Market Overview

The Global

Plus Size Womens Clothing Market size is expected to reach a

value of USD 308.0 billion in 2024, and it is further anticipated to reach a market

value of USD 444.4 billion by 2033 at a

CAGR of 4.2%.

Plus-size Womens wear is a market that has changed so much and reflects an increasingly strong commitment to body positivity and inclusivity in the fashion industry. Traditionally overlooked, plus-size women now have various amounts of stylish options for themselves and their peculiar traits and preferences. This has been driven by the increasing awareness of the importance of representation in fashion, helping extend the market's offerings and push for an inclusive approach.

The high demand for fashionable yet comfortable clothing has continuously driven retailers to attempt to conquer the plus-size segment of the market. As a result, this has led to the launch of fashion-forward collections in sync with a more significant percentage of the population. This, in turn, helps plus-size women become confident with their style. Social media has also played its part in this evolution, as the plus-size community- influencer and content creators-retort back for diversity, modeling styles differently.

Furthermore, this is also the sector where e-commerce is on the rise, allowing for plus-size clothing access to be revolutionized as consumers can shop online with an unprecedented array. This shift not only enhances the shopping experience but allows brands to reach an international market as well. Innovation has never been higher, many companies prioritize sustainability and ethics to meet changing customer tastes in an environmentally-conscious society.

Overall, the plus-size Women's clothing market displays a dynamic landscape inclusive of style and accessibility for people of various shapes and sizes that opens more avenues of fashion creativity and diversity.

The US Plus Size Womens Clothing Market

The US Plus Size Women's Clothing Market is projected to be valued at USD 107.0 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 151.6 billion in 2033 at a CAGR of 3.9%.

The U.S. plus-size Women's clothing market has witnessed several significant trends that have significantly altered consumer purchasing decisions and consumer behavior. One such development is the increase in online shopping as an avenue to discover fashionable apparel options without physical store constraints limiting choices or restricting inventory levels, retailers are optimizing their websites to make shopping simpler leading to higher sales and market expansion.

Sustainability has also become more significant within the U.S. market as consumers become increasingly mindful of their environmental footprint when making purchasing decisions, prompting brands to adopt eco-friendly practices and materials in their clothing lines. Sustainable fashion resonates strongly with consumers, particularly plus-size women looking for stylish but responsible choices.

Body diversity, inclusive sizing, and sustainability are shaping the U.S. plus-size Women's apparel market today; an increasing number of brands are shifting their strategies accordingly to stay attuned to these trends. Recent developments, including collaborations between influencers and product lines, have further elevated plus-size fashion's profile within mainstream culture and made its presence known to more Americans than ever. Thus, its U.S. market stands to experience considerable expansion with the potential to set global fashion trends over time.

Key Takeaways

- Global Market Size: The global plus-size Women's clothing market size is estimated to have a value of USD 308.0 billion in 2024 and is expected to reach USD 444.4 billion by the end of 2033.

- The US Market Value: The US plus size Women's clothing market is projected to be valued at USD 151.6 billion in 2033 from a base value of USD 107.0 billion in 2024 at a CAGR of 3.9%.

- Regional Analysis: North America is expected to have the largest market share in the global plus-size Women's clothing market with a share of about 41.3% in 2024.

