Market Overview

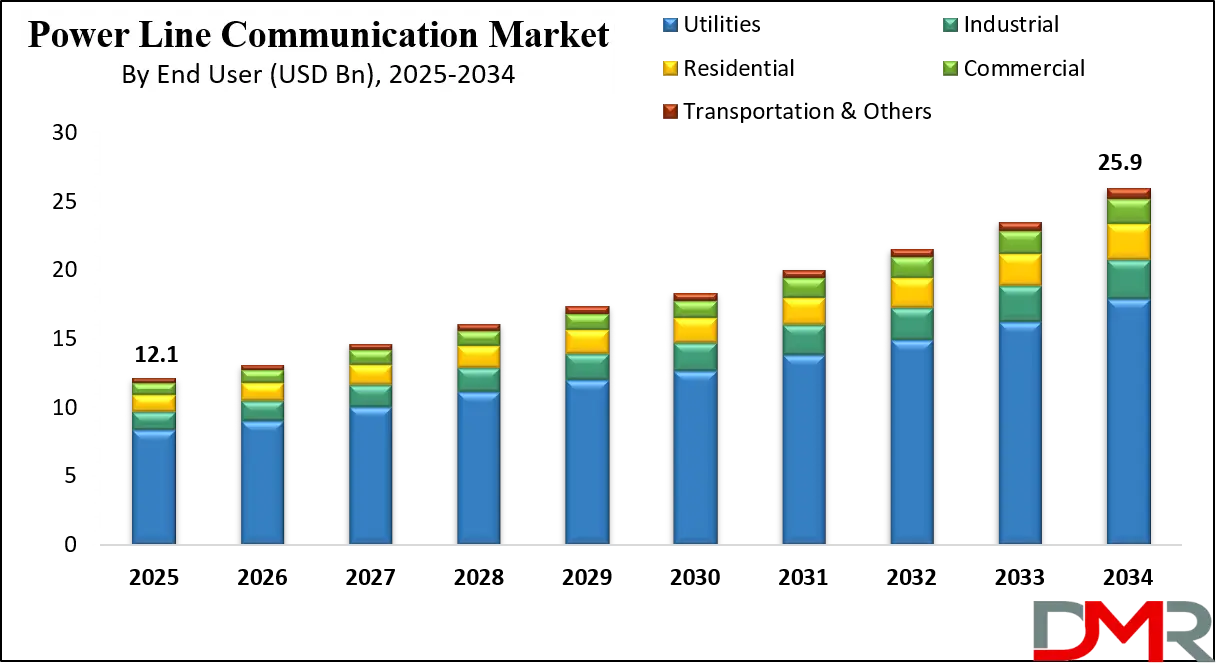

The global power line communication market is projected to reach USD 12.1 billion in 2025 and is expected to grow to USD 25.9 billion by 2034, registering a CAGR of 8.8%, driven by growing smart grid adoption, energy management solutions, and advanced communication technologies over existing power infrastructure.

Power line communication is a technology that enables the transmission of data and voice signals over existing electrical wiring infrastructure. It uses the same network of power cables that deliver electricity to homes, buildings, and industrial facilities, eliminating the need for additional dedicated communication lines. PLC can operate in narrowband for low data rate applications such as smart metering, grid control, and home automation, or in broadband for high-speed networking and multimedia streaming within buildings. This technology leverages different modulation techniques to ensure reliable signal transmission despite electrical noise, making it a cost-effective and versatile option for integrating communication capabilities into power networks.

The global power line communication market represents the industry segment that develops, manufactures, and deploys PLC-based products, solutions, and services across various sectors including energy utilities, industrial automation, smart cities, and residential networking.

It is shaped by the growing adoption of smart grid infrastructure, rising demand for energy efficiency, and the need for secure, long-range data communication over existing power lines. Advancements in standards like G3-PLC, PRIME, and HomePlug, along with integration into IoT and renewable energy systems, are expanding the scope of PLC applications globally.

The market’s growth is supported by its ability to reduce infrastructure costs, improve communication reliability in remote or hard-to-wire locations, and enable real-time monitoring and control of distributed assets. Regions such as Europe and Asia-Pacific are leading in deployment due to large-scale smart metering rollouts, while North America is witnessing growing adoption in grid modernization and smart building systems. With continuous innovation in chipsets, couplers, and network management software, the PLC market is expected to see robust expansion in the coming years, catering to both utility-scale and consumer-oriented applications.

