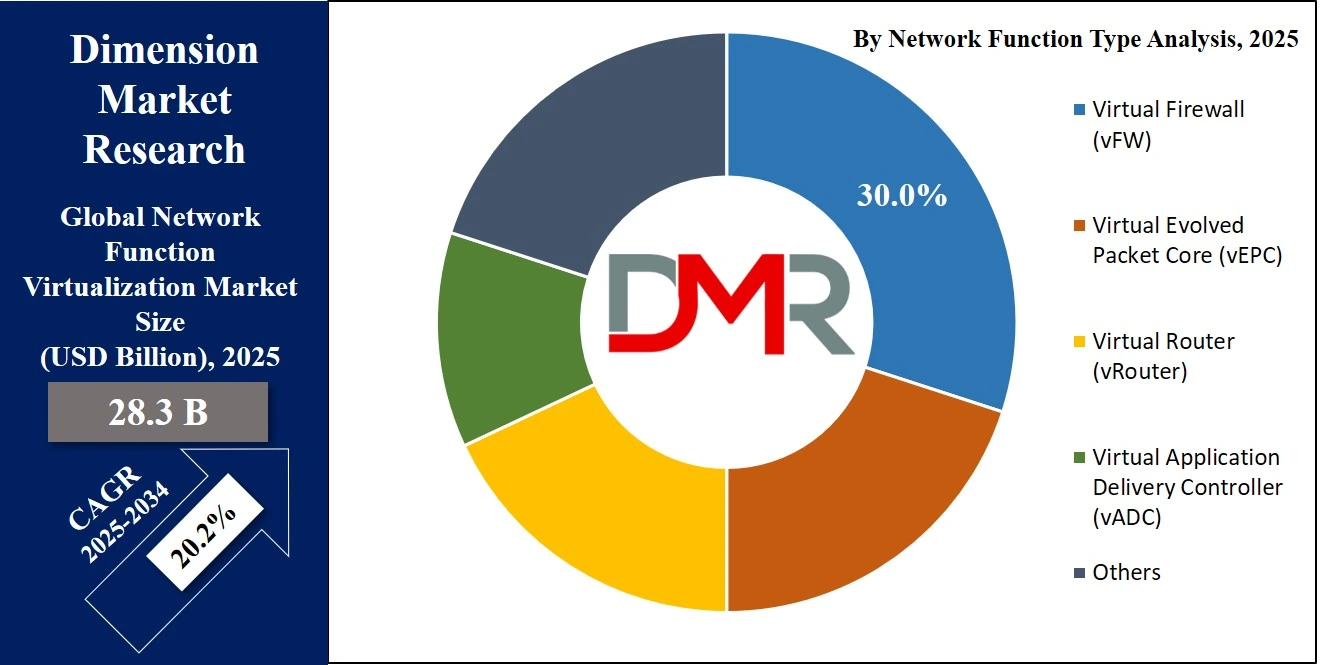

- By Network Function Type Segment Analysis: Virtual Firewall (vFW) is expected to maintain its dominance in the network function type segment, capturing 30.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-Based mode is expected to consolidate its position in the deployment mode segment, capturing 58.0% of the market share in 2025.

- By Enterprise Size Segment Analysis: Large Enterprises are poised to consolidate their dominance in the enterprise size segment, capturing 70.0% of the total market share in 2025.

- By Application Segment Analysis: Core Network Virtualization applications will account for the maximum share in the application segment, capturing 35.0% of the total market value.

- By Industry Vertical Segment Analysis: The Telecommunications industry is expected to consolidate its dominance in the industry vertical segment, capturing 58.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global network function virtualization market landscape with 35.0% of total global market revenue in 2025.

- Key Players: Some key players in the global network function virtualization market are Cisco Systems, Huawei Technologies, Nokia Corporation, Ericsson, Juniper Networks, VMware, HPE, NEC Corporation, IBM, Dell Technologies, ZTE Corporation, Fujitsu, Intel Corporation, Samsung Electronics, Affirmed Networks (Microsoft), Ribbon Communications, Radisys, Mavenir, Amdocs, and Others.

