The non-invasive glucose meter allows users to read their blood glucose without pricking needles or collecting a sample of it and is, therefore, more handy or comfortable to handle than conventional meters.

They utilize various advanced sensors, such as

optical, electromagnetic, and transdermal sensors, which measure levels through the skin or interstitial fluids to deliver real-time solutions. Because of this, demand for painless glucose monitoring is increasingly rising, hence a strong expansion of the global non-invasive glucose meter market.

However, the market has experienced significant growth in North America and Europe due to better penetration rates of advanced

medical devices. Besides, these economies also boast strong healthcare infrastructure, higher spending on healthcare, and increased awareness about the solutions available to manage diabetes.

The geographical markets presenting compelling growth opportunities have been the Asia-Pacific with its rising prevalence rates of diabetes, besides higher investments in healthcare, growing awareness among patients, and rising patient awareness in these emerging markets.

Wearable devices dominate product segments like smartwatches, patches, and skin sensors, very convenient to use and integrate into the platforms of digital health for constant glucose level monitoring. Non-invasive continuous glucose meters will inevitably prevail in diabetes management, given the recent transformations like optical and electromagnetic methods of sensing, which enhance their accuracy and reliability.

Global non-invasive glucose meters will experience rapid growth in the following years because of technical development, increasing healthcare awareness, and the availability of more user-friendly glucose monitoring solutions.

As per nature This study introduces a non-invasive, accurate method for continuous blood glucose monitoring using a multiple photonic band near-infrared (mbNIR) sensor combined with personalized medical features (PMF) in Shallow Dense Neural Networks (SDNN).

Trained on 401 blood samples with ten-fold validation, the model achieved 97.8% accuracy, 96.0% precision, 94.8% sensitivity, and 98.7% specificity for diabetes classification based on a 126 mg/dL fasting blood glucose threshold.

Additionally, a cohort of 234 individuals, not included in the training set, was used to evaluate model performance. For real-time non-invasive blood glucose monitoring, the model demonstrated a ±15% error with a 95% confidence interval and a detection range of 60-400 mg/dL. These results were validated using the standard hexokinase enzymatic method for glucose estimation.

