Market Overview

The Global Procurement Software Market is estimated to be valued at

USD 9.7 billion in 2025 and is further anticipated to reach

USD 28.7 billion by 2034 at a

CAGR of 12.8%.

Procurement software is a digital solution designed to streamline and automate purchasing processes, supplier management, and spend analysis within organizations. It enhances efficiency by enabling data-driven decision-making, optimizing procurement workflows, and ensuring compliance with company policies and regulatory requirements.

These platforms facilitate seamless sourcing, contract management, and purchase order tracking while integrating with enterprise systems to improve transparency and cost control. By leveraging cloud-based technologies, AI, and analytics, procurement software helps businesses reduce manual efforts, mitigate risks, and achieve greater operational agility in managing supply chains and vendor relationships.

The global procurement software market is experiencing rapid growth, driven by the increasing need for digital transformation in supply chain and purchasing operations. Businesses across industries are adopting advanced procurement solutions to enhance efficiency, reduce costs, and improve supplier collaboration. These software platforms enable organizations to automate procurement workflows, manage vendor relationships, and ensure regulatory compliance, reducing manual interventions and human errors.

With enterprises shifting towards data-driven decision-making, procurement software plays a critical role in streamlining sourcing, contract management, and purchase order processing.

Cloud-based procurement solutions are gaining significant traction due to their scalability, flexibility, and cost-effectiveness. Organizations are moving away from traditional on-premises software to leverage cloud-based platforms that offer seamless integration with enterprise resource planning (ERP) systems.

This shift is further supported by advancements in artificial intelligence, machine learning, and predictive analytics, which enhance procurement efficiency by enabling real-time insights, spend analysis, and automated supplier selection. As a result, companies can optimize their procurement strategies, negotiate better contracts, and gain a competitive advantage in a rapidly evolving business landscape.

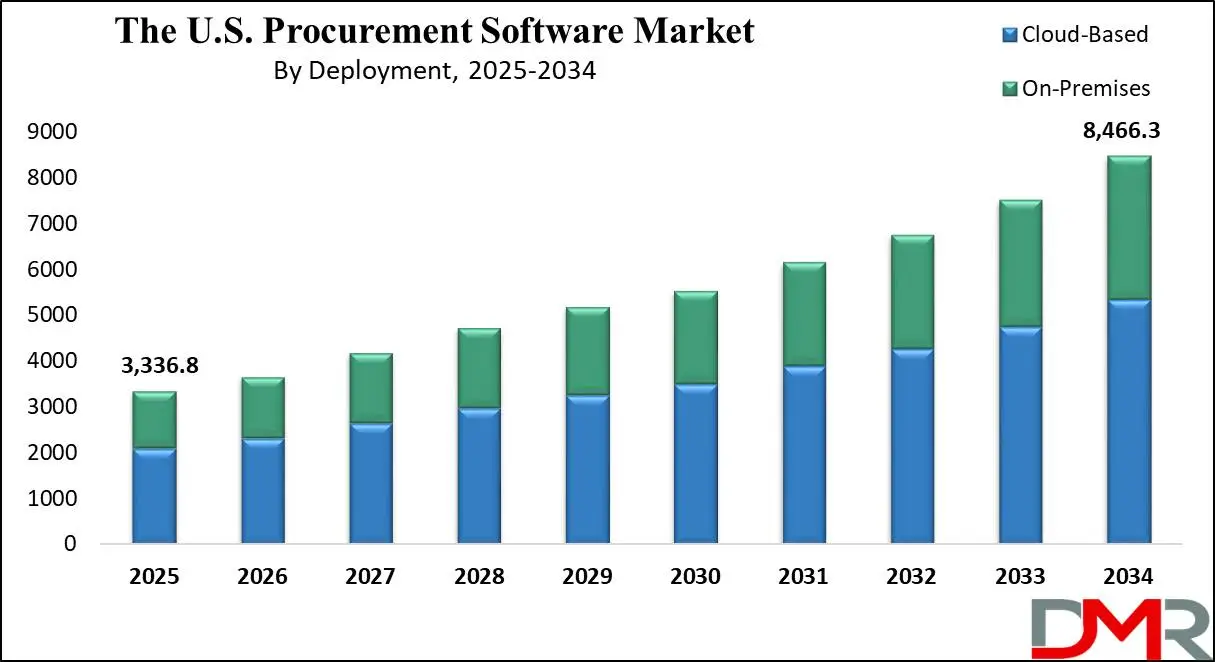

The US Procurement Software Market

The US Procurement Market is projected to be valued at USD 3.0 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 8.4 billion in 2034 at a CAGR of 12.0%.

The procurement software market in the US is witnessing significant growth as businesses adopt digital solutions to streamline purchasing, supplier management, and spend analysis. The country’s strong emphasis on automation, data-driven decision-making, and cost optimization has fueled demand for advanced procurement technologies. Large enterprises and government agencies are investing in AI-powered and cloud-based procurement platforms to improve efficiency, enhance transparency, and ensure regulatory compliance. Additionally, the growing focus on risk management and supply chain resilience is prompting organizations to integrate procurement software into their operations to mitigate disruptions and maintain business continuity.

Cloud-based procurement solutions are dominating the U.S. market, with companies shifting away from traditional on-premises systems to leverage the flexibility and scalability of cloud technology. Leading vendors such as SAP Ariba, Oracle, Coupa Software, and IBM are continuously enhancing their offerings with AI, machine learning, and predictive analytics to provide real-time insights and automation. The adoption of robotic process automation (RPA) and blockchain technology is further transforming procurement workflows, ensuring secure transactions and reducing manual intervention. These innovations are enabling U.S. businesses to optimize procurement strategies, improve contract negotiations, and gain a competitive advantage.

Global Procurement Software Market: Key Takeaways

- Market Value: The global Procurement market size is expected to reach a value of USD 28.7 billion by 2034 from a base value of USD 9.7 billion in 2025 at a CAGR of 12.8%.

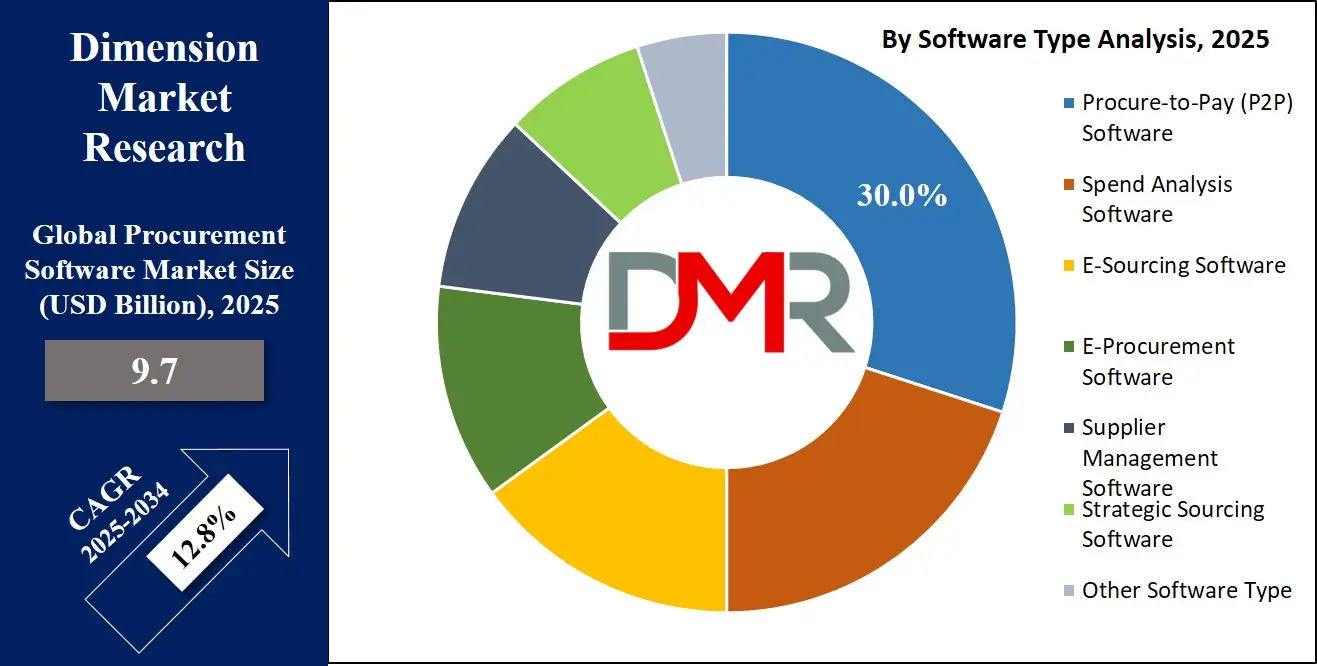

- By Software Type Segment Analysis: The Procure-to-Pay (P2P) Software type is poised to consolidate its dominance in the software type segment, capturing 30.0% of the total market share in 2025.

- By Deployment Type Segment Analysis: Cloud-based deployment mode is anticipated to maintain its dominance in the deployment type segment, capturing 65.0% of the total market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises are poised to consolidate their market position in the organization size segment, capturing 71.7% of the total market share in 2025.

- By End-User Type Segment Analysis: The Manufacturing industry is expected to maintain its dominance in the end-user type segment, capturing 29.6% of the total market share in 2025.

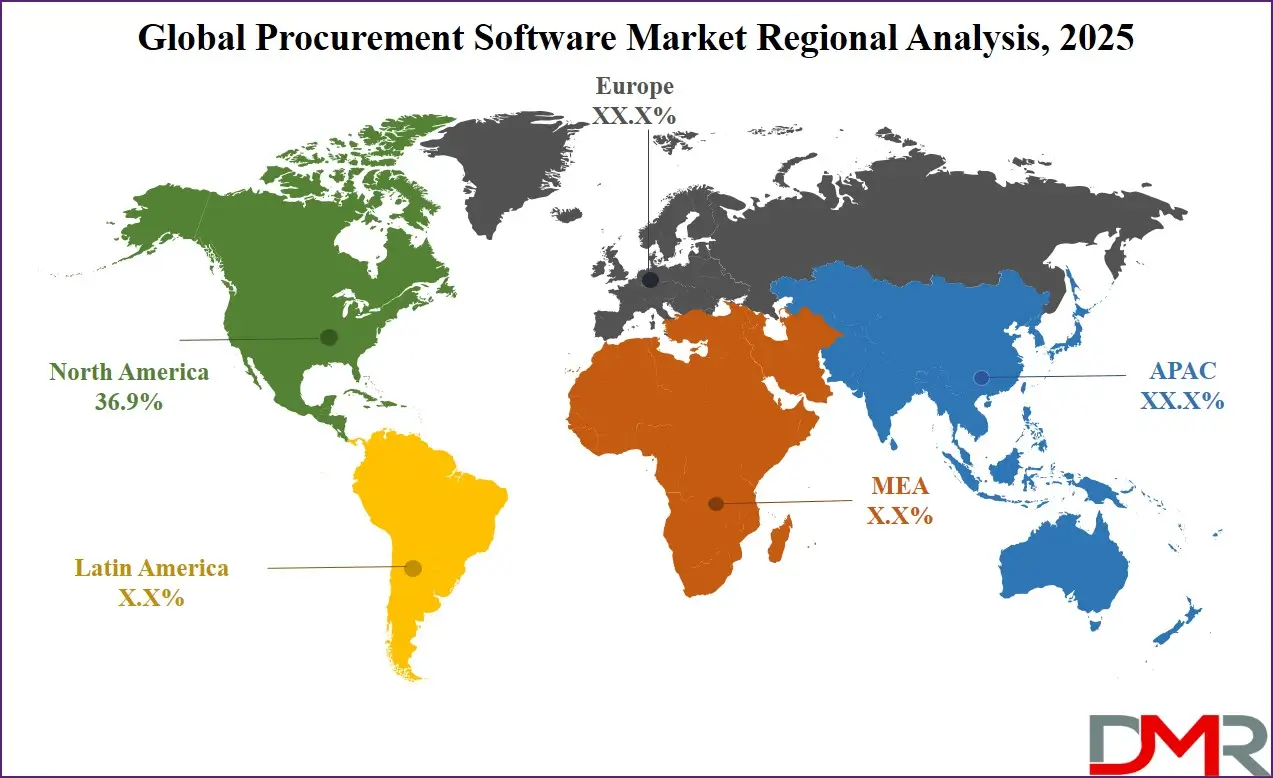

- Regional Analysis: North America is anticipated to lead the global procurement software market landscape with 36.9% of total global market revenue in 2025.

- Key Players: Some key players in the global procurement software market are SAP SE, Oracle Corporation, Coupa Software, Jaggaer, Basware, GEP, Ivalua, Zycus, IBM, Workday, Proactis, SynerTrade, Tradeshift, Epicor Software Corporation, Tungsten Network, Corcentric, Ariba (SAP), and Other Key Players.

Global Procurement Software Market: Use Cases

- Automated Supplier Management and Risk Mitigation: Procurement software enables businesses to streamline supplier onboarding, monitor vendor performance, and mitigate supply chain risks. Companies dealing with multiple suppliers across different regions face challenges in ensuring consistent quality, compliance, and timely deliveries. By using AI-powered procurement solutions, organizations can automate supplier evaluations, track contract adherence, and assess risks based on historical data and market trends.

- Real-Time Spend Analysis and Cost Optimization: Large enterprises often struggle with uncontrolled spending and fragmented procurement processes across various departments. Procurement software provides real-time visibility into expenses, helping organizations analyze spending patterns, identify cost-saving opportunities, and enforce budgetary controls. Retail and e-commerce businesses, for example, use spend analysis tools to track purchasing trends, negotiate better pricing with vendors, and reduce unnecessary expenditures.

- Enhanced Strategic Sourcing for Competitive Advantage: Organizations aiming to optimize supplier selection and sourcing strategies rely on procurement software to conduct data-driven negotiations and manage sourcing events effectively. The strategic sourcing capabilities of these platforms help businesses compare supplier bids, evaluate contract terms, and select vendors that align with their cost, quality, and sustainability goals.

- Seamless Procurement Automation for Public Sector Organizations: Government agencies and public sector organizations often deal with complex procurement processes, requiring strict adherence to transparency, compliance, and budget constraints. Procurement software simplifies these workflows by automating bidding, contract approvals, and audit processes while ensuring compliance with local and international procurement regulations.

Global Procurement Software Market: Stats & Facts

- According to the U.S. Government Accountability Office (GAO), government procurement constitutes a significant potential market for international trade, with an estimated annual global size of USD 4.4 trillion. Additionally, the U.S. federal government procured more than twice as much from the other six main parties to the GPA and NAFTA as vice versa. Foreign sourcing by central governments varied in value by party from about 2% to 19% of overall central government procurement.

- Reported by the U.S. Bureau of Labor Statistics (BLS), as of May 2023, there were approximately 77,530 purchasing managers employed in the United States. Additionally, the mean annual wage for purchasing managers in the U.S. was USD 146,710.

- According to the U.S. General Services Administration (GSA), the Procurement Co-Pilot tool assists acquisition professionals by providing data on prices paid and procurement information across government agencies. Additionally, the GSA offers a Forecast of Contracting Opportunities tool, which helps vendors identify potential prime contracting opportunities early in the process.

- As per the World Bank, the World Integrated Trade Solution (WITS) is a trade software tool that allows users to query several international trade databases, including procurement-related information.

- According to the U.S. Trade and Development Agency (USTDA), the Global Procurement Initiative trains public officials in emerging markets on establishing procurement practices that integrate life-cycle cost analysis and best value determination.

- An assessment by the U.S. Department of Commerce and the Department of Homeland Security, critical supply chains supporting the ICT industry assessment was conducted using data from various sources, including the Bureau of Industry and Security, to improve procurement security and supply chain resilience.

- According to the U.S. General Services Administration (GSA), the Transactional Data Reporting Program collects pricing data from thousands of Multiple Award Schedule contracts to improve procurement efficiency. Additionally, the Acquisition Gateway is an online platform designed to assist government-wide acquisition programs, policies, initiatives, and tools.

Global Procurement Software Market: Market Dynamics

Global Procurement Software Market: Driving Factors

Growing Adoption of Cloud-Based Procurement SolutionsBusinesses are moving away from traditional on-premises systems to leverage the scalability, flexibility, and cost-efficiency of cloud platforms. Cloud-based procurement solutions enable real-time data access, seamless integration with enterprise resource planning (ERP) systems, and enhanced collaboration between procurement teams and suppliers. This transition is particularly beneficial for multinational companies managing complex supply chains across multiple locations, as it ensures streamlined operations and remote accessibility. Additionally, cloud technology facilitates faster deployment, automatic updates, and improved security measures, making it a preferred choice for organizations seeking digital transformation in procurement.

Increasing Focus on Cost Optimization and Spend Transparency

Procurement platforms equipped with AI-driven spend analysis, predictive analytics, and automated reporting help businesses gain better visibility into purchasing patterns, detect inefficiencies, and implement cost-saving strategies. Companies can monitor supplier performance, identify opportunities for bulk discounts, and eliminate maverick spending, leading to significant savings. In industries such as manufacturing, retail, and BFSI, where procurement costs directly impact profitability, businesses are investing in procurement software to enhance financial control and maximize return on investment.

Global Procurement Software Market: Restraints

High Implementation Costs and Integration Challenges

Deploying procurement software involves costs related to software licensing, customization, employee training, and system integration with existing enterprise resource planning (ERP) and financial management tools. Additionally, businesses using legacy systems often face compatibility issues, requiring extensive modifications or third-party integrations. These challenges can delay adoption and create resistance among organizations that lack the technical expertise or financial resources to transition to digital procurement solutions.

Data Security and Compliance Concerns

Cyber threats, data breaches, and unauthorized access pose risks to companies relying on cloud-based procurement solutions. Furthermore, stringent regulatory requirements such as GDPR, CCPA, and industry-specific compliance standards add complexity to procurement operations. Organizations must ensure that their procurement platforms comply with these regulations while implementing robust cybersecurity measures to prevent data leaks and unauthorized access. The fear of security vulnerabilities and non-compliance penalties can slow down adoption, particularly in highly regulated industries such as BFSI, healthcare, and government sectors.

Global Procurement Software Market: Opportunities

Integration of AI and Automation for Enhanced Efficiency

AI-driven tools can enhance supplier selection, predict demand fluctuations, and optimize procurement strategies by analyzing historical data and market trends. Automation streamlines repetitive tasks such as purchase order creation, invoice processing, and contract management, reducing human errors and improving operational efficiency. Companies investing in AI-powered procurement solutions can gain a competitive advantage by accelerating decision-making, minimizing risks, and achieving cost savings through smarter sourcing strategies.

Rising Demand for Sustainable and ESG-Compliant Procurement

Procurement software solutions are evolving to include features that help organizations track supplier sustainability metrics, ensure ethical sourcing, and comply with ESG regulations. This creates an opportunity for vendors to offer solutions that enable businesses to evaluate supplier carbon footprints, monitor responsible sourcing practices, and align procurement strategies with corporate sustainability goals. Companies leveraging ESG-focused procurement software can enhance brand reputation, mitigate regulatory risks, and appeal to environmentally conscious consumers and stakeholders.

Global Procurement Software Market: Trends

Growing Adoption of Blockchain for Transparent Procurement

By leveraging decentralized ledgers, businesses can create immutable records of procurement activities, ensuring authenticity in contracts, invoices, and payment processing. This technology helps eliminate fraud, enhances traceability, and streamlines compliance with regulatory requirements. Companies in industries such as manufacturing, retail, and pharmaceuticals are integrating blockchain into procurement systems to improve supply chain visibility, prevent counterfeit goods, and establish secure, tamper-proof transactions.

Rise of Embedded Procurement in ERP and Business Suites

This trend enables organizations to manage procurement processes without switching between multiple systems, improving efficiency and decision-making. Leading software providers are expanding their offerings by embedding procurement functionalities into existing business suites, making it easier for enterprises to adopt digital procurement solutions without requiring standalone software investments. As a result, businesses benefit from unified data visibility, automated workflows, and improved collaboration between procurement, finance, and supply chain teams.

Global Procurement Software Market: Research Scope and Analysis

By Software Type Analysis

The Procure-to-Pay (P2P) Software segment is expected to maintain its leadership position in the procurement software market, capturing approximately 30.0% of the total market share in 2025. This dominance is driven by the increasing need for end-to-end procurement automation, allowing businesses to streamline the entire purchasing cycle from requisition and supplier selection to invoicing and payment processing.

P2P solutions enhance procurement efficiency by integrating with financial and enterprise resource planning (ERP) systems, ensuring real-time visibility into transactions and reducing manual errors. The shift toward cloud-based platforms further fuels P2P adoption, providing scalability and seamless integration across departments. Large enterprises, particularly in manufacturing, retail, and BFSI sectors, are prioritizing P2P software to gain better financial control, improve compliance, and optimize working capital management.

Spend Analysis Software also plays a crucial role in procurement by helping organizations gain deep insights into their spending patterns, identify cost-saving opportunities, and enhance financial transparency. This software collects, cleanses, and categorizes procurement data from multiple sources, allowing businesses to track supplier expenses, detect maverick spending, and enforce strategic sourcing decisions. Companies leveraging spend analysis tools can negotiate better contracts with vendors, eliminate inefficiencies, and ensure compliance with budgetary constraints.

By Deployment Type Analysis

The cloud-based deployment mode is projected to dominate the procurement software market, accounting for approximately 65.0% of the total market share in 2025. This growth is fueled by the increasing demand for flexible, scalable, and cost-efficient solutions that enable real-time procurement management across multiple locations.

Cloud-based procurement software eliminates the need for heavy IT infrastructure, allowing businesses to implement and scale solutions without significant upfront investments. Companies benefit from enhanced collaboration between procurement teams and suppliers, seamless system updates, and advanced security protocols. One of the key drivers behind this trend is the rising adoption of AI, machine learning, and predictive analytics in procurement workflows, which are best leveraged through cloud platforms. Cloud-based solutions provide automated data synchronization, ensuring real-time visibility into procurement processes and spend analytics.

On-premises deployment also remains the relevant segment, particularly for enterprises requiring greater control, customization, and data security. On-premises procurement software is installed directly on a company’s servers and infrastructure, providing full ownership of data and enabling businesses to implement tailored procurement workflows based on their unique operational needs. Industries dealing with highly sensitive procurement data, such as government organizations, defense, and banking institutions, often prefer on-premises solutions due to regulatory compliance requirements and heightened cybersecurity concerns.

By Organization Size Analysis

The large enterprises segment is expected to dominate the procurement software market, accounting for 71.7% of the total market share in 2025. This is primarily driven by the increasing need for scalable and integrated procurement solutions that streamline complex purchasing operations across multiple business units and geographic locations. Large organizations handle high procurement volumes, manage diverse supplier networks, and operate under stringent compliance regulations, making advanced procurement software a critical investment.

Leading enterprises across manufacturing, BFSI, healthcare, IT & telecom, and government sectors are adopting procurement solutions to automate workflows, enhance supplier collaboration, and optimize spend management. These businesses leverage AI-driven analytics, predictive insights, and real-time procurement tracking to drive cost efficiency, improve contract negotiations, and mitigate supply chain risks.

SMEs are also playing a crucial role in this market segment. They face unique challenges such as limited procurement budgets, fewer dedicated procurement professionals, and fragmented supplier management. However, the rise of cloud-based and subscription-based procurement solutions has made it more accessible for SMEs to adopt procurement software without significant upfront investment.

SMEs primarily seek cost-effective, user-friendly, and scalable solutions that can grow with their business needs. Unlike large enterprises that focus on advanced AI-driven procurement strategies, SMEs prioritize simplified vendor management, automated purchase order tracking, and spend control tools.

By End-User Industry Analysis

The manufacturing industry is projected to dominate the procurement software market, capturing 29.6% of the total market share in 2025. This dominance is driven by the sector's complex supply chain networks, high-volume purchasing, and the need for stringent supplier management. Manufacturers rely on procurement software to automate sourcing, manage multi-tier supplier relationships, and optimize procurement costs while ensuring on-time delivery of raw materials and components.

Given the industry's reliance on just-in-time (JIT) inventory systems, procurement software enables real-time tracking of supplier performance, demand forecasting, and risk mitigation in supply chain disruptions. Additionally, manufacturers are adopting AI-driven procurement tools that help analyze historical purchasing trends, negotiate better supplier contracts, and enhance compliance with regulatory requirements. Procurement automation also plays a crucial role in reducing procurement cycle times, minimizing waste, and maintaining profitability amid fluctuating raw material costs.

The retail and e-commerce industry is another key end-user of procurement software, leveraging it to streamline vendor selection, optimize inventory procurement, and enhance cost control. Unlike manufacturing, where procurement focuses on raw materials and production inputs, retail and e-commerce businesses prioritize supplier collaboration, bulk purchasing, and demand-driven procurement strategies.

With the rapid expansion of online marketplaces and omnichannel retailing, businesses require procurement software to manage high-volume transactions, track supplier deliveries, and ensure smooth logistics operations. Retailers also benefit from automated purchase order generation, AI-powered demand forecasting, and integration with warehouse management systems, ensuring optimal stock levels and reducing instances of overstocking or stockouts.

The Procurement Software Market Report is segmented on the basis of the following

By Software Type

- Procure-to-Pay (P2P) Software

- Spend Analysis Software

- E-Sourcing Software

- E-Procurement Software

- Supplier Management Software

- Strategic Sourcing Software

- Other Software Type

By Deployment

By Organization Size

- Large Enterprise

- Small and Medium Enterprise

By End-User Industry

- Manufacturing

- Retail & E-commerce

- BFSI (Banking, Financial Services & Insurance)

- Healthcare & Pharmaceuticals

- IT & Telecom

- Government & Defense

- Energy & Utilities

- Other End Users

Regional Analysis

Region with the Largest Revenue Share

North America is expected to dominate the global procurement software market, accounting for 36.9% of total global market revenue in 2025. This dominance is driven by the rapid digital transformation of procurement operations across industries, learning, blockchain, and automation in procurement workflows, enabling businesses to enhance efficiency, reduce costs, and improve supply chain visibility.

The United States, as the largest contributor to the regional market, is witnessing significant adoption of procurement software across industries such as manufacturing, BFSI, retail, healthcare, and IT & telecom. Large enterprises in these sectors are investing heavily in AI-driven spend analytics, supplier management tools, and automated procurement platforms to optimize sourcing decisions and ensure compliance with evolving regulatory standards. Additionally, the growing reliance on cloud-based procurement solutions is driving market expansion, as organizations seek scalable, flexible, and cost-efficient procurement platforms to support remote and multi-location operations.

Region with the Highest CAGR

The Asia-Pacific region is expected to experience the highest Compound Annual Growth Rate (CAGR) in the global procurement software market, driven by rapid digital transformation, increasing adoption of cloud-based procurement solutions, and the expanding presence of multinational corporations in the region.

With economies such as China, India, Japan, and South Korea leading the adoption curve, businesses across industries are recognizing the value of procurement automation to streamline purchasing processes, enhance supplier collaboration, and optimize cost efficiency. One of the key factors contributing to Asia-Pacific’s rapid market expansion is the region's booming manufacturing and industrial sectors, which are heavily reliant on procurement software for supply chain management, vendor negotiations, and inventory optimization.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Procurement Software Market: Competitive Landscape

The global procurement software market is highly competitive, with a mix of established enterprise software providers, specialized procurement technology firms, and emerging cloud-based solution providers. Companies in this space are focused on enhancing procurement automation, supplier relationship management, and spend optimization through AI-driven analytics and cloud-based integrations. The competition is fueled by continuous innovation, strategic acquisitions, and the increasing demand for scalable procurement solutions that cater to businesses of all sizes.

Leading enterprise software providers such as SAP SE, Oracle Corporation, IBM, and Workday dominate the market with their well-integrated procurement solutions that complement existing enterprise resource planning (ERP) systems. These companies have a stronghold among large multinational corporations due to their ability to offer full-suite procurement functionalities, including contract lifecycle management, supplier risk assessment, and AI-powered spend analysis. Their extensive cloud-based ecosystems and longstanding industry presence give them a competitive advantage, making them the preferred choice for organizations looking for comprehensive and deeply integrated procurement platforms.

Some of the prominent players in the Global Procurement Software are

- SAP SE

- Oracle Corporation

- Coupa Software

- Jaggaer

- Basware

- GEP

- Ivalua

- Zycus

- IBM

- Workday

- Proactis

- SynerTrade

- Tradeshift

- Epicor Software Corporation

- Tungsten Network

- Corcentric

- Ariba (SAP)

- Xeeva

- Esker

- Determine (a Corcentric company)

- Other Key Players

Global Procurement Software Market: Recent Developments

- February 2025: Bain Capital considers selling Rocket Software, potentially valuing the automation software provider at up to USD 10 billion.

- October 2024: QAD Inc. acquires Phenix Software Inc., enhancing its advanced scheduling capabilities for adaptive enterprises.

- September 2024: Salvatore Lombardo joins Coupa as Chief Product and Technology Officer, following Thoma Bravo's acquisition of Coupa in December 2022.

- August 2024: Blue Yonder acquires One Network Enterprises for USD 839 million, expanding its digital supply chain network capabilities.

- June 2024: TPG and CDPQ acquire Aareon for USD 4.2 billion, a provider of SaaS solutions for the property industry.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 9.7 Bn |

| Forecast Value (2034) |

USD 28.7 Bn |

| CAGR (2025–2034) |

12.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Software Type (Procure-to-Pay (P2P) Software, Spend Analysis Software, E-Sourcing Software, E-Procurement Software, Supplier Management Software, Strategic Sourcing Software, Other Software Type), By Deployment Type (Cloud-Based, and On-Premises), By Organization Size (Large Enterprise, and Small and Medium Enterprise), By End-User Industry (Manufacturing, Retail & E-commerce, BFSI (Banking, Financial Services & Insurance), Healthcare & Pharmaceuticals, IT & Telecom, Government & Defense, Energy & Utilities, and Other End Users) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

SAP SE, Oracle Corporation, Coupa Software, Jaggaer, Basware, GEP, Ivalua, Zycus, IBM, Workday, Proactis, SynerTrade, Tradeshift, Epicor Software Corporation, Tungsten Network, Corcentric, Ariba (SAP), Xeeva, Esker, Determine (a Corcentric company), and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The global procurement market size is estimated to have a value of USD 9.7 billion in 2025 and is expected to reach USD 28.7 billion by the end of 2034.

The US procurement market is projected to be valued at USD 3.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.4 billion in 2034 at a CAGR of 12.0%.

North America is expected to have the largest market share in the global procurement market, with a share of about 36.9% in 2025.

Some of the major key players in the global procurement market are SAP SE, Oracle Corporation, Coupa Software, Jaggaer, Basware, GEP, Ivalua, Zycus, IBM, Workday, Proactis, SynerTrade, Tradeshift, Epicor Software Corporation, Tungsten Network, Corcentric, Ariba (SAP), and Other Key Players, and many others.

The market is growing at a CAGR of 12.8 percent over the forecasted period.