Global Network Function Virtualization Market: Use Cases

- 5G Core Network Deployment for Telecom Operators: Telecommunications service providers are leveraging NFV to virtualize their 5G core networks, replacing traditional hardware-based functions with scalable virtual network functions (VNFs). By deploying virtual evolved packet core (vEPC), virtual IMS, and vRAN components on commercial off-the-shelf (COTS) hardware, operators can drastically reduce both CapEx and OpEx. NFV, integrated with software-defined networking (SDN), allows telcos to dynamically allocate network resources, manage high traffic loads, and launch services such as network slicing and ultra-reliable low-latency communications (URLLC). Through centralized orchestration and automation, telecom operators can manage virtualized network infrastructure efficiently, accelerate time-to-market for new services, and respond flexibly to changing consumer and enterprise demands in the 5G era.

- Enterprise Virtual Firewall and Secure SD-WAN Implementation: Enterprises across sectors like banking, healthcare, and e-commerce are adopting NFV to modernize their security architecture using virtual firewalls (vFW), intrusion detection systems (vIDS), and secure SD-WAN solutions. Instead of deploying costly physical security appliances at every branch or data center, businesses can host these security functions as VNFs in the cloud or at the edge, ensuring centralized policy control and seamless updates. This virtualized approach enhances cybersecurity posture while reducing hardware dependencies and improving scalability. By integrating NFV with cloud-native security frameworks and edge computing platforms, enterprises benefit from increased network agility, policy-based traffic routing, real-time threat response, and reduced total cost of ownership.

- Cloud Service Provider Infrastructure Optimization: Cloud and data center service providers are utilizing NFV to streamline their infrastructure by deploying virtualized routers, load balancers, and application delivery controllers (vADCs) within multitenant environments. NFV enables service providers to abstract and automate network services, improving service delivery speed, resource utilization, and tenant isolation. The orchestration of virtual network services across public, private, and hybrid clouds supports elastic scaling of applications and services, especially during peak demand. Combined with Kubernetes, container networking, and AI-driven monitoring, NFV empowers cloud providers to offer on-demand, high-performance network services tailored to enterprise clients. It also facilitates multi-cloud interoperability and network function chaining in distributed environments.

- Edge Computing for Smart Manufacturing and IoT: NFV is playing a pivotal role in enabling edge computing across Industry 4.0 use cases, especially in smart manufacturing, logistics, and IoT-enabled operations. By virtualizing network functions at the edge, such as gateways, traffic prioritization, and data filtering VNFs, organizations can process data closer to the source. This reduces latency, enhances operational efficiency, and supports mission-critical workloads like robotic automation, real-time analytics, and predictive maintenance. When integrated with MEC (Multi-access Edge Computing) and 5G connectivity, NFV allows manufacturers to build agile, programmable networks capable of adapting to dynamic factory conditions. It also helps maintain robust network security and resilience across geographically distributed facilities.

Impact of Artificial Intelligence on Network Function Virtualization Market

Artificial Intelligence (AI) is significantly transforming the Network Function Virtualization (NFV) market, enhancing how virtualized network services are deployed, managed, and optimized. By integrating AI with NFV, service providers and enterprises can achieve higher levels of automation, intelligence-driven orchestration, and predictive maintenance, which were not possible with traditional manual network management systems.

One of the most impactful areas is intelligent network orchestration and automation. AI algorithms analyze real-time traffic data, network usage patterns, and resource allocation to dynamically scale or shift virtual network functions (VNFs) across cloud and edge environments.

This leads to optimized resource utilization, reduced operational costs, and faster fault detection and resolution. AI-powered orchestration also simplifies service provisioning and lifecycle management, allowing for agile deployment of services like virtual firewalls, vRouters, and vEPC across multi-cloud or hybrid infrastructures.

AI is also pivotal in predictive analytics and network assurance within NFV ecosystems. By applying machine learning models to large volumes of telemetry and performance data, network operators can predict potential service disruptions, proactively mitigate latency or congestion issues, and ensure SLA compliance.

In addition, AI supports zero-touch network operations, enabling fully autonomous management of virtualized network environments without human intervention. As NFV environments grow more complex with the adoption of 5G, IoT, and edge computing, AI becomes critical for managing network slicing, detecting anomalies, automating root-cause analysis, and maintaining end-to-end network performance.