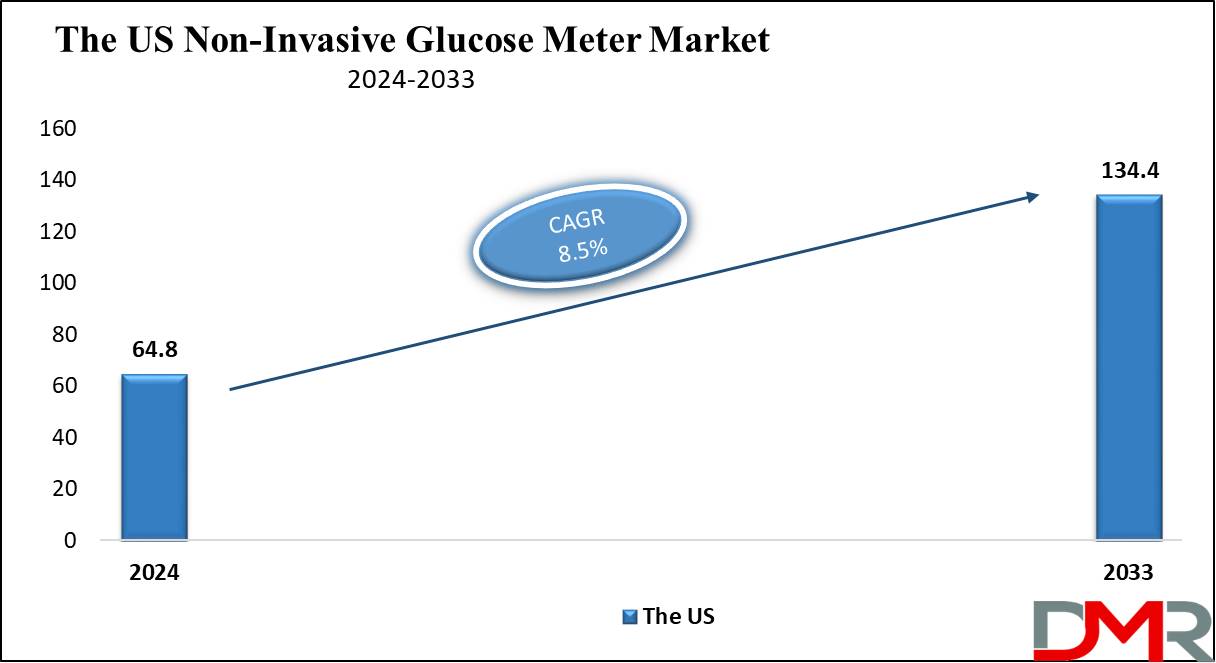

The US Non-Invasive Glucose Meter Market

The US Non-Invasive Glucose Meter Market is projected to be valued at

USD 64.8 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds

USD 134.4 million in 2033 at a

CAGR of 8.5%.

The leading force in the global non-invasive glucose meter market is driven by the U.S. with high prevalence rates of diabetes and a highly developed

healthcare infrastructure. Non-invasive glucose meters have a better catch in the region due to developing optical or transdermal technologies that can help patients monitor blood sugar without painful processes. Some of the keystone trends in the US market include wearables for continuous monitoring of glucose, increasing interest in personalized care, and improvement in awareness about the integration of regular monitoring of blood glucose. Due to the high demand from consumers for non-invasive solutions, companies have invested heavily in research and development to develop more accurate and user-friendly glucose meters.

Recent developments within the U.S. marketplace include partnerships between healthcare providers and technology companies in integrating glucose monitors into broader health monitoring systems. Furthermore, regulatory approvals by the likes of the FDA have facilitated further growth in the market, since this ensures that standards associated with the safety and efficacy of a product are met. This demand is likely to increase as health policies continue to favor technologies associated with the management of diabetes.

Key Takeaways

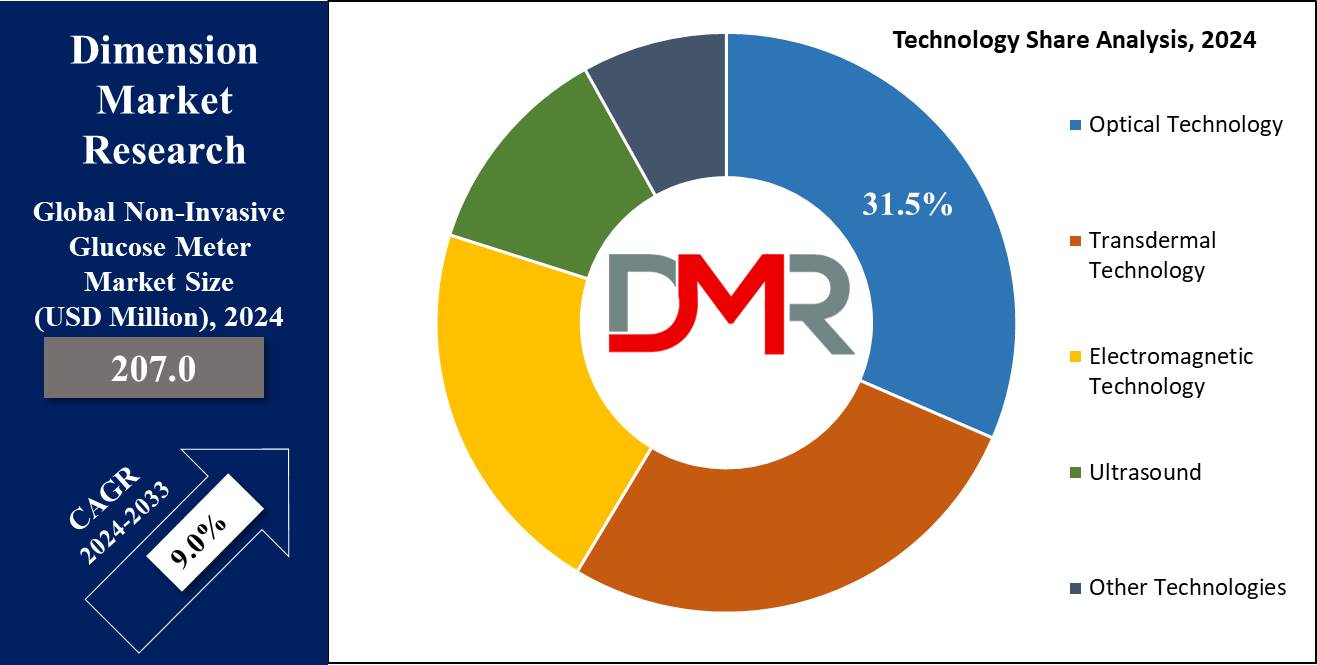

- Global Market Value: The global non-invasive glucose meter market size is projected at a value of USD 207.0 Mn in 2024 and is expected to reach a value of USD 449.0 Mn by the end of 2033.

- The US Market Value: The non-invasive glucose meter market in the US is prophesied to advance from its base value of USD 64.8 million in 2024 to a value of USD 134.4 million in 2033, growing at a CAGR of 8.5%.

- Product Type Segment Analysis: Wearable devices are projected to dominate this segment in the context of a product as it holds 43.2% of the market share in 2024.

- Technology Segment Analysis: Optical technology is likely to dominate this segment, as it had a 31.5% market share in 2024.

- End User Segment Analysis: According to the forecast, the global non-invasive glucose meter market is expected to be ruled by hospitals due to the higher share it will have in 2024.

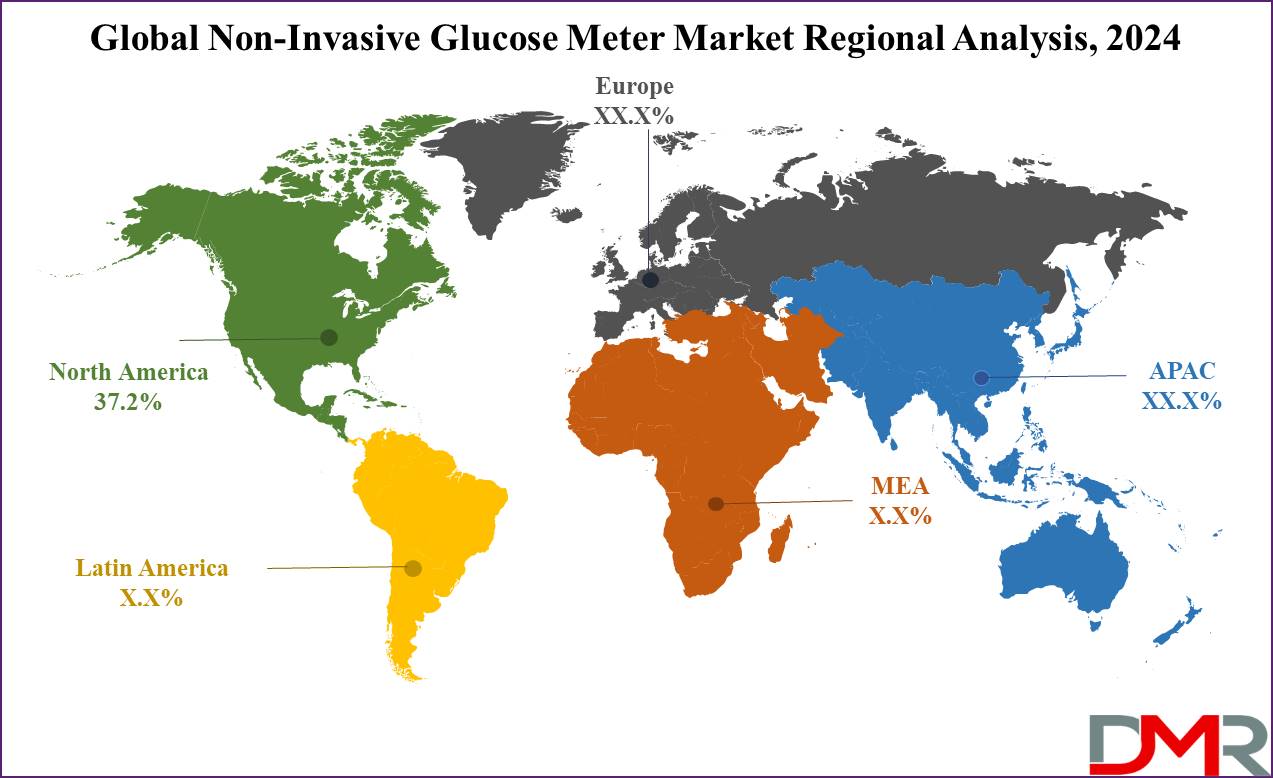

- Regional Analysis: North America holds the largest market share in the global non-invasive glucose meter market, accounting for a share of around 37.2% in 2024.

