Market Overview

The Global

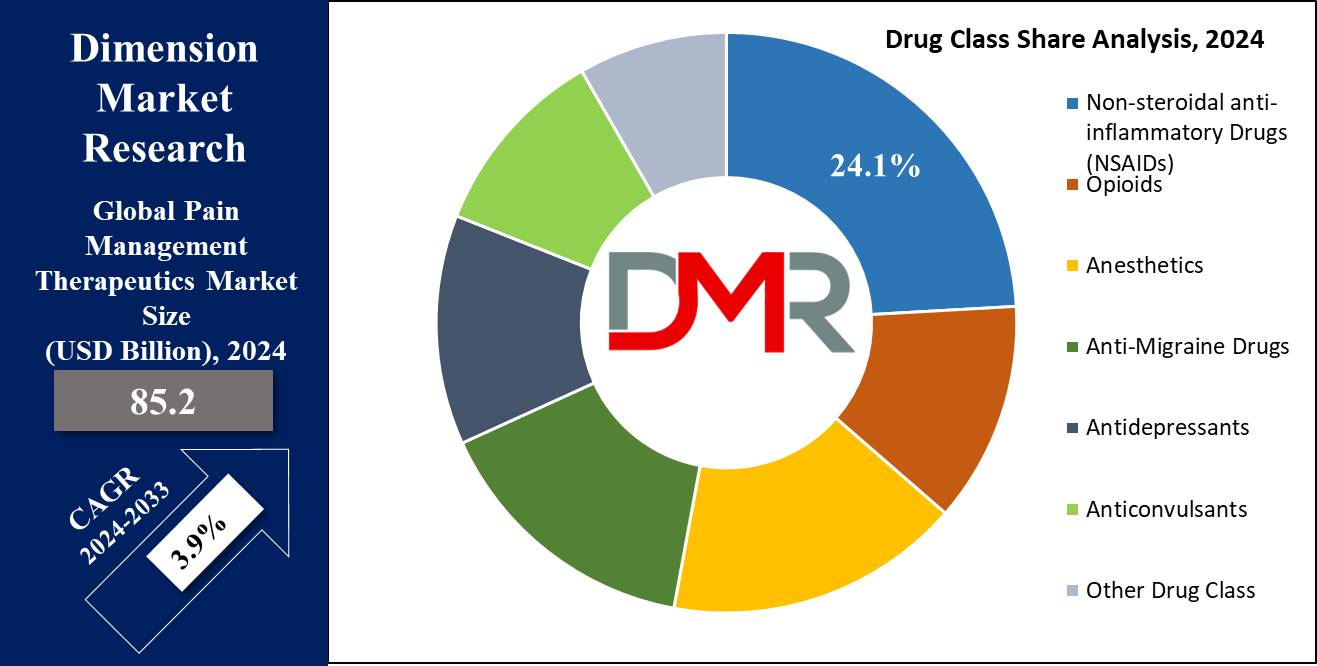

Pain Management Therapeutics Market size is expected to reach a

value of USD 85.2 billion in 2024, and it is further anticipated to reach a market

value of USD 120.7 billion by 2033 at a

CAGR of 3.9%.

The pain management therapeutics market is set to grow at a considerable rate as there are many patients with chronic pain conditions due to the growth in the global geriatric population. Factors such as the prevalence of diseases like arthritis, cancer, diabetes, and fibromyalgia are the main drivers of the market due to the conditions accompanying them, chronic pain.

This market is categorized according to the intensity and type of pain it targets, and the largest targets involve chronic pain, arthritic pain, neuropathic pain, cancer pain, and post-operative pain. Persistent pain disorders are increasing internationally the majority of the elderly are living with degenerative diseases and musculoskeletal conditions. Also, there has been an improvement in the type of drugs used in pain management especially the nonopioid drugs to suit the patient’s needs.

Advanced therapies include gene therapies, biologics, and neuromodulation devices that disrupt chronic pain management by providing excellent pain relief with minimal side effects. In addition, the opportunities in non-opioid analgesics due to the opioid crisis are believed to form new markets for the industry.

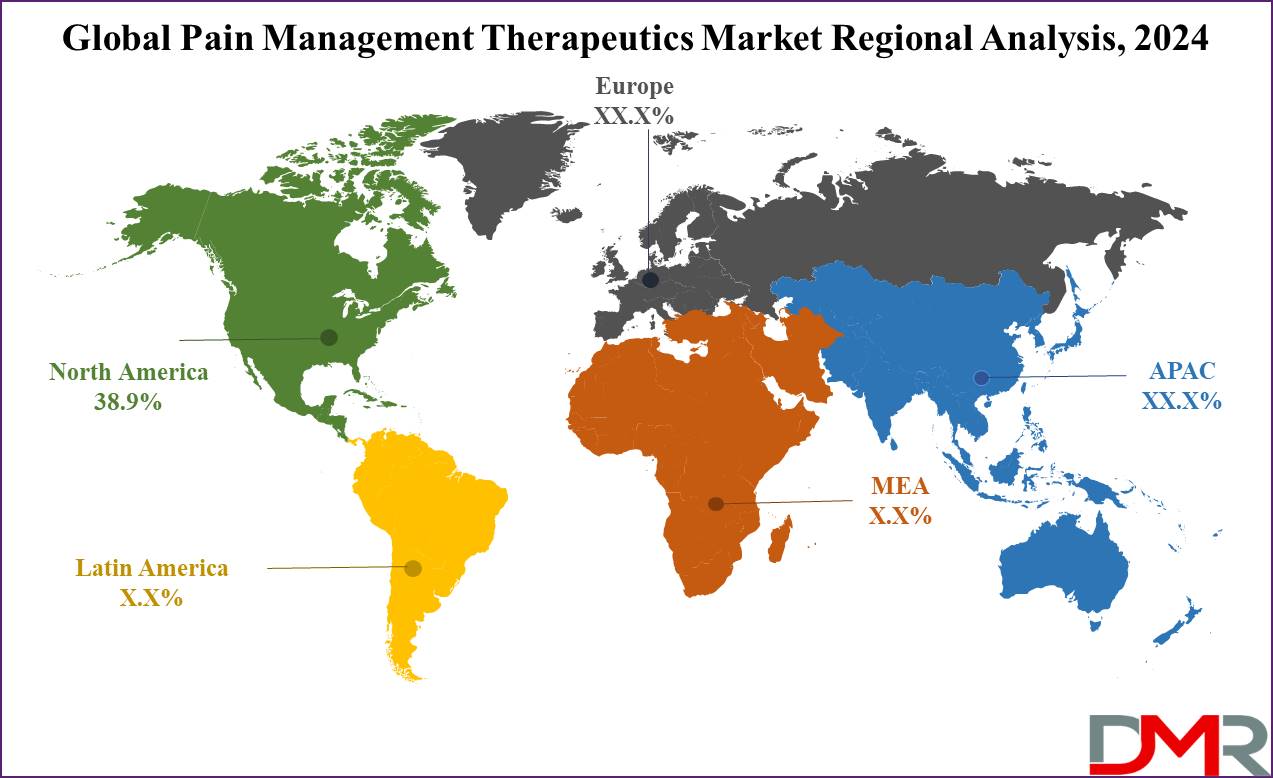

North America holds the largest share of the pain management therapeutics market due to a high number of healthcare expenditures, well-developed infrastructures, and integration of the latest pain management technologies. Still, markets in Asia-Pacific new appearing for strong growth for similar reasons of enhancing healthcare availability and increasing consciousness of pain management remedies.

The market is expected to grow significantly at a global level in the future since WHO-compliant pharma companies are shifting their focus towards product research, development, and establishing strategic collaborations.

The US Pain Management Therapeutics Market

The US Pain Management Therapeutics Market is projected to be valued at USD 27.9 billion in 2024 which is further expected to reach USD 38.5 billion in 2033 at a CAGR of 3.7%.

The U.S. pain management therapeutics market is the largest one due to its high healthcare spending and increasing prevalence of chronic pain diseases. Approximately 100 million people in the United States have chronic pain, such as back pain, arthritis, cancer-related pain, and neuropathic pain, all of which are often rooted in chronic diseases.

This has led to the emergence of an enormous need for good and affordable pain relief measures. Another important aspect that affects the structure of the US market is the opioid crisis. Its excessive use has resulted in increased cases of use and misuse hence the need for nonopioid medications for use in the management of pain. This has led to an interest in non-opioid analgesics such as NSAIDs, third-generation antidepressants, anticonvulsants, and opioids with new formulations with lower risk for abuse of these drugs.

Moreover, better pain management clinics' availability and increased use of telemedicine services for pain consultations also capture attention. Since patients can get prescribed medications as well as consultation from their doctors remotely, Telemedicine has been particularly useful during and after the COVID-19 outbreak.

New directions include clinical efficacy studies of third-wave analgesics, focusing on neuropathic and arthritic pain, and newly FDA-approved therapeutics for mitigating opioid addiction. Ideas of fewer opioid prescriptions with proper substitutes will keep evolving the growth of the market in the coming years, which will make the United States one of the leading countries in terms of innovation and regulatory changes.

Key Takeaways

- Global Market Value: The Global Pain Management Therapeutics Market size is estimated to have a value of USD 85.2 billion in 2024 and is expected to reach USD 120.7 billion by the end of 2033.

- The US Market Value: The US Pain Management Therapeutics Market is projected to be valued at USD 38.5 billion in 2033 from a base value of USD 27.9 billion in 2024 at a CAGR of 3.7%.

- By Drug Class Segment Analysis: NSAIDs (Non-Steroidal Anti-Inflammatory Drugs) are projected to dominate this segment as it is anticipated to hold 24.1% of the market share in 2024.

- By Indication Segment Analysis: arthritic pain is anticipated to dominate this segment of the global pain management therapeutics market with 35.0% of the market share by the end of 2024.

- Regional Analysis: North America is expected to have the largest market share of this market with a share of about 38.9% in 2024.

- Key Players: Some major key players in the Global Pain Management Therapeutics Market are Pfizer Inc., Johnson & Johnson (Janssen Pharmaceuticals), Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, AbbVie Inc., and many others.

- Global Growth Rate: The market is growing at a CAGR of 3.9 percent over the forecasted period.

Use Cases

- Chronic Pain Management: Conditions leading to chronic conditions include arthritis and fibromyalgia, which require long-term therapies for the management of pain. These include NSAIDs, anti-depressants, and opioids.

- Cancer Pain: Cancer pain management is one of the major applications in the pain management therapeutics market, wherein opioids such as morphine and fentanyl play a major role.

- Post-Operative Pain Relief: Pain management after surgery employs the use of local anesthetics, opioids, and NSAIDs. The management of pain in post-surgical patients most of the time requires a multimodality approach to pain management.

- Neuropathic Pain: Diabetic neuropathy and multiple sclerosis are among the conditions that need advanced therapies such as anticonvulsants and antidepressants.

Market Dynamic

Trends

Non-Opioid Therapies Gaining GroundThe continually increasing cases of opioid-related diseases, especially in North America have pushed for the development of non-opioid pain management therapies. Other options such as neuromodulation, Cannabinoid treatment, and Gene therapies are revolutionizing this segment in pain management. Focusing on the methods that can replace opioids, innovation has tools that can treat chronic pain and neuropathic pain. Drug makers are now raising the stakes, investing in CGRP antagonists for migraine and new options to replace NSAIDs for pain relief more safely.

Digital Health and Telemedicine in Pain Management

The practice of pain management through the use of telemedicine has grown exponentially until now, particularly after the COVID-19 pandemic. Patients, especially those from remote areas, can have better access to health professionals for consultation on pain management, medication reviews, and follow-up treatment.

This was of great help for chronic pain patients who needed constant consultations and monitoring. This trend is expected to continue, further encouraging demand in terms of e-prescriptions and digital healthcare solutions to manage pain remotely.

Personalized Medicine and Targeted Therapies

Treatment for pain management enters personalized medicine, courtesy of advances in genomics and biotechnology. Gene therapies and biologics will enable the clinician to offer treatments that are targeted to individual patient profiles based on root causes of chronic pain conditions such as fibromyalgia, neuropathy, and arthritis.

These new targeted therapies offer greater efficacy and fewer side effects compared to traditional pain relief drugs. Since personalized medicine will continue to advance, this is likely to add more growth in the pain management therapeutics market by availing more specific and hence effective modes of treatment.

Growth Drivers

Aging Global Population

As the aging of the world's population increases, diseases that emanate from pain due to aging pervasiveness, such as osteoarthritis, chronic back pain, and neuropathic pain, are on the increase. The elderly succumb easily to chronic pains resulting from degenerative conditions and increased chances of surgical interventions, meaning demand is up for long-term pain management solutions. Aged populations, especially in developed markets like North America and Europe, act as major drivers in the pain management therapeutics market due to the concentration of healthcare systems on improving the quality of life for elderly people.

Increased Prevalence of Chronic Diseases

The burden of chronic diseases like diabetes, cancer, cardiovascular diseases, and fibromyalgia is increasing due to which the demand for diseases is very high. Most of these diseases are related to chronic pain, especially when the disease progresses further. Hence, there is an increasing demand for appropriate therapies for the management of pain.

For example, neuropathic pain that develops post-chemotherapy in cancer patients or diabetic neuropathy that may develop in diabetic patients and requires pain relief options requiring specialization. The increase in the prevalence of these diseases is expected to raise demand for pain management drugs and other therapeutic interventions.

Technological Advancements in Drug Delivery Systems

Innovation in drug delivery systems is considered one more factor that drives growth within the pain management therapeutics market. Advancements in extended-release formulation technology, transdermal patches, implantable devices, and PCA devices will present patients with a more effective and convenient option to deal with pain. Such systems will improve patient compliance and therefore make treatments for improving pain control more consistent over longer periods, especially among people suffering from chronic pain.

Growth Opportunities

Expansion into Emerging Markets

The areas of greatest potential for growth of the pain management therapeutics market are the Asia-Pacific, Latin America, and Africa. Over the past few years, these markets have signified growth in the establishment of infrastructure in the medical sector, growth of awareness of the solutions for effective management of pain, and relatively higher per capita incomes that upscale opportunities in the market.

There are also marketing sponsoring expenses, which include educational programs and training activities aimed at increasing awareness among prescribers and patients across those geographies of the value of advanced pain management therapies.

Development of Biologics and Gene Therapies

Biologics and especially gene therapies are two of the largest promising areas for pharma in the context of neuropathy and other autoimmune diseases tied to chronic pain. Biologic drugs are made from living tissue, so they are very specific in their action and have fewer side effects than small molecule medicines. Thus, although gene therapy is yet to be developed fully, it holds the long-term opportunity to influence the alteration in chronic pain at the genetic level. While research goes on in these areas, they are believed to emerge with the growth of more opportunities in the pain management therapeutics market.

Restraints

Regulatory Challenges with Opioids

The tightening of regulations in opioid prescriptions due to addiction, abuse, and deaths remains considered the major restraint in the pain management therapeutics market. There has been a relentless effort by several governments, particularly in the U.S., to establish strict guidelines and monitoring programs to reduce opioid misuse. While these regulations are put in place to help control and combat the opioid crisis, they also limit the opioids that can be available for patients who truly need them for controlling serious pain. This may have a negative impact on market growth.

Pricing Pressures and Patent Expirations

Patent expirations for a few large pain management drugs have attracted heavy competition from generic drug manufacturers. As generics flood the market, the price is driven downwards, supplying shrinking profit margins for the branded forms of these drugs. The price erosion thereby experienced is an issue faced by pharmaceuticals, most specifically in parts of Europe and North America, which have strict pricing regulations. Besides, increasing R&D costs for developing new pain management therapies add to financial constraints and could further impede market growth.

Research Scope and Analysis

By Pain Type

Chronic pain is estimated to lead the pain type segment in the global pain management therapeutics market in 2024 for the following factors. The reason why chronic pain has the largest share in the pain type segment of the global pain management therapeutics market is because chronic pain has been estimated to affect a large percentage of the general populace, the elderly especially are most susceptible to arthritis, fibromyalgia, and chronic lower back pain.

Another classification of pain distinguishes between chronic pain, which is non-incident, and may go on for months, and sometimes even for years, following the opposite to acute pain that disappears with the removal of the cause. The rising elderly population is discussed as one of the key trends in the chronic pain market. This has called for concern, especially in developed countries like North America, Europe, and the Asia-Pacific region; elderly people have been experiencing excruciating pains mostly from age-related illnesses.

The main types of chronic pain attributable to the elderly population encompass osteoarthritis and degenerative spinal disorders among other musculoskeletal diseases. Apart from being a complaint that affects an individual, chronic pain has mammoth financial implications. This makes a lot of people lose their jobs, spend lots of money on hospital bills, and end up with less happy and less healthy lives. As the incidence rate rises, there is now a heightened emphasis on finding new and better pain management therapeutic interventions that lessen symptoms and enhance treatment.

Due to the ongoing nature and the marked incidence, this segment retains the largest share of the pain type segment. Players from the pharmaceutical sector and healthcare sector are looking for better and non-opioid products to manage the health needs of patients in this segment for chronic pain.

By Drug Class

NSAIDs (Non-Steroidal Anti-Inflammatory Drugs) are projected to dominate the drug class segment of the pain management therapeutics market as it is anticipated to hold 24.1% of the market share by the end of 2024. The drug class segment of the pain management therapeutics market shows a leading contribution due to the broad range of effectiveness of NSAIDs in treating pain conditions and their affordability and availability. Accordingly, NSAID is used in the management of arthritic pain conditions, acute pain, post-operative pain, and chronic musculoskeletal conditions.

Most fundamentally, one commonly underlying key mechanism of action in NSAIDs involves the inhibition of critical enzymes known as cyclooxygenases, which mediate the process of inflammation and pain. The blockage of enzymes by NSAIDs reduces inflammation and, with it, pain, thus providing effective management in conditions characterized by chronic inflammation, such as arthritis and post-surgical recoveries.

Some of the main reasons driving this dominance of NSAIDs relate to their readiness for over-the-counter formulations. Common NSAIDs, such as ibuprofen, aspirin, and naproxen, can be bought over the counter without any prescription, widening the circles of their applicability to a wide range of patients. It is this accessibility that, when combined with the relatively low cost of these products, significantly contributes to the popularity of NSAIDs for everyday pains.

Besides, NSAIDs are considered to have lower addictive risks than opioids, which has become one of the major concerns for public health. While opioids are very effective in severe pain, dependency, and overdose are part of the risks, and it is for this reason that healthcare providers often recommend NSAIDs as a safer first-line treatment for most pain conditions. This has contributed to their dominance in the pain management market.

By Route of Administration

The oral route of administration is anticipated to dominate the pain management drugs market, either in the form of tablets and capsules or liquid formulations, due to its ease and high patient compliance because a wide variety of drugs are available as oral formulations. Oral administration of therapeutic agents is indeed one of the most common routes for pain medications; hence, this mode of drug delivery will be preferred by patients and healthcare providers alike because it is convenient and simple.

Most of the commonly used medications for pain have oral forms: NSAIDs, opioids, anticonvulsants, and antidepressants come either as tablets, capsules, or liquid solutions. In chronic conditions, ease of administration at home, without the need for medical supervision, is a real advantage given to medication compliance, and oral administration has practical applications covering a long pain management course.

The development of extended-release and sustained-release formulations is yet another factor that guarantees oral administration dominance. These new formulations permit a gradual drug release over time, reducing the frequency of dosing-smoothing out pain relief throughout the day. This is of particular value for patients with chronic pain, as it reduces the burden of multiple daily doses and improves overall treatment adherence.

Furthermore, healthcare costs for drugs given orally are lower than in other routes of administration because it eliminates or at least minimizes the length of hospitalization, injections, or several specific treatments. Thus, oral administration has remained the most widely used and accessible for delivering pain management therapies across various pain conditions.

By Indication

The indication segment of the global pain management therapeutics market is projected to be dominated by arthritic pain as it will hold 35.0% of the market share by the end of 2024. This dominance is due to the prevalence of arthritis all over the world, especially in elderly patients. Arthritis is among the leading causes of pain and disability globally, with millions of people the world over suffering from the disease. Various forms of arthritis including osteoarthritis and rheumatoid arthritis, are very painful stiff, and crippling, thus leading to long-term pain management.

Another factor contributing to the enhanced incidence found includes the more recent global increase in the population of older adults and lengthening life spans. The prevalence of osteoarthritis and other degenerative joint diseases is increasing throughout large parts of North America and Europe, hence fueling demand for effective pain management therapies. The pharmacologic treatment of the pain and inflammation in arthritis symptoms involves the use of classic NSAIDs, steroids, and biologics while the research for other more specific therapies continues.

Although conventional medicines form the mainstream of pain management, with all the development in biologics and DMARDs promising to alter the pain management scenario in arthritis, management protocols available for these treatments aim at pain management along with slowing down the progression of joint damage, hence improving the long-term outcomes for the patients. Hence, arthritic pain is poised to remain one of the dominant indications in the pain management therapeutics market in the near future.

By Distribution Channel

The retail pharmacy segment is expected to dominate the distribution channel segment of the global pain management therapeutics market, owing to better accessibility and more convenience, coupled with a growing trend toward self-medication. Moreover, retail pharmacies are thus considered the main point of sales for both over-the-counter and prescription pain medicines, hence being a very important distribution channel in pain management therapies.

Community pharmacy thus presents a very accessible and convenient source of medications for pain relief to patients with chronic pain conditions, such as back pain, arthritis, and migraine. With the emergence of chain pharmacies along with online pharmacy websites, it has now become easy for patients to gain access to their medicines without necessarily having to go to any hospital or clinic. It therefore makes the community pharmacy the preferred choice of millions of patients in need of pain management drugs.

In addition to offering convenience, retail pharmacies also generally have competitive pricing and discounts for the most popular pain medications, which further reinforces their dominance in this distribution channel segment. Quite often, PBMs or insurance providers also create partnerships with retail chains to enable patients to have cost-effective access to their medication, hence making retail pharmacies an integral part of this market. The growth of the retail pharmacy segment is also driven by the emergence of online and mail-order pharmacies.

Such portals offer patients the convenience of ordering their medications online from the comfort of their homes and having them delivered to their doors, thus improving access to pain management therapies for patients with mobility problems or those who are unable to survey stores located in inaccessible geographical locations.

The Pain Management Therapeutics Market Report is segmented on the basis of the following

By Pain Type

By Drug Class

- Non-steroidal anti-inflammatory Drugs (NSAIDs)

- Opioids

- Oxycodone

- Hydrocodones

- Tramadol

- Morphine

- Fentanyl

- Others

- Anesthetics

- Anti-Migraine Drugs

- Triptans

- Ergot Alkaloids

- CGRP Inhibitors

- Antidepressants

- Anticonvulsants

- Other Drug Class

By Route of Administration

By Indication

- Arthritic Pain

- Neuropathic Pain

- Chronic Back Pain

- Post-Operative Pain

- Cancer Pain

- Fibromyalgia

- Other Indication

By Distribution Channel

- Online Pharmacy

- Retail Pharmacy

- Hospital Pharmacy

Regional Analysis

North America is projected to dominate the global pain management therapeutics market as it

hold 38.9% of the market share by the end of 2024. North America dominated the global pain management therapeutics market due to the developed health infrastructure, high prevalence of chronic pain conditions, and high level of healthcare expenditure. The region is also home to a substantial population that suffers from various disorders such as arthritis, cancer, neuropathic pain, and chronic back pain.

All these conditions require effective management and, therefore, are driving the demand for effective pain management drugs and novel treatments. Another important reasons that explain the dominance of North America is the increasing burden of chronic pain associated with an aging population. As people continue to age, the likelihood of age-related painful conditions, such as osteoarthritis and degenerative spinal disorders, also increases, hence creating a demand for long-term solutions to relieve pain. The Centers for Disease Control and Prevention estimate that millions of adults in the U.S. have chronic pain, which further boosts the growth of the pain management market in the region.

Besides that, North America is a hub that fosters innovation within the pain management therapeutics market. The region encompasses a lot of the leading pharmaceutical companies in the world including Pfizer, Johnson & Johnson, and Eli Lilly are at the pinnacle of retaining top talent in developing newer pain management therapies. These firms translate into a rich product portfolio of pain management drugs, including biologics, neuromodulation devices, and cannabinoid-based treatments when partnered with heavy research and development investment.

Also, favorable healthcare policies, such as reimbursement programs for pain management therapies, along with easily accessible healthcare services, serve as additional factors for North America's dominance in the global pain management therapeutics market. The region has an extremely developed infrastructure concerning health care and a great emphasis on innovation, which will surely keep it at the top in the pain management therapeutics market throughout the forecast period.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global pain management therapeutics market is highly competitive and consolidated, with just a few players holding the majority of shares in the market due to strategic initiatives such as mergers and acquisitions, R&D investments, and new product launches. Some of its major characteristics are the huge pharmaceutical organizations offering continuous new and innovative pain management therapies with the aim of gaining a strategic edge within the market.

The market is also rendered opaque by the presence of giants like Pfizer Inc., Johnson & Johnson (Janssen Pharmaceuticals), Eli Lilly and Company, and AbbVie Inc. with their large pain management drug portfolios. The companies operating within this market are frankly keen to diversify their product offerings to non-opioid pain management solutions in light of the opioid crisis. For example, Pfizer and Johnson & Johnson are investing in biologics, neuromodulation devices, and cannabinoid-based treatments to be used instead of the more traditional opioid therapies.

A few strategic partnerships and collaborations also exist within the pain management therapeutics market. Teva Pharmaceuticals and Grünenthal GmbH have entered into strategic partnerships focused on the development and commercialization of new drugs to manage pain, especially in those diagnosed with chronic pain and neuropathic pain. Such collaboration allows these companies to develop new therapies and take them to market more quickly by leveraging the strengths of each partner.

Besides well-established pharmaceutical companies, several small biotech firms are also making immense contributions to the market. Their main focus is on the development of new pain management solutions, such as gene therapies and personalized medicine, which have more pinpointed scopes and effectiveness in the treatment of patients suffering from chronic pain.

Some of the prominent players in the Global Pain Management Therapeutics Market are

- Pfizer Inc.

- Johnson & Johnson (Janssen Pharmaceuticals)

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly and Company

- AbbVie Inc.

- Sanofi S.A.

- Novartis AG

- AstraZeneca

- Endo Pharmaceuticals

- Mallinckrodt Pharmaceuticals

- Purdue Pharma L.P.

- Grünenthal GmbH

- Other Key Players

Recent Developments

- October 2024: Pfizer launched a new extended-release NSAID (Non-Steroidal Anti-Inflammatory Drug) aimed at treating arthritic pain. The formulation is designed to provide longer-lasting relief, improving patient compliance and reducing the need for frequent dosing.

- September 2024: AbbVie expanded its pain management portfolio by introducing a new biologic targeting chronic back pain and neuropathic pain. This biologic offers a novel approach to managing pain by modulating the immune response.

- August 2024: Johnson & Johnson (Janssen Pharmaceuticals) announced a strategic collaboration with Novartis to develop a cannabinoid-based therapy for managing cancer pain. This partnership aims to harness the therapeutic potential of cannabinoids to provide a safer, non-opioid alternative for cancer patients.

- July 2024: Grünenthal GmbH, a leader in pain management solutions, expanded its R&D efforts into gene therapy for neuropathic pain. With pre-clinical trials already showing promise, the company plans to initiate human trials by early 2025.

- June 2024: Teva Pharmaceuticals received FDA approval for a new migraine drug targeting the CGRP (Calcitonin Gene-Related Peptide) pathway, a key mechanism involved in migraine attacks.

- May 2024: Eli Lilly announced positive results from its Phase 3 clinical trials for a novel treatment for fibromyalgia, a condition characterized by widespread chronic pain. The treatment, expected to be launched by 2025, represents a breakthrough in managing fibromyalgia.

- April 2024: Endo Pharmaceuticals launched a new opioid formulation equipped with abuse-deterrent technology. This innovation is designed to reduce the potential for misuse and addiction while still providing effective pain relief for patients with severe pain conditions.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 85.2 Bn |

| Forecast Value (2033) |

USD 120.7 Bn |

| CAGR (2024-2033) |

3.9% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 27.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Pain Type (Chronic Pain, and Acute Pain), By Drug Class (Non-steroidal anti-inflammatory Drugs (NSAIDs), Opioids, Anesthetics, Anti-Migraine Drugs, Antidepressants, Anticonvulsants, and Other Drug Class), By Route of Administration (Oral, and Parenteral), By Indication (Arthritic Pain, Neuropathic Pain, Chronic Back Pain, Post-Operative Pain, Cancer Pain, Fibromyalgia, and Other Indication), By Distribution Channel (Online Pharmacy, Retail Pharmacy, and Hospital Pharmacy)) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Pfizer Inc., Johnson & Johnson (Janssen Pharmaceuticals), Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, AbbVie Inc., Sanofi S.A., Novartis AG, AstraZeneca, Endo Pharmaceuticals, Mallinckrodt Pharmaceuticals, Purdue Pharma L.P., Grünenthal GmbH, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Pain Management Therapeutics Market size is estimated to have a value of USD 85.2 billion in 2024 and is expected to reach USD 120.7 billion by the end of 2033.

The US Pain Management Therapeutics Market is projected to be valued at USD 27.9 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 38.5 billion in 2033 at a CAGR of 3.7%.

North America is expected to have the largest market share in the Global Pain Management Therapeutics Market with a share of about 38.9% in 2024.

Some major key players in the Global Pain Management Therapeutics Market are Pfizer Inc., Johnson & Johnson (Janssen Pharmaceuticals), Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, AbbVie Inc., and many others.

The market is growing at a CAGR of 3.9 percent over the forecasted period.