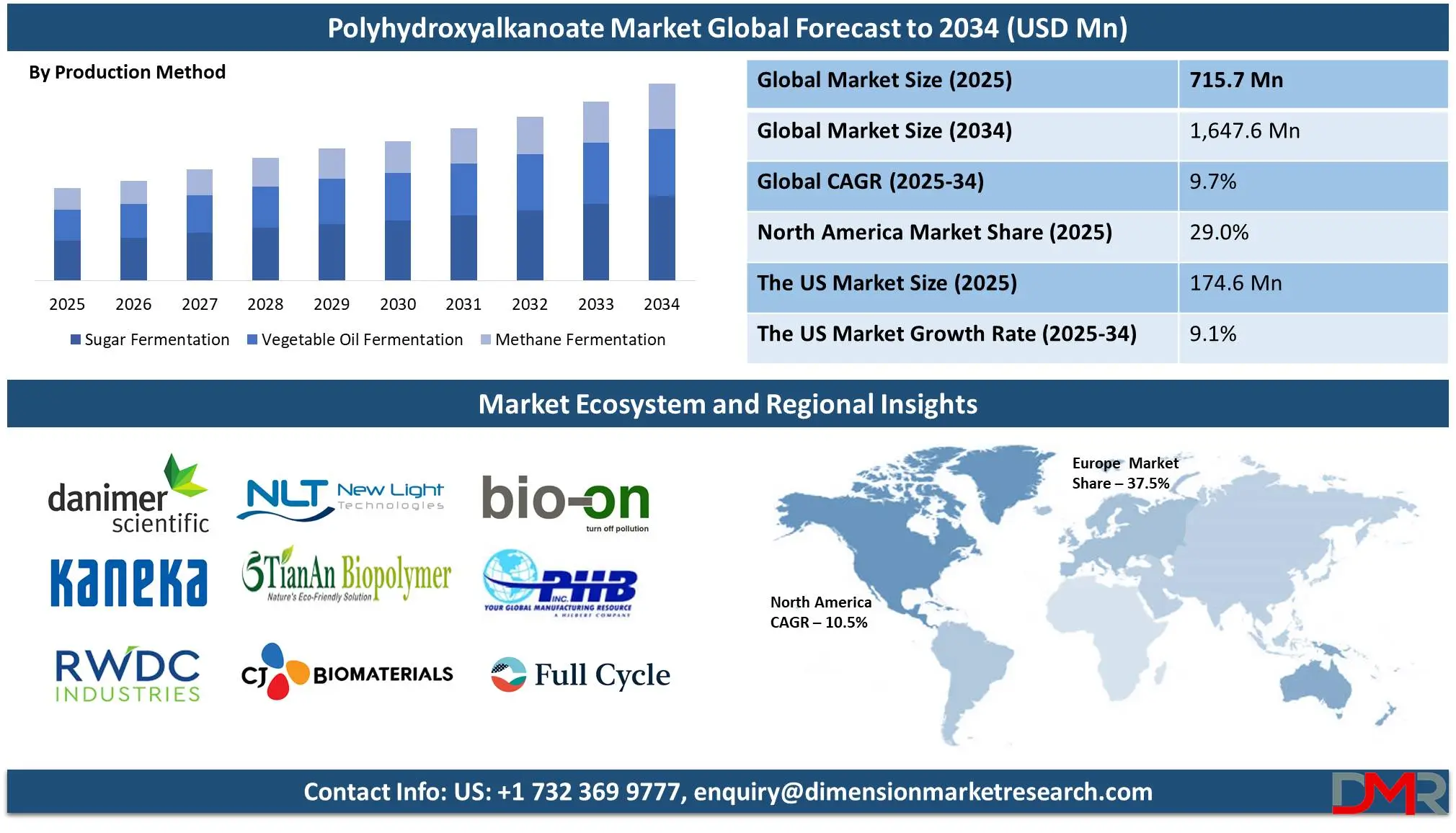

Market Overview

The Global

Polyhydroxyalkanoate Market size is estimated at

USD 715.7 million in 2025 and is expected to reach

USD 1,647.6 million by 2034, at a

CAGR of 9.7% during the forecast period of 2025 to 2034.

The global polyhydroxyalkanoate (PHA) market is experiencing significant expansion, driven by increasing demand for sustainable bioplastics. The rise in stringent environmental regulations, coupled with growing consumer awareness about plastic pollution, has accelerated the adoption of PHA across various industries. Biodegradable and bio-based, PHAs offer a viable alternative to fossil-fuel-derived plastics, supporting the circular economy. The shift toward sustainable materials in packaging, agriculture, and biomedical applications is bolstering market growth.

Moreover, advancements in microbial fermentation and cost-effective production processes are making PHA more competitive against conventional polymers. As countries introduce bans on single-use plastics, the demand for bio-based alternatives continues to rise, reinforcing the expansion of the global PHA market.