The US Power Line Communication Market

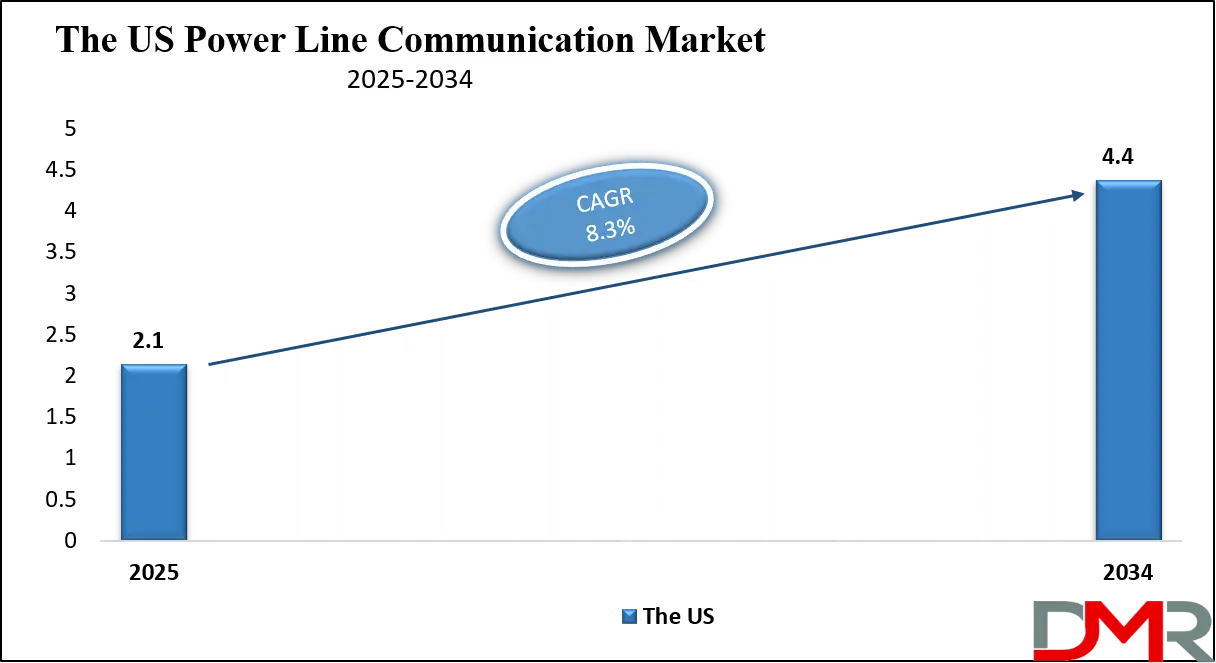

The U.S. Power Line Communication market size is projected to be valued at USD 2.1 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 4.4 billion in 2034 at a CAGR of 8.3%.

The US power line communication market is experiencing steady growth fueled by the modernization of the nation’s electrical grid and the deployment of advanced smart grid infrastructure. Utilities across the United States are increasingly adopting PLC technology for automated meter reading, outage management systems, and real-time grid monitoring, enabling more efficient energy distribution and improved reliability. The integration of narrowband PLC in advanced metering infrastructure and distribution automation is helping utility providers reduce operational costs while enhancing service delivery.

Additionally, the growing demand for seamless communication in remote and rural areas, where installing dedicated communication lines is costly, is boosting PLC adoption as a cost-effective alternative that leverages existing power networks.

In addition to the utility sector, the US PLC market is seeing expanding applications in smart building systems, industrial automation, and electric vehicle charging infrastructure. Broadband PLC is gaining momentum for in-building networking, home automation, and IoT device connectivity, particularly in commercial and residential complexes.

Federal and state-level initiatives promoting energy efficiency, renewable energy integration, and smart city development are further accelerating PLC deployments. The presence of leading PLC technology providers, advancements in chipset design, and the adoption of standards like IEEE 1901 and G3-PLC are creating a favorable ecosystem for innovation and scalability. As digital transformation in energy management accelerates, the US power line communication market is poised to capture significant opportunities in both urban and underserved regions.

Europe Power Line Communication Market

The Europe power line communication market is projected to reach USD 3.6 billion in 2025, underscoring the region’s position as a global leader in PLC adoption. This growth is driven by large-scale smart grid rollouts, advanced metering infrastructure deployments, and regulatory mandates promoting energy efficiency and renewable energy integration.

Countries such as Germany, France, Italy, and the United Kingdom have been at the forefront of integrating PLC technology into utility networks, street lighting systems, and smart city projects. The presence of harmonized CENELEC standards has further facilitated interoperability and accelerated adoption across both public and private sector applications, while mature electrical infrastructure enables faster and more cost-efficient PLC deployments.

With a projected CAGR of 9.2%, Europe’s PLC market is expected to see consistent expansion through the next decade as utilities modernize grid systems and cities embrace digital transformation. Increasing investment in distributed energy resources, electric vehicle charging infrastructure, and IoT-enabled urban management is creating new opportunities for both narrowband and broadband PLC solutions.

The combination of established technology providers, strong government support, and an expanding base of smart infrastructure projects positions Europe to maintain its dominance in the global PLC landscape while serving as a key innovation hub for next-generation power line communication technologies.

Japan Power Line Communication Market

Japan’s power line communication market is projected to reach approximately USD 300 million in 2025, highlighting its growing importance within the Asia-Pacific PLC landscape. The country’s strong focus on smart grid modernization, disaster-resilient infrastructure, and energy efficiency has been a key driver of adoption. Japanese utilities are actively deploying PLC-based smart metering systems and integrating them with renewable energy sources to optimize grid stability.

Additionally, government-backed initiatives such as the “Smart Community” concept and the expansion of electric vehicle charging networks are creating steady demand for both narrowband and broadband PLC technologies, especially in densely populated urban centers.

With an anticipated CAGR of 9.7%, Japan’s PLC market is set for sustained growth over the next decade. The combination of advanced manufacturing capabilities, high penetration of smart home devices, and a well-developed electrical infrastructure positions Japan as a fertile ground for PLC innovation.

Furthermore, the push towards carbon neutrality and enhanced energy management is fostering collaborations between technology vendors, utilities, and research institutions, ensuring that PLC remains a critical enabler of Japan’s energy transition. As the country continues to invest in IoT-driven urban solutions and grid automation, its role in shaping the regional PLC ecosystem will strengthen considerably.

Global Power Line Communication Market: Key Takeaways

- Market Value: The global power line communication market size is expected to reach a value of USD 25.9 billion by 2034 from a base value of USD 12.1 billion in 2025 at a CAGR of 8.8%.

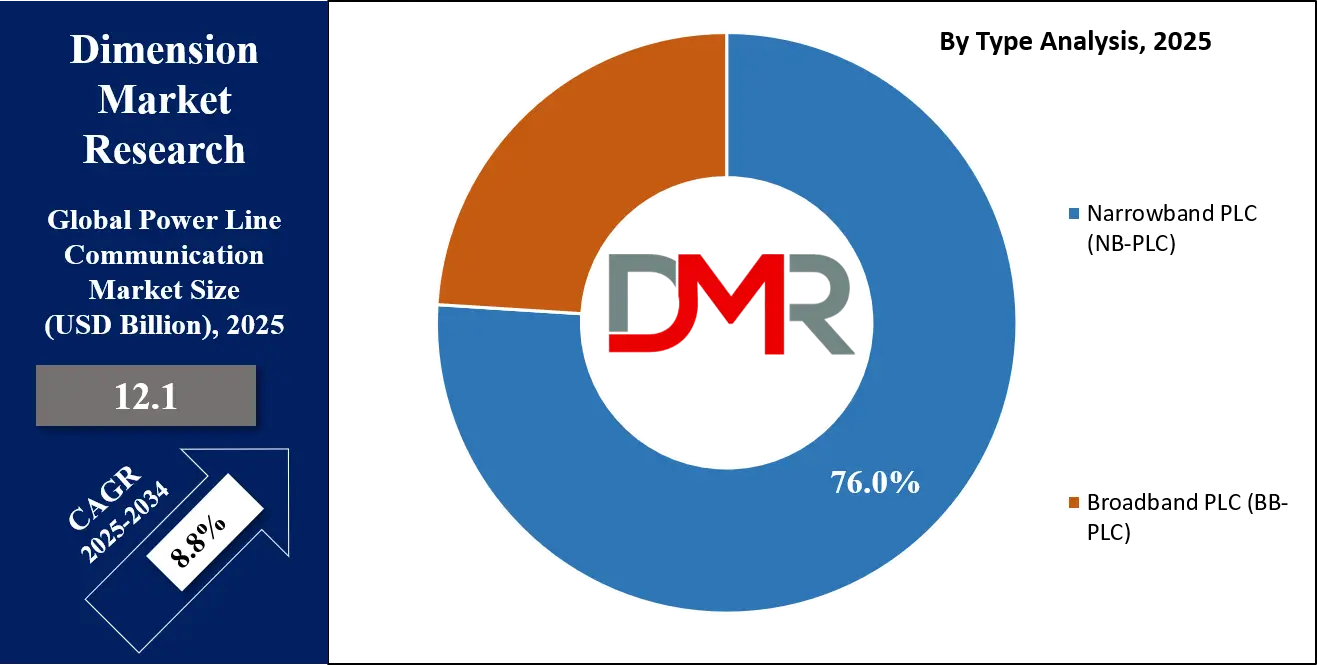

- By Type Segment Analysis: Narrowband PLC (NB-PLC) is anticipated to dominate the type segment, capturing 76.0% of the total market share in 2025.

- By Offering Segment Analysis: Hardware components are expected to maintain their dominance in the offering segment, capturing 62.0% of the total market share in 2025.

- By Application Segment Analysis: Smart Metering/AMI applications will dominate the application segment, capturing 47.0% of the market share in 2025.

- By End User Segment Analysis: Utilities are poised to consolidate their dominance in the end user segment, capturing 69.0% of the market share in 2025.

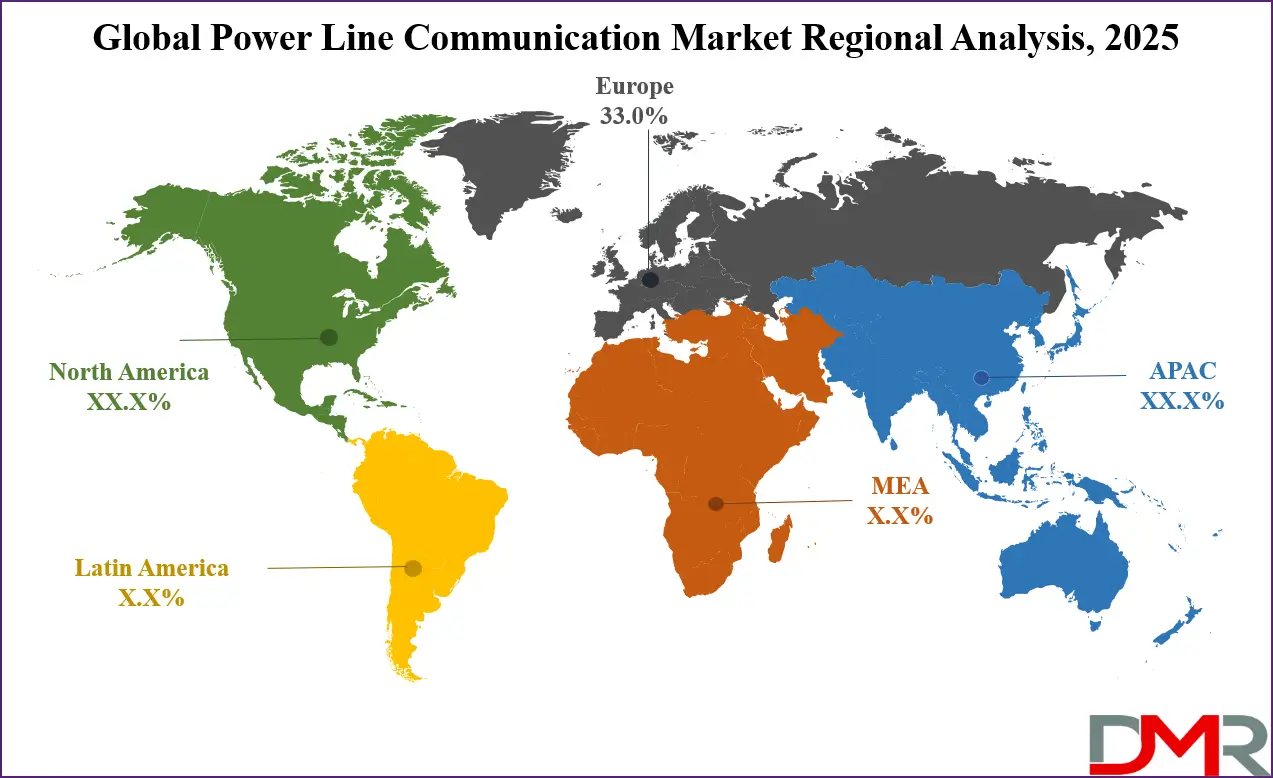

- Regional Analysis: Europe is anticipated to lead the global power line communication market landscape with 33.0% of total global market revenue in 2025.

- Key Players: Some key players in the global power line communication market are Siemens AG, ABB Ltd., General Electric (GE), Schneider Electric SE, Cisco Systems Inc., STMicroelectronics N.V., Texas Instruments Incorporated, Microchip Technology Inc., Maxim Integrated (Analog Devices), Landis+Gyr Group AG, Echelon Corporation (Adesto Technologies), Devolo AG, Netgear Inc., D-Link Corporation, Zyxel Communications Corp., Corinex Communications Corp., and Others.

Global Power Line Communication Market: Use Cases

- Smart Grid and Advanced Metering Infrastructure: Power line communication plays a critical role in enabling two-way data transfer between utilities and consumers through advanced metering infrastructure (AMI). By using narrowband PLC, utilities can remotely collect consumption data, detect outages, and manage load distribution without deploying additional communication lines. This enhances energy efficiency, supports demand response programs, and improves the reliability of electricity supply. The integration of PLC into smart grids also enables real-time monitoring, fault detection, and predictive maintenance, reducing downtime and operational costs.

- Smart City Street Lighting Systems: In smart city initiatives, PLC is widely used for centralized streetlight control and monitoring. By leveraging existing power cables, municipalities can manage streetlights remotely, schedule dimming, detect lamp failures, and integrate energy-saving measures without investing in separate network infrastructure. This reduces maintenance costs, lowers energy consumption, and contributes to sustainability goals. Narrowband PLC ensures reliable communication even in challenging outdoor environments, making it ideal for large-scale urban lighting networks.

- Renewable Energy Integration and Distributed Energy Resources: With the rise of solar, wind, and other renewable energy sources, PLC enables seamless integration of distributed energy resources (DER) into the grid. Utilities use PLC to exchange operational data between inverters, energy storage systems, and control centers, ensuring optimal load balancing and stability. By providing secure and cost-effective connectivity, PLC supports real-time monitoring of renewable generation, fault isolation, and coordination between decentralized assets, improving overall grid resilience.

- Electric Vehicle Charging Infrastructure: Power line communication, especially standards like HomePlug Green PHY, is increasingly used in electric vehicle (EV) charging systems to facilitate communication between EVs, chargers, and grid operators. PLC enables secure data exchange for billing, authentication, and smart charging functions, ensuring grid stability during peak demand. Its ability to operate over existing electrical infrastructure simplifies deployment and reduces installation costs, making it a preferred choice for both public and private EV charging networks.

Impact of Artificial Intelligence on Power Line Communication Market

Artificial intelligence is transforming the power line communication market by enhancing the efficiency, reliability, and scalability of PLC-based networks. AI-driven analytics can process vast amounts of data collected through PLC-enabled smart grids, allowing utilities to predict equipment failures, optimize energy distribution, and detect anomalies in real time. Machine learning algorithms help improve signal quality by dynamically adjusting modulation schemes and filtering out electrical noise, ensuring consistent performance even in challenging environments. This leads to improved data throughput, reduced downtime, and enhanced user experience across industrial, commercial, and residential applications.

AI also plays a vital role in enabling autonomous decision-making in PLC-integrated systems such as smart cities, renewable energy grids, and electric vehicle charging networks. By leveraging predictive analytics, AI can forecast demand patterns, balance loads, and coordinate distributed energy resources more effectively. In electric vehicle charging, AI-powered PLC communication can manage charging schedules to avoid grid congestion. As AI technologies mature, the integration of intelligent automation with PLC infrastructure is expected to unlock new business models, reduce operational costs, and accelerate the adoption of next-generation energy and communication networks.

Global Power Line Communication Market: Stats & Facts

European Commission (DG Energy – Smart Electricity Grids)

- EU electricity grid investments needed by 2030 are estimated at €584 billion.

- EU smart meter investment needs by 2030 are ~€47 billion for ~266 million electricity/gas smart meters.

- Typical EU smart meter cost is in the €180–€200 per meter range.

- Average consumer savings attributed to smart meters are ~€230 for gas and ~€270 for electricity over a meter’s lifecycle.

- Smart meter rollouts can deliver 2%–10% energy savings depending on use cases.

- Implementing Regulation (EU) 2023/166 (June 2023) strengthens interoperability and data access rules underpinning smart metering rollouts.

UK Department for Energy Security & Net Zero (Great Britain Smart Meter Statistics)

- By end-June 2024, 36.2 million smart and advanced meters were in operation in Great Britain.

- Of these, 32.7 million were operating in smart mode or were advanced meters.

- 57% of all GB meters were smart in smart mode or advanced by end-Q2 2024; including traditional-mode smart meters brings the total to 63%.

- In GB domestic premises, 64% of meters were smart or advanced by end-Q2 2024.

- In smaller non-domestic sites, 58% of meters were smart or advanced by end-Q2 2024.

- Large suppliers installed 663,200 domestic smart meters in Q2 2024, down 11% vs. Q1 2024.

- Large suppliers installed 29,000 smart/advanced meters at smaller non-domestic sites in Q2 2024; ~79% of these installs were smart meters.

- As of end-June 2024, GB domestic smart meters operating in smart mode reached 30.7 million, up ~3.5% quarter-on-quarter.

U.S. Federal Energy Regulatory Commission (2024 Assessment of Demand Response & Advanced Metering)

- In 2023, demand response registered in U.S. wholesale markets totaled ~33,055 MW, up ~135 MW year-over-year.

- In 2023, demand response could meet ~6.5% of aggregate RTO/ISO peak demand (sum of non-coincident peaks ~512 GW).

- As of year-end 2022, the U.S. had ~119.3 million advanced meters in operation; this represented ~72.3% penetration across ~165 million meters.

- 2022 marked the first time the nationwide advanced meter penetration rate for the residential class exceeded 70%.

- Three U.S. Census Divisions—Pacific, South Atlantic, and West South Central—had >80% AMI penetration in 2022.

- From 2007 to 2022, U.S. advanced meters grew from 6.7 million to 119.3 million.

Japan METI / Agency for Natural Resources and Energy

- As of end-FY2023 (March 2024), Japan had ~80.644 million smart meters installed.

- National smart meter rollout completion stood at ~99.9% by end-FY2023.

- Major general transmission/distribution operators in Japan report near-universal completion, underpinning next-generation metering and grid-edge use cases.

- Japan’s completed rollout supports continued upgrades toward “next-generation” smart meters through the mid-2020s.

Australian Energy Market Commission (AEMC) – National Electricity Rules

- The AEMC’s 2024 rule change accelerates the smart meter rollout with a national target of 100% small customer smart meter coverage by 2030.

- The accelerated rollout is intended to unlock DER orchestration, flexible pricing, and network visibility—key digital prerequisites for PLC-enabled applications.

- The 2024 final determination updates distributor obligations, installation timeframes, and data-access arrangements to speed deployments through 2025–2030.

U.S. Department of Energy – Grid Deployment Office (GRIP Program)

- DOE is administering a USD 10.5 billion GRIP program to enhance grid flexibility and resilience nationwide.

- Across the first two GRIP rounds, DOE announced ~$7.6 billion for 105 grid projects spanning all 50 states and D.C. (as of late 2024).

- DOE announced up to USD 3.46 billion for 58 projects in October 2023 and ~$4.2 billion for 46 projects in October 2024, targeting resilience, capacity growth, and digital grid modernization in 2024–2025.

Global Power Line Communication Market: Market Dynamics

Global Power Line Communication Market: Driving Factors

Rising Adoption of Smart Grid Infrastructure

The growing shift toward modernizing power distribution systems is significantly driving the demand for power line communication technology. Smart grids require reliable, long-range, and cost-effective communication channels for advanced metering infrastructure, real-time monitoring, and automated fault detection. PLC leverages existing electrical wiring, reducing deployment costs and making it an attractive solution for utilities upgrading their networks without large-scale infrastructure investments.

Increasing Need for Energy Efficiency and Demand Response

The push for sustainable energy management and lower carbon emissions is boosting the adoption of PLC-based solutions. By enabling utilities to remotely monitor consumption, manage load balancing, and execute demand response programs, PLC supports energy optimization initiatives. Its integration with renewable energy systems and distributed energy resources further enhances grid stability while meeting regulatory requirements for efficiency.

Global Power Line Communication Market: Restraints

Signal Interference and Noise Challenges

One of the major limitations of PLC technology is its susceptibility to electrical noise and signal attenuation, particularly in broadband applications. Industrial environments, older wiring systems, and high-voltage equipment can degrade communication quality, leading to reduced reliability and higher maintenance costs.

Competition from Alternative Communication Technologies

The availability of advanced wireless communication technologies such as RF mesh, cellular IoT, and fiber-optic networks poses a challenge to PLC adoption. These alternatives often provide higher data rates, lower latency, and broader scalability, prompting utilities and enterprises to weigh their investment choices carefully.

Global Power Line Communication Market: Opportunities

Expansion of Electric Vehicle Charging Infrastructure

The rapid growth of electric mobility presents significant opportunities for PLC integration in charging stations. Standards like HomePlug Green PHY enable secure communication between EVs, chargers, and grid operators, facilitating smart charging and load management. As EV adoption accelerates, the demand for PLC-enabled charging solutions is expected to rise.

Smart City and IoT Deployments

The growing number of smart city projects, including streetlight automation, building management systems, and connected IoT devices, creates a favorable environment for PLC adoption. Its ability to operate over existing power lines makes it an efficient option for scaling connected infrastructure across urban and rural settings.

Global Power Line Communication Market: Trends

Integration of Artificial Intelligence in PLC Networks

AI-powered analytics and machine learning are being incorporated into PLC systems to enhance performance and predictive capabilities. Intelligent algorithms can optimize signal modulation, detect faults proactively, and improve network resilience, driving higher efficiency in smart grids and industrial automation.

Hybrid Communication Models for Enhanced Reliability

A growing trend in the market is the adoption of hybrid solutions that combine PLC with wireless or fiber-optic technologies. This approach ensures redundancy, expands coverage, and addresses the limitations of standalone PLC systems, making it particularly valuable for mission-critical applications such as grid automation and renewable energy integration.

Global Power Line Communication Market: Research Scope and Analysis

By Type Analysis

Narrowband PLC (NB-PLC) is expected to lead the type segment in the power line communication market, accounting for 76.0% of the total market share in 2025. Its dominance is primarily due to its suitability for long-distance, low-data-rate applications such as smart metering, grid automation, streetlight control, and other utility-based communication needs.

NB-PLC operates at lower frequencies, allowing it to transmit signals reliably over extended distances with minimal signal degradation, even in challenging electrical environments. This makes it a preferred choice for utilities and smart city projects that require secure and cost-effective data transfer without the need for additional network infrastructure.

Broadband PLC (BB-PLC), while holding a smaller share, plays a crucial role in high-speed, short-to-medium-range communication applications. It is commonly used for in-building networking, home automation, multimedia streaming, and IoT device connectivity.

BB-PLC operates at higher frequencies, enabling it to deliver higher data rates but with a shorter transmission range compared to NB-PLC. Its adoption is growing in commercial and residential sectors where high-bandwidth applications are essential, particularly in regions with well-developed power distribution networks and a demand for fast, reliable connectivity over existing wiring.

By Offering Analysis

Hardware components are projected to remain the dominant segment in the power line communication market, holding 62.0% of the total market share in 2025. This dominance is driven by the essential role of physical devices such as PLC modems, couplers, gateways, repeaters, and network interface modules that enable data transmission over existing electrical wiring.

These components form the backbone of PLC infrastructure, supporting applications in smart grids, industrial automation, smart city deployments, and in-building connectivity. The ongoing expansion of smart metering projects, renewable energy integration, and EV charging infrastructure continues to fuel demand for durable, high-performance PLC hardware capable of operating reliably in varied environmental conditions.

Software in the PLC market, while representing a smaller share, is becoming increasingly important as it enables the management, optimization, and monitoring of PLC networks. This includes network management platforms, data analytics tools, firmware solutions, and application-specific software for energy monitoring, automation control, and fault detection.

With the growing complexity of smart grids, IoT ecosystems, and hybrid communication models, software solutions are playing a vital role in enhancing network efficiency, security, and scalability. As AI and machine learning technologies are integrated into PLC systems, the software segment is expected to gain momentum, offering utilities and enterprises advanced capabilities for predictive maintenance, adaptive communication, and real-time decision-making.

By Application Analysis

Smart metering and advanced metering infrastructure (AMI) are set to dominate the application segment of the power line communication market, capturing 47.0% of the market share in 2025. This strong position is attributed to the widespread adoption of PLC technology in utility networks for enabling two-way communication between service providers and end users.

PLC allows utilities to collect consumption data remotely, perform load management, detect outages instantly, and support demand response programs without deploying additional communication infrastructure. Its ability to provide secure, long-distance, and cost-effective data transfer makes it a preferred choice for large-scale smart metering rollouts, especially in regions focusing on energy efficiency, grid modernization, and regulatory compliance.

Street lighting and smart city applications represent another significant growth area for PLC technology. By leveraging existing electrical infrastructure, PLC enables centralized control, monitoring, and automation of streetlight systems, allowing municipalities to reduce energy consumption, schedule dimming, and detect faults in real time.

This capability is particularly valuable for smart city projects, where integration with traffic management systems, surveillance networks, and environmental sensors is essential for efficient urban operations. The combination of low operational costs, scalability, and reliable communication performance positions PLC as a key enabler for connected city infrastructure.

By End User Analysis

Utilities are expected to solidify their leading position in the end user segment of the power line communication market, capturing 69.0% of the market share in 2025. This dominance is driven by the extensive use of PLC technology in electricity distribution, smart grid deployments, and advanced metering infrastructure. Utilities rely on PLC for cost-effective and reliable communication over long distances without the need for additional cabling, enabling real-time monitoring, load balancing, outage management, and integration of renewable energy sources.

Large-scale initiatives for grid modernization, integrated with regulatory mandates for energy efficiency and infrastructure upgrades, continue to fuel PLC adoption within the utility sector across both developed and emerging markets.

The industrial segment, while smaller in share, represents a growing opportunity for PLC adoption, particularly in manufacturing plants, oil and gas facilities, and large-scale industrial complexes. PLC is used for equipment monitoring, predictive maintenance, building automation, and integration of industrial IoT devices within existing power networks.

Its resilience in harsh environments, ability to operate without additional communication lines, and compatibility with automation protocols make it an attractive choice for industries aiming to enhance operational efficiency. As industrial facilities increasingly embrace Industry 4.0, PLC solutions are gaining traction for connecting machines, sensors, and control systems in a secure and scalable manner.

The Power Line Communication Market Report is segmented on the basis of the following:

By Type

- Narrowband PLC (NB-PLC)

- Broadband PLC (BB-PLC)

By Offering

- Hardware

- Software

- Services

By Application

- Smart Metering/AMI

- Street Lighting & Smart City

- Grid Automation

- In-Building Networking

- Renewable Energy Integration

- Building Automation

- EV Charging Communication

- Others

By End User

- Utilities

- Industrial

- Residential

- Commercial

- Transportation & Others

Global Power Line Communication Market: Regional Analysis

Region with the Largest Revenue Share

Europe is projected to lead the global power line communication market in 2025, accounting for 33.0% of total market revenue, driven by extensive smart grid rollouts, widespread adoption of advanced metering infrastructure, and strong regulatory support for energy efficiency and renewable integration. Countries such as Germany, France, Italy, and the UK have been early adopters of PLC technology in utility networks, street lighting, and smart city projects, benefiting from established electrical infrastructure and harmonized standards like CENELEC.

The region’s focus on modernizing grid systems, integrating distributed energy resources, and promoting sustainable urban development continues to create a favorable environment for PLC deployment across residential, commercial, and industrial sectors.

Region with significant growth

Asia-Pacific is expected to witness significant growth in the power line communication market, driven by rapid urbanization, expanding smart city initiatives, and growing investments in grid modernization across countries like China, Japan, India, and South Korea. The region is seeing accelerated deployment of smart metering systems, renewable energy integration, and industrial automation, creating strong demand for reliable and cost-effective communication solutions.

Supportive government policies, rising electricity consumption, and the push for energy efficiency are further boosting PLC adoption, while advancements in broadband PLC for in-building networking and IoT connectivity are opening new opportunities in both urban and rural applications.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Power Line Communication Market: Competitive Landscape

The global competitive landscape of the power line communication market is characterized by the presence of a mix of established multinational corporations and specialized technology providers competing to expand their market share through innovation, strategic partnerships, and geographic expansion. Leading players such as Siemens AG, ABB Ltd., General Electric, Schneider Electric, Cisco Systems, STMicroelectronics, and Texas Instruments focus on delivering end-to-end PLC solutions, including hardware, software, and integration services, catering to utilities, industrial, and smart city applications.

Meanwhile, niche companies like Devolo AG, Corinex Communications, and Nyx Hemera Technologies are strengthening their positions by offering customized PLC products for specific sectors such as home networking, street lighting, and industrial automation. The market is also witnessing continuous R&D investment to improve data transmission reliability, enhance interoperability with IoT and AI-driven systems, and develop hybrid communication models that integrate PLC with wireless or fiber technologies to meet the evolving needs of smart infrastructure.

Some of the prominent players in the global power line communication market are:

- Siemens AG

- ABB Ltd.

- General Electric (GE)

- Schneider Electric SE

- Cisco Systems, Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Microchip Technology Inc.

- Maxim Integrated (Analog Devices)

- Landis+Gyr Group AG

- Echelon Corporation (now part of Adesto Technologies)

- Devolo AG

- Netgear, Inc.

- D-Link Corporation

- Zyxel Communications Corp.

- Corinex Communications Corp.

- Nyx Hemera Technologies Inc.

- Ametek, Inc.

- Mitsubishi Electric Corporation

- Panasonic Holdings Corporation

- Other Key Players

Global Power Line Communication Market: Recent Developments

- August 2025: Hubbell Inc. announced its acquisition of DMC Power for USD 825 million in cash, enhancing its portfolio of high-voltage connector solutions to support expanding power infrastructure needs driven by AI and data center demands.

- July 2025: Siemens unveiled its Electrification X portfolio as part of its Xcelerator ecosystem—a scalable IoT SaaS offering aimed at revitalizing electrification infrastructure across commercial, industrial, and utility domains.

- June 2025: Power Grid Corporation of India acquired MEL Power Transmission Ltd. (an SPV) for ₹8.53 crore via tariff-based competitive bidding, underscoring its strategy to expand transmission capacity.

- May 2025: Charter Communications announced its planned acquisition of Cox Communications in a USD 34.5 billion deal, combining two of the top U.S. cable operators to create a broadband and TV powerhouse.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 12.1 Bn |

| Forecast Value (2034) |

USD 25.9 Bn |

| CAGR (2025–2034) |

8.8% |

| The US Market Size (2025) |

USD 2.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Narrowband PLC, Broadband PLC), By Offering (Hardware, Software, Services), By Application (Smart Metering/AMI, Street Lighting & Smart City, Grid Automation, In-Building Networking, Renewable Energy Integration, Building Automation, EV Charging Communication, Others), and By End User (Utilities, Industrial, Residential, Commercial, Transportation & Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Siemens AG, ABB Ltd., General Electric (GE), Schneider Electric SE, Cisco Systems Inc., STMicroelectronics N.V., Texas Instruments Incorporated, Microchip Technology Inc., Maxim Integrated (Analog Devices), Landis+Gyr Group AG, Echelon Corporation (Adesto Technologies), Devolo AG, Netgear Inc., D-Link Corporation, Zyxel Communications Corp., Corinex Communications Corp., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global power line communication market size is estimated to have a value of USD 12.1 billion in 2025 and is expected to reach USD 25.9 billion by the end of 2034.

The US power line communication market is projected to be valued at USD 2.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.1 billion in 2034 at a CAGR of 8.3%.

Europe is expected to have the largest market share in the global power line communication market, with a share of about 33.0% in 2025.

Some of the major key players in the global power line communication market are Siemens AG, ABB Ltd., General Electric (GE), Schneider Electric SE, Cisco Systems Inc., STMicroelectronics N.V., Texas Instruments Incorporated, Microchip Technology Inc., Maxim Integrated (Analog Devices), Landis+Gyr Group AG, Echelon Corporation (Adesto Technologies), Devolo AG, Netgear Inc., D-Link Corporation, Zyxel Communications Corp., Corinex Communications Corp., and Others.

The market is growing at a CAGR of 8.8 percent over the forecasted period.