Global Network Function Virtualization Market: Stats & Facts

U.S. Department of Energy (DOE)

- The DOE noted that emerging 5G (and by extension NFV/SDN) infrastructure encompasses deployments from low-power edge sensors to supercomputers, including AI at the edge and real-time digital twins for scientific and industrial applications.

Government Publishing Office (5G & NFV)

- Transitioning core mobile network functions to NFV can lower operational costs and streamline operations, but introduces novel security vulnerabilities in shared Internet-connected small cell gateways.

- NFV enables decentralized core functions and edge virtualization to reduce latency and increase spectral efficiency when used with cloud-RAN architectures.

DHS / NTIA

- 5G deployments map to enhanced mobile broadband, ultra‑reliable low‑latency communications, and massive machine‑type IoT, many requiring NFV/SDN infrastructure.

- Government guidance includes implementing Software Bill of Materials (SBOM) and NIST SP 800-53/161/162 for supply chain risk management in Open RAN and NFV environments.

Global Network Function Virtualization Market: Market Dynamics

Global Network Function Virtualization Market: Driving Factors

Rapid Adoption of 5G and Cloud-Native Network Infrastructure

The global rollout of 5G networks is a major catalyst for NFV adoption. Telecom operators are transitioning from legacy hardware to cloud-native virtualized network functions (VNFs) to meet the agility, scalability, and low-latency demands of 5G services. NFV allows providers to deploy and manage components such as vRAN, vEPC, and network slicing architectures efficiently, supporting dynamic workloads and faster service delivery. The convergence of NFV with SDN (Software Defined Networking) and containerized platforms like Kubernetes is further enhancing the flexibility of next-gen mobile networks.

Growing Need for Cost-Efficient and Agile Network Management

Organizations are under pressure to reduce capital and operational expenditures while meeting growing user demand for high-speed and reliable services. NFV enables the replacement of specialized hardware with software-based virtual appliances, allowing service providers to cut infrastructure costs and improve network agility. This shift is particularly beneficial in multi-tenant environments and hybrid cloud deployments, where virtualized network orchestration ensures seamless scalability and efficient resource allocation.

Global Network Function Virtualization Market: Restraints

Complexity in Integration and Interoperability

Despite its benefits, NFV faces significant challenges in terms of integration with legacy systems and ensuring interoperability among multi-vendor solutions. Many organizations struggle to align their existing network management frameworks with new virtualized components. Additionally, ensuring consistent performance across heterogeneous virtual network functions (VNFs) and orchestrators from different vendors can lead to operational delays and increased deployment costs.

Security Concerns in Virtualized Environments

The transition to virtualized infrastructures introduces new layers of cybersecurity risk, especially in cloud-hosted or multi-access edge computing (MEC) environments. Unlike traditional networks, NFV-based architectures are more susceptible to threats like data breaches, hypervisor attacks, and unauthorized access to orchestration layers. The dynamic and distributed nature of VNFs makes it challenging to implement unified security policies, thus requiring advanced AI-powered threat detection and automation-driven policy enforcement to maintain network integrity.

Global Network Function Virtualization Market: Opportunities

Expansion of NFV in Edge Computing and Private 5G Networks

The rising demand for real-time processing in applications such as industrial automation, remote healthcare, and smart cities is opening doors for NFV deployment at the edge of the network. NFV enables lightweight, software-based deployment of network services like traffic filtering, local breakout, and data routing close to end-users. Additionally, the growing adoption of private 5G networks in enterprise environments is creating strong demand for scalable and customizable virtual network functions integrated with edge infrastructure.

Integration with AI and Machine Learning for Network Automation

AI and ML technologies are unlocking new capabilities in predictive analytics, anomaly detection, and autonomous network orchestration. This creates significant opportunities for NFV vendors to offer intelligent platforms that self-optimize and self-heal based on real-time performance metrics. AI-enhanced NFV solutions allow for zero-touch provisioning, dynamic scaling of VNFs, and proactive maintenance, transforming traditional networks into smart, responsive digital infrastructures.

