Market Overview

The

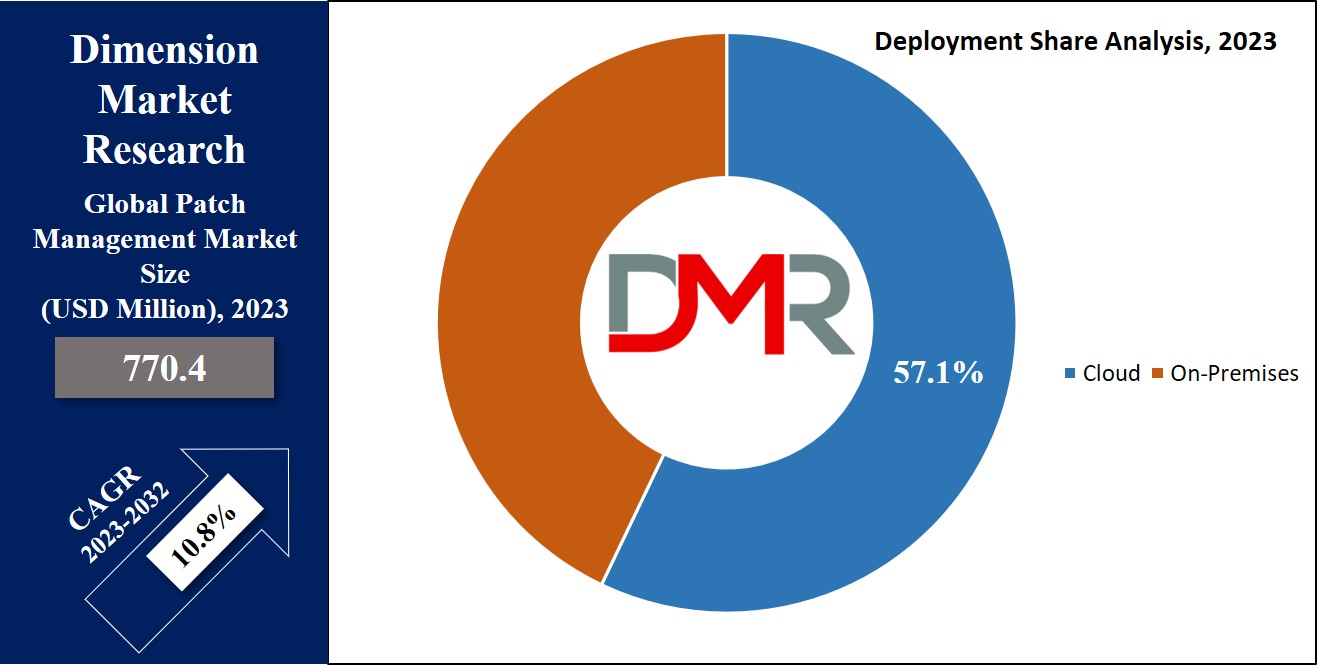

Global Patch Management Market is expected to reach a value of

USD 770.4 million in 2023, and it is further anticipated to reach a market value of

USD 1,938.3 million by 2032 at a

CAGR of 10.8%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Patch management is the process of executing updates from vendors to address security vulnerabilities, and optimize software & device performance. It's an essential aspect of maintaining

cybersecurity while making certain smooth business operations. Cyber attackers target vulnerabilities in IT systems, encouraging vendors to release updates or "patches" for remediation.

However, patching can disrupt workflows & cause downtime. The objective of patch management is to effectively install these patches, reducing operational disruptions while improving security.

As per Nikolaroza, the average time to detect a breach is 201 days, but effective patch management reduces this to just 60 days. Recent surveys reveal 84% of businesses faced cyberattacks last year, with 80% caused by unpatched software vulnerabilities. Microsoft found over 80% of attacks could be prevented through timely patches.

Software vulnerabilities increased 50% in 5 years, with IoT vulnerabilities rising 200% in 3 years. In 2024, vulnerabilities surged 22% to 32,450, with 90% of cyberattacks exploiting unpatched software. Alarmingly, only 50% of organizations have documented patch management, despite 75% acknowledging vulnerability and 71% citing patching complexity.

Patch management involves identifying, testing, and applying updates or patches to software and systems to fix vulnerabilities, improve functionality, and enhance security. The rising demand for robust cybersecurity in the face of increasing cyber threats has made patch management a critical IT function.

Conferences and events like Black Hat, DEF CON, and Gartner Security & Risk Summit spotlight its importance, offering opportunities for networking, innovation, and collaboration. With the global patch management market growing rapidly, businesses are investing in automated solutions to minimize downtime and protect assets, creating a significant opportunity for service providers and technology developers.

Market Dynamic

In the growing market of the Internet of Things (IoT), security plays a major role. The proliferation of interconnected devices generates significant data, fueling innovative business models such as Products-as-a-Service & real-time automated decision-making. However, this fast IoT expansion also reveals new attack vectors like data theft, identity breaches, IP infringement, device manipulation, & network tampering.

To prevent these threats, cybersecurity firms & service providers are constantly crafting security solutions that empower organizations to automate their IT security efforts. These systems offer automated threat detection, largely reducing the time & effort needed to look into malicious activities. By presenting real-time monitoring & swift identification of emerging threats, these solutions also allow autonomous responses. These factors are further driving anticipated market growth during the forecast period.

However, complexity presents a major challenge to the patch management market's growth. Implementing & managing patch solutions need substantial IT expertise, making it difficult for small businesses lacking resources. To address this, patch management vendors are focusing on user-friendly interfaces to ease device & application management for organizations.

Research Scope and Analysis

By Component

The software segment dominates the market share of the global patch management market in 2023, as various organizations are adopting patch management solutions to reveal vulnerabilities that could potentially trigger attacks. The vulnerability management framework helps in evaluating, rectifying, & pinpointing vulnerabilities in software & systems, allowing strategic security measures to critical threats & lower vulnerability to attacks.

For instance, in December 2022, cybersecurity distributor Balbix expanded the MITRE ATT&CK framework, reinforcing software vulnerability & endpoint security control mapping. These evaluations empower enterprises to access unresolved cyber risks & prioritize vulnerability resolution.

Balbix uses advanced analytics to link common vulnerabilities & exposures (CVEs) to the MITRE ATT&CK framework's methodologies, techniques, & procedures, showcasing opportunities for vulnerability management vendors to tap into novel revenue streams & drive segment growth.

By Deployment

The cloud-based deployment plays a significant role in the global patch management market in 2023. Despite the advancements in

cloud computing, cloud-based platforms continue to see threats from cybercriminals & data breaches. Cloud patch management solutions use cloud-powered tools to oversee & implement Operating Systems (OS), third-party patches, & software updates on endpoints. Different from many endpoint management solutions that require hardware at each site, cloud-based solutions avoid this need for ongoing version upkeep, as patch management providers constantly release new features & bug fixes.

Also, the on-premise segment is anticipated for substantial growth in the forecasted future. On-premise patch management solutions find use among enterprises for their ability to automatically patch internal servers & devices situated on-premises. Large businesses, housing important databases of valuable business information, opt for full control over solutions & upgrades.

However, as workforces grow and the shift towards remote operations gains traction, IT experts using on-premise patching tools & solutions often struggle to adequately secure endpoints due to the limited visibility of software assets.

By Organization Size

The large enterprise segment takes a significant market share in 2023, reflecting the growing demand for patch management solutions in this domain. These solutions play a major role in detecting threats, instituting patching protocols, & reaping benefits such as productivity, security, & cost-efficiency. Moreover, they provide complete visibility across servers, desktops, & laptops.

Moreover, while allowing employee access to critical company information through mobile devices improves productivity, it also addresses business security risks like data breaches. The proliferation of Bring-your-own-device (BYOD) practices further complexes IT management's task of overseeing personal mobile devices under strict protocols & standards. These factors are set to fuel the need for patch management systems among large enterprises during the forecasted period.

By End User Industry

In 2023, the IT & telecom sector emerges as a significant driver of the patch management market. The growing utilization of endpoint devices, along with the growth in connections on vulnerable private networks, growing the frequency of cyber-attacks. In addition, IT & telecom enterprises turned their attention to crafting & implementing in-house patch management solutions.

This strategic shift not only assisted the market during the pandemic but also contributed to the expansion of this segment. With IT & telecom companies storing users' personal details, such as names, addresses, and financial data, become prime targets for cyber attackers. To protect and secure sensitive information & avert data breaches, telecom firms are projected to grow their investments in patch management solutions. Moreover, the complex regulatory landscape across the globe requires telecom entities to stay aligned with evolving compliances, further driving the growth of this segment in the market.

The Global Patch Management Market Report is segmented on the basis of the following:

By Component

By Deployment

By Organization Size

By End User Industry

- IT & Telecom

- BFSI

- Retail

- Government

- Healthcare

- Manufacturing

- Others

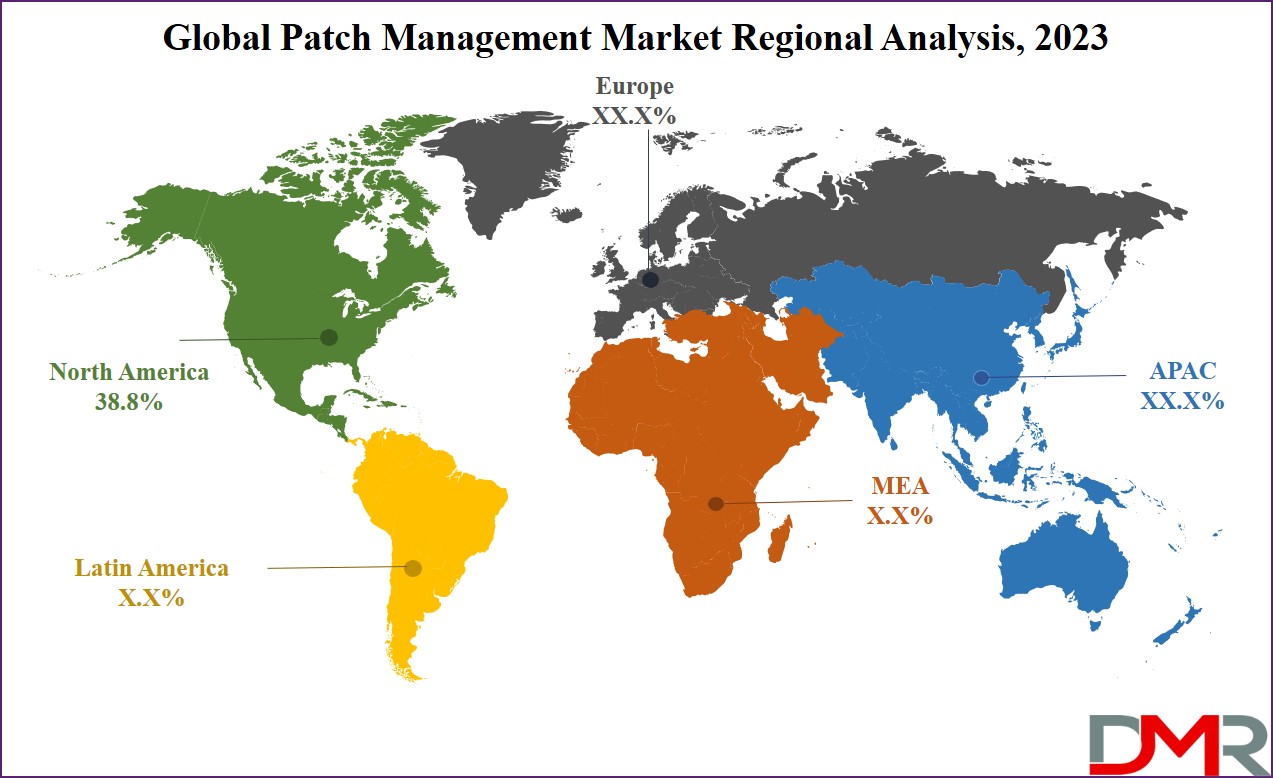

Regional Analysis

In 2023, North America has a significant hold on the global patch management market by capturing a significant market

share of 38.8%, setting it apart as a leading region. This regional strength in the patch management market can be seen due to various key factors, including the growth in SMEs the emergence of major IT hubs, & the increasing adoption of security & vulnerability assessment and management tools by organizations within the area. These factors are further driving the rising demand for strong and secure cybersecurity measures.

Furthermore, the growing preference for cloud-based patch management solutions, especially among SMEs, is further driving the growth of patch management solutions. This expansion is motivated by the look into increasing operational efficiency, achieving cost-effectiveness, and attaining greater agility.

With significant adoption rates for these solutions & services and a concentration of patch management providers, the United States is anticipated to continue maintaining a considerable market share throughout the forecasted period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global patch management market has a competitive landscape driven by intense rivalry among key players focusing on meeting the growing demand for robust cybersecurity solutions. With an aim for innovation and seamless integration, companies, both established & emerging, are continuously developing advanced patch management solutions using automation and vulnerability assessment.

Strategic partnerships, product enhancements, & industry-specific offerings underscore the dynamic nature of this landscape, as players constantly look to excel in the evolving cybersecurity arena.

For instance, in August 2022, Malwarebytes introduced its Patch Management module for OneView, complementing its Vulnerability Assessment module to improve vulnerability detection, threat response, and customer safety & productivity, which addresses the essential need for identifying vulnerabilities & implementing system patches to strengthen security however, these tasks often prove exhausting for many organizations, with the average patch application time at 102 days, & approx. 75% of businesses, both small &large, cite resource limitations that hinder quick vulnerability resolution.

Some of the prominent players in the Global Patch Management Market are:

- Microsoft Corp.

- IBM Corp.

- VMware

- Broadcom Inc.

- Avast Software

- Freshworks

- NinjaOne

- Solar Winds

- Pulseway

- Qualys

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Patch Management Market

The global patch management market noticed the impact of the COVID-19 pandemic & recession. With remote work growing, cyber threats increased, making efficient patching essential. Even after budget constraints, organizations invested in patch management to secure their systems. The demand for streamlined processes led to a growth in automated patch management tools. As the situation evolves, the patch management market adapts to meet evolving cybersecurity needs.

| Report Characteristics |

| Market Size (2023) |

USD 770.4 Mn |

| Forecast Value (2032) |

USD 1,938.3 Mn |

| CAGR (2023-2032) |

10.8% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Software and Services), By Deployment (Cloud and On-Premises), By Size (SMEs and Large Enterprises), By End User Industry (IT & Telecom, BFSI, Retail, Government, Healthcare, Manufacturing, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Microsoft Corp., IBM Corp., VMware, Broadcom Inc., Avast Software, Freshworks, NinjaOne, Solar Winds, Pulseway, Qualys, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Patch Management Market size is estimated to have a value of USD 770.4 million in 2023 and is expected to reach USD 1,938.3 million by the end of 2032.

North America has the largest market share for the Global Patch Management Market with a share of about 38.8% in 2023.

Some of the major key players in the Global Patch Management Market are IBM Corp, Broadcom Inc., VMware, and many others.

The market is growing at a CAGR of 10.8% over the forecasted period.