Market Overview

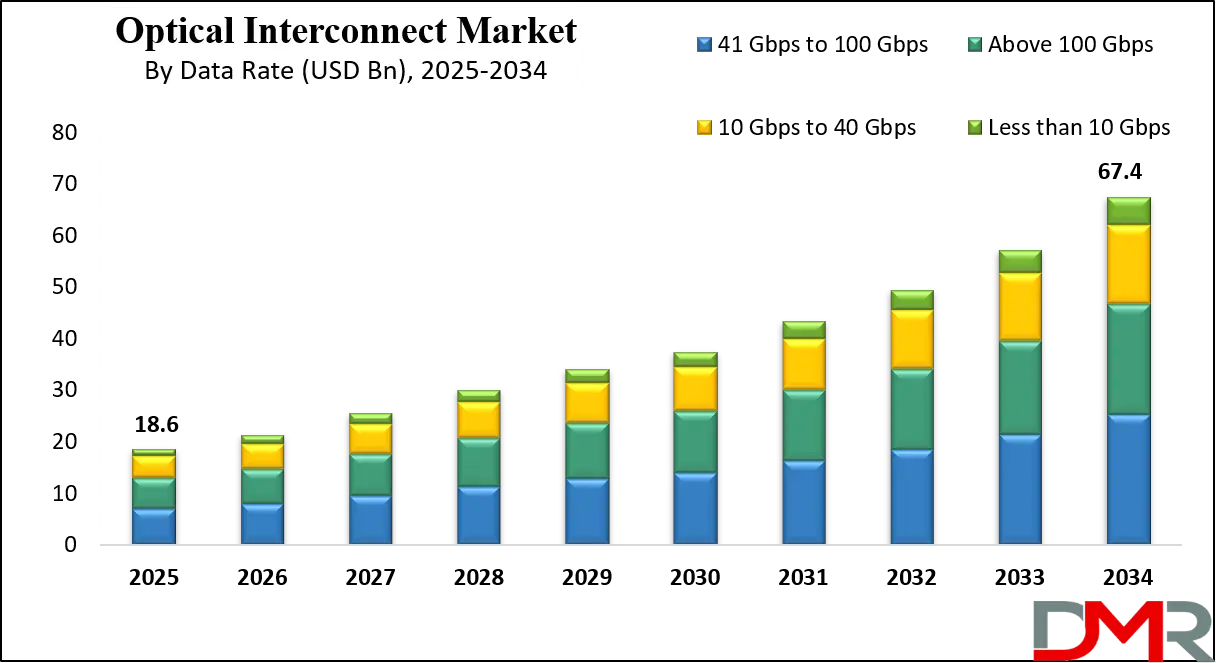

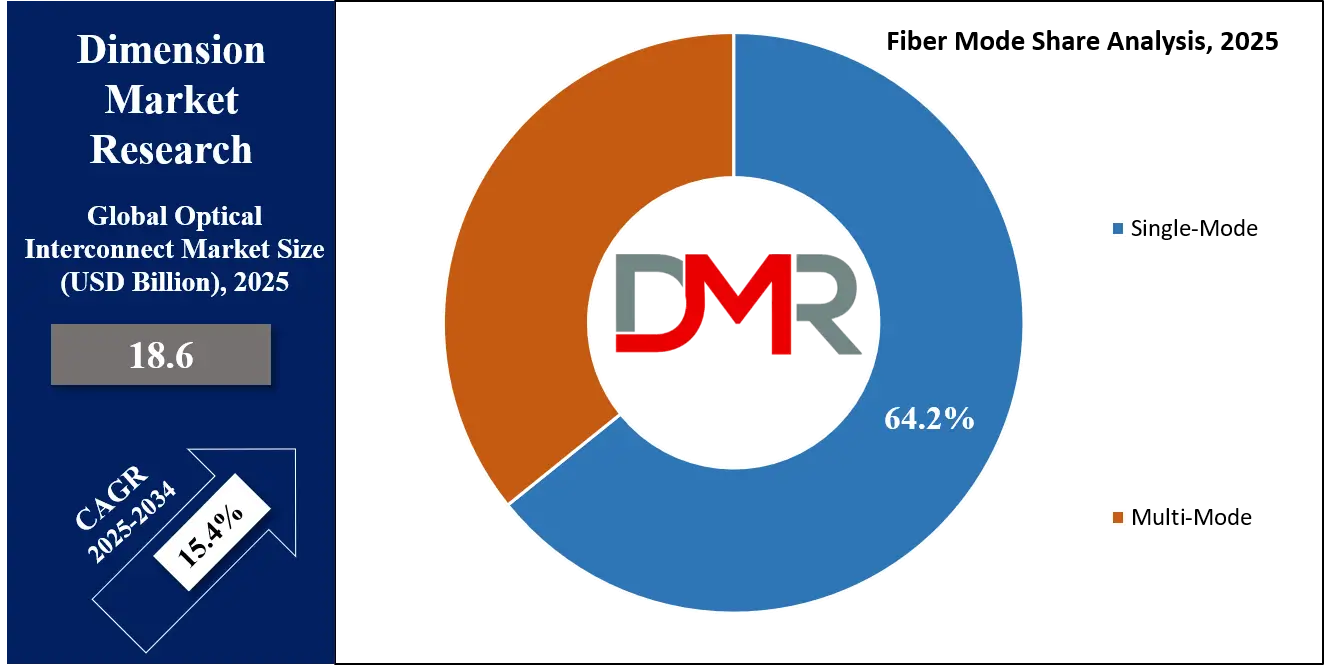

The Global Optical Interconnect Market size is projected to reach USD 18.6 billion in 2025 and grow at compound annual growth rate of 15.4% from there until 2034 to reach a value of USD 67.4 billion.

