Robotic palletizer is an automated machine used in manufacturing & distribution environments to stack and organize products onto pallets for transportation or storage. It is a type of palletizer that uses a robotic arm to pick, place, & arrange individual items into a single stack on a pallet.

Their advantages, such as lower capital costs, flexibility, and adaptability, make them a preferred choice for specific applications. This process improves efficiency, reduces labor costs, & minimizes the risk of injury by automating what would otherwise be a physically demanding task.

The global robotic palletizer market is experiencing substantial growth, fueled by the rising adoption of automation across various industries. These systems provide several benefits, such as increased productivity, enhanced workplace safety, and greater efficiency in warehouse and distribution operations.

As per explodingtopics The global robotics industry is rapidly expanding, with a projected $43.32 billion in revenue by 2027. Asia dominates the market, accounting for over one-third of global revenue, while Europe leads in commercial service robot revenue. The industry's growth is driven by the increasing demand for automation, with a notable surge in service robotics over the past few years.

In 2023, the global robotics industry generated $37.37 billion, up from $18.47 billion in 2016. The demand for vision-guided robots (VGRs) is also growing, with projections indicating the market could reach $20.1 billion by 2030. AI-powered robots, used in both service and industrial applications, are expected to continue their rapid growth, reaching $184.75 billion by 2023.

The number of robots worldwide is increasing significantly, with over 3.4 million industrial robots in operation. China leads the world in new industrial robot installations, followed by Japan, the U.S., and South Korea. The professional service robot market is also expanding, especially in industries like transportation, logistics, and hospitality, with installations growing rapidly in recent years.

Recent advancements in robotic palletizer technology have enhanced their flexibility and capabilities. Modern robotic palletizers are now equipped with AI, vision systems, and machine learning to optimize the palletizing process. These innovations enable them to handle a wide range of products, making them more versatile and appealing to various industries looking to streamline operations.

The market also offers numerous growth opportunities for manufacturers of robotic palletizers. With the rise of Industry 4.0, companies are looking to integrate smart robotics into their existing production lines. Additionally, the rising labor costs and shortage of skilled workers are pushing industries to adopt automation, further boosting demand for robotic palletizers in the near future.

The US Robotic Palletizer Market

The US Robotic Palletizer Market is expected to reach USD 0.6 billion by the end of 2024 and is projected to grow to USD 1.0 billion by 2033, with a CAGR of 6.6%.

The US robotic palletizer market is driven by increasing demand for automation in logistics & manufacturing to enhance productivity and reduce labor costs. The e-commerce boom and the need for efficient handling of diverse product types have accelerated the adoption of robotic palletizers.

Growing adoption of collaborative robots that work with human operators, offers flexibility & safety, are some of the key trends in US for robotic palletizer market. There’s also an increasing preference for modular & customizable robotic palletizers, allowing businesses to tailor automation solutions to specific needs.

