Market Overview

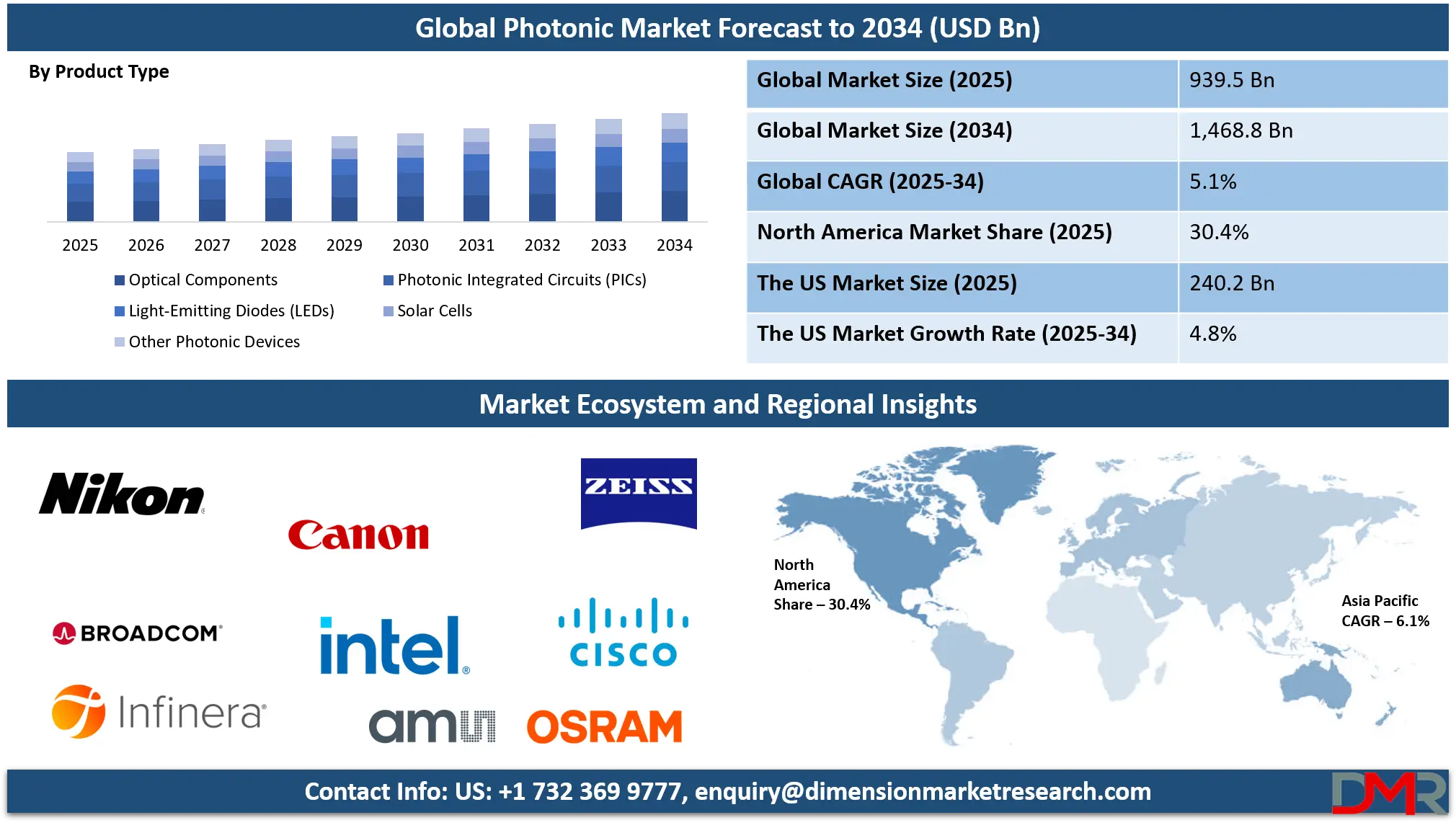

The Global Photonic Market size is projected to reach USD 939.5 billion in 2025 and grow at compound annual growth rate of 5.1% to reach a value of USD 1,468.8 billion in 2034.