The key market trend is increased R&D investments in producing PHA by non-food biomass to diversify dependence on traditional sugar- and starch-derived raw materials. Companies are examining cost-effective production processes, including genetically modified microorganisms, to stimulate yield while minimizing production prices. Meanwhile, incorporation in 3D printing and absorbable implants is widening market potential. Asia-Pacific is emerging to be a leader with influential governmental support in favor of biodegradable plastics through investments by Japan and China in mega-sized production facilities. Europe is leading in regulatory policy with support in favor of biodegradable packaging alternatives while stimulating demand in the food and beverage sector.

Despite promise, production cost is among the major hindrance to full-scale commercialization of PHA. Production in PHA is costly compared to traditional plastics through fermentation processes, rendering it non-cost-competitive. Furthermore, scalability in producing increased yields through fermentation is always a challenge to producers' margins. Small producers in full production result in supply chain limitations towards extensive adaptation. Furthermore, material inconsistencies in PHA require formulation modifications to match traditional polymer performance. Addressing this hindrance through economies of scale and breakthroughs in technology is necessary to push market penetration.

The market potential in the PHA market lies in its application in agricultural mulching film where biodegradability precludes plastic buildup. The pharmaceuticals sector is full of potential where PHAs can be employed in sutures, drug delivery systems, and in tissue engineering owing to their biocompatibility.

New economies in Southeast Asia and Latin America are expected to drive demand where stricter laws against plastic waste have been adopted by governments. Strategic collaborations between packaging companies and companies in the biotech sector continue to propel market growth through growing market uses. Consumer preference towards eco-friendly packaging is expected to continue to drive investments in driving future growth in the market in the long term.

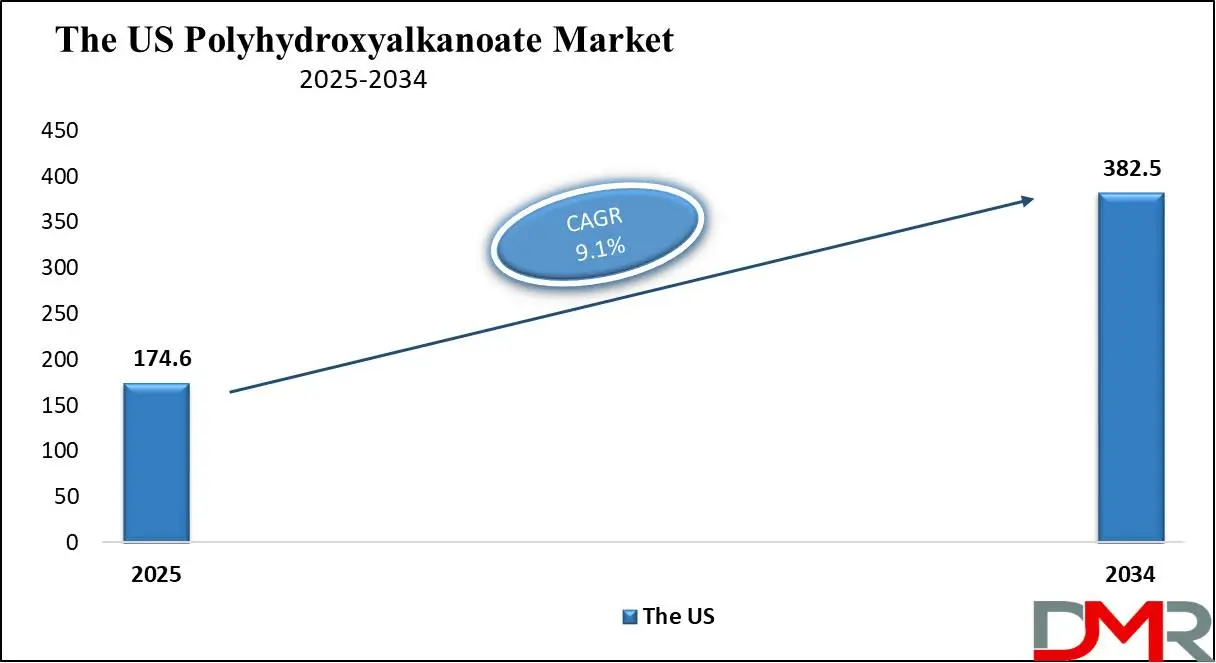

The US Polyhydroxyalkanoate Market

The US Polyhydroxyalkanoate Market is projected to be valued at USD 174.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 1,647.6 million in 2034 at a CAGR of 9.1%.

The US market for PHA is expanding aggressively due to regulatory crackdowns in single-use plastics and increased consumer preference towards eco-friendly products. It is expected to register healthy growth with increased penetration in diverse industries through adoption of bioplastic. Government support towards green packaging, coupled with bans on traditional plastics in locations like New York and California, is facilitating market penetration at an accelerated pace. Nestlé and Unilever, among multinational corporations, are investing in bio-packaging, thereby driving American market demand in PHAs. Robust R&D infrastructure in the US, coupled with the presence of key market players, propel cost-effective production through development in technology.

