Market Overview

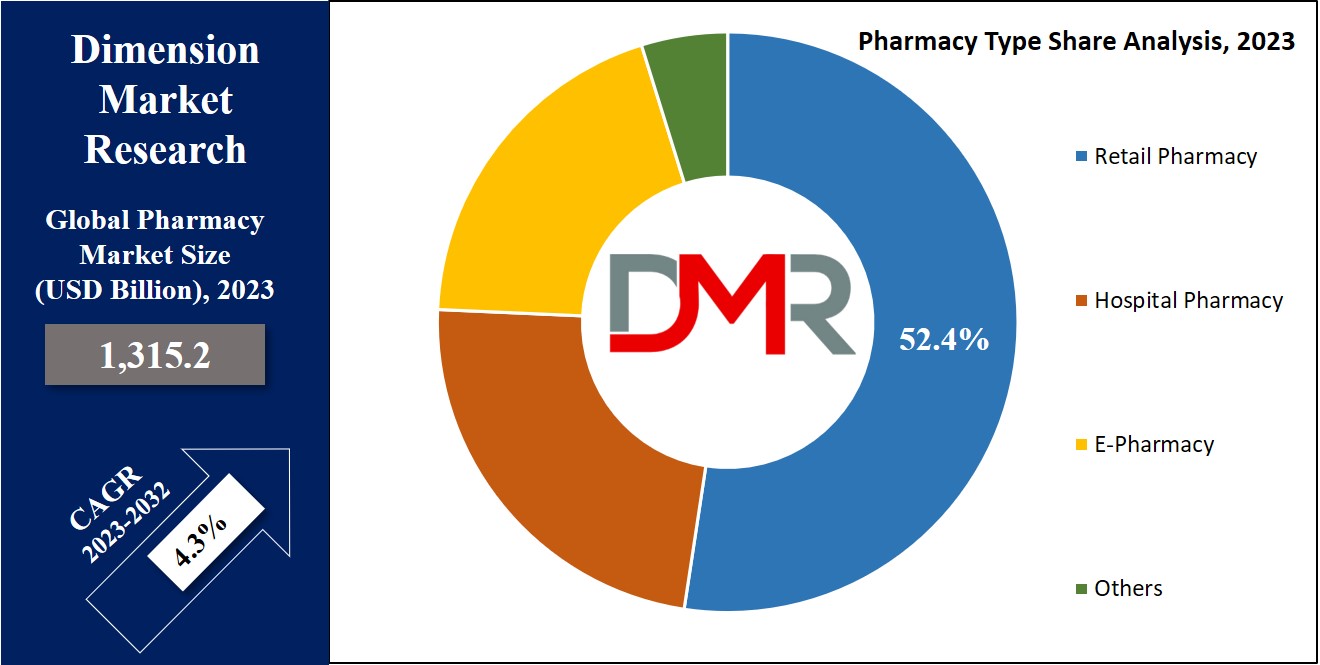

The Global Pharmacy Market is expected to have a value of USD 1,315.2 billion in 2023, and it is further predicted to reach a market value of USD 1,914.6 billion by 2032 at a CAGR of 4.3%.

A pharmacy is a place in an online or offline mode where one can get medicines & health-related products. Pharmacists at the pharmacy help one understand how to take one's medications & provide guidance on health and wellness. It's like a store for getting the right medicines & healthcare items required by an individual.

According to Ravimiamet, the pharmacy market has shown consistent growth, with total turnover reaching €691 million in 2023, marking significant long-term expansion. Of this, general pharmacies accounted for €542 million, with medicines representing 73% (€393 million) and other products 27% (€149 million). The sector handled 12 million prescriptions, up from 11.6 million in 2022.

Prescriptions reimbursed by EHIF comprised 10.2 million, while non-discounted prescriptions totaled 1.8 million. Hospital pharmacies saw a 9% increase in turnover, reaching €149 million. Per capita, medicine expenditure was €369 annually, with €129 on prescription medicines, reflecting an 8% rise in prescription spending and a 3% dip in non-prescription.

Key Takeaway

- Market Growth: The global pharmacy market is set to increase from USD 1,315.2 billion in 2023 to USD 1,914.6 billion by 2032, achieving a CAGR of 4.3%.

- Prescription Demand: Prescription products dominate revenue share, fueled by higher chronic disease prevalence and a rapidly aging global population needing ongoing medication.

- Retail Dominance: Retail pharmacies contributed the highest revenue in 2023, benefiting from widespread pharmacy chains and increased use of automation technologies.

- Digital Expansion: E-pharmacies and online channels are growing fast, offering privacy, discounts, free delivery, and convenience that drive consumer adoption.

- Regional Trends: North America holds 54.3% of market revenue, while Asia-Pacific is the fastest-growing region, led by rising demand for generics and healthcare improvements.

- Automation & Services: Advanced pharmacy robots, dispensing systems, and pharmacy-provided health management services boost operational efficiency and expand service offerings.

- Competitive Moves: Leading companies are pursuing global expansion through partnerships, product launches, and acquisitions to reinforce competitiveness and market reach.

Use Cases

- Prescription Fulfillment Automation: Pharmacies can use automated robots and dispensing systems to streamline prescription processing, reducing errors and improving service efficiency for both staff and patients.

- E-Pharmacy Platforms: Businesses can establish online pharmacies to offer remote medication ordering, privacy, discounts, and home delivery—attracting tech-savvy and convenience-seeking consumers.

- Personalized Medicine Services: Pharmacies can provide genetic-based medication recommendations, supporting more effective and individualized treatment, especially for chronic or complex conditions.

- Retail Health Expansion: Retail pharmacies can increase revenue by offering health management services like vaccinations, health screenings, and counseling, positioning themselves as community healthcare hubs.

- Generic Drug Expansion: Companies can focus on supplying affordable generics, especially in fast-growing Asia-Pacific markets, to address rising demand and improve healthcare accessibility.

- Pandemic Preparedness Solutions: Pharmacies can develop protocols and systems to manage spikes in product demand and supply chain disruptions during public health crises.

Market Dynamic

The global pharmacy market is being significantly driven by the growing healthcare expenditure worldwide, increased by factors like aging populations, a rise in chronic diseases, & advances in medical technology. As healthcare

spending grows, there is an increase in demand for prescription medications & related products, thus positively influencing the growth of the pharmacy retail sector.

In addition, the emphasis on personalized medicine, which customizes medical treatment to an individual's unique genetic makeup, is fueling the need for specialized pharmaceutical products., as pharmacy retail stores play a pivotal role in offering these personalized medications, thereby propelling market growth.

However, operating in a regulatory environment characterized by stringent rules & compliance requirements set by health authorities & licensing bodies, the pharmacy retail market imposes challenges for its participants, which can be added costs, time-consuming processes, & potential legal & reputational risks.

Furthermore, high competition prevails in this market, marked by the presence of many local & global players competing against established pharmacy chains, online retailers, & other healthcare providers can pose challenges for newcomers & smaller players.

Research Scope and Analysis

By Product Type

The prescription product category holds the largest share of revenue in 2023, which is primarily due to the growth in the prevalence of chronic illnesses & the rise in the elderly population, which is propelling the need for prescription drugs.

Further, according to the United Nations reports a global population of over 703 million adults aged 65 & above, a number projected to

reach 1.5 billion by 2050. The need for prescription medications, mainly for treating conditions like diabetes, respiratory ailments, cardiovascular diseases, blood disorders, antibiotics, &

oncology, is driving the growth of the prescription segment.

In addition, the over-the-counter (OTC) segment is expected to notice a rapid expansion during the forecasted period, as the growth in demand for OTC medicines to treat ailments like upper respiratory issues, pain relief, & heartburn is the driving force behind this growth. Moreover, the rise in occurrences of colds, coughs, & flu are also contributing to the segment's expansion.

Furthermore, factors like the increase in popularity of private-label OTC products, the accessibility of OTC items through online platforms, escalating prescription costs, a growing trend of self-medication, and the transition of prescription drugs to OTC offerings are further strengthening the growth of the OTC segment.

By Pharmacy Type

The retail pharmacies leads in revenue in 2023, driven by the proliferation of independent pharmacies and chains, along with the availability of medications in supermarkets & mass retailers in countries like the U.S. & U.K. Major chains like CVS Health, Lloyd, & Well Pharmacy in countries including Canada, the U.S., the U.K., Australia, & Russia are contributing to the segment's growth.

In addition, the quick expansion of automation technologies like pharmacy robots & dispensing systems is boosting the segment's expansion. Retail pharmacies are not only dispensing prescriptions but also providing vaccination & health management services, further boosting market growth.

Moreover, during the pandemic, many e-Pharmacies experienced a growth in revenue. Like, CVS Health reported a 50% rise in digital refills for specialty products through their apps. E-pharmacies provide advantages like privacy, discounts, free shipping, time savings, & a variety of offers.

Thus, the increasing use of digital technologies in healthcare, higher smartphone penetration, & the introduction of online channels by different retailers is expected to drive the growth of the e-Pharmacy segment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Pharmacy Market Report is segmented on the basis of the following

By Product Type

By Pharmacy Type

- Hospital Pharmacy

- Retail Pharmacy

- E-Pharmacy

- Others

Regional Analysis

North America leads pharmacy market revenue in 2023, accounting for 54.3% of the total revenue share, which is due to the presence of major multinational chains like CVS Health, Cigna, Walmart, Kroger, & others, which are opting for various strategies & automation technologies to grow their market share. Like, Rite Aid Corp. introduced its Wellness + rewards program, providing high discounts & rewards to customers. In addition, the growth in the aging population is also contributing to market growth, as is the rising demand for both over-the-counter & prescription drugs.

Moreover, Asia Pacific is expected to be the fastest-growing pharmacy market in the coming years, which is attributed to the expanding

pharmaceutical industry in China & India, along with a rising demand for generic medications. Also, key pharmacies in the region are also expanding rapidly. The burden of diseases, higher healthcare spending, & a higher elderly population in countries like Japan are further fueling the market expansion in the Asian market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

In the competitive landscape of the global pharmacy market, major players are applying diverse strategies to strengthen their market position, as they are forming partnerships, making agreements, launching new products, expanding to new regions, & engaging in mergers and acquisitions to expand their presence & competitiveness on an international scale.

In February 2022, Biocon Biologics Ltd (BBL), a Biocon subsidiary, completed a deal worth USD 3.34 billion to purchase Viatris' biosimilar assets. This strategic decision will allow BBL access to Viatris' global sales & distribution network in both established & growing markets.

Some of the prominent players in the global Pharmacy Market are:

- Cigna

- Walmart

- CVS Health

- Well Pharmacy

- GSK Plc

- Pfizer Inc

- Merck & Co

- Kroger

- Lloyd Pharmacy

- Sanofi

- Other Key Players

Recent Developments

- In September 2025, Johnson & Johnson acquired Intra-Cellular Therapies for $14.6 billion, marking the largest pharmaceutical sector deal of the year.

- In August 2025, Pharmacy Times released its 2025 OTC Guide, highlighting top pharmacist-recommended brands across 149 product categories for consumer self-care and trust.

- In July 2025, Sanofi announced the acquisition of Blueprint Medicines for $9.1 billion, strengthening its oncology and precision medicine portfolio globally.

- In April 2025, Sun Pharmaceutical Industries launched a new product line, including fexuprazan in India for treatment of erosive esophagitis.

- In March 2025, Merck’s CFO emphasized continued strategic acquisitions, responding to major upcoming patent cliffs and pipeline needs for future growth.

- In January 2025, ResMed launched AirSense 11 in India, advancing digital health technology for sleep apnea management.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 1,315.2 Bn |

| Forecast Value (2032) |

USD 1,914.6 Bn |

| CAGR (2023-2032) |

4.3% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Prescription and OTC), By Pharmacy Type (Hospital Pharmacy, Retail Pharmacy, E- Pharmacy, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Cigna, Walmart, CVS Health, Well Pharmacy, GSK Plc, Pfizer Inc, Merck & Co, Kroger, Lloyd Pharmacy, Sanofi, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Pharmacy Market?

▾ The Global Pharmacy Market is estimated to reach USD 1,315.2 billion in 2023, which is further expected

to reach USD 1,914.6 billion by 2032.

Which region accounted for the largest Global Pharmacy Market?

▾ North America dominates the Global Pharmacy Market with a share of 54.3% in 2023.

Who are the key players in the Global Pharmacy Market?

▾ Some of the major key players in the Global Pharmacy Market are Cigna, CVS Health, GSK Plc, and many

others.

What is the growth rate in the Global Pharmacy Market?

▾ The market is growing at a CAGR of 4.3% over the forecasted period