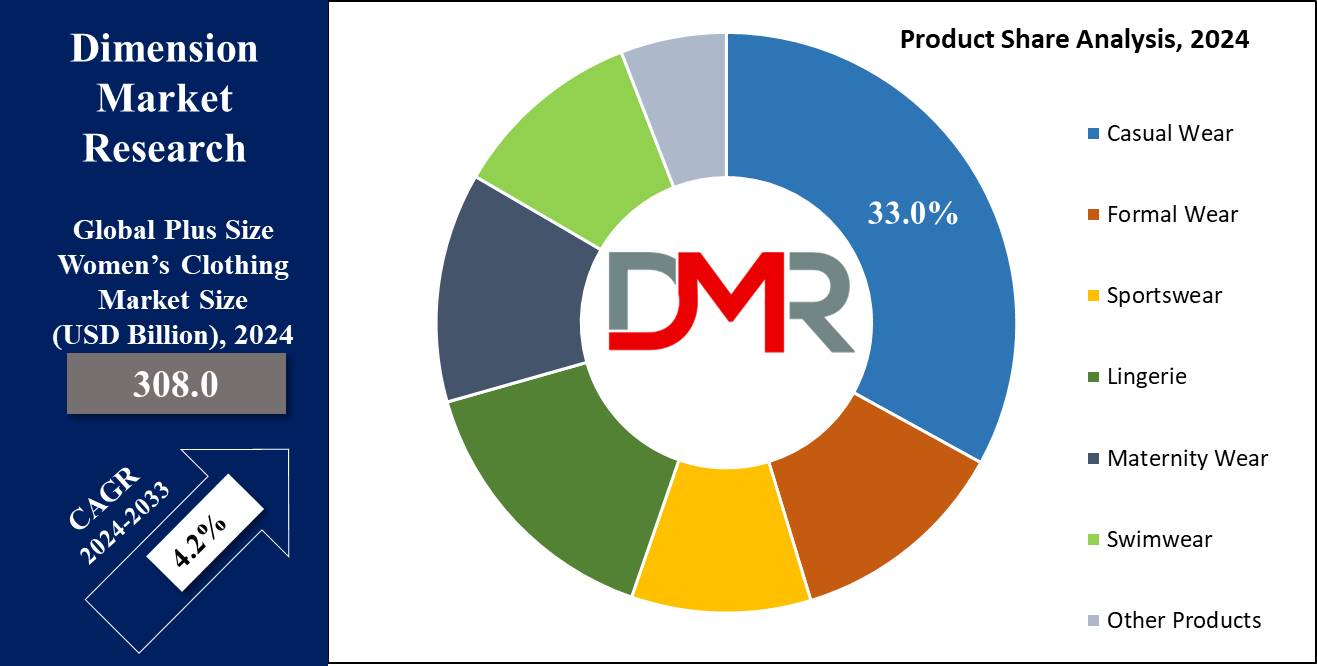

- By Product Segment Analysis: Casual wear clothing products are projected to dominate the product segment in this market with 33.0% of the market share in 2024.

- By Price Range Segment Analysis: Mid-range priced Women's clothing is projected to dominate the pricing segment with 44.9% of the market share in 2024.

- Key Players: Some of the major key players in the Global Plus Size Womens Clothing Market are ASOS plc, H&M Group, Nike Inc., Adidas AG, forever 21 Inc., Macy's Inc., Torrid LLC, and many others.

- Global Growth Rate: The market is growing at a CAGR of 4.2 percent over the forecasted period.

Use Cases

- Casual Wear: Plus-size casual wear is a high-demand category wherein customers need comfort tees, T-shirts, and loungewear that can accommodate larger body types in style and functionality.

- Activewear: With the increasing activewear market, different brands try to incorporate stylish and functional activewear for plus-size women, enabling them to take part in different physical activities while at the same time boosting their body confidence.

- Formal Wear: As more plus-size women enter corporate environments, the demand for plus-size formal wear has gone up to provide women with fashionably appealing business wear that caters to their needs.

- Special Occasion Clothing: The plus-size market is also growing for special occasions, such as weddings and events, offering stylish plus-size gowns and dresses that cater to various body shapes and sizes.

Market Dynamic

Trends

Growing Body Positivity MovementThe body positivity movement has gradually gained significant momentum over the last couple of years, side-stepping to act as an influencer for consumer attitudes toward fashion and size inclusivity. This trend encourages acceptance of every different type of body shape and hence contributes to enlarging demand for plus-size clothing with variance in personal styles and choices.

In this vein, its adoption by brands further secures collections put out speaking to a wider audience to nurture a culture of inclusivity and self-acceptance. This trend is expected to continue influencing the plus-size Women's clothing market in terms of growth and innovation as consumers seek brands that stand for the values they support.

Rise of E-commerce

Online shopping has completely revamped the retail space in recent times, especially in the plus-size clothing market for women. These websites expose consumers to more varieties and sizes of products and brands involved in business than their real-time brick-and-mortar stores. The ease of use during online shopping with price comparisons and customer reviews has made it the favorite choice for most plus-size women. The online shopping trend is most likely to bring principal growth in plus-size clothing due to the reason that brands are enhancing user experience and investing increasingly in their online presence.

Growth Drivers

Increased Demand for Fashionable Options

The awareness brought about by the realization of one's body type has increased demands for fashionable clothes that are on trend. As consumers demand clothing that best fits their fashion sense, brands respond by adding fresh new clothes that suit the plus-size market. The recent trend of changes in consumer preference opened new paths to clothes design for the fulfillment of changing consumer needs, thereby acting as a driver for market growth.

Influence of Social Media

Social media platforms have emerged as very strong channels for promoting fashion and lifestyle, hence influencing the plus-size Women's clothing market. With the help of social media, multiple social influencers and content creators belonging to the plus-size community share different styles that help them connect with others and even convince people to love their bodies. With social media continuing to be the huge driver in consumer preferences, brands that participate in these platforms and influencer partnerships will see a continued upward trajectory in visibility and sales within the plus-size clothing segment.

Growth Opportunities

Expansion into Emerging Markets

Plus-size garments have enormous scope in emerging markets around the world, especially where there is a potential upward aspiration for fashion combined with affordability. Awareness about body positivity and inclusivity drives brands to expand their offerings toward servicing the diverse needs of plus-size women. This, in turn, allows companies to tap into new consuming segments and becomes a driver of growth as companies enter these markets with tailored marketing strategies and localized product lines.

Sustainable Fashion Initiatives

The increasing demand for green and sustainable apparel from consumers provides a good opportunity for plus-size Women's wear brands to differentiate themselves in the marketplace. By integrating sustainable practices into product design, such as material recycling and ethical methods of production, companies will be able to position themselves with geeky environmentalists while improving their overall brand equity. Emphasizing sustainability within their plus-size collections can lead to increased customer loyalty and drive growth in the market.

Restraints

Limited Retail Availability

Even as plus-size demand in the apparel industry increases, many brick-and-mortar retailers still can't seem to carry enough size and style options. That same inefficiency due to limited availability will at some point prevent customers from buying and shifting to online alternatives. Therefore, not stocking enough plus-size products in stores means a brand is likely to lose sales and be unfavorable among this big consumer segment.

Stereotypes and Stigma

Social stereotyping and stigma associated with plus-size women serve as a damper toward buying decisions. For this reason, negative perceptions of body sizes can contribute to insecure and self-conscious feelings that may form part of the relevant approach of plus-size consumers to fashion. Those brands not capable of overcoming the issue by means of their marketing and product will not win the hearts of target audiences and hence limit potential growth in the plus-size Womens clothing market.

Research Scope and Analysis

By Product

Casual wear is projected to emerge as the dominant product segment in the plus-size Women's clothing market as it will hold 33.0% of the total market share by the end of 2024. Casual wear has quickly emerged as the go-to product category in plus-size Women's apparel due to consumer preferences and lifestyle shifts specifically an increased desire for comfort and practicality in a daily fashion.

Casual apparel remains one of the market's strongest performers among plus-size women's wear products, especially as work-from-home arrangements and looser dress codes have led to greater demands for comfortable options. Plus-size women have increasingly turned to casual clothing like T-shirts, joggers, loungewear, and lounge robes as a means of expressing themselves while prioritizing comfort. Such apparel allows them to express themselves while prioritizing personal style without compromising comfort levels.

Cultural shifts toward body positivity also influence consumer decisions as plus-size consumers search for fashionable options tailored specifically for them and their body shapes. Retailers have responded to this trend by expanding their casual wear offerings for women of all sizes, providing stylish but comfortable apparel options for them all. Brands such as Eloquii and Old Navy have taken steps toward expanding these collections towards plus-size women, featuring eye-catching designs made of quality materials in attractive collections tailored specifically towards them.

Social media influencers and content creators have played an instrumental role in popularizing casual wear within the plus-size Women's clothing market, encouraging plus-size women to embrace casual styles as an expression of individualism and inclusive fashion. Plus-size consumers have rapidly adopted this look, thus it will likely remain dominant during its forecast period as consumers' needs and preferences evolve.

By Age Group

The age group of 31 to 45 years is projected to dominate the plus-size Women's clothing market with the highest market share in 2024. Most of the life-changing events such as career advancement, family commitments, and personal growth happen during this age bracket and hence will possibly influence Women's choices in clothing. In this age bracket, the trend is toward fashion and versatile clothes suitable for their lifestyle. Comfort and practicality drive this age group toward fashion brands that offer a good mix of style, comfort, and functionality.

Since women in the 31- to 45-year-old demographic generally draw on better disposable incomes compared to their younger counterparts, financial stability allows them to invest in quality plus-size clothing that not only fits but also reflects personal style. The brands are therefore increasingly realizing this trend and aligning their product offerings to the particular needs of this age group, focusing on styles that balance well between trendiness and practicality.

Besides, the acceptance of diverse body types and the promotion of body positivity have enabled ladies in this age bracket to love their bodies and find self-expression through fashion. Because of this, more fashion clothes can be bought, and women between 31 to 45 years are most likely to try different trends, colors, and patterns. This confirms their leading position in the plus-size Women's wear market. Because plus-size women in this age bracket are still being served by retailers, growth, and engagement can be expected to continue through the forecast period.

By Raw Material

Cotton is projected to dominate the raw material segment in the plus-size Women's clothing market as it holds the highest market share in 2024 due to comfort, breathability, and versatility. Comfort is one of the aspects that plus-size consumers consider whereby they seek clothes that are gentle on the skin besides allowing free movement of the body. Being made from a natural fiber, cotton exhibits these qualities which is ideal for casual wear, formal wear, and even activewear.

One of the prime reasons that keep cotton in such high demand involves its breathability. Plus-size women, in particular, favor those fabrics that in warm climates are capable of effecting moisture-wicking coupled with airflow to reduce the probability of skin irritation and discomfort. The moisture-absorbing property of cotton makes it particularly suitable for everyday wear, undergarments, and sleepwear because it allows the skin to stay dry and cool.

Cotton is also versatile, intended for everything from casual wear T-shirts to elegant blouses. Its durability and adaptability to different designs further make it a preferred fabric choice among many clothing manufacturers. Besides, cotton is hypoallergic; as such, it certainly meets the needs of those consumers who have sensitive skin common concern in the plus-size segment. Sustainability is another growing factor.

As demand increases for eco-friendly and ethically produced garments, cotton, particularly organic cotton, meets the demand of consumer preference for natural and renewable products. This echoes the calls of environmentally sensitive buyers, boosted by their dominance. Conclusion Cotton's comfort, breathability, versatility, and sustainable qualities will provide it with a leading position as the raw material in the plus-size Women's clothing market, meeting practical requirements and changing consumer preferences.

By Pricing

The mid-priced is projected to dominate the pricing category in the plus size Women's clothing market as it holds 44.9% of the market share in 2024. Consumers are increasingly looking for a balance between quality and affordability, and mid-priced clothing options offer just that. There is an increasing demand by buyers to have a balance between quality and price. Mid-priced clothing just offers that.

This price enables brands to make fashion and functionality available without making budgets obsolete. Plus-size women are very value-sensitive and would go for brands that deliver on style and price. Besides, the middle-price segment enables retailers to reach more people, including plus-size consumers who, for their part, do not have the financial freedom to invest in high-end fashion but would nevertheless like quality and style.

Brands such as Old Navy and Eloquii have positioned themselves within this pricing segment, appealing to the ever-increasing demographics of plus-size women looking to find easy, available fashion wear. Moreover, this mid-price range category constrains companies to be at par in terms of quality so that the level of material input and the degree of craftsmanship can match consumer requirements.

Mid-priced clothing provides brands with an incentive to maintain competitive quality standards, meeting consumer expectations for materials and craftsmanship while creating brand loyalty among repeat purchasers. As demand for inclusive yet stylish clothing continues to increase, mid-priced Women's options should continue to serve budget constraints or individual style needs throughout the forecast period from 2024-2033.

By Distribution Channel

The offline distribution channel remains dominant in the plus-size Women's clothing market for several reasons, primarily rooted in consumer preferences and shopping behaviors. One of the key factors is the desire for a tactile shopping experience. Many plus-size consumers prefer to try on clothing before making a purchase, as fit and comfort are crucial when selecting garments.

Brick-and-mortar stores allow customers to feel the fabric, assess the fit, and experience the clothing firsthand, which significantly influences their purchasing decisions. Additionally, offline retail provides a sense of immediacy that online shopping cannot match. Consumers can browse plus-size clothing collections in person, allowing them to take home their purchases immediately.

This instant gratification is especially appealing to those who need clothing for specific events or occasions. Moreover, the growing trend of curated plus-size sections within established retailers has made it easier for consumers to access a wider variety of stylish options in-store, further boosting the offline channel's appeal.

Furthermore, the rise of personalized customer service in physical stores enhances the shopping experience for plus-size women. Retailers are increasingly focusing on training staff to understand the unique needs of plus-size consumers, offering tailored recommendations and fitting assistance. This personalized approach fosters a positive shopping environment and encourages repeat visits.

As the demand for plus-size clothing continues to grow, offline distribution channels will likely remain dominant, providing consumers with the tactile experience and personalized service they seek while fostering a sense of community among plus-size shoppers.

The Plus Size Women Clothing Market Report is segmented based on the following

By Product

- Casual Wear

- T-shirts

- Jeans

- Casual Dresses

- Leggings

- Hoodies

- Formal Wear

- Office Suits

- Blazers

- Trousers

- Formal Dresses

- Skirts

- Sportswear

- Activewear

- Gym Wear

- Yoga Pants

- Joggers

- Sports Bras

- Lingerie

- Everyday Bras

- Shapewear

- Panties

- Sleepwear

- Maternity Wear

- Maternity Dresses

- Nursing Bras

- Maternity Leggings

- Swimwear

- One-Piece

- Tankinis

- Swim Dresses

- Beachwear Accessories

- Other Products

By Age Group

- 15–30 Years

- 31–45 Years

- 46–60 Years

- 60+ Years

By Raw Material

- Cotton

- Wool

- Silk

- Chemical

- Others

By Pricing

- Low-Priced

- Mid-Priced

- Premium

By Distribution Channel

- Online

- E-commerce Platforms

- Official Websites

- Offline

- Department Stores

- Specialty Stores

- Hypermarkets and Supermarkets

- Fashion Boutiques

- Outlet Stores

Regional Analysis

North America is projected to dominate the plus-size women's clothing market as it will hold 41.3% of the total market share in 2024. The key factors that can be attributed to its dominance include that the women in this region are becoming increasingly aware and promoting, body positive image and inclusive fashion according to their body type.

Consumers in North America are relatively more vocal about what they want in terms of size and style offerings. This demand for change compels brands to give heed and hence, introduce relevant offerings targeted at plus-size women. This has culturally translated into increased acceptance of varied body types and a higher demand for fashionable plus-size clothing. In addition, North American consumers enjoy relatively decent disposable incomes, which can be spent on good-quality plus-size apparel.

Several popular brands and plus-size retailers exist within the region, adding to competitiveness and eventually innovation and variety. The presence of key players, such as Lane Bryant, Torrid, and Ashley Stewart, further established the position of North America in the global market. Moreover, it was e-commerce and online shopping that allowed North American consumers to access different brands offering plus-size clothing, irrespective of geographical region.

This accessibility has encouraged market growth and empowered consumers to move towards diversity in choices, which has increased sales. Since inclusivity and diversity are likely to continue in North America, this region is probable to prevail in leadership within the plus-size womens clothing market.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the plus-size women's clothing market comprises a diverse array of brands and retailers that address the specific needs of plus-size customers. Leading players like Lane Bryant, Torrid, and Ashley Stewart have long dominated the market with their extensive product offerings and strong brand recognition.

These companies have been able to establish themselves as leaders within the plus-size segment due to offering fashionable options for all sizes of women. Newer brands like Eloquii and Good American also gained noticeable strides in the market due to their fashionable designs and promoting inclusivity. These brands create collections that speak to plus-size women, appealing to a more fashion-oriented and younger audience that recognizes themselves and expresses themselves in such a way.

Besides, large retailers increasingly realize that plus-size Women's clothing markets are a very fertile ground to expand their businesses, and as such, they are rapidly increasing their plus-size-related offerings. Fashion retailers like Old Navy, ASOS, and Target have embraced inclusive sizing and proudly tout separate plus-size sections. Competition herein is such that there is continuous innovation, with individual brands striving hard to find distinctive patterns in sustainability and marketing.

Given the consumer demand for plus-size clothing on the rise, competition among players will increase further, and, in turn, drive further growth and evolution in the plus-size Women's clothing market.

Some of the prominent players in the Global Plus-Size Women's Clothing Market are

- ASOS plc

- H&M Group

- Nike, Inc.

- Adidas AG

- Forever 21, Inc.

- Macy's, Inc.

- Torrid LLC

- Lane Bryant (Ascena Retail Group)

- Ralph Lauren Corporation

- C&A

- Eloquii

- Marks & Spencer Group plc

- Other Key Players

Recent Developments

- September 2024: Lane Bryant launched a new collection focusing on athleisure wear designed specifically for plus-size women, combining comfort and style for an active lifestyle. This move aligns with the growing demand for fashionable activewear options within the plus-size Women's clothing market.

- August 2024: Eloquii announced a collaboration with a various well-known fashion influencers to promote body positivity and showcase their latest collection of plus-size clothing. The partnership aims to engage younger consumers and increase brand visibility on social media platforms.

- July 2024: Old Navy expanded its plus-size clothing range to include more seasonal options, emphasizing trendy styles for summer and fall. This expansion aims to meet the growing demand for stylish and functional clothing among plus-size women.

- June 2024: Torrid unveiled a new initiative focused on sustainability, introducing eco-friendly materials into their plus-size clothing collections. This initiative caters to the increasing consumer demand for responsible fashion and reinforces the brand's commitment to inclusivity.

- May 2024: Good American launched a denim collection that includes a wider variety of sizes, ensuring that plus-size women have access to stylish and comfortable jeans. This launch reflects the brand's dedication to body diversity and commitment to providing fashionable options for all consumers.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 308.0 Bn |

| Forecast Value (2033) |

USD 444.4 Bn |

| CAGR (2024-2033) |

4.2% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 107.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Casual Wear, Formal Wear, Sportswear, Lingerie, Maternity Wear, Swimwear, and Other Products), By Raw Material (Cotton, Wool, Silk, Chemical, Other Raw Materials), By Age Group (15–30 Years, 31–45 Years, 46–60 Years, and 60+ Years), By Pricing (Low-Priced, Mid-Priced, and Premium), By Distribution Channel (Online, and Offline) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

ASOS plc, H&M Group, Nike Inc., Adidas AG, Forever 21 Inc., Macy's Inc., Torrid LLC, Lane Bryant (Ascena Retail Group), Ralph Lauren Corporation, C&A, Eloquii, Marks & Spencer Group plc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Plus Size Womens Clothing Market size is estimated to have a value of USD 308.0 billion in 2024 and is expected to reach USD 444.4 billion by the end of 2033.

The US Plus Size Women's Clothing Market is projected to be valued at USD 107.0 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds USD 151.6 billion in 2033 at a CAGR of 3.9%.

North America is expected to have the largest market share in the Global Plus Size Womens Clothing Market with a share of about 41.3% in 2024.

Some of the major key players in the Global Plus Size Womens Clothing Market are ASOS plc, H&M Group, Nike Inc., Adidas AG, forever 21 Inc., Macy's Inc., Torrid LLC, and many others.

The market is growing at a CAGR of 4.2 percent over the forecasted period.