The US market strength lies in its demographics with consumers who have high purchasing power and increased awareness regarding the environment. Gen Z and millennials who incline eco-friendly packaging and biodegradable plastics drive this. Robust agricultural feedstocks in the US aid production with renewable materials in the form of corn and sugar beets. Established healthcare in the US is an attractive market opportunity through profitable sales in biodegradable sutures and implants. Robust startup presence through innovation and collaboration between life science companies and institutions is expected to drive meaningful breakthroughs in making the US an international leader in PHA.

Global Polyhydroxyalkanoate Market: Key Takeaways

- Global Market Value Insights: The Global Polyhydroxyalkanoate Market size is estimated to have a value of USD 715.7 million in 2025 and is expected to reach USD 1,647.6 million by the end of 2034

- The US Market Insights: The US Polyhydroxyalkanoate Market is expected to witness subsequent growth in the upcoming period as it holds USD 382.5 million in 2034 at a CAGR of 9.1%.

- Regional Analysis: Europe is expected to have the largest market share in the Global Polyhydroxyalkanoate Market with a share of about 37.5% in 2025.

- Key Players: Some of the major key players in the Global Polyhydroxyalkanoate Market are Danimer Scientific, Kaneka Corporation, RWDC Industries, Newlight Technologies, TianAn Biologic Materials, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 9.7 percent over the forecasted period of 2025.

Global Polyhydroxyalkanoate Market: Use Cases

- Sustainable Packaging: Alternatives to conventional plastics derived from petroleum have been used in an expanding range of food, beverage, and pharmaceutical packaging. Their biodegradability is causing minimal harm to the planet while ensuring products remain intact. Compliance with stringent international standards, including the EU's Single-Use Plastics Directive, is driving adoption across industries.

- Biomedical Applications: PHAs have been reshaping biodegradable sutures, bone implants, and drug delivery systems owing to non-toxic body breakdown and biocompatibility. Their body breakdown naturally precludes secondary removal surgeries and saves healthcare spending. Their potential in tissue engineering and regenerative medicine is being studied to further apply to these purposes.

- Agricultural Films: PHA-based film mulches condition the soil better, prevent plastic accumulation, and prevent agricultural microplastic contamination. Unlike polyethylenes in film mulching, these naturally degrade without extensive extraction. Their incorporation in controlled-release fertilizers maximizes yield while minimizing ecoimpact to aid in agricultural practices in eco-friendly ways.

- 3D Printing Materials: PHA is increasingly being used in additive manufacturing in the form of a biodegradable substitute to conventional polymer filaments. It is employed in rapid prototyping, implants in medicine, and design in industry, to have an eco-friendly substitute to reduce wastage. Developments in PHA formulation continue to enhance printability, strength in prints, and compatibility with diverse additive manufacturing methods.

- Cosmetic Packaging: The personal care industry is integrating PHA into biodegradable bottles, jars, and containers, addressing rising consumer demand for eco-friendly products. PHA packaging serves to keep products in top condition while reducing landfill wastage. Large cosmetic companies are investing in PHA solutions to achieve market growth while fulfilling sustainability targets and regulatory standards.

Global Polyhydroxyalkanoate Market: Stats & Facts

- Bioplastics Growth: Global bioplastic production capacity was approximately 1.8 million tons in 2022 and projected to expand exponentially through sustainability initiatives and environmental awareness campaigns by reaching 7.5 million tons by 2028. This phenomenal expansion could only occur because of rapid advances in sustainability initiatives and rising environmental consciousness.

- European Market Dominance: Europe holds 37.54% of the PHA market share and benefits from strong regulatory frameworks, advanced waste management systems and consumer preferences favoring sustainable biodegradable alternatives to conventional plastics.

- North American Growth: Both North American nations are leading in PHA expansion. Corporate sustainability programs and laws such as California's Plastic Pollution Reduction Act help drive this expansion while Canada has placed restrictions on single-use plastics to limit environmental impact.

- Industry Investments: Leading companies like Danimer Scientific, Kaneka Corporation, RWDC Industries and Newlight Technologies have invested significantly to meet global demand for biodegradable plastics.

- Microbial Synthesis: PHAs are produced microbiologically as water-insoluble granules within bacterial cells in an eco-friendly process that provides a sustainable alternative to petroleum-based plastics.

- Complete Biodegradability: PHAs biodegrade quickly in soil, marine environments, and composting facilities to form water and carbon dioxide; significantly decreasing global plastic waste levels and pollution.

- Microplastic-Free: PHAs do not produce microplastic pollution like synthetic plastics do, ensuring environmental safety for marine ecosystems and wildlife - making them perfect for ocean-friendly applications.

- High Production Costs: Production costs associated with PHA production remain higher than petroleum-based plastics, restricting large-scale commercialization efforts. However, cost reduction options through alternative feedstocks and improved processing technologies are being actively explored to offset this issue.

- Waste Management Issues: Misleading biodegradable labels pollute recycling and composting systems, necessitating clear disposal guidelines as well as public awareness campaigns to maximize PHA's circular economy potential.

- Scalability Concerns: Genetic engineering and microbial fermentation may provide increased PHA yields; however, scalability obstacles remain, inhibiting widespread industrial adoption and cost-efficient mass production.

- Short-Chain PHA Producers: Cupriavidus necator and Azohydromonas lata are highly efficient producers of short-chain PHAs that are recognized for their exceptional mechanical properties and versatility across various applications.

- Medium-Chain PHA Producers: Pseudomonas mendocina and Pseudomonas putida produce medium-chain PHAs that offer increased flexibility and elasticity for biodegradable packaging and medical uses.

- Long-Chain PHA Producers: Aureispira marina and Shewanella oneidensis produce long-chain PHAs suitable for biomedicine, coatings and high strength bioplastic applications.

- Recombinant Strains: E. coli is genetically engineered to increase PHA production efficiency and yield, making large-scale bioplastic manufacturing more economically sustainable.

- PHA Monomer Diversity: Over 150 different PHA monomers have been identified, opening doors for applications in biomedicine, textile manufacturing and packaging industries while expanding market potential.

- Low-Cost Feedstocks: Companies typically focus on waste oils, agricultural byproducts, and other cost-effective carbon sources to lower production costs while improving scalability and reducing production expenses.

- PHA Blended Bioplastics: Recent advances in PHA polymer blends are providing biodegradable plastics a competitive edge over their petroleum-based alternatives, increasing mechanical strength, flexibility, and durability compared to standard alternatives.

Global Polyhydroxyalkanoate Market: Market Dynamic

Driving Factors in the Global Polyhydroxyalkanoate Market

Rising Consumer Demand for Eco-Friendly ProductsGrowing consumer awareness regarding the environment and consumer preference towards eco-friendly products is driving the market for PHA significantly. Customers prefer to go in for biodegradables over conventional plastics in packaging, cosmetics, and food segments. Businesses are responding by resorting to PHA-based materials in compostable packaging for food products, biodegradable straws, and green cosmetics packaging.

Large multinational corporations such as Unilever and Nestlé have pledged to reduce their presence in plastics by adopting bio-derived polymers in the form of PHA. Social media influence and global awareness programs towards sustainability are further making companies go in favor of biodegradables. This attitude change is expected to drive PHA demand in the future in segments where eco-labels influence purchasing decisions.

Increased Investments and Strategic Partnerships in the Bioplastics Sector

The growing investments by companies in production facilities to stimulate growth in production capacity is driving market growth in PHA. Danimer Scientific and RWDC Industries have been investing significantly to ramp up production capacity worldwide. Strategic partnerships among companies, research institutions, and biotech companies are enabling cost savings by sharing facilities and scalability in production.

Venture capital companies are making investments in startups working to innovate in biodegradable polymer products. Government incentives in terms of subsidy and grant to perform research in bio-based polymers are further enabling companies to invest in developing new uses in PHAs. All these investments and partnerships are expected to drive scalability in production to render PHA commercially viable.

Restraints in the Global Polyhydroxyalkanoate Market

High Production Costs Limiting Mass Adoption

Besides its benefits to the environment, production cost is currently the major hindrance to widespread commercialization of PHA. Production cost is fueled by costly feedstocks employed in the process of microbial fermentation to yield PHA, specialized fermentation equipment, and downstream processing intricacy. This pushes production cost to significantly higher levels compared to conventional plastics derived from petroleum products, making production economically prohibitive in cost-conscious markets.

Economies of scale have yet to be achieved since only a limited number of large plants have been established to yield PHA. R&D is working continuously to drive down production cost through novel feedstocks and improved fermentation processes. However, price competitiveness is currently an area of concern among producers of PHA. If significant cost savings cannot be achieved, market penetration by PHA can continue to remain in specialty uses in place of mainstream plastics.

Limited Infrastructure for Bioplastic Waste Management

The scarcity of developed industrial composting and bioplastic waste management infrastructure is yet another hindrance in the market for PHA. Though described to be biodegradable in nature, breakdown is dependent upon certain environmental factors that can't always be met in traditional landfill or recycling systems. Compost facilities in industrial settings in most locations remain in short supply or non-existent, hindering the final life benefits to products manufactured with PHA. Consumer uncertainty regarding handling biodegradables during final life leads to improper handling of these plastics, diluting the effectiveness of PHA’s eco-friendly benefits. Lack of proper infrastructure to manage waste and awareness programs can hinder full potential realization in PHA as an eco-friendly alternative to plastics, inhibiting market growth.

Opportunities in the Global Polyhydroxyalkanoate Market

Expansion in the Biomedical Sector for Biodegradable Implants

PHA's biodegradability and biocompatibility present an immense growth prospect in life sciences. As increased attention is placed upon life sciences research in medicines that can be used in an eco-friendly manner, PHAs are employed to design sutures, drug carriers, and bone implants that can degrade in the body naturally. Unlike conventional synthetic polymers, PHAs degrade naturally in the body, making unnecessary the process of extracting implants through surgeries and reducing patients' complications.

Enhanced demand in absorbable products in medicine is expected to propel the market towards adopting PHA in healthcare products. Additionally, better polymer modification techniques are enhancing PHA strength to aid in developing biomaterials with superior performance. Government incentives in life sciences through funding support and greater attention to absorbable implants further support expanding PHA in this market.

Integration in Agriculture for Sustainable Farming Practices

The agricultural market is providing profitable avenues towards adopting PHA, most notably in seed coats, controlled-release fertilizers, and biodegradable mulch film. Laborious to remove polyethylene mulch film destroys the soil, while traditional polyethylene mulch film naturally disintegrates in the environment. As eco-friendly cultivation is finding greater favor among consumers, agricultural companies and producers alike search for products that not only enrich the soil but avoid wastage.

Consumption of controlled-release fertilizers in conjunction with PHA-coated products is optimizing nutrient supply while minimizing run-off chemicals. Government schemes to embrace eco-friendly agricultural practices and increased demand in organically oriented farm products have created an optimum situation where PHAs can have an active role to play in eco-friendly agricultural uses.

Trends in the Global Polyhydroxyalkanoate Market

Increasing R&D in Cost-Effective PHA Production

The global polyhydroxyalkanoate (PHA) market is facing increased research and development to drive down production cost and achieve greater efficiency. Current production through conventional methods is dependent upon microbial fermentation, which is costly because specialized sources of carbon and complicated purification steps are required. Businesses have been working towards producing PHA through cheaper sources of waste material, including agricultural residues and food scraps.

Furthermore, genetically modified bacteria and improved fermentation conditions have been used to boost yields of PHA to make production commercially viable. Research institutions and governments have been sponsoring projects to design production methods that can be scaled up while reducing cost. This is bound to be an influential driving force behind the widespread penetration of PHA in packaging and biomedical uses.

Expansion of Regulatory Support for Biodegradable Plastics

The global polyhydroxyalkanoate (PHA) market is boosted by Regulatory Support, strict regulatory laws and policies in favor of eco-friendly alternatives to plastics derived from oil, are driving market growth in PHA. The European Union's Single-Use Plastics Directive and China's ban on non-biodegradable plastic bags are shaping an enabling regulatory environment in favor of PHAs. Tax incentives to producers of biodegradable plastics by multiple governments are driving market growth.

Demands for products derived from PHA are rising because extended producer responsibility (EPR) policies compel producers to assume responsibility for getting plastics disposed of. Businesses to achieve circular economic objectives are investing in products derived from PHA. As regulatory changes continue to shape, market segments such as food packaging, agricultural practices, and pharmaceuticals are adopting PHAs in products to achieve sustainability targets and avoid regulatory penalties.

Global Polyhydroxyalkanoate Market: Research Scope and Analysis

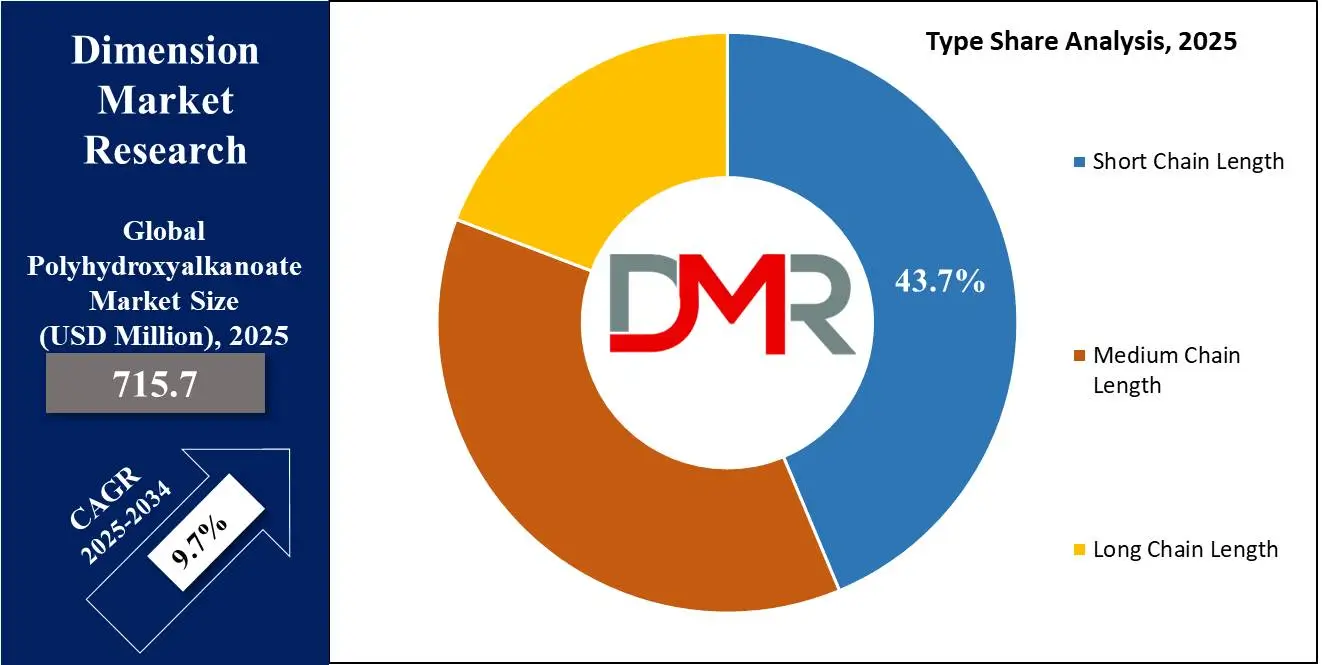

By Type

Short-chain length polyhydroxyalkanoates (SCL-PHAs) are projected to take the lead in the global market as it is poised to command over 43.7% of market share in 2025 due to improved mechanical strength, increased rates of biodegradability, and extensive uses in various industries. SCL-PHAs with three to five carbons in each unit exhibit better elasticity, tensile strength, and processability compared to others. Their applications range from packaging to agricultural film to pharmaceuticals. All these can be achieved since SCL-PHAs possess an improved performance to price ratio in comparison to medium- and long-chain PHAs to be used in bulk in various commercial purposes.

Another advantage in support of SCL-PHAs is that they can be produced efficiently by microbial fermentation with various sources of carbon including renewable sources like sugar, starch, and waste lipids. This efficient production process adds to their value in commerce by making producers in a position to supply plastics that can degrade to meet regulatory standards, in addition to consumer demand to have non-petrochemical plastics.

Another reason behind the dominance of SCL-PHA is that they can be used in traditional plastic processing methods such as injection molding, extrusion, and blowing. This enables producers to incorporate SCL-PHAs in established production lines with minimal adjustments to equipment, thus minimizing production costs. Their processability renders them appropriate for uses in compostable packaging in the food sector, disposable medical equipment, and agricultural film.

The increased demand for biodegradable plastics because of increased international regulatory requirements and consumer preference towards eco-friendly products further benefits leadership by SCL-PHAs in the PHA market. As R&D is continuously targeted towards minimizing cost while optimizing performance, SCL-PHAs should continue to lead in being used in biopolymer products.

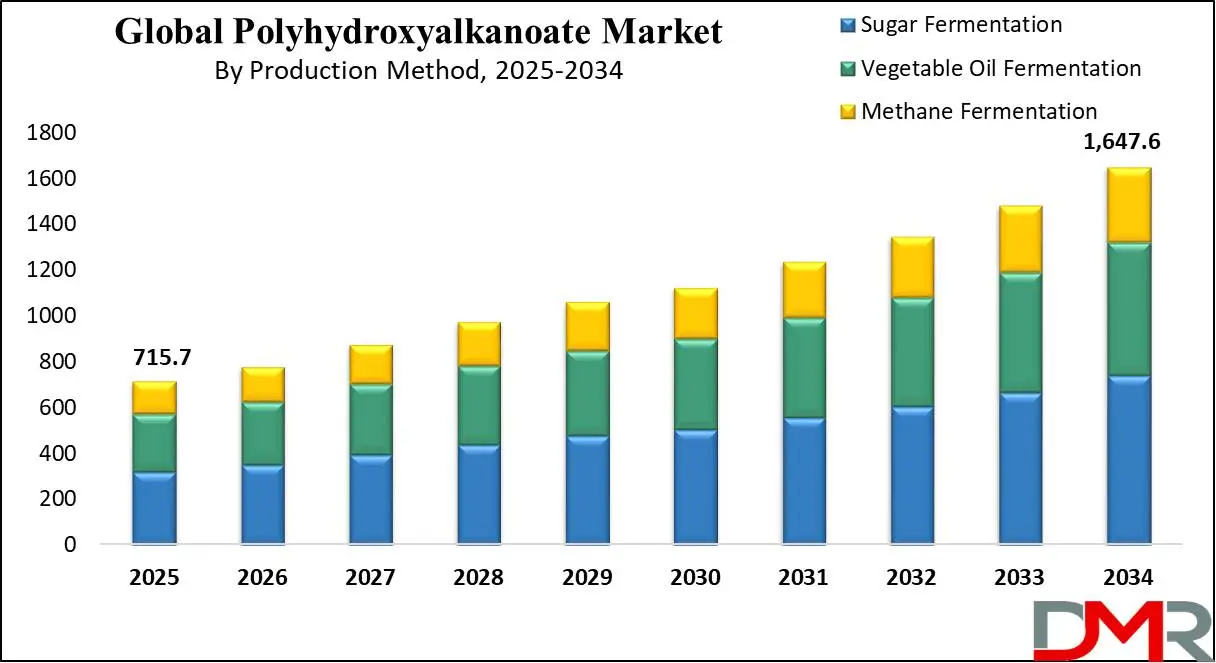

By Production Method

The market in production methods is dominated by sugar fermentation owing to scalability, effectiveness, and potential to utilize renewable raw materials. This process involves microbial fermentation of sugarcane-derived, corn-derived, or beet-derived sugars to achieve economical production of PHAs. Sugar fermentation is superior to production methods involving gas fermentation or wastewater treatment processes owing to improved yields, faster production cycles, and consistency in polymer quality to support mass production.

The most significant among these is established infrastructure in sugar fermentation. Production by fermentation of biopolymers utilizes various decades of experience in industrial biotechnology through better microbial strains, fermentation conditions, and downstream processing practices. Sugar-derived feedstocks have extensive availability in addition to optimizing production efficiency through reducing dependence upon fossil fuels and minimizing environmental impacts.

Besides this, fermentation by sugar is employed to aid production of pure PHAs to fit diverse purposes in packaging, in medical implants, and production of biodegradable film. Polymer properties can be modified by controlled fermentation to fit desired specifications in diverse industries. This has been used extensively in diverse industries in quest of environmentally friendly alternatives to traditional plastics.

The increased focus on circular economy practices and bio-based alternatives is driving investments in sugar fermentation technologies faster. Genetically modified bacteria and improved fermentation pathways are being researched by companies to reduce production costs and yield better results. As governments around the globe impose stricter standards on plastics derived from petroleum and encourage bio-based products, sugar fermentation is anticipated to continue to be the leading method of producing PHAs, leading to market growth in future years.

By PHA Type

Poly (3-hydroxybutyrate) (P3HB) and polyhydroxybutyrate (PHB) are expected to dominate the PHA type market because of superior biodegradability, physical strength, and extensive application range. These PHAs are among the most studied and commercially produced biopolymers to have an equilibrium between tensile strength, elasticity, and thermoplastic stability. Their ability to naturally degrade in composting plants, in oceans, and in soils makes these products exceedingly desirable in developing eco-friendly plastics.

P3HB and PHB are most preferred in agricultural, packaging, and biomedical industries owing to improved processability and biocompatibility. Production can be done through microbial fermentation by using renewable resources to keep an eco-friendly production process. Between different forms of PHAs, including medium-chain length PHAs, both P3HB and PHB possess improved crystallinity, hence improved strength, making these products ideal to be used in tough biodegradable plastics.

Another secret to their supremacy is that they can be processed by conventional equipment employed in injection molding, extrusions, and film blowing to reduce requirements in specialized facilities. Additionally, blending P3HB and PHB with other biopolymers in development adds strength to their performance to compete favorably with conventional plastics.

Due to increased regulatory scrutiny against plastics derived from oil and consumer preference towards eco-friendly materials, both P3HB and PHB continue to be market leaders in the market for PHA. Research in microbial development is continuously optimizing production to maintain both in the top position as the most commercially viable forms of PHA.

By End-User

The market is projected to be led by packaging in the global market for PHA because consumers increasingly prefer eco-friendly alternatives to conventional plastic packaging. As consumers continue to gain awareness about protecting the planet while regulatory authorities increasingly impose laws against the consumption of single-use plastics, companies resort to biodegradable products to replace conventional plastics. One area driving this is in the market for food items and beverages because compostable packaging is required to avoid wastage through plastics. PHA-derived film, tray, and container products have better biodegradability to leave behind minimal residues in the environment.

The market dominance by PHA is due to the ability to have the functional properties equal to those of plastics derived from petroleum while being compostable. PHAs possess better moisture barrier performance, elasticity, and durability to be employed in wrapping utensils, cosmetic products, and food. Their ability to degrade naturally in water bodies and terrestrial environments is an added value in response to global fears about plastics in water bodies and landfills.

Regulatory policy in the shape of EU bans on single-use plastics and extended producer responsibility (EPR) laws is compelling companies to adopt biodegradable packaging alternatives. Industry majors Nestlé and PepsiCo have already started to integrate PHA-based packaging in supply chains to pursue sustainability targets.

Besides this, production technology in PHA is improving in cost-effectiveness, making it an increasingly viable alternative to conventional plastics in packaging. As consumers continue to opt for eco-friendly products, market demand for PHA-based packaging is expected to continue to rise, cementing leadership in the market among end-users.

The Global Polyhydroxyalkanoate Market Report is segmented based on the following

By Type

- Short Chain Length

- Medium Chain Length

- Long Chain Length

By Production Method

- Sugar Fermentation

- Vegetable Oil Fermentation

- Methane Fermentation

By PHA Type

By End-user

- Packaging

- Agriculture

- Textiles

- Consumer Goods

- Others

Global Polyhydroxyalkanoate Market: Regional Analysis

Region with Highest Market Share

Europe is expected to dominate the global polyhydroxyalkanoate (PHA) market as it is poised to command over

37.5% of the total market revenue in 2025. Europe is leading globally in the polyhydroxyalkanoate (PHA) market owing to stringent regulatory policies, governmental support towards green material development, and strong consumer awareness regarding environmental aspects. Circular Economy Action Plan, Green Deal, and EU's Single-Use Plastics Directive have led to companies focusing towards biodegradables, making PHA a key material in green packaging and industrial applications. Germany, the Netherlands, and France have made vast investments in developing biopolymers to achieve mass commercialization.

The region is serviced by an advanced infrastructure to compost biodegradable plastics efficiently, further spurring PHA consumption. Additionally, Europe has top producers in the area of biopolymers such as Danimer Scientific, Biomer, and Kaneka Corporation who continue to invest in expanded production capacity to keep pace with rising demand. Expanding in the market for food and beverage products, in addition to increased momentum towards eco-friendly packaging, further solidifies leadership in the market in Europe. As corporations continue to collaborate with institutions to undertake research, Europe is certain to continue to lead in the international market in PHA.

Region with Highest CAGR

North America is witnessing the highest compound annual growth rate (CAGR) in the global polyhydroxyalkanoate (PHA) market, driven by increasing investments in biodegradable plastics, corporate sustainability initiatives, and stringent regulations against petroleum-based plastics. The U.S. and Canada are leading in PHA adoption with applications in food packaging, medical devices and agriculture; rising consumer demands for sustainable alternatives has encouraged key industries like PepsiCo, Nestle, Unilever to incorporate PHA solutions to reduce plastic waste thereby stimulating market expansion significantly and fueling market expansion significantly thereby driving market expansion significantly further than ever before.

Regulators such as California's Plastic Pollution Reduction Act and Canada's single-use plastics ban are helping accelerate PHA adoption. Leading industry players, like Danimer Scientific and RWDC Industries, contribute to continuous innovation and large scale production of bioplastics such as PHA in North America. Furthermore, sophisticated biotechnology capabilities in terms of fermentation techniques further boost efficiency while cost effectiveness; expanding research collaborations coupled with increasing venture capital funding solidify North America as the fastest-growing PHA market worldwide.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Polyhydroxyalkanoate Market: Competitive Landscape

The global PHA market is fiercely competitive, and key players in it focus on product innovation, capacity expansion and strategic collaboration to remain at the top. Leading players include Danimer Scientific, Kaneka Corporation, RWDC Industries, Newlight Technologies, TianAn Biologic Materials--each making significant strides forward with production efficiency expansion, application expansion, and cost reductions.

Danimer Scientific and RWDC Industries lead the North American PHA production market with fermentation-based PHA production technologies and long-term partnerships with consumer goods giants to offer sustainable packaging solutions. Kaneka Corporation dominates both European and Asian markets thanks to their expertise in biopolymer production for medical, agricultural, food packaging applications. Newlight Technologies pioneered air carbon PHA production as an eco-friendly replacement to conventional plastics production with growing adoption from both consumer goods makers as well as automotive OEMs.

Strategic mergers, acquisitions and joint ventures are altering the competitive landscape. Companies are joining forces with food and beverage producers, pharmaceutical firms and government agencies to expedite PHA commercialization. Furthermore, increased biopolymer research and pilot projects demonstrate an emphasis on high performance solutions with cost efficiency that provide long term growth prospects within this market.

Some of the prominent players in the Global Polyhydroxyalkanoate Market are

- Danimer Scientific

- Kaneka Corporation

- RWDC Industries

- Newlight Technologies

- TianAn Biologic Materials

- CJ Biomaterials

- Bio-on

- PHB Industrial S.A.

- Full Cycle Bioplastics

- Shenzhen Ecomann Biotechnology

- Bluepha Co., Ltd.

- Yield10 Bioscience

- Other Key Players

Recent Developments in Global Polyhydroxyalkanoate Market

In 2024

February 2024: RWDC Industries announced a $150 million investment to expand its PHA production facility in the U.S., addressing the growing demand for biodegradable plastics in food packaging and medical applications.

January 2024: Kaneka Corporation formed a strategic partnership with a European packaging manufacturer to develop and commercialize PHA-based films for food and beverage packaging, enhancing its market penetration in the sustainable packaging sector.

In 2023

December 2023: Danimer Scientific collaborated with a leading cosmetics brand to introduce biodegradable PHA-based cosmetic packaging, catering to rising consumer demand for sustainable beauty products.

October 2023: A global PHA-focused conference in Germany showcased technological advancements and market trends, emphasizing PHA’s potential in diverse industries.

August 2023: Newlight Technologies secured funding to expand its air-carbon PHA production technology, enabling larger-scale commercialization and wider industry adoption.

In 2022

November 2022: The European Bioplastics Expo highlighted next-generation PHA applications, particularly in the medical and agricultural sectors, reinforcing Europe’s leadership in biodegradable materials.

July 2022: TianAn Biologic Materials expanded PHA production capacity in China to meet the rising demand in the Asia-Pacific region, strengthening its presence in emerging markets.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 715.7 Mn |

| Forecast Value (2033) |

USD 1,647.6 Mn |

| CAGR (2024-2033) |

9.7% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 174.6 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Short Chain Length, Medium Chain Length, and Long Chain Length), By Production Method (Sugar Fermentation, Vegetable Oil Fermentation, and Methane Fermentation), By PHA Type (P3H4B + PHB, PHBH, and PHBV), By End-user (Packaging, Agriculture, Textiles, Consumer Goods, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Danimer Scientific, Kaneka Corporation, RWDC Industries, Newlight Technologies, TianAn Biologic Materials, CJ Biomaterials, Bio-on, PHB Industrial S.A., Full Cycle Bioplastics, Shenzhen Ecomann Biotechnology, Bluepha Co., Ltd., Yield10 Bioscience, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |