Power transformers are electrical equipment that transform power from one circuit to another without changing the frequency. They work on the basic principle of electromagnetic induction & transmit electricity between generators & primary distribution circuits. Power transformers are majorly expensive and are customized to the end user's requirements, resulting in longer lead times of over half a year to manufacture.

The power transformer industry is expected to witness significant growth, driven by increasing research into transmission networks, the quick adoption of non-traditional and renewable energy sources, and the rising importance of energy storage systems. These transformers, essential for transmitting electricity without altering frequency, are often custom-built to meet specific user requirements, leading to longer manufacturing lead times of over six months. Furthermore, the emergence of smart grids—capable of remote access, monitoring, and integration with

energy storage—enables rapid adaptation to changing electricity demand, ensures efficient cooling and power delivery, and helps minimize carbon emissions.

Further, there is a shift towards eco-friendly products, with traditional transformers expected to be replaced due to environmental & technological incompatibility. Developed nations are integrating renewable energy sources, like wind power, into cross-border electricity trading, growing pressure on aging networks. Also, challenges like frequent short circuits in aging infrastructures provide good growth opportunities, encouraging the development of super grids & smart grids to address low-carbon emission concerns.

Still, obstacles like the scarcity of quality steel, extended manufacturing processes, and the major capital investment required for supporting infrastructure create challenges to industry expansion. These challenges make leading competitors explore cost-reduction strategies, like the adoption of more efficient monitoring methods and alternative materials.

Despite these hurdles, the power transformer is set to benefit from the growth of PCB replacement programs, increasing green initiatives, and growth in resource-based industries, providing significant prospects for power transformer manufacturers.

As per the Department of Energy, the U.S. power transformer market holds between 60–80 million

distribution transformers, supporting an installed capacity of approximately 3 TW. Preliminary analysis by NREL projects a significant rise in capacity, forecasting a

160%–260% increase in overall stock capacity by 2050 compared to 2021 levels.

This growth aligns with the rising demand for energy infrastructure modernization and renewable energy integration. Such a trajectory highlights substantial investment opportunities in advanced transformer technologies to meet evolving energy needs and bolster grid resilience, positioning the market for sustained growth through transformative energy transitions.

Key Takeaways

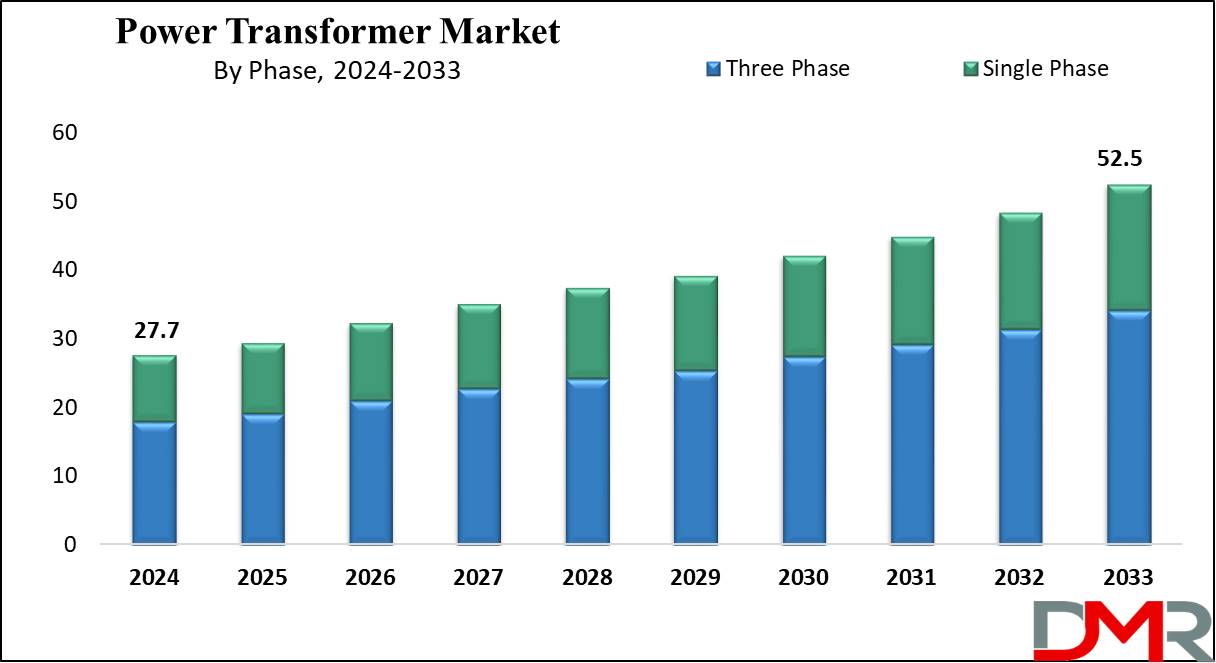

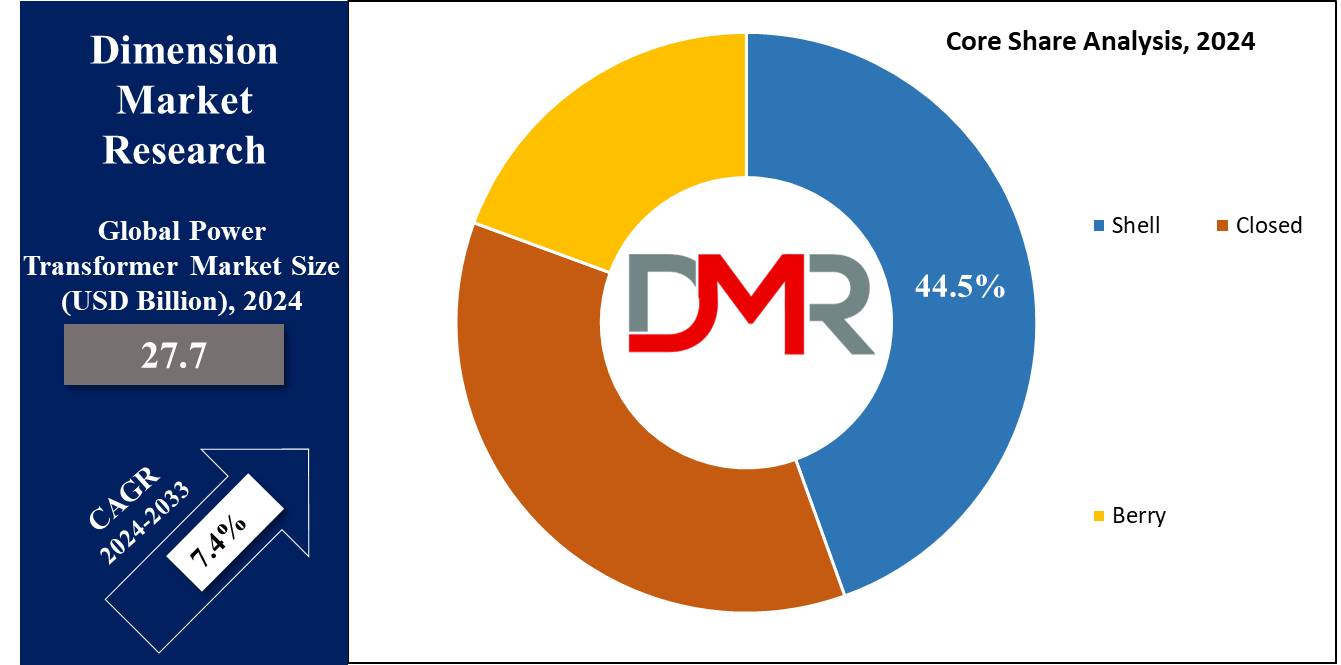

- Market Growth: The Power Transformer Market is expected to grow by 23.0 billion, at a CAGR of 7.4% during the forecasted period of 2025 to 2033.

- By Core: The shell core segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Phase: Three-phase is expected to get the largest revenue share in 2024 in the power transformer market.

- By Rating: 100 MVA to 500 MVA is expected to lead the power transformer market in 2024

- By End User: The industrial sector is expected to get the largest revenue share in 2024 in the power transformer market.

- Regional Insight: Asia Pacific is expected to hold a 41.6% share of revenue in the Global Power Transformer Market in 2024.

- Use Cases: Some of the use cases of the power transformer include voltage step-up for transmission, voltage step-down for distribution, and more.

Use Cases

- Voltage Step-Up for Transmission: One of the main functions of power transformers is to step up the voltage of electricity generated at power plants for effective transmission over long distances. Higher voltages minimize transmission losses, as they enable lower currents to carry the same amount of power, which is important for transmitting electricity over long distances from power generation centers to distribution centers or substations.

- Voltage Step-Down for Distribution: Power transformers also play an important role in stepping down high transmission voltages to lower distribution voltages suitable for use in homes, businesses, & industries. Distribution transformers deployed at substations or pole-mounted units minimize voltage levels to safer & more usable levels for consumers, which allows the safe & efficient delivery of electricity to end-users.

- Grid Interconnection and Power Exchange: Power transformers support the interconnection of different electrical grids, allowing the exchange & sharing of electricity between regions or countries. Interconnected grids can support balance supply & demand, improve grid stability, and provide backup power during emergencies. Transformers at grid interconnection points may need to adapt voltage levels between different grid systems to allow smooth power exchange.

- Industrial Applications and Voltage Regulation: In industrial settings, power transformers are used for many applications, like voltage regulation & power quality improvement. Industries often need stable & reliable power supply to operate machinery & equipment efficiently. Voltage-regulating transformers help maintain constant voltage levels even after fluctuations in the input supply. In addition, transformers equipped with filtering & conditioning features can reduce power quality issues such as harmonics & voltage sags, ensuring uninterrupted operation of industrial processes.

Market Dynamic

The power transformer market is being driven by many factors, like the growth of electricity demand in emerging economies, the growth in adoption of renewable energy sources, and the advancing infrastructure in developed nations. In addition, the market is advancing from the necessity for grid modernization & the expansion of smart grid networks. Technological developments, like the development of more efficient & compact transformers, further drive market growth.

The industrial sector's growth, primarily in the Asia Pacific region, generates a high demand for power transformers for industrial applications. Rising electrification rates in emerging economies like India, Brazil, China, & Russia have grown the need for power generation, along with the demand for more substations due to rising load growth & high transmission and distribution losses.

Given the rapid economic advancement and the growing need for uninterrupted and reliable power supply in these regions, the need for power transformers is expected to expand in the near future, thereby driving growth in the global power transformers market.

However, challenges like the volatility in raw material prices, mainly steel and oil, develop challenges to market growth. Fluctuations in the prices of raw materials like steel, important for manufacturing Cold Rolled Grain Oriented (CRGO) steel used in transformers, and unpredictable crude oil prices, have been clear over the past few years, potentially restraining the market expansion.

Moreover, the lack of standardization in product offerings provides another prevalent challenge. The absence of standardized products in the market complicates efforts for manufacturers to deliver uniform products, thereby hampering the growth prospects of the global power transformers market in the coming future.

Research Scope and Analysis

By Core

Based on core type, power transformers include closed, shell, and berry cores, with the shell core expected to dominate in 2024, highlighting the fastest growth trajectory. Shell cores are favored for low-voltage & high-output applications, providing versatility across industries like Power Sports and Outdoor Power Equipment.

Having a square or rectangular cross-sectional core, shell core transformers are preferred for their affordability, allowing the optimization of circuit expenses. Moreover, the shell core design provides many advantages, like an efficient cooling system, providing better heat dissipation, design flexibility to accommodate numerous application demands, high resilience against seismic activity, effective control of leakage magnetic flux, and better resistance to short circuits.

Also, such characteristics make shell core transformers highly desirable for industries looking for reliable and low-cost power distribution solutions. In addition, the versatility and adaptability of shell core transformers make them suitable for various applications, from electronic devices to industrial machinery. As industries constantly evolve and demand for efficient power solutions increases, the market for shell-core transformers is expected to show sustained growth.

Moreover, current developments in technology & design innovations are likely to further improve the capabilities and applications of shell core transformers, supporting their position as a foundation in modern electrical systems.

By Phase

The power transformer market segment categorized by phase type includes single and three phases, with the three-phase segment expected to dominate the market share by 2024 and experience high growth in the coming years. Three-phase transformers are largely used across many sectors, like precision machine tools, mining, manufacturing, automation, petrochemicals, and telecommunications, mainly for power generation & distribution purposes.

Further known for their affordability, lightweight construction, and compact design, three-phase transformers are the main choice for industrial equipment due to their low cost and space efficiency, mainly in applications with higher power ratings. In addition, in three-phase configurations, the incorporation of multiple single-phase toroid or ferroresonant devices can provide further advantages.

These transformers expand in low voltage distribution environments characterized by high fluctuations & low voltage scenarios, due to their superior isolation properties, strong common-mode interference suppression, & customizable designs customized to meet the specific parameters of end-users.

Further, the wide-ranging applications & inherent benefits of three-phase transformers are expected to drive their constant growth over the forecast period, highlighting a promising trajectory for market expansion. As industries constantly evolve & demand for efficient power distribution solutions grows, the adoption of three-phase transformers is expected to grow steadily, bonding their position as an important component in modern electrical systems.

By Insulation

In terms of insulation type, the power transformer market is segmented into categories like gas, oil, solid, air, and other insulation types, where oil insulation is predicted to hold the largest market share in 2024, and is expected to exhibit high growth throughout the forecast period.

Majorly used across industries for its capacity to resist high temperatures, oil serves as a vital insulation medium. Its electrical insulation properties, mainly its dielectric ability, effectively reduce high voltage, making oil insulators the preferred choice among manufacturers. In addition, oil acts as a protective barrier, avoiding damage like burning components like copper coils.

It finds high usage in many applications, like fluorescent lamp ballasts, high-voltage capacitors, oil-filled transformers, switches, & circuit breakers. While transformers mainly use mineral oil, majorly naphthenic, along with silicone and bio-based oils for insulation, a main industry trend reflects a switch towards eco-friendly alternatives like ester oil, which is driven by the growth in prominence of environmental concerns among transformer manufacturers globally.

By using more sustainable options, like ester oil, the industry focuses on addressing environmental challenges while maintaining performance & reliability standards, which not only highlights a commitment to sustainability but also supports innovation towards greener transformer technologies to meet evolving market demands.

By Rating

The market is segmented into 100 MVA to 500 MVA, 501 MVA to 800 MVA, and 801 MVA to 1200 MVA transformers. The 100 MVA to 500 MVA transformers are expected to hold the major market share in 2024 and experience the most rapid growth. These transformers are used in various industrial applications, including

power tools and vehicle motors.

Further, the rising electricity demand, driven by global industrialization & urbanization trends, is driving the demand for transformers within the 100 MVA to 500 MVA range. Furthermore, current technological development and design refinements are contributing to the growing usage of these transformers.

As industries change & need more efficient power distribution solutions, the need for transformers in this rating range is expected to rise steadily, which also highlights the importance these transformers play in helping various sectors & facilitating the reliable supply of electricity to meet the changing needs of modern infrastructure & industrial operations.

By End User

The power transformer market is segmented by end user into residential & commercial, utilities, and industrial sectors, where the industrial sub-segment commands the highest market share in 2024, with further anticipates to show the fastest growth rate throughout the forecast period, as power transformers used in industrial settings play a major role in providing the safe, reliable, and accurate usage of electricity within industries, which is closely linked to the inception of smart transformers, providing market players with a competitive edge.

In addition, higher global investments directed toward energy generation, industrial expansion, and urban development are making market players allocate resources toward research and development efforts focused on producing eco-friendly transformers, which also highlights the industry's commitment to sustainability and aligns with the growing demand for environmentally conscious solutions in industrial applications.

The Power Transformer Market Report is segmented on the basis of the following

By Core

By Rating

- 100 MVA to 500 MVA

- 501 MVA to 800 MVA

- 801 MVA to 1200 MVA

By End User

- Industrial

- Residential & Commercial

- Utilities

Regional Analysis

Asia Pacific's power transformer industry is set to capture

over 41.6% of the global revenue share and is also projected to experience significant growth, which is fueled by rapid economic development & the growing need for consistent & dependable power supply, driven by the region's growing population.

China, in particular, is leading this growth with investments focused on supporting its electrical transmission and distribution infrastructure to meet the growing electricity demand resulting from its rapid industrialization & urbanization.

The industry in China is expected to exceed further through the growth of new transmission lines & substations, addressing the increasing gap between energy supply & demand. Also, the rising concerns regarding greenhouse gas emissions & environmental risks are increasing the growth prospects across the Asia Pacific.

The region's growing industrialization, infrastructure development, & construction activities have highly supported the demand for power transformers. Notably, the market expansion in China is driven by growing energy needs and a focus on renewable energy production.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global power transformer market experiences a competitive landscape characterized by strong rivalry among key players looking to innovate & expand their market presence. These companies engage in strategic initiatives like mergers & acquisitions, partnerships, and product developments to gain a competitive edge. In addition, the market is witnessing growth towards the development of eco-friendly transformers in response to growing environmental concerns.

Key factors influencing competition like technological development, pricing strategies, and geographical expansion efforts. Moreover, strict government regulations focused on reducing greenhouse gas emissions are reshaping the competitive dynamics of the market, making manufacturers invest in sustainable solutions to meet changing consumer demands while maintaining profitability.

Some of the prominent players in the global Power Transformer Market are

- ABB Ltd

- GE Company

- Toshiba Corporation

- Crompton Greaves Ltd

- SPX Transformer Solutions

- Siemens AG

- Bharat Heavy Electricals Ltd

- Hitachi Ltd

- WEG SA

- Schneider Electric SE

- Other Key Players

Recent Developments

- In February 2024, the government of Maharashtra, India announced that it has developed an uninterrupted power scheme to change all the old transformers. Further, the scheme would cost USD 19.3 billion to change all the transformers and provide a stable electricity supply to its power consumers, mainly the ones, living in rural areas and agricultural consumers across the state.

- In February 2024, Hitachi Energy announced that the company has made an investment of over USD 32 million in the expansion and modernization of its power transformer manufacturing facility in Germany. Further, the expansion is expected to be completed in 2026, and the project will generate more than a hundred new jobs in the region and address the growing demand for transformers to support Europe's clean energy transition. Also, the investment highlights an expansion of the facility to 15,000 square meters. Combined with process enhancements, the upgraded facility is geared towards optimizing operational performance and boosting the overall manufacturing capacity to address the growing demand.

- In February 2024, Siemens Energy announced that the company will spend USD 149.8 million to build a large power transformer factory in Charlotte, North Carolina, Government, and it will be the first power transformer manufacturing facility in the U.S. and will expand its Charlotte operations. Moreover, the new facility will also create more than 500 jobs in logistics, mechanics, assembly, and other roles. Also, the development is expected to begin in 2024 and production is anticipated to begin in early 2026, making 24 LPTs a year and later advancing to 57 annually once it’s at full capacity.

- In February 2024, ELSEWEDY ELECTRIC launched its advanced Oil Distribution Transformers, meeting to the diverse energy needs of the Egyptian Market. Having power ratings of about 15 MVA and voltages reaching 36 kV, these top-notch transformers are set to revolutionize power distribution throughout the region. Further, the range includes a complete selection, featuring hermetically sealed & conservator transformers, grid-mounted, pole-mounted, smart, eco, and special transformers, which ensures that the company can cater to a high spectrum of applications & requirements, offering customized solutions for many energy distribution aspects.

- In December 2023, WEG S.A. announced that the company will invest USD 240 million, over the coming three years, to expand transformer production capacity in Brazil, Mexico, & Colombia, aiming at the main markets in which it operates. Also, the company plans initiatives to grow more than half of its production capacity. Further, the addition to building the expansion to allocate a new winding area, assembly, laboratory, and warehouse, the company will build a new factory dedicated to the production of radiators with about 50k sq. ft with an investment of about USD 39.9 million.

- In December 2023, Prolec GE announced its plan to double its single-phase pad-mount transformer manufacturing capacity with the new facility, as the company announced additional manufacturing investments of USD 85 million to meet the growing North American demand for single-phase pad-mount transformers. Further, the company plans to increase its manufacturing capacity in Monterrey by equipping a new facility capable of annually duplicating the number of transformers produced at its existing Mexico facility. Also, the company will take this opportunity to incorporate advanced manufacturing technology to grow productivity & enhance ergonomics in major areas throughout the new plant.