Market Overview

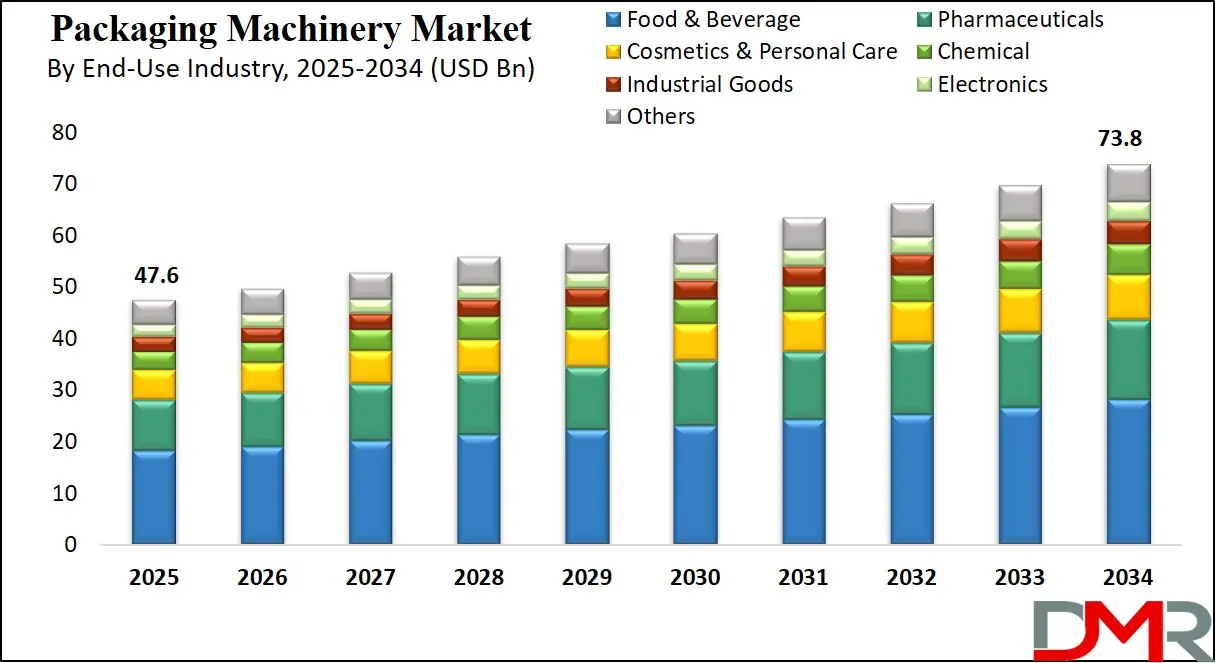

The global packaging machinery market is projected to reach USD 47.6 billion in 2025 and is expected to grow to USD 73.8 billion by 2034, expanding at a CAGR of 5.0% during the forecast period. Growth is driven by rising demand for automated packaging systems, growing adoption of smart packaging technologies, and expanding applications across food & beverage, pharmaceuticals, and e-commerce sectors.

Packaging machinery refers to the broad range of mechanical devices and systems used to complete the packaging process of various products across different industries. These machines are designed to handle functions such as filling, wrapping, sealing, labeling, coding, strapping, palletizing, and bundling of goods into primary, secondary, or tertiary packaging. Their main purpose is to protect the integrity of the product, ensure hygiene, and enhance convenience and shelf appeal.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

From compact tabletop units for small businesses to highly automated, high-speed lines for large-scale production, packaging machines vary significantly in scale and sophistication. With the integration of robotics, smart sensors, and IoT technologies, modern packaging machinery also offers real-time monitoring, predictive maintenance, and improved operational efficiency.

The global packaging machinery market represents a dynamic segment of the industrial automation landscape, driven by the growing demand for packaged goods across food and beverage, pharmaceuticals, personal care, and chemical sectors. The market’s growth is strongly influenced by rising consumer expectations for convenience, longer shelf life, and product safety, as well as stricter regulatory compliance for labeling and traceability.

As manufacturers shift toward eco-friendly materials and more sustainable packaging formats, there is an accelerating demand for machines that can handle biodegradable films, recyclable containers, and lightweight packaging without compromising speed or precision. In parallel, digital transformation is reshaping production lines, prompting companies to invest in intelligent, connected machinery that supports smart packaging practices.

Another key driver of market expansion is the growing emphasis on customization and flexibility. With shorter product lifecycles and frequent SKU changes, manufacturers require packaging solutions that offer fast changeovers, modular design, and compatibility with diverse container types. Regional growth trends are especially strong in Asia-Pacific, where rapid industrialization and rising disposable income levels are fueling consumption and investments in automation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Meanwhile, Europe and North America are witnessing upgrades to existing systems, focusing on integrating Industry 4.0 features for traceability, energy efficiency, and data analytics. Overall, the packaging machinery market is transitioning from conventional, task-specific equipment to highly adaptive, multifunctional systems capable of meeting the evolving needs of a digitized, sustainability-focused global supply chain.