Optical interconnect refers to the use of light (usually through fiber optics) to transfer data between different parts of a system, such as within or between chips, boards, or systems. Instead of using traditional copper wires, it uses optical fibers, waveguides, or lasers to send information quickly and efficiently. This technology is widely used in data centers, high-performance computing (HPC), and advanced communication systems where fast and high-bandwidth data transfer is necessary.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The demand for optical interconnects has grown sharply due to the rapid expansion of data traffic, cloud services, AI, and

big data processing. As more people and businesses rely on digital services, data centers must handle more data at faster speeds. Traditional copper connections face limitations in speed and energy efficiency, making optical interconnects a better alternative. With emerging technologies like 5G, IoT, and autonomous systems also relying on large-scale data exchange, optical interconnect is becoming a crucial part of modern infrastructure.

One of the major trends is the shift from electrical to optical connections in shorter-range environments, like inside data center racks. Previously, optical links were mainly used for long-distance communication, but now they are being used even at the chip-to-chip level. Another trend is the integration of photonics directly into silicon chips, known as silicon photonics. This helps in reducing costs and improving performance by combining optical and electronic functions in a single chip. The rise in co-packaged optics is also notable, where optical components are packed together with switching chips.

In the past few years, there has been increased investment and partnerships focused on optical interconnect technologies. Major tech companies have started developing in-house solutions using silicon photonics to meet their growing internal data needs. Several start-ups and semiconductor companies are working on next-generation optical engines and pluggable transceivers. Events like the Optical Fiber Communication Conference (OFC) and the European Conference on Optical Communication (ECOC) have highlighted the growing industry focus on optical interconnect advances.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Despite the promise, there are still challenges. Cost is one of the biggest barriers, especially for small-scale applications. Making the shift from traditional systems to optical requires significant changes in design and manufacturing. Handling heat in densely packed optical systems is another technical challenge. Moreover, compatibility between different types of equipment and standardization across the industry are still developing.

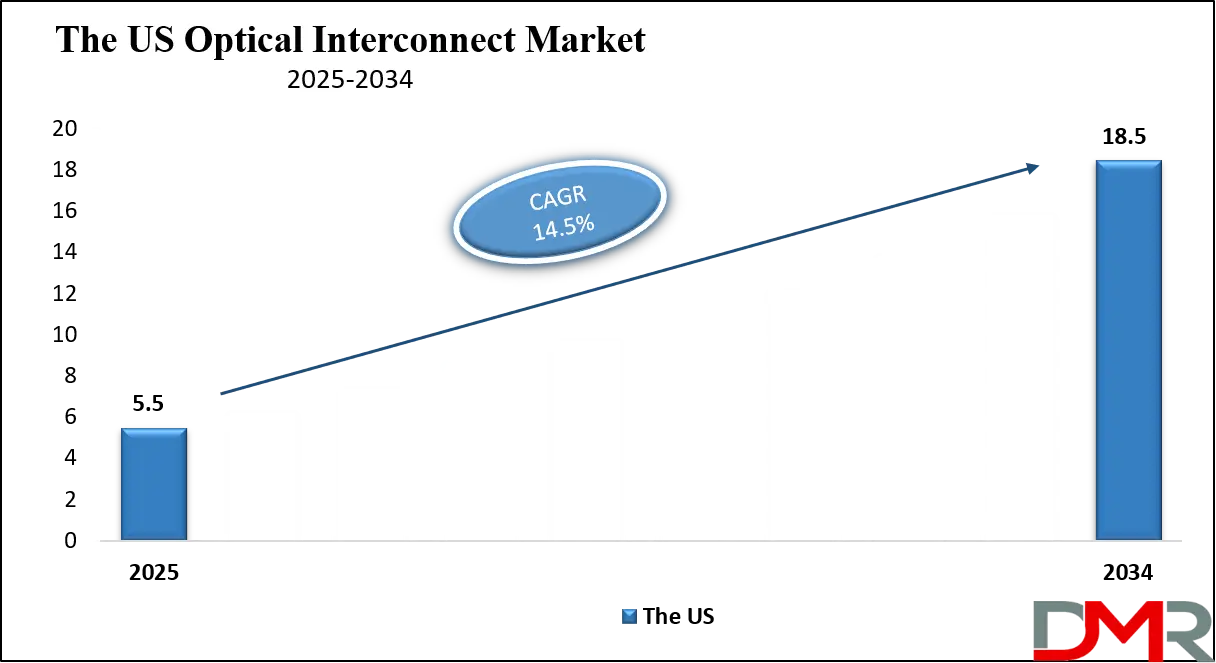

The US Optical Interconnect Market

The US Optical Interconnect Market size is projected to reach USD 5.5 billion in 2025 at a compound annual growth rate of 14.5% over its forecast period.

The US plays a leading role in the optical interconnect market due to its strong presence in advanced technology sectors such as cloud computing, AI, 5G, and high-performance computing. Home to major data center operators, semiconductor firms, and research institutions, the US drives innovation in silicon photonics, co-packaged optics, and integrated optical systems.

The country also supports the market through government-backed R&D initiatives and public-private partnerships focused on next-generation connectivity. With increasing demand for low-latency, high-bandwidth infrastructure, US-based companies are heavily investing in the development and deployment of optical interconnect solutions. This strong ecosystem of innovation, investment, and demand positions the US as a global hub for growth, development, and commercialization in the optical interconnect landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Optical Interconnect Market

Europe Optical Interconnect Market size is projected to reach USD 10.1 billion in 2025 at a compound annual growth rate of 24.9% over its forecast period.

Europe plays a vital role in the optical interconnect market through its focus on research, innovation, and sustainable digital infrastructure. The region is home to several leading research institutions and technology firms working on advanced photonics and optical communication solutions. European Union programs, such as Horizon Europe, support collaborative projects in optical technologies, helping accelerate the development of silicon photonics and next-generation interconnects.

Europe's emphasis on green data centers and energy-efficient technologies further drives the adoption of optical interconnects. The region also benefits from strong demand in sectors like telecom, automotive, and industrial automation, which require high-speed, low-latency data transmission. As digital transformation accelerates across Europe, its role in shaping optical interconnect standards and applications continues to grow.

Japan Optical Interconnect Market

Japan Optical Interconnect Market size is projected to reach USD 2.1 billion in 2025 at a compound annual growth rate of 28.9% over its forecast period.

Japan holds a significant position in the optical interconnect market due to its advanced electronics industry, strong focus on R&D, and early adoption of high-speed communication technologies. The country has been a pioneer in developing optical components, photonics, and precision manufacturing processes, which are essential for high-performance interconnect solutions. Japanese companies actively contribute to innovation in data center connectivity, 5G infrastructure, and next-generation computing systems.

Government support for digital transformation and investment in smart cities and industrial automation further drive demand for optical interconnects. Japan also plays a key role in global standardization efforts, ensuring interoperability and quality in optical technologies. With a strong foundation in technology and innovation, Japan continues to influence the direction and growth of the optical interconnect market.

Optical Interconnect Market: Key Takeaways

- Market Growth: The Optical Interconnect Market size is expected to grow by USD 46.2 billion, at a CAGR of 15.4%, during the forecasted period of 2026 to 2034.

- By Data Rate: The 41 Gbps to 100 Gbps is anticipated to get the majority share of the Optical Interconnect Market in 2025.

- By Fiber Mode: The single-mode segment is expected to get the largest revenue share in 2025 in the Optical Interconnect Market.

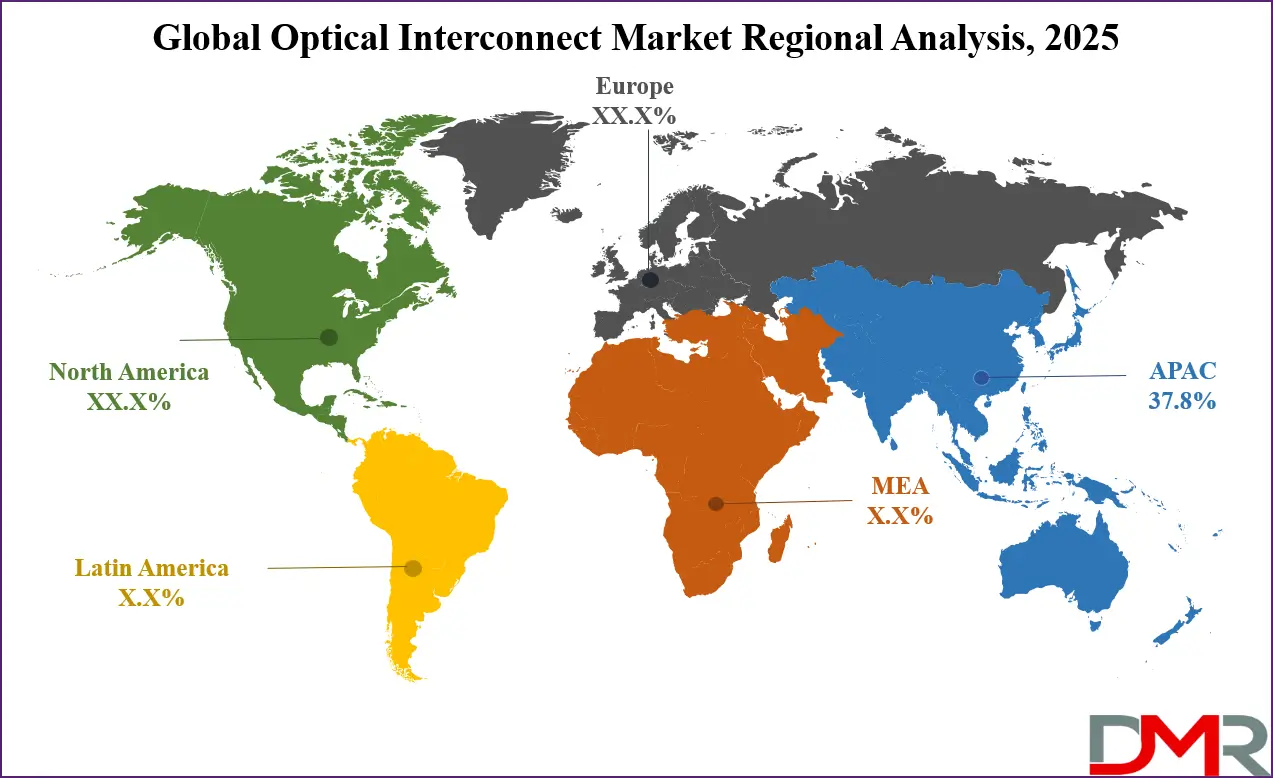

- Regional Insight: Asia Pacific is expected to hold a 37.8% share of revenue in the Global Optical Interconnect Market in 2025.

- Use Cases: Some of the use cases of Optical Interconnect include data centers, 5G Infrastructures, and more.

Optical Interconnect Market: Use Cases

- Data Centers: Optical interconnects are widely used in data centers to connect servers, switches, and storage systems. They help transfer large volumes of data at high speeds with lower power consumption compared to copper. This ensures smooth functioning of cloud services and big data applications.

- High-Performance Computing (HPC): In supercomputers and HPC systems, optical interconnects enable fast data exchange between processors and memory units. They reduce latency and improve bandwidth, which is essential for scientific research, simulations, and complex calculations. This supports faster problem-solving and data analysis.

- 5G Infrastructure: Optical interconnects are important for 5G networks to handle large amounts of data generated by users and connected devices. They support low-latency and high-speed communication between base stations and core networks. This helps deliver reliable and high-performance 5G services.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML systems rely on quick data movement between GPUs, CPUs, and storage units. Optical interconnects help speed up training and inference tasks by offering higher bandwidth. This improves the performance of AI models and reduces processing time.

Stats & Facts

- According to Ericsson:

- Service providers that focus on strong network coverage and quality performance are seen as 5G leaders by 70% of their existing customer base, positioning themselves ahead of competitors in brand trust and satisfaction.

- These quality-led operators are three times more likely to retain their customers and also have 50% more users intending to upgrade to better 5G services, making user loyalty a major growth driver.

- They are nearly twice as likely to see their average revenue per user (ARPU) and mobile service revenues grow by at least 1% year-on-year, showing a direct link between service quality and profitability.

- A successful trial achieved 340 Mbps uplink speed over a live commercial 5G Standalone network using sub-6 GHz frequency, showcasing next-level performance using widely deployable spectrum.

- A world-first long-range achievement of 11.18 km was recorded using millimeter wave spectrum, hitting peak speeds of 1 Gbps, proving that high-band 5G can support extended fixed wireless coverage.

- A 3.6 Gbps data call was delivered using six-component carrier aggregation on sub-6 GHz in a commercial 5G network, setting new standards in speed and spectrum efficiency.

- Mid-band 5G carrier aggregation demonstrated more than 60% better reach than traditional dual connectivity setups, helping service providers improve their field-tested coverage significantly.

- Superior network performance allows operators to better handle the growing demand for mobile data while also increasing monetization potential and strengthening long-term return on infrastructure investments.

- As per OECD (Organisation for Economic Co-operation and Development):

- Fixed Wireless Access (FWA) subscriptions across member countries rose by 17% from June 2023 to June 2024, with Hungary, the United States, and the United Kingdom recording the highest growth.

- FWA plays a much larger role in broadband access in countries like Czechia (39%), Slovak Republic (23%), New Zealand (20%), and Estonia (18.7%), particularly where terrain or infrastructure limits fiber rollout.

- Satellite broadband usage is also rising fast, with a 22.6% increase in subscriptions in the past year, and the United States accounting for nearly three-quarters of all OECD satellite broadband users.

- Total fixed broadband subscriptions reached 504 million by mid-2024, with France, Korea, Switzerland, and Norway leading in penetration per 100 inhabitants, reflecting strong infrastructure development.

- Mobile broadband subscriptions grew to 1.9 billion by June 2024, with Japan and the US leading in penetration rates, showing continued adoption even in highly connected markets.

- Mobile data usage more than doubled over two years, increasing from 8 GB per month in June 2022 to 17 GB in June 2024, driven by expanding 5G networks and heavier app usage.

- Machine-to-machine (M2M) SIM cards rose by 14% in one year, with Sweden and Austria topping the list, largely due to operators registering M2M devices for global service usage.

Market Dynamic

Driving Factors in the Optical Interconnect Market

Rising Data Traffic and Cloud Expansion

The explosive growth of data traffic from video streaming, social media, cloud storage, and enterprise software is a major driver for the optical interconnect market. As more services move online and rely on real-time data exchange, data centers must scale their networks to meet increasing demand. Optical interconnects offer higher bandwidth and faster speeds than traditional copper solutions, making them ideal for modern data infrastructure.

Cloud providers are rapidly upgrading their facilities with optical solutions to reduce latency and support massive data volumes. With edge computing and hybrid cloud models also on the rise, fast and reliable interconnects have become essential. This surge in data usage directly translates to higher demand for optical connectivity. Businesses that depend on quick and seamless data access are accelerating this shift.

Technological Advancements and Adoption of Silicon Photonics

Ongoing innovation in optical technology, especially in silicon photonics, is fueling market growth. Silicon photonics allows optical components to be integrated with electronic circuits, reducing size, power consumption, and manufacturing costs. This makes optical interconnects more practical for a wider range of applications beyond just long-distance communication.

As silicon-based optical systems become more affordable and scalable, industries like AI, 5G, and autonomous vehicles are increasingly adopting them. Co-packaged optics and integrated optical engines are also gaining traction, allowing tighter connections between processors and optics. These advancements are creating new possibilities in system design and network performance. The continued push for more efficient, compact, and high-speed data transfer is making advanced optical interconnects a top priority across industries.

Restraints in the Optical Interconnect Market

High Initial Costs and Complex Integration

One of the main restraints for the optical interconnect market is the high initial cost of deployment and system upgrades. Optical components like transceivers, connectors, and silicon photonics chips are more expensive than traditional copper-based solutions. Additionally, installing and maintaining optical systems requires specialized equipment and expertise, which can increase operational costs. For many small and mid-sized businesses, these expenses can be a barrier to adoption.

Integrating optical interconnects into existing electronic systems also presents design and compatibility challenges. Engineers often need to redesign hardware and adapt infrastructure, which adds time and complexity to implementation. These cost and integration hurdles can slow down widespread market adoption, especially in sectors with tight budgets or legacy systems.

Lack of Standardization and Interoperability Issues

Another significant restraint is the lack of unified standards across optical interconnect technologies. With many companies developing proprietary solutions, it becomes difficult to ensure compatibility between different systems and components. This lack of interoperability creates challenges for organizations that want to mix products from different vendors or scale their systems easily. It can also lead to longer testing and certification times, slowing down deployment.

Furthermore, the rapid pace of innovation sometimes outpaces standard-setting processes, causing confusion in the market. Without clear guidelines and widely adopted standards, integration and long-term support become risky for end users. This uncertainty can discourage investment and slow down adoption, especially in industries that rely on stable, long-term infrastructure planning.

Opportunities in the Optical Interconnect Market

Expansion of AI, Machine Learning, and Edge Computing

The growing adoption of artificial intelligence, machine learning, and edge computing presents a major opportunity for the optical interconnect market. These technologies require massive data movement across multiple processing units, which demands high bandwidth and low latency. Optical interconnects are well-suited to meet these needs, offering faster data transfer and better energy efficiency compared to traditional methods.

As AI and edge applications expand across sectors like healthcare, automotive, finance, and manufacturing, the need for reliable, high-speed connections will grow. Optical solutions can significantly boost the performance of data-intensive applications such as real-time analytics, autonomous systems, and neural network training. This trend opens up new use cases and markets for optical interconnect vendors. Organizations seeking a competitive advantage will increasingly turn to optical technologies.

Emerging Demand from 5G and Next-Gen Telecom Networks

The rollout of 5G and future communication networks presents another significant opportunity for optical interconnect technologies. Telecom infrastructure must handle vast amounts of data with ultra-low latency to support applications like smart cities, IoT, remote healthcare, and autonomous vehicles. Optical interconnects play a key role in linking cell towers, edge nodes, and core data centers to deliver fast and stable connections.

As network operators build out their 5G infrastructure, they require scalable, high-speed solutions that traditional copper wiring cannot support. Optical links provide the backbone needed for dense, high-capacity telecom networks. Additionally, with future technologies like 6G already in early research stages, long-term demand for advanced optical systems is expected to rise. This creates ongoing growth potential for suppliers and developers of optical interconnects.

Trends in the Optical Interconnect Market

Silicon Photonics and Co‑Packaged Optics Are Rewriting Network Design

Today, there's a clear shift toward embedding optical components directly into network hardware, such as switches and AI accelerators. Co‑packaged optics (CPO) now integrates lasers and silicon photonics directly on switch chips to deliver ultra‑fast speeds (400 G, 800 G, and beyond) while cutting energy use and improving signal integrity. This evolution supports massive AI workloads and hyperscale data centers, enabling one terabit‑plus per port configurations and simplifying infrastructure design by reducing reliance on pluggable modules. These advances are redefining how data centers scale and operate, making optical design central to future networking architectures.

Breakthroughs in Silicon Photonic Chip Tech and Ultra‑High Density Modules

Research breakthroughs are accelerating optical interconnect capabilities, especially in silicon photonics. For example, a newly developed silicon photonic multiplexer chip reportedly achieves transmission rates of up to 38 Tbps using light instead of electronics. Other innovations include microring‑based coherent transmitters capable of compact, energy‑efficient, high‑speed links using advanced modulation formats like QAM‑16. These developments promise unprecedented bandwidth in chip‑level and inter‑chip communication. As these technologies mature, they will enable more efficient, high‑density interconnects across next‑generation AI, HPC, and telecom systems.

Impact of Artificial Intelligence in Optical Interconnect Market

- Accelerated Demand for High-Speed Data Transfer: AI applications such as deep learning and real-time analytics require rapid movement of large datasets across multiple processors. This drives demand for high-bandwidth, low-latency optical interconnects to support AI workloads in data centers and HPC environments.

- Optimization of Network Performance: AI algorithms are increasingly used to monitor, manage, and optimize optical networks. They help predict traffic patterns, detect faults, and dynamically adjust bandwidth allocation, improving the efficiency and reliability of optical interconnect systems.

- Development of AI-Specific Interconnect Solutions: The rise of AI hardware like GPUs, TPUs, and AI accelerators has led to the development of specialized optical interconnect solutions designed for chip-to-chip and board-to-board communication in AI infrastructure.

- Support for Co-Packaged Optics and Photonic Integration: AI enables better design and simulation of complex optical components, speeding up innovations in co-packaged optics and silicon photonics. These advancements improve interconnect density and reduce power consumption.

- Enabling Edge AI and Smart Devices: As AI moves toward the edge—powering smart factories, vehicles, and devices—optical interconnects play a key role in enabling high-speed local data transfer, supporting real-time processing and decision-making in edge computing environments.

Research Scope and Analysis

By Product Type Analysis

Cable assemblies are expected to be leading in 2025 with a share of 38.7%, playing a vital role in the growth of the optical interconnect market. These assemblies are essential for ensuring secure, high-speed connections across servers, storage systems, and networking equipment. As data centers, telecom infrastructure, and cloud platforms grow, the demand for reliable and flexible cable assemblies increases. They support short- and mid-range transmission with minimal signal loss and easy integration into existing setups. The rising adoption of high-bandwidth applications, edge computing, and AI workloads further boosts the need for strong connectivity.

Their durability, ease of installation, and compatibility with transceivers and optical engines make them a preferred choice in both enterprise and hyperscale environments. Cable assemblies also help simplify complex network configurations, reducing downtime and enhancing performance. Their growing use across IT, telecom, and industrial automation sectors adds to their importance in the evolving optical ecosystem.

Silicon photonics is set to witness significant growth over the forecast period, becoming a game-changer in the optical interconnect market. This product type enables the integration of optical components into silicon chips, making systems smaller, faster, and more power-efficient. With the rise of cloud computing, machine learning, and data-heavy applications, demand for low-latency, high-speed communication is soaring. Silicon photonics helps meet these needs by offering compact, scalable, and cost-effective interconnect solutions.

As network speeds increase to 800G and beyond, traditional electrical methods struggle to keep up, making silicon photonics a critical technology. Its application in optical transceivers, co-packaged optics, and chip-to-chip communication is expanding rapidly. The growing interest in next-generation data center architectures, AI accelerators, and 5G backhaul also supports its adoption. Ongoing R&D and manufacturing improvements are making silicon photonics more accessible, positioning it as a core component in the future of high-speed optical networking.

By Data Rate Analysis

41 Gbps to 100 Gbps data rate is expected to be leading in 2025 with a share of 37.3%, driving major advancements in the optical interconnect market. This range supports high-performance connectivity across cloud platforms, enterprise networks, and hyperscale data centers. It balances speed, cost, and power efficiency, making it ideal for current-generation data processing needs. As data usage continues to grow with video streaming, IoT devices, and AI applications, this data rate helps manage large volumes with stable, fast communication.

It also enables smooth system upgrades from legacy bandwidths without the complexity of higher-end solutions. Widely used in switches, transceivers, and server links, the 41–100 Gbps range plays a key role in modernizing infrastructure. With its ability to deliver reliable and scalable performance across various sectors, it remains a preferred choice in expanding digital ecosystems that demand mid-to-high-speed transmission.

Above 100 Gbps data rate is on track for significant growth over the forecast period as industries push for faster and more powerful connectivity. This segment supports next-generation applications like AI model training, real-time analytics, and large-scale simulation that require ultra-high bandwidth and low latency. It plays a critical role in high-density data centers, advanced HPC systems, and emerging technologies such as 800G and beyond.

As demand rises for faster interconnects between switches, processors, and memory systems, above 100 Gbps solutions are being adopted to keep pace. They offer superior data throughput, reducing bottlenecks and improving system efficiency. With growing interest in co-packaged optics, chip-to-chip communication, and cloud-native architectures, this segment becomes vital for future-ready networks. Investments in R&D and photonic integration are also making ultra-high-speed solutions more accessible, further boosting their adoption in performance-critical environments.

By Fiber Mode Analysis

Single-mode fiber is projected to be leading in 2025 with a share of 64.2%, playing a central role in the growth of the optical interconnect market. Known for its ability to carry data over long distances with minimal loss and high bandwidth, single-mode fiber is widely used in large-scale data centers, telecom networks, and long-haul connections. Its low signal interference and superior performance make it ideal for supporting 5G backhaul, AI systems, and cloud computing infrastructure.

As organizations scale their digital operations and demand more efficient, high-speed connections, single-mode fiber provides the needed reliability and speed. It supports ultra-fast transceivers and advanced optical engines, helping reduce latency and maintain network integrity. With continuous upgrades in network architecture and growing emphasis on high-capacity communication, single-mode fiber is becoming essential in building future-ready, high-density, and energy-efficient data environments across the globe.

Multi-mode fiber continues to show significant growth over the forecast period due to its key role in short-distance, high-speed connections across enterprise networks and localized data centers. It is commonly used in environments where cost-efficiency and easy installation are priorities, such as campus networks, small data facilities, and industrial setups. Multi-mode fiber supports quick deployment and works well with VCSEL-based transceivers, reducing overall infrastructure expenses.

As demand rises for compact networking in edge computing and in-building systems, multi-mode solutions provide a practical balance between performance and affordability. This fiber type supports high data transfer rates while simplifying maintenance and integration with existing systems. With growing adoption of digital tools in education, healthcare, and smart buildings, multi-mode fiber remains a preferred solution for boosting bandwidth without the complexity of long-haul optical systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Data communication is anticipated to be leading in 2025 with a share of 47.1%, playing a key role in driving the growth of the optical interconnect market. As demand for faster and more reliable communication increases, especially in cloud services, data centers, and enterprise networks, optical interconnects help meet these needs by enabling high-speed, low-latency data transfer. The rise of remote work, video conferencing, big data, and AI applications has further pushed the need for efficient data communication systems.

Optical solutions offer better performance over longer distances, lower power usage, and reduced interference compared to traditional copper-based systems. Their use in switches, servers, and routers ensures smooth and secure data flow. As digital traffic continues to surge globally, especially in hyperscale environments, data communication remains a major area of application, ensuring stability, speed, and scalability for modern and future-ready infrastructure.

Automotive applications are set to witness significant growth over the forecast period as vehicles become increasingly connected, autonomous, and software-driven. Optical interconnects are being used in advanced driver-assistance systems (ADAS), infotainment platforms, and real-time sensor communication. As cars generate and process more data in real time, they require fast, reliable, and interference-free internal networks, which optical links can support effectively.

The push toward electric and self-driving vehicles demands robust in-vehicle data communication, and optical technologies help reduce electromagnetic interference while offering lightweight and flexible installation options. Automakers are also adopting optical solutions to manage high-bandwidth needs across multiple vehicle systems, from cameras to navigation units. This makes optical interconnects an important enabler of smarter and safer mobility, as the automotive sector transforms rapidly through technology integration.

The Optical Interconnect Market Report is segmented on the basis of the following:

By Product Type

- Cable Assemblies

- Indoor Cable Assemblies

- Outdoor Cable Assemblies

- Active Optical Cables (AOC)

- Passive Optical Cables (POC)

- Connectors

- Optical Transceivers

- Free Space Optics

- Silicon Photonics

By Data Rate

- Less than 10 Gbps

- 10 Gbps to 40 Gbps

- 41 Gbps to 100 Gbps

- Above 100 Gbps

By Fiber Mode

- Single-Mode Fiber

- Multi-Mode Fiber

By Application

- Data Communication

- Data Centers

- High-Performance Computing (HPC)

- Telecommunication

- Long Haul

- Metro

- Access Networks

- Military & Aerospace

- Automotive

- Medical

- Consumer Electronics

Regional Analysis

Leading Region in the Optical Interconnect Market

Asia Pacific, leading in 2025 with a share of 37.8%, plays a crucial role in the growth of the optical interconnect market due to its expanding digital economy, large-scale data center development, and strong presence of electronics and semiconductor manufacturing. Countries like China, Japan, South Korea, and India are heavily investing in high-speed internet infrastructure, 5G networks, and advanced computing systems, all of which rely on fast and efficient data transfer.

Rapid urbanization, growing cloud adoption, and the increasing use of artificial intelligence and IoT are further fueling the demand for optical interconnect solutions. The region also benefits from government initiatives supporting digital transformation and local production of photonics and connectivity components. With a rising need for low-latency, high-bandwidth communication across industries, the Asia Pacific optical interconnect market is expanding quickly. The presence of key suppliers, rising internet penetration, and increasing investments in smart technologies are expected to keep the region at the forefront of global market growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Optical Interconnect Market

Europe shows significant growth over the forecast period in the optical interconnect market, supported by rising demand for high-speed connectivity, green data centers, and advanced computing systems. The region benefits from strong investments in fiber optics, photonics, and silicon-based optical technologies, driven by digital transformation across industries.

Countries like Germany, France, and the UK are focusing on building energy-efficient data infrastructure and expanding 5G networks, both of which rely heavily on optical communication. Research institutions and tech firms across Europe are also working on optical transceivers and integrated photonic circuits. With continued focus on smart cities, AI, and industrial automation, Europe strengthens its role in driving optical interconnect adoption.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The optical interconnect market is becoming more competitive as demand grows for faster, more efficient data transfer across industries like cloud computing, telecommunications, and high-performance computing. Many companies are focusing on developing advanced solutions such as silicon photonics, co-packaged optics, and high-speed optical engines to meet rising bandwidth needs. The market includes a mix of established players and new innovators working on improving performance while lowering costs.

Partnerships, product launches, and research investments are common as companies try to stay ahead. With rapid changes in technology and strong demand from data-heavy sectors, competition is intense. Players are also working to improve energy efficiency, miniaturization, and integration with existing systems to gain an edge in this fast-evolving market.

Some of the prominent players in the global Optical Interconnect are:

- Broadcom Inc.

- Intel Corporation

- Cisco Systems, Inc.

- II-VI Incorporated (now Coherent Corp.)

- Fujitsu Limited

- Mellanox Technologies (NVIDIA Corporation)

- Finisar Corporation (acquired by II-VI)

- Lumentum Holdings Inc.

- Ciena Corporation

- Corning Incorporated

- Fujikura Ltd.

- Sumitomo Electric Industries, Ltd.

- Amphenol Corporation

- TE Connectivity

- HUBER+SUHNER

- OFS Fitel, LLC (a Furukawa Company)

- NeoPhotonics Corporation

- Keysight Technologies

- Infinera Corporation

- ADVA Optical Networking

- Other Key Players

Recent Developments

- In June 2025, PCI-SIG® announced a new revision to its optical interconnect specification, introducing the Optical Aware Retimer Engineering Change Notice (ECN) to enhance PCI Express® (PCIe®) performance. This update to the PCIe 6.4 and upcoming PCIe 7.0 specifications introduces the first industry-standard method for deploying PCIe over optical fiber using a retimer-based solution. According to PCI-SIG President Al Yanes, this modular optical advancement is expected to see initial adoption in data centers for AI/ML and cloud applications, with broader use cases anticipated as PCIe over optics becomes mainstream.

- In May 2025, Broadcom Inc. launched its third-generation co-packaged optics (CPO) product line, delivering 200G per lane (200G/lane) technology. Alongside this milestone, the company showcased progress in its second-generation 100G/lane CPO solutions, emphasizing advancements in thermal design, OSAT processes, fiber routing, handling, and manufacturing yield. These developments reflect the growing maturity of Broadcom’s CPO ecosystem. Supported by a growing list of industry partners, Broadcom’s platform is positioned to meet the high-performance demands of AI scale-out and scale-up deployments in large-scale environments.

- In April 2025, Ayar Labs has launched the first Universal Chiplet Interconnect Express (UCIe) optical interconnect chiplet, delivering 8 Tbps bandwidth to enhance AI system performance while reducing latency and power use. Featuring an integrated UCIe electrical interface, the chiplet removes data bottlenecks and ensures compatibility with chiplets from multiple vendors. The TeraPHY optical I/O chiplet, powered by Ayar Labs’ 16-wavelength SuperNova light source, integrates easily into chip designs. By combining silicon photonics with CMOS processes, Ayar Labs supports efficient chip-to-chip communication across scalable AI architectures.

- In March 2025, Molex introduced its VersaBeam Expanded Beam Optical (EBO) Interconnect Solutions, designed for hyperscale data centers, cloud, and edge computing, which features high-density fiber connectors using the 3M™ EBO Ferrule, which expands the light beam to reduce dust sensitivity and minimize the need for cleaning and maintenance. VersaBeam EBO enables faster, simpler deployments with fewer connections required. With a one-click setup and no special skills needed, organizations can quickly achieve scalable, reliable fiber connectivity with improved performance and reduced installation complexity.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 18.6 Bn |

| Forecast Value (2034) |

USD 67.4 Bn |

| CAGR (2025–2034) |

15.4% |

| The US Market Size (2025) |

USD 5.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Cable Assemblies, Connectors, Optical Transceivers, Free Space Optics, and Silicon Photonics), By Data Rate (Less than 10 Gbps, 10 Gbps to 40 Gbps, 41 Gbps to 100 Gbps, and Above 100 Gbps), By Fiber Mode (Single-Mode Fiber and Multi-Mode Fiber), By Application (Data Communication, Telecommunication, Military & Aerospace, Automotive, Medical, and Consumer Electronics) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Broadcom Inc., Intel Corporation, Cisco Systems, Inc., II-VI Incorporated (now Coherent Corp.), Fujitsu Limited, Mellanox Technologies (NVIDIA Corporation), Finisar Corporation (acquired by II-VI), Lumentum Holdings Inc., Ciena Corporation, Corning Incorporated, Fujikura Ltd., Sumitomo Electric Industries, Ltd., Amphenol Corporation, TE Connectivity, HUBER+SUHNER, OFS Fitel, LLC, NeoPhotonics Corporation, Keysight Technologies, Infinera Corporation, ADVA Optical Networking, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Optical Interconnect Market?

▾ The Global Optical Interconnect Market size is expected to reach a value of USD 18.6 billion in 2025 and is expected to reach USD 67.4 billion by the end of 2034.

Which region accounted for the largest Global Optical Interconnect Market?

▾ Asia Pacific is expected to have the largest market share in the Global Optical Interconnect Market, with a share of about 37.8% in 2025.

How big is the Optical Interconnect Market in the US?

▾ The Optical Interconnect Market in the US is expected to reach USD 5.5 billion in 2025.

Who are the key Optical Interconnect Market?

▾ Some of the major key players in the Global Optical Interconnect Market are Broadcom Inc., Intel Corporation, Cisco Systems, and others

What is the growth rate in the Global Optical Interconnect Market?

▾ The market is growing at a CAGR of 15.4 percent over the forecasted period.