Photonics is the science and technology of working with photons, the tiny particles of light and electromagnetic radiation. It includes creating light, detecting it, and controlling its movement for different uses. Photonics is present in everyday items like lasers, LEDs, and fiber-optic cables. It also supports advanced areas such as high-speed internet, medical imaging, and precision sensors. Because light can carry information quickly and with little energy loss, photonics has become an essential part of modern communication and computing.

Demand for photonics has been growing because the world needs faster and more efficient ways to transmit and process data. Data centers, artificial intelligence systems, and cloud computing services all rely on high-speed, low-energy technologies, and photonics provides a solution. It also supports emerging technologies like quantum computing, advanced sensors for cars and healthcare, and augmented or virtual reality devices. These industries are pushing for smaller, more powerful, and energy-efficient photonic components, which has increased research and investment.

One major trend is the growth of silicon photonics, which allows photonic components to be built directly on silicon chips. This makes them easier to produce and integrate with existing electronics. Another trend is quantum photonics, where photons are used to carry quantum information for next-generation computing and secure communications. Photonics is also being integrated with artificial intelligence hardware to improve data transfer speeds and reduce power use, making it attractive for large-scale AI models and servers.

In recent years, several notable events have highlighted photonics’ importance. Companies like Lightmatter have introduced new photonic chip technologies to improve AI performance. Researchers in China developed a silicon photonic chip capable of extremely fast data transfer, and TDK unveiled a breakthrough optical detector for high-speed systems. The European Union has invested in photonic semiconductor production facilities to strengthen regional capabilities. These developments show that governments, researchers, and businesses see photonics as critical to future technologies.

The US Photonic Market

The US Photonic Market size is projected to reach USD 240.2 billion in 2025 at a compound annual growth rate of 4.8% over its forecast period.

The US plays a leading role in the global photonics market through innovation, investment, and advanced manufacturing. It is home to world-class research institutions, national laboratories, and technology companies driving breakthroughs in silicon photonics, quantum photonics, and optical communication systems.

The US government supports photonics development through funding programs, defense projects, and collaborations with private industry, ensuring national security and technological leadership. Major US-based universities and startups contribute to advancing photonic chips, lasers, and sensing technologies. The country’s strong semiconductor and AI industries also boost demand for photonic solutions in data centers, 5G networks, and emerging quantum computing. Overall, the US remains a critical hub for photonics research, commercialization, and global market growth.

Europe Photonic Market

Europe Photonic Market size is projected to reach USD 140.9 billion in 2025 at a compound annual growth rate of 3.9% over its forecast period.

Europe holds a prominent position in the global photonics market through strong research, innovation, and government-backed initiatives. The region has invested heavily in photonic technologies to drive digital transformation, sustainability, and advanced manufacturing. European Union programs, such as Horizon Europe and regional photonics clusters, fund research and pilot production facilities to strengthen local supply chains. Europe is advancing silicon photonics, quantum communication, and optical sensing for applications in healthcare, automotive, and industrial automation.

Collaborative projects between universities, research institutes, and private companies help accelerate breakthroughs. With a focus on sustainability and energy efficiency, Europe is using photonics to support smart cities, renewable energy systems, and cutting-edge communication networks, reinforcing its global leadership.

Japan Photonic Market

Japan Photonic Market size is projected to reach USD 112.7 billion in 2025 at a compound annual growth rate of 5.3% over its forecast period.

Japan plays a vital role in the global photonics market through its advanced research, precision manufacturing, and strong industrial base. The country is a leader in developing optical components, lasers, and photonic devices used in telecommunications, healthcare, and consumer electronics. Japanese companies and research institutes are pioneering innovations in silicon photonics, quantum communication, and next-generation optical sensors.

Government initiatives and public-private partnerships support photonics R&D, ensuring continued competitiveness in global markets. Japan’s expertise in miniaturization and high-quality production helps drive photonic applications in automotive LiDAR, medical imaging, and semiconductor manufacturing. By combining technological excellence with long-term investment, Japan continues to shape the evolution and adoption of photonics across multiple industries worldwide.

Photonic Market: Key Takeaways

- Market Growth: The Photonic Market size is expected to grow by USD 486.5 billion, at a CAGR of 5.1%, during the forecasted period of 2026 to 2034.

- By Product Type: The optical components is anticipated to get the majority share of the Photonic Market in 2025.

- By Application: The Telecommunication & Data Center segment is expected to get the largest revenue share in 2025 in the Photonic Market.

- Regional Insight: Asia Pacific is expected to hold a 45.2% share of revenue in the Global Photonic Market in 2025.

- Use Cases: Some of the use cases of Photonic includes, healthcare & medical imaging, automotive & transportation, and more.

Photonic Market: Use Cases

- Telecommunications and Data Centers: Photonics powers high-speed fiber-optic networks, enabling fast internet and efficient data transfer. It reduces energy use and heat compared to traditional electronics. Data centers use photonic interconnects to handle growing demand from cloud services and AI workloads.

- Healthcare and Medical Imaging: Photonics is used in advanced medical imaging, like optical coherence tomography and laser surgery tools. It allows doctors to see tissues in detail without invasive procedures. Light-based sensors and diagnostic devices also improve accuracy and patient care.

- Automotive and Transportation: Photonics enables LiDAR systems and advanced sensors in autonomous and connected vehicles. These technologies improve safety by detecting obstacles and mapping surroundings in real time. It also supports smart traffic systems and vehicle-to-infrastructure communication.

- Quantum Computing and Security: Photonics is key to building quantum computers and secure communication networks. Photons can carry quantum information over long distances with low loss. This makes photonics essential for next-generation computing power and ultra-secure data transmission.

Market Dynamic

Driving Factors in the Photonic Market

Rising Demand for High-Speed Data and Connectivity

The growing need for faster internet, cloud computing, and artificial intelligence workloads is driving the photonic market forward. As data traffic increases worldwide, traditional electronic systems struggle with speed and energy efficiency. Photonics provides a solution through optical fibers and integrated photonic chips that can transmit vast amounts of information with minimal loss.

Data centers, 5G networks, and emerging 6G technologies are adopting photonics to handle growing demands. The shift toward remote work, streaming services, and connected devices also fuels this growth. By offering low latency and reduced power consumption, photonics is becoming the backbone of modern communication.

Expansion of Advanced Applications in Emerging Technologies

Photonics is gaining importance in fields like quantum computing, autonomous vehicles, and advanced medical imaging. These areas require precise, fast, and reliable light-based technologies. Quantum communication networks depend on photons for secure data transfer, while autonomous vehicles rely on photonic LiDAR systems for accurate sensing. In healthcare, photonics powers non-invasive diagnostics and laser-based surgeries, improving patient outcomes.

Additionally, augmented and virtual reality devices use photonic components for realistic visuals and responsiveness. As industries look for innovative solutions, the versatility of photonics makes it a preferred technology. Its integration into diverse applications ensures long-term growth across multiple sectors.

Restraints in the Photonic Market

High Production Costs and Complex Manufacturing

One major restraint for the photonic market is the high cost of production and the complexity of manufacturing advanced photonic components. Creating precise optical devices requires specialized materials, cleanroom facilities, and advanced fabrication processes that are expensive to set up and maintain. Smaller companies and startups may struggle to compete due to these financial barriers. Scaling production for mass markets while keeping quality consistent remains challenging. Additionally, integrating photonics with existing electronic systems can require custom designs, adding to overall expenses. These factors can slow down widespread adoption and limit growth in cost-sensitive industries.

Technical Challenges and Standardization Issues

The photonic market also faces challenges related to technology integration and the lack of universal standards. Combining photonic components with traditional electronics can be difficult, as differences in materials and operating conditions create compatibility issues. Packaging and ensuring reliability of photonic devices under different environments remain ongoing concerns.

Without standardized protocols and interfaces, manufacturers risk incompatibility across systems and regions, which can delay market expansion. Developing robust standards requires global cooperation among industries, governments, and researchers. Until these issues are resolved, some potential users may hesitate to adopt photonic solutions, slowing broader implementation.

Opportunities in the Photonic Market

Integration with Emerging Technologies and AI

A major opportunity for the photonic market lies in its integration with fast-growing fields such as artificial intelligence, machine learning, and next-generation computing. As AI models become larger and data processing demands skyrocket, photonics offers faster data transfer and reduced power consumption compared to traditional electronics. Optical interconnects and photonic chips can overcome bottlenecks in data centers and supercomputers, making them essential for future AI infrastructure.

Additionally, advancements in edge computing and Internet of Things devices can benefit from photonic components for efficient communication. This creates a wide range of opportunities for photonics in shaping next-generation digital ecosystems.

Expansion into Healthcare, Automotive, and Quantum Applications

Another significant opportunity comes from the use of photonics in healthcare, transportation, and quantum technologies. In medicine, photonics enables breakthroughs in non-invasive diagnostics, advanced imaging, and precision laser surgeries, improving patient outcomes and healthcare efficiency. The automotive sector is adopting photonic-based LiDAR and sensors for safer autonomous vehicles and smart traffic systems.

Quantum communication and computing also depend heavily on photons for secure data transfer and powerful computation. As these industries continue to evolve and invest in innovative solutions, photonics stands to play a central role, opening up new revenue streams and long-term growth potential.

Trends in the Photonic Market

Advancement of Silicon Photonics and Chip Integration

A key recent trend in the photonic market is the rapid advancement of silicon photonics and the integration of photonic components onto semiconductor chips. This approach allows manufacturers to use existing semiconductor fabrication processes, reducing costs and improving scalability. By placing lasers, modulators, and detectors on a single chip, silicon photonics improves performance while shrinking device size. This trend is particularly important for data centers, 5G networks, and AI hardware, where high-speed and energy-efficient data transfer is critical. The growing adoption of silicon photonics is making photonic solutions more accessible and practical for widespread commercial use.

Growth of Quantum Photonics and Secure Communication

Another notable trend is the increasing focus on quantum photonics, which uses photons to process and transmit quantum information. This technology is at the core of developing ultra-secure communication networks and next-generation quantum computers. Governments, research institutions, and private companies are investing heavily in quantum photonics to gain a competitive edge in secure data transfer and advanced computation. Recent breakthroughs in quantum encryption and long-distance photon transmission have accelerated interest in this field. As industries look for solutions to cybersecurity and computing limitations, quantum photonics is becoming one of the most promising frontiers in the photonic market.

Impact of Artificial Intelligence in Photonic Market

- Enhanced Design and Optimization: AI helps create more efficient photonic components by simulating and optimizing designs faster than traditional methods, reducing development time and cost.

- Smarter Manufacturing Processes: AI-driven automation improves the precision and quality control of photonic device production, ensuring consistent performance and minimizing defects.

- Advanced Data Processing and Communication: AI integrates with photonics to boost data transfer speeds in data centers and telecommunication networks, supporting the growth of high-speed connectivity.

- Support for Emerging Technologies: Combining AI with photonics enables breakthroughs in quantum computing, autonomous vehicles, and medical imaging by improving sensing accuracy and processing capabilities.

- Predictive Maintenance and Reliability: AI tools analyze performance data to predict potential failures in photonic systems, increasing reliability and reducing downtime.

Research Scope and Analysis

By Product Type Analysis

Optical components leading in 2025 with a share of 28.7% are expected to be a key driver of growth in the photonic market by enabling efficient light transmission, modulation, and detection across various applications. These components, which include lenses, mirrors, filters, and optical fibers, are essential for telecommunications, medical imaging, and industrial automation.

Their widespread use in high-speed data networks, laser-based systems, and sensing technologies supports advancements in sectors like healthcare, automotive LiDAR, and renewable energy. Growing demand for energy-efficient and high-performance devices is pushing manufacturers to develop advanced optical components. Strategic collaborations and technological innovation are further strengthening their role in expanding the global photonics landscape.

Photonic integrated circuits, having significant growth over the forecast period, are expected to transform the photonic market by combining multiple optical functions on a single chip. These circuits improve speed, efficiency, and miniaturization, making them crucial for data centers, quantum computing, and advanced sensing systems.

Their integration with electronic components reduces power consumption and enhances performance. With increasing adoption in telecommunications, AI hardware, and automotive technologies, photonic integrated circuits are becoming essential for next-generation devices. Ongoing research, investment, and improved fabrication techniques are set to expand their applications and boost their influence on the global photonics market.

By Technology Analysis

Optical communication is expected to lead in 2025 with a share of 36.5% and is set to be a central force driving the growth of the photonic market by enabling ultra-fast and energy-efficient data transmission, which forms the backbone of global telecommunications networks, supporting fiber-optic cables, high-speed internet, and data centers. Its ability to transmit large amounts of information with minimal loss makes it vital for expanding 5G and developing future 6G networks.

Optical communication is also vital for cloud computing, AI workloads, and smart city infrastructure, where reliability and speed are vital. Continuous innovation in wavelength division multiplexing, optical amplifiers, and integrated photonic systems is strengthening its role in meeting growing connectivity demands worldwide.

Further, photonic computing, having significant growth over the forecast period, is expected to reshape the photonic market by offering faster data processing and lower power consumption compared to traditional electronics. This technology uses light instead of electrons to perform computations, enabling advanced capabilities for AI, big data analytics, and scientific simulations.

Photonic computing promises to overcome the limitations of conventional chips, reducing heat generation and improving speed. Its adoption in data centers, quantum systems, and next-generation processors is driving interest from researchers and industries. Ongoing investments, breakthroughs in integrated photonics, and growing demand for energy-efficient computing are set to accelerate its development and market impact.

By Application Analysis

Telecommunication & data centers, which are expected to lead the market in 2025 with a share of 24.3%, are anticipated to be a major driver of the photonic market by enabling high-speed, reliable, and energy-efficient data transmission. The growing demand for cloud computing, streaming services, and large-scale AI applications is pushing data centers to adopt photonic solutions for faster communication and lower power consumption.

Optical fibers, photonic chips, and integrated photonic systems are helping telecommunication networks handle massive data traffic while improving latency and bandwidth. The rise in deployment of 5G and the development of future 6G networks further reinforce the importance of photonics in this sector. Continuous innovation in optical communication technologies is making telecommunication and data centers a core application for the global photonic market.

Further, Defense & aerospace, having significant growth over the forecast period, are set t strengthen the photonic market by enabling advanced sensing, imaging, and communication systems. Photonics is used in applications such as secure communication, LiDAR-based navigation, missile guidance, and high-resolution surveillance.

Its ability to operate at high speeds, with precision and reliability under harsh conditions, makes it ideal for military and aerospace operations. Innovations in photonic sensors and laser systems are enhancing situational awareness, targeting accuracy, and overall mission efficiency. Governments and defense organizations are investing in photonic technologies to maintain strategic advantages. As aerospace and defense programs expand globally, photonics continues to emerge as a critical technology supporting advanced operational capabilities and security systems.

The Photonic Market Report is segmented on the basis of the following:

By Product Type

- Optical Components

- Lasers

- Detectors & Sensors

- Modulators

- Amplifiers

- Waveguides

- Photonic Integrated Circuits (PICs)

- Light-Emitting Diodes (LEDs)

- Solar Cells

- Other Photonic Devices

By Technology

- Optical Communication

- Biophotonics

- Imaging & Display Technologies

- Photonic Computing

- Other Emerging Technologies

By Application

- Telecommunications & Data Centers

- Healthcare & Life Sciences

- Consumer Electronics

- Industrial Manufacturing & Processing

- Defense & Aerospace

- Other Applications

Regional Analysis

Leading Region in the Photonic Market

Asia Pacific leading in 2025 with a share of 45.2% plays a crucial role in driving the growth of the photonic market through rapid industrialization, strong manufacturing capabilities, and expanding technology adoption. Countries such as China, Japan, South Korea, and India are investing heavily in photonics for telecommunications, consumer electronics, automotive LiDAR, and healthcare applications.

The region benefits from a robust semiconductor industry, skilled workforce, and supportive government initiatives that promote research, development, and large-scale production. Growing demand for high-speed internet, advanced medical imaging, and smart transportation systems further strengthens Asia Pacific’s position. Strategic collaborations between regional companies, universities, and global players are accelerating innovation, making Asia Pacific a key hub for photonic advancements and commercialization during the ongoing year.

Fastest Growing Region in the Photonic Market

Middle East and Africa, showing significant growth over the forecast period is becoming an emerging region in the expansion of the photonic market, driven by investments in telecommunications, renewable energy, and smart city projects. Countries in the Gulf Cooperation Council are adopting photonic technologies to improve high-speed data networks, advanced medical imaging, and industrial automation.

Growing renewable energy initiatives and solar power projects also create opportunities for photonic applications in energy-efficient systems. Supportive government programs, infrastructure development, and partnerships with global technology providers are accelerating adoption. With a focus on innovation and sustainability, the region is steadily building its presence in the global photonics landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The photonic market is highly competitive, with many global and regional players working across communications, sensing, imaging, and advanced computing. Companies compete by developing faster, smaller, and more energy-efficient photonic components, as well as by improving integration with existing electronic systems.

Innovation in areas like silicon photonics, quantum technologies, and optical interconnects drives intense research and investment. Startups and established manufacturers alike are racing to secure patents, partnerships, and supply chain advantages. Governments and research institutes also play a role by funding projects and setting standards, making the market dynamic and pushing rapid advances in performance and applications.

Some of the prominent players in the global Photonic are:

- ASML Holding N.V.

- Corning Incorporated

- Canon Inc.

- Nikon Corporation

- Zeiss Group (Carl Zeiss AG)

- Broadcom Inc.

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Intel Corporation (Silicon Photonics)

- Coherent Corp. (incl. II-VI)

- Lumentum Holdings Inc.

- IPG Photonic Corporation

- Hamamatsu Photonic K.K.

- Trumpf GmbH + Co. KG

- ams OSRAM AG

- Lumileds Holding B.V.

- Nichia Corporation

- Cree LED (Smart Global Holdings)

- Ciena Corporation

- Infinera Corporation

- Other Key Players

Recent Developments

- In July 2025, French deeptech startup Arago raised USD 26 million in its seed round, co-led by Earlybird, Protagonist, and Visionaries Tomorrow, to fund its photonic processor project called “JEF.” The “JEF” processor is designed to achieve similar performance to leading GPUs, but with ~10× lower energy consumption, aiding deployment of energy-efficient AI compute infrastructure.

- In June 2025, Quantum computing / networking company IonQ completed its acquisition of Lightsynq Technologies, a startup specialising in photonic interconnects and quantum memory. The deal boosts IonQ’s roadmap toward scalable, fault-tolerant quantum systems and accelerates progress toward quantum internet infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 939.5 Bn |

| Forecast Value (2034) |

USD 1,468.8 Bn |

| CAGR (2025–2034) |

5.1% |

| The US Market Size (2025) |

USD 240.2 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Optical Components, Photonic Integrated Circuits (PICs), Light-Emitting Diodes (LEDs), Solar Cells, and Other Photonic Devices), By Technology (Optical Communication, Biophotonics, Imaging & Display Technologies, Photonic Computing, and Other Emerging Technologies), By Application (Telecommunications & Data Centers, Healthcare & Life Sciences, Consumer Electronics, Industrial Manufacturing & Processing, Defense & Aerospace, and Other Applications) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ASML Holding N.V., Corning Incorporated, Canon Inc., Nikon Corporation, Zeiss Group (Carl Zeiss AG), Broadcom Inc., Huawei Technologies Co., Ltd., Cisco Systems, Inc., Intel Corporation (Silicon Photonics), Coherent Corp. (incl. II-VI), Lumentum Holdings Inc., IPG Photonic Corporation, Hamamatsu Photonic K.K., Trumpf GmbH + Co. KG, ams OSRAM AG, Lumileds Holding B.V., Nichia Corporation, Cree LED (Smart Global Holdings), Ciena Corporation, Infinera Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Photonic Market size is expected to reach a value of USD 939.5 billion in 2025 and is expected to reach USD 1,468.8 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Photonic Market, with a share of about 45.2% in 2025.

The Photonic Market in the US is expected to reach USD 240.2 billion in 2025.

Some of the major key players in the Global Photonic Market are Intel, Nikon, Canon, and others

The market is growing at a CAGR of 5.1 percent over the forecasted period.