The US Packaging Machinery Market

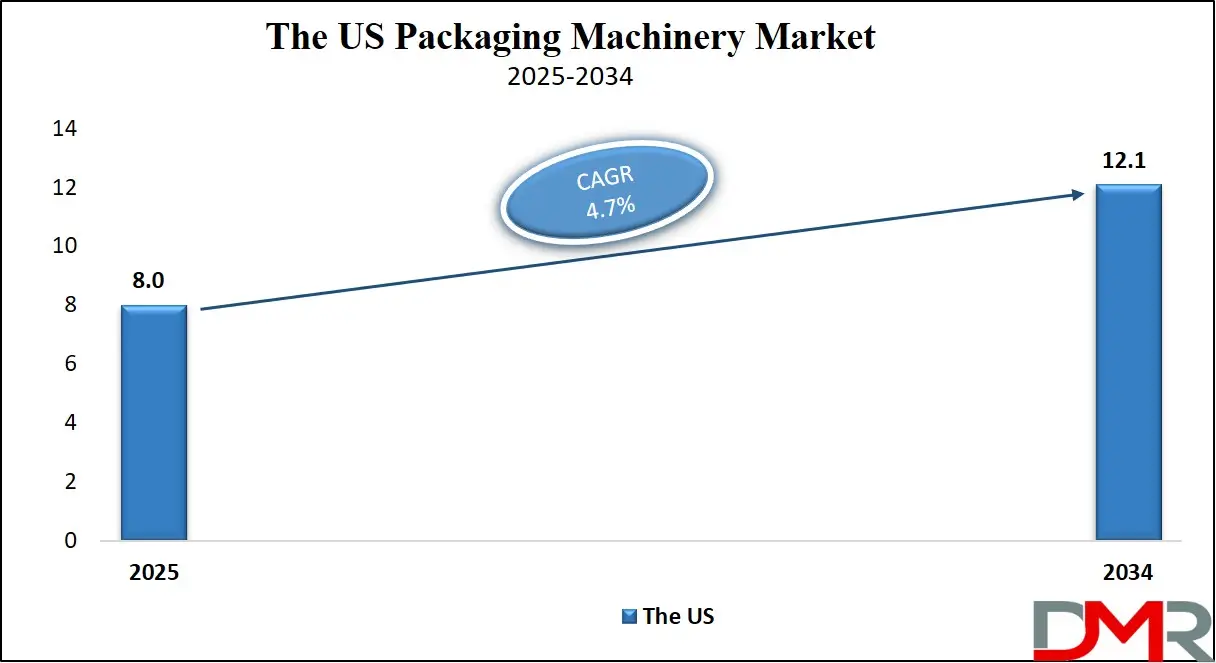

The U.S. Packaging Machinery Market size is projected to be valued at USD 8.0 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 12.1 billion in 2034 at a CAGR of 4.7%.

The U.S. packaging machinery market is witnessing robust advancement, fueled by growing automation across manufacturing sectors and rising demand for innovative, flexible packaging solutions. As consumer preferences shift toward convenience, single-serve, and sustainable formats, American manufacturers prioritize investments in next-generation equipment that offers faster changeovers, improved energy efficiency, and greater compatibility with eco-friendly materials.

Additionally, the growth of the e-commerce and direct-to-consumer (DTC) landscape has pushed companies to adopt intelligent packaging machinery that can handle high-speed order fulfillment while ensuring product safety and traceability. The integration of Industry 4.0 technologies, including IoT sensors, robotics, and machine learning, has further transformed packaging operations by enabling predictive maintenance, real-time data analytics, and remote monitoring.

Furthermore, sectors such as pharmaceuticals, personal care, and processed food are driving innovation in automated filling, labeling, and sealing machines within the U.S. market. Stringent FDA regulations around product labeling, hygiene, and serialization have led to the widespread adoption of track-and-trace packaging systems and tamper-evident solutions. Meanwhile, small and mid-sized enterprises (SMEs) opt for modular and semi-automatic machinery that allows scalability without high upfront capital expenditure.

The presence of a mature manufacturing ecosystem, combined with ongoing R&D and a focus on sustainable packaging technologies, positions the U.S. as a leading innovator in the global packaging machinery industry. Emerging trends like smart labeling, biodegradable packaging formats, and high-speed robotics are expected to further define the future of packaging automation across the American landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Packaging Machinery Market

In 2025, Europe is projected to account for USD 12.3 billion in the global packaging machinery market, securing a substantial 26.4 percent share of total market revenue. This strong position is largely attributed to the region's advanced industrial infrastructure, stringent regulatory standards, and strong presence of leading packaging machinery manufacturers.

Countries such as Germany, Italy, and Switzerland serve as key innovation hubs, offering high-performance solutions tailored for the food and beverage, pharmaceutical, and cosmetics sectors. European manufacturers are widely recognized for their focus on precision engineering, energy efficiency, and compliance with sustainability norms, which has positioned the region as a global leader in high-end packaging technologies.

