in the forthcoming period of 2024 to 2033.

The pet insurance market globally offers insurance to a cross-section of pets which include dogs, cats, horses, birds, small mammals, and reptiles. The main goal of this market is to help pet owners cope with the sudden veterinary costs that are not planned and thus be an additional economic help. On the same note, many policies that exist in the market consumer’s provide economical recompense for pet owners in case of accidents, diseases, medical operations, and other vital treatments for the animals.

The pet insurance policies of CIGNA also offer Economic reimburses on pet’s veterinarian bills, diagnostic measures, medications, surgical operations, and Preventive care coverage. The market for pet insurance around the world has been expanding fast over the last few years due to factors including a rise in pet ownership and pet health consciousness. This steady expansion is a key indicator of Pet Insurance Industry Growth and reflects the growing Pet Insurance Market Share of leading providers. Some of the players in this industry include Healthy Paws Pet Insurance and Nationwide Mutual Insurance Company which have been useful in expanding this growth.

New plans of insurance and viable coverage plans developed by pet insurers aim at satisfying the needs of its consumers to boost demand. This has also brought about a large number of insurance providers coupled with competitive pricing that boosts the market size. Moreover, innovations such as

Pet DNA Testing and increased awareness of organic pet food trends are influencing the types of insurance products and coverage options being offered.

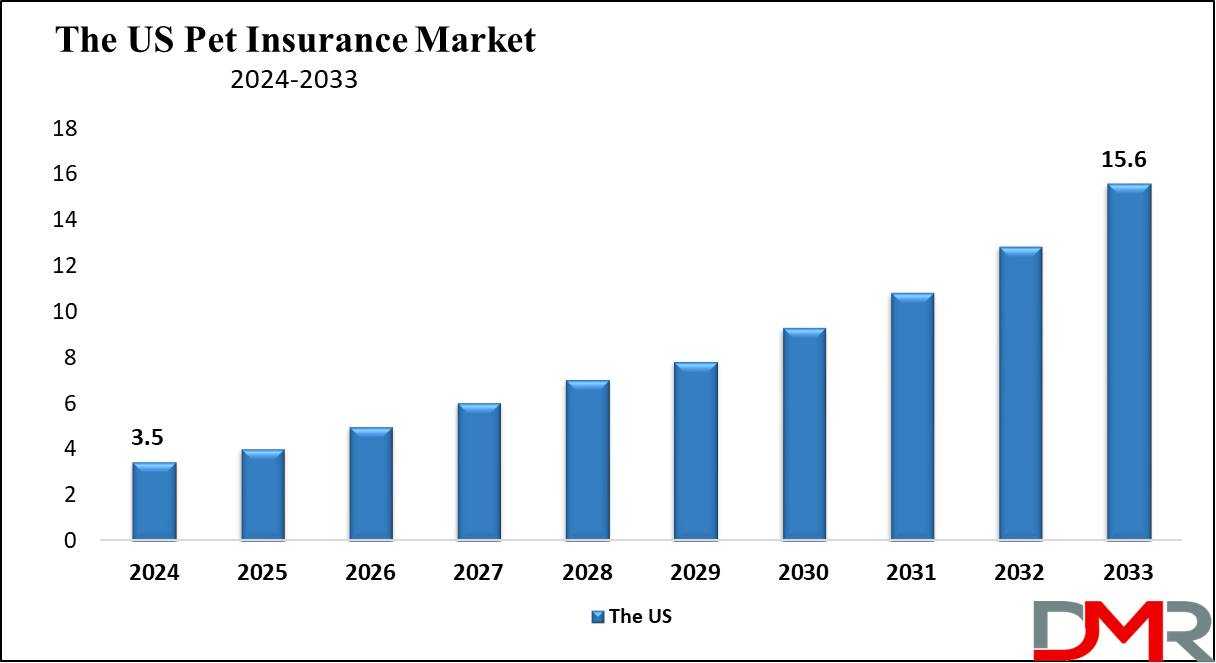

The US Pet Insurance Market

The United States is projected to hold a

value of about USD 3.5 billion in the pet insurance market at

a CAGR of 18.1% in 2024 which is further forecasted to cross the threshold of USD 15.6 billion in 2033.

The United States holds a significant place in the pet insurance market because Pet insurance is expected to be a consistently growing trend, and North America is again expected to have the lion's share because it is considered a region with high pet awareness and quality veterinary services.