- Growth Rate: The market is growing at a CAGR of 9.0 percent in the forecasted period.

Use Cases

- Home Monitoring: Non-invasive glucose meters can be utilized by patients to monitor their blood sugar levels without requiring them to go to the hospital. This helps individuals cope better with diabetes because the reading gives them immediate feedback in the comfort of their own homes.

- Wearable Devices for Continuous Monitoring: Smartwatches, which boast easy integration of in-daily-life blood glucose monitoring, may offer users continuous yet non-invasive glucose level monitoring throughout the day.

- Clinical Trials & Research: Non-invasive glucose meters may be employed on-site in clinics about clinical trials to measure the blood glucose levels of participants in the trials, hence accurate data collection without uncomfortable invasive testing methods.

- Pediatric Diabetes Care: Non-invasive continuous glucose meters prove to be of great benefit for children suffering from diabetes. These meters provide for consistent monitoring and management of the disease rather than going through painful procedures and discomforts to monitor the levels.

Market Dynamic

Trends

Increasing Adoption of Continuous Glucose Monitoring (CGM)The market of non-invasive glucose meters has shown a shift from traditional conventional finger-prick glucose testing methods to continuous glucose monitoring systems. Wearables have now become inclined for non-invasive glucose meters, which keep on providing real-time glucose data to their patients, thereby offering them such a facility wherein there will not be any invasive approach to monitor their blood glucose level. Advances in sensor technology and data analytics have promoted this trend, which has improved disease management for individuals with diabetes. As the adoption of these CGM devices continues, demand for non-invasive glucose meters will further increase once more patients and providers realize the benefit of the technology in improving blood glucose control.

Integration with Digital Health Platforms

Meanwhile, non-invasive glucose meters increasingly interface with digital health platforms, mobile applications, and software-enabled by cloud-based data storage. In turn, these digital platforms will be able to track glucose longitudinally, analyze trends, and share this information with healthcare professionals remotely. Thereby, one of the fastest growth areas is linking glucose monitoring with telemedicine services for diabetes care which is becoming increasingly personalized. Also, the market is driven by remote real-time monitoring of blood glucose levels in diabetic patients, since healthcare systems increasingly use digital software to deal with chronic diseases.

Growth Drivers

Rising Prevalence of Diabetes

One of the major reasons for growth in the non-invasive glucose meter market is the increasing prevalence of diabetes. According to the estimates made by the International Diabetes Federation, over 537 million suffering from diabetes in 2021 are very likely to increase by 2030. Since more people are being diagnosed with diabetes, equipment associated with monitoring blood glucose has become high in demand. Non-invasive glucose meters make the entire process far less of a hassle and pain-bearing in comparison to the traditional glucose monitoring meters for those who need constant monitoring.

Growing Demand for Minimally Invasive Devices

Growth in this market is accompanied by an increasing demand for a non-invasive, patient-friendly healthcare solution. Blood glucose monitors have a greater demand when worn due to the high inclination that patients have toward alternatives of some invasive patient testing methods that require finger-pricking or blood sampling. Non-invasive glucose meters are designed using optical, electromagnetic, and transdermal technologies that ensure comfort in blood glucose monitoring. Correspondingly, this increases demand, especially for the minimally invasive technologies available in homecare settings, directing the course market growth.

Growth Opportunities

Expansion in Emerging Markets

Diabetes cases are growing within the fast-emerging economies of Asia-Pacific, Latin America, and the Middle East region, thus, non-invasive glucose meters have a huge potential. Other factors that have contributed to increased demand for blood glucose monitoring devices within emerging economies include rapid urbanization, changing lifestyles, and improvements in access to healthcare services in India and China. Economically viable offerings with features relevant at localized levels have thus encouraged more and more manufacturers to penetrate these markets. Apart from that, various government initiatives on diabetes awareness regarding precautionary care will further definitely support the growth of non-invasive glucose meters in these regions.

Technological Innovations and R&D Investments

Continuous innovation in the technology of glucose monitoring is creating a huge opportunity for market growth. Companies are highly investing in research and development to progress the non-invasive glucose meters with higher accuracy and reliability. Innovation in optical, electromagnetic, and ultrasound-based technologies is developing the accuracy of glucose readings sans any blood samples. Coupled with further increases in sensor technology, the development of hybrid devices that combine more than one technology might create further growth in the market.

Restraints

High Costs of Non-Invasive Glucose Meters

The relatively high cost of the non-invasive glucose meter devices compared to the traditional ones is one of the main challenges that the market still faces. Advanced technologies from optical and transdermal sensors are somewhat expensive to make, consequently returning higher retail prices to the consumer. This can dampen the adoption of non-invasive glucose meters, especially in low- and middle-income regions where affordability is a key issue. Consequently, cost remains one of the major plants to significant market penetration.

Accuracy and Reliability Concerns

Though the list of non-invasive glucose meters has many advantages, devices have different accuracy concerns with the consistency of glucose readings. Skin conditions, hydration status, and environmental factors may alter sensor performance and can thereby potentially create disparities in glucose readings. These accuracy concerns have been one of the limiting factors in adapting a non-invasive meter into specific clinical settings where accurate glucose monitoring is required. While sensor accuracy is continually being improved with investments by manufacturers, these issues remain one of the significant restraints to market growth.

Research Scope and Analysis

By Product Type

Wearable devices are projected to dominate the product type segment in the global non-invasive glucose market as they hold 43.2% of the market share by the end of 2024. Non-invasive glucose meters include smartwatches, smart lenses, and patches. Wearing devices continue to dominate the market due to friendly usage, convenience, and the ability of continuous monitoring. These meters can allow real-time blood glucose levels in a patient and make diabetes management more effective and accessible. Wearable glucose meters, integrated into smartphones and health applications, offer seamless data analysis that is alluring to tech-savvy users.

This too pertains to comfort and non-invasiveness regarding its alternative to traditional blood glucose meters. The patches, armbands, and skin sensors replace finger prick testing, which minimizes pain and discomfort for the user. Thus, wearables have become very popular among people looking for an easy, facile, and non-invasive way of monitoring their blood glucose throughout the day. Accentuation of healthcare consumers on health monitoring and preventive care will drive the market for wearable glucose meters to rapid growth. Development of increasing adoption of smartwatches and skin sensors, followed by increasing market growth is expected during the forecast period.

By Technology

Optical technology is anticipated to dominate the technology segment as it commands over 31.5% of the market share by the end of 2024. The optical technology segment leads the non-invasive glucose meter market on account of its superior ability to provide appropriate and timely glucose monitoring without invasive procedures. Included in the optical Technique are near-infrared spectroscopy, mid-infrared spectroscopy, and Raman spectroscopy, from which the glucose meters detect the blood glucose level from the interaction between light and skin glucose.

These methods have emerged as a non-invasive alternative to finger-prick tests and therefore look quite attractive to both patients and health care providers. Of the many optical technologies, near-infrared spectroscopy stands out because it estimates glucose concentration entering the skin and detects glucose in interstitial fluid. Its reliability and accuracy have rated this technique widely used. Another rapidly gaining favor technology is Raman spectroscopy; the principle of operation involves the measurement of molecular vibrations caused by glucose hence providing very accurate blood glucose measurement.

Also, optical has become more of a preference for the development of non-invasive devices with ongoing significant advancement in the field of optics regarding sensor accuracy and cost. Besides, the optical glucose meter is developed in such a way that it easily integrates with continuous glucose monitoring systems, making them very efficient for real-time blood glucose level tracking. While ongoing studies will advance both these technologies, their applications will be more likely to be dominated by optical solutions due to the high grade of performance and increased consumer demand.

By Application

Intensive insulin therapy is the leading application segment of the global non-invasive glucose meter market, necessitated by the continuous and accurate monitoring of glucose among patients with type 1 diabetes or those requiring rigorous blood glucose management. Intensive insulin therapy is a form of treatment wherein patients maintain tight blood glucose control by adjusting doses of insulin based on frequent glucose readings throughout the day.

Non-invasive glucose meters, particularly wearable continuous glucose monitors, would be ideal for the purpose. These would deliver current blood glucose levels to allow the patient to make appropriate decisions regarding the dosing of insulin and dietary adjustments essential for the effective management of insulin levels. In addition, noninvasive glucose meters do not require pricking the fingertips, thus improving compliance with the therapeutic regimen; hence, these meters are becoming indispensable in intensive insulin therapy.

Besides that, the devices provide feedback, so patients would know when there is a fluctuation in the blood glucose, for instance, hypoglycemia or hyperglycemia, which requires immediate attention to lessen the chances of complication. The dominance of non-invasive glucose meters in intensive insulin therapy is occasioned by the ease of their use, comfort, and the ability to monitor consistently. It is the leading market segment because more people have diabetes, and its management protocols have increased considerably in their rate of adoption.

By End User

As primary customers, hospitals are projected to dominate the non-invasive glucose meter market in terms of end users because of the demand for precise, real-time blood glucose monitoring solutions at both inpatient and outpatient levels. Glucose meters are utilized in hospitals to observe critically ill patients, particularly diabetic patients, within the ICU and emergency departments. Non-invasive glucose meters offer a painless and routine glucose level to hospitals, thereby improving patient comfort and reducing the risk of infection resulting from invasive testing methods. Non-invasive continuous glucose meters are being utilized in hospitals, which monitor the blood glucose level among patients around the clock.

This helps medical personnel today, especially in diabetic patients undergoing surgery or when in critical conditions, needing real-time management of glucose fluctuations to prevent further complications. Their integration with hospital EHR systems facilitates better collection and analysis of the data from the glucose meters for improving patient outcomes. Other factors contributing to this demand include increasing hospital admissions reported due to diabetic patients, supplemented by raising the prevalence of various diseases related to lifestyles. All these factors mentioned above, along with an emphasis on quaternary prevention or, more generally, person-centered care, make hospitals the largest segment in the market for non-invasive glucose meters.

The Non-Invasive Glucose Meter Market Report is segmented on the basis of the following

By Product Type

- Wearable Devices

- Smartwatches

- Smart Lenses

- Patches

- Armbands

- Skin Sensors

- Standalone Devices

- Handheld Meters

- Glucometer Scanners

- Accessories & Consumables

- Disposable Patches

- Adhesive Strips

- Skin-Safe Gels

- Continuous Monitoring Sensors

- Electrochemical Sensors

- Optical Biosensors

- Enzyme-Based Sensors

- Other Products

By Technology

- Optical Technology

- Near-Infrared Spectroscopy

- Mid-Infrared Spectroscopy

- Raman Spectroscopy

- Transdermal Technology

- Electromagnetic Technology

- Ultrasound

- Other Technologies

By Application

- Intensive Insulin Therapy

- Hypoglycemia And Diabetic Foot Ulcer Tracking

By End-User

- Hospitals

- Home Care Settings

- Diagnostic Centers

- Research Institutes

Regional Analysis

North America is projected to dominate the global non-invasive glucose meter market as it accounts for the largest market share and holds

37.2% of total revenue in 2024. It has the highest market share in the global non-invasive glucose meter market due to several factors like the high prevalence of diabetes, advanced healthcare infrastructure, and a well-established market presence by leading glucose meter manufacturing companies. The well-established healthcare system in the region enables rapid market adoption of innovative medical technologies.

Non-invasive glucose meters are one such medical technology designed to enhance patient comfort and accuracy in glucose monitoring. Increasing awareness of diabetes management, besides government initiatives for preventive healthcare, also contributes to the demand for non-invasive glucose monitoring devices in the North American region. The U.S. is the largest market in this region-predicted encouraging market growth owing to prevalent health policies supportive of adopting advanced ends.

Further, North America houses some major companies investing in research and development for newer non-invasive glucose monitors to meet the growing demand for minimal invasion.

Growing cases of diabetes, particularly among the geriatric population, have continued bolstering the growth in the market. North America will lead during the forecast period owing to the region's high disposable income, access to advanced healthcare technologies, and attention to personalized medical care.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global non-invasive glucose meter market is highly competitive, with major players delving into innovation, strategic partnerships, and fresh product launches as a strategy for maintaining and increasing market share. Major market players such as Abbott Laboratories, Dexcom, Inc., GlucoTrack, and Integrity Applications retain influential positions in the market due to their front-runner standing in CGM technology and non-invasive solutions.

This is due to their strong presence in North America and Europe, where demand for more sophisticated diabetes management tools is highest. Abbott's Freestyle Libre is a leading noninvasive glucose monitoring system, intending to hold more market share with its usability and in-built real-time glucose tracking features. Dexcom, on the other hand, is an alternative well-recognized player within the CGM systems for integrating with mobile apps for the nonstop monitoring of glucose levels. Also, new players enter the market with new solutions, such as skin sensors and optical-based glucose meters. Such entries add up to increased competition.

Commonly practiced strategies are mergers, acquisitions, and collaborations by medical device manufacturers and technology companies to strengthen market presence. New entrants entering the market with new technologies for non-invasive glucose meters keep changing the competitive scenario toward more accuracy issues and the scope of the market.

Some of the prominent players in the Global Non-Invasive Glucose Meter Market are

- Abbott

- PHC Holdings Corporation

- WellDoc, Inc

- Sanofi

- Dexcom, Inc

- DarioHealth Corp.

- Medtronic

- B. Braun SE

- F. Hoffmann-La Roche Ltd

- Insulet Corporation

- Ascensia Diabetes Care Holdings AG

- Tidepool

- Tandem Diabetes Care

- Other Key Players

Recent Developments

- August 2024: Dexcom announced the launch of its next-generation CGM system, which uses enhanced optical sensors to improve the accuracy of non-invasive glucose monitoring.

- July 2024: Abbott received FDA clearance for its advanced Freestyle Libre 4 continuous glucose monitoring system. This system features improved sensor technology, longer battery life, and more accurate real-time glucose monitoring without the need for calibration.

- June 2024: GlucoTrack expanded its product lineup by launching a new non-invasive glucose monitoring device in European markets. The device features an enhanced transdermal sensor and is designed for use in both home care and clinical settings.

- May 2024: Integrity Applications announced a partnership with Medtronic to integrate their GlucoTrack device into Medtronic's diabetes care platform, allowing for seamless glucose data transmission and remote patient monitoring.

- April 2024: Senseonics entered into a collaboration with Verily, a Google subsidiary, to develop a new non-invasive glucose meter using miniaturized sensors and AI-powered algorithms to improve glucose level predictions.

- March 2024: Philips Healthcare introduced a non-invasive glucose monitoring patch designed for use in intensive care units (ICUs). This patch uses near-infrared spectroscopy to monitor glucose levels in critically ill patients without blood sampling.

- February 2024: Medtronic launched a wearable glucose monitor designed for pediatric diabetes patients. This device is integrated with a companion mobile app, enabling real-time tracking and data sharing with caregivers and healthcare professionals.

- January 2024: Novo Nordisk partnered with Apple to integrate blood glucose data from non-invasive glucose meters into Apple Health, allowing users to monitor their diabetes alongside other health metrics in a single interface.

- December 2023: Abbott entered the Asian market with its Freestyle Libre CGM system, expanding its product availability in key countries such as Japan, South Korea, and India to meet the growing demand for non-invasive glucose monitoring solutions.

- November 2023: GlucoWise received CE certification for its electromagnetic-based glucose meter, making it eligible for sale across European markets

- October 2023: Dexcom partnered with Amazon Web Services (AWS) to develop cloud-based platforms for storing and analyzing CGM data, enhancing data accessibility for patients.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 207.0 Mn |

| Forecast Value (2033) |

USD 449.0 Mn |

| CAGR (2024-2033) |

9.0% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 64.8 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Wearable Devices, Standalone Devices, Accessories & Consumables, Continuous Monitoring Sensors, and Other Products), By Technology (Optical Technology, Electromagnetic Technology, Ultrasound, and Other Technologies), By Application (Intensive Insulin Therapy, and Hypoglycemia and Diabetic Foot Ulcer Tracking), By End-User (Hospitals, Home Care Settings, Diagnostic Centers, and Research Institutes) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Abbott, PHC Holdings Corporation, WellDoc, Inc, Sanofi, Dexcom Inc, DarioHealth Corp., Medtronic, B. Braun SE, F. Hoffmann-La Roche Ltd, Insulet Corporation, Ascensia Diabetes Care Holdings AG, Tidepool, Tandem Diabetes Care, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |