Market Overview

The Global Pet DNA Testing Market is expected to reach a value of USD 371.4 million in 2023, and it is further anticipated to reach a market value of USD 844.1 million by 2032 at a CAGR of 9.6%.

DNA, or Deoxyribonucleic Acid, serves as the informational blueprint for genes in living organisms, guiding their development & function. Comprised of nucleotide chains, DNA carries critical genetic instructions passed via generations, influencing fundamental characteristics through protein synthesis, which is vital in biological studies, assisting comprehension of genetics & evolution.

In human & animal DNA testing, vital for applications in forensics,

biotechnology, healthcare, & research, samples like tissue, hair, or blood undergo laboratory processing for DNA extraction. Various techniques, like

DNA sequencing and polymerase chain reaction, analyze extracted DNA, shaping the foundation of important scientific endeavors.

Pet DNA testing market growth is being driven by innovative products introduced by key players to meet evolving veterinary needs. Zoetis recently introduced their Basepaws Breed + Health Dog DNA Test which allows pet owners to take a proactive approach in caring for their animals with mobile friendly results that allow access genetic insights for better care management.

Also, pet owners have become more willing to invest in advanced care for their animals, furthering market expansion. According to the FEDIAF 2024 report, sales of pet related products and services reached $27.45 billion in 2023 representing a substantial year on year growth.

Developments in veterinary genomics are making DNA testing kits more widely available over 15 years, companies have provided at home DNA tests for pet owners, breeders and veterinarians; since Mars Petcare began providing direct to consumer testing in 2009, the market has rapidly grown in parallel with human genomics growth; DNA profiling now forms part of veterinary care offering greater potential adoption from adoptive pet parents.

Key Takeaways

- By Animal Type, Dogs in 2023 & are anticipated to dominate throughout the forecasted period.

- In addition, Cats are expected to have significant growth over the forecasted period.

- By Sample, Saliva is the major segment in 2023 contributing to the revenue and driving the market.

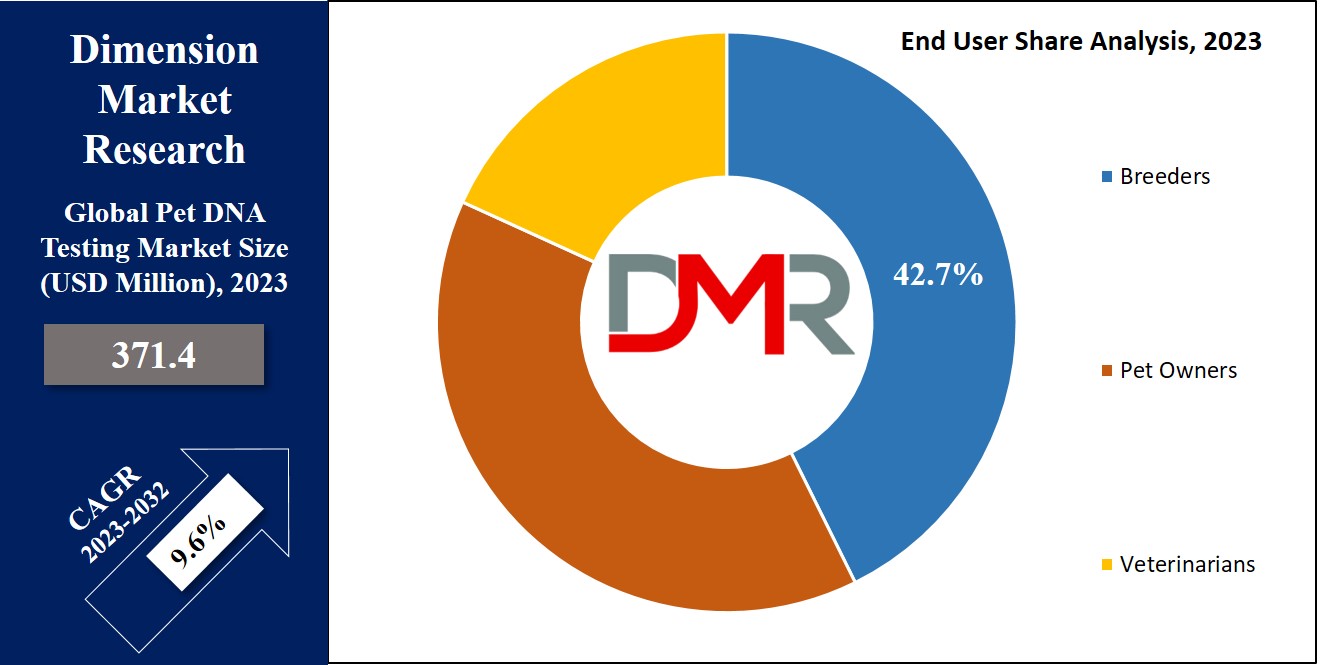

- By End User, Breeders account for a major revenue share in 2023

- North America has a 43.3% share of revenue in the Global Pet DNA Testing Market in 2023

Use Cases

- Preventive Healthcare: Pet DNA testing enables early identification of genetic predispositions to diseases, allowing veterinarians and pet owners to take preventive measures, create customized wellness plans, and reduce long-term healthcare costs.

- Breed Identification & Ancestry Insights: Helps pet owners, breeders, and shelters understand breed composition, ancestry, and behavioral traits—supporting better training, nutrition, and lifestyle planning for companion animals.

- Responsible Breeding Practices: Breeders use DNA testing to screen for hereditary conditions and select optimal mating pairs, improving breed health, reducing risks of inherited diseases, and ensuring ethical breeding standards.

- Veterinary Diagnostics & Personalized Medicine: Veterinarians leverage DNA test results to recommend targeted treatments, diet plans, and disease management strategies tailored to individual pets, aligning with the trend of precision veterinary care.

- Shelter & Adoption Programs: Animal shelters and rescue organizations use DNA testing to provide potential adopters with detailed insights about an animal’s health risks, temperament, and future needs, increasing transparency and adoption success rates.

Market Dynamic

The global PET DNA testing market is expected to grow, driven by a rising trend in pet adoption & the increasing awareness of responsible pet care for their overall well-being. Further a worldwide switch, with more couples or individuals opting to adopt pets rather than having biological children.

Pets are now seen as integral family members, receiving the same level of attention as humans, elevating increased interest among pet owners in gaining genetic,

genetic testing insights into their companions. Also, the affordability of DNA testing, along with ongoing R&D in the field, contributes to the market's expansion.

Moreover, technological developments in DNA testing address previous limitations, providing users accurate and quickly interpreted results, making these systems more accessible on a global scale.

However, a potential challenge to global sales lies in the high costs associated with pet DNA testing, mainly affecting budget-conscious pet owners.

The starting price for dog DNA testing is about USD 100, with additional charges for disease detection. Also, the lack of regulation & standardization in the pet DNA testing industry creates concerns about inconsistencies and inaccuracies in test results.

Drivers

Driving Trends Pet adoption and humanization trends are one of the primary drivers of pet DNA testing market growth. Pet owners increasingly view pets as family members, prioritizing their health and well being. DNA tests help identify genetic predispositions to disease for preventive care plans as well as tailored nutrition plans something pet owners looking for advanced veterinary solutions appreciate.

Furthermore, rising awareness about breed specific traits has increased demand for DNA tests; and rising disposable income combined with willingness to invest in premium pet care contribute to its expansion; especially among developed regions with high ownership rates of pet ownership rates.

Trend

Technological advancements in genetic testing are revolutionizing the pet DNA testing market. Innovations such as next generation sequencing (NGS) and

machine learning enable accurate and comprehensive genetic analysis, while companies are creating at home DNA kits which make testing more accessible to pet owners.

Collaborations between biotechnology firms and veterinary clinics improve accessibility to this service; digital platforms enable users to receive detailed reports regarding health issues, ancestry information, traits analysis reports. As consumers demand convenience and precision from this technology these developments are revolutionizing this global industry and supporting growth across borders.

Restraint

The high cost of pet DNA testing represents an obstacle to market expansion, especially in price sensitive regions. Many potential customers perceive these services as luxury rather than necessities and so limit widespread adoption. Furthermore, pet owners lack awareness about its benefits; further compounded by limited access to advanced veterinary infrastructure and services in developing markets.

To address these issues successfully requires strategic pricing policies, increased consumer education efforts, partnerships with veterinary clinics to build trust between all parties involved, as well as partnerships to demonstrate genetic testing's practical value to pets' parents/owners/care partners as well.

Opportunities

The pet DNA testing market holds significant potential in emerging economies due to increasing pet ownership and rising disposable incomes. Furthermore, with increased awareness about pet health issues and genetic testing's potential benefits, businesses have the chance to tap into unexploited markets.

Forming partnerships with local veterinary clinics and pet care providers will help build strong local representation while offering cost effective testing kits tailored specifically for certain regions can drive adoption rates forward. Adding online platforms will facilitate accessibility further expanding market penetration thus opening new avenues of innovation within industry players themselves.

Research Scope and Analysis

By Animal Type

The global pet DNA testing market was led by the dog’s segment in 2023, capturing the major share of overall revenue, as the growth in pet adoption, particularly of dogs, is significant in the American population. Dogs, cherished as loyal family members, hold significant and enduring popularity in North America, where almost one-third of the US population expresses a greater affection for their dogs than their partners.

Further, cats emerge as the second-most favored pet choice. The preference for cats is boosted by a rising trend, mainly among younger generations like millennials, who are drawn to their calm nature & impressive memory and learning capabilities. Cats are considered low-maintenance pets, requiring less training for basic self-care. Further, over 250 hereditary diseases have been identified in cats, highlighting the importance of understanding their breed history for effective treatment.

By Sample Type

The pet DNA testing market is categorized by sample types into saliva, blood, semen, & others, saw the saliva segment emerged as the leader. Saliva claimed the largest share of overall revenue in 2023 and is projected to exhibit the fastest growth during the forecast period, which can be attributed to the broad use of saliva or cheek swab samples for most pet DNA tests.

Collecting a saliva sample from a dog's jowl is mainly more convenient than other sample collection methods, despite the requirement for special preparation due to the presence of pathogenic agents in dog saliva.

Further, blood & semen samples are utilized in specific cases, as they offer a gentle & straightforward means of identifying genetic & inheritable diseases in animals. Typically, these tests involve drawing blood from animal veins & securely sending the collected sample to the designated laboratory.

By Test Type

The genetic diseases segment took a leading role in the pet industry in 2023, commanding a major share of the total revenue, as certain pet breeds are mainly susceptible to inheritable diseases, influencing their life expectancy, as conducting a high genetic attribute profile proves invaluable in assessing the risk of genetic conditions for mixed-bred, purebred, & hybrid pets. In instances where the breed mix is known, targeted genetic DNA tests can pinpoint specific medical issues.

Further, Pet owners are keen on understanding the established personalities & physical traits of their companion pets. Awareness of a pet's breeds & mixes facilitates predictions regarding temperament, future size, color patterns, behavior training needs, energy levels, and exercise requirements. Also, there is a notable demand for pet DNA test kits among pet owners who prioritize early preventive care.

By End User

The breeder segment emerged as the major driver in the pet industry in 2023, as breeders worldwide look to enhance dog & cat breeds across generations, personalizing them to meet changing owner preferences.

Further apart from physical attributes like fur and eye color, there's a growing focus on breeding animals with superior health & specific talents. Breeders are highly educating themselves on diverse breed mixes & mating possibilities to align with people's varied needs, making pet DNA test kits a commonly used tool in this pursuit.

Moreover, the pet owners’ segment is anticipated to experience the fastest growth in the forecast period, which particularly in developed countries, stems from the numerous benefits pets bring relief in loneliness, reducing anxiety and stress, boosting health & mood, and giving unconditional love.

Mainly, millennials in the US lead as both the major group of pet owners & the biggest spenders, contributing significantly to the substantial increase in pet expenditure, particularly for dogs, over the years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Pet DNA Testing Market Report is segmented on the basis of the following:

By Animal Type

By Sample Type

- Saliva

- Blood

- Semen

- Others

By Test Type

- Genetic Diseases

- Breed Profile

- Health & Wellness

By End User

- Breeders

- Pet Owners

- Veterinarians

Regional Analysis

North America secured the highest revenue share in 2023, exceeding

43%, driven by growth in pet spending & a large pet population., which is further supported by the active involvement of many major industry players, positively impacting overall sector expansion.

Further, the Asia Pacific region is expected to have rapid growth, expecting the fastest growth in the forecast period, which is attributed to a growing inclination among people to adopt companion animals, along with a rise in disposable income, encouraging heightened expenditure on pet care in the region. Also, significant steps in pet care practices in countries like China, India, South Korea, & Japan are expected to drive the overall growth of the pet care market in the Asia Pacific region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global pet DNA testing market features strong competition with many players competing for market share, as companies offer diverse testing services, using advanced genetic technologies & vast breed databases. Further, major strategies like product innovation, partnerships, & geographical expansion. The market is dynamic, with firms looking to cater to the growing need for pet DNA testing services globally

In October 2023, Basepaws launched the Basepaws Breed + Health Dog DNA Test, an expansive genetic analysis tool, which allows pet owners to swab their dogs for comprehensive and mobile-friendly results. By examining over 280 genetic markers associated with various canine hereditary conditions, the test provides valuable insights into a dog's genetics.

In addition, it offers a detailed breakdown of breed similarity by comparing the pet's genome to the large Basepaw database of over 200 canine breeds, like information on 30 distinct genetic trait markers influencing physical characteristics.

Some of the prominent players in the global Pet DNA Testing Market are

- Embark Veterinary Inc

- Neogen Corp.

- PetDx

- Wisdom Panel

- FidoCure

- GenSoIDiagnostics

- DNA MY DOG

- Orivet Genetic Pet Care

- Dognomics

- Basepaws Inc

- Other Key Players

Recent Developments

- In October 2022, Embark Veterinary Inc. announced the Age test, a pioneering product, which includes an algorithm designed by Embark to accurately determine a dog’s age, using epigenetics as its fundamental processing principle, which provides pet owners with valuable insights into their dog's age through advanced genetic analysis.

- In December 2022, Urban Animal, India's first DNA testing service with convenient doorstep services, announced its dog DNA testing kit. Using Next Generation Sequencing (NGS) technology, the kit ensures pain-free sampling with a simple swab. The comprehensive test offers efficient analysis, allowing pet owners to gain valuable insights into their dogs' genetic makeup.

- In January 2023, DNA My Dog launched its latest dog breed analysis service, featuring the Essential Breed ID test & Premium Breed ID test, drawing from a vast database of over 350 breeds, leveraging advanced CNV genetic technology for unparalleled accuracy. Also, it provides a cost-effective at-home Canine Allergy Test, identifying over 120 food and environmental allergens to help pet owners address their dog's sensitivities.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 371.4 Mn |

| Forecast Value (2032) |

USD 844.1 Mn |

| CAGR (2023-2032) |

9.6% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Animal Type (Cats and Dogs), By Sample Type (Saliva, Blood, Semen, and Others), By Test Type (Genetic Diseases, Breed Profile, and Health & Wellness), By End User (Breeders, Pet Owners, and Veterinarians) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Embark Veterinary Inc, Neogen Corp, PetDx, Wisdom Panel, FidoCure, GenSoIDiagnostics, DNA MY DOG, Orivet Genetic Pet Care, Dognomics, Basepaws Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

"

Frequently Asked Questions

How big is the Global Pet DNA Testing Market?

▾ The Global Pet DNA Testing Market size is estimated to have a value of USD 371.4 million in 2023 and is

expected to reach USD 844.1 million by the end of 2032.

Which region accounted for the largest Global Pet DNA Testing Market?

▾ North America has the largest market share for the Global Pet DNA Testing Market with a share of about

43.3% in 2023

Who are the key players in the Global Pet DNA Testing Market?

▾ Some of the major key players in the Global Pet DNA Testing Market are Embark Veterinary Inc, Neogen

Corp, PetDx, and many others.

What is the growth rate in the Global Pet DNA Testing Market?

▾ The market is growing at a CAGR of 9.6 percent over the forecasted period.