- Key players like Nationwide, Trupanion, and Healthy Paws are expanding coverage options and using technology for seamless claims processing. Recent developments include customizable plans, telehealth services, and wellness coverage.

- The US pet insurance market has seen rapid growth, with a 27.5% increase in insured pets from 2020 to 2021, reaching over 4 million—a pivotal contribution to Pet Insurance Industry Growth.

Key Takeaways

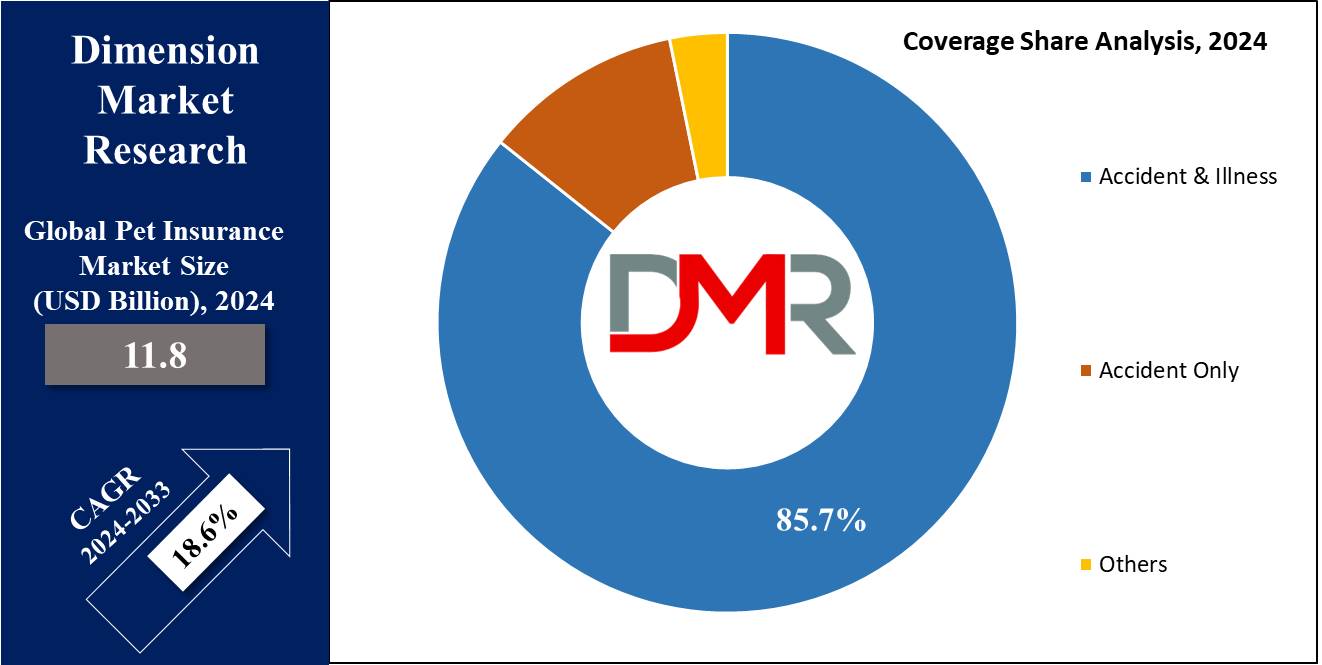

- Market Size: The global pet insurance market is projected to be valued at USD 54.6 billion in 2033 from the base value of USD 11.8 billion in 2024 at a CAGR of 18.6%.

- Definition: The pet insurance market offers insurance for veterinary expenses, selling financial protection and health care of pets. It consists of diverse plans, customization alternatives, and emerging telehealth offerings to enhance pet well-being. Increasingly, pet owners who already hold term insurance or cyber insurance for personal risks are seeing the value in extending financial protection to their pets.

- By Coverage Area Segment Analysis: By coverage area, accident, and illness are projected to dominate this market and hold around 85.7% market share in 2024.

- By Animal Segment Analysis: Dogs are projected to dominate the global pet insurance market as they hold the highest market share in 2024.

- By Sales Channel Segment Analysis: The direct sales of insurance policies are predicted to occupy over 36.2% of the market share in 2024.

- Regional Analysis: North America is projected to dominate this market as it is anticipated to hold the highest revenue share of 35.0% in 2024.

Use Cases

- Emergency Medical Treatment: Pet coverage covers sudden injuries or ailments, making sure pets get hold of set-off veterinary care without owners dealing with financial pressure from costly treatments and methods.

- Chronic Condition Management: Policies aid long-term treatments for conditions like diabetes or arthritis, protecting ongoing medicinal drugs, consultations, and therapies to manage puppy fitness efficiently and cost-effectively.

- Routine Wellness Care: Insurance aids in overlaying normal check-ups, vaccinations, dental cleanings, and preventive remedies, promoting proactive puppy health management and decreasing out-of-pocket prices for preventive care prices.

- Specialist Referrals and Surgeries: Comprehensive plans cover expert visits, diagnostics, and complicated surgeries, enabling access to specialized care for pets with complicated scientific needs, ensuring they receive important remedies without economic barriers.

Market Dynamic

Trends

Digital TransformationThe latest trend of digitization of the policy management system and claims servicing is the major driving factor for the pet insurance industry. These technological gadgets enrich the customer experience because they offer policy details and claims statuses at the customer’s convenience and in addition they receive consultations from a vet online. The use of AI in insurance and also the use of

machine learning in personalizing the services and also in predicting the health needs of the people also fuel the market for the insurance industry. This digitization is also helping insurers to cut operational expenses and increase productivity hence boosting the affordability of pet insurance among the population.

Customized Insurance PlansCompanies are adopting the strategy of providing the client with the policy the company develops taking into consideration breed, age, and health of your pet. So for example today’s policies encompass breed-specific pre-existing conditions and age-related wellness plans. This customization appeals to more consumers with young healthy pets, to the elderly with sickly or prone to-sick pets, and all in between. In other words, if the existing needs of the pet are met by the insurer, then the clients’ satisfaction and loyalty level are bound to increase, thereby promoting the growth of the market.

Growth Drivers

Rising Pet OwnershipGlobal factors strengthen the market and the central motivation coming from the market is the rising pet population. Recent statistics show that there are more than 85 million households with pets in the United States alone. This rise has been attributed to the increased realization of the pets as part of the family hence more cash is spent on their health and popularity. Pet insurance policies are on the rise due to demands to provide adequate health care to one’s pets; thus, the market enjoys a steep growth inclination. Consumers are also becoming more conscious of pet wellness, exploring options like

organic pet food and preventive health measures, which contribute to the demand for insurance products.

Increasing Veterinary CostsThe continually increasing price of pet care is one of the forces behind the growth of the pet insurance industry. Spinal and other procedures, treatments, and tests, necessary in comprehending and addressing various chronic illnesses, can also become rather costly to pet owners. For instance, the basic emergency veterinary surgery cost ranges from USD 1,500 to USD 5,000. This is a financial constraint that is forcing customers to seek insurance policies to cover the high cost of emergency treatments, thus the growth of the market.

Growth Opportunities

Expansion in Emerging MarketsAn increase in per capita spending on pets makes emerging markets holders of massive opportunities for the pet insurance industry. Pet adoptions and understanding regarding pet’s health have increased in Asia-Pacific and Latin American countries. For example, pet ownership in China has increased by 20 percent within the last five years. Since people’s disposable income has increased and they come to understand that pet insurance has a lot of advantages, there is a significant market that has not been exploited. Insurance companies should therefore take advantage of this by developing and providing cheaper and readily available insurance solutions to those regions. Additionally, as digital adoption rises in these regions, integrating pet insurance into

digital insurance platforms can improve penetration rates, as seen in markets for cyber insurance and term insurance.

Innovative Insurance Products

The pet insurance market has significant growth opportunities through creativity in insurance products. Policies are being brought in that cover multiple pets, health care plans, and optional extras such as dental, and non-traditional treatments. For example, wellness plans also include things like vaccinations and annual physicals, and multi-pet policies allow the policyholder to get a discount on the policy price for every animal. Such plans target the dynamism in the pet owners and serve to increase the value offered in pet insurance and consequently the market.

Restraints

High Premium Costs

This is still one of the biggest hurdles to the growth of the market since higher premiums are paid for insuring pets. The actual rates of premiums may differ greatly; however, the costs of a very expensive package for older animals or for animals already diagnosed with certain diseases can be much higher. Such costs may be expensive occasioned by the purchasing power, the extent to which people in different regions can afford to pay for pet insurance.

Lack of AwarenessOne major challenge is that a large number of pet owners are not informed about the advantages of pet insurance so the market has not reached its full potential. Although the number of pet owners has grown, the general population remains unaware of how insurance can make veterinary costs more manageable and improve the health outcomes of their pets. Less than a third of pet owners get pet insurance, and out of the rest, more than 60% have never even thought of it because of a lack of information about the product. This lack of knowledge reduces the pool of interested customers and thus represents a problem for the market. Educational efforts similar to those seen in promoting cyber insurance or

healthcare insurance could help increase awareness and adoption rates for pet insurance.

Research Scope and Analysis

By Coverage

Based on the area of coverage provided by insurance companies, accident, and illness are projected to dominate this segment as they

hold 85.7% of shares in this segment in 2024 and are expected to show subsequent growth in the upcoming period of 2024 to 2033. The dominance of accidents and illness in this segment can be attributed to the extensive coverage that attracts pet owners as these policies address a broad range of potential health issues, including accidents, injuries, and various illnesses. This type of coverage ensures that the pet receives necessary medical attention for both sudden and ongoing health concerns.

Also, accident and illness coverage often provides lifetime coverage, ensuring continuous protection for pets throughout their lives. This long-term assurance is appealing to pet owners who want consistent and reliable coverage as their pets age and potentially develop chronic health conditions. Many accident and illness policies may include preventive care options, such as vaccinations and wellness exams. This encourages pet owners to take a proactive approach to their pets' health, emphasizing preventive measures alongside coverage for unexpected accidents and illnesses.

By Animal

Based on the majority of animals who are insured, dogs are projected to dominate this segment as they hold the majority portion of the market in 2024. Dogs represent a significantly larger portion of the pet population in many regions as their popularity as companion animals plays a major role in their adoption which leads to a higher demand for insurance coverage. Also, dogs require more extensive and costly healthcare compared to other pets as they are prone to various health issues, including genetic conditions, injuries, and age-related ailments. That is why pet owners are now more inclined to seek insurance coverage for dogs to mitigate the financial risks associated with potential veterinary expenses.

Furthermore, different dog breeds have specific health predispositions where they can require specific medical care which pushes the pet owners of purebred dogs to invest in buying pet insurance to address the breed-specific health concerns of their pets. Also, on average, dogs tend to have a longer lifespan compared to some other pets, such as rodents or reptiles. The extended duration of pet ownership increases the likelihood of encountering health issues, prompting pet owners to consider insurance for comprehensive coverage throughout their dog's life.

By Sales Channel

In terms of the sales channel for pet insurance, direct sales channels generate the highest revenue and are anticipated to dominate the market in 2024, they hold 36.2% of the market share and are projected to show promising growth in the forthcoming period as well. Direct sales channels are more popular than other sales channels as they offer direct interaction with customers. In direct interactions insurance providers can educate potential policyholders about the benefits of pet insurance, helping them make informed decisions.

It also offers personalized and tailored pet insurance policies directly to consumers especially customization according to the specific needs and preferences of pet owners, enhancing the overall customer experience and satisfaction. This direct communication of insurance providers to consumers fosters a sense of trust and transparency which act as a major factor in the popularity of direct sales in this segment. Also, direct sales streamline the purchasing process, enabling pet owners to quickly and efficiently buy insurance policies which is particularly advantageous in a market where convenience and ease of access play crucial roles in attracting and retaining customers.

The Pet Insurance Market Report is segmented based on the following

By Coverage

- Accident & Illness

- Accident Only

- Others

By Animal

By Sales Channel

- Direct Sale

- Agency

- Broker

- Bancassurance

- Others

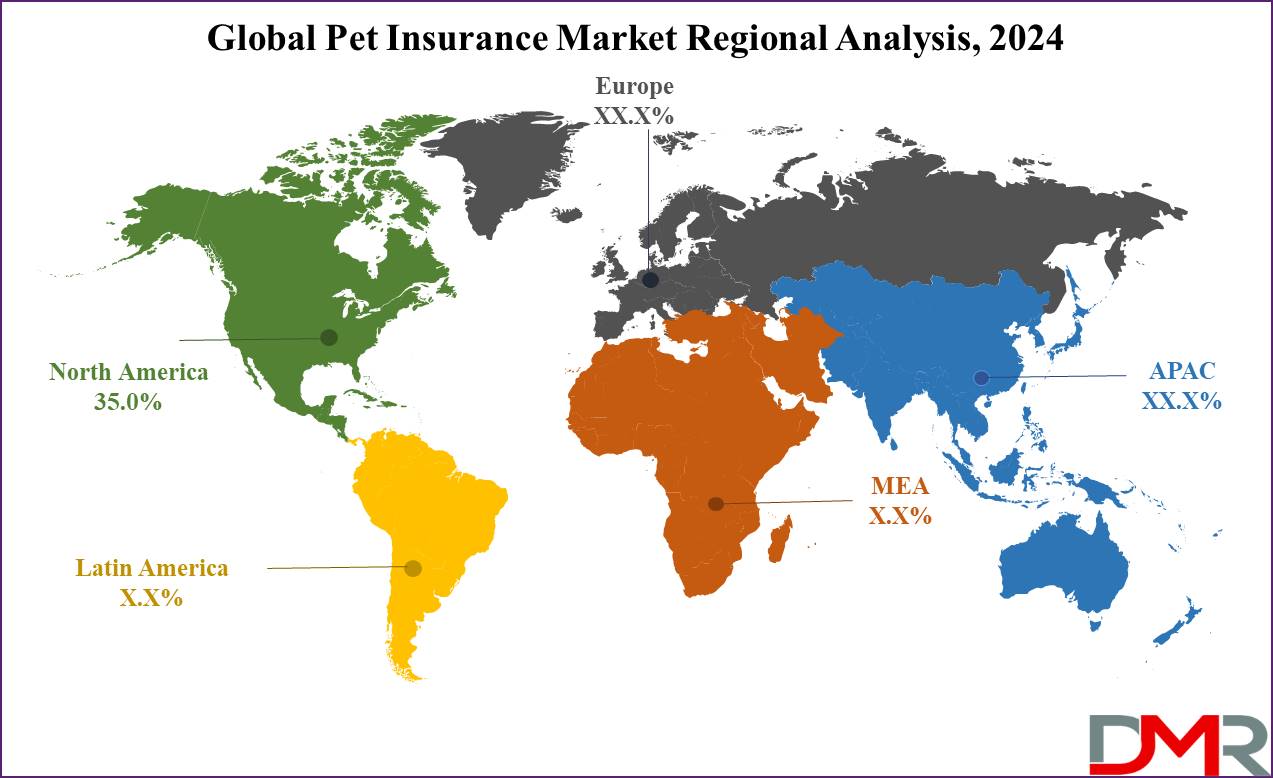

Regional Analysis

North America is projected to dominate the pet insurance market, contributing

a majority of 35.0% of the

total revenue in 2024, and is also projected to show subsequent growth for the forecasted period of 2024 to 2033. This region occupies the largest share of the market as there has been a growing trend in the rate of pet adoption in the past few years, hence expanding the target customer base in pet insurance. Thus, the growth of new pet owners in North America seeking to offer their animals the best care boosts the need for pet insurance policies. The region has a high incidence of pet acquisition with many households owning pets thanks to the cultural endowment of pet companions. North America, having modern means of veterinary care, prescribes expensive treatment, which forces people to insure their pets.

Further, the level of understanding and therefore, the consciousness of the benefits of pet insurance among the North American pet owners is better than in the rest of the world, which has resulted in higher insurance penetration in this world region. Moreover, due to the strong market research companies and the availability of quality market reports, strategic market analysis is enhanced thus attributing to the domination of the North American pet insurance market. Key players in the market, such as Healthy Paws Pet Insurance and Nationwide Mutual Insurance Company, have established strong footholds in the region, offering diverse and comprehensive insurance plans.

North America has the leading role in the global Pet Insurance Business. Besides, the target consumers of North America have a high level of awareness of the need for pet insurance. This makes pet owners in this region more well informed with the kind of policies that are in place hence increasing the uptake rate compared to the other regions. Also, North America has good and rapidly growing Veterinary healthcare facilities, making sure that pets are easily served with quality veterinary healthcare. This infrastructure support provided in this region illustrates the proposition of selling forget insurance, and now the pet owners are looking for the pros of protecting themselves against the soaring price of Veterinary insurance services.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global pet insurance market is highly competitive, with numerous players striving to capture market share through innovative product offerings and strategic partnerships. Key companies include Healthy Paws Pet Insurance, Nationwide Mutual Insurance Company, and Figo Pet Insurance, each offering unique coverage options tailored to pet owners' needs. These companies invest heavily in marketing and customer education to raise awareness about the benefits of pet insurance. The market is also characterized by the presence of smaller, specialized insurance providers that focus on niche segments, such as exotic pets or specific breeds.

Market share analysis shows a trend towards consolidation, with larger players acquiring smaller firms to expand their customer base and geographic reach. The insurance market size is expected to grow as companies leverage digital platforms for better customer engagement and streamline claims processes. Continuous innovation and competitive pricing are crucial strategies adopted by these companies to maintain and enhance their positions in the global pet insurance market. For example, in June 2020, Trupanion formed a partnership with Vetter Software, a provider of technology solutions for animal healthcare this collaboration involved integrating Vetter Software's cloud-based veterinary practice management platform with Trupanion's software which facilitates direct economic transactions to veterinarians during check-out.

The entry of major players like AXIS Insurance into the pet insurance market further heightens competition. AXIS Insurance's partnership with Petplan facilitated through its Accident and Health unit, signifies a strategic move to tap into the growing pet insurance sector.

Some of the prominent players in the Global Pet Insurance Market are

- Trupanion Inc.

- Petplan (Allianz)

- Animal Friends Insurance Services Limited

- Figo Pet Insurance LLC

- Direct Line

- Deutsche Familienversicherung AG

- Nationwide Mutual Insurance Company

- Embrace Pet Insurance Agency LLC

- Anicom Insurance

- ipet Insurance Co. Ltd.

- MetLife Services and Solutions LLC

- Pumpkin Insurance Services Inc.

- Other Key Players

Recent Developments

2024:

- April 2024: Chubb, a global insurance leader, announced its definitive agreement to acquire Healthy Paws, a U.S.-based managing general agent (MGA) specializing in pet insurance, from Aon. This acquisition is strategically aimed at enhancing Chubb's position in the niche but rapidly growing pet insurance market. Healthy Paws' expertise in managing pet insurance programs will enable Chubb to expand its offerings and capitalize on the increasing demand for comprehensive pet health coverage.

- April 2024: MetLife Pet Insurance formed a collaboration with the Association of Animal Welfare Advancement (AAWA) to empower pet parents in providing lifelong care for their pets. This partnership focuses on developing educational content addressing challenges in veterinary care access. Additionally, it includes recognizing innovative animal welfare organizations through the Golden Beagle Award.

2023:

- November 2023: Fetch, a pet insurance provider, partnered with Best Friends Animal Society to contribute towards their goal of making America a no-kill nation by 2025. Fetch's substantial donations support Best Friends' efforts in rehoming shelter pets and advocating for animal welfare, aligning with Fetch's mission to protect pets' well-being beyond insurance coverage.

- September 2023: Independence Pet Group (IPG) expanded its market presence by acquiring Felix, the sole U.S.-based pet insurance brand exclusively serving cats. This strategic acquisition allows IPG to diversify its pet insurance offerings and cater specifically to the unique needs of cat owners, reinforcing its commitment to comprehensive pet health solutions.

- August 2023: Global Risk Partners (GRP) entered the UK pet insurance market by acquiring Petsmedicover, a pet insurance broker trading as VetsMediCover. This acquisition integrates Petsmedicover into GRP's digital brokerage platform, InSync Insurance, enhancing GRP's capabilities in delivering innovative insurance solutions and expanding its footprint in the competitive UK pet insurance sector.

- August 2023: Go Digit General Insurance collaborated with Vetina Healthcare LLP to introduce extensive insurance coverage for dogs to Vetina Family members in India. This partnership aims to meet the rising demand for pet insurance in India, providing comprehensive health protection for pets and enhancing accessibility to quality veterinary care across the region.

- August 2023: Bajaj Allianz General Insurance launched a 'Pet Insurance Policy' covering cats and dogs in India, offering comprehensive health coverage for pets. This initiative reflects Bajaj Allianz's commitment to addressing the growing need for pet health protection in India and providing financial security to pet owners against unexpected veterinary expenses.