The market in Europe is expected to grow at a CAGR of 4.3% from 2025 to 2034, driven by the continued demand for automation, smart packaging systems, and eco-friendly machinery. With the rise of Industry 4.0 across manufacturing sectors, European packaging equipment is being integrated with AI, IoT, and robotics to enhance production efficiency and reduce downtime.

Additionally, consumer preferences are shifting toward recyclable and biodegradable packaging, pushing machinery providers to innovate in terms of material compatibility and flexibility. The strong export orientation of European packaging machinery companies, particularly to Asia and North America, further reinforces the region’s global influence and long-term growth potential.

The Japanese Packaging Machinery Market

Japan is anticipated to contribute USD 3.5 billion to the global packaging machinery market in 2025, reflecting a notable share driven by its reputation for precision engineering and innovation. The country is known for its compact, high-speed, and multifunctional packaging systems that cater to space-constrained production environments, making it particularly influential in industries such as pharmaceuticals, electronics, cosmetics, and processed foods.

Japanese manufacturers are also recognized for their emphasis on automation, durability, and energy efficiency, which aligns with the growing demand for smart manufacturing solutions both domestically and in international markets. The strong culture of quality control and regulatory compliance further enhances the reliability and appeal of Japanese packaging machinery across global supply chains.

Over the forecast period, Japan’s packaging machinery market is expected to expand at a CAGR of 3.6%, supported by a steady rise in demand for packaged consumer goods, an aging population driving growth in the pharmaceutical sector, and a national focus on productivity through automation.

Additionally, Japan is investing in sustainable packaging technologies and machinery capable of handling eco-friendly materials, responding to both regulatory pressure and changing consumer behavior. The country’s export-oriented manufacturing sector and emphasis on robotics and AI integration into packaging lines will also play a pivotal role in shaping the market’s future growth and reinforcing its competitiveness on the global stage.

Global Packaging Machinery Market: Key Takeaways

- Market Value: The global packaging machinery market size is expected to reach a value of USD 73.8 billion by 2034 from a base value of USD 47.6 billion in 2025 at a CAGR of 5.0%.

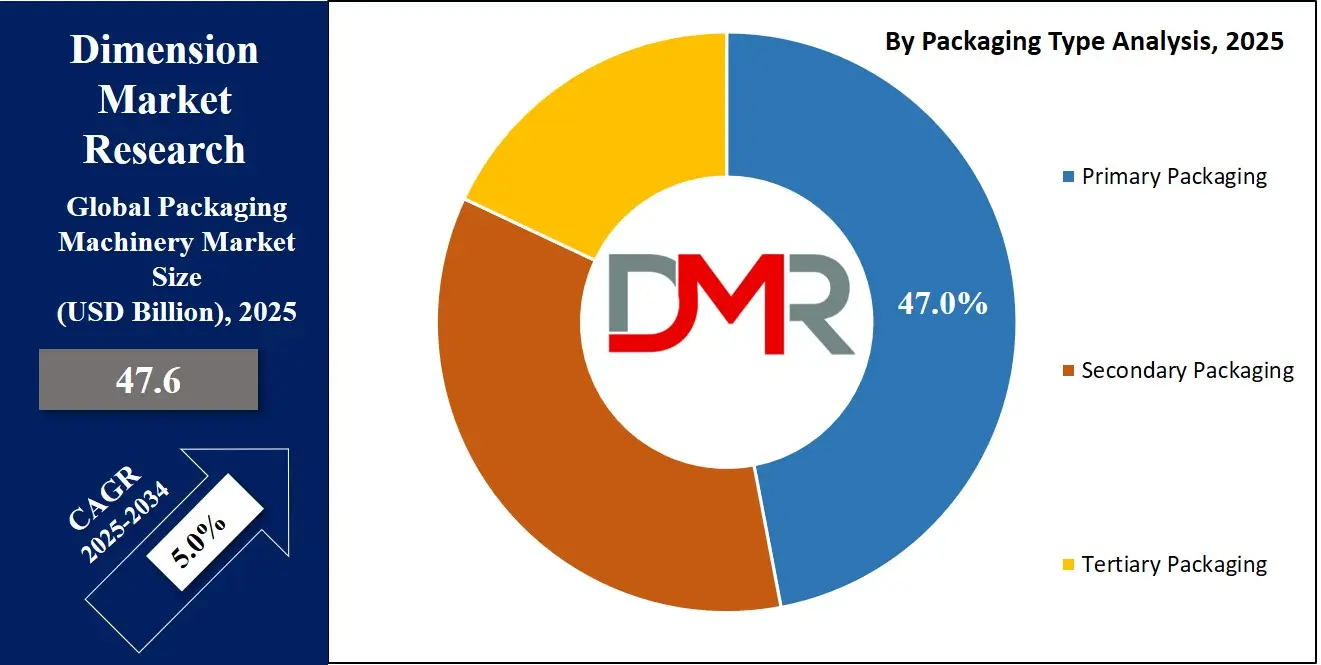

- By Packaging Type Segment Analysis: Primary Packaging is anticipated to dominate the packaging type segment, capturing 47.0% of the total market share in 2025.

- By Machine Type Segment Analysis: Filling Machines are poised to consolidate their dominance in the machine type segment, capturing 24.0% of the total market share in 2025.

- By Automation Type Segment Analysis: Fully Automatic is expected to maintain its dominance in the automation type segment, capturing 55.0% of the total market share in 2025.

- By Packaging Material Segment Analysis: Plastics will lead in the packaging material segment, capturing 48.0% of the market share in 2025.

- By End-User Industry Segment Analysis: Food & Beverage will lead the end-user industry segment, capturing 38.0% of the market share in 2025.

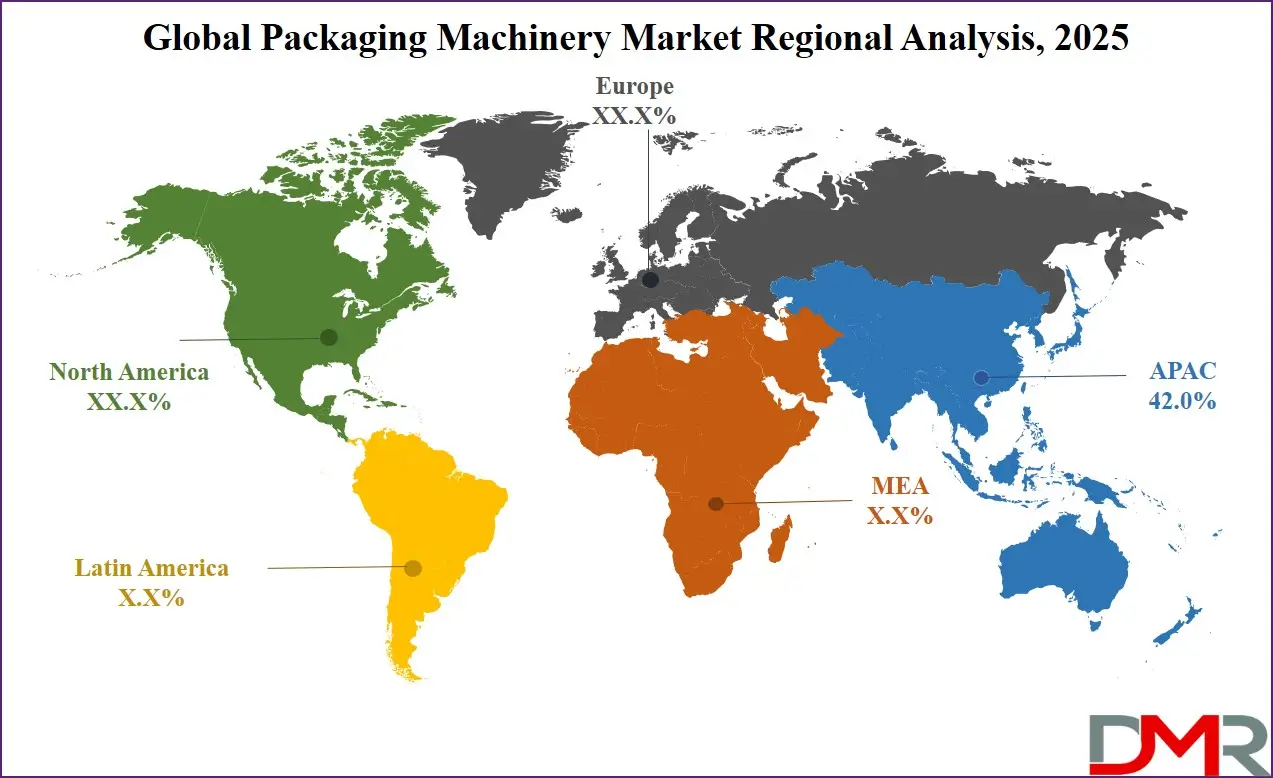

- Regional Analysis: Asia Pacific is anticipated to lead the global packaging machinery market landscape with 42.0% of total global market revenue in 2025.

- Key Players: Some key players in the global packaging machinery market are Krones AG, Tetra Pak, Syntegon Technology GmbH, Coesia S.p.A., ProMach Inc., IMA Group, SIG Combibloc, Barry-Wehmiller, GEA Group, Ishida Co., Marchesini Group, and Other Key Players.

Global Packaging Machinery Market: Use Cases

Food & Beverage Industry

- Scaling with Automation: In the food and beverage sector, packaging machinery is essential for ensuring hygiene, efficiency, and product consistency across high-volume production lines. Companies utilize form-fill-seal machines, automated fillers, and labeling systems to handle a wide range of products, from dairy and snacks to beverages, while adapting quickly to different SKUs. These machines help meet the rising demand for single-serve formats and sustainable packaging, with smart sensors and IoT integration improving line monitoring, waste reduction, and overall throughput.

Pharmaceutical Industry

- Compliance and Precision: Pharmaceutical companies depend on advanced packaging machinery for accurate dosing, tamper-evident sealing, and regulatory compliance. Automated blister packers, vial fillers, and labeling machines equipped with serialization capabilities enable end-to-end traceability and reduce the risk of counterfeiting. These systems not only ensure patient safety but also streamline packaging in sterile environments, meeting global standards for quality and safety with minimal human intervention.

E-Commerce and Logistics

- Rapid, Flexible Packaging: In e-commerce and logistics, packaging machinery helps streamline fulfillment by automating repetitive tasks like box forming, sealing, and labeling. Warehouses use case erectors, automated baggers, and robotic palletizers to handle diverse product sizes and reduce order turnaround times. This improves operational efficiency, minimizes material waste, and ensures safe last-mile delivery, especially important in a market where speed and package integrity are critical.

Personal Care & Cosmetics

- Aesthetic and Functional Solutions: The personal care and cosmetics industry uses packaging machinery to deliver visually appealing and functionally secure packaging for a wide range of products, including creams, serums, and aerosols. Machines with precise filling, capping, and labeling capabilities support high-speed production while ensuring that design elements like shape, texture, and branding remain intact. Rapid changeover features allow brands to respond quickly to seasonal trends and product customization demands.

Global Packaging Machinery Market: Stats & Facts

United States (EPA & FDA)

- In 2018, approximately 53.9% of containers and packaging generated in U.S. municipal solid waste were recycled.

- In 2007, paper and plastic foodservice packaging accounted for just 1.3% by weight of total U.S. municipal solid waste.

- Under the Food Safety Modernization Act (FSMA) enacted in 2011, the FDA was granted authority to suspend facility registrations and enforce mandatory hygienic packaging processes for food manufacturers.

European Union (European Commission & Official Journal)

- As of July 3, 2021, the EU banned retail sales of certain single‑use plastic items (polystyrene food containers, cutlery, cups, stirrers) under Directive (EU) 2019/904.

- Germany introduced a tax on single‑use plastic manufacturers to be enforced beginning in 2025.

India (Bureau of Indian Standards & Government Reports)

- New technical regulations under the Omnibus Technical Regulation (OTR) Order, 2024, will require BIS certification for packaging machinery (filling, sealing, labeling units) starting August 28, 2025.

- India imports over USD 130 million worth of packaging equipment annually, with approximately 45% used in food processing, 25% in pharmaceuticals.

- The Indian Institute of Packaging (IIP), under the Ministry of Commerce and Industry, is the national apex body for packaging standards and R&D since 1966.

Japan (METI & JIS Standards)

- As of March 2019, Japan Industrial Standards (JIS), administered by METI, cover nearly 743 product categories under over 10,773 standards, including industrial machinery.

- In 2022, 45% of global industrial robots were produced or designed by Japanese companies; Japan had 631 robots per 10,000 manufacturing workers in 2021.

- Export controls under METI mandate classification, transaction screening, and licensing for industrial machinery exports, including packaging machines.

Intergovernmental Trade Data (UN Comtrade / UNCTAD / WITS)

- UN Comtrade and UNCTAD’s WITS database aggregate detailed trade data on machinery exports and imports—including packaging machines—reported by over 140 countries.

- These data form the backbone of global machinery trade statistics, though any discrepancies depend on national reporting accuracy.

Global Packaging Machinery Market: Market Dynamics

Global Packaging Machinery Market: Driving Factors

Growing Demand for Automation in Packaging

The growing focus on enhancing production efficiency and reducing manual intervention is a major growth driver. Manufacturers across industries are rapidly adopting automated packaging systems to streamline workflows, lower labor costs, and minimize operational errors. These systems, which include robotic palletizers, intelligent labeling machines, and automatic fillers, are becoming essential in high-speed environments like food processing and pharmaceuticals, where output consistency and hygiene are non-negotiable.

Surge in Packaged Goods Consumption

The rising global consumption of packaged foods, beverages, personal care, and pharmaceuticals is fueling demand for diverse and advanced packaging solutions. Urbanization, rising disposable incomes, and shifting lifestyles are pushing companies to adopt flexible packaging machinery that can handle a variety of container formats and sizes. Additionally, growing consumer awareness of product safety and freshness has driven the adoption of smart packaging technology integrated with tamper-evident and freshness indicators.

Global Packaging Machinery Market: Restraints

High Capital Investment and Maintenance Costs

One of the major restraints is the significant upfront cost associated with installing fully automated packaging machinery. Small and medium enterprises (SMEs), especially in emerging economies, often struggle to invest in high-end machinery with integrated digital features. Additionally, the ongoing cost of regular maintenance, system upgrades, and operator training can strain limited operational budgets and delay modernization initiatives.

Complexity in Integrating with Legacy Systems

Many manufacturers still operate on traditional production lines that are incompatible with new-generation packaging systems. Integrating smart packaging machinery with existing infrastructure often requires expensive customization, lengthy downtimes, and complex system reengineering. This integration challenge slows down the digital transformation process and can deter companies from fully adopting Industry 4.0-enabled packaging technologies.

Global Packaging Machinery Market: Opportunities

Rising Demand for Sustainable Packaging Solutions

The global shift toward eco-friendly practices is creating significant opportunities for machinery manufacturers that support biodegradable films, recyclable materials, and lightweight packaging. Companies are seeking machines that can efficiently handle sustainable packaging formats without compromising speed or durability. This opens up avenues for innovation in green packaging machinery and materials-handling technologies that comply with evolving environmental regulations.

Growth in Emerging Markets

Rapid industrialization and urban expansion in countries like India, China, Brazil, and Vietnam are fostering robust demand for modern packaging solutions. The expansion of organized retail, increased consumption of packaged foods, and government incentives for local manufacturing are prompting investment in cost-effective, modular packaging equipment. These markets represent untapped potential for global OEMs and local machinery suppliers alike, especially in sectors like agriculture and small-scale food processing.

Global Packaging Machinery Market: Trends

Integration of AI and IoT in Packaging Lines

A major trend reshaping the industry is the adoption of Industry 4.0 technologies, particularly artificial intelligence and the Internet of Things (IoT), in packaging operations. Smart machines equipped with real-time analytics, predictive maintenance, and remote monitoring capabilities are improving operational uptime and decision-making. These systems also enable packaging customization, quality inspection, and production forecasting, making lines more agile and data-driven.

Customization and Multi-Format Packaging Capabilities

As consumer markets become fragmented, manufacturers are turning to multi-format packaging machines that offer quick changeovers and support multiple product lines. From seasonal cosmetic kits to limited-edition beverages, this trend is driving the demand for highly adaptable machinery that accommodates varying pack sizes, shapes, and branding requirements. Such flexibility reduces inventory waste and enhances responsiveness to market shifts.

Global Packaging Machinery Market: Research Scope and Analysis

By Packaging Type Analysis

In the global packaging machinery market, the primary packaging segment is expected to dominate by capturing approximately 47.0% of the total market share in 2025. This dominance is primarily driven by its direct role in preserving, protecting, and containing the product itself.

Primary packaging, which includes materials like bottles, pouches, blister packs, and cans, is critical in industries such as food and beverage, pharmaceuticals, and cosmetics. It not only maintains product integrity and extends shelf life but also serves as the first layer of branding and consumer engagement.

The growing demand for unit-dose and single-serve packaging formats, especially in convenience-driven and health-focused markets, has significantly boosted the adoption of primary packaging machinery. Furthermore, manufacturers are prioritizing automation in this segment to improve throughput, ensure hygiene, and reduce waste.

On the other hand, secondary packaging, while not in direct contact with the product, plays a crucial role in bundling, organizing, and safeguarding primary packaged goods for logistics, storage, and retail display. This includes cartons, shrink wraps, trays, and boxes. The machinery used for secondary packaging, such as case erectors, cartoners, and palletizers, is gaining traction due to the growing need for faster order fulfillment in the e-commerce and retail sectors.

Although it holds a smaller share compared to primary packaging, the secondary packaging segment is evolving rapidly, particularly with the rise of customization and automation technologies aimed at improving packaging efficiency and optimizing supply chains. As sustainability becomes a priority, secondary packaging machinery is also being adapted to reduce material use and accommodate recyclable or biodegradable packaging formats.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Machine Type Analysis

Filling machines are projected to lead the machine type segment in the global packaging machinery market, accounting for 24.0% of the total market share in 2025. These machines are essential across multiple industries, including food and beverages, pharmaceuticals, and cosmetics, where accurate and efficient product dosing is critical. Their dominance is supported by their versatility, as they can handle a wide variety of liquid, semi-solid, and powder products across different container types such as bottles, tubes, pouches, and jars.

The demand for hygienic and contamination-free filling processes, especially in the pharmaceutical and dairy sectors, has pushed companies to invest in advanced aseptic and vacuum filling machines. Moreover, the shift towards automation and the need for higher throughput in manufacturing lines are accelerating the adoption of high-speed, multi-head filling systems equipped with smart controls and real-time monitoring.

Labeling machines also play a vital role in the packaging line, ensuring that each product is accurately identified and compliant with regulatory and branding requirements. These machines are used across sectors where traceability, tamper evidence, and aesthetics are crucial. Modern labeling systems are designed to apply pressure-sensitive, shrink sleeve, and wraparound labels on a variety of containers with precision and speed.

As regulations around product information and serialization become stricter, especially in the pharmaceutical and food sectors, manufacturers are integrating advanced labeling machines that offer dynamic printing, barcode generation, and inspection systems. In addition, the rising emphasis on product differentiation and smart packaging has increased the demand for machines that can handle diverse label formats and customized packaging solutions.

By Automation Type Analysis

Fully automatic packaging machinery is expected to retain its leading position in the automation type segment, accounting for 55.0% of the total market share in 2025. This dominance is largely due to the growing demand for speed, efficiency, and minimal human intervention in high-volume production environments. Industries such as food and beverage, pharmaceuticals, and personal care are investing in fully automatic systems that offer continuous operations, reduced labor costs, and higher precision.

These machines integrate seamlessly into smart production lines with features like real-time monitoring, automated changeovers, and predictive maintenance capabilities. The trend toward Industry 4.0 and the need for scalable, future-ready solutions further reinforce the preference for fully automated systems, especially in regions where labor shortages and production cost optimization are key considerations.

Semi-automatic packaging machinery continues to hold relevance, particularly among small and medium enterprises and in applications where full automation may not be economically viable. These machines require some level of manual input but provide greater control and flexibility for businesses handling limited or diverse product runs. Semi-automatic systems are commonly used for tasks like filling, sealing, or labeling in niche markets, artisanal production, or startups where capital investment needs to be minimized.

They offer a practical balance between operational efficiency and cost-effectiveness and are especially useful in settings where customization and frequent changeovers are needed. As these systems evolve, newer models are being equipped with modular upgrades and digital interfaces, allowing companies to gradually transition toward more automated operations without a complete overhaul of existing infrastructure.

By Packaging Material Analysis

Plastics are set to dominate the packaging material segment in the global packaging machinery market, holding 48.0% of the total market share in 2025. Their widespread use is attributed to their versatility, durability, cost-effectiveness, and compatibility with various types of packaging machinery. Plastic materials such as polyethylene, polypropylene, and PET are used extensively for both rigid and flexible packaging formats, including bottles, pouches, trays, and wraps.

They are favored across industries like food and beverages, pharmaceuticals, and personal care due to their excellent barrier properties, lightweight nature, and ability to be molded into different shapes. The compatibility of plastics with high-speed automated machines also enhances production efficiency and reduces material wastage. Despite growing environmental concerns, innovations in recyclable and biodegradable plastic alternatives are helping to sustain their usage across global markets.

Paper and paperboard are also gaining significant traction within the packaging material segment, especially as sustainability becomes a major focus for brands and consumers. These materials are widely used for secondary and tertiary packaging purposes such as boxes, cartons, and wraps, particularly in the foodservice, retail, and e-commerce sectors. The recyclability and biodegradability of paper-based packaging make them a preferred choice for companies aiming to reduce their environmental footprint.

Moreover, advancements in coating technologies are improving the strength and moisture resistance of paper packaging, making it more viable even for primary packaging in certain applications. Packaging machinery designed to handle paper and paperboard is evolving to support these materials without compromising on speed or precision, aligning well with the global push toward eco-friendly packaging solutions.

By End-Use Industry Analysis

The food and beverage industry is projected to lead the end-user industry segment of the global packaging machinery market, accounting for 38.0% of the total share in 2025. This dominance is driven by the rising global demand for packaged and processed foods, the growth of ready-to-eat meal segments, and growing consumer preference for convenience and safety. Packaging machinery used in this industry includes filling machines, sealing machines, labeling systems, and automated wrapping units, all of which help ensure product freshness, shelf-life extension, and hygienic handling.

The need for high-speed production, packaging customization, and compliance with food safety standards is further fueling the adoption of advanced and automated packaging solutions. Additionally, trends such as single-serve portions, sustainable packaging, and on-the-go consumption are shaping machinery development and pushing companies to invest in more flexible and efficient equipment.

The pharmaceutical industry also plays a critical role in driving demand within the packaging machinery market due to its stringent regulatory requirements and the need for precision, traceability, and contamination control. Pharmaceutical packaging machinery must meet high standards for safety and accuracy in packaging solid doses, liquids, powders, and injectables.

Equipment such as blister packaging machines, vial fillers, and tamper-evident labeling systems is essential for ensuring product integrity and regulatory compliance. With the growing focus on serialization and track-and-trace systems, pharmaceutical manufacturers are integrating smart packaging technologies that allow real-time monitoring and authentication. The rising global demand for vaccines, over-the-counter drugs, and chronic disease treatments continues to expand the need for sophisticated packaging machinery tailored to the specific requirements of the healthcare sector.

The Packaging Machinery Market Report is segmented on the basis of the following:

By Packaging Type

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Machine Type

- Filling Machines

- Labeling Machines

- Form-Fill-Seal (FFS) Machines

- Cartoning Machines

- Wrapping Machines

- Palletizing Machines

- Cleaning Machines

- Coding/Marking Machines

- Others

By Automation Type

- Fully Automatic

- Semi-Automatic

- Manual/Assistive

By Packaging Material

- Plastic

- Paper & Paperboard

- Glass

- Metal

- Others

By End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Chemical

- Industrial Goods

- Electronics

- Others

Global Packaging Machinery Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is projected to lead the global packaging machinery market in 2025, accounting for 42.0% of total market revenue. This dominance is driven by rapid industrial growth, rising demand for packaged goods, and significant investments in manufacturing automation across countries such as China, India, and Japan. Expanding middle-class populations, urbanization, and increased consumption of processed foods and pharmaceuticals are further accelerating the adoption of advanced packaging technologies.

Additionally, government initiatives supporting industrial modernization and local production, along with a growing focus on export-driven manufacturing, are reinforcing the region’s position as the global hub for packaging machinery demand and production.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Middle East and Africa region is expected to witness the highest CAGR in the global packaging machinery market over the forecast period. This rapid growth is primarily driven by expanding food and beverage industries, growing investments in pharmaceutical manufacturing, and rising demand for consumer packaged goods across emerging economies such as the UAE, Saudi Arabia, South Africa, and Nigeria.

Government-led diversification initiatives, growing urban populations, and a growing shift toward automation and industrial development are encouraging the adoption of modern packaging solutions. Additionally, the rise of e-commerce and retail infrastructure in the region is further fueling the need for efficient and scalable packaging machinery.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Packaging Machinery Market: Competitive Landscape

The global competitive landscape of the packaging machinery market is characterized by the presence of several well-established players alongside a growing number of regional manufacturers, all competing on technological innovation, customization capabilities, and service support. Industry leaders such as Krones AG, Tetra Pak, Syntegon, Coesia, and IMA Group focus on developing advanced, energy-efficient, and automated machinery tailored to the specific needs of end-use industries. The market is witnessing increased mergers and acquisitions as companies aim to expand their geographic presence and product portfolios.

Additionally, firms are investing heavily in R&D to integrate Industry 4.0 technologies such as IoT, AI, and machine learning into packaging solutions, offering enhanced precision, operational efficiency, and predictive maintenance capabilities. The competition is intensifying as demand shifts toward sustainable and flexible packaging machinery that can adapt to evolving consumer preferences and regulatory standards across different regions.

Some of the prominent players in the global packaging machinery market are:

- Krones AG

- Tetra Pak

- Syntegon Technology GmbH

- Coesia S.p.A.

- ProMach, Inc.

- IMA Group

- SIG Combibloc Group AG

- Barry-Wehmiller Companies, Inc.

- GEA Group AG

- Ishida Co., Ltd.

- Marchesini Group S.p.A.

- OPTIMA Packaging Group GmbH

- Fuji Machinery Co., Ltd.

- MULTIVAC Group

- Sidel Group

- Norden Machinery AB

- Robert Bosch GmbH (Packaging division – now Syntegon)

- Viking Masek

- ARPAC LLC

- Adelphi Group of Companies

- Other Key Players

Global Packaging Machinery Market: Recent Developments

Product Launches

- March 2025: ULMA Packaging launched its new TFX series of thermoforming machines for food packaging, featuring built-in production monitoring and a focus on reducing environmental impact.

- December 2024: CMC Packaging Automation unveiled its Genesys Compact right-size boxmaker at up to 500 units/hour, designed to optimize packaging waste and eliminate void fillers.

Mergers and Acquisitions

- November 2024: Monomoy Capital Partners acquired Oliver Packaging & Equipment, expanding its footprint in food packaging systems and compostable meal tray lines.

- May 2024: ATS Corporation entered a definitive agreement to acquire Paxiom Group, adding primary, secondary, and end-of-line packaging machines to its portfolio across food, cannabis, and pharmaceuticals.

Funding and Investments

- May 2025: MPE Partners, with financing support from Churchill Asset Management and FS Investments, launched a new food packaging platform investing in Central Coated Products and Sun America.

- June 2024: Monroe Capital acted as lead arranger for financing Specialized Packaging Group’s acquisition of Clark Foam Corporation, boosting engineered protective packaging for medical, industrial, and tech markets.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 47.6 Bn |

| Forecast Value (2034) |

USD 73.8 Bn |

| CAGR (2025–2034) |

5.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 8.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Packaging Type (Primary Packaging, Secondary Packaging, and Tertiary Packaging), By Machine Type (Filling Machines, Labeling Machines, Form-Fill-Seal (FFS) Machines, Cartoning Machines, Wrapping Machines, Palletizing Machines, Cleaning Machines, Coding/Marking Machines, and Others), By Automation Type (Fully Automatic, Semi-Automatic, and Manual/Assistive), By Packaging Material (Plastic, Paper & Paperboard, Glass, Metal, and Others), and By End-Use Industry (Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care, Chemical, Industrial Goods, Electronics, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Krones AG, Tetra Pak, Syntegon Technology GmbH, Coesia S.p.A., ProMach Inc., IMA Group, SIG Combibloc, Barry-Wehmiller, GEA Group, Ishida Co., Marchesini Group, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global packaging machinery market?

▾ The global packaging machinery market size is estimated to have a value of USD 47.6 billion in 2025 and is expected to reach USD 73.8 billion by the end of 2034.

What is the size of the US packaging machinery market?

▾ The US packaging machinery market is projected to be valued at USD 8.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 12.1 billion in 2034 at a CAGR of 4.7%.

Which region accounted for the largest global packaging machinery market?

▾ Asia Pacific is expected to have the largest market share in the global packaging machinery market, with a share of about 42.0% in 2025.

Who are the key players in the global packaging machinery market?

▾ Some of the major key players in the global packaging machinery market are Krones AG, Tetra Pak, Syntegon Technology GmbH, Coesia S.p.A., ProMach Inc., IMA Group, SIG Combibloc, Barry-Wehmiller, GEA Group, Ishida Co., Marchesini Group, and Other Key Players.

What is the growth rate of the global packaging machinery market?

▾ The market is growing at a CAGR of 5.0 percent over the forecasted period.