Global Network Function Virtualization Market: Trends

Shift Toward Multi-Cloud and Hybrid NFV Deployments

A growing number of enterprises and telcos are adopting multi-cloud NFV strategies to avoid vendor lock-in and enhance service resiliency. NFV platforms are being designed to support orchestration across public cloud, private cloud, and on-premises environments. This trend enables dynamic workload distribution, optimized cost-performance ratios, and broader geographic coverage for service delivery. The rise of containerized network functions (CNFs) is also supporting more lightweight, portable NFV deployments across distributed cloud ecosystems.

Standardization and Open-Source Collaboration

Industry efforts toward NFV standardization and open-source development are gaining momentum, with initiatives like ETSI NFV, ONAP (Open Network Automation Platform), and OPNFV fostering interoperability and innovation. Vendors and operators are embracing open-source NFV orchestration tools to accelerate development cycles, improve transparency, and reduce deployment complexity. This trend is creating a more robust and vendor-neutral NFV ecosystem, encouraging the adoption of interoperable virtual network services on a global scale.

Global Network Function Virtualization Market: Research Scope and Analysis

By Component Analysis

In the Network Function Virtualization (NFV) market, the component segment is primarily divided into solutions and services, with solution components expected to take the lead. Solution components are projected to capture approximately 65.0% of the total market share in 2025, driven by the growing demand for software-based virtual network functions such as virtual firewalls, virtual routers, vEPC, and vIMS. These solutions are essential for enabling telecom operators and enterprises to replace traditional, hardware-based appliances with scalable and flexible software alternatives.

As network infrastructure becomes more cloud-native and distributed, solution components offer enhanced agility, automation, and cost-efficiency, particularly when deployed across hybrid cloud, multi-cloud, and edge environments. The increased rollout of 5G and the expansion of data-intensive services further accelerate the need for robust and intelligent NFV solutions.

On the other hand, services in the NFV market play a crucial role in ensuring the successful implementation, integration, and ongoing management of virtualized network infrastructure. These services are typically categorized into professional services and managed services. Professional services include consulting, network design, deployment, and support, helping organizations transition from legacy infrastructure to NFV-enabled environments with minimal disruption.

Managed services, meanwhile, allow enterprises to outsource the monitoring, orchestration, and maintenance of NFV systems to specialized providers, thereby reducing operational complexity and freeing up internal IT resources. As NFV deployments scale across regions and industries, the demand for expert-driven service models continues to grow, enabling seamless upgrades, security compliance, and lifecycle management of virtualized network functions.

By Network Function Type Analysis

Within the network function type segment of the Network Function Virtualization (NFV) market, the virtual firewall (vFW) is expected to retain its dominant position, capturing around 30.0% of the total market share in 2025. This dominance is primarily driven by the growing need for advanced network security solutions that can be deployed flexibly across cloud, data center, and edge environments.

As organizations migrate to virtualized and distributed infrastructures, the demand for scalable, software-defined security tools has surged. Virtual firewalls offer real-time threat detection, traffic inspection, and policy enforcement without the need for physical hardware, making them ideal for dynamic environments like hybrid cloud and SD-WAN. The rise in cyber threats, combined with the shift toward remote work, 5G, and IoT, has further amplified the importance of deploying secure and adaptable network defenses such as vFWs.

Alongside virtual firewalls, virtual routers (vRouters) play a critical role in the NFV ecosystem by enabling flexible and cost-effective routing capabilities within virtualized networks. vRouters replicate the core functions of traditional hardware routers but offer enhanced agility and scalability through software-based deployment.

They are commonly used in telecom networks, data centers, and enterprise WAN architectures to route traffic efficiently across physical and virtual network layers. With the expansion of multi-cloud strategies and the adoption of SDN, vRouters help service providers manage complex routing demands, reduce latency, and improve network performance.

Their ability to integrate seamlessly with orchestration platforms and support dynamic configuration makes them essential in building resilient and programmable virtual network infrastructures. As NFV adoption deepens, vRouters continue to gain traction for their ability to simplify network operations while optimizing connectivity across diverse environments.

By Deployment Mode Analysis

In the deployment mode segment of the Network Function Virtualization (NFV) market, the cloud-based mode is projected to consolidate its position as the leading choice, accounting for approximately 58.0% of the total market share in 2025. This growth is largely fueled by the rising adoption of public and hybrid cloud environments among telecom operators, cloud service providers, and large enterprises.

Cloud-based NFV enables the flexible deployment of virtual network functions across geographically distributed environments, offering benefits such as rapid scalability, automated updates, cost efficiency, and centralized orchestration. As 5G networks continue to expand and enterprise IT strategies shift toward digital-first models, the cloud is becoming the preferred platform for hosting VNFs like vFirewall, vRouter, and vEPC.

Furthermore, the integration of NFV with cloud-native technologies and container orchestration tools such as Kubernetes enhances its agility, performance, and ability to support emerging use cases like edge computing and private 5G networks.

In contrast, the on-premises deployment mode continues to hold significant relevance, especially among organizations with strict regulatory requirements, data privacy concerns, or legacy infrastructure constraints. On-premises NFV solutions allow enterprises and service providers to retain full control over their network architecture, ensuring tighter security, customization, and data governance.

This mode is often favored in industries such as government, defense, healthcare, and finance, where localized control and minimal latency are critical. While on-premises NFV may involve higher initial infrastructure costs and more complex management, it offers enhanced reliability and integration with existing hardware systems. As a result, although cloud-based NFV is gaining momentum, the on-premises model remains a vital part of the deployment landscape, particularly for mission-critical or compliance-driven applications.

By Enterprise Size Analysis

In the enterprise size segment of the Network Function Virtualization (NFV) market, large enterprises are expected to solidify their dominance by capturing nearly 70.0% of the total market share in 2025. This is primarily due to their robust IT infrastructure, higher capital investments, and growing demand for scalable, agile, and secure network operations.

Large enterprises, particularly in sectors like telecommunications, banking, and cloud services, rely heavily on NFV to modernize their legacy systems, support complex network functions, and handle large volumes of data across global operations.

These organizations are leading adopters of virtualized infrastructure to support 5G rollouts, hybrid cloud migration, and AI-driven network automation. Their preference for customizable, end-to-end NFV solutions enables them to improve operational efficiency, reduce hardware dependency, and accelerate service delivery while maintaining high performance and reliability standards.

While large enterprises dominate the segment, small and medium-sized enterprises (SMEs) are gradually growing their presence in the NFV market. SMEs are beginning to recognize the cost-saving benefits and operational flexibility offered by virtualized network services. With the availability of cloud-based NFV solutions and managed service models, smaller organizations can now access advanced network capabilities without the need for significant upfront investments in physical infrastructure.

NFV allows SMEs to streamline their IT operations, enhance security with virtual firewalls, and scale services as their business grows. Although adoption among SMEs is still in a developing phase compared to larger firms, the rise of digital transformation initiatives and remote working environments is encouraging more small businesses to embrace NFV technologies for improved network agility and competitiveness.

By Application Analysis

In the application segment of the Network Function Virtualization (NFV) market, core network virtualization is expected to command the largest share, accounting for around 35.0% of the total market value in 2025. This dominance is driven by the urgent need among telecom operators and service providers to modernize their core infrastructure and support the growing data demands of 5G, IoT, and cloud-native applications.

Core network virtualization involves deploying key virtual network functions such as virtual evolved packet core (vEPC), virtual IMS, and virtual DNS on commercial hardware to replace legacy appliances. These virtualized core components provide greater flexibility, improved scalability, and faster deployment of services, allowing network operators to manage traffic efficiently and deliver high-performance connectivity across their networks. With the rise of network slicing, dynamic resource allocation, and real-time analytics, core virtualization is becoming essential for enabling resilient and responsive digital ecosystems.

In parallel, security functions such as virtual firewalls (vFW) and virtual intrusion detection systems (vIDS) are gaining strong traction within the NFV application space. As enterprises and telecom providers shift to software-defined and virtualized environments, the need for robust, scalable, and dynamic security solutions becomes more critical.

Virtual security functions can be deployed across cloud, on-premises, and edge environments to monitor traffic, detect anomalies, and enforce policies without relying on physical appliances. These security VNFs are particularly valuable in distributed architectures and multi-cloud setups where centralized visibility and control are essential.

The growing complexity of cyber threats and the growing adoption of remote work, edge computing, and IoT devices are further driving demand for flexible, AI-enhanced virtual security layers. As a result, security-focused applications are evolving into a strategic priority within the broader NFV ecosystem.

By Industry Vertical Analysis

In the industry vertical segment of the Network Function Virtualization (NFV) market, the telecommunications sector is expected to maintain its dominant position, capturing approximately 58.0% of the total market share in 2025. This leadership is primarily driven by the telecom industry's urgent need to modernize network infrastructure, reduce operational costs, and meet the performance demands of next-generation services like 5G, VoLTE, and ultra-reliable low-latency communication.

Telecom operators are deploying NFV to virtualize core network elements such as vEPC, vIMS, and vRAN, enabling them to deliver faster, more flexible services while reducing reliance on costly proprietary hardware.

NFV also supports dynamic bandwidth management, network slicing, and seamless integration with SDN and edge computing, key components for delivering enhanced mobile broadband and IoT connectivity. As global data traffic continues to surge, NFV helps telecom providers stay competitive through improved network scalability, automation, and service agility.

In addition to telecommunications, the BFSI sector is emerging as a notable adopter of NFV solutions, leveraging them to enhance network security, agility, and compliance. Banks and financial institutions are under growing pressure to support digital banking platforms, real-time transactions, and secure remote access for customers and employees.

NFV enables these organizations to deploy virtual security appliances such as firewalls and intrusion detection systems across their IT environments with greater speed and flexibility. It also supports disaster recovery, branch connectivity, and secure cloud access through virtualized SD-WAN and routing solutions.

As regulatory requirements evolve and cyber threats become more sophisticated, NFV provides BFSI firms with a scalable and cost-effective framework to ensure network resilience and secure data management. This trend is expected to continue as financial institutions deepen their investments in digital infrastructure and real-time service delivery.

The Network Function Virtualization Market Report is segmented based on the following:

By Component

- Solutions

- Orchestration & Automation

- Services

- Professional Services

- Managed Services

By Network Function Type

- Virtual Firewall (vFW)

- Virtual Router (vRouter)

- Virtual Evolved Packet Core (vEPC)

- Virtual Application Delivery Controller (vADC)

- Others

By Deployment Mode

By Enterprise Size

By Application

- Core Network Virtualization

- Security Functions (vFW, vIDS)

- Edge Computing

- Traffic Routing & Optimization

- Load Balancing & ADCs

By Industry Vertical

- Telecommunications

- BFSI

- IT & Cloud Service Providers

- Government & Defense

- Healthcare

- Retail & eCommerce

Global Network Function Virtualization Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global Network Function Virtualization (NFV) market in 2025, accounting for approximately 35.0% of total global market revenue. This dominance is attributed to the region’s early adoption of advanced network technologies, strong presence of major NFV solution providers, and aggressive investments in 5G infrastructure and cloud-native architectures.

Telecom operators and enterprises across the United States and Canada are rapidly deploying virtualized network services to enhance scalability, reduce operational costs, and support next-generation applications such as IoT, edge computing, and AI-driven network automation.

Additionally, the region benefits from a mature regulatory framework, a highly digitized enterprise environment, and a strong emphasis on cybersecurity and network innovation, all of which contribute to the accelerated adoption of NFV solutions across diverse industry verticals.

Region with significant growth

Asia-Pacific is expected to witness the most significant growth in the Network Function Virtualization (NFV) market over the forecast period, driven by rapid digital transformation, expanding 5G infrastructure, and growing demand for scalable and cost-efficient network solutions across emerging economies like China, India, South Korea, and Japan.

Governments and telecom operators in the region are making substantial investments in virtualized core networks, cloud data centers, and edge computing to support next-generation services and rural connectivity.

The region’s strong manufacturing base, rise in IoT adoption, and growing reliance on AI and cloud-native architectures are further accelerating NFV deployment. As enterprises across Asia-Pacific prioritize agility and real-time service delivery, the region is poised to become a key contributor to the global NFV market’s expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Network Function Virtualization Market: Competitive Landscape

The global competitive landscape of the Network Function Virtualization (NFV) market is characterized by a mix of established technology giants, specialized telecom vendors, and emerging innovators, all striving to capture a share of the rapidly expanding virtualized network ecosystem.

Companies such as Cisco Systems, Huawei Technologies, Nokia Corporation, Ericsson, and Juniper Networks lead the market with comprehensive NFV portfolios, offering end-to-end virtual network solutions, orchestration platforms, and integration services.

Meanwhile, players like VMware, HPE, Dell Technologies, and IBM are enhancing their positions through cloud-native infrastructure, virtualization software, and strategic partnerships with telecom operators.

Additionally, firms like Mavenir, Affirmed Networks (Microsoft), and Netcracker are focusing on agile, AI-driven solutions tailored for 5G, edge computing, and enterprise connectivity. The market is witnessing intense competition fueled by technological advancements, open-source collaboration, and vendor-neutral architectures, as providers aim to differentiate through innovation, scalability, and cost efficiency in delivering next-generation NFV capabilities.

Some of the prominent players in the global network function virtualization market are:

- Cisco Systems

- Huawei Technologies

- Nokia Corporation

- Ericsson

- Juniper Networks

- VMware

- HPE (Hewlett-Packard Enterprise)

- NEC Corporation

- IBM

- Dell Technologies

- ZTE Corporation

- Fujitsu

- Intel Corporation

- Samsung Electronics

- Affirmed Networks (Microsoft)

- Ribbon Communications

- Radisys

- Mavenir

- Amdocs

- Netcracker Technology

- Other Key Players

Global Network Function Virtualization Market: Recent Developments

- July 2025: T-Mobile US finalized its USD 4.4 billion acquisition of UScellular, extending its wireless infrastructure and spectrum holdings, reinforcing NFV-ready network assets.

- June 2025: ETSI introduced a new NFV architecture aimed at evolving the MANO framework into a telco cloud-centric model designed to support future 6G environments and advanced orchestration platforms.

- April 2025: Radisys launched its NFV‑Accelerated Media Processing platform, enabling telecom and cloud communications providers to scale voice and video services more efficiently with enhanced NFV orchestration and reduced total cost of ownership.

- January 2025: Denver-based startup Stateless secured USD 11.3 billion in a Series A funding round to enhance its Luxon SD-interconnect platform targeting NFV and SD-WAN deployments.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 28.3 Bn |

| Forecast Value (2034) |

USD 148.3 Bn |

| CAGR (2025–2034) |

20.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 8.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Network Function Type (Virtual Firewall, Virtual Router, Virtual Evolved Packet Core, Virtual Application Delivery Controller, and Others), By Deployment Mode (On-Premises and Cloud-Based), By Enterprise Size (Large Enterprises and SMEs), By Application (Core Network Virtualization, Security Functions, Edge Computing, Traffic Routing & Optimization, and Load Balancing & ADCs), and By Industry Vertical (Telecommunications, BFSI, IT & Cloud Service Providers, Government & Defense, Healthcare, and Retail & eCommerce) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Cisco Systems, Huawei Technologies, Nokia Corporation, Ericsson, Juniper Networks, VMware, HPE, NEC Corporation, IBM, Dell Technologies, ZTE Corporation, Fujitsu, Intel Corporation, Samsung Electronics, Affirmed Networks (Microsoft), Ribbon Communications, Radisys, Mavenir, Amdocs, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global network function virtualization market size is estimated to have a value of USD 28.3 billion in 2025 and is expected to reach USD 148.3 billion by the end of 2034.

The US network function virtualization market is projected to be valued at USD 8.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 39.7 billion in 2034 at a CAGR of 18.9%.

North America is expected to have the largest market share in the global network function virtualization market, with a share of about 35.0% in 2025.

Some of the major key players in the global network function virtualization market are Cisco Systems, Huawei Technologies, Nokia Corporation, Ericsson, Juniper Networks, VMware, HPE, NEC Corporation, IBM, Dell Technologies, ZTE Corporation, Fujitsu, Intel Corporation, Samsung Electronics, Affirmed Networks (Microsoft), Ribbon Communications, Radisys, Mavenir, Amdocs, and Others.

The market is growing at a CAGR of 20.2 percent over the forecasted period.