Key Takeaways

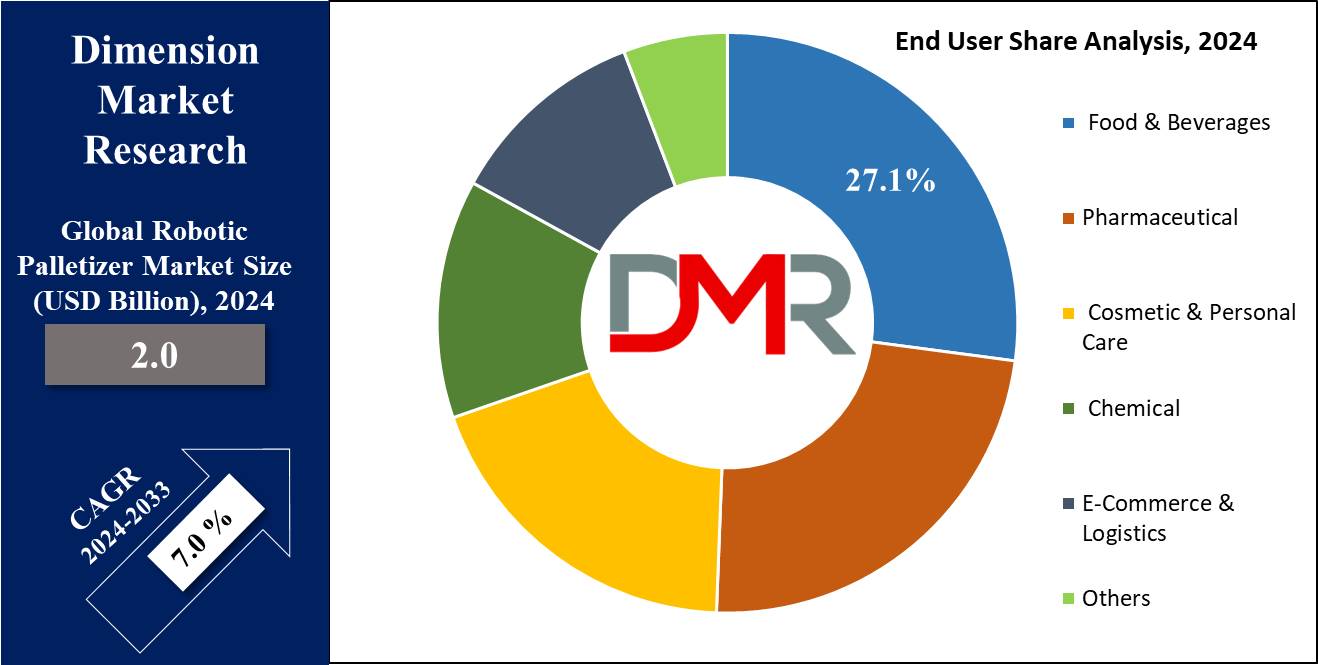

- Market Growth: The Global Robotic Palletizer market is expected to grow by USD 1.5 billion, at a CAGR of 7.0 %, during the forecasted period i.e. from 2025 to 2033.

- Market Definition: Robotic palletizer is an automated system that arranges products, such as boxes or bags, onto pallets for storage or shipping.

- Component Analysis: In terms of component, robotic arm is predicted to lead the global market with a high revenue share in 2024.

- Robot Type Analysis: Based on robot type, collaborative robot is expected to dominate the global market with a high market share of 37.5 % in 2024.

- Application Analysis: Bags is projected to lead the market with a substantial market share of 27.3% based on application in 2024.

- End User Analysis: Food and beverages are projected to lead the global market in terms of revenue, with a high market share in 2024.

