The global nutraceutical excipients market is concerned with different factors that shape its trajectory over time. Primarily the growing demand for nutraceuticals is fueled through heightened attention to health and wellness. Innovations in formulations constantly drive the need for specialized excipients, which play an important position in ensuring the effectiveness of nutraceutical products.

The regulatory landscape imposes stringent requirements, impacting excipient choices and product development. Technological advancements, particularly in excipient technology, make a contribution to market dynamics by enhancing solubility, stability, and bioavailability.

Shifting consumer preferences towards natural and clean-label products impacts excipient selection, aligning with cutting-edge tendencies. Global economic situations wield massive effect on, affecting consumer purchasing power and therefore, the demand for nutraceuticals.

Supply chain challenges, exemplified by disruptions visible during occasions just like the COVID-19 pandemic, impact the availability and pricing of nutraceutical excipients. Additionally, investments in research and development through major players power the introduction of advanced excipients, in addition to impacting the evolving dynamics of the nutraceutical excipients marketplace.

Nutraceutical Excipients Market has seen substantial expansion due to increased consumer interest in nutritional supplements and functional food products, increasing health awareness, and rising demands for excipients like binders, fillers and stabilizers in nutraceutical formulations. Binders fillers and stabilizers play key roles in improving efficiency, safety and bioavailability in nutraceuticals products.

As consumer preferences move toward natural and organic ingredients, manufacturers have begun investigating new excipient formulations to meet this increase in clean label products. This trend aligns with consumer preference for sustainable, plant-based, allergen-free excipients - creating new opportunities for innovation and expansion within this sector.

Nutraceutical excipients have seen increasing usage with personalized nutrition's increasing popularity and an aging population driving demand in recent years, including immunoglobulin products tailored for immunity, joint health, digestive wellness and immunity concerns. Furthermore, online platforms for supplement sales provide excipient manufacturers with an opportunity to reach wider consumer pools worldwide.

Key Takeaways

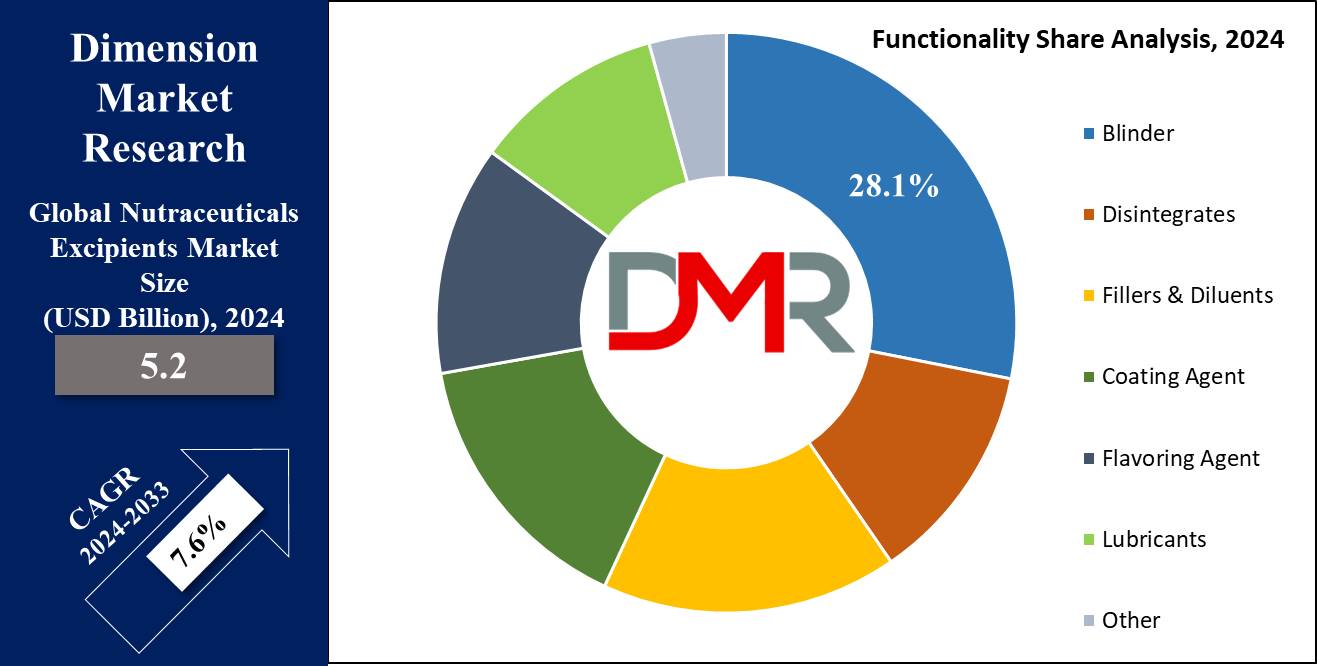

- Market Size: This market is expected to reach a value of USD 10.0 billion by 2033 at a CAGR of 7.6%.

- By Functionality Segment Analysis: Blinders have surged to prominence in the nutraceuticals excipients market on the basis of their functionality as they are projected to hold 64.9% of the market share in 2024.

- By Product Segment Analysis: In 2024, probiotic excipients are projected to claim a significant majority in this segment, comprising 54.2% of the market share based on product, and is projected to show following growth in the upcoming period of 2024 to 2033 as well.

- By Type Segment Analysis: Based on type, natural or organic excipients are expected to dominate this segment as they hold 54.2% of the market share in 2024.

- By End User Segment Analysis: Protein and amino acids are anticipated to hold a dominant position in the nutraceuticals market based on end-users as they hold 34.5% of the market share in 2024.

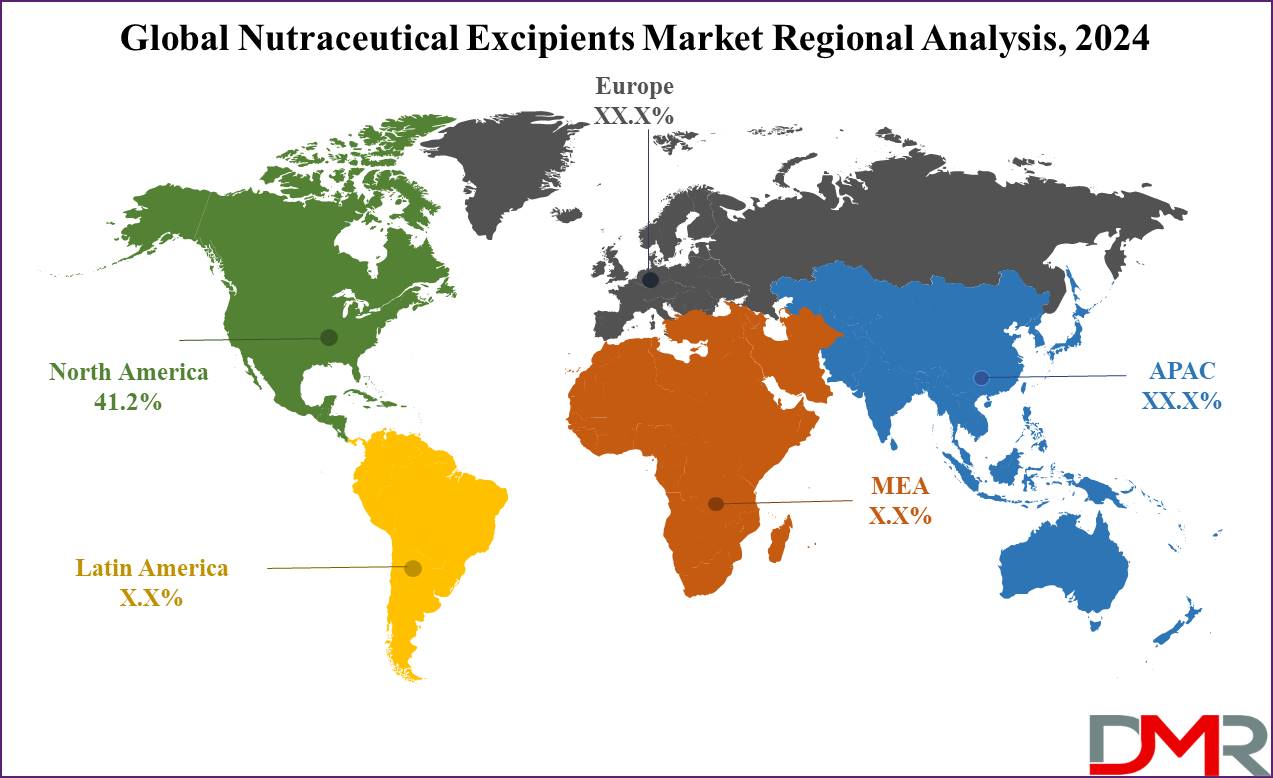

- Regional Analysis: North America is projected to dominate the global nutraceutical excipients market as it holds 42.2% of the market share in 2024.

Use Cases

- Tablet Formulation: Binders and fillers help form stable, uniform tablets by ensuring proper ingredient cohesion and bulk, improving dosage consistency and ease of consumption.

- Capsule Manufacturing: Lubricants and disintegrants enhance the capsule manufacturing process and ensure well-timed release and absorption of active ingredients, optimizing therapeutic effects and consumer experience.

- Functional Food Enhancement: Flavoring and coloring agents improve the flavor and appearance of functional foods and beverages, increasing consumer appeal and marketability whilst delivering health benefits.

- Nutraceutical Powders: Preservatives and anti-caking agents maintain the steadiness and flow properties of nutraceutical powders, extending shelf existence and ensuring uniform dosage all through use.

Market Dynamic

Trends

Increasing Demand for Plant-Based ExcipientsPresently, there is a rapidly increasing demand for nutraceutical excipients of natural origin in the global market. The increasing concerns of consumers towards natural and soy products are the major factors for the growth of this market. Multinational companies in the nutraceutical and pharmaceutical industries are focusing on plant-based excipients to meet this trend, thus improving their competitiveness and product offerings in line with consumers’ healthy lifestyle trends.

Rise of Multifunctional Excipients

Another trend that emerges in the nutraceutical excipients market is that the function of excipients is gradually shifting from single to multiple functions. These emergent excipients increase the utility of nutraceuticals because they improve the stability, solubility, and particle size of the products. This trend is expected to foster market growth because the nutraceutical excipients market would want to provide better excipients that will help in compounding difficult formulations.

Growth Drivers

Rising Demand for Nutraceutical Products

Some of the factors that are helping propel this market include the rising demand for nutraceutical products in the global market. Global customers are acting smarter by investing more in their health and this will lead to increased demand for dietary supplements and nutraceutical products. This trend is expected to follow the same trend during the forecast period hence leading to increased market growth of nutraceutical excipients due to the increasing demand for high-quality and effective products from the manufacturers.

Technological Advancements in Excipients

The emerging technologies associated with the creation of new nutraceutical excipients are also driving the growth of the nutraceutical excipients market. Due to the advanced development of excipients, there are enhanced quality and safety of the nutraceuticals in the market hence making them more attractive. Prominent industry participants such as Ashland Global Holdings are working on research and development to bring newer generations of excipients into the market that is driving the growth of the market.

Growth Opportunities

Expansion in Emerging Markets

The nutraceutical excipients industry reflects the fact that the extant and expected growth opportunities will largely occur in developing markets around the globe. The Asian-Pacific and Latin American regions are economically progressing and are expanding their healthcare expenditure, which will in turn increase the consumption of nutritive products. This can be achieved through increased market penetration and opening up production facilities to support the local demand in nutraceutical excipients markets.

Integration with Advanced TechnologiesThe advancement in technology concerning

artificial intelligence and

machine learning in the designing and manufacturing of excipients presents strong growth prospects. The subsequent technologies in making the excipients render are expected to increase the precision, efficiency, and control of the quality of the excipients as well as the innovation. These technologies are useful and market participants that incorporate them will be in a better position to secure competitive advantage and therefore spur growth of the nutraceutical excipients market.

Restraints

High Initial Investment CostsNew plant construction and the high costs of initial investment constraints are also issues that remain as restraints to the advanced excipients market growth. Smaller to mid-scale nutraceutical excipient suppliers might not be able to fund such investments thereby inhibiting the market’s growth. Overall, complexity escalates costs because specialized tools, equipment, and trained professionals underpin the processes, altering the market’s landscape.

Regulatory and Consumer Skepticism

There are some challenges to the market such as regulatory issues that affect the nutraceutical products due to the poor knowledge of the rural and underdeveloped society. Such regulatory measures and lengthy approval procedures for new excipients may slow product development and innovation, and raise costs. Also, people have some doubts about the efficiency and safety of nutraceutical products, which can influence the consumers’ confidence and sluggish the speed of the new excipients appearing within the market.

Research Scope and Analysis

By Functionality

Blinders have surged to prominence in the nutraceuticals excipients market as they are expected to hold 64.9% of the market share in 2024 and are anticipated to show significant growth in the forthcoming period of 2024 to 2033. Binders dominate the nutraceutical excipients market because of their major role in tablet and capsule formulation. These marketers accounted for the biggest share in the nutraceutical excipients marketplace in 2023, reflecting their significance in ensuring the structural integrity of nutraceutical products. Binders help keep the cohesion of ingredients in nutraceutical products, making them important for product stability and efficacy. The nutraceutical marketplace is witnessing substantial growth within the nutraceutical excipients segment, pushed by using the growing demand for high-quality, reliable products.

Excipients play a crucial function in the pharmaceutical and nutraceutical sectors, with binders being particularly significant. Major corporations in the nutraceutical industry rely on multifunctional binders to improve product performance and consumer satisfaction. The share of the North American nutraceutical excipients market in binders is notably high, reflecting the area's advanced production competencies and consumer trust. However, consumer skepticism associated with nutraceutical products due to rural incorrect information can hinder growth.

The nutraceutical excipients market during the forecast period is expected to peer the continued dominance of binders, with the market size projected to reach USD billions. This dominance is attributed to the binders' ability to release to hold the largest share in nutraceutical formulations, presenting prospects for growth and diversification. The use of excipients with multifunctional properties further drives demand, validating the total size of the marketplace.

By Product

In 2024, probiotics are projected to comprise 54.2% of the market share based on product and are projected to show following growth in the upcoming period of 2024 to 2033. Probiotics dominate this section as they captivate consumers due to the fact probiotics comprise live microorganisms, predominantly beneficial microorganisms, which provide a spectrum of digestive health benefits by fostering a balanced gut microbiota, facilitating improved digestion, and nutrient absorption. Beyond digestive health, probiotics play a pivotal position in helping the immune system, strategically located in the gut, making them a proactive choice for bolstering immune defenses.

Emerging research highlighting the intestine-brain axis underscores probiotics' capability impact on intellectual fitness, influencing neurotransmitter manufacturing and reducing inflammation. The belief in probiotics as a proactive approach to average well-being and disease prevention has in addition propelled their dominance in the wellbeing segment. Consumer consciousness about the importance of preserving a wholesome intestine microbiome has grown exponentially, riding a surge in demand for probiotic products. The availability of probiotics in numerous forms, inclusive of yogurt, kefir, supplements, and fermented foods, caters to numerous possibilities and existence, fostering substantial adoption.

Ongoing research and superb media coverage have contributed to the recognition of probiotics, instilling acceptance as true among clients and encouraging their incorporation into everyday exercises. In precis, the good-sized embrace of probiotics stems from their verified digestive fitness advantages, immune system support, potential mental health advantages, and the escalating reputation of a healthful intestine microbiome's significance, amplified via numerous product services and wonderful press coverage.

By Type

Based on type, natural or organic excipients are projected to dominate this segment as they hold 54.2% of the market share in 2024 and are anticipated to show subsequent growth in the forthcoming period of 2024 to 2033. The prevalence of natural/organic excipients in the nutraceuticals industry is driven by a variety of factors reflecting evolving consumer preferences. A growing demand for clean-label products, characterized by transparency and a perception of greater health benefits, has fueled the dominance of natural/organic excipients. Aligned with broader health and wellness trends, these excipients are perceived as safer and purer, fostering increased consumer trust.

Sustainability considerations and the desire for eco-friendly products further amplify the appeal of natural/organic excipients, often sourced from renewable resources. The avoidance of synthetic additives, regulatory support for natural ingredients, and catering to allergen concerns contribute to the market's shift toward these excipients. Leveraging positive perceptions of authenticity and a connection to nature, companies strategically market and brand products emphasizing the natural and organic attributes of their formulations. Despite the continued use of artificial excipients for specific purposes, the prevailing trend underscores consumers' prioritization of clean, natural, and sustainably sourced options in the nutraceuticals sector.

By End User

Protein and amino acids are projected to hold a dominant position in the nutraceuticals market based on end-users as they hold 34.5% of the market share in 2024. This dominance is propelled by global trends in health and wellness, heightened fitness awareness, and the recognized importance of protein in maintaining a healthy lifestyle. This dominance is particularly evident in the growing emphasis on physical fitness, where protein's role in muscle repair and growth aligns with the demands of fitness enthusiasts. The surge in the sports nutrition sector, driven by athletes and fitness enthusiasts utilizing protein supplements, further contributes to their prominence.

Additionally, the aging population's awareness of muscle health, the appeal of protein for weight management, the rise of plant-based diets, and ongoing innovations in formulations all underscore the extensive applications and versatility of protein and amino acids. The combination of consumer education, diverse applications, and ongoing product innovation cements the enduring dominance of Protein and amino Acids in the nutraceuticals market.

The Nutraceutical Excipients Market Report is segmented on the basis of the following

By Functionality

- Blinder

- Disintegrates

- Fillers & Diluents

- Coating Agent

- Flavoring Agent

- Lubricants

- Other

By Product

- Probiotics

- Prebiotics

- Proteins Amino Acids

By Type

- Artificial

- Natural/Organic

By End User

- Protein & Amino Acids

- Omega 3 Fatty Acids

- Vitamins

- Minerals

- Prebiotics & Probiotics

- Others

Regional Analysis

North America is projected to dominate the global nutraceutical excipients market as it

holds 42.2% of the market share in 2024 and is expected to show subsequent growth in the forthcoming period of 2024 to 2033. North America has established its dominance in the nutraceutical excipients market due to several key factors. The region benefits from a large and mature market with a well-established consumer base that prioritizes health and wellness, leading to a robust demand for nutraceuticals and their excipients. The advanced healthcare infrastructure and stringent regulatory standards contribute to a trustworthy environment for consumers.

Additionally, the presence of major market players, ongoing innovation and research initiatives, and a rising interest in functional foods further solidify North America's position. The region's efficient distribution channels and retail networks also play a vital role in ensuring the widespread availability of nutraceutical products. While North America currently leads, the dynamics of regional dominance can evolve based on changing consumer preferences, regulatory shifts, and emerging market opportunities.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global nutraceuticals excipients market's competitive landscape is shaped by influential factors, including major market players such as DuPont, Ingredion, Kerry Group, Roquette Freres, and BASF. These companies differentiate themselves through continuous product innovation, focusing on developing excipients that enhance the stability, bioavailability, and taste of nutraceutical formulations. Strategic collaborations, adherence to regulatory standards, global distribution networks, and strong customer relationships are crucial elements that contribute to a competitive edge. The ability to expand into new markets and diversify product portfolios, along with cost competitiveness, plays a significant role in navigating the dynamic landscape of the nutraceutical excipients industry. As the industry evolves, staying attuned to market trends and swiftly adapting to regulatory changes remain essential for sustained competitiveness.

Some of the prominent players in the Global Nutraceuticals Excipients Market are:

- BASF SE

- Cargill Inc

- Shin-Etsu Chemical Co Ltd

- Associated British Foods

- Roquette Freres

- Meggle Group Wasser

- Kerry Group PLC

- Fuji Chemical Industries Co Ltd

- PharmatransSanaq AG

- Pioma Chemicals

- Gattefosse

- Ingredion Plc

- Sensient Technologies

- W.R. Grace & Co

- Other Key Players

Recent Development

- In May 2024, BASF expanded its portfolio of natural and plant-based excipients, responding to the growing demand for organic ingredients in nutraceutical products. This expansion supports the market's trend towards cleaner labels and sustainable practices, driving demand for nutraceutical excipients.

- In April 2024, Qiagen announced a partnership with Helix to advance companion diagnostics for hereditary diseases. This collaboration aims to integrate Qiagen's QIAseq NGS technology with Helix’s population genomics expertise, enhancing the development of precise diagnostic tools and driving growth in the nutraceutical excipients market.

- In February 2024, Thermo Fisher Scientific introduced a new suite of NGS analysis software designed to streamline data interpretation and integration into clinical workflows. This advancement addresses the complexity of NGS data and aims to improve the accuracy of genetic testing, benefiting the nutraceutical excipients market by facilitating more precise product formulations.

- In January 2024, Illumina launched a new high-throughput sequencing system aimed at reducing costs and increasing accessibility for clinical research and diagnostics. This development is expected to drive growth within the nutraceutical excipients market by enhancing the adoption of personalized medicine and cancer research applications.

- In February 2022, Kerry Group Plc. marked a pivotal moment in its trajectory by strategically augmenting its capabilities through two substantial biotechnology acquisitions. These include the acquisition of c-LEcta, a trailblazer in precision fermentation, optimized bio-processing, and bio-transformation, and Enmex, a well-established Mexican-based enzyme manufacturer catering to diverse bio-process.

- In September 2022, DFE Pharma, a globally acclaimed leader in pharma- and nutraceutical excipient solutions, proudly unveiled its latest initiative - the "Closer to the Formulator" (C2F) Center of Excellence in Hyderabad, India. This state-of-the-art facility is a testament to DFE Pharma's commitment to advancing pharmaceutical development. The C2F Center of Excellence serves as a dynamic hub, enabling pharmaceutical companies to expedite their journey from conceptualization to finalizing commercial products.