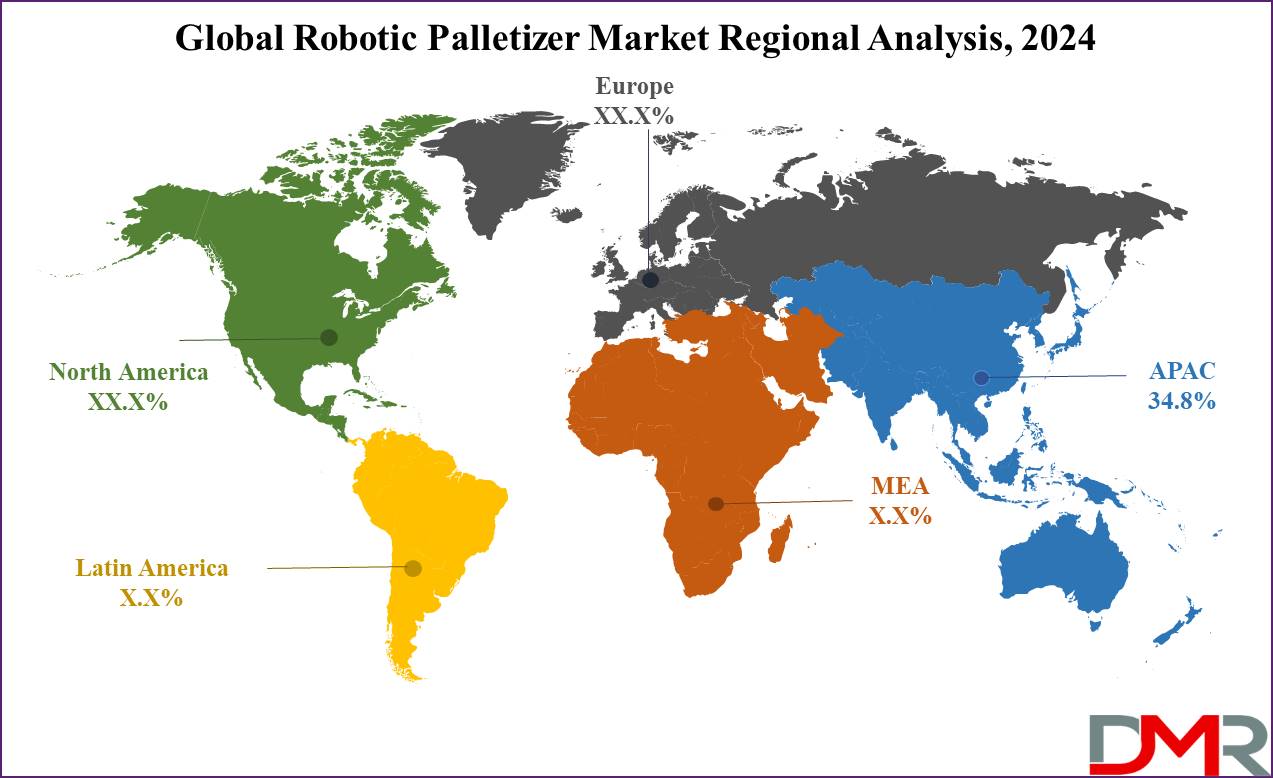

- Regional Analysis: Asia-Pacific is predicted to dominate the global robotic palletizer market with the highest market share of 34.8 % in 2024.

Use Cases

- Automotive Manufacturing: Robotic palletizers are used to handle heavy & bulky components like engine parts, tires, and transmissions as they efficiently stack & organize these components onto pallets.

- E-commerce and Warehousing: These palletizers are increasingly used in warehouses to manage the high volume of goods that need to be packed, stacked, and shipped as robots streamline operations, reduce lead times, and manage inventory more effectively.

- Pharmaceuticals: Robotic palletizers handle delicate & precise tasks, such as stacking cartons of medication or medical supplies which ensure accuracy & consistency in the palletizing process and are important for maintaining the integrity of pharmaceutical products.

- Consumer Goods: Robotic palletizers are used to palletize products like household items, electronics, and personal care products as they handle various packaging sizes and shapes, optimizing the packing process and ensuring stability during transport.

Market Dynamic

Drivers

Rising Labor Shortages and Workforce OptimizationThe robotic palletizer market is driven by labor shortages and optimization efforts within manufacturing sector organizations. Skill gaps exist within organizations due to an evaporating labor pool, making it harder to hire qualified workers which leads them to opt for robotic palletizers as a viable solution that runs without breaks or rest periods by dramatically increasing productivity when compared with manual labor methods.

Enhanced Workplace Safety and Efficient Workforce Utilization

Manual palletizing often involves lifting heavy loads, which can result in workplace injuries such as muscle strains, backache and repetitive strain injuries for laborers. With robotic palletizers eliminating manual handling requirements for large loads, workplace safety greatly improved by decreasing risks related to work injuries while cutting associated costs and driving growth of this market.

Restraints

High Initial Investment Costs

The robotic palletizer market is experiencing obstruction, largely due to the substantial initial investment required to implement robotic palletizing systems. The costs associated with purchasing & installing these systems and the expenses for training personnel and integrating the technology into existing workflows are high, which restraints the growth of the market.

Challenges for Small & Medium-Sized Enterprises

The significant financial burden of adopting robotic palletizers is particularly challenging for small and medium-sized enterprises (SMEs). Despite the long-term advantages of increased efficiency and productivity, the steep upfront costs limit the ability of SMEs to invest in this technology. This financial constraint poses a barrier to wider market adoption, as many smaller companies struggle to afford the initial investment required to benefit from robotic palletizing solutions.

Opportunities

Expanding adoption by Small and Medium-Sized Enterprises (SMEs)

Small and medium-sized enterprises (SMEs) are increasingly using robotic palletizers as they are facing challenges like labor shortages and rising labor costs. They often have more limited budgets for hiring and may struggle to attract and retain skilled workers only.

Robotic palletizers address this issue by automating palletizing tasks, allowing SMEs to maintain consistent production levels without the need for a large workforce. These systems are highly adaptable and capable of handling a wide range of products and packaging types.

User-Friendly Design and Space Efficiency

Many robotic palletizers have a compact design, which makes them ideal for businesses with limited floor space. This allows enterprises to optimize their workspace and minimize downtime during the installation phase, enabling them to quickly benefit from automation.

By investing in robotic palletizing technology, SMEs can enhance their operational efficiency, better meet customer demands, and establish themselves as forward-thinking, technologically advanced companies.

Trends

Emergence of Hybrid Palletizers and Strategic Collaborations

Technological developments are leading to the creation of hybrid palletizers that combine features from both robotic and traditional palletizers into one device, creating significant momentum within the robotic palletizer market. Furthermore, strategic collaborations and emerging market expansion is likely to benefit this sector further and open doors for growth opportunities within it.

Rising Demand for Zero-Damage HandlingRobotic palletizer markets have seen an increasing interest in zero-damage handling across various industries, one of the growing trends. Robotic palletizers can be programmed to apply just the right amount of pressure so as to lift products without incurring damage like tears in bags, cases breaking, or boxes being bent - saving on product misplacements, misplacing errors and stacking errors from manual labor processes compared with robotic ones.

Research Scope and Analysis

By Component

The robotic arm is predicted to dominate the global robotic palletizer market with the largest revenue share in 2024 based on component, due to ongoing advancements in robotic arm design, which have enhanced their flexibility, payload capacity, and precision of robotic palletizer. Adoption of robotic palletizers is increasing due to this improvement, particularly in industries such as

food and beverage, e-commerce, and automotive, where efficient material handling is required.

They are perfectly able to perform complex tasks with high accuracy and reliability making them an important component in these sectors, further solidifying their leading position in the market. EOATs are customizable tools attached to the end of a robotic arm, enabling the robot to handle a wide variety of products, from delicate items to heavy loads. It is used across multiple applications and industries, enhancing their utility and value.

Meanwhile, the control system tool is growing significantly as they are responsible for programming, monitoring, and controlling the robot's movements. Advanced control systems enable precise coordination of the robotic arm and EOAT, ensuring that products are handled efficiently and safely.

By Robot Type

Collaborative robot is anticipated to lead the global robotic palletizer market with the highest

revenue share of 37.5% in 2024, due to rising emphasis on workplace safety and efficiency. They can operate alongside human workers without requiring safety barriers. These robots are widely used for palletizing applications due to advancements in robotic technology, including enhanced sensors and

artificial intelligence.

The scalability and flexibility of these robots make them an ideal choice for businesses looking for adaptable and cost-effective automation solutions. These robots are equipped with advanced sensors and artificial intelligence which allow them to perform complex palletizing tasks with precision and ease.

Traditional robots are predicted to show significant growth due to their established reliability, precision, and scalability in handling complex and high-volume palletizing tasks. These robots are preferred in industries that require consistent, high-speed operations and can manage heavier payloads and more extensive ranges of motion. Articulated robots, with their multi-jointed arms, offer flexibility in maneuvering products, making them suitable for complex palletizing patterns.

By Application

Bags are expected to dominate the robotic palletizer market with a market share of 27.3% in 2024, due to their global use across many industries and their advantageous characteristics for automated handling.

Bags for storing food products, chemicals, or

pharmaceuticals often require uniform shapes and sizes, which makes them ideal for robotic systems. The simplicity in the design of a bag allows for more efficient and accurate placement on pallets, which is crucial for maintaining productivity and reducing errors. They are easily handled by robotic arms equipped with specialized grippers, contributing to their dominance in the market.

Also, the increase in e-commerce and demand for efficient logistics solutions has further boosted the adoption of robotic palletizers for bags. These palletizers are outfitted with key features like infeed conveyors for uninterrupted bag movement, bag flatteners for accurate positioning, layer forming stations for meticulous arrangement, and pallet dispensers to ensure a constant pallet supply.

The ability to automate the palletizing process of bags helps businesses streamline their operations, reduce labor costs, and increase throughput.

By End Use Industry

Food and beverages are projected to account for the largest revenue share of the robotic palletizer market by 2024. This industry requires high-volume production and packaging, demanding efficient palletizing solutions to handle large quantities of products. Robotic palletizers are capable of managing a range of packaging formats used in food and beverage manufacturing, including cartons, trays, bottles, cans, & pouches.

This industry experiences constant pressure to meet production demands while adhering to strict hygiene standards, which increases the use of these palletizers. Palletizing equipment from Pallex Solutions delivers fast, accurate and clean palletizing - essential in this sector for accommodating differing package sizes and weights. As these systems can operate continuously without fatigue and can accommodate different packaging formats, they make ideal machines for food and beverage processing applications.

Pharmaceuticals have experienced dramatic expansion due to the precision and cleanliness standards provided by robotic palletizers. Robotic palletizers ensure accurate handling, while simultaneously decreasing errors during palletizing by eliminating contamination risk and errors during storage and shipping processes.

The Global Robotic Palletizer Market Report is segmented based on the following

By Component

- Robotic Arm

- End-of-Arm Tooling (EOAT)

- Control System

- Others

By Robot Type

- Traditional Robot

- Articulated Robot

- Cartesian Robot

- Scara

- Collaborative Robot

By Application

- Bags

- Boxes and Cases

- Pails and Drums

- Others

By End-Use Industry

- Food & Beverages

- Pharmaceutical

- Cosmetic & Personal Care

- Chemical

- E-Commerce & Logistics

- Others

Regional Analysis

Asia Pacific is projected to dominate the robotic palletizer market with an

anticipated 34.8 % revenue share by 2024 due to the increased adoption of advanced technologies like robotics and automation across manufacturing and commercial industries. China, Japan, South Korea, and India all offer government initiatives designed to support manufacturing and automation technologies which should help increase market expansion.

This region serves as an epicenter for raw material production in industries including consumer electronics,

healthcare, pharmaceuticals, and automotive that utilize robotic palletizers in large production runs. This region has experienced unprecedented industrial expansion, driving the demand for automation solutions like robotic palletizers to maximize production efficiency and cut labor costs. North America is experiencing growth in its robotic palletizer market following Asia-Pacific, due to increasing labor shortages within manufacturing and logistics sectors.

Palletizers provide a practical way of responding to labor shortages by automating time-intensive processes and increasing productivity without needing human workers. Furthermore, this region stands out as being at the forefront of innovation and technological advancement by seeking out advanced solutions like collaborative robots or AI-powered systems which fuel its rapid development and market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the robotic palletizer market is characterized by a diverse array of key players who offer a variety of solutions to meet industry demands. Major players in the market focus on providing customizable solutions that cater to various industries such as logistics, manufacturing, and food and beverage.

Companies differentiate themselves through technological advancements, such as enhanced automation capabilities, improved precision, and integration with advanced software for better performance monitoring and control. Competitive strategies also include offering comprehensive service packages, including installation, maintenance, and training to ensure optimal use of robotic systems.

In the robotic palletizer industry, introducing innovative products is crucial for fostering competitiveness and capturing market share. A key driver of competition is the launch of collaborative robotic palletizers, which feature advanced safety mechanisms for safe human-robot interaction in shared workspaces.

Some of the prominent players in the global robotic palletizing system market are

- Fanuc Corporation

- Kion Group Ag

- Krones AG

- Schneider Packaging Equipment Company Inc.

- Honeywell International Inc.

- Kaufman Engineered Systems

- ABB Flexible Automation Inc

- Kuka Roboto GmbH

- ABC Packaging

- Intelligrated Inc

- Cermex group

- Adept Technology Inc.

- Other

Recent Development

- In February 2024, OMRON Automation has announced the introduction of TM S Series Collaborative Robots in its robotics portfolio in India. This latest addition to OMRON’s innovative lineup combines faster joints and expanded safety features, making it an ideal solution to improve the efficiency of factories in workspaces shared with people.

- In January 2024, KUKA AG introduced the second generation of the KR QUANTEC PA, featuring enhancements in weight distribution and center of gravity, along with upgraded drive units utilizing the latest advancements in gear units and motors. This new model offers an ideal balance between axis speed and acceleration, optimizing cycle times.

- In January 2024, ABB expanded its leadership in AI-powered mobile robotics by acquiring Sevensense. This acquisition reinforces ABB's strategic focus on innovative AI solutions that are revolutionizing industries like logistics and manufacturing.

- In November 2023, Schneider Packaging Equipment Company, Inc. and ESS Technologies (Blacksburg, Virginia), leveraging 80 years of collective experience in designing and manufacturing palletizers, collaborated to create a new collaborative palletizer. This off-the-shelf solution is designed to optimize floor space, enhance throughput, and increase operational flexibility.

- In August 2023, CMES Robotics, a leading provider of advanced AI vision software, is proud to announce a fully automated mixed-case palletizing system using Yaskawa Motoman. The new mixed-case palletizing solutions combine CMES Robotics' expertise in automation systems with state-of-the-art robotic technologies.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 2.0 Bn |

| Forecast Value (2033) |

USD 3.7 Bn |

| CAGR (2024-2033) |

7.0% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 0.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Robotic Arm, End-of-Arm Tooling, Control System, and Others), By Robot Type (Traditional Robot, and Collaborative Robot), By Application (Bags, Boxes and Cases, Pails and Drums, and Others), By End-Use Industry(Food & Beverages, Pharmaceutical, Cosmetic & Personal Care, Chemical, E-Commerce & Logistics, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Fanuc Corporation, Kion Group Ag, Krones AG, Schneider Packaging Equipment Company Inc., Honeywell International Inc., Kaufman Engineered Systems, ABB Flexible Automation Inc., Kuka Roboto GmbH, ABC Packaging, Intelligrated Inc, Cermex